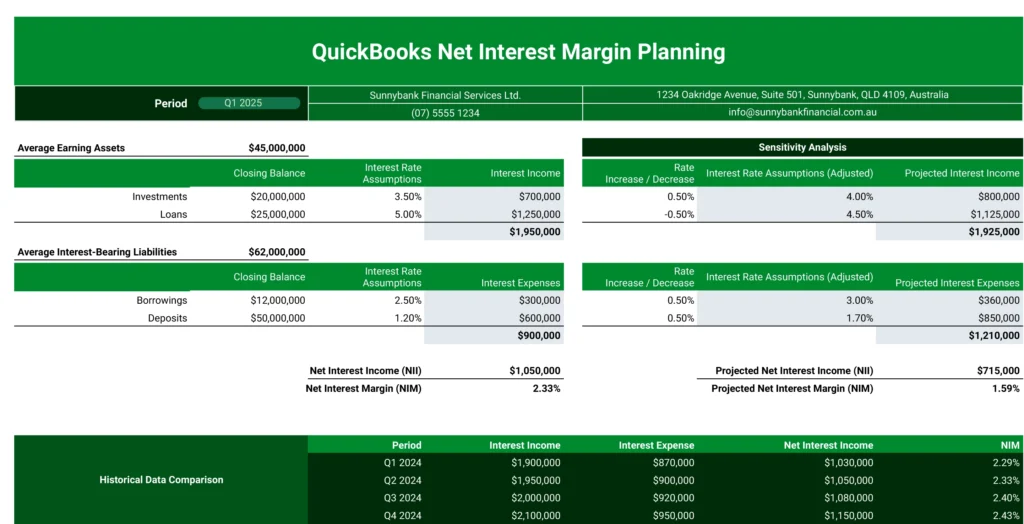

Managing net interest margins across loans, investments, and deposits demands precision and regular updates. This QuickBooks template helps financial teams analyze and plan their net interest margins with a structured, comprehensive approach.

What is a Net Interest Margin Planning Report?

A Net Interest Margin Planning report tracks the difference between interest income earned and interest paid out, expressed as a percentage of average earning assets. This report is essential for banks, credit unions, and financial institutions to monitor profitability from their core lending activities. The report analyzes interest income from loans and investments against interest expenses from deposits and borrowings to calculate the net interest margin.

Who is Net Interest Margin Planning Template Built For?

This template serves:

- Financial controllers and CFOs at banks and credit unions

- Treasury management professionals

- Financial analysts in lending institutions

- Risk management teams monitoring interest rate exposure

- Banking executives making strategic decisions about loan and deposit pricing

What is the Primary Use Case for Net Interest Margin Planning Template?

The template helps financial teams:

- Calculate and track net interest margins across different product lines

- Project future margins based on interest rate scenarios

- Compare historical performance against current margins

- Monitor the impact of rate changes on overall profitability

Benefits of Using QuickBooks Net Interest Margin Planning Template

- Structured Analysis: Organized view of interest income and expenses across all categories

- Scenario Planning: Built-in calculations for different interest rate scenarios

- Performance Tracking: Clear comparisons between historical and current margins

- Comprehensive Reporting: Complete breakdown of earning assets and interest-bearing liabilities

Metrics Tracked in the Report

- Interest Income

- Loans

- Investments

- Interest Expense

- Deposits

- Borrowings

- Net Interest Income

- Average Earning Assets

- Average Interest-Bearing Liabilities

- Net Interest Margin Calculation

- Interest Rate Assumptions

- Sensitivity Analysis

- Historical Data Comparison

- Projected Net Interest Margin

Additional QuickBooks Reports Available

- P&L Budget vs. Actuals

- P&L by Class

- Expenses by Vendor

- Profit & Loss by Month & Class

- Consolidated P&L

- Profit & Loss – MoM Growth

- A/P Dashboard

- A/R Dashboard