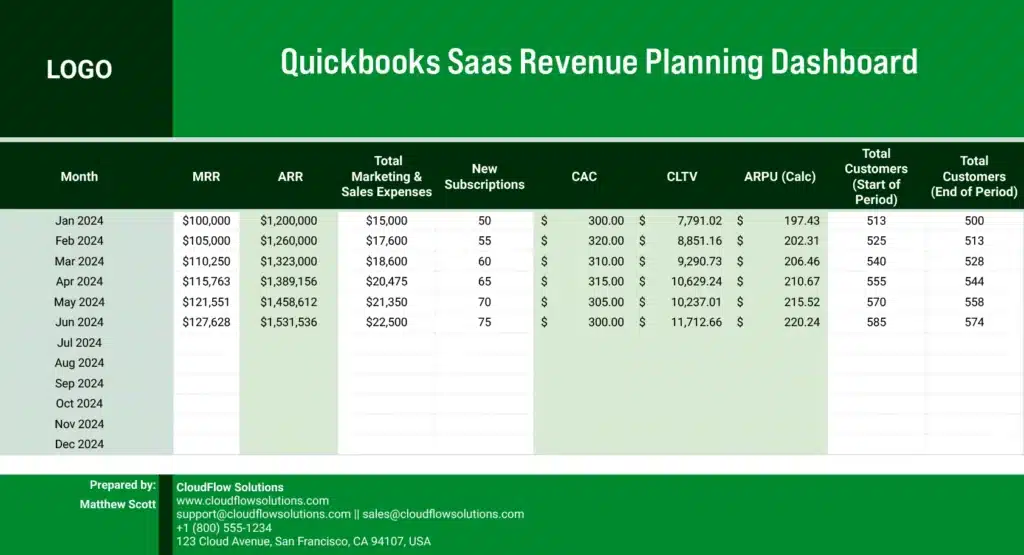

Managing SaaS revenue data in QuickBooks can be complex and time-consuming. This free QuickBooks SaaS Revenue Planning Dashboard template helps finance teams track, analyze, and plan their revenue metrics directly in spreadsheets.

What is a SaaS Revenue Planning Dashboard Report?

A SaaS Revenue Planning Dashboard report combines essential financial metrics from QuickBooks to provide a comprehensive view of your subscription-based business performance. This dashboard template organizes your revenue data, subscription metrics, and financial KPIs in a structured format, making it easier to track growth, identify trends, and make data-backed decisions.

Who is the SaaS Revenue Planning Dashboard Template Built For?

This template serves:

- SaaS Finance Teams

- Revenue Operations Managers

- Financial Planning & Analysis (FP&A) Professionals

- SaaS Company Founders

- CFOs and Finance Directors

Primary Use Case for SaaS Revenue Planning Dashboard Template

The template helps finance teams:

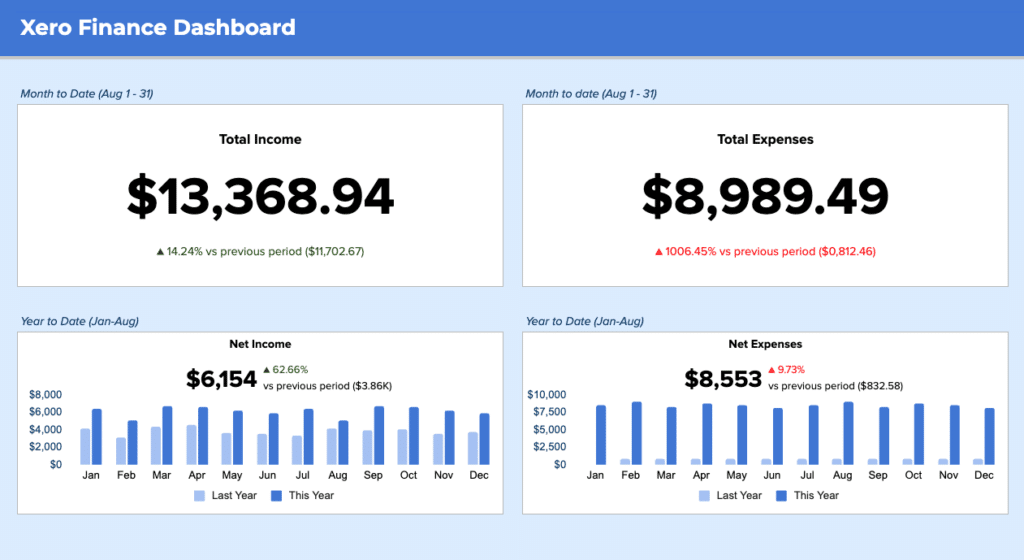

- Monitor key revenue metrics in one central dashboard

- Track subscription growth and revenue patterns

- Analyze financial performance across different time periods

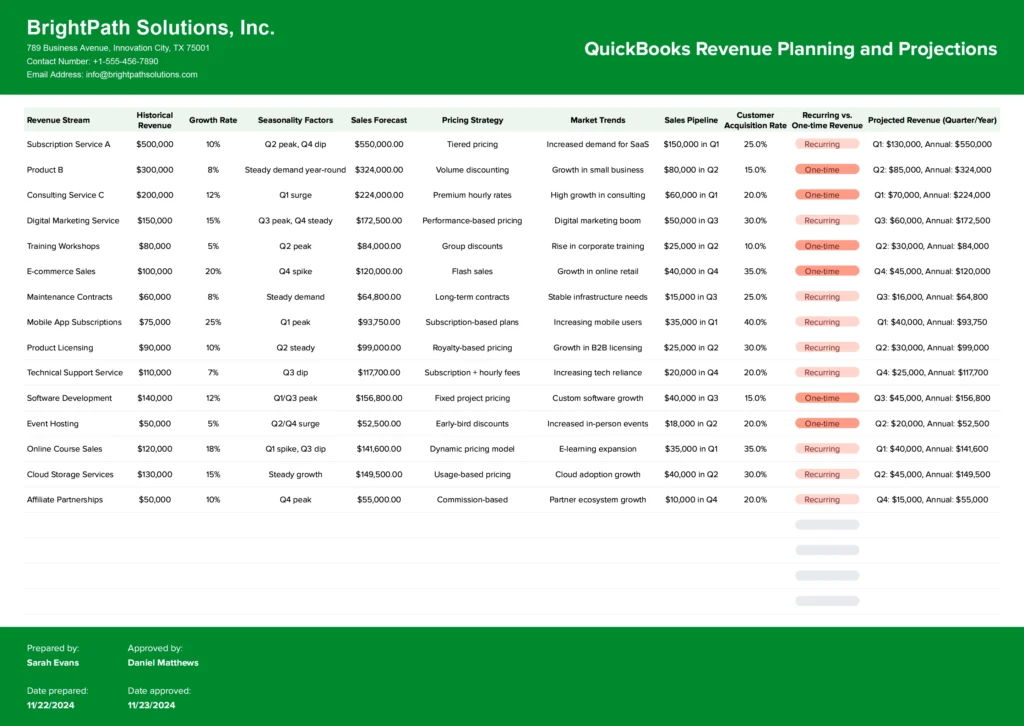

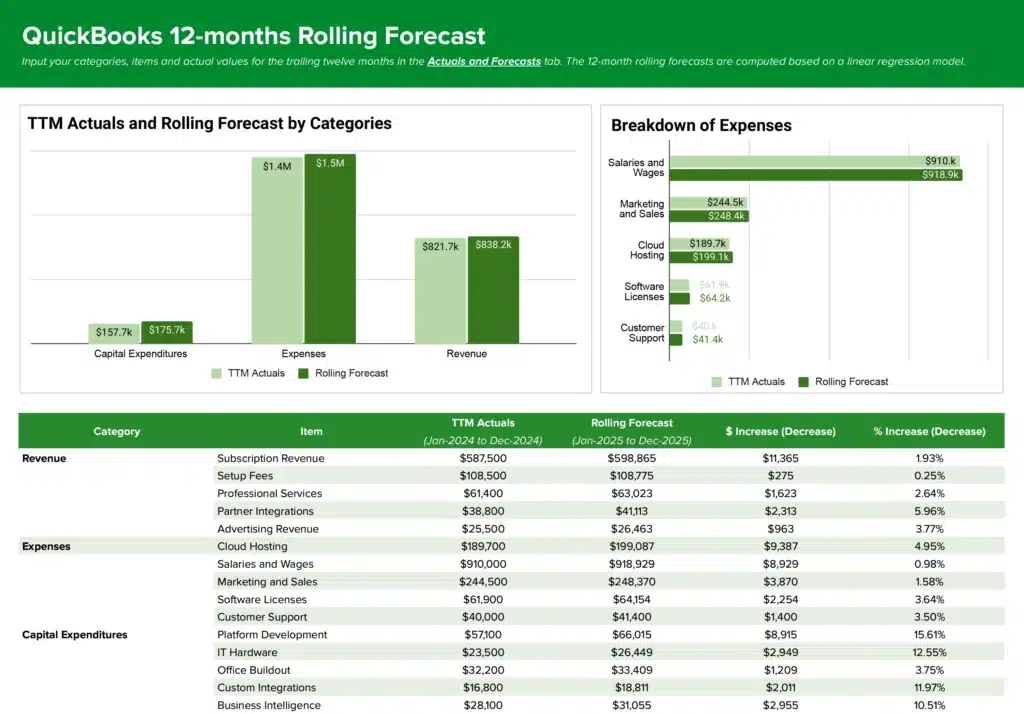

- Create revenue forecasts and planning scenarios

- Present financial data to stakeholders

Benefits of Using QuickBooks SaaS Revenue Planning Template

- Standardized Reporting: Access pre-built calculations and formulas for essential SaaS metrics

- Time Savings: Eliminate manual data entry with ready-to-use dashboard layouts

- Better Decision Making: View all critical revenue metrics in a single dashboard

- Professional Presentation: Share polished, well-organized financial reports with stakeholders

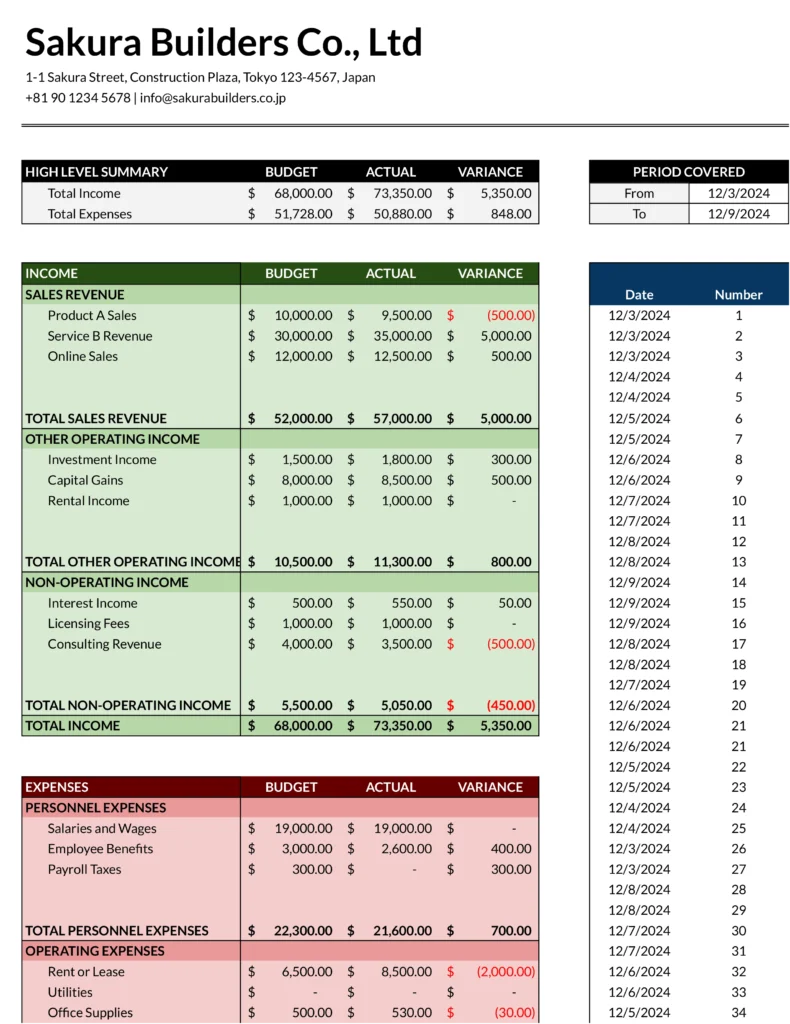

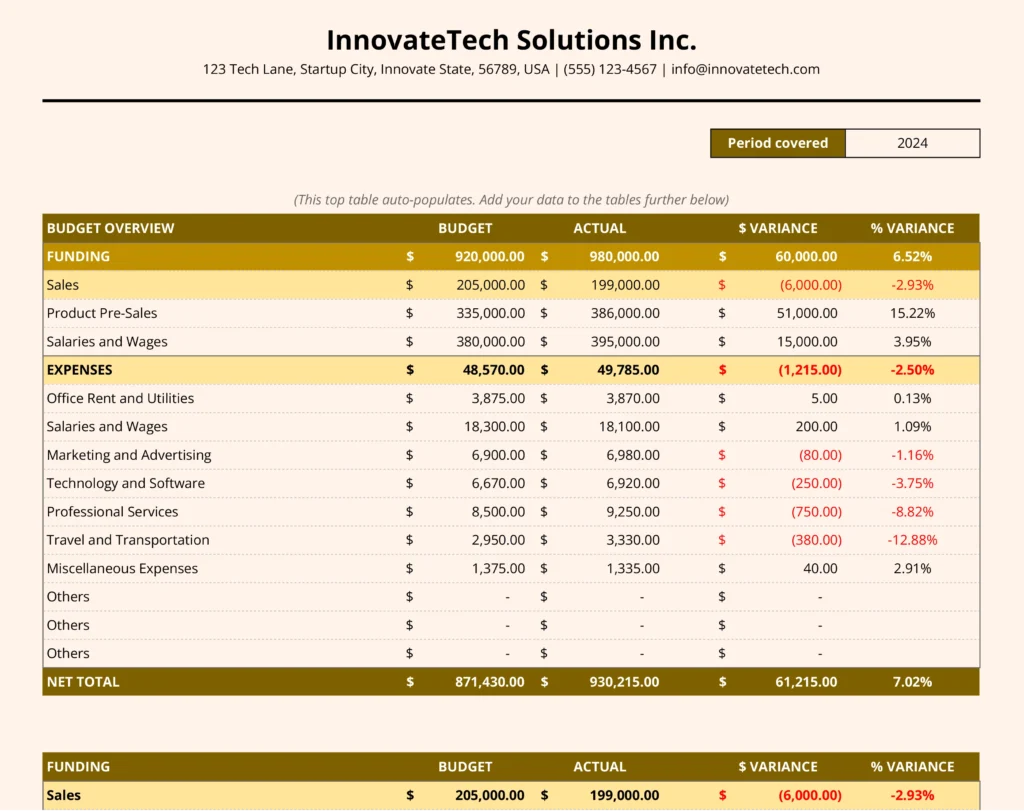

Metrics Tracked in the Report

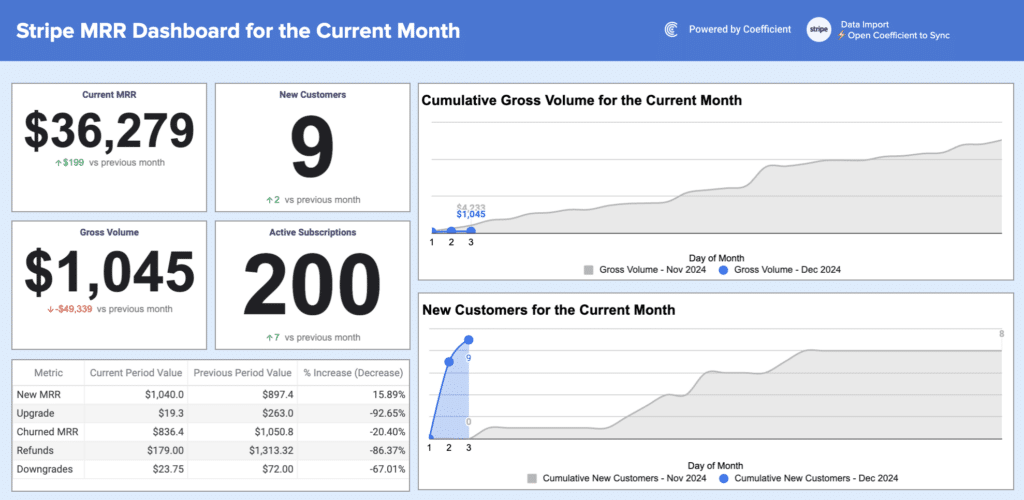

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLTV)

- Churn Rate

- Average Revenue Per User (ARPU)

- New Subscriptions

- Upgrades/Downgrades

- Expansion Revenue

- Deferred Revenue

- Sales Pipeline Metrics

- Revenue Growth Rate

Additional QuickBooks Metrics to Track and Analyze

- Profit & Loss by Month & Class

- Expenses by Vendor

- Consolidated P&L statements

- Accounts Payable tracking

- Accounts Receivable monitoring

- Department and location-specific data

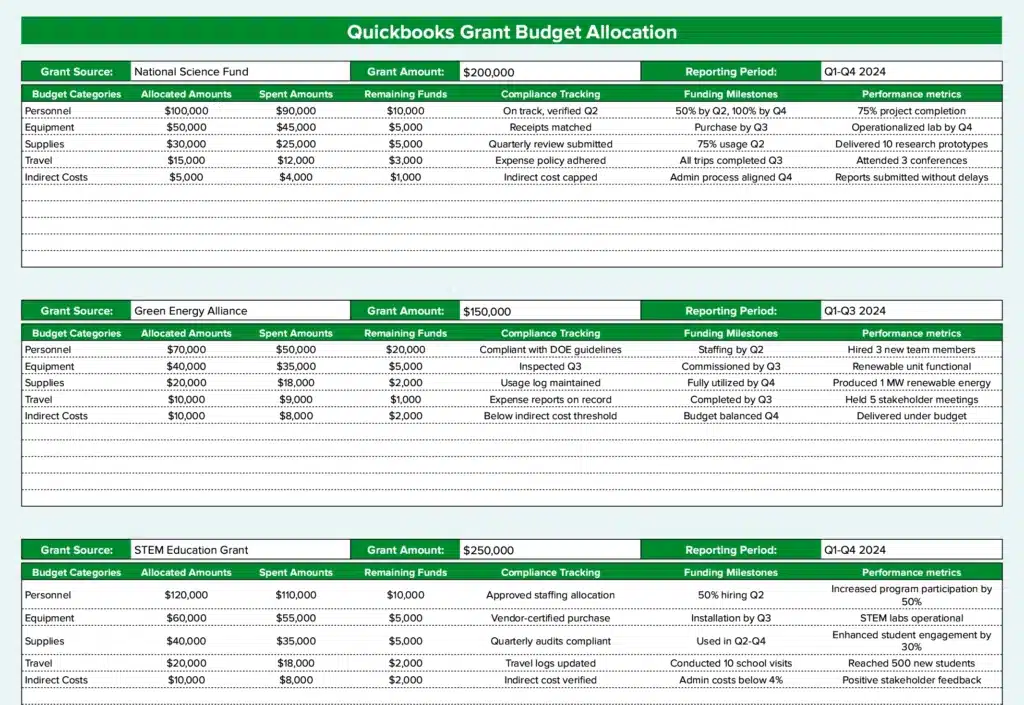

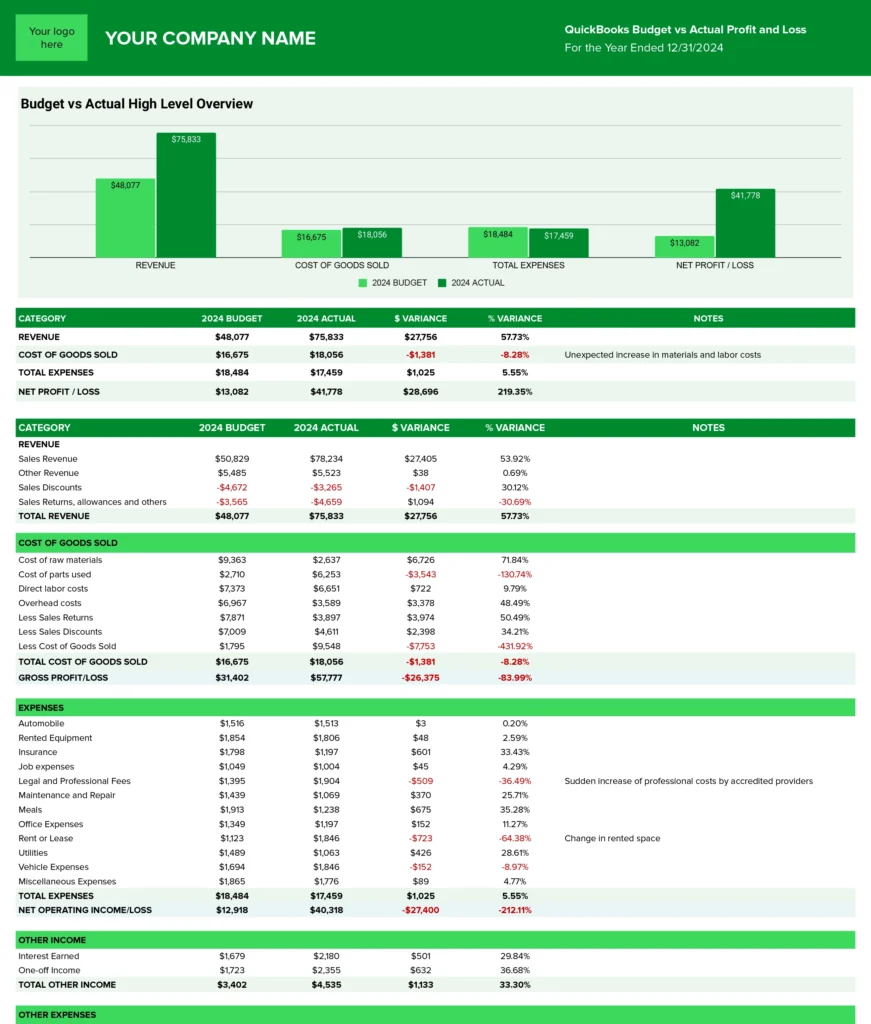

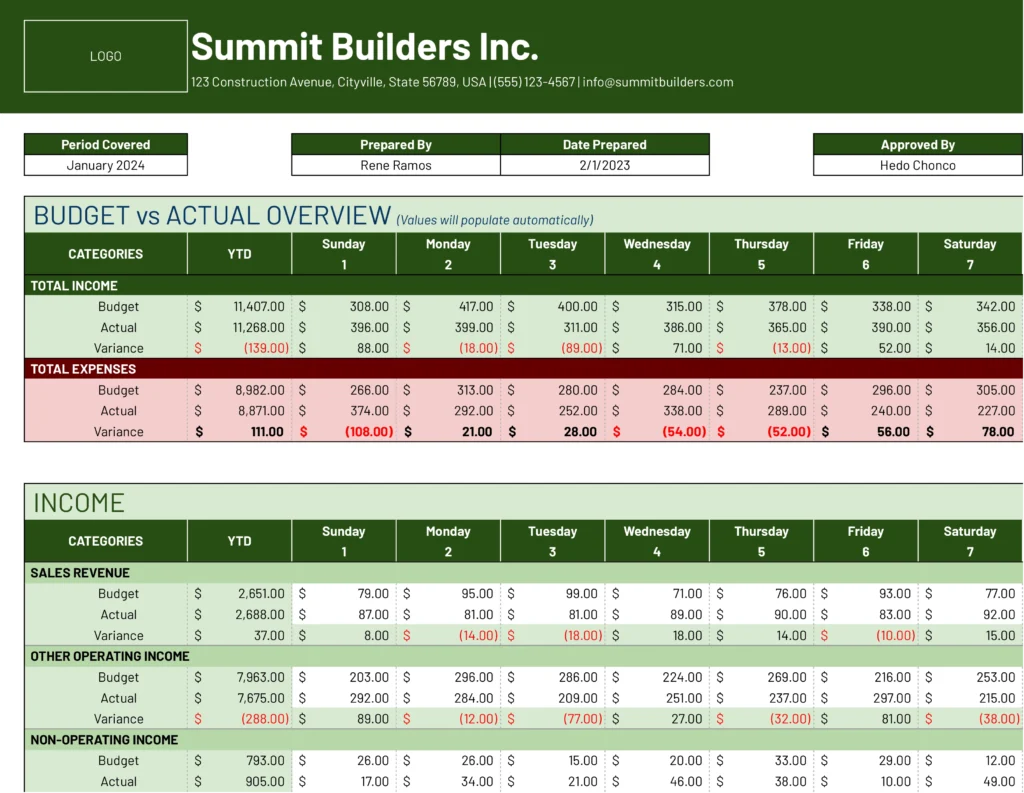

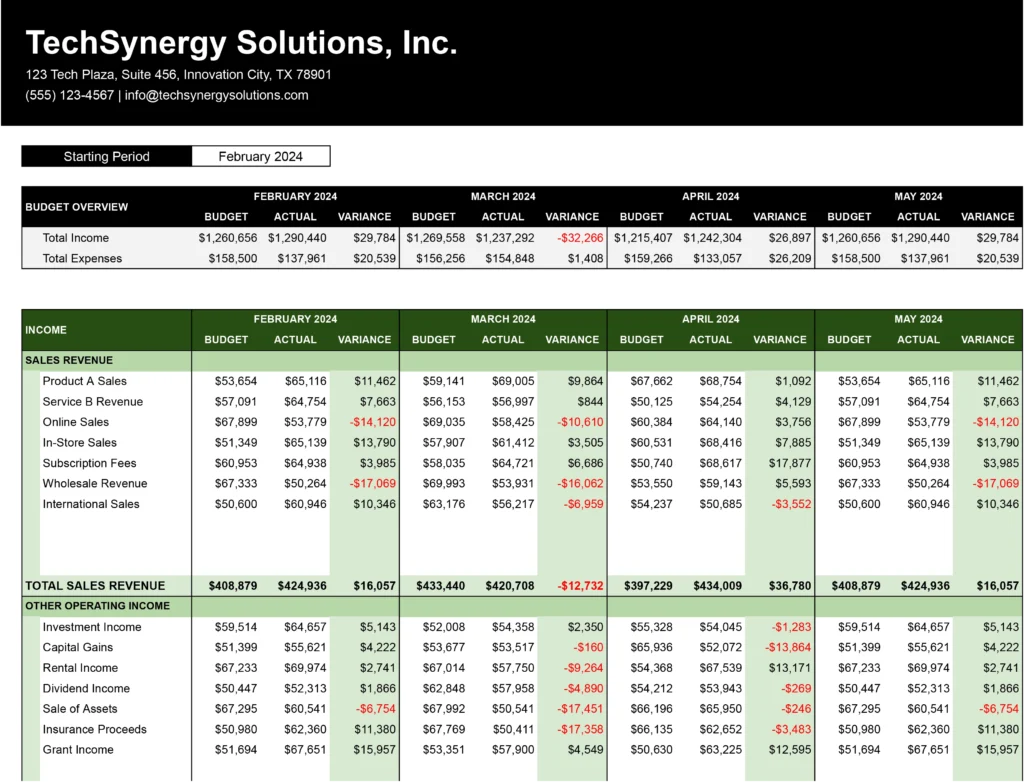

- Budget vs. Actuals comparison

- Revenue by customer segments