Cash runs out fast when you can’t see it coming. Most businesses fail because they run out of money—not because they lack customers. A 13-week cash flow forecast checklist gives you a rolling view of your cash position, payment cycles, and funding needs before problems hit.

This template helps you track cash in and cash out week by week, spot shortfalls early, and make informed decisions about spending, collections, and financing.

What is a 13-Week Cash Flow Forecast Checklist?

A 13-week cash flow forecast maps your cash position for the next quarter. Week by week. Dollar by dollar.

You track expected receipts from customers. List upcoming payments to vendors. Monitor payroll obligations. This rolling forecast updates weekly—giving you 90 days of visibility into your cash runway. Banks require it. Investors demand it. Smart businesses live by it.

Benefits of using this template

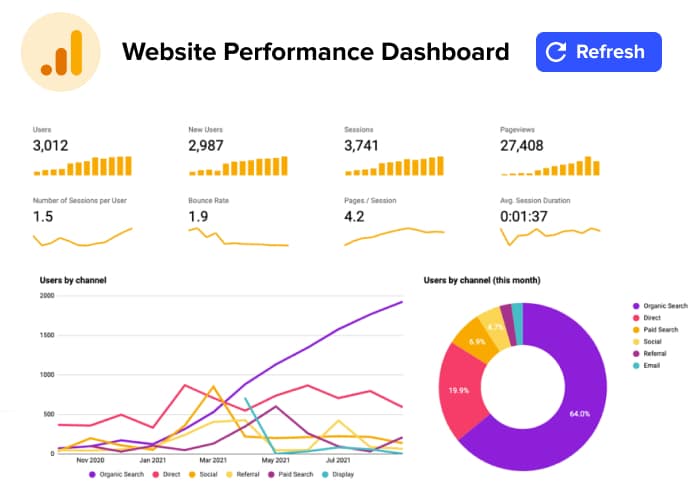

- Real-Time Cash Visibility – Coefficient pulls live data from your accounting systems into Google Sheets, showing actual cash balances alongside forecasts so you see variances instantly.

- Weekly Rolling Updates – The 13-week window rolls forward each week, maintaining a constant three-month view while incorporating actual results and adjusting projections based on real performance.

- Scenario Planning Built In – Test different collection rates, payment terms, and growth scenarios to understand how decisions impact cash—all with live data feeding your models.

- Multi-Department Input – Sales, finance, and operations teams update their sections simultaneously in Google Sheets, creating a unified cash view without version control issues.

- Automated Alert System – Set triggers for low cash balances or variance thresholds, with automatic Slack or email notifications when intervention is needed.

What should be included in a 13-week cash flow forecast?

Your forecast needs seven core components:

- Beginning cash balance – Your starting point each week

- Customer receipts – Collections from accounts receivable

- Operating disbursements – Vendor payments, rent, utilities

Additional elements include payroll and benefits, debt service payments, capital expenditures, and ending cash balance. Track these weekly. Compare to minimums. Flag shortfalls immediately.

How do you prepare a 13-week cash flow?

Start with your current cash balance. Pull aged receivables from your accounting system. List all committed payments.

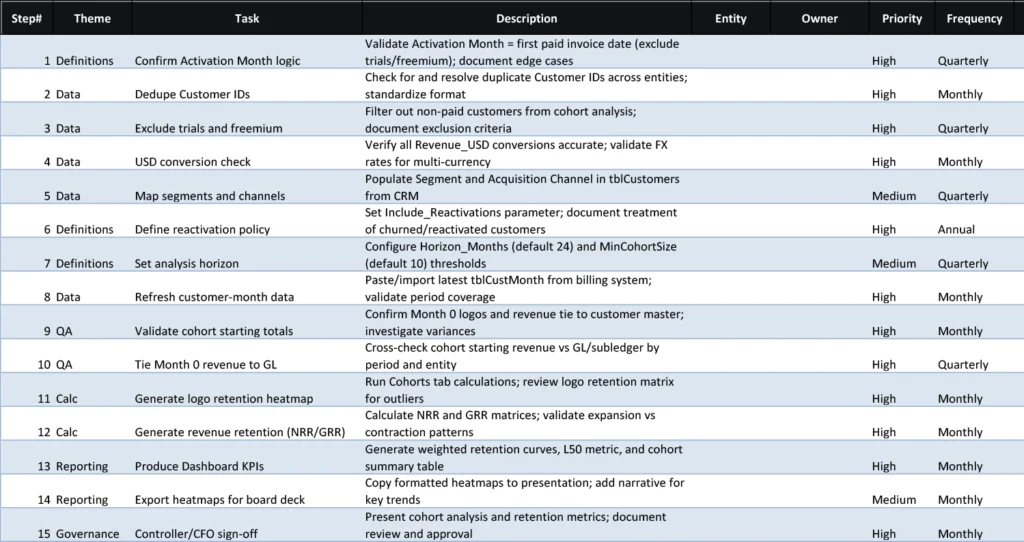

Here’s the process:

- Set up the rolling 13-week grid – Weeks across columns, line items down rows

- Input known receipts – Contract payments, recurring revenue, confirmed orders

- Schedule fixed costs – Rent, payroll, loan payments on actual due dates

- Add variable expenses – Estimate based on revenue forecasts and historical ratios

- Calculate weekly positions – Beginning cash plus receipts minus payments

- Identify gaps – Mark weeks where cash drops below minimum thresholds

- Update weekly – Roll forward one week, add actuals, adjust forecasts

The key? Update it every week. Compare forecasts to actuals. Adjust assumptions based on real results.

Common challenges with cash flow forecasting

- Collection timing uncertainty. Customers pay late. Your forecast shows cash arriving Week 3. Reality delivers it Week 6.

- One-time expenses hide. Annual insurance premiums. Tax payments. Equipment purchases. These large outflows surprise teams who focus only on monthly averages.

- Revenue concentration risk. When 40% of receipts come from one customer, their payment delay crushes your forecast accuracy.

How Coefficient improves your 13-week forecast

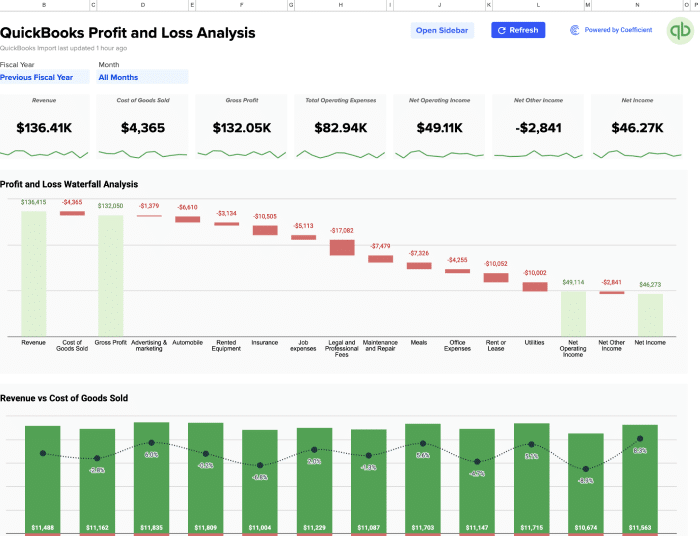

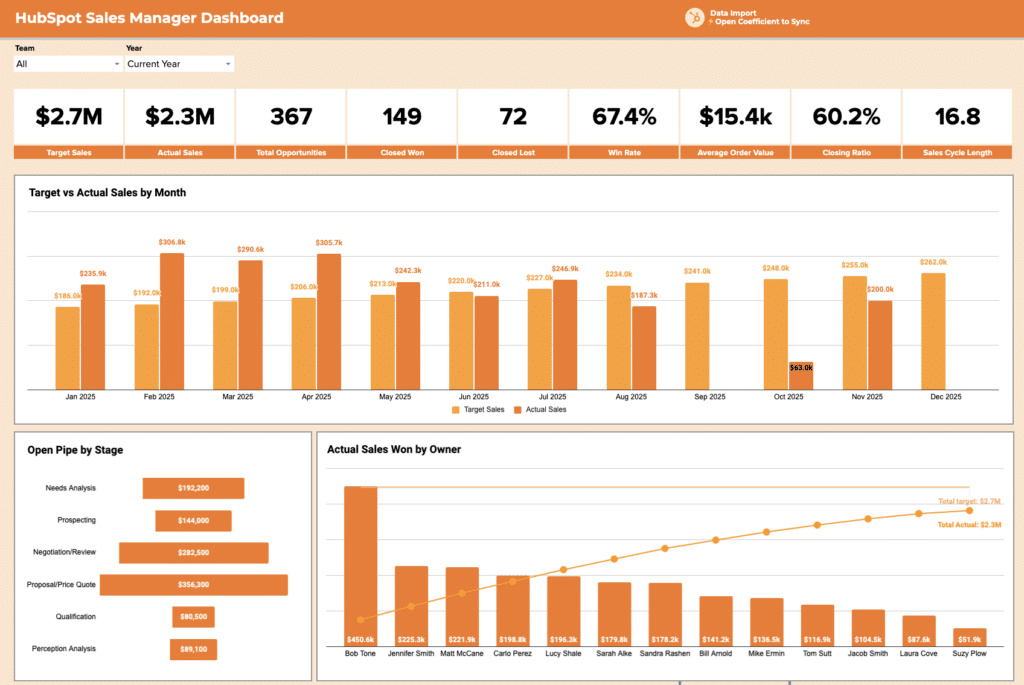

Manual forecasts break down because data lives in different systems. Coefficient connects your spreadsheet directly to QuickBooks, NetSuite, Salesforce, and other systems.

Your receivables update automatically. Payment schedules sync in real-time. Bank balances refresh daily. This eliminates the Monday morning scramble to update numbers—your forecast stays current automatically.

Teams using Coefficient report:

- 75% reduction in forecast preparation time

- Daily updates instead of weekly

- Automated variance reporting

- Earlier warning signs of cash crunches

Take Control of Your Cash Flow

Running out of cash kills businesses. Even profitable ones. Your 13-week forecast checklist creates the visibility you need to spot problems early, secure funding proactively, and sleep better knowing exactly where your cash stands.

Stop managing cash in the dark. Download the template. Connect your data. Get started with Coefficient to automate your cash flow forecasting today.