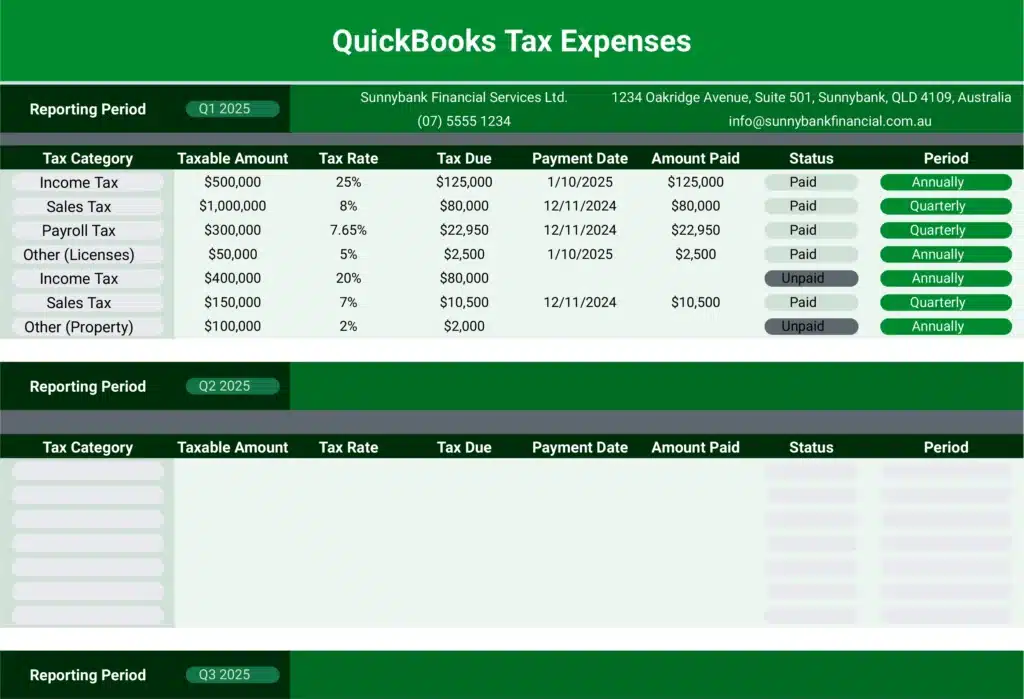

Tracking tax expenses can be overwhelming for businesses of all sizes. Coefficient’s free Tax Expenses Template simplifies this process, helping you organize and manage your tax-related costs effectively, and can be powered by your live data from QuickBooks or any other system.

What is a Tax Expenses Report?

A Tax Expenses Report is a comprehensive document that outlines all tax-related costs incurred by a business over a specific period. This report typically includes various categories of taxes, such as income tax, sales tax, and payroll tax, along with their respective amounts, due dates, and payment statuses.

The report serves as a crucial financial tool, enabling businesses to:

- Monitor their tax obligations

- Plan for upcoming tax payments

- Identify potential areas for tax savings

- Ensure compliance with tax regulations

Who is the Tax Expenses Template Built For?

This template is designed for:

- Small business owners

- Self-employed individuals

- Freelancers

- Accountants and bookkeepers

- Financial managers in larger organizations

Anyone responsible for tracking and managing tax expenses will find this template valuable for maintaining accurate financial records and preparing for tax season.

What is the Primary Use Case for the Tax Expenses Template?

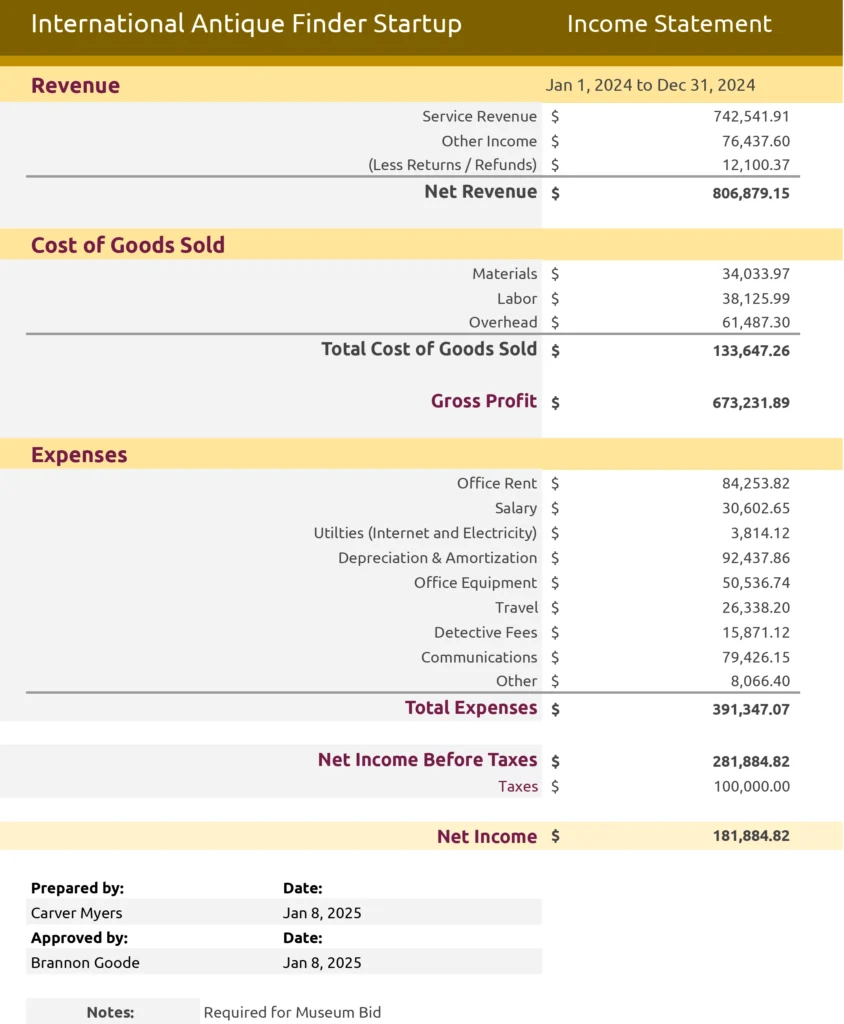

The primary use case for the Tax Expenses Template is to provide a structured, easy-to-use system for:

- Recording various types of tax expenses

- Calculating tax liabilities

- Tracking payment statuses

- Organizing tax-related information for reporting purposes

This template simplifies tax expense management, making it easier to stay on top of tax obligations and prepare for filing.

Benefits of Using the Tax Expenses Template

- Organized Tax Tracking: Keep all your tax expenses in one place, categorized for easy reference.

- Time-Saving: Reduce the time spent on manual data entry and calculations.

- Error Reduction: Minimize mistakes in tax calculations with pre-built formulas.

- Better Financial Planning: Gain a clear overview of your tax obligations to plan your finances more effectively.

- Simplified Reporting: Generate reports quickly for internal use or tax preparation.

Metrics Tracked in the Report

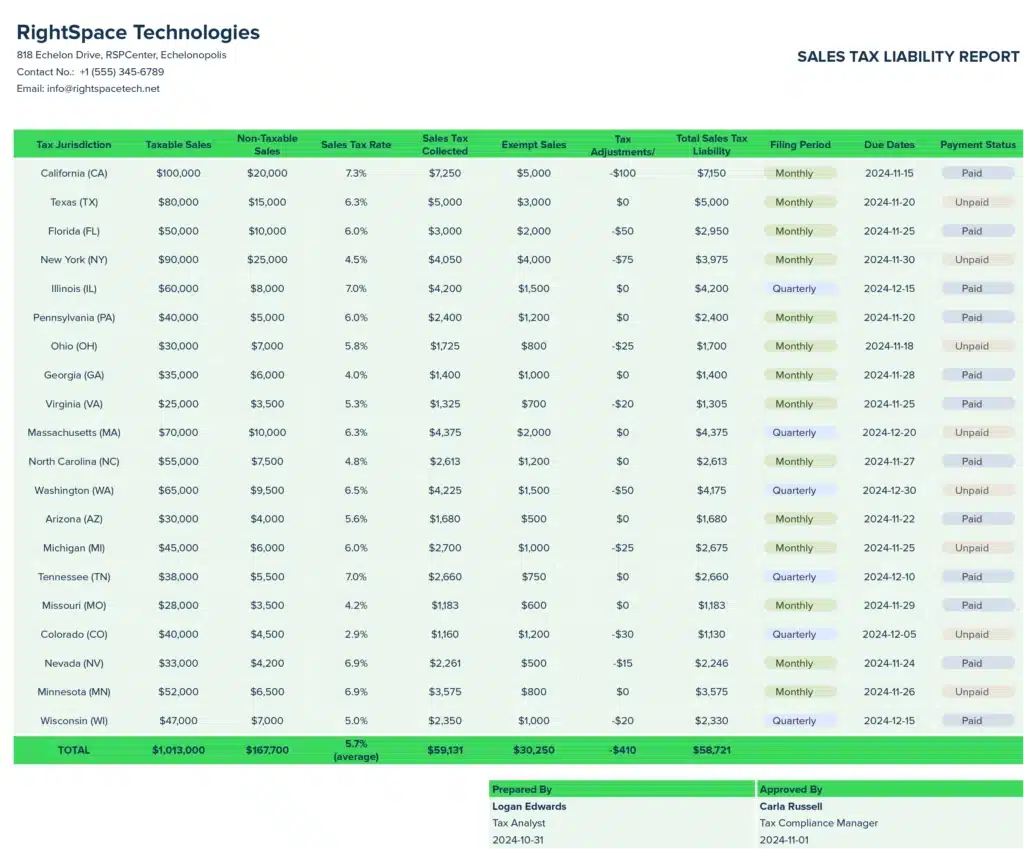

The Tax Expenses Template tracks the following key metrics:

- Tax Category (Income Tax, Sales Tax, Payroll Tax, Other)

- Taxable Amount

- Tax Rate

- Tax Due

- Payment Date

- Amount Paid

- Status (Paid, Unpaid, or Pending)

- Period (e.g., quarterly, annually)

More Metrics to Track and Analyze on Google Sheets

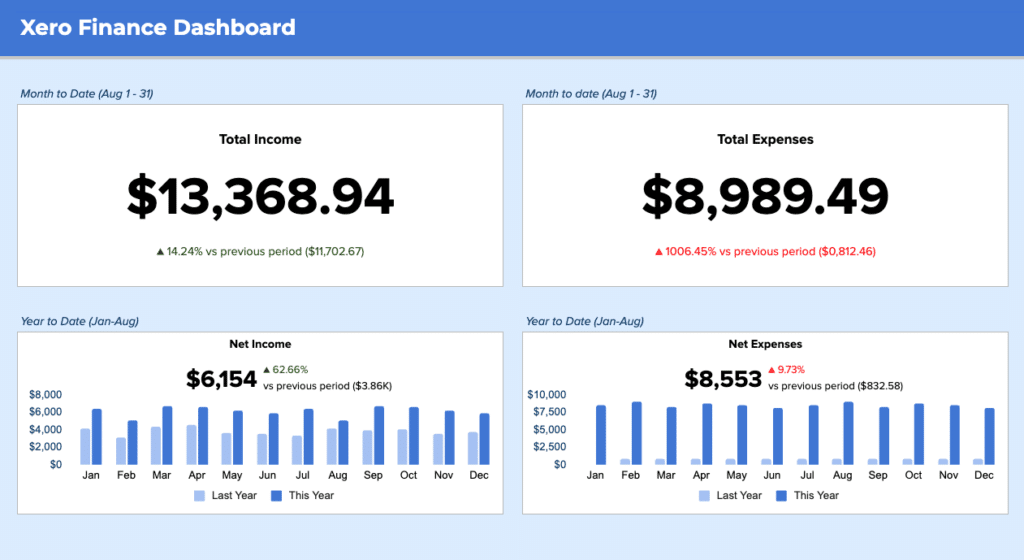

With Coefficient’s connectors for Google Sheets and Excel, you can expand your tax expense tracking capabilities:

- Connect to multiple company accounts

- Choose from various report types

- Maintain cell references during data refreshes

- Drill down into detailed data

- Automatically consolidate reports

- Sort data by Department or Location

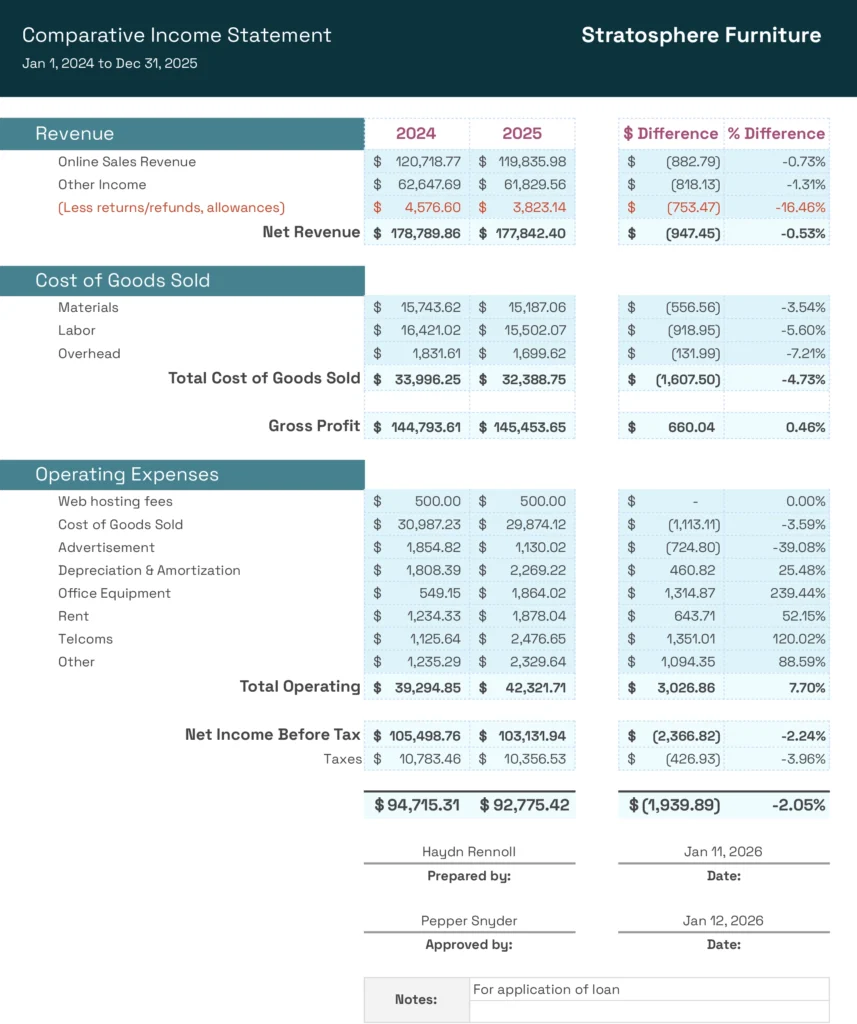

- Access free financial templates, including:

- P&L Budget vs. Actuals

- P&L by Class

- Expenses by Vendor

- Profit & Loss by Month & Class

- Consolidated P&L

- Live A/P Dashboard

- Live A/R Dashboard