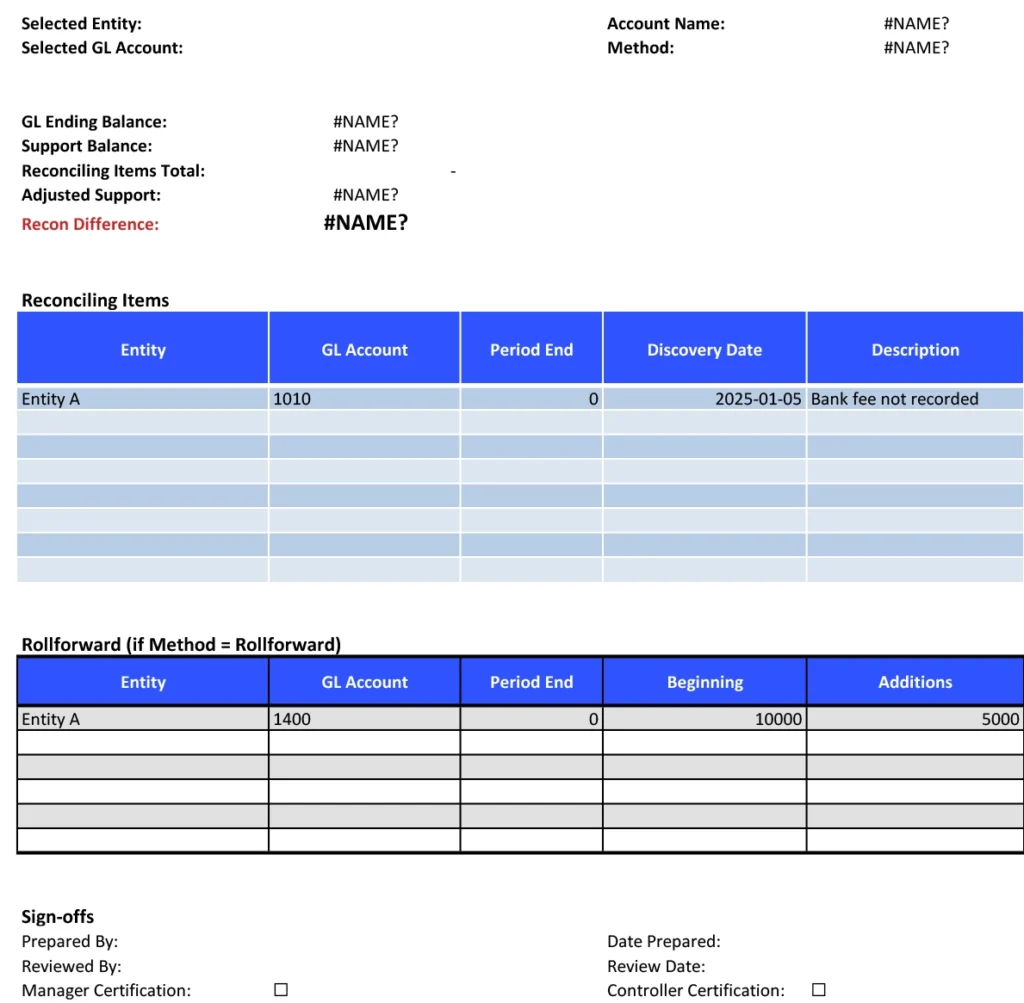

Most accounting teams scramble at month-end because they lack a systematic reconciliation process. A balance sheet account reconciliation checklist standardizes how you verify every account against supporting documentation—so you catch discrepancies early, close faster, and present audit-ready financials every period.

This template gives you a centralized tracker to manage reconciliations across all balance sheet accounts, assign ownership, and maintain complete documentation for internal and external audits.

What is a Balance Sheet Account Reconciliation Checklist?

Balance sheet reconciliation verifies every account is accurate. You match balances to supporting docs—bank statements, invoices, loan papers. This catches errors, prevents misstatements, and ensures your balance sheet reflects reality. Without it, your financial position is a guess.

Benefits of using this template

- Centralized Reconciliation Management – The template provides a single source of truth for tracking all balance sheet account reconciliations across the organization. Coefficient keeps all supporting data current and accessible in one place.

- Standardized Reconciliation Process – Every balance sheet account follows the same proven reconciliation methodology, ensuring consistency and completeness regardless of which team member performs the work.

- Automated Evidence Collection – Supporting documentation and reconciliation evidence are automatically linked and stored within Google Sheets, eliminating the scramble to locate backup during audits.

- Exception-Based Management – The template highlights accounts with discrepancies or missing reconciliations, allowing managers to focus attention where it’s needed most rather than reviewing every account.

Accelerated Close Cycle – With automated data imports and standardized workflows, balance sheet reconciliation that once took weeks can now be completed in days, dramatically improving financial close timelines.