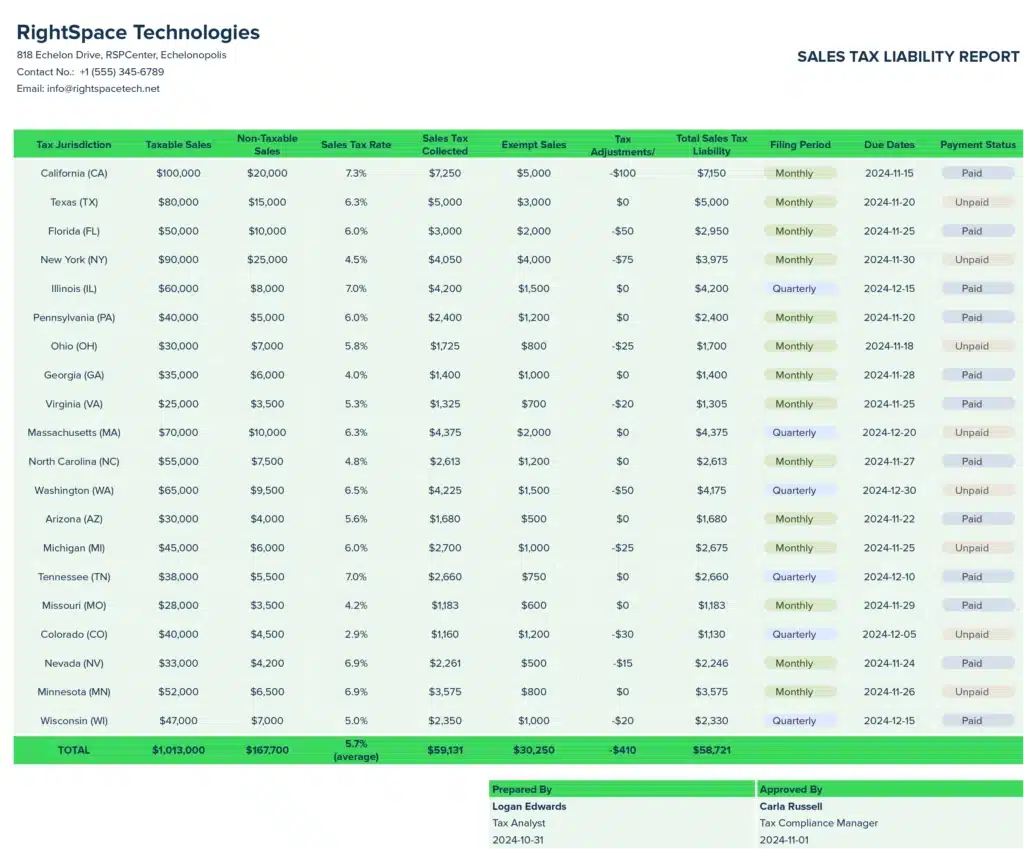

Tracking sales tax across multiple jurisdictions can be complex and time-consuming. Coefficient’s free QuickBooks template for Sales Tax Liability reporting simplifies this process, providing real-time data and comprehensive insights to manage your tax obligations effectively.

What is a Sales Tax Liability Report?

A Sales Tax Liability Report is a crucial financial document that summarizes the taxable and non-taxable sales, along with the total sales tax collected from customers over a specific period. This report is essential for businesses to understand their tax obligations, ensure compliance with various tax jurisdictions, and prepare for tax filings.

The report typically includes details such as tax jurisdictions, taxable and non-taxable sales amounts, applicable tax rates, and the total tax liability. It serves as a vital tool for businesses to track, manage, and remit sales taxes accurately and on time.

Who is the Sales Tax Liability Template Built For?

This template is designed for:

- Small to medium-sized business owners

- Accountants and bookkeepers

- Finance managers and CFOs

- Tax professionals

- E-commerce businesses dealing with multi-state sales

Anyone responsible for managing sales tax collection, reporting, and remittance will find this template invaluable for maintaining accurate records and ensuring compliance.

What is the Primary Use Case for the Sales Tax Liability Template?

The primary use case for this template is to provide a clear, up-to-date view of a company’s sales tax obligations across various jurisdictions. It allows users to:

- Track sales tax collected by jurisdiction

- Monitor taxable and non-taxable sales

- Calculate total sales tax liability

- Prepare for tax filings and audits

- Identify discrepancies or potential issues in tax collection

By automating data collection and presentation, this template saves time and reduces the risk of errors in sales tax management.

Benefits of Using QuickBooks Sales Tax Liability Template

- Real-time Data Updates: The template syncs directly with QuickBooks, ensuring you always have the most current sales tax information.

- Improved Accuracy: By automating data collection and calculations, the template minimizes human error in tax reporting.

- Time Savings: Eliminate manual data entry and report generation, freeing up valuable time for analysis and decision-making.

- Multi-jurisdiction Management: Easily track and manage sales tax across multiple states, counties, and cities from a single dashboard.

- Audit Readiness: Maintain detailed, organized records of your sales tax collection and liability, making it easier to prepare for potential audits.

Metrics Tracked in the Report

- Tax Jurisdiction (State/County/City)

- Taxable Sales

- Non-Taxable Sales

- Sales Tax Rate

- Sales Tax Collected

- Exempt Sales

- Tax Adjustments/Refunds

- Total Sales Tax Liability

- Filing Period (Monthly/Quarterly)

- Due Dates

- Payment Status

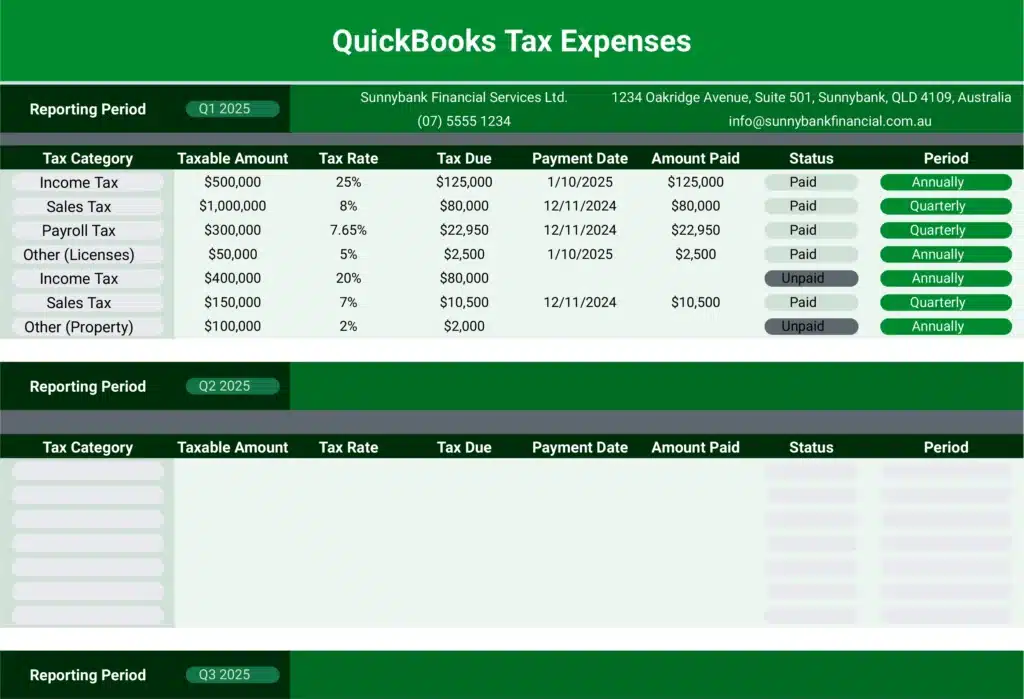

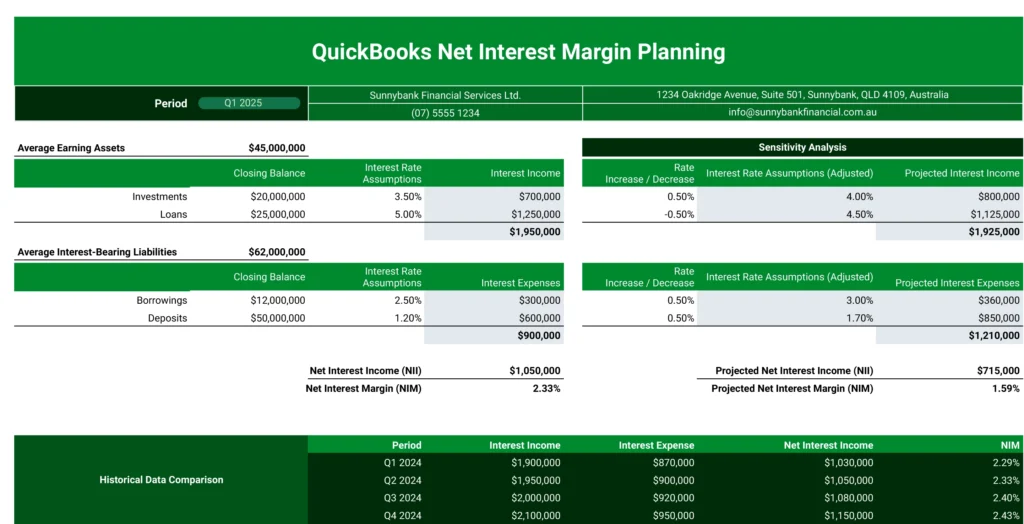

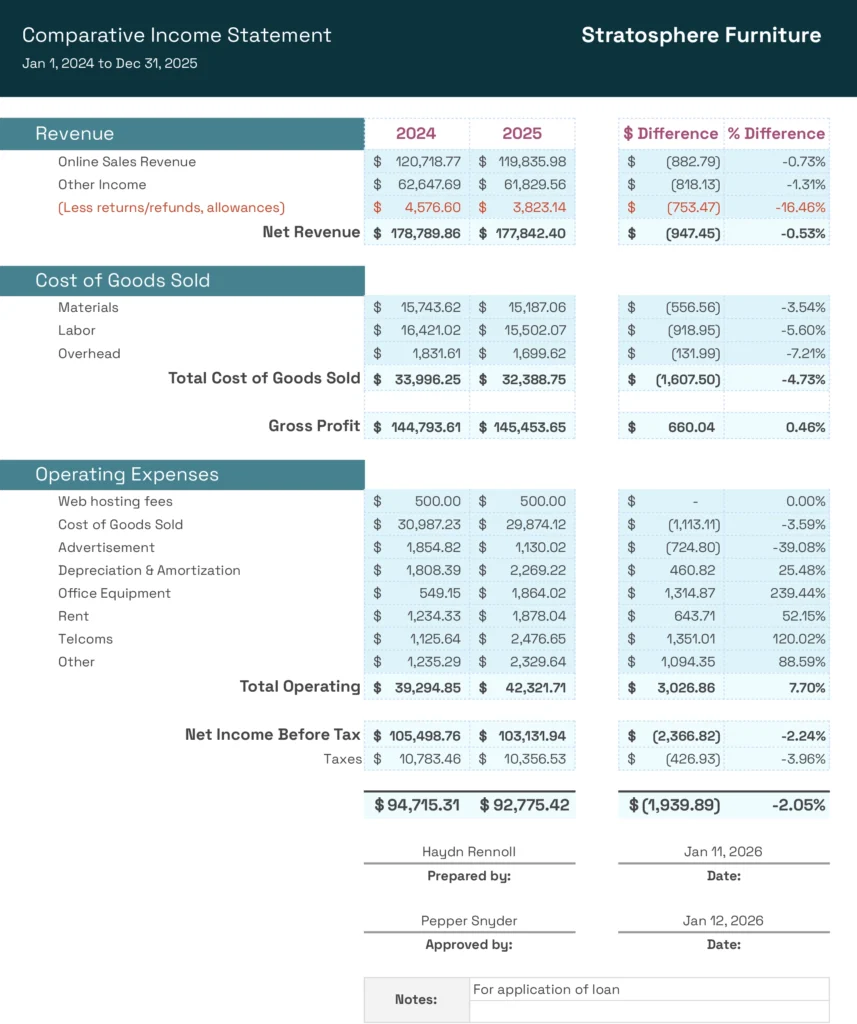

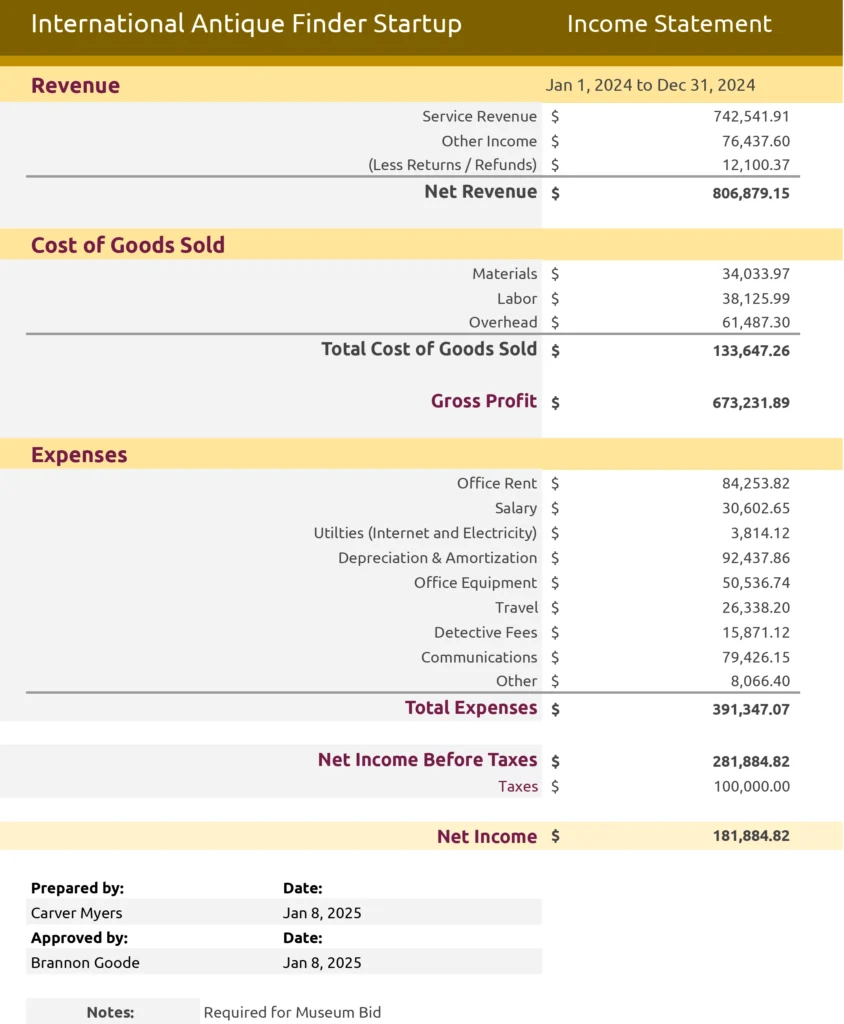

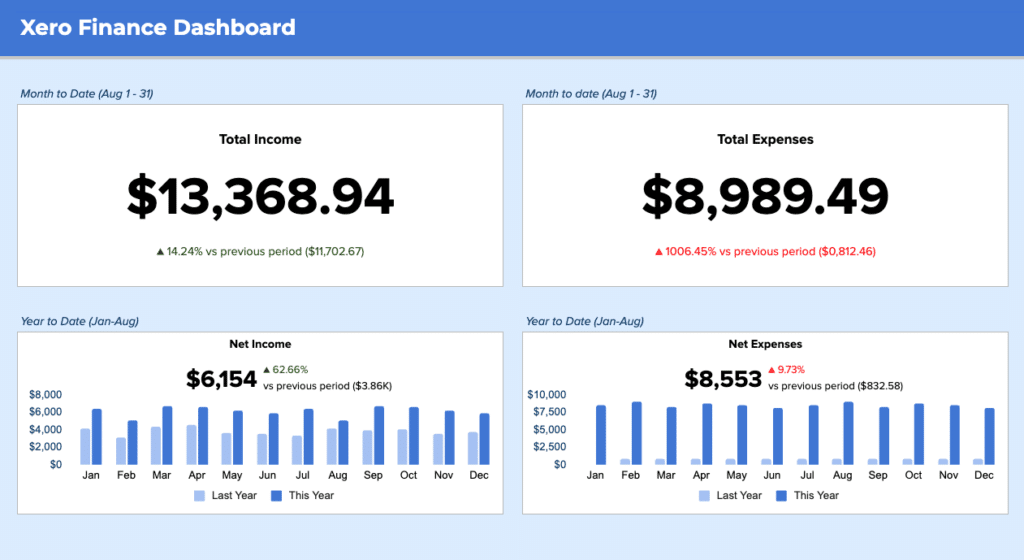

More Metrics to Track and Analyze on Google Sheets

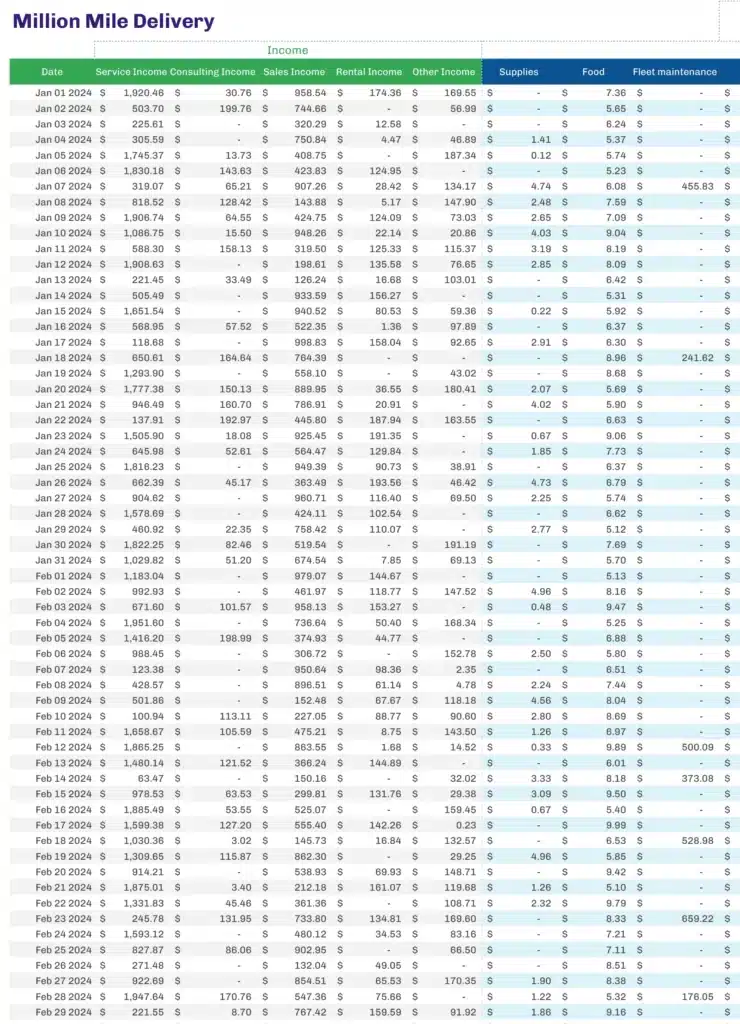

With Coefficient’s QuickBooks integration, you can pull additional data into your Google Sheets, including:

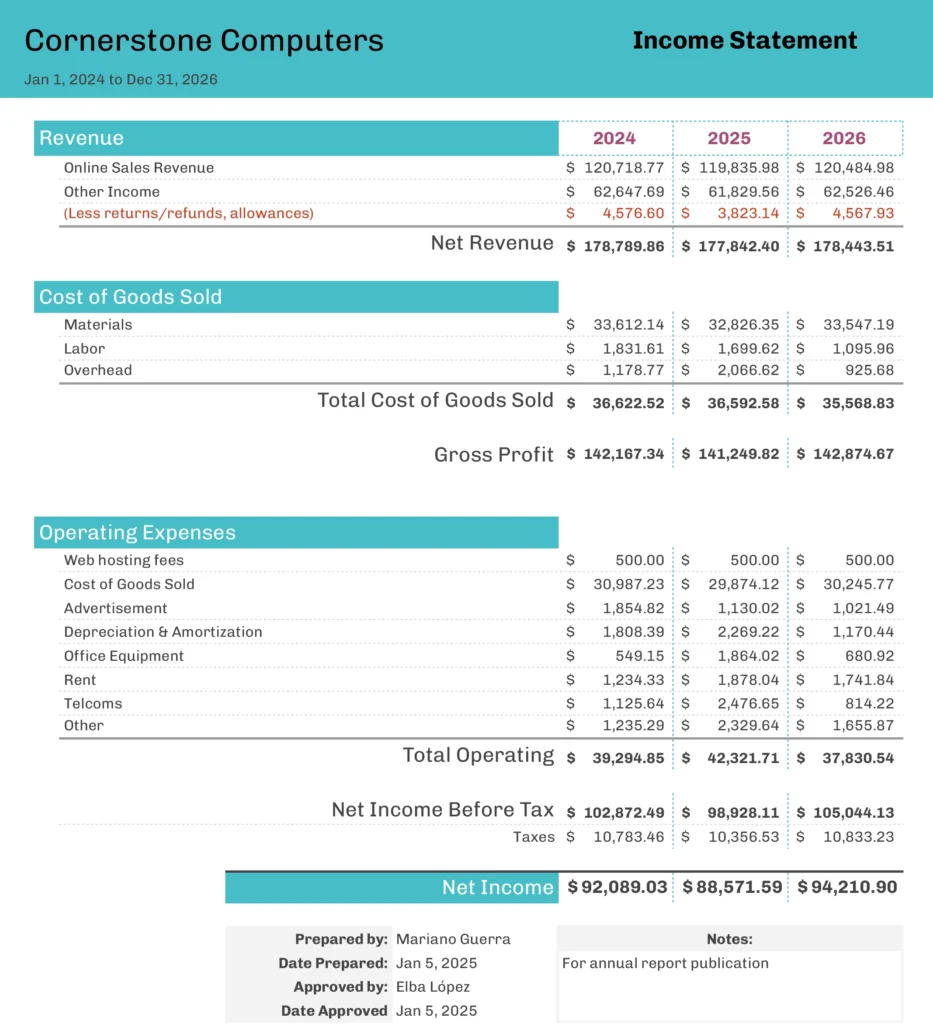

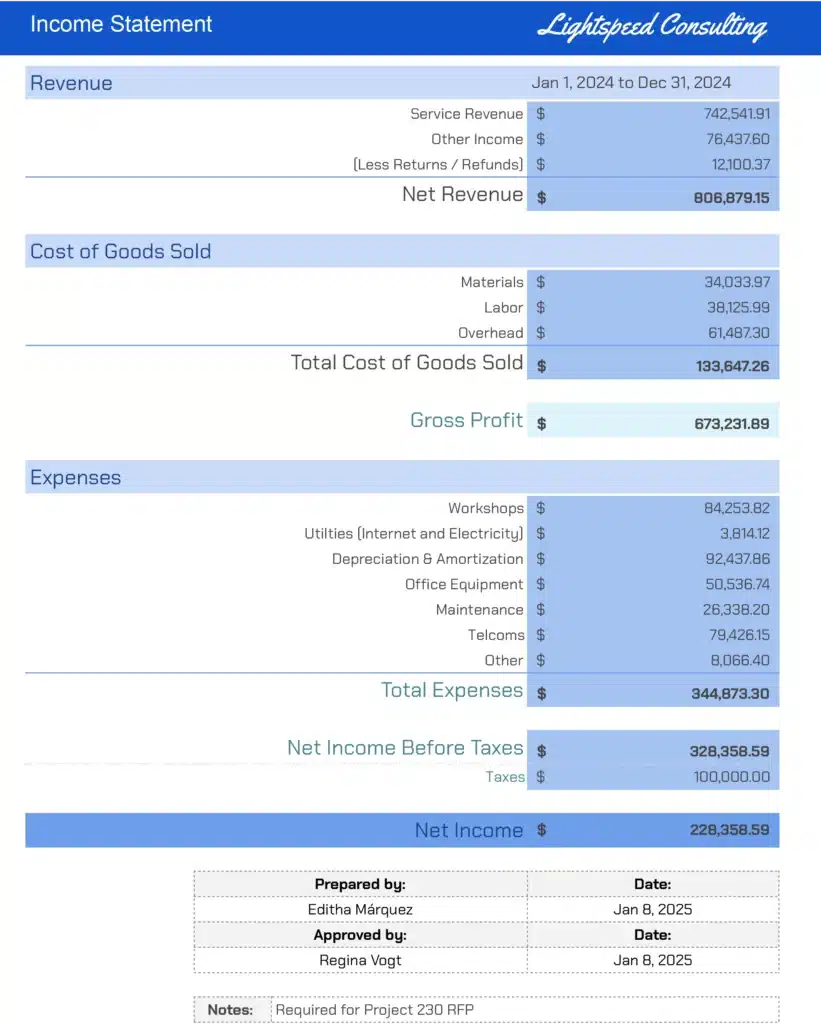

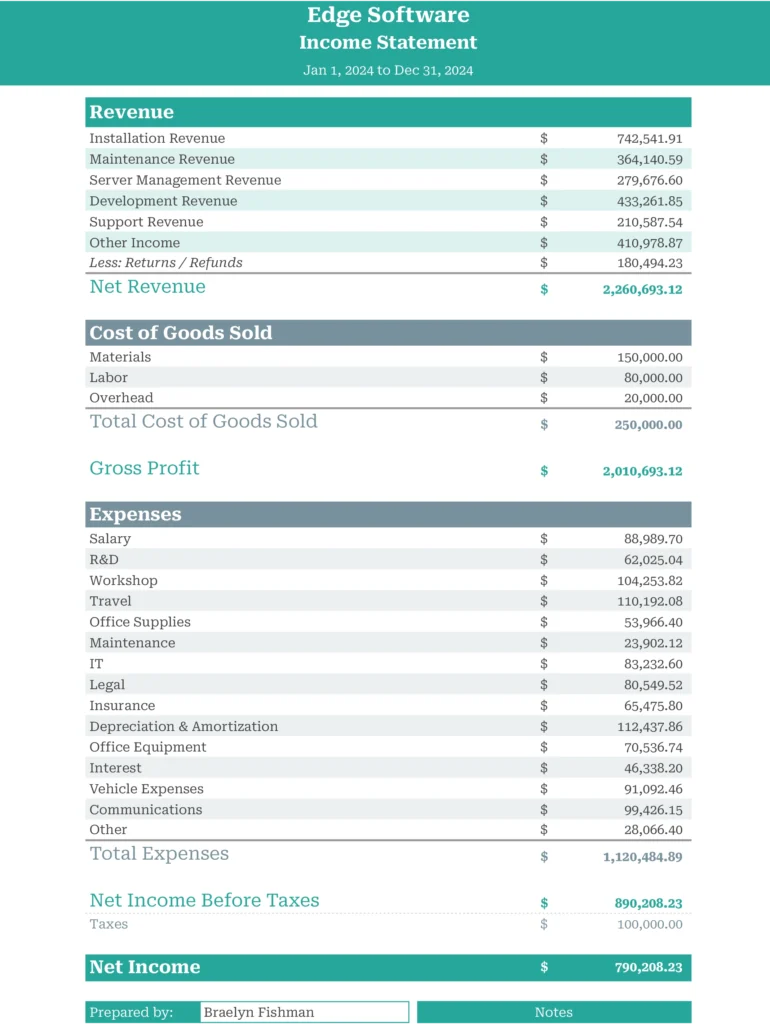

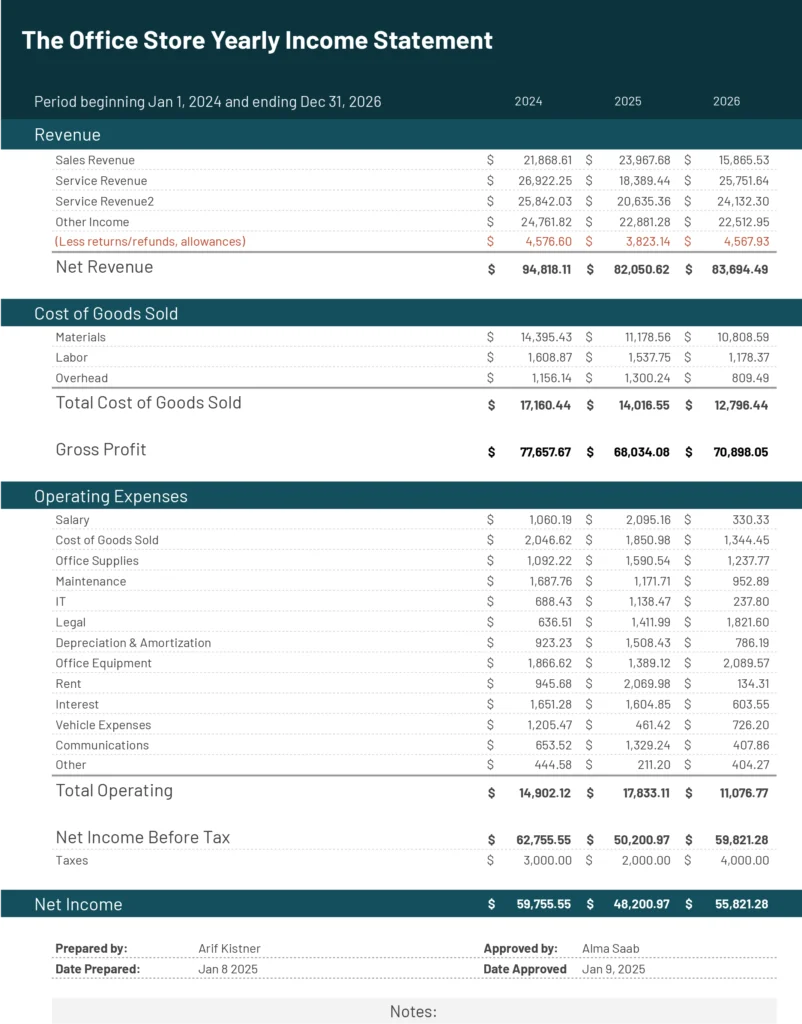

- Profit & Loss statements

- Budget vs. Actuals comparisons

- Expenses by Vendor

- Accounts Payable and Accounts Receivable data

- Monthly and quarterly financial performance

- Department or location-specific financial data

You can also:

Access a set of free, plug-and-play financial templates

Connect to multiple QuickBooks companies

Choose from various report types

Automatically consolidate reports

Sort data by department or location