Most AR teams lose thousands in uncollected revenue because they lack a consistent follow-up system. A collections process checklist standardizes every step from invoice delivery to payment collection—so your team reduces DSO, improves cash flow, and maintains professional customer relationships throughout the collection cycle.

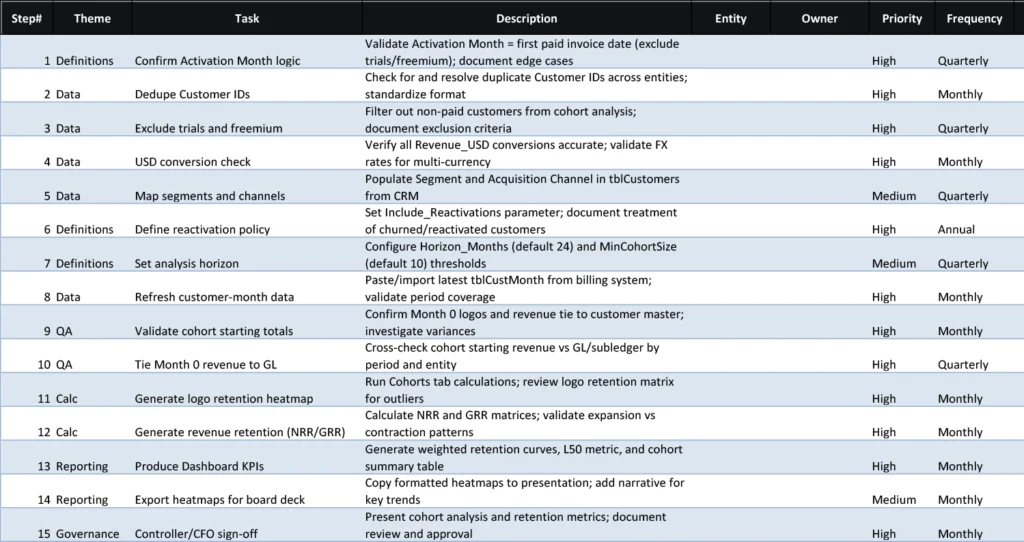

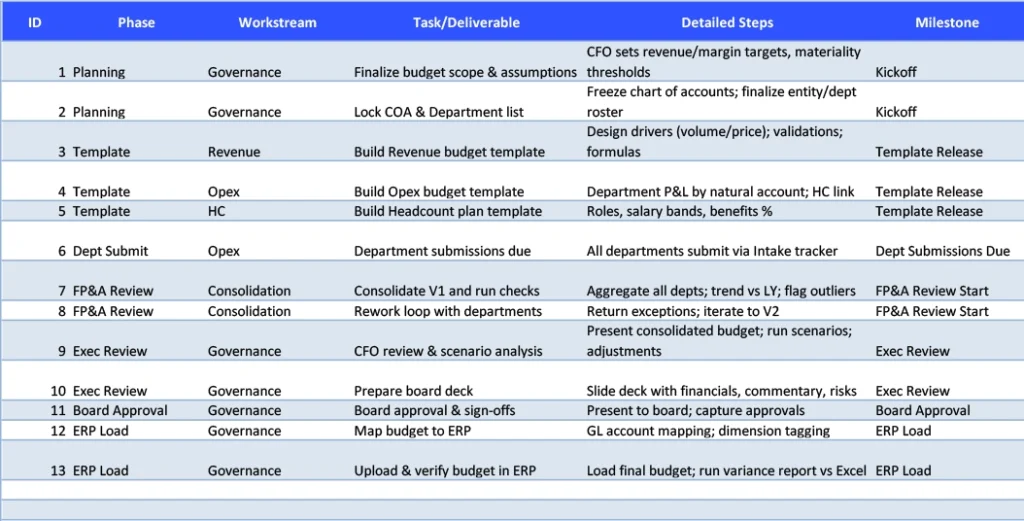

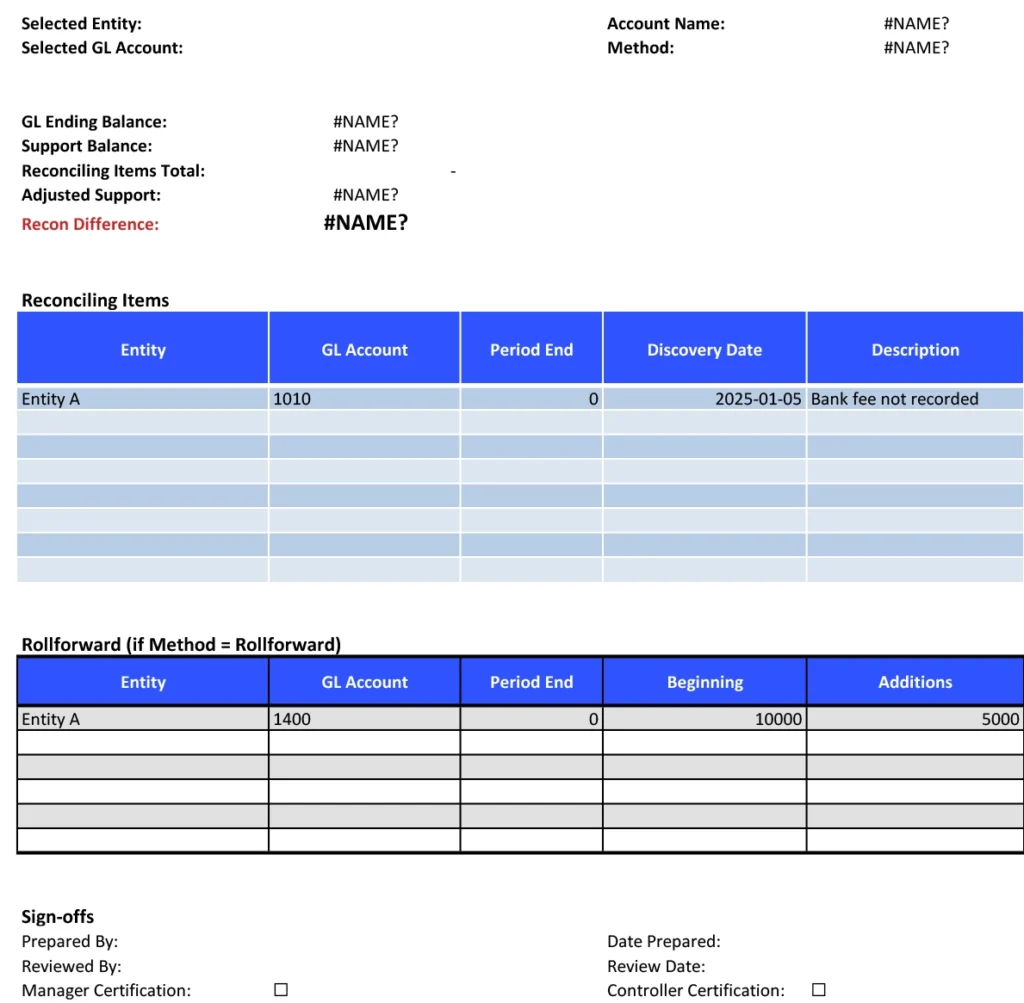

This template gives you a systematic workflow to monitor aging receivables, schedule follow-ups, escalate past-due accounts, and document every collection effort for compliance.

What is a Collections Process Checklist?

A Collections Process Checklist is a systematic workflow that helps accounts receivable teams maximize cash collection while maintaining positive customer relationships. This structured approach ensures consistent follow-up on outstanding invoices, proper escalation procedures, effective communication strategies, and appropriate documentation of collection efforts. By following this checklist, organizations can reduce days sales outstanding (DSO), improve cash flow, minimize bad debt write-offs, and maintain professional customer interactions throughout the collection cycle.

Benefits of using this template

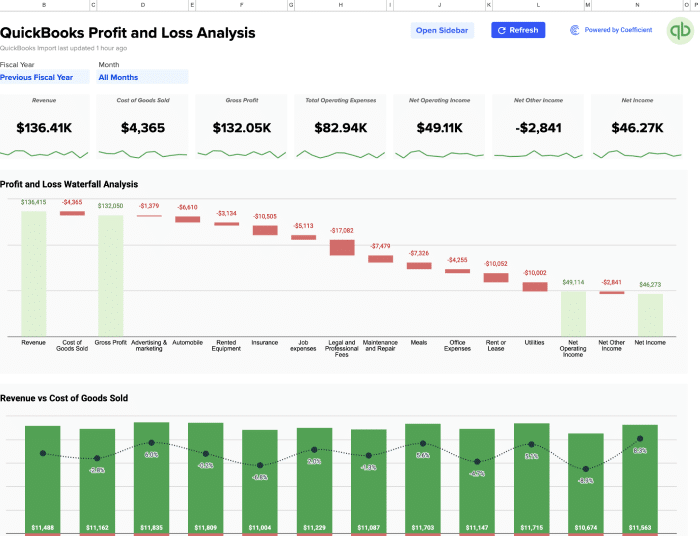

- Real-Time Data Automation – Connect your financial systems directly to Google Sheets with Coefficient. Your collections process data stays current automatically, eliminating manual data entry and ensuring your team always works with accurate, up-to-date information.

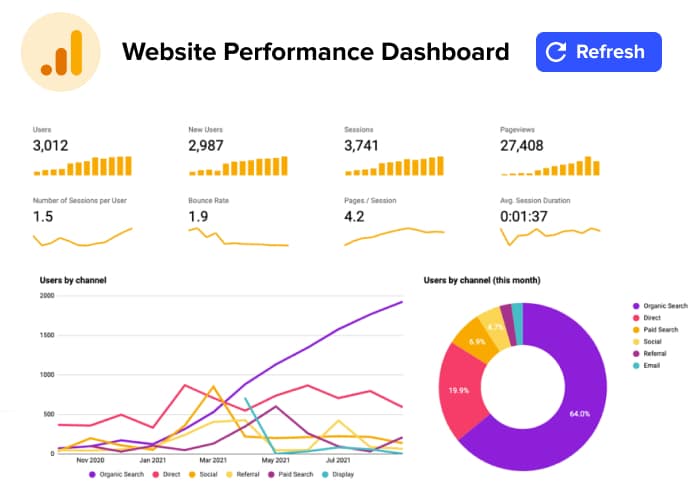

- Streamlined Collaboration – Share your checklist with teammates who can update progress in real-time. Everyone sees the same information simultaneously, reducing status meeting time, preventing duplicate work, and ensuring accountability.

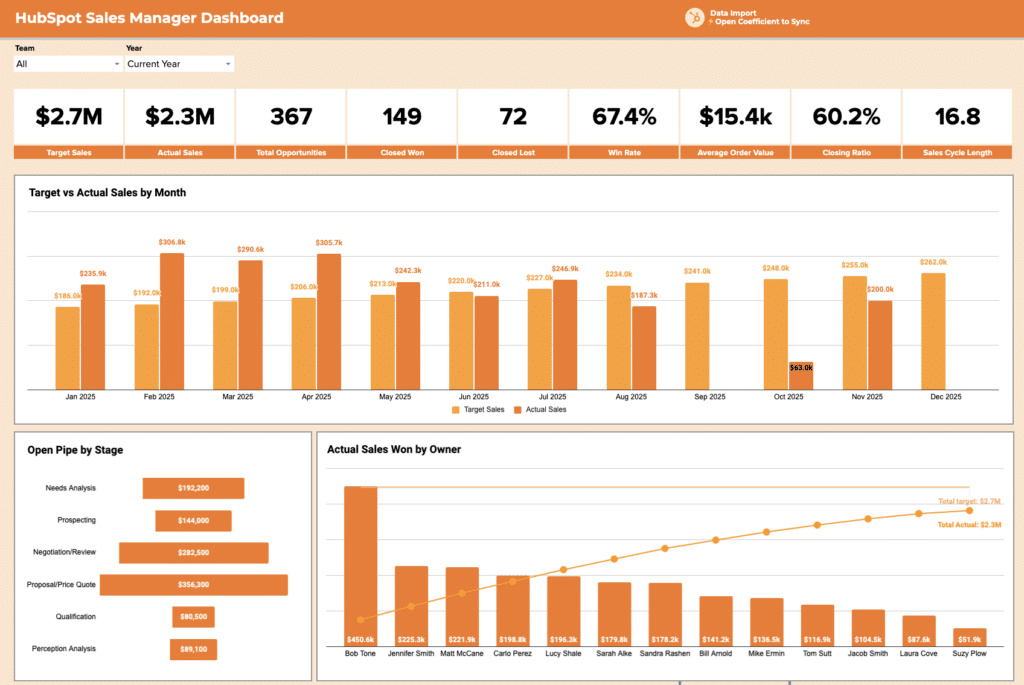

- Improved Efficiency – Reduce the time spent on your collections process by up to 50% through automation and standardization. The checklist ensures nothing gets missed while automation handles repetitive data tasks.

- Enhanced Compliance and Control – Maintain a complete audit trail of who completed each step and when. The structured checklist format ensures all required procedures are followed consistently, reducing compliance risks and supporting internal and external audit requirements.

Flexible and Scalable – Customize the template to match your organization’s specific requirements. Add or remove steps, modify workflows, and adjust automation as your processes evolve.he template to match your organization’s specific requirements. Add or remove steps, modify workflows, and adjust automation as your processes evolve.