What is an Invoice and Why is it Important for Business?

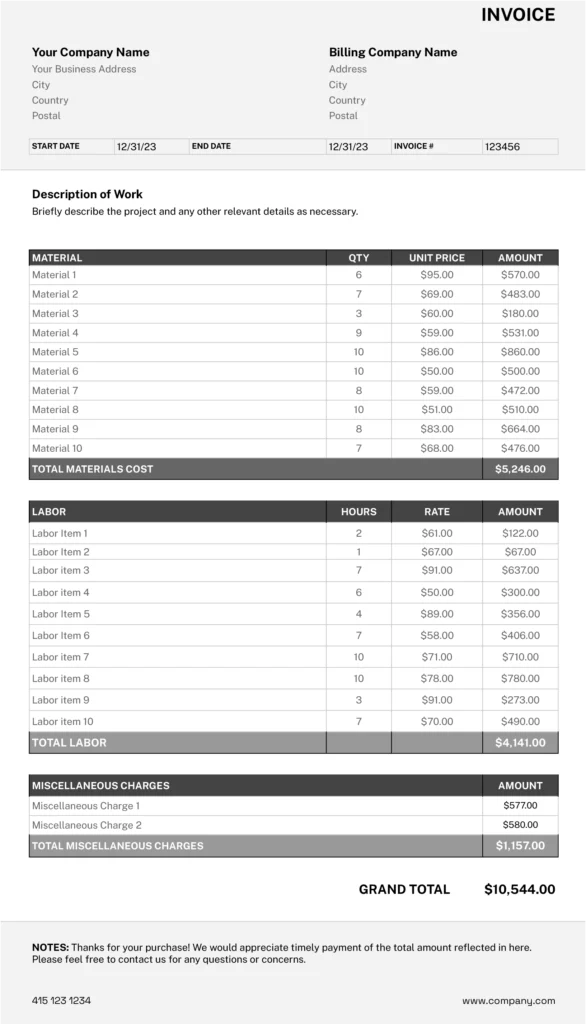

An invoice is a vital financial document that is used to maintain transaction records of both parties including business names, account numbers, total amount, taxes, date, time, etc.

It ensures financial transparency by streamlining all the payment processes at any business.

Purpose of Invoices

- Maintaining official transaction records

- Monitoring payments

- Offering legal proof of agreements between the parties

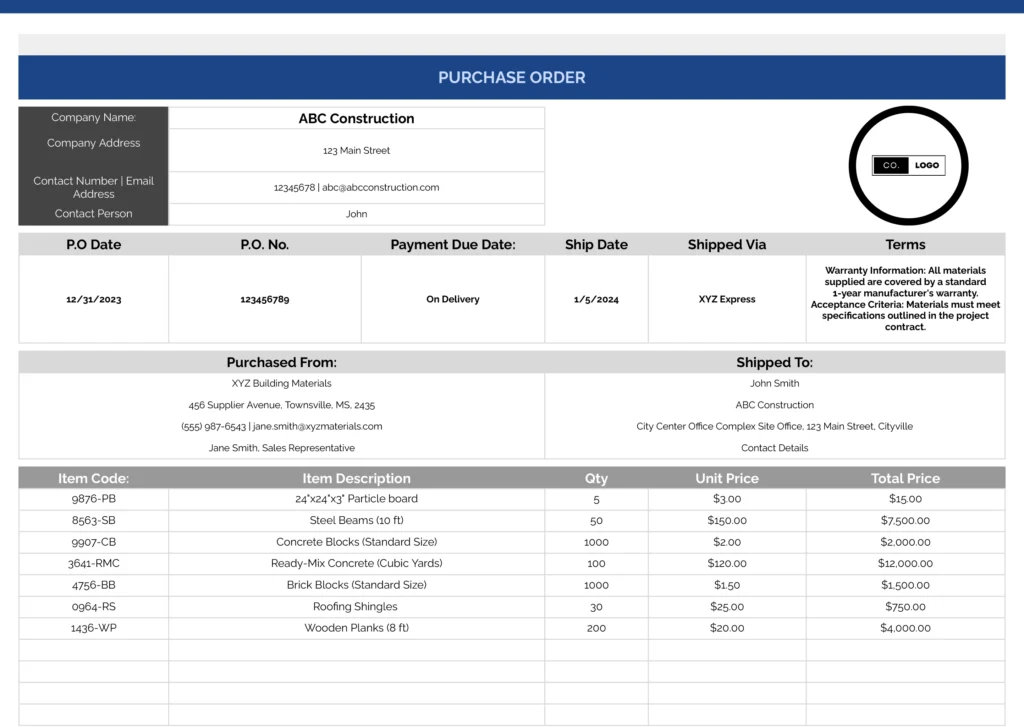

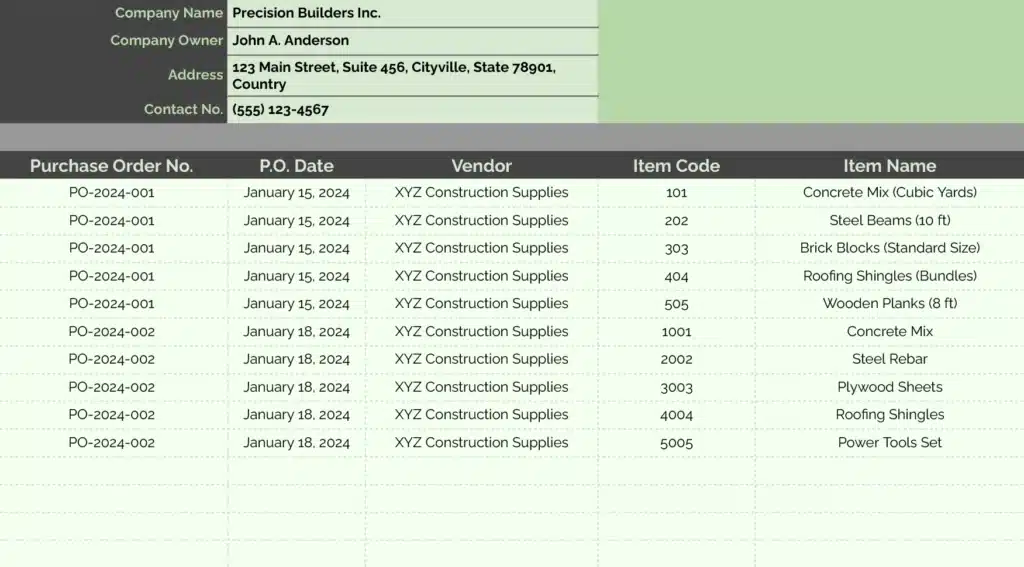

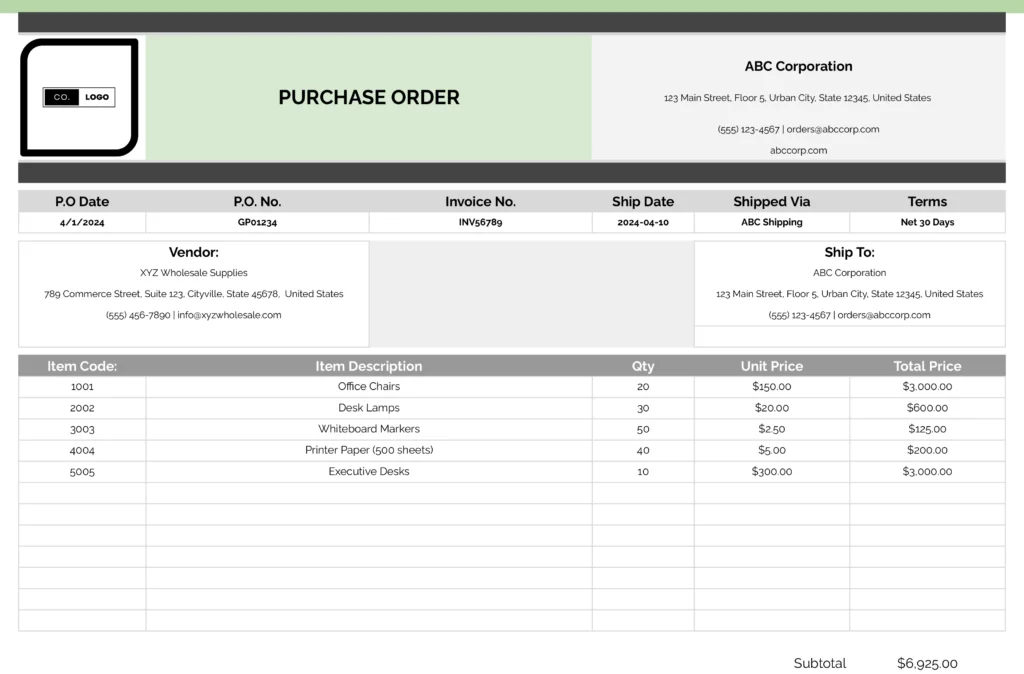

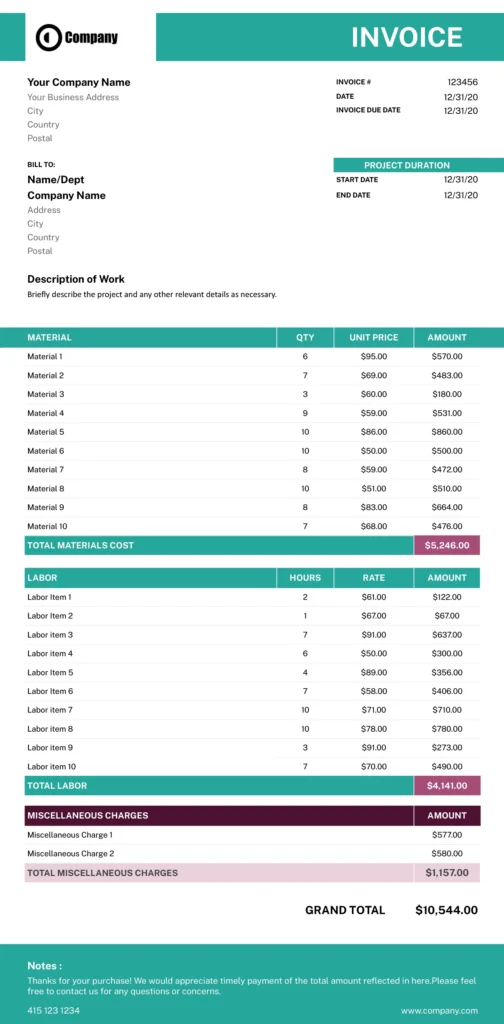

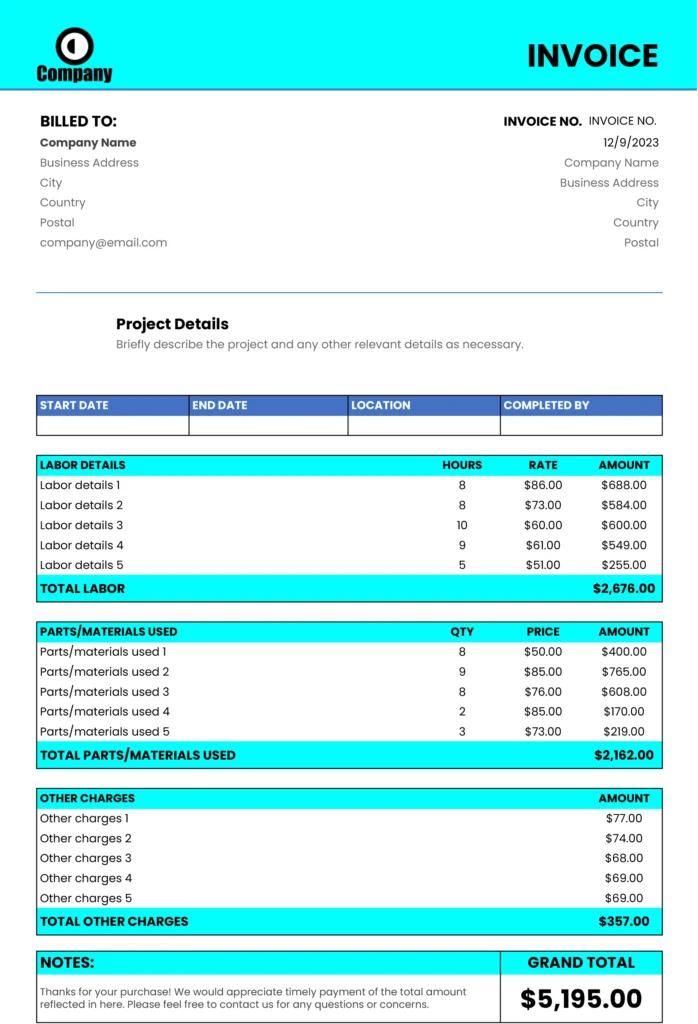

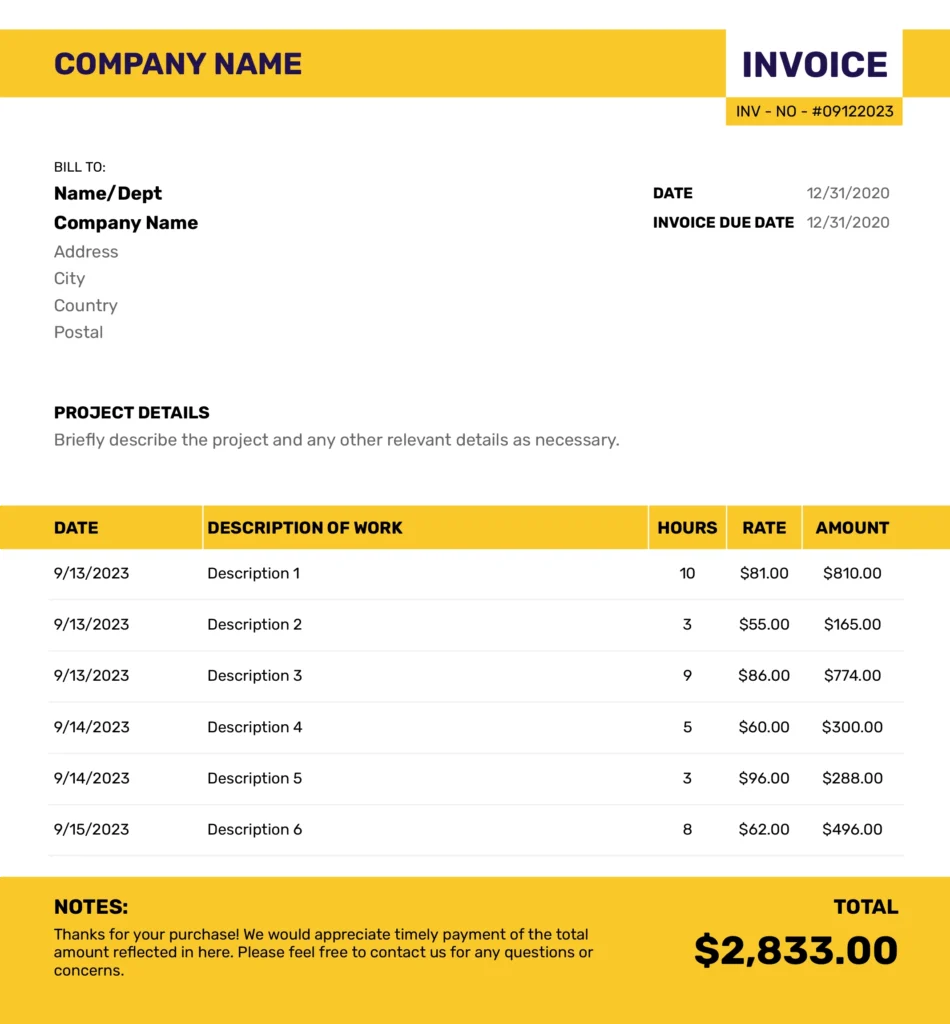

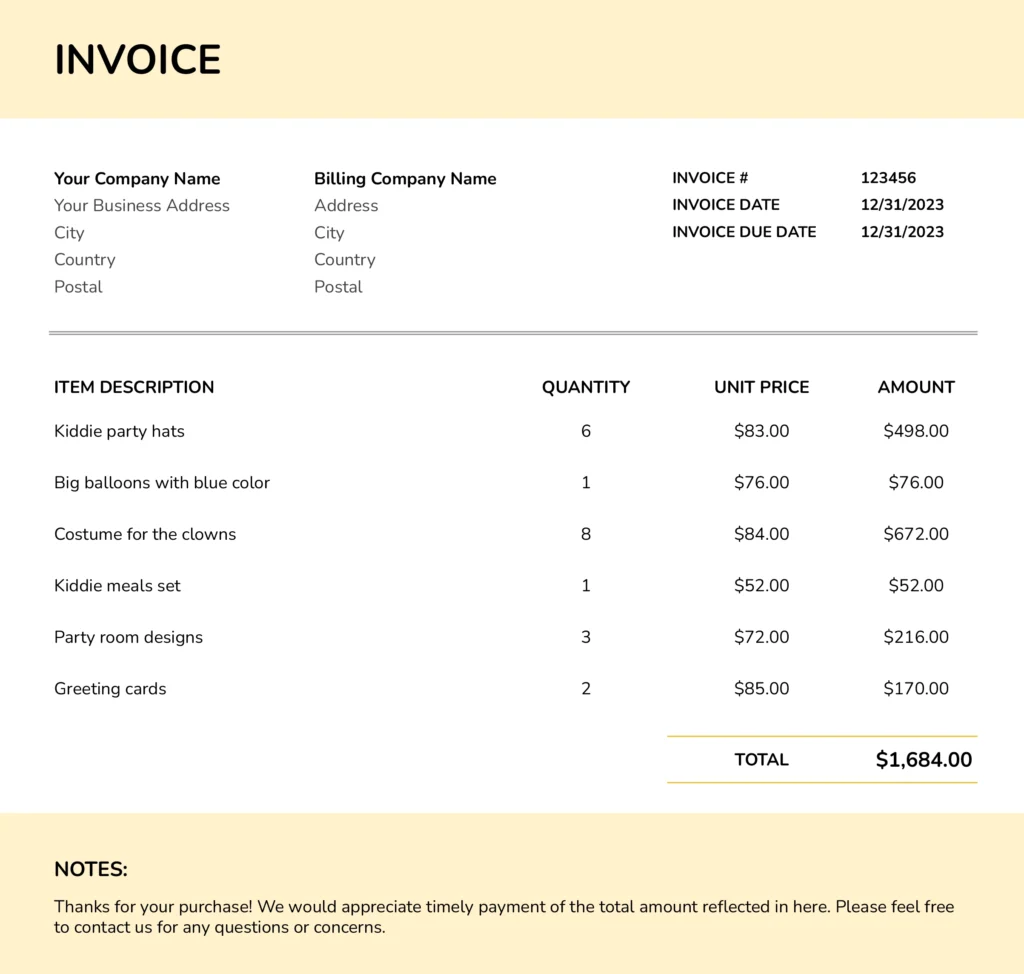

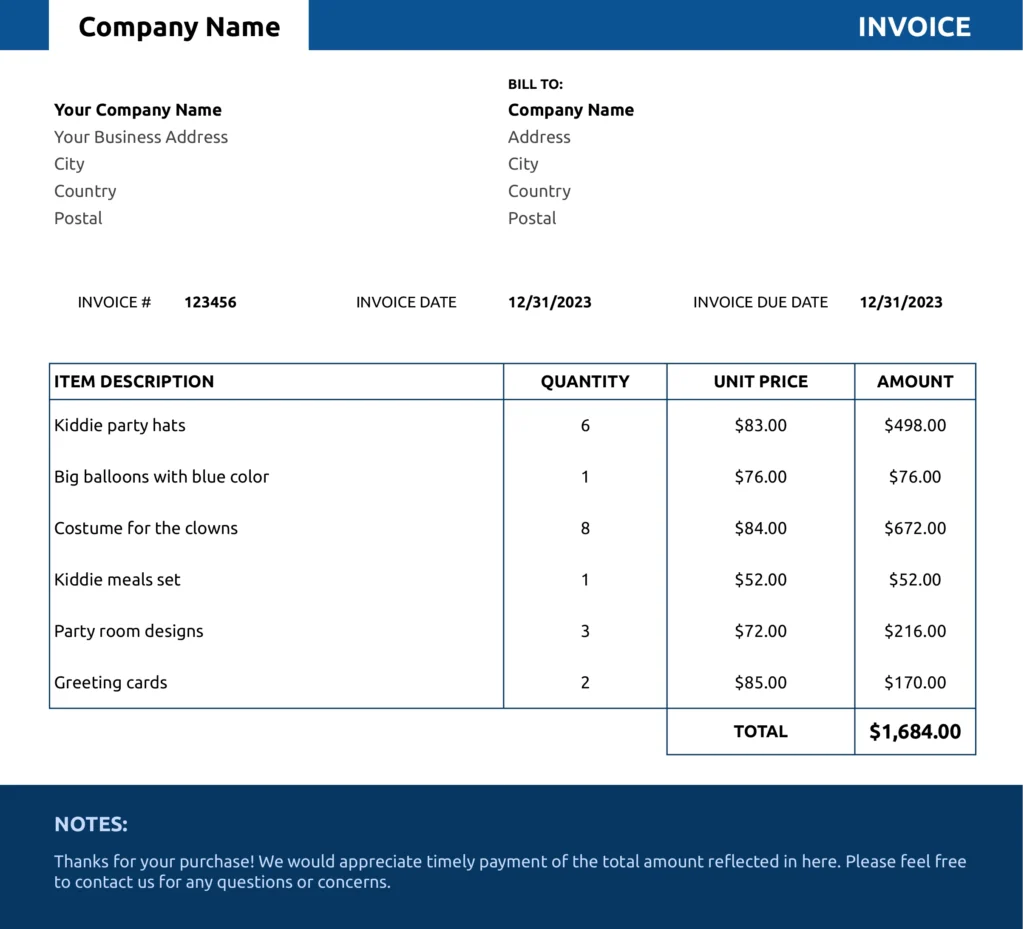

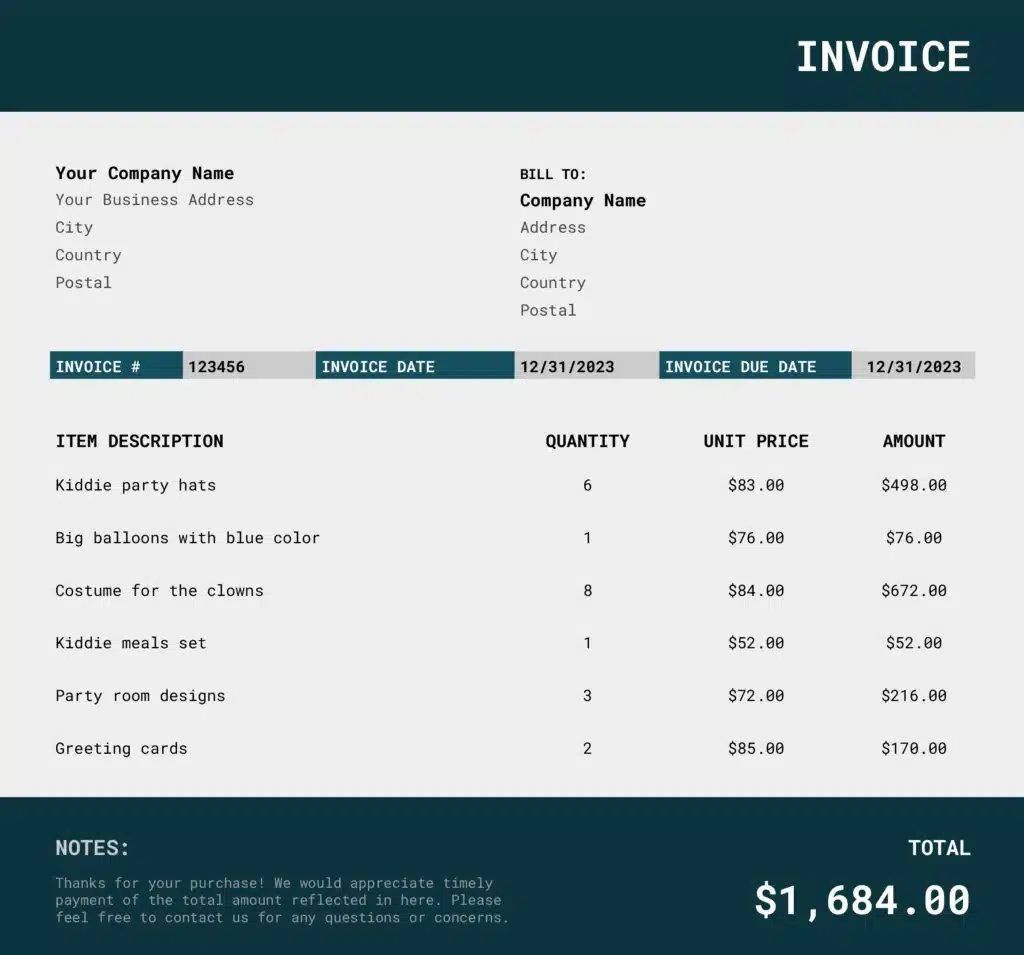

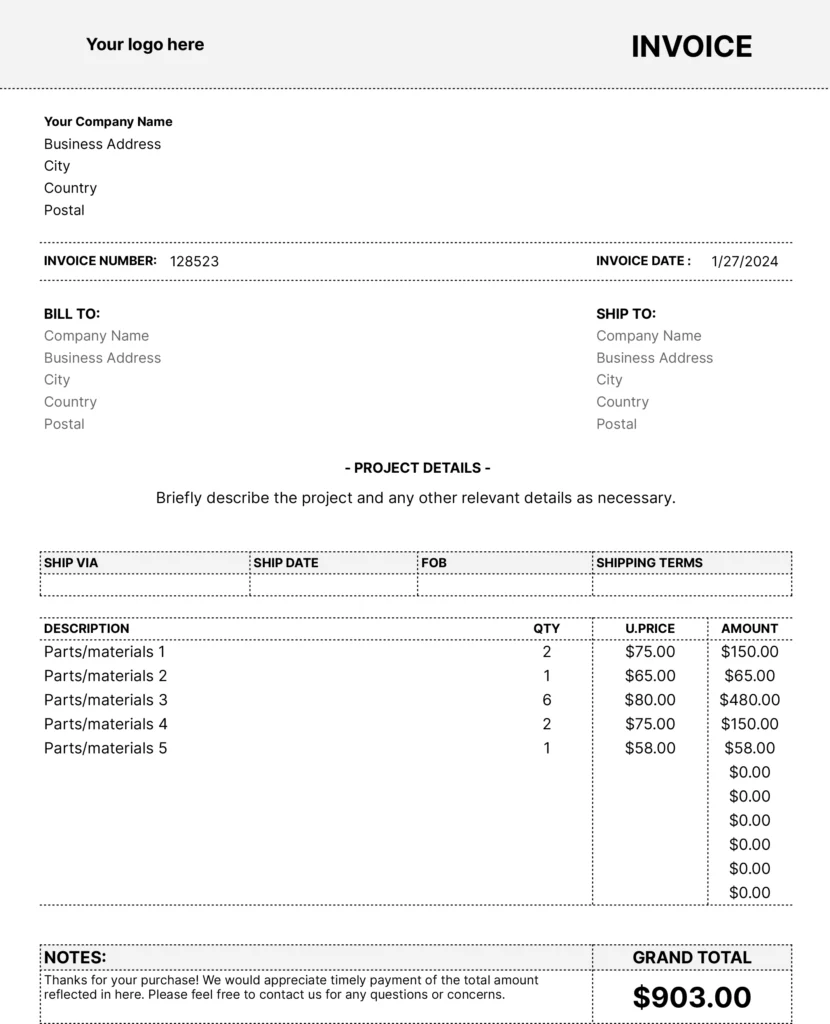

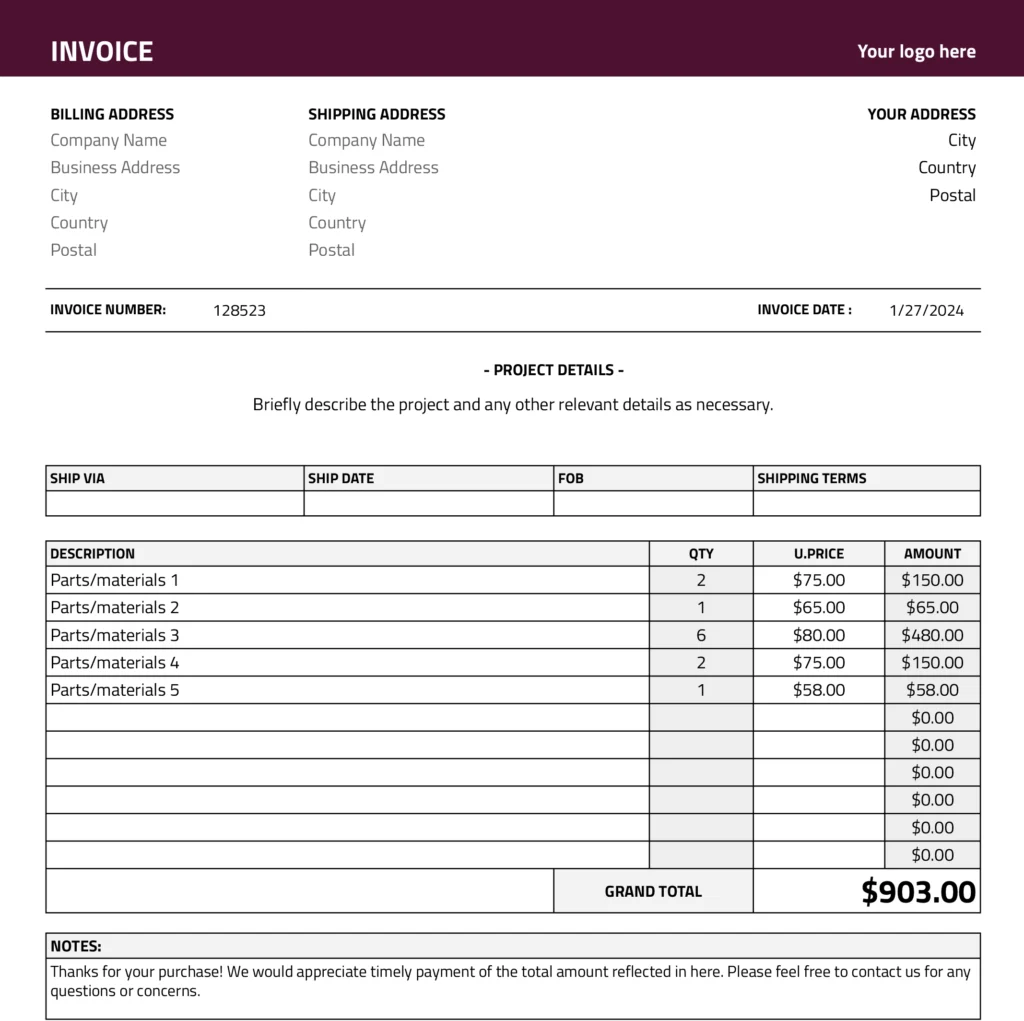

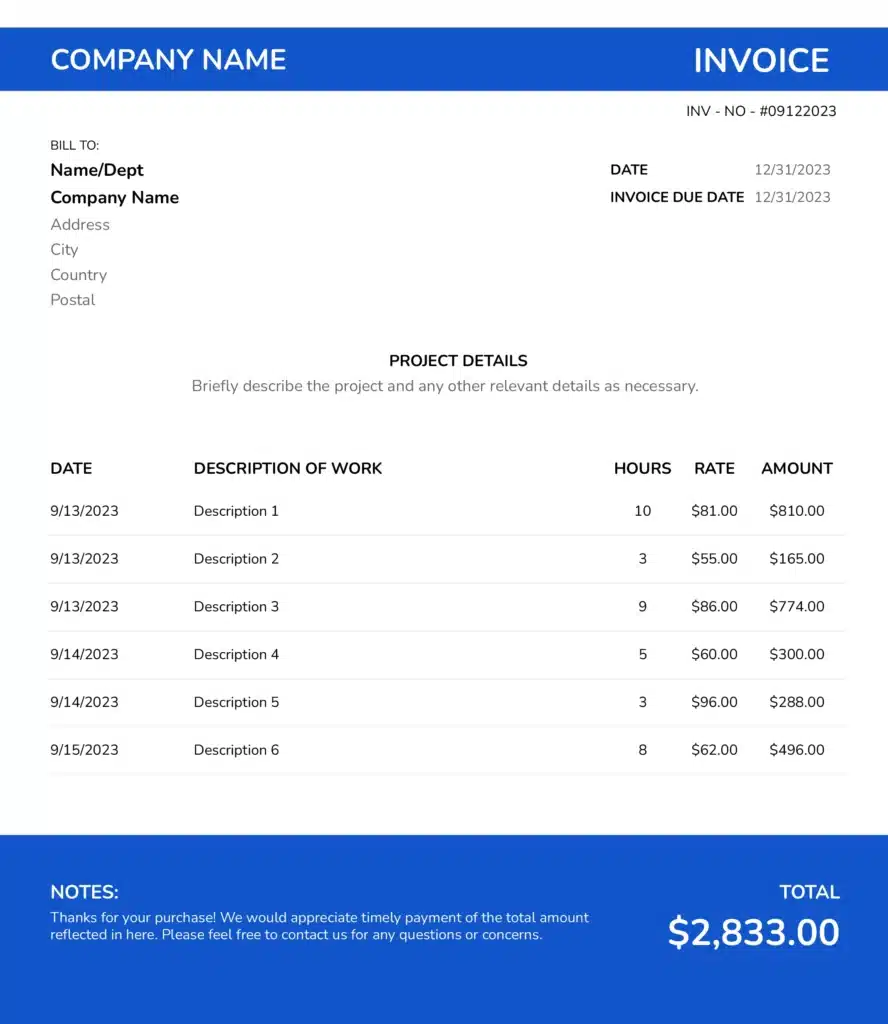

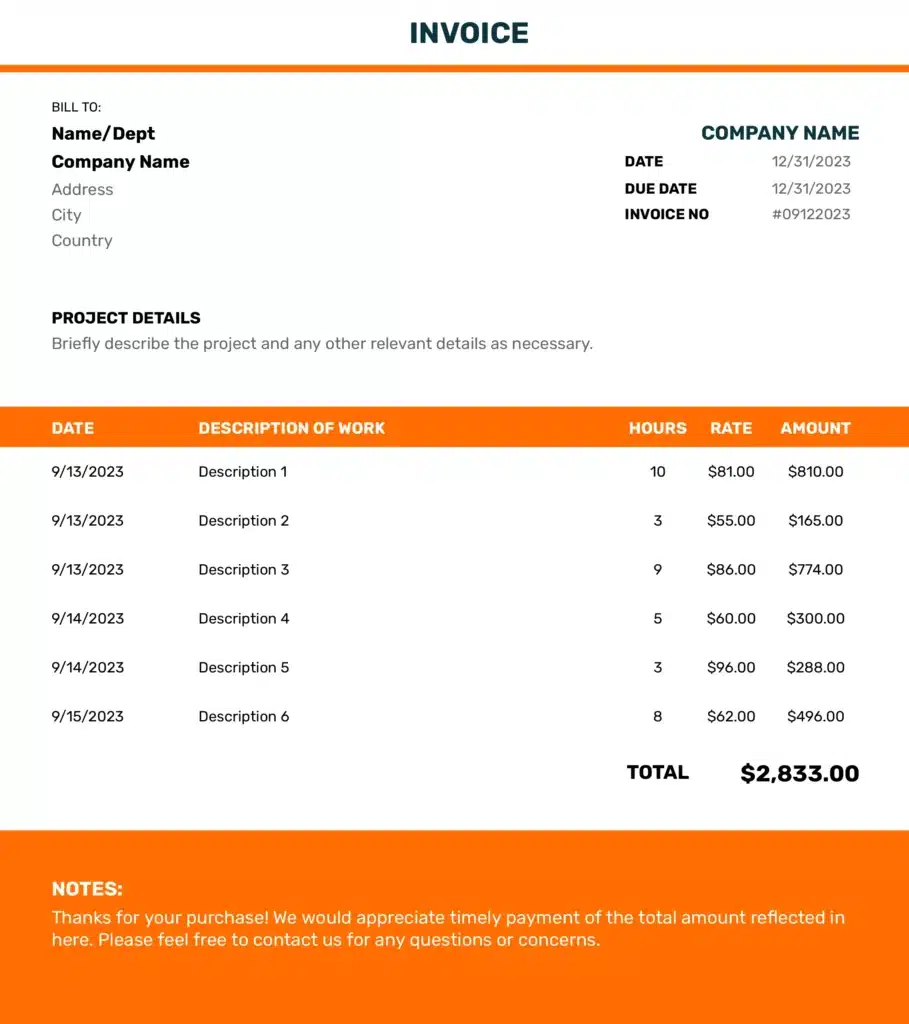

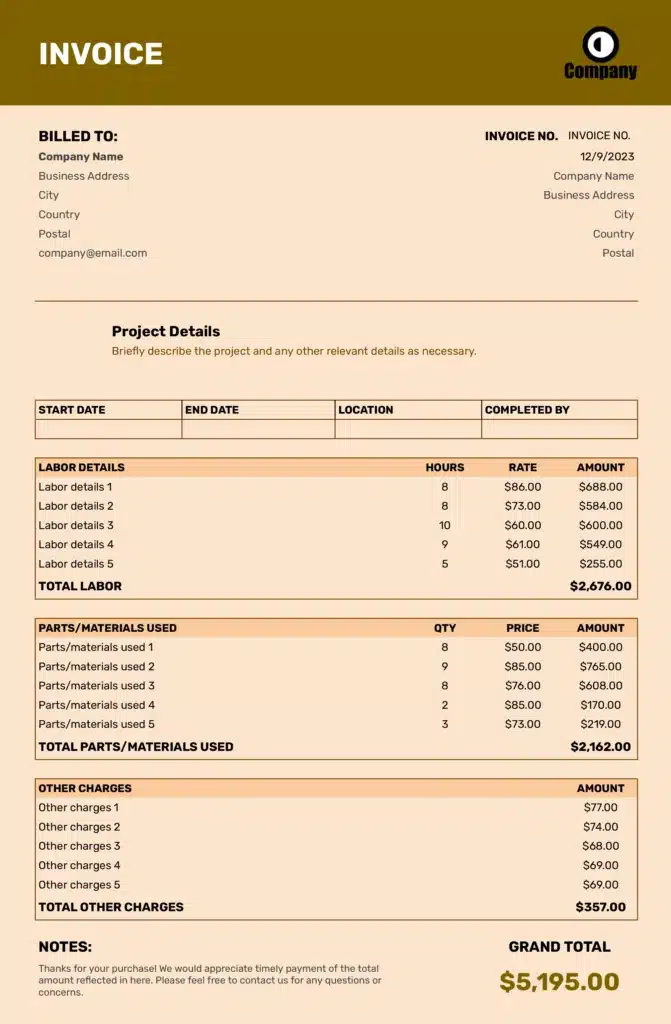

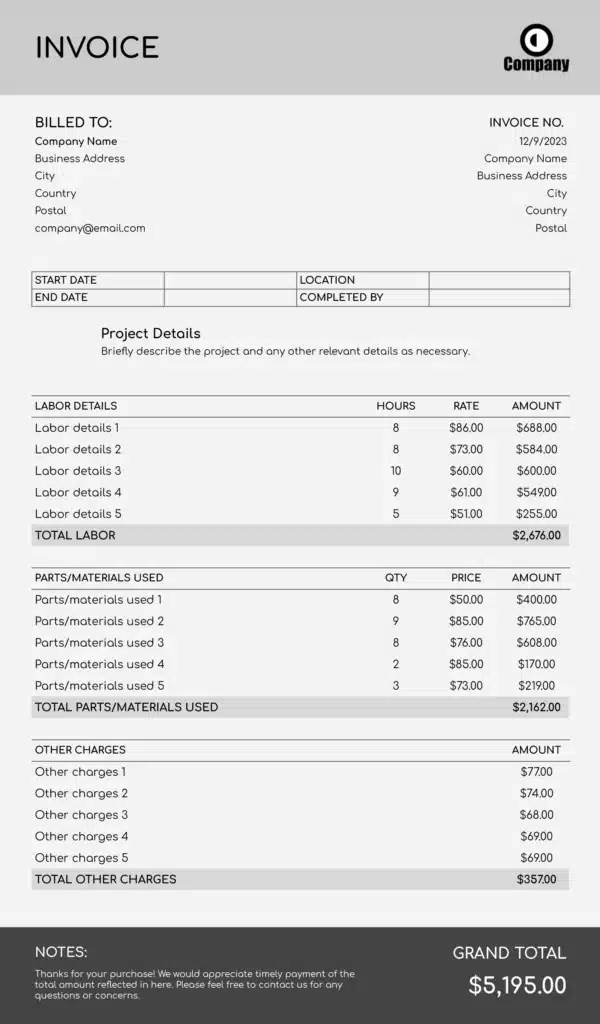

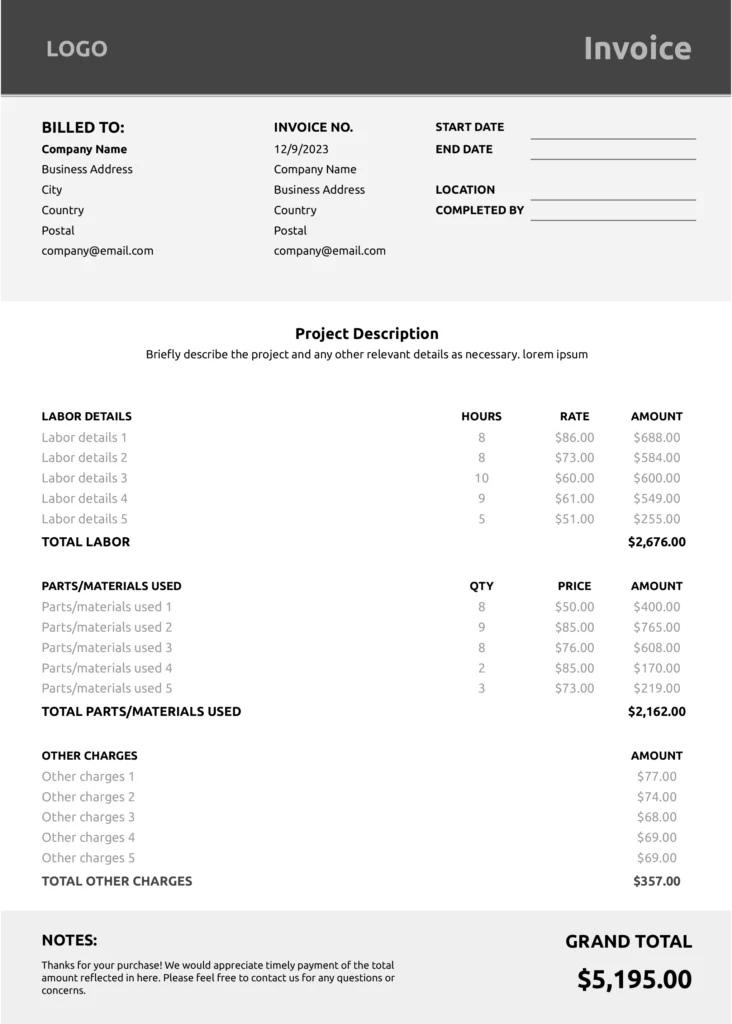

What Are the Key Components of a Proper Invoice?

- Business name and logo

- Invoice number

- Names of goods/services

- Unit cost of goods/services

- Total quantity of goods /services

- The total amount paid

- Tax applied

- Invoice date and time

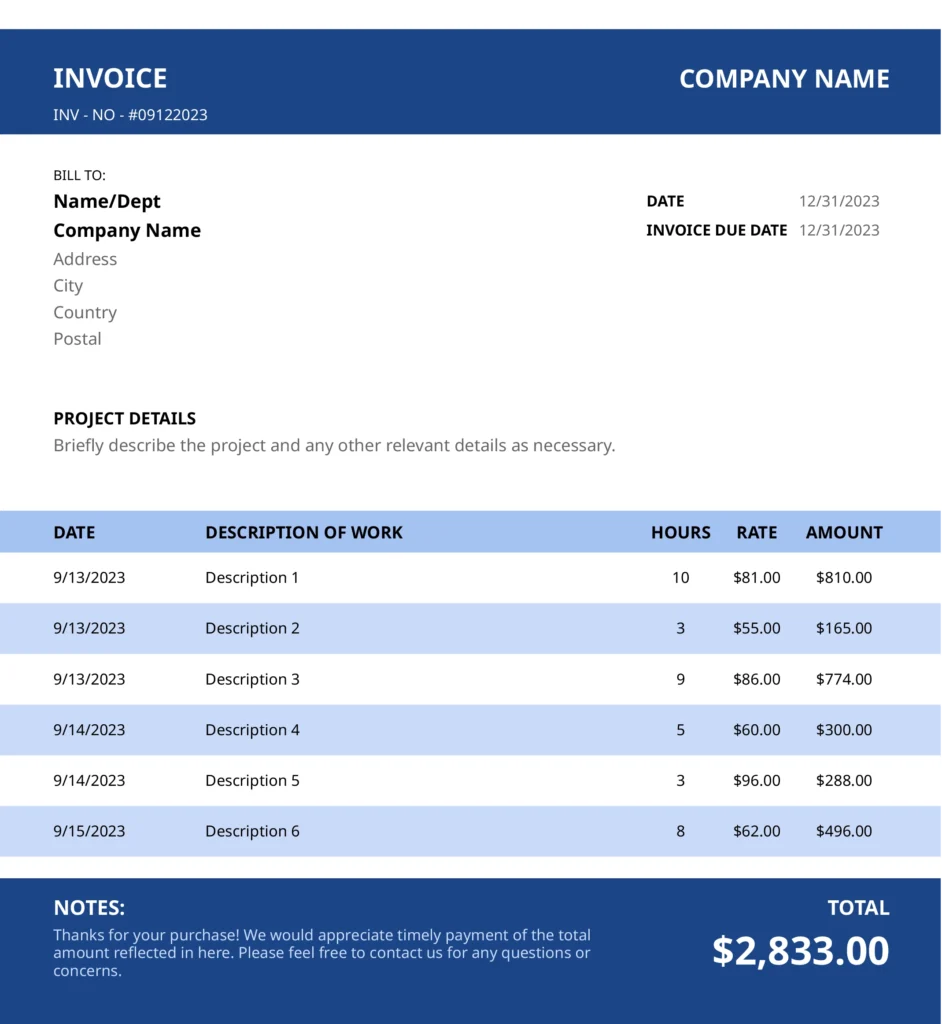

What Are the Benefits of Using a Template?

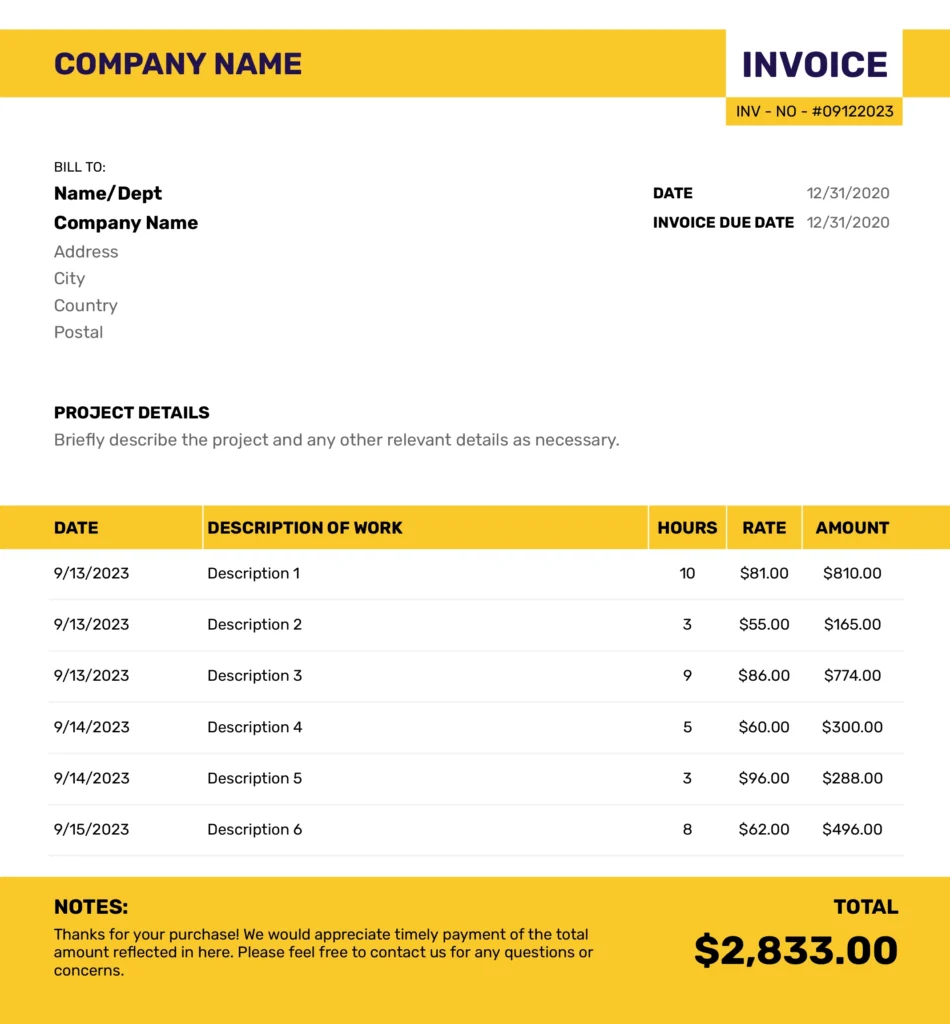

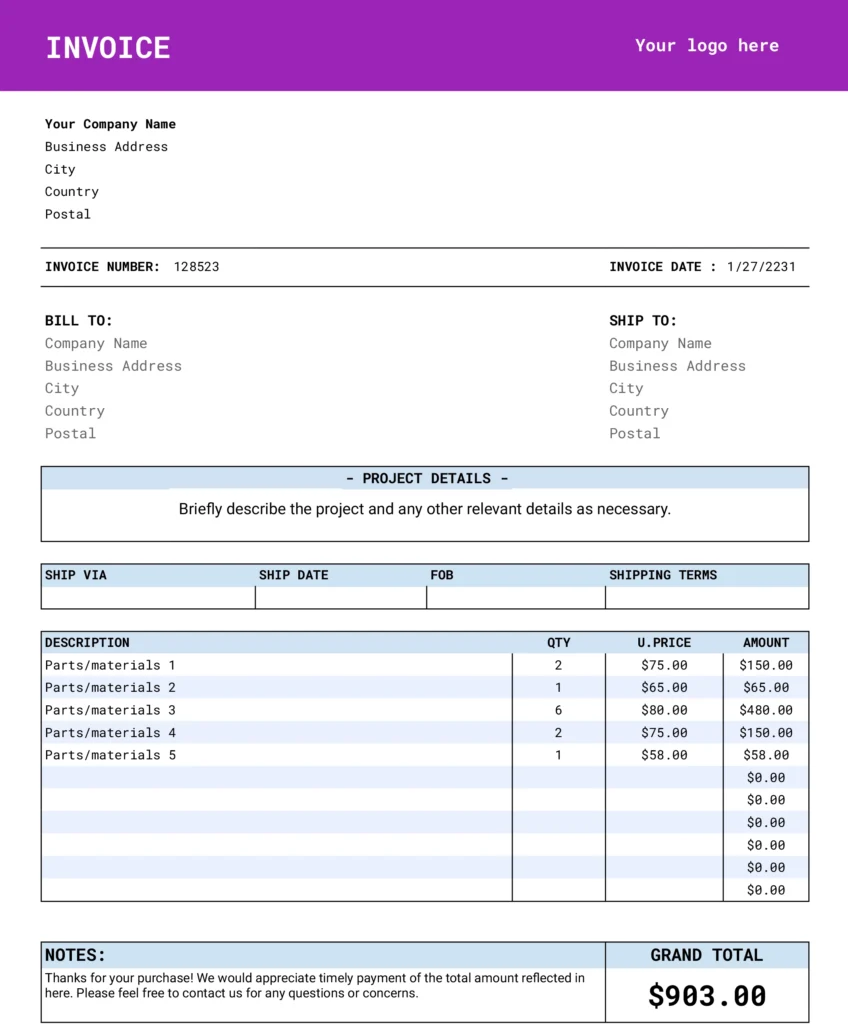

Invoice templates offer several benefits, including efficiency, accuracy, and professionalism. A template provides a standardized format that streamlines the invoicing process.

- Save Business Time

Invoice templates save time by providing a pre-designed format for users to fill in with specific details. Once the template is accessed you can generate an invoice with a few clicks.

- Consistent Experience

A consistent invoice format fosters a customer's sense of trust and reliability. It clarifies communication, elevates professionalism, and bolsters a company's brand identity.

- Error Reduction

Invoice discrepancies, especially calculation errors, can cause payment delays and disputes. This template provides designated sections for subtotals, taxes, and totals, minimizing the chance of manual mistakes.

How Do You Use This Google Sheets Template?

Now you have learned the basics of a simple invoice template, let's dig into how to use a Google Sheets invoice template and customize it with your business details:

- Launch Google Sheets: Then, open the Coefficient simple invoice template.

- Update Business Details: At the top, replace placeholders with your specific business information.

- Input Customer Details: Fill in the designated box with your customer's information.

- Invoice Essentials: Within the invoice section, include the date, invoice number, payment terms, and reference number.

- Itemize Products/Services: Use the provided table to list and describe each product or service, noting quantity, price, and line total.

- Check the Calculations: Most templates will auto-calculate subtotals, taxes, and the final payment amount.

- Include Payment Instructions: If necessary, specify how your customers should proceed with their payment.

What Are Some Tips for Creating Effective Invoices?

There are several established tips that can assist you in creating effective invoices. Here are a few tips to follow.

Include All The Payment Details

As mentioned earlier, include all the important payment details while creating an effective invoice. These details can be your

- Business name and logo

- Invoice number

- Names of goods/services

- The unit cost of goods/services

- The quantity of goods /services

- The total amount paid

- Tax applied

- Invoice date and time

Send Invoice Promptly

Immediately send an invoice upon delivery of goods. This not only ensures that customers receive timely documentation of their purchases but helps you collect the cash on time.

Adding Payment Term

When outlining payment terms in invoices, make it clear and specific. Avoid ambiguous phrases like “payment due upon receipt” and instead provide an exact due date. A timeline will help the customers stay organized and pay the dues before the deadlines.

Many Payment Options

Offer your customer multiple payment options. It gives your customer flexibility to pay you instantly. Also offering varied payments not only simplifies payment but also nurtures positive customer relationship and enhance your cash flow management.

Send Out Regular Reminders

Lastly, issue a reminder to the customers regarding outstanding invoices. This approach is not only helpful for smooth operation but also helps you collect late payments.