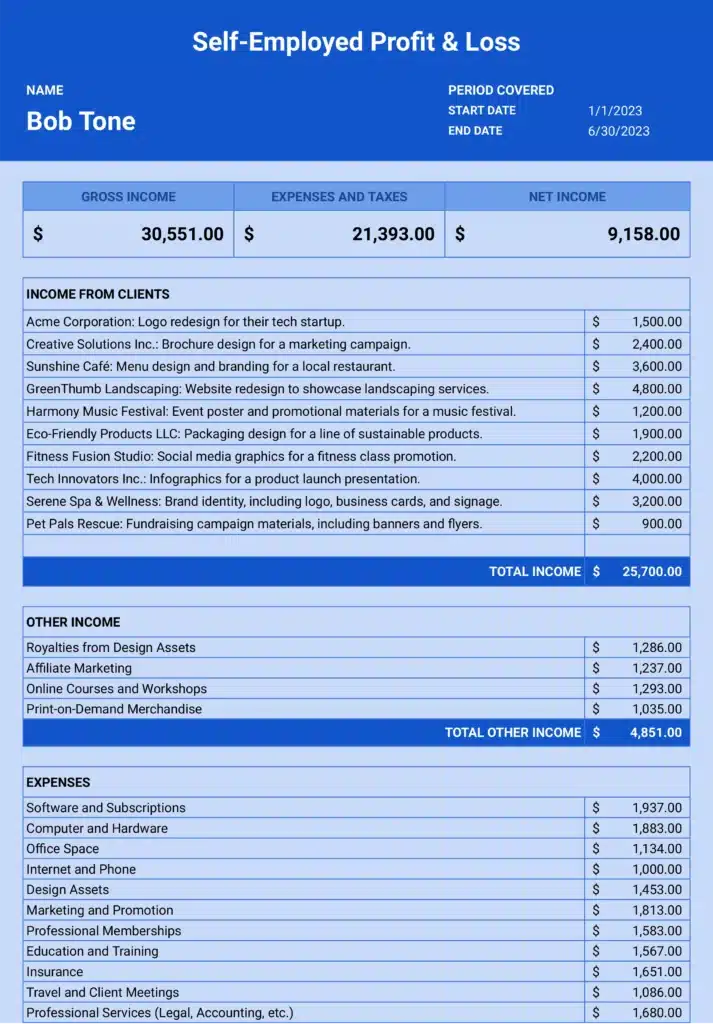

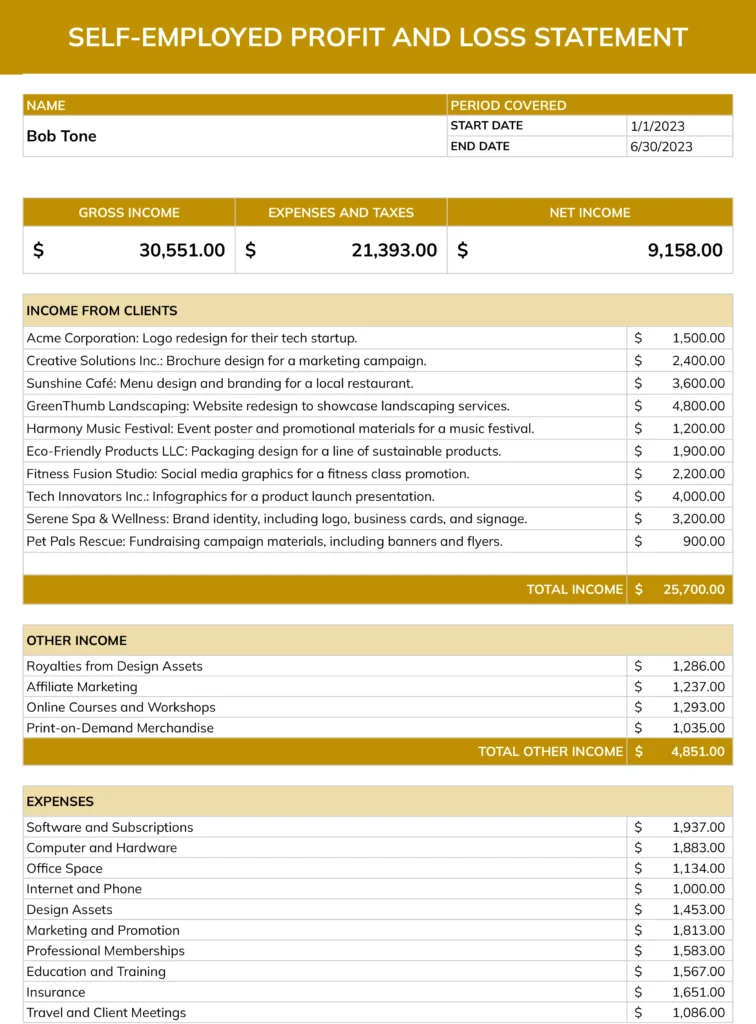

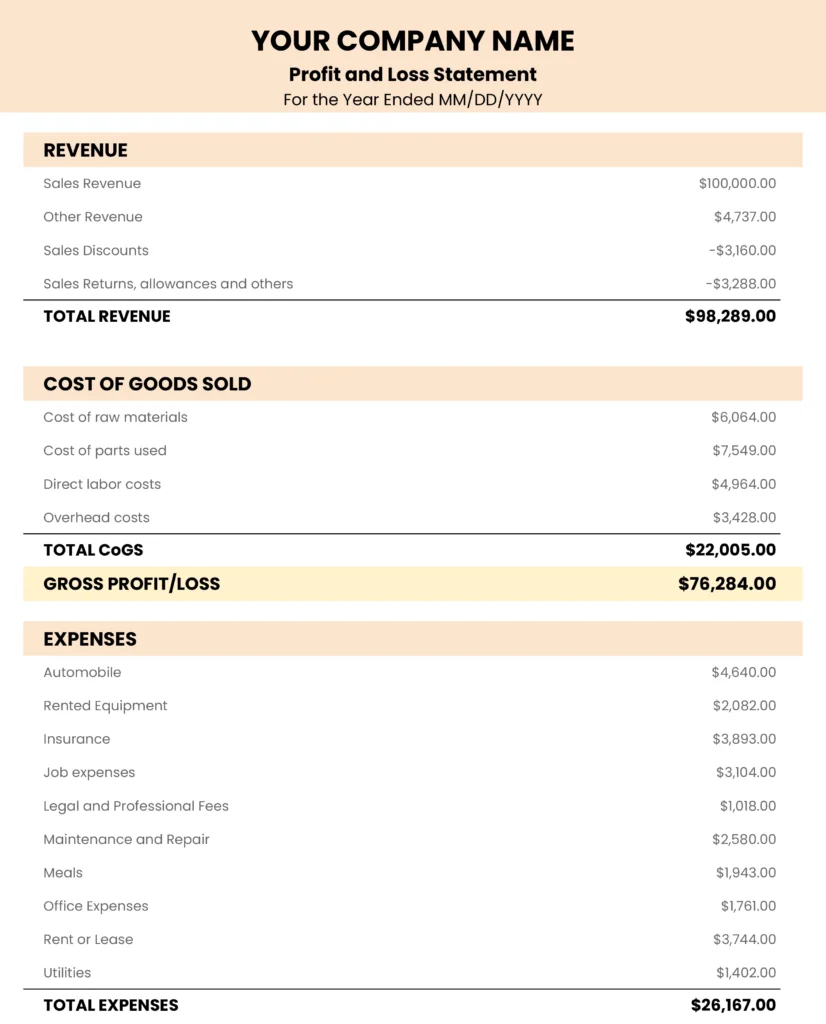

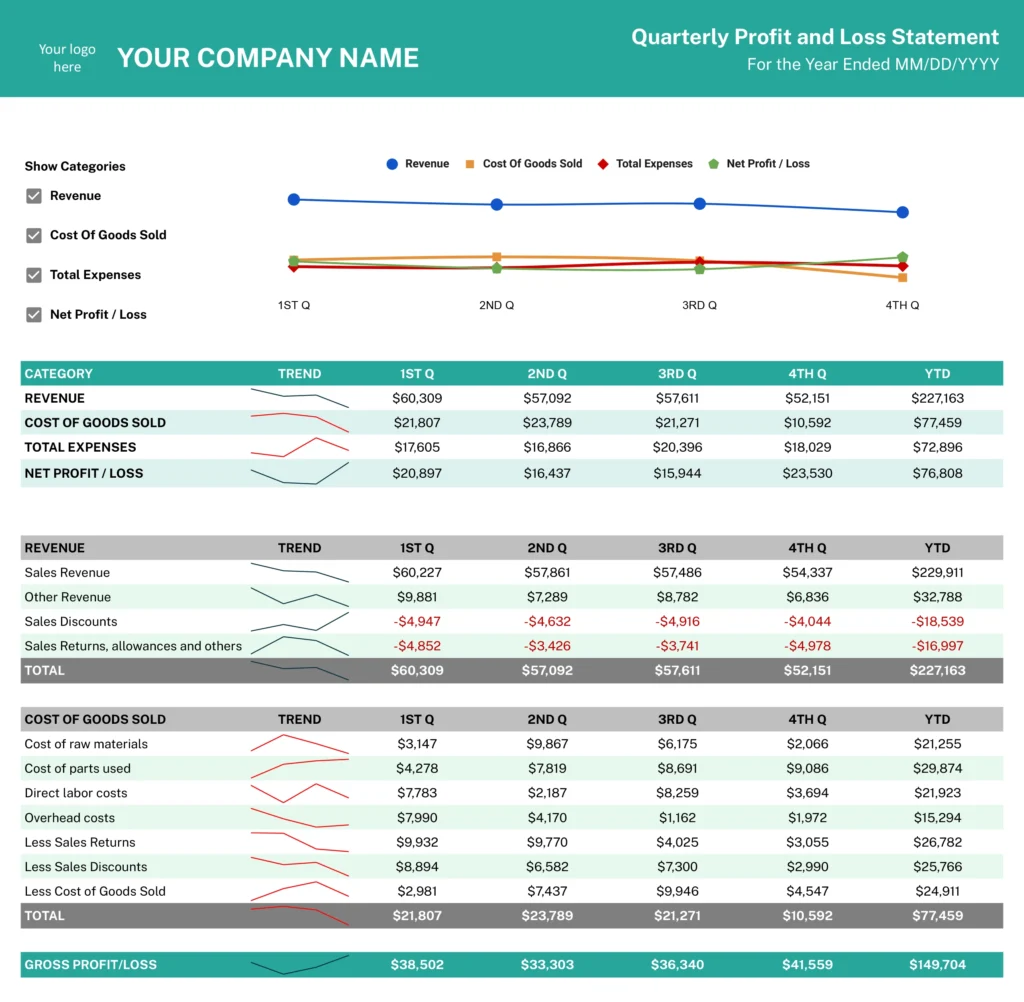

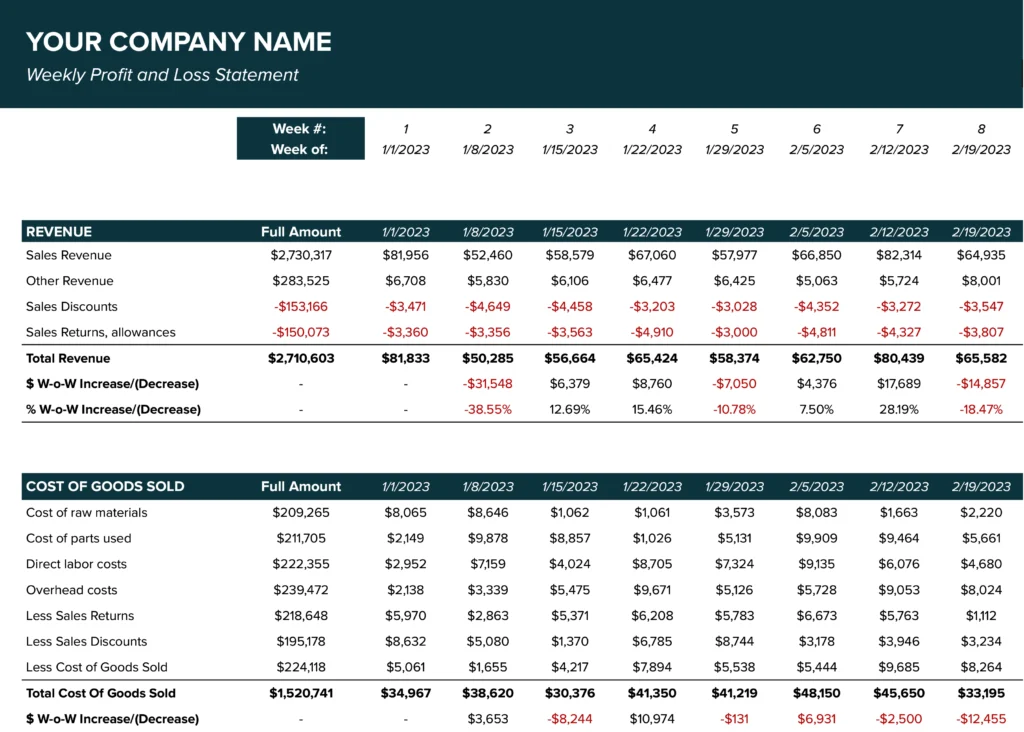

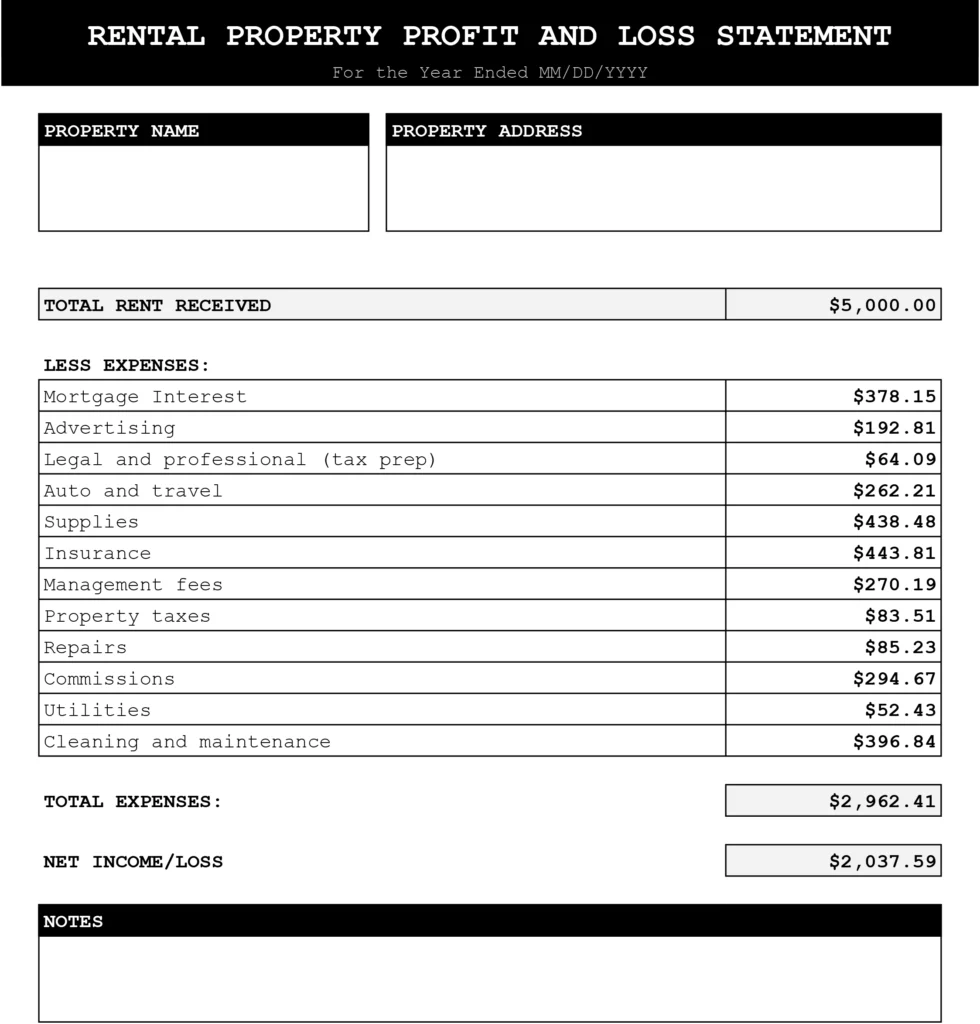

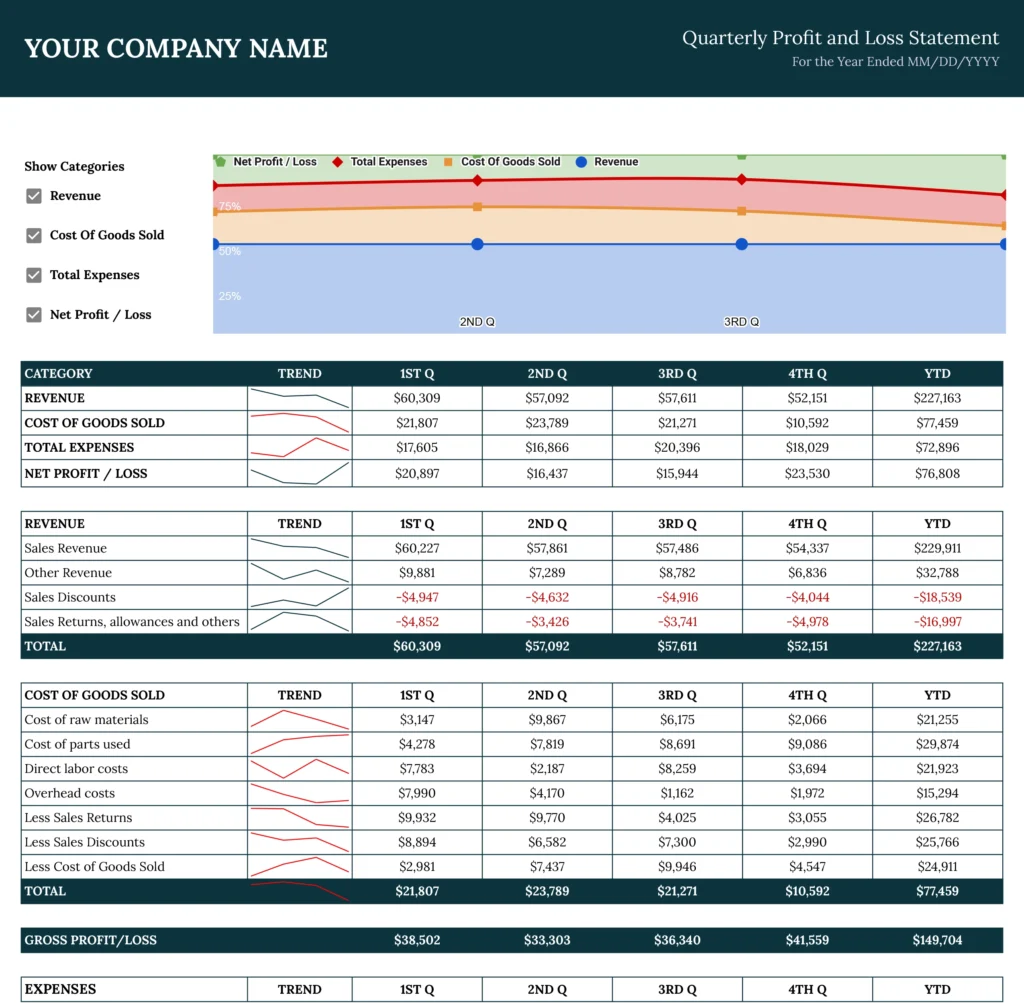

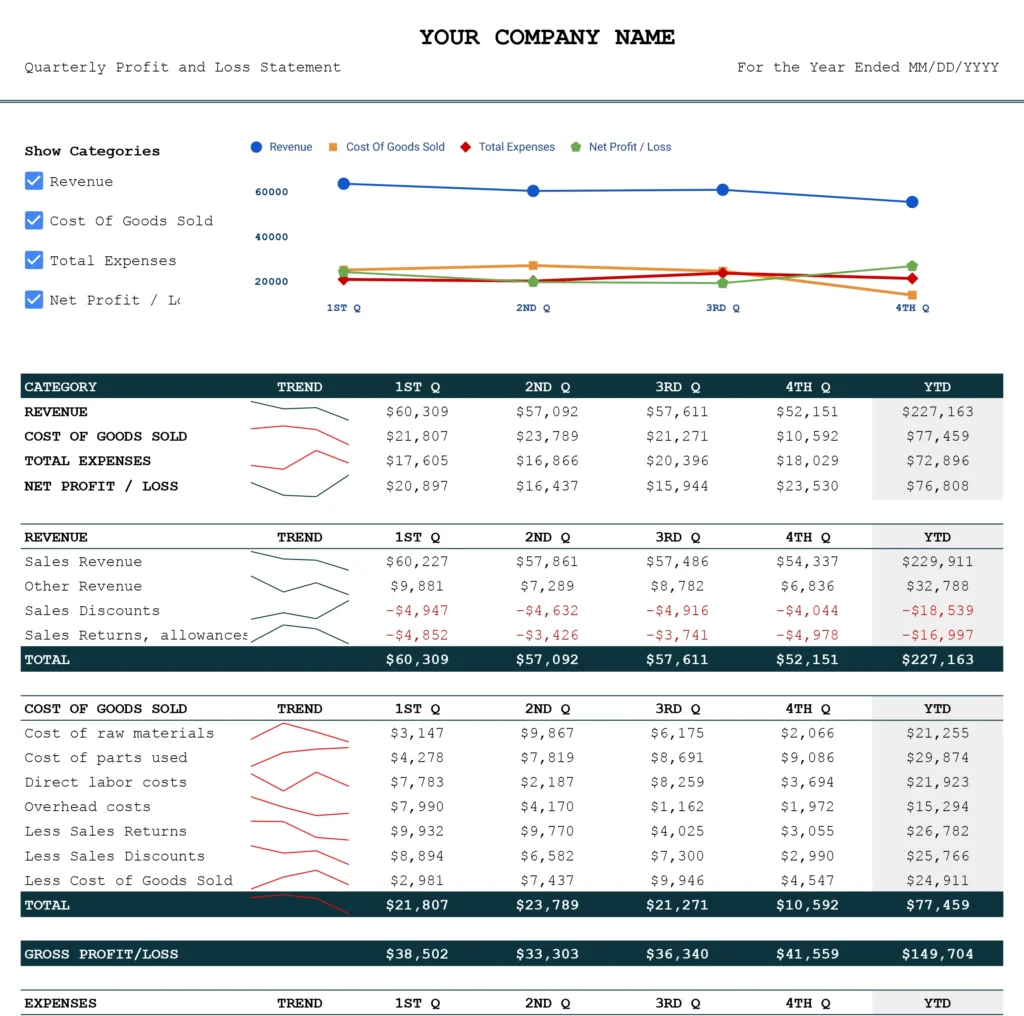

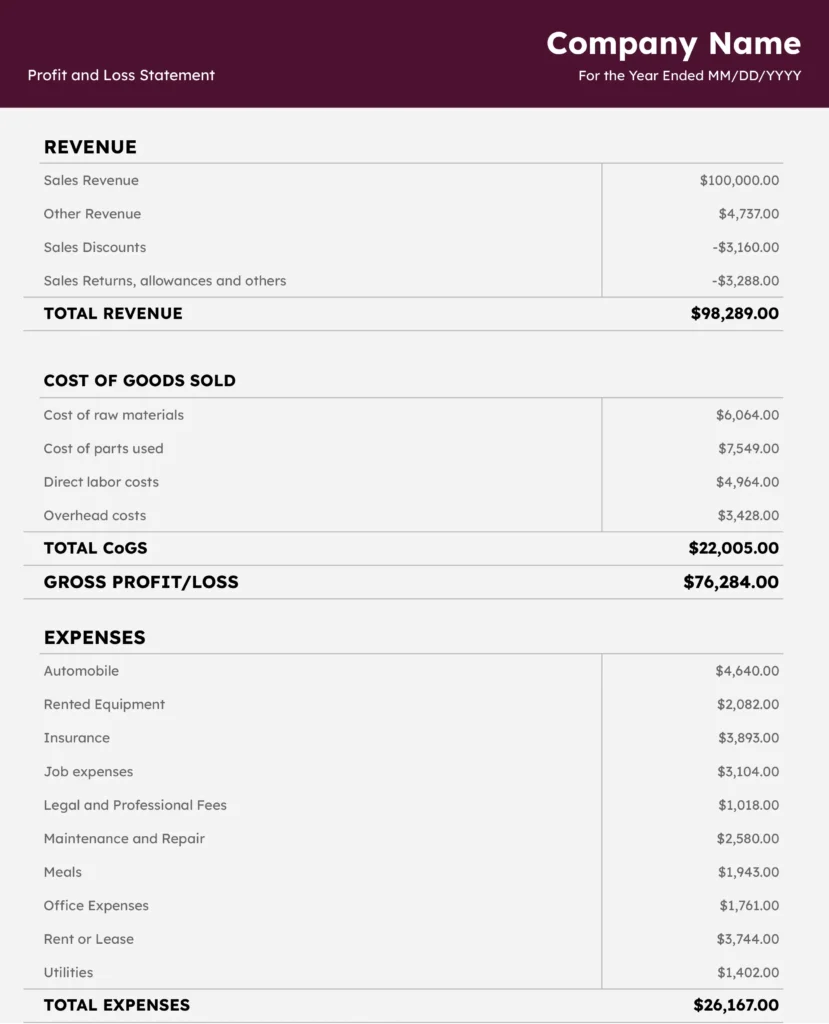

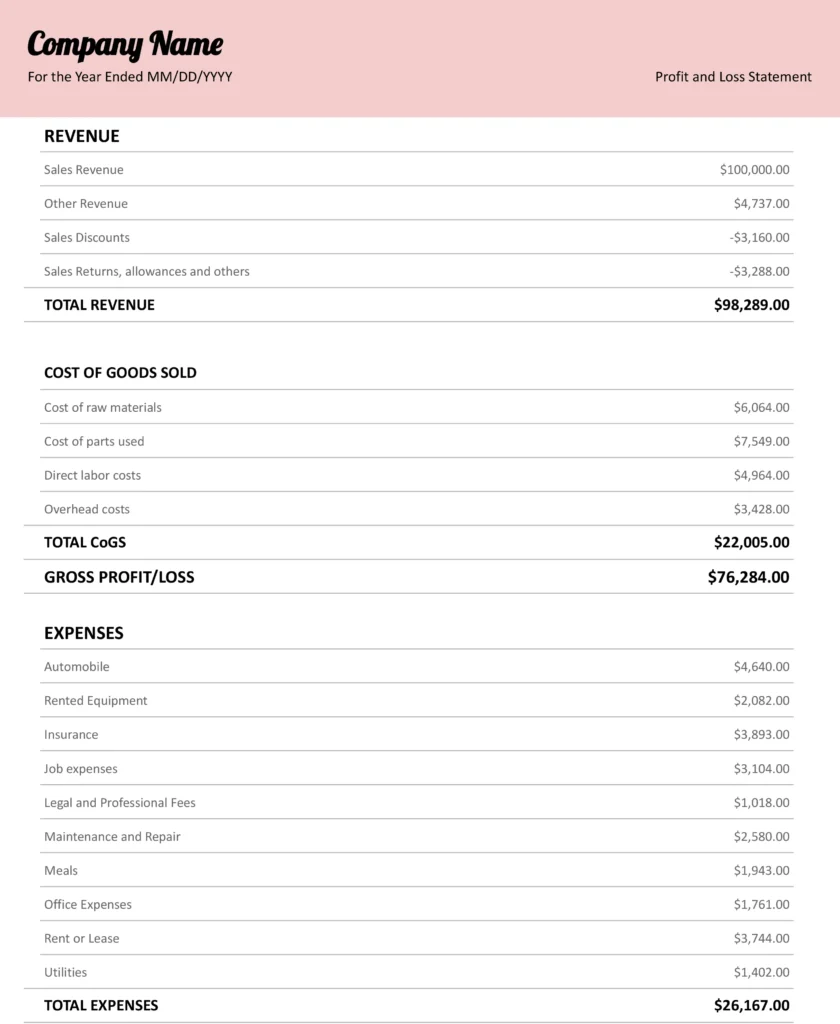

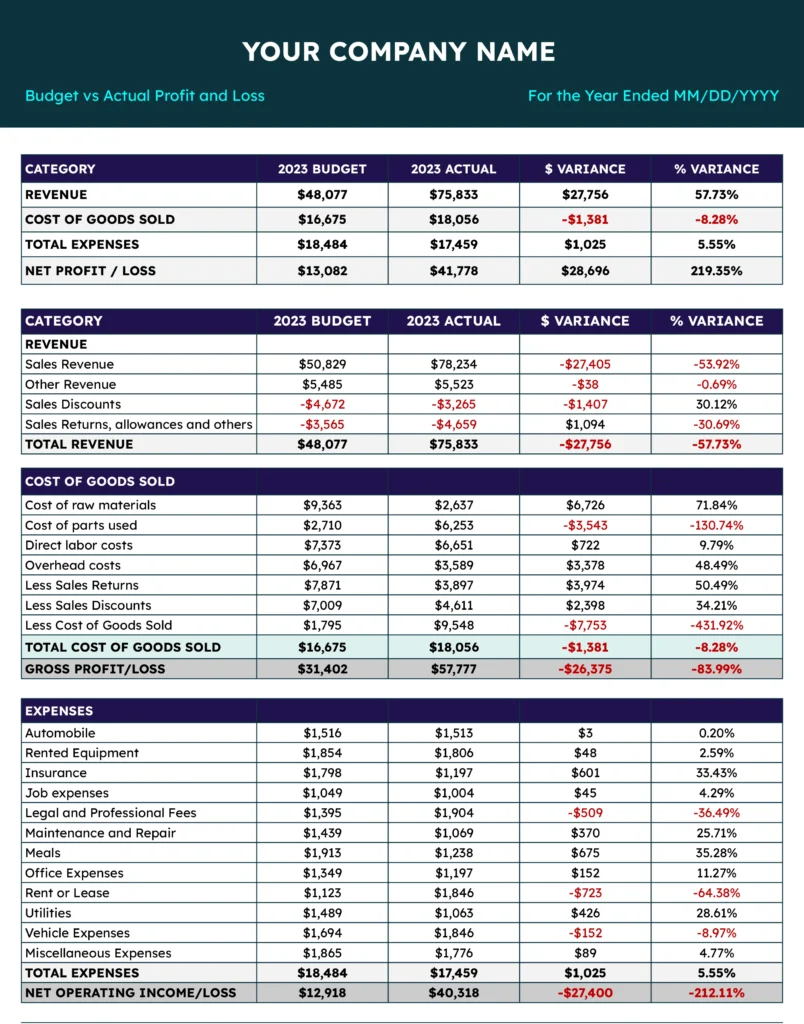

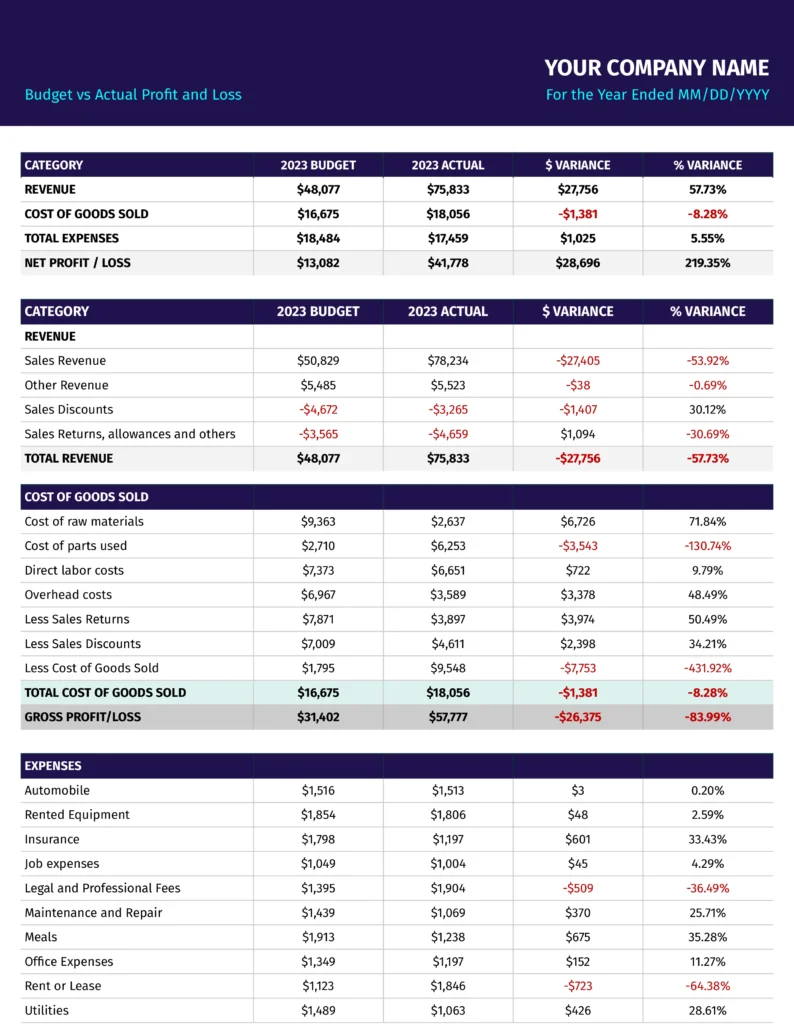

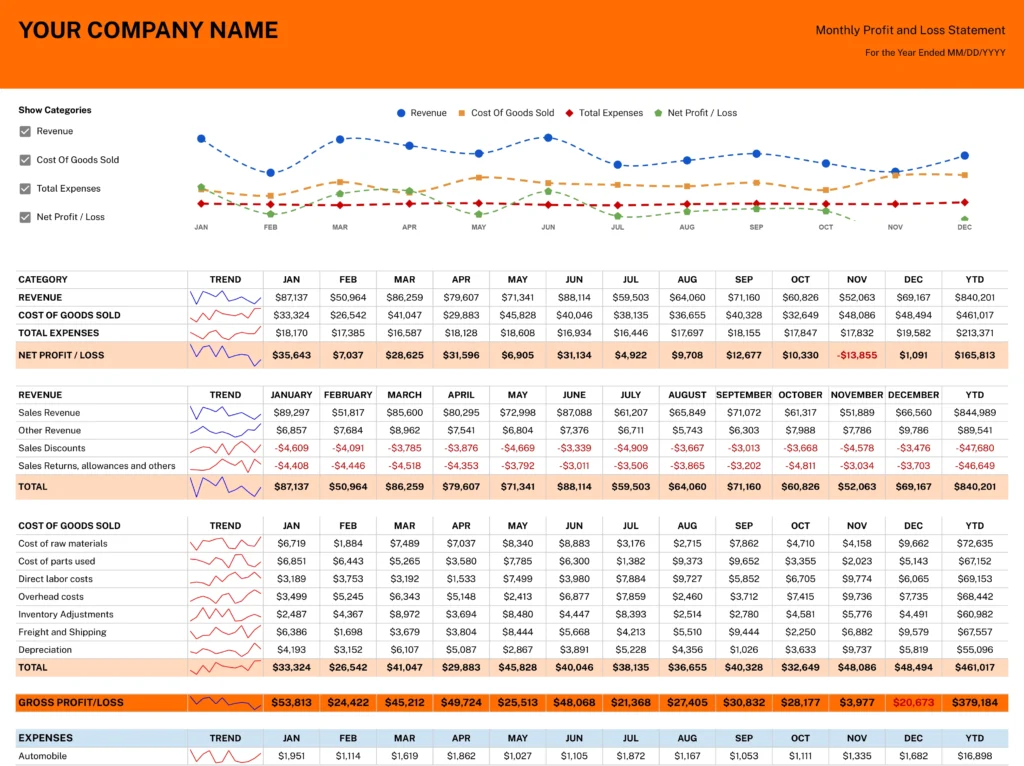

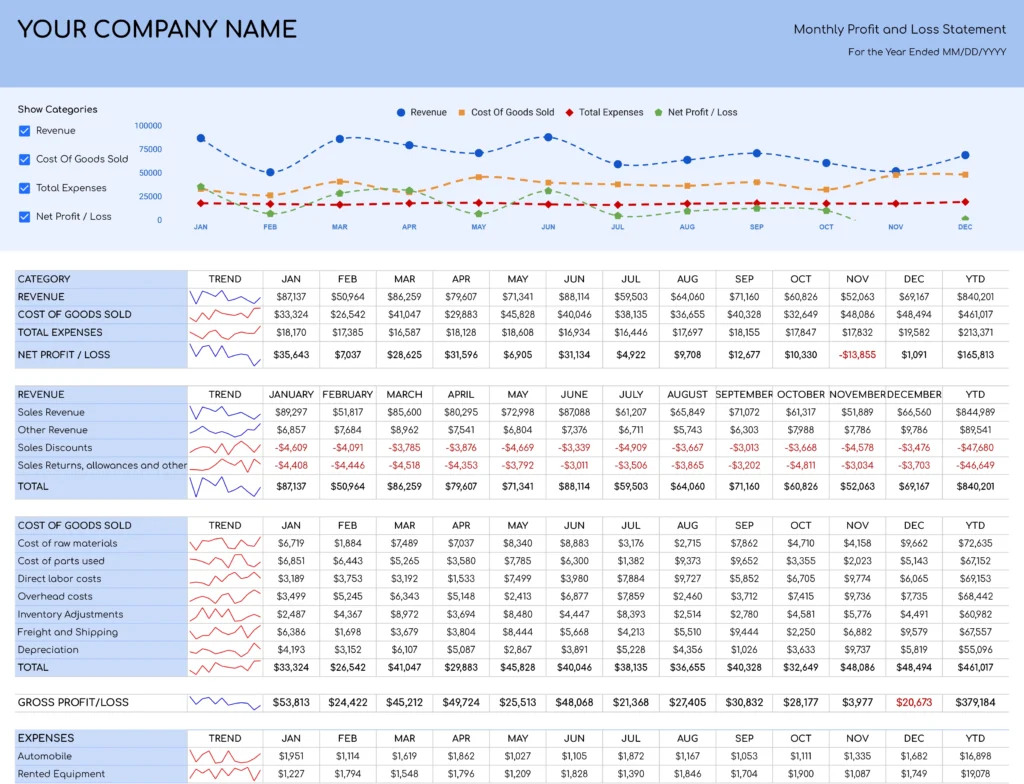

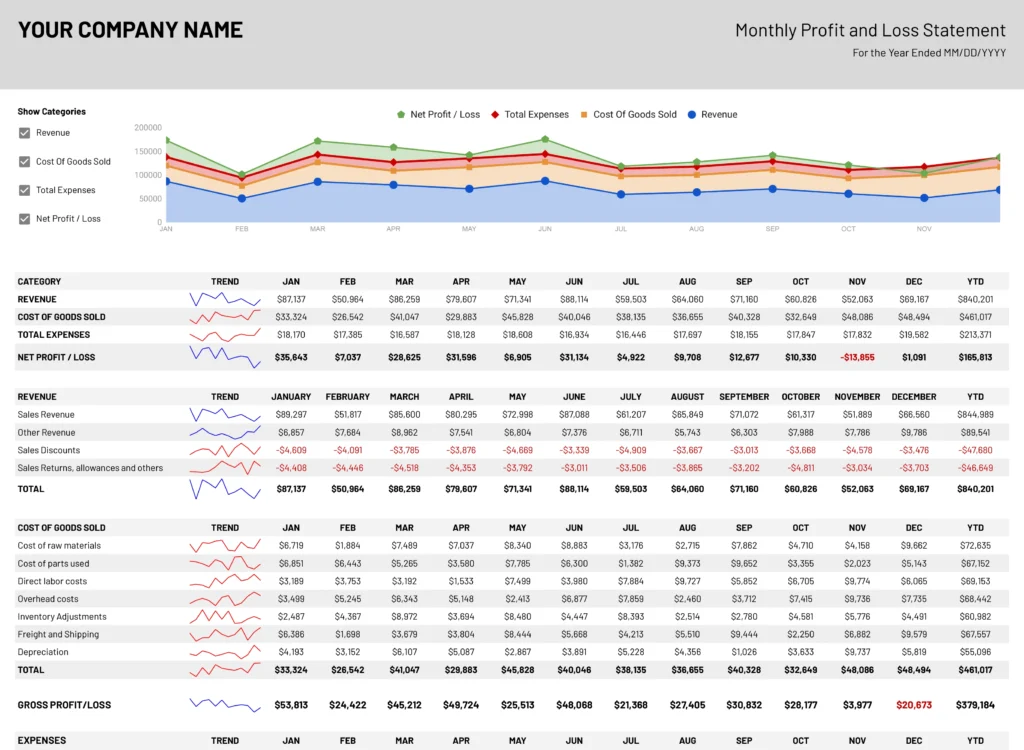

Small Business P&L Statement

Streamline your financial tracking with our small business Profit and Loss statement template for 2024. Download your free copy now.

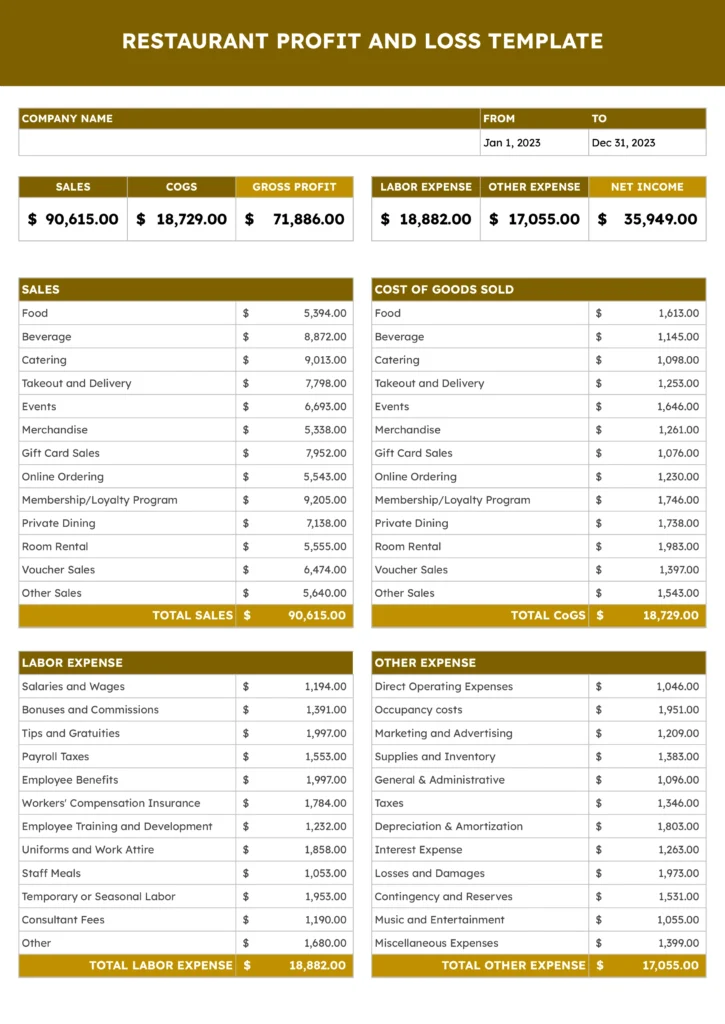

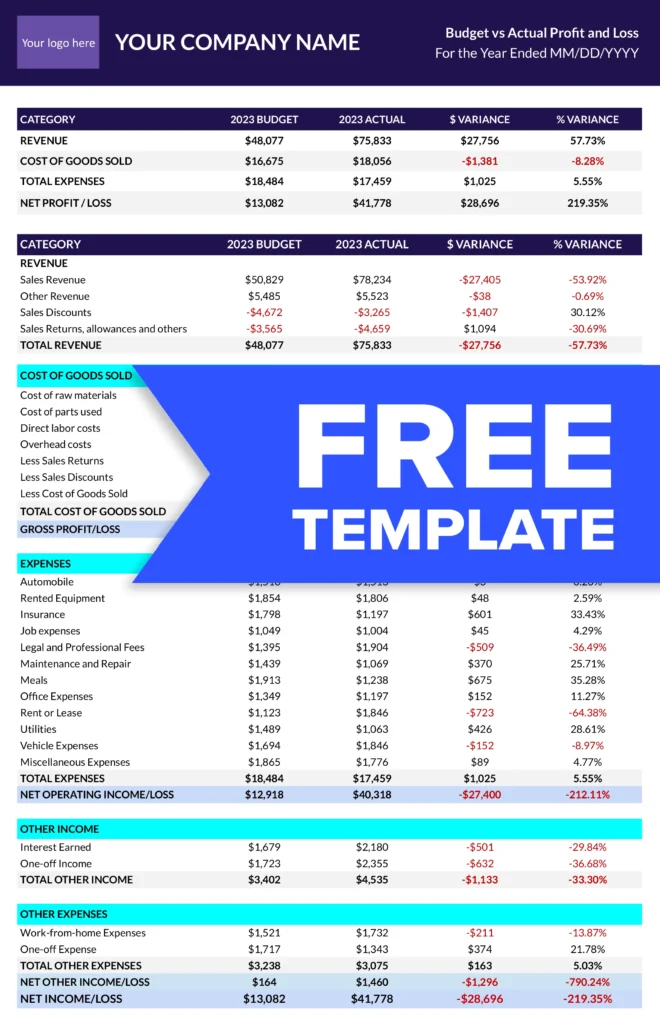

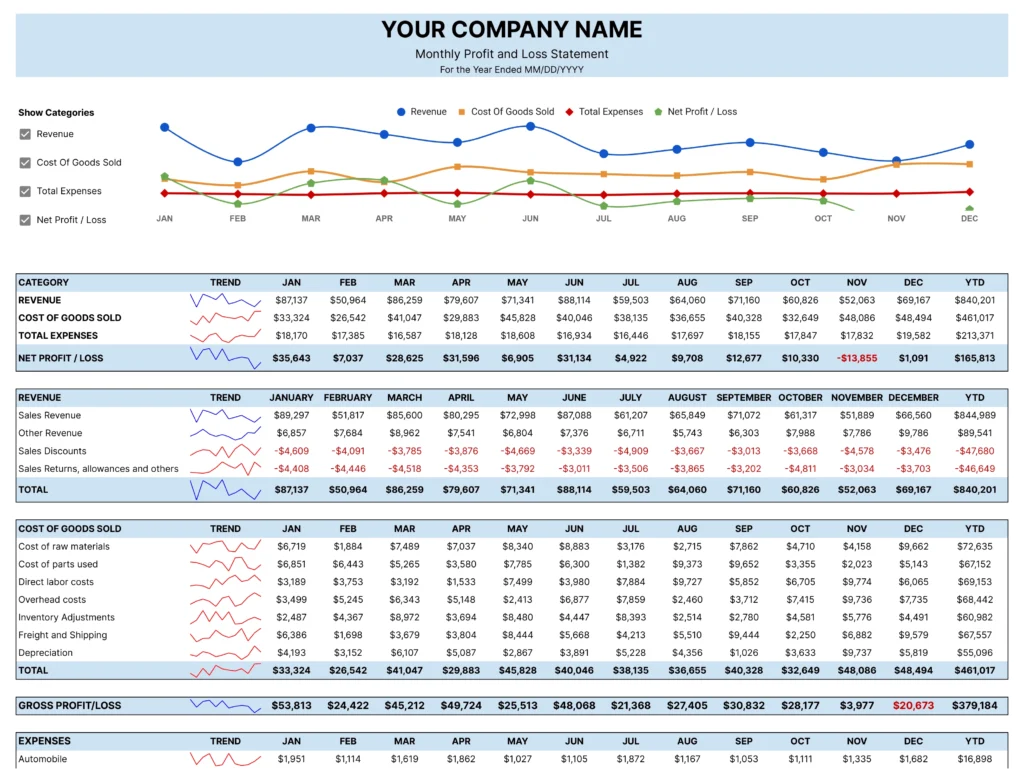

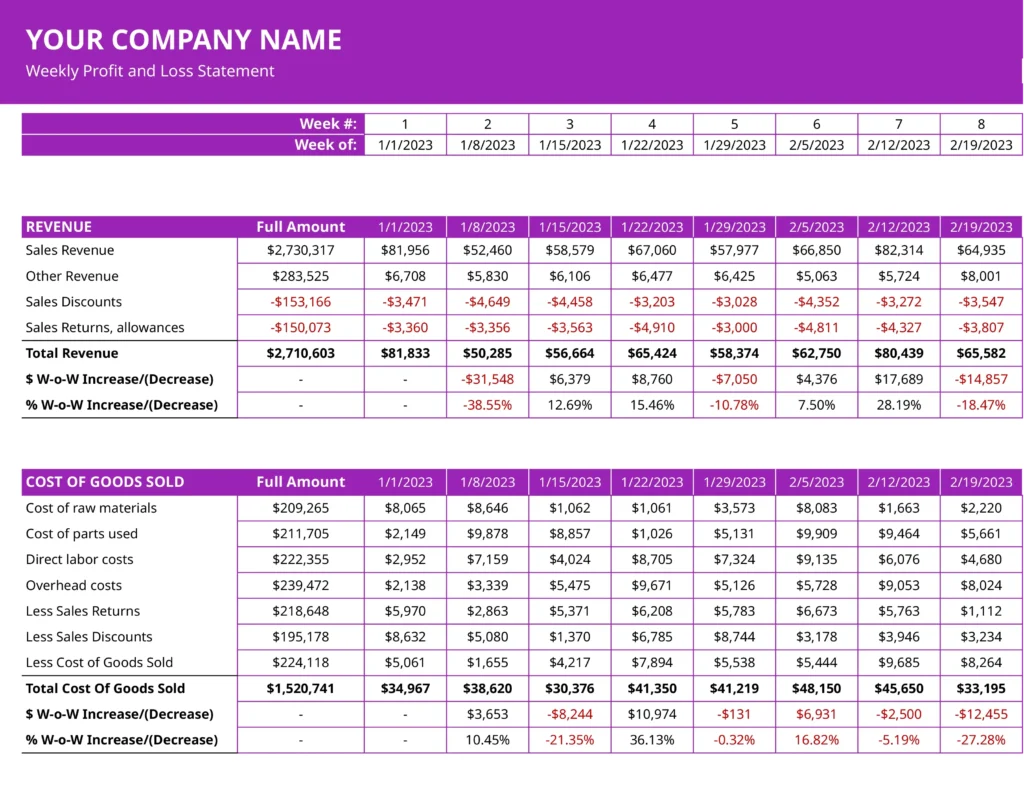

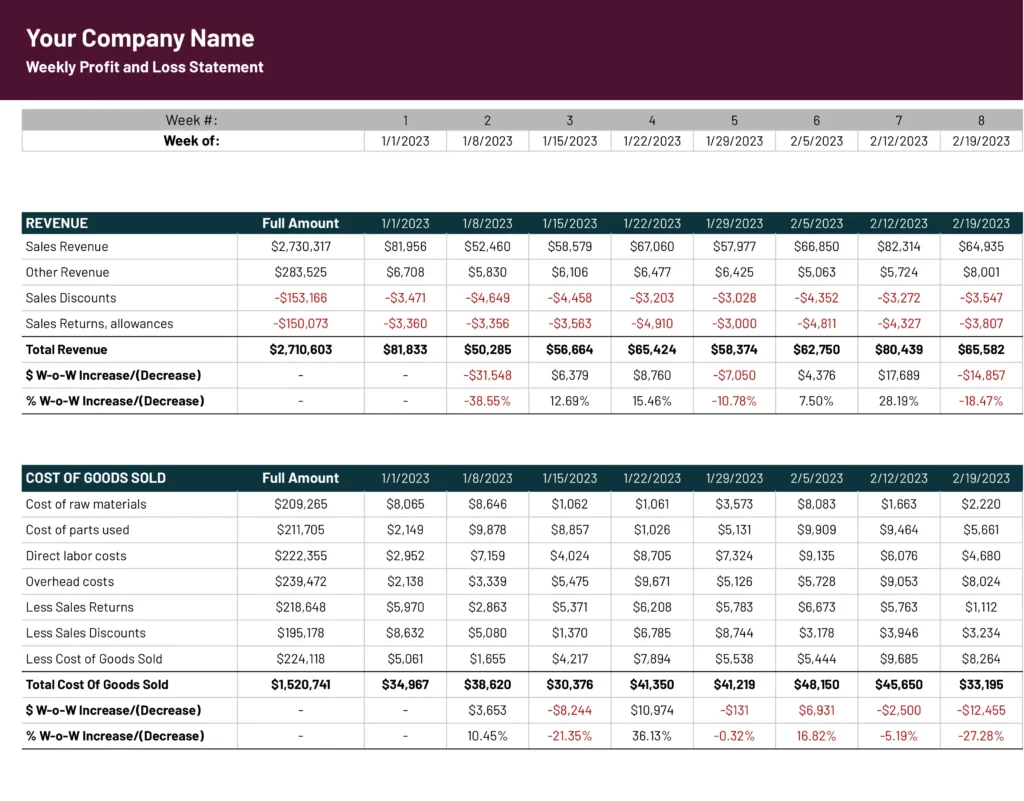

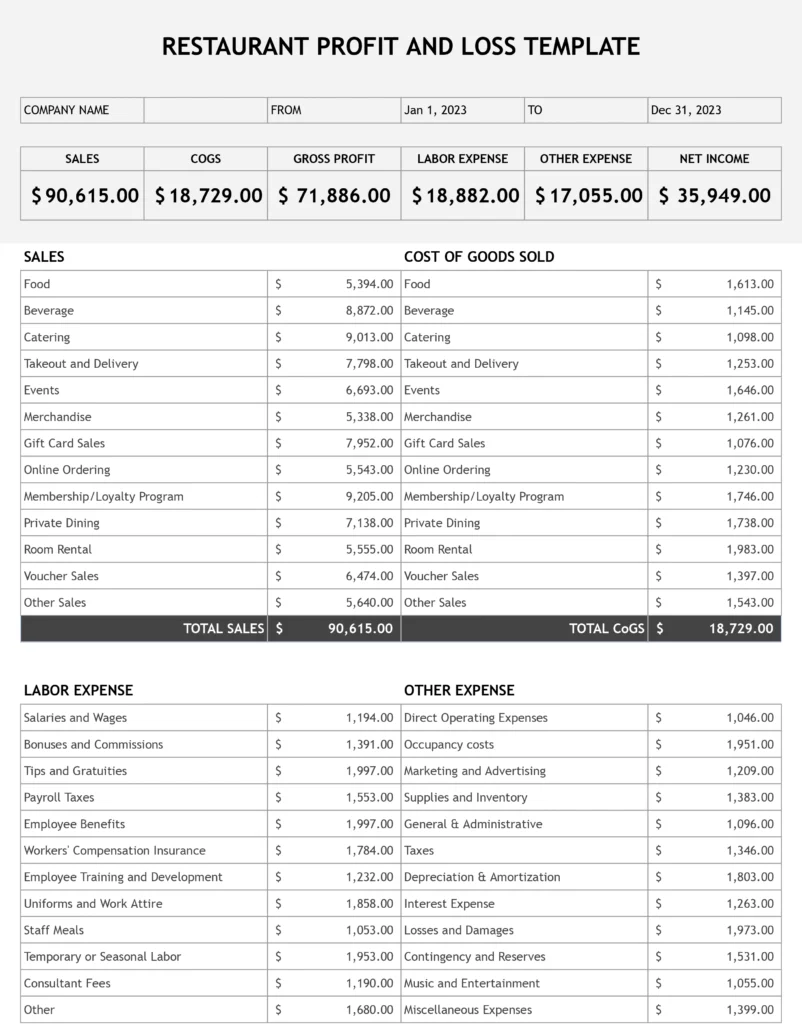

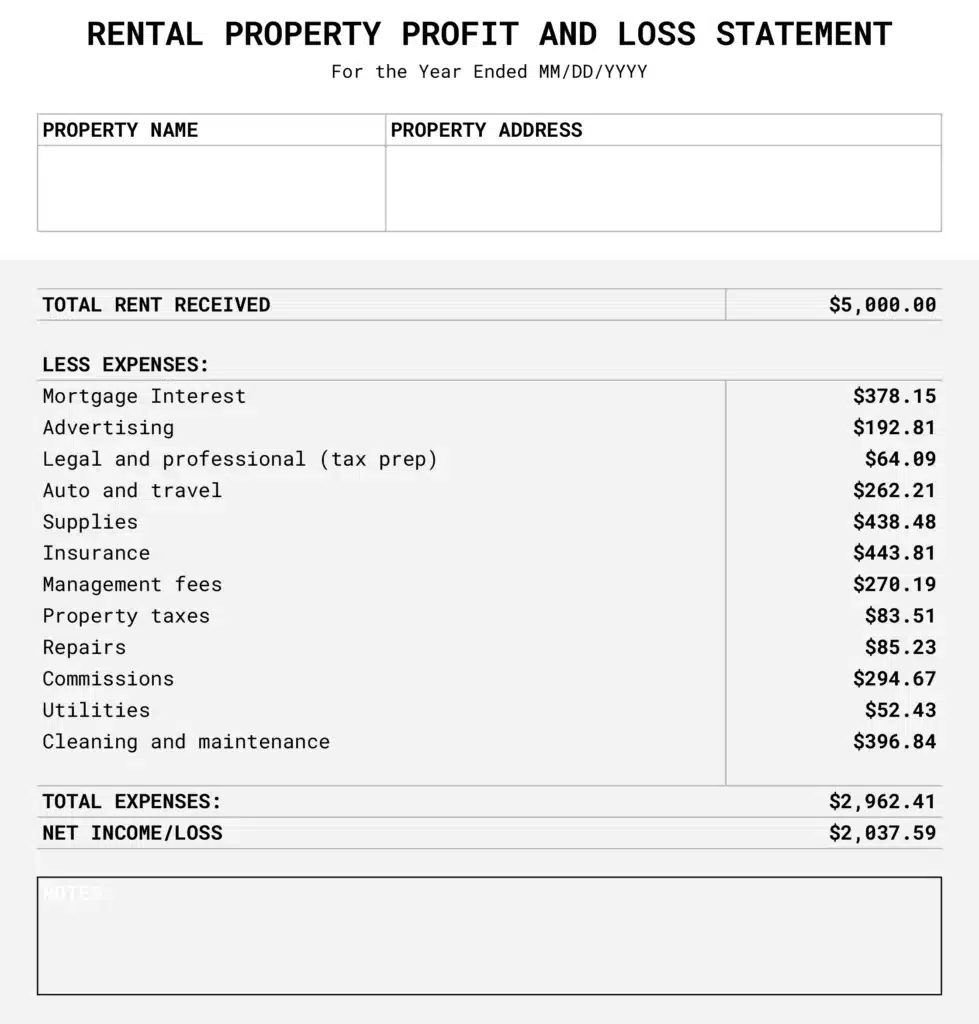

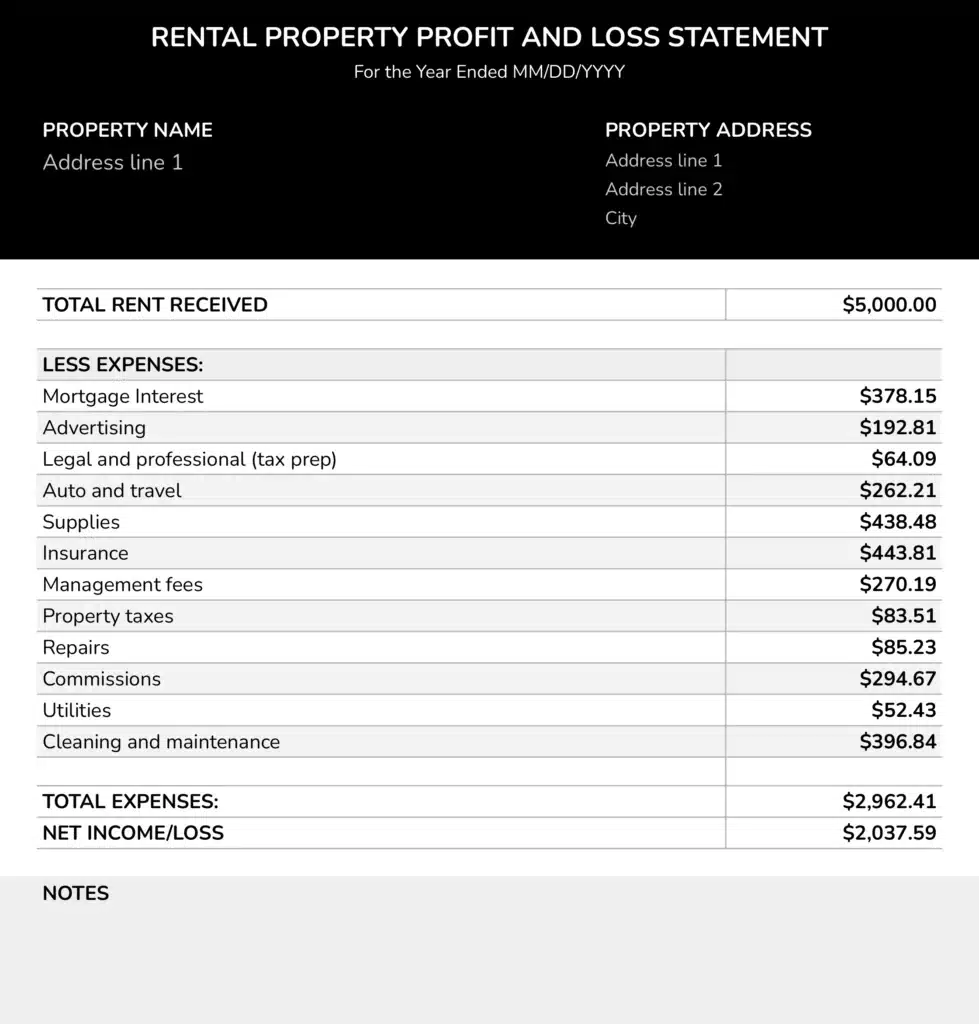

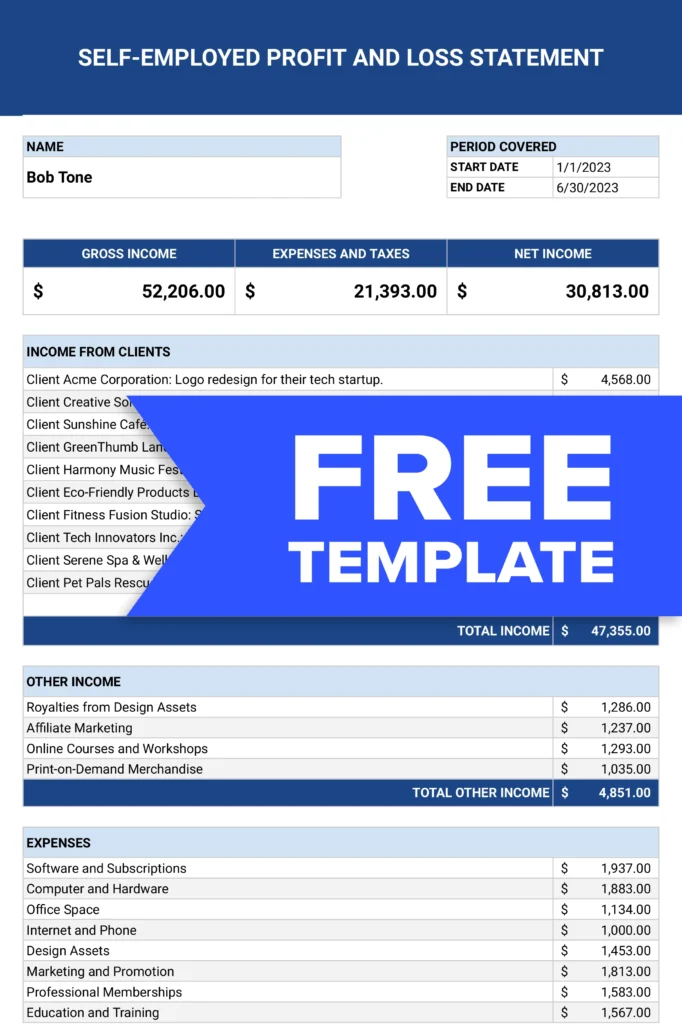

More Profit and Loss Templates

Advanced Excel & Sheets Templates with Live Business Data

Cashflow Template

Tracks sources of cash inflows and outflows and categorize them into operating,…

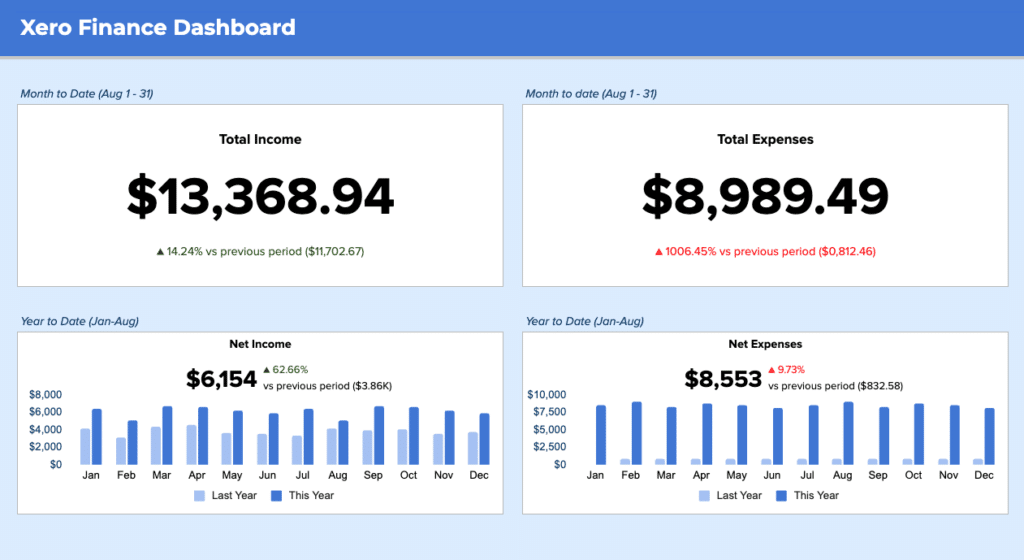

Dashboard

Boost your financial insights with our free Xero finance dashboard template. Track…

Forecasting Template

Get real-time insights and accurate projections to drive business growth.

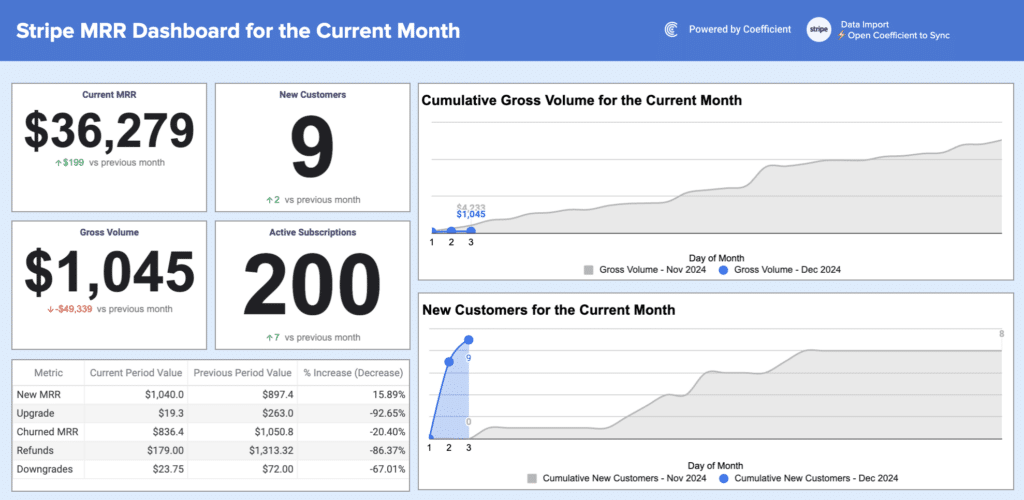

Dashboard

Track key metrics, visualize data, and make informed decisions to drive growth.

Analysis Template

Compare monthly results for pipeline creation, win rates, average deal age, and…

Browse Other Templates