Sales tax compliance creates headaches when you operate in multiple jurisdictions with different rates, filing deadlines, and exemption rules. Most finance teams struggle to track nexus obligations, maintain exemption certificates, and file returns on time across dozens of states. This template centralizes compliance tracking and automates sales data collection so you never miss a filing deadline or face audit penalties.

What is a Sales Tax Compliance Checklist?

Sales tax compliance ensures you collect, report, and remit taxes correctly across jurisdictions. You determine nexus, calculate rates, file returns, and maintain documentation. This prevents penalties and audit issues. States get accurate payments. Your business stays compliant. Finance avoids costly surprises.

Benefits of using this template

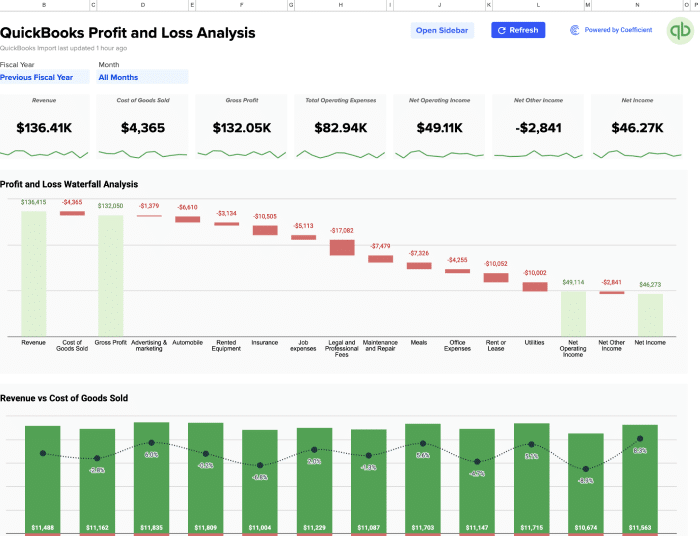

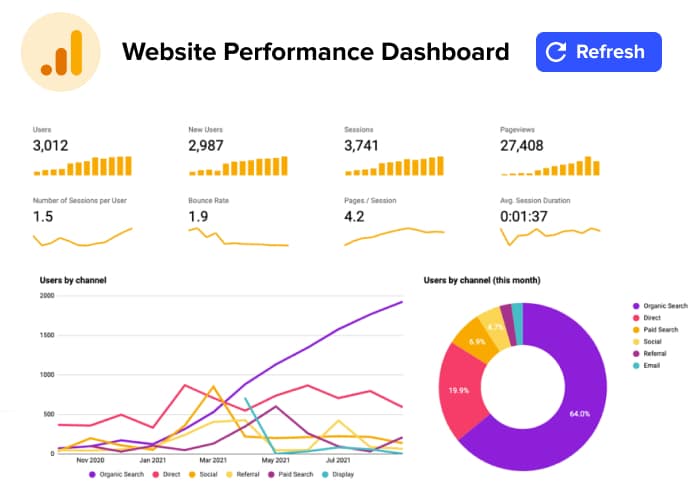

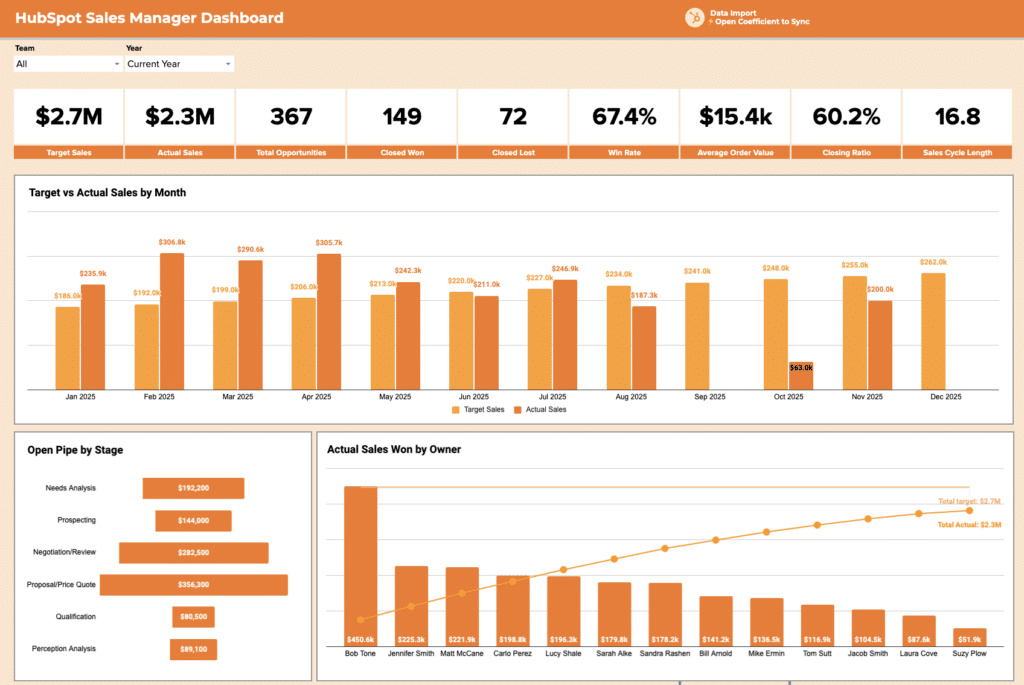

- Real-time automation and data accuracy – Coefficient automatically syncs your financial data into Google Sheets, eliminating manual data entry and ensuring your Sales Tax Compliance Checklist is always up-to-date with live information from your source systems.

- Enhanced team collaboration – Multiple team members can work simultaneously in Google Sheets, providing real-time visibility into task status, completion, and any issues that arise during the process.

- Time savings and efficiency – Streamline your process by automating repetitive tasks and data collection, allowing your team to focus on analysis and strategic activities rather than manual work.

- Improved compliance and control – Maintain a clear audit trail and ensure all required steps are completed consistently, reducing compliance risks and improving internal controls.

Flexible and scalable solution – Easily customize the template to fit your organization’s unique requirements and scale as your business grows without expensive software investments.