Managing finances can be challenging for small businesses. Coefficient’s free QuickBooks budgeting template simplifies the process, allowing you to track and analyze your financial data with ease.

What is a QuickBooks Budgeting Report?

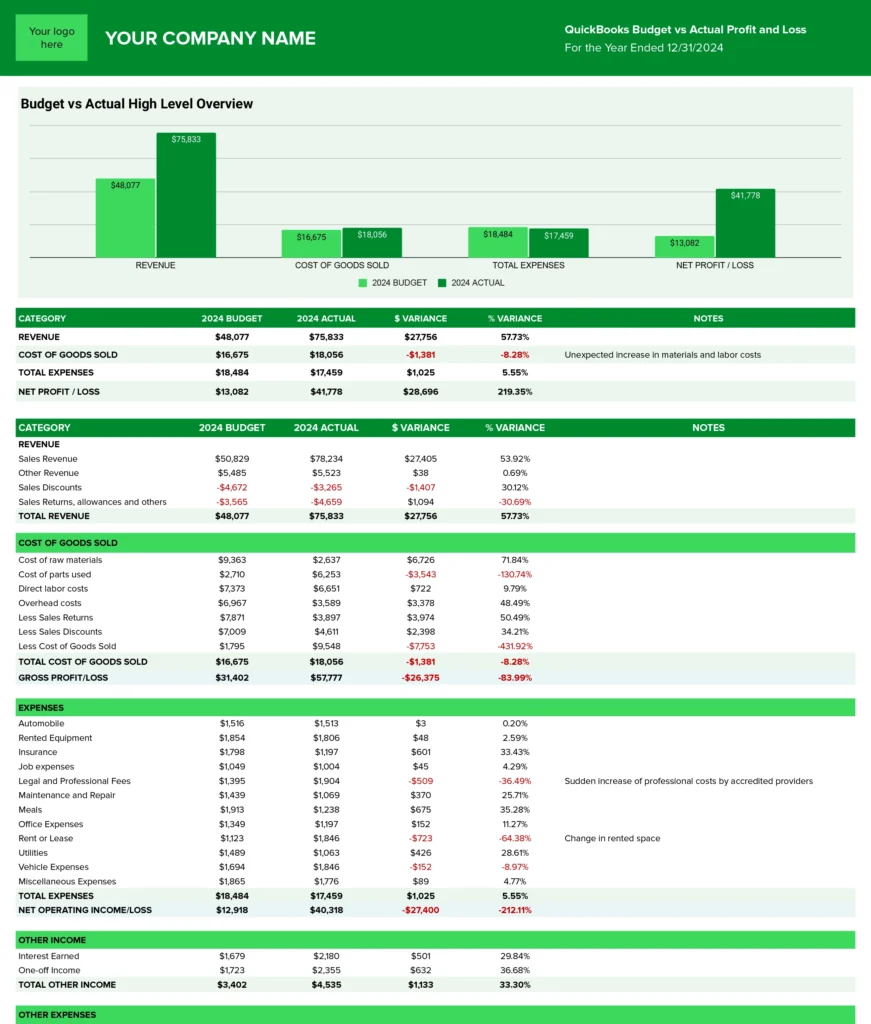

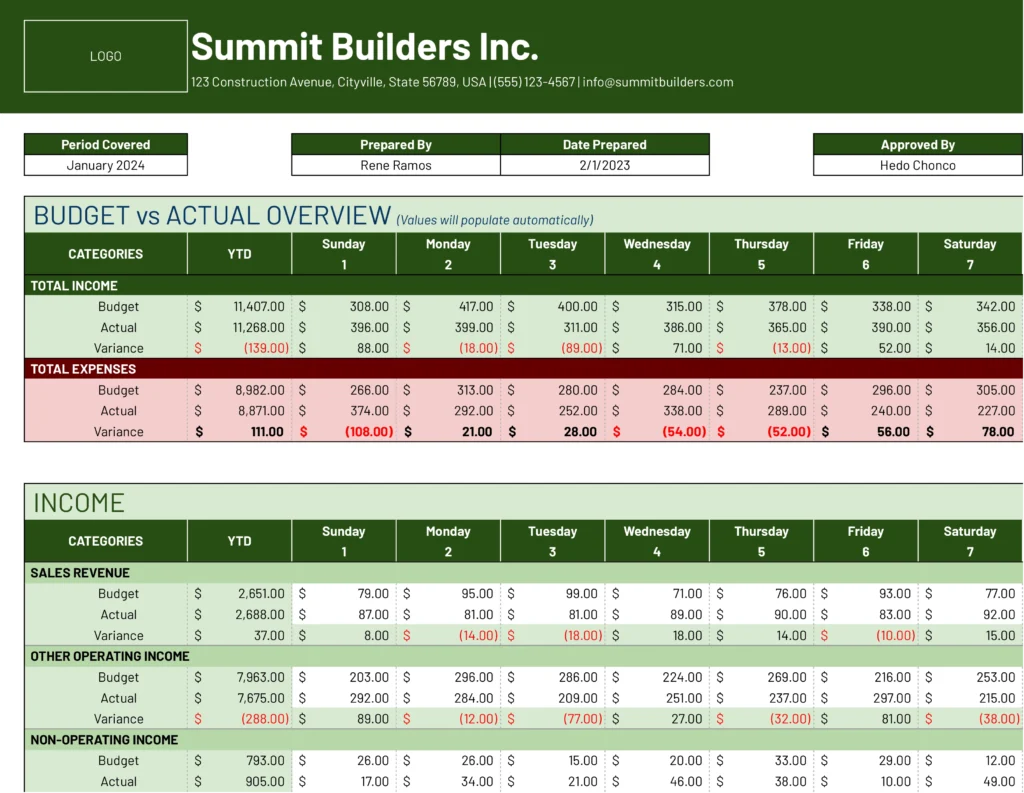

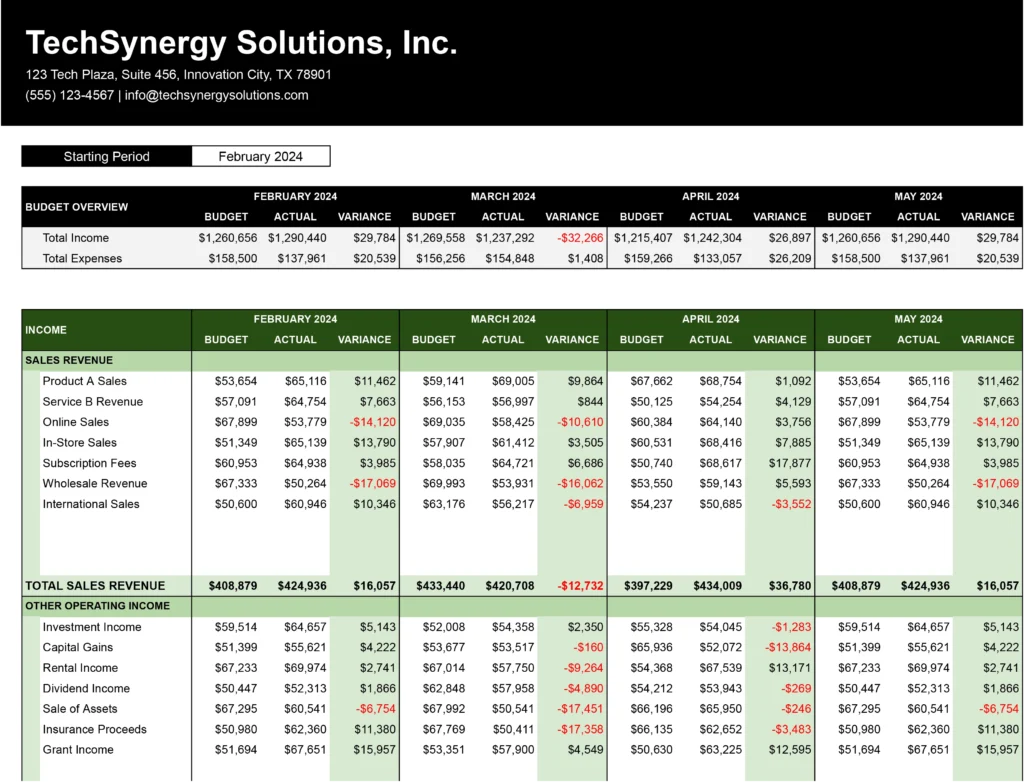

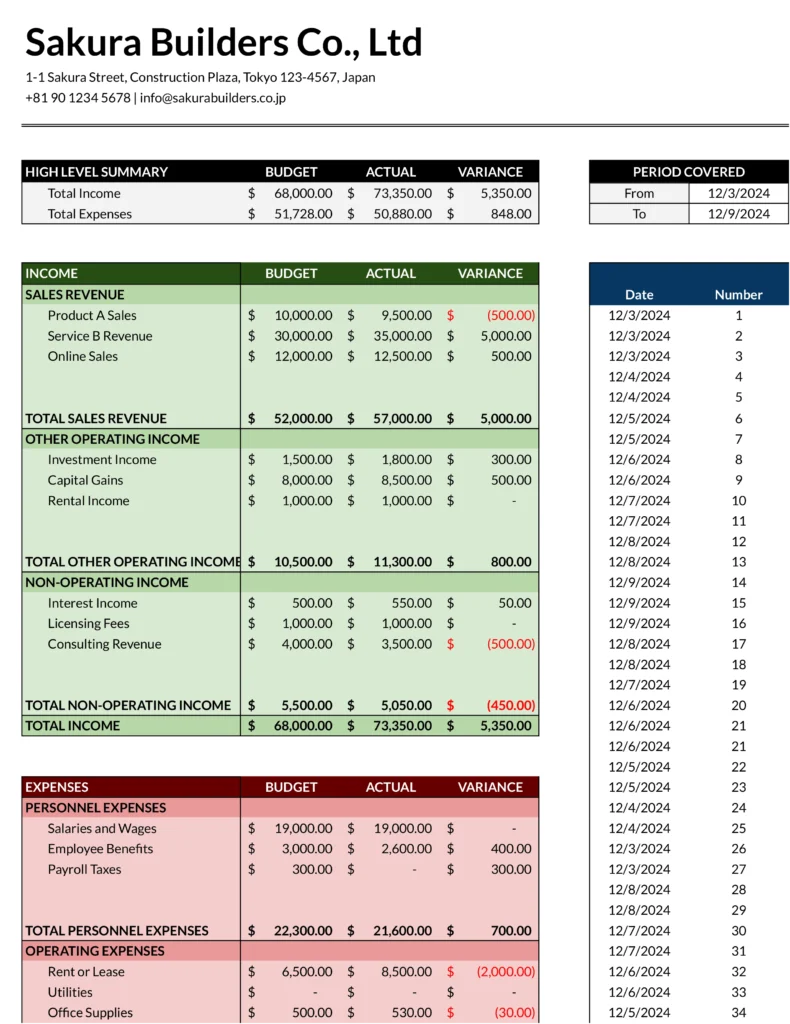

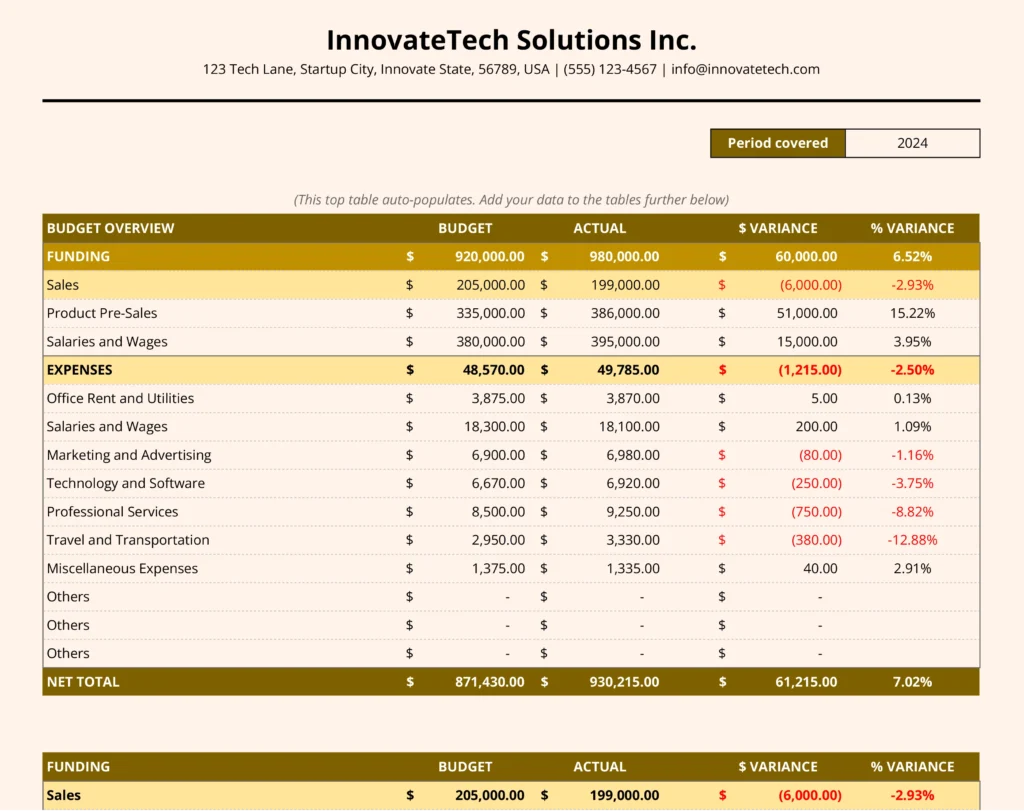

A QuickBooks budgeting report is a financial planning tool that helps businesses forecast and track their income and expenses over a specific period. It typically includes projected revenue, planned expenses, and cash flow estimates, allowing companies to make informed financial decisions and monitor their performance against set goals.

This report is crucial for maintaining financial health, as it provides a clear picture of expected income and outgoings. By comparing actual results to budgeted figures, businesses can identify areas of overspending or underperformance and make necessary adjustments to stay on track.

Who is the QuickBooks Budgeting Template Built For?

The QuickBooks budgeting template is designed for:

- Small business owners

- Financial managers

- Accountants and bookkeepers

- Entrepreneurs and startups

- Non-profit organizations

Anyone responsible for financial planning and management in their organization can benefit from this template, especially those using QuickBooks for their accounting needs.

What is the Primary Use Case for the QuickBooks Budgeting Template?

The primary use case for the QuickBooks budgeting template is to create, monitor, and adjust financial budgets for businesses. Specifically, it helps users:

- Set realistic financial goals

- Plan for future expenses and revenue

- Compare actual performance against budgeted figures

- Make data-driven financial decisions

- Identify areas for cost-cutting or investment

By providing a clear framework for financial planning, this template enables businesses to maintain better control over their finances and adapt quickly to changing economic conditions.

Benefits of Using the Coefficient QuickBooks Budgeting Template

- Real-time data synchronization: The template automatically updates with the latest QuickBooks data, ensuring your budget always reflects the most current financial information.

- Customizable reporting: Tailor the template to your specific business needs, focusing on the metrics that matter most to your organization.

- Time-saving automation: Eliminate manual data entry and reduce the risk of errors by connecting directly to your QuickBooks account.

- Enhanced collaboration: Share budget reports easily with team members or stakeholders, fostering better communication and alignment on financial goals.

- Historical trend analysis: Compare current budget performance with past periods to identify patterns and make more accurate future projections.

Metrics Tracked in the Report

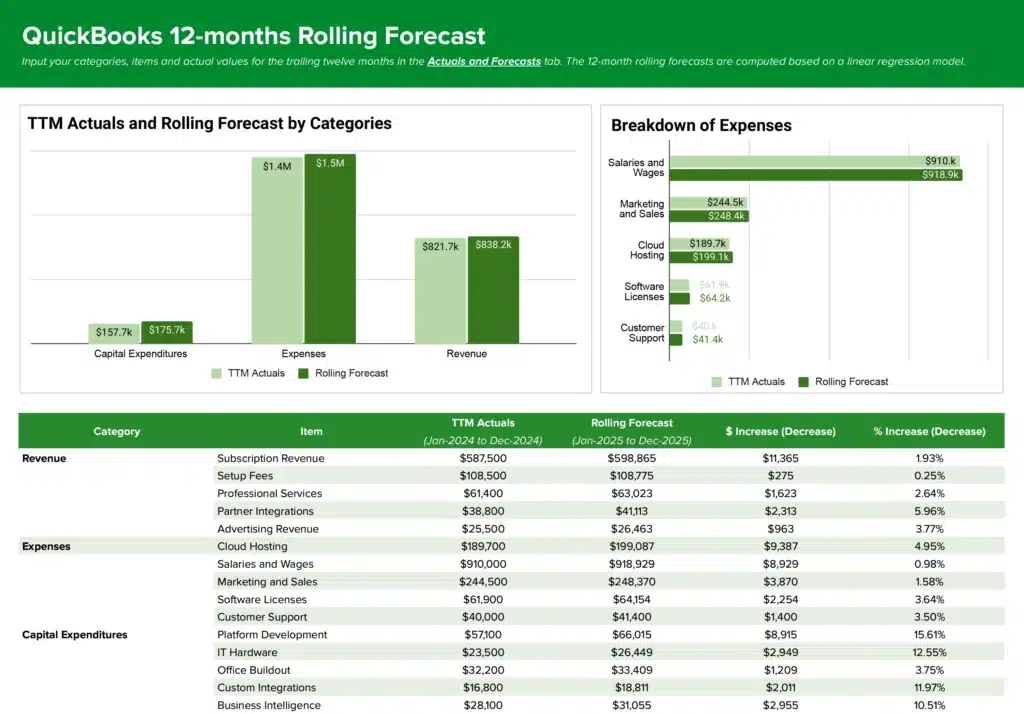

The QuickBooks budgeting template tracks the following key metrics:

- Budget Period (Monthly/Quarterly/Yearly)

- Revenue Categories

- Sales Revenue

- Service Revenue

- Expense Categories

- Fixed Expenses (Rent, Salaries)

- Variable Expenses (Utilities, Marketing)

- Budgeted Amounts

- Actual Amounts

- Variance (Budget vs. Actual)

- Percentage Variance

- Notes/Comments

More Metrics to Track and Analyze on Google Sheets

With Coefficient’s QuickBooks integration, you can pull additional data into your Google Sheets for comprehensive financial analysis:

- Multiple company data

- Various report types available in QuickBooks

- Department and location-specific data

- Consolidated reports from multiple sources

- Accounts payable and receivable information

- Profit and loss statements by month and class

- Month-over-month growth analysis

Coefficient also offers a set of free financial templates that are ready to use, including:

- P&L Budget vs. Actuals

- P&L by Class

- Expenses by Vendor

- Profit & Loss by Month & Class

- Consolidated P&L

- Profit & Loss – MoM Growth

- Live A/P Dashboard

- Live A/R Dashboard