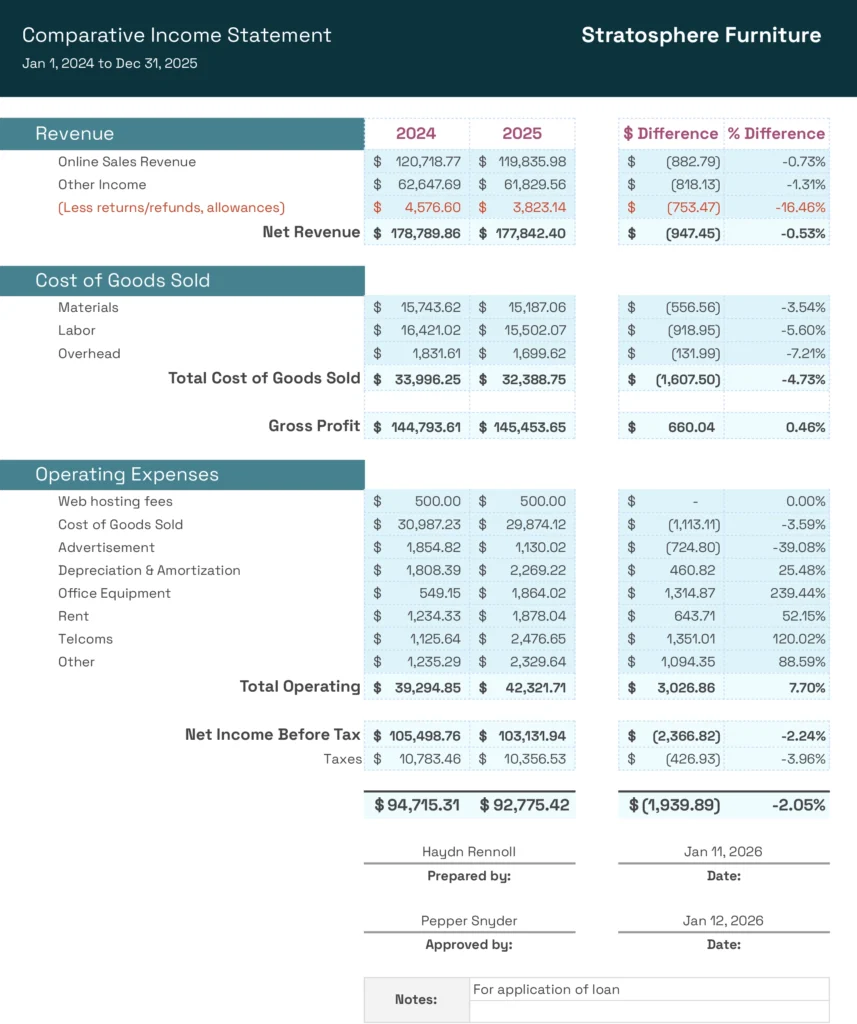

Discover the significance of comparative income statements and how they serve as a cornerstone for financial analysis in small enterprises. This section elucidates:

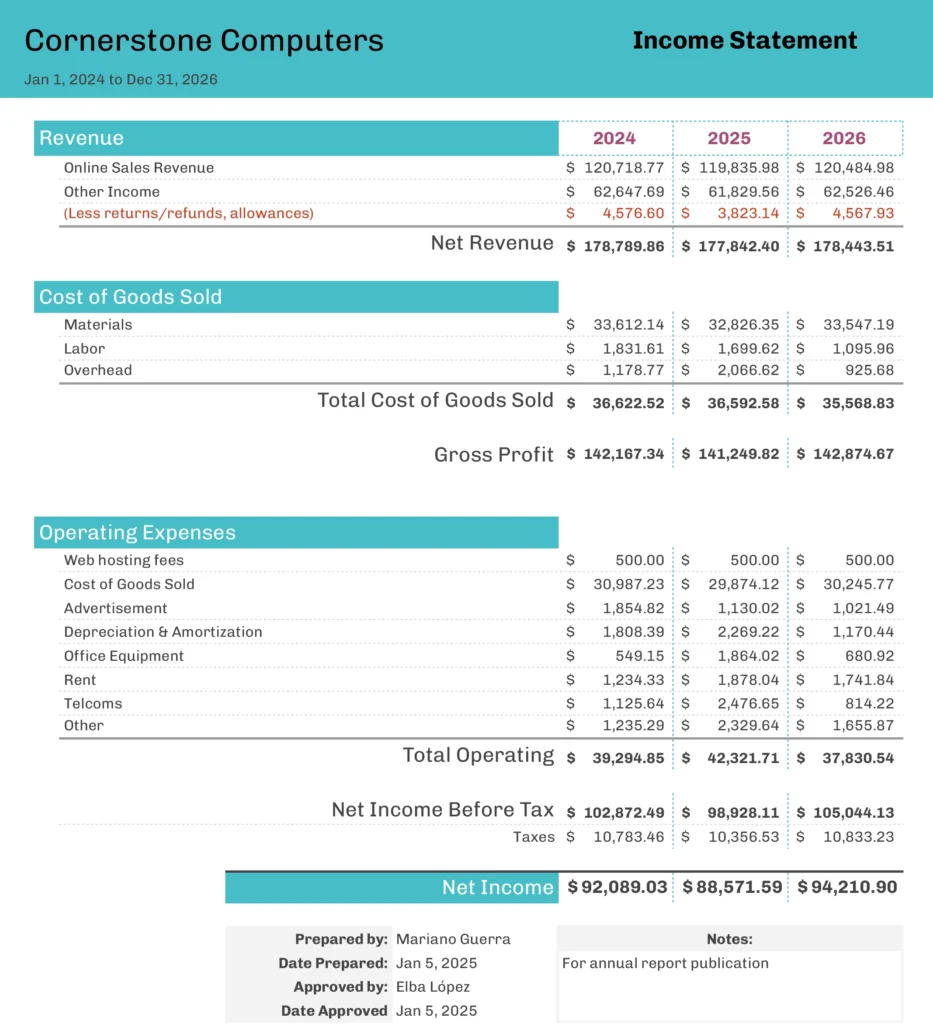

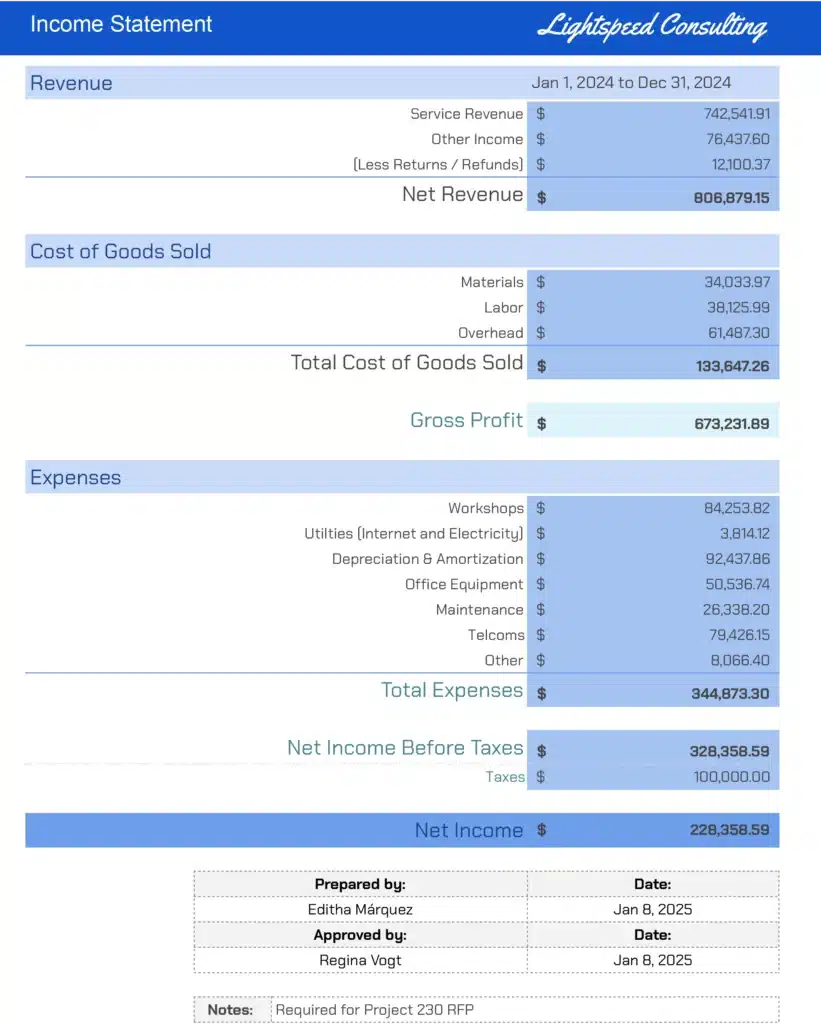

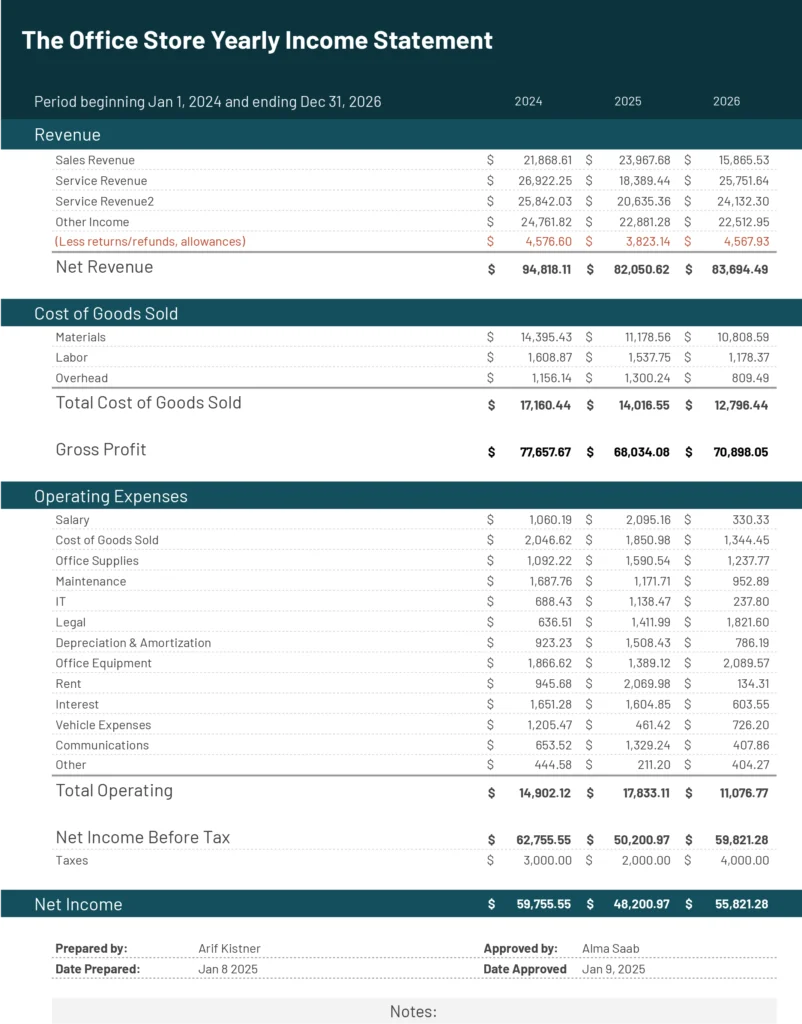

- Comparative Income Statement Essentials: Understand what a comparative income statement is—showcasing financial performance across different periods, enabling trend analysis and strategic planning.

- Template Advantages: Learn how the template streamlines this crucial analysis, facilitating quick, accurate comparisons and insightful business decisions.

How do you prepare a comparative income statement using the template?

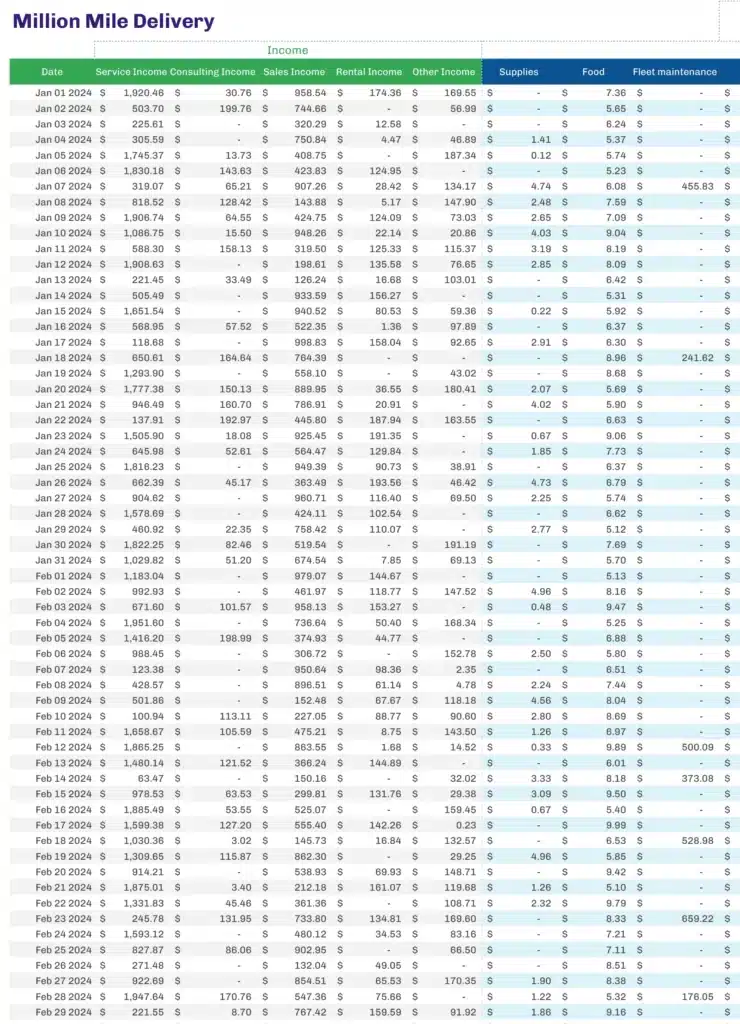

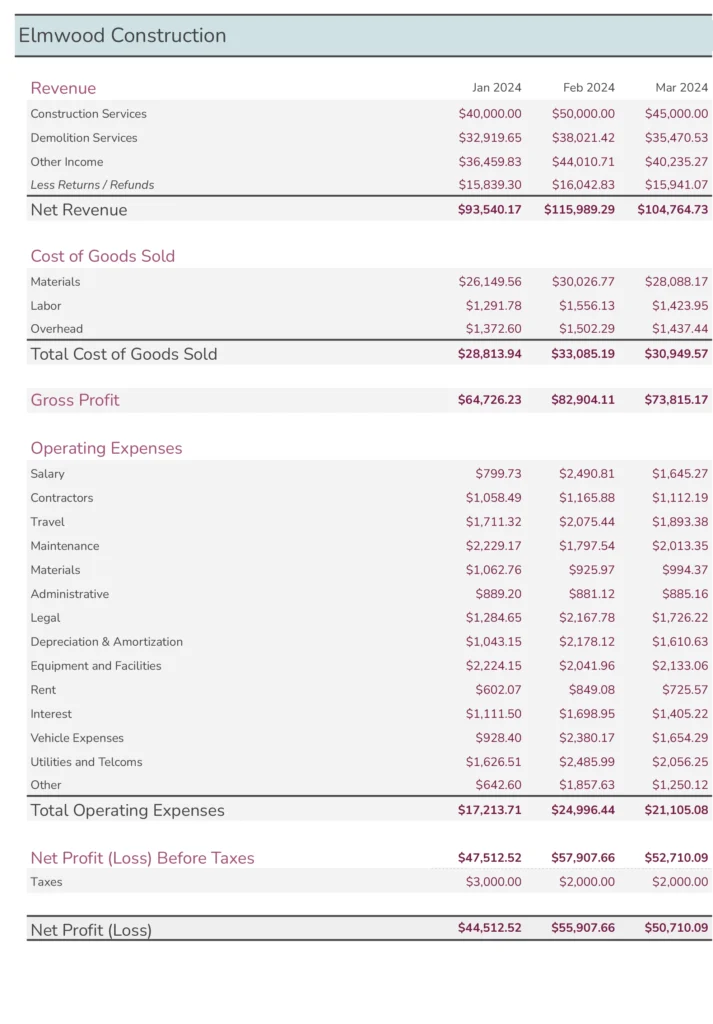

- Data Compilation: Begin by gathering financial data for the periods you wish to compare. This includes revenue, cost of goods sold, operating expenses, and other pertinent financial figures.

- Template Customization: Adjust the template to accommodate your specific financial categories, ensuring a tailored analysis that reflects your business’s unique aspects.

- Input Financial Data: Enter your collected data into the respective sections of the template. The predefined structure facilitates an organized, systematic approach to data entry.

- Review Automated Calculations: Utilize the template’s built-in formulas to automatically generate comparative financial metrics, providing a clear, concise view of your business’s financial evolution.

Maximizing Benefits with the Small Business Comparative Income Statement Template

Explore the tailored features of the template designed to enhance your financial review process:

- User-Friendly Design: Emphasize how the template’s intuitive layout simplifies financial tracking for business owners, regardless of their accounting expertise.

- Accuracy and Efficiency: Highlight the template’s automatic calculation features that ensure data accuracy and save time.

- Strategic Decision-Making: Illustrate how the template’s organized data presentation aids in identifying financial trends and making informed business choices.

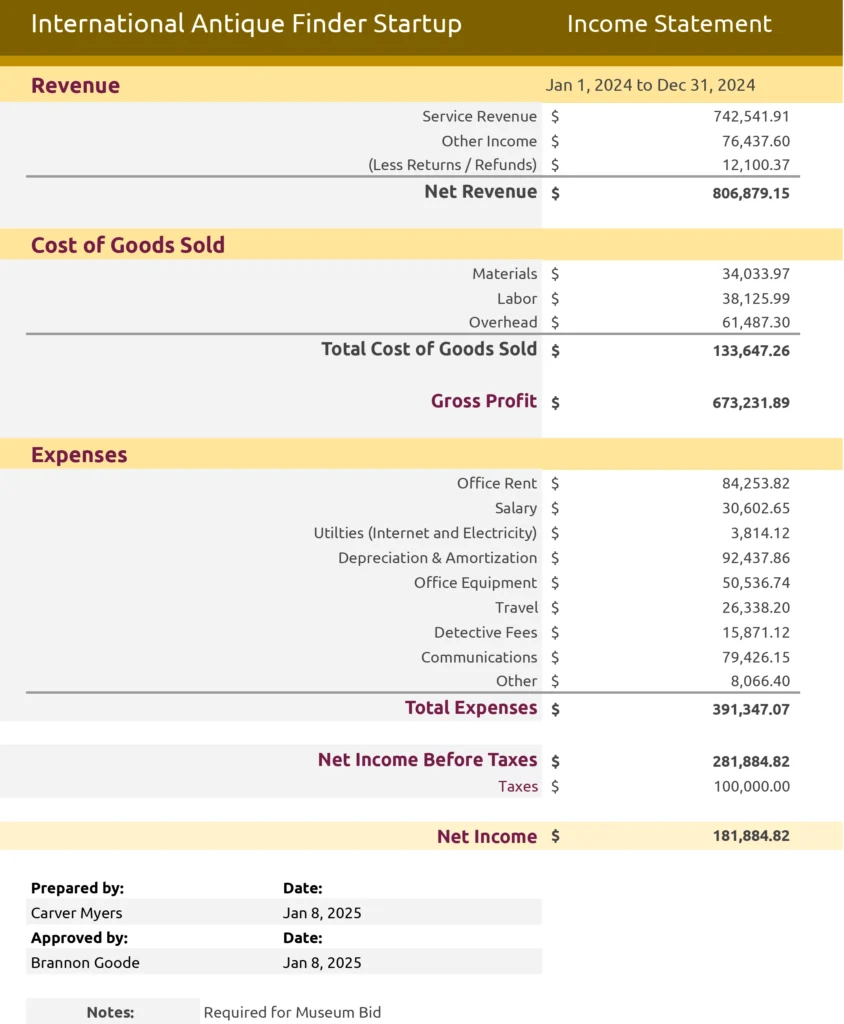

How do I write an income statement for a small business using the template?

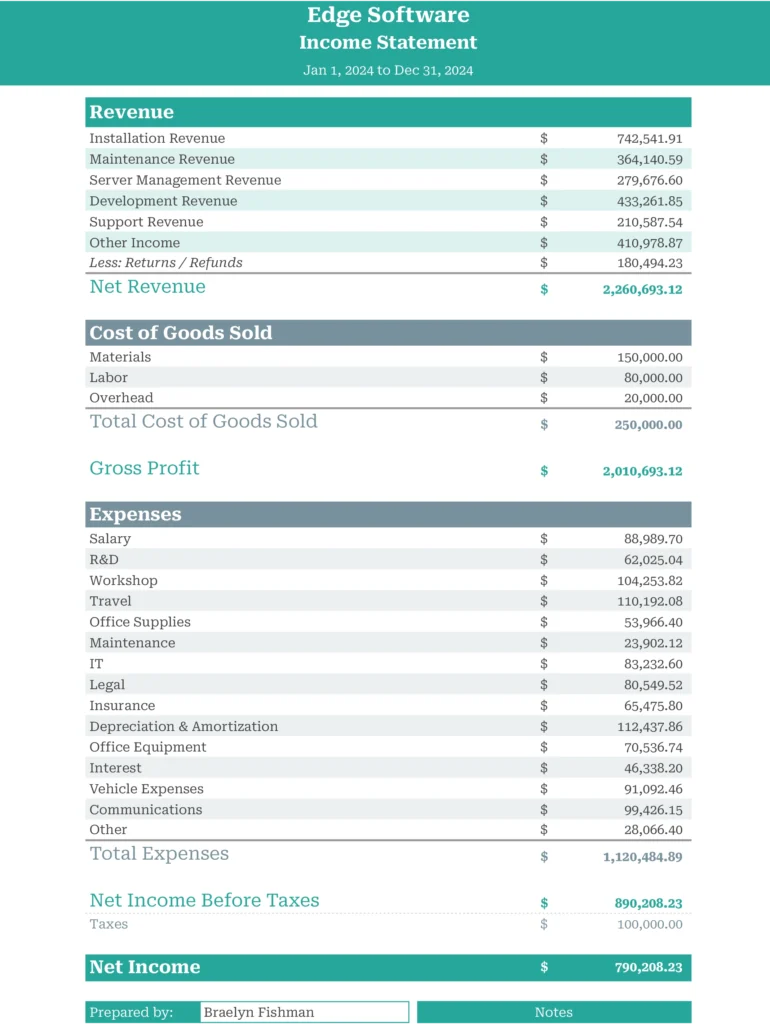

- Identify Financial Components: Clarify the key components of your income statement: revenues, expenses, net income, and any other critical financial categories.

- Leverage the Template: Use the template’s structured fields to input these components, ensuring each is accurately reflected in the appropriate section.

- Utilize Built-In Features: Engage the template’s features to calculate total revenues, expenses, and ultimately, net income, presenting a coherent financial narrative for your business.

- Iterative Review: Regularly update and review your income statement using the template to monitor financial performance and make timely, data-driven decisions.

What is the statement of comprehensive income for a small business, and how is it integrated into the template?

- Comprehensive Income Overview: Define comprehensive income, which encompasses all revenue, gains, expenses, and losses, providing a holistic view of financial performance.

- Template Integration: Demonstrate how the template allows for the incorporation of both traditional income statement figures and other comprehensive income elements, offering a complete financial picture.

- Data Segregation: Guide users on segregating and entering operating, non-operating, and other comprehensive income data to ensure clarity and comprehensive analysis.

- Analysis Empowerment: Explain how this integrated approach aids in understanding the broader financial impacts on the business, facilitating more nuanced strategy development.

How do I create a balance sheet for my small business using insights from the income statement template?

- Correlate Financial Data: Highlight the interplay between the income statement and balance sheet, emphasizing how income statement outcomes influence balance sheet figures.

- Data Extraction: Instruct on extracting net income and other relevant figures from the income statement template to update the equity section of the balance sheet.

- Balance Sheet Construction: Detail steps to input assets, liabilities, and equity in the balance sheet template, using insights gleaned from the income statement for accuracy and coherence.

- Comprehensive Review: Encourage periodic reconciliation of both documents using the template, ensuring consistency and reliability in financial reporting.

Propel Your Business Forward with the Comparative Income Statement Template

Embrace the template’s role as a pivotal resource in your financial toolkit, streamlining analysis, enhancing accuracy, and fostering informed decision-making to demystify financial complexities and steer your business toward sustained success.