Most budgets just repeat last year’s spending. They maintain the status quo by making small adjustments based on what departments spent before. This approach might work when business stays predictable, but it fails when companies need to grow, pivot, or compete in changing markets.

Strategic budgeting takes a different path. Instead of asking “what did we spend last year,” it starts with “what investments will help us achieve our goals.” This forward-looking approach aligns every dollar with specific business objectives over a three to five year horizon.

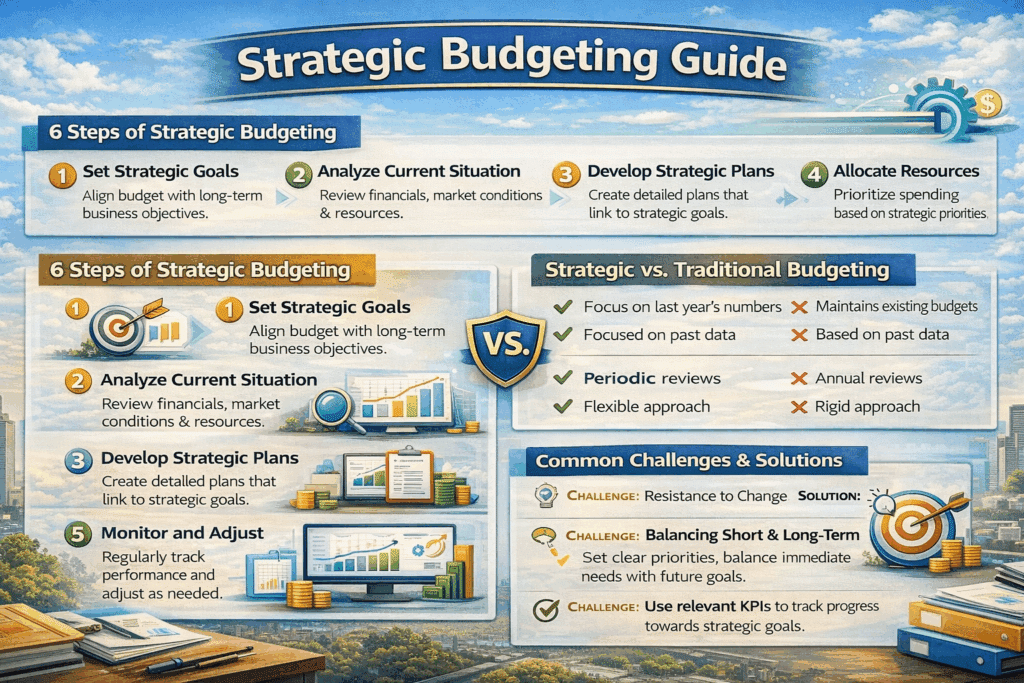

This guide explains how strategic budgeting works and how to implement it. You’ll learn the six-step process, compare strategic versus traditional approaches, and understand common challenges teams face when making the shift.

What is strategic budgeting?

Strategic budgeting is a financial planning approach that aligns an organization’s budget with its long-term strategic objectives. Unlike traditional budgeting that relies on historical data and incremental adjustments, strategic budgeting focuses on funding initiatives that drive growth and competitive advantage over a three to five year period.

The core difference is focus. Traditional budgets ask “how much did we spend last year?” Strategic budgets ask “what investments will move us closer to our goals?” This shift changes how organizations prioritize spending.

Key characteristics include:

- Future-focused planning that allocates resources based on where the company wants to go

- Goal-driven decisions where every budget line item connects to specific strategic objectives

- Cross-functional collaboration requiring input from all departments to ensure alignment

- Built-in flexibility allowing adjustments as market conditions and priorities shift

Strategic budgeting helps finance teams move from cost control to value creation. Instead of spreading money evenly across departments, it concentrates resources on initiatives that deliver the most strategic impact.

Why strategic budgeting matters

Strategic budgeting creates clear connections between financial decisions and business goals.

Aligns financial resources with long-term goals

Strategic budgeting ensures every financial decision directly supports your organization’s vision. Instead of spreading resources thinly across all departments equally, strategic budget planning concentrates funding on initiatives that deliver maximum impact toward your three to five year targets.

This alignment creates organizational focus. When budgets reflect strategic priorities, everyone works toward common goals rather than competing for resources. Research from McKinsey shows companies aligning budgetary decisions with strategic objectives realize up to 20% higher ROI. Money flows to activities that create value, not just activities that existed before.

Improves agility and responsiveness

Traditional annual budgets become outdated quickly. A budget set in November might be obsolete by March when market conditions shift or new opportunities emerge.

Strategic budgeting incorporates scenario planning, rolling forecasts, and regular review cycles that let organizations adapt. Companies can respond to challenges in real-time rather than waiting for the next annual planning cycle. When a new market opportunity appears, they can reallocate resources within weeks instead of being locked into outdated plans.

Enables data-driven decision making

Strategic budgeting transforms abstract strategies into measurable financial outcomes. By establishing clear KPIs tied to budget allocations, organizations track whether investments deliver expected returns.

Finance teams use real-time data to monitor variance between actual performance and strategic targets. They identify issues early and make course corrections before small problems become big losses. The data-driven approach also improves stakeholder communication—board members see which strategic goals are on track and which need attention.

Strategic budgeting process: 6 steps

Step 1: Define strategic objectives

Strategic budgeting starts with clarity about where the organization is headed. Without well-defined objectives, you can’t determine which initiatives deserve funding.

Leadership establishes 3-5 year strategic goals that cascade throughout the organization. These goals should be specific, measurable, and tied to the company’s mission. For example, a SaaS company might target 40% annual recurring revenue growth, 90% customer retention, and expansion into three new markets.

Each strategic goal needs supporting objectives that break down high-level targets into actionable components. If market expansion is a goal, supporting objectives might include hiring regional sales teams, adapting product for local requirements, and establishing partner networks.

Finance works with department heads to establish priority ranking across strategic initiatives. Not everything can be top priority. Strategic budgeting requires tough choices about which initiatives get funded first when resources are limited.

Step 2: Assess current financial position

Before allocating resources to strategic priorities, organizations must understand their current financial reality. This assessment provides the foundation for realistic budget planning.

Finance teams analyze revenue trends, profitability by product or segment, cash flow patterns, working capital requirements, and debt obligations. This creates a comprehensive picture of financial health and capacity for strategic investment.

Coefficient integration: Finance teams often spend hours pulling multi-year financial data from ERPs. Coefficient can automatically pull profit and loss data directly into spreadsheets to establish baseline and identify historical trends without manual exports.

The assessment identifies both opportunities and constraints. Strong cash flow might enable aggressive investment in growth initiatives. High debt service requirements might necessitate more conservative approaches focusing on profitability over expansion.

Step 3: Identify strategic initiatives

With objectives clear and financial capacity understood, organizations develop specific initiatives that will drive progress toward strategic goals. Each initiative needs clear definition including objectives, timeline, resource requirements, expected outcomes, and success metrics.

For example, a strategic initiative to expand into healthcare vertical might include hiring industry-specialized sales representatives, developing vertical-specific product features, creating industry-focused marketing campaigns, and establishing partnerships with healthcare technology platforms.

This step also involves identifying dependencies between initiatives. Some projects must succeed before others can begin. Understanding these relationships helps sequence investments appropriately.

Step 4: Estimate costs and benefits

Finance teams work with initiative owners to build detailed resource requirements including headcount and compensation, technology and infrastructure, marketing and customer acquisition, professional services, and operational expenses. These requirements become the building blocks for budget allocation decisions.

Return on investment analysis is critical here. What revenue growth, cost savings, or competitive advantage will each initiative deliver? When will the organization see returns? ROI projections help prioritize which initiatives receive funding when resources are limited.

Build multiple scenarios for each initiative—optimistic, baseline, and pessimistic—to understand the range of potential outcomes and risks.

Step 5: Allocate resources strategically

Resource allocation represents the core of strategic budgeting. This is where organizations make explicit choices about which initiatives receive funding and how much.

Leadership uses a structured framework to evaluate and prioritize initiatives. Common approaches include strategic impact scoring, risk-adjusted return models, and portfolio management frameworks.

- High-impact, high-confidence initiatives typically receive full funding

- Medium-impact or higher-risk initiatives might receive phased funding contingent on achieving milestones

- Low-impact initiatives get deferred or eliminated

Organizations also maintain reserves for unexpected opportunities or challenges. Strategic budgeting isn’t about allocating every dollar in advance—it’s about creating frameworks for making smart allocation decisions as circumstances evolve.

Step 6: Monitor KPIs and adjust

Implementation requires clear accountability, regular tracking, and transparent communication. Each strategic initiative needs an owner responsible for execution and results.

Finance establishes reporting cadences that track initiative progress against plans. Monthly dashboards typically include spending versus budget, milestone achievement, key performance indicators, and variance explanations.

Regular review meetings enable course corrections. If an initiative is off track, leadership determines whether to provide additional support, adjust timelines, or reallocate resources. The goal is identifying problems early when corrective action is still effective.

Strategic budgeting is not an annual exercise. Quarterly reviews reassess strategic priorities and resource allocation based on market changes, competitive moves, initiative performance, and updated forecasts.

Strategic budget vs traditional budget

|

Aspect |

Traditional Budget |

Strategic Budget |

|---|---|---|

|

Starting point |

Last year’s spending |

Strategic objectives |

|

Time horizon |

1 year |

3-5 years |

|

Focus |

Cost control |

Value creation |

|

Allocation method |

Incremental adjustments |

Priority-based funding |

|

Flexibility |

Fixed annual targets |

Rolling adjustments |

|

Decision criteria |

Historical precedent |

Strategic impact |

|

Review cycle |

Annual |

Quarterly or continuous |

|

Department role |

Defend existing budget |

Propose strategic initiatives |

The fundamental shift is from backward-looking to forward-looking. Traditional budgets assume the future looks like the past. Strategic budgets assume the future requires deliberate choices about where to invest for growth.

How to implement strategic budgeting

Shifting from traditional to strategic budgeting requires organizational change, not just new spreadsheets.

Secure executive sponsorship

Strategic budgeting changes how resources get allocated. Some departments will receive more funding, others less. Without clear executive support, political resistance will derail implementation. Leadership must communicate why the shift matters and reinforce the new approach consistently.

Start with pilot programs

Don’t overhaul the entire budget process at once. Select one business unit or initiative category for strategic budgeting pilot. Demonstrate value with concrete results before expanding organization-wide.

Build cross-functional alignment

Strategic budgeting requires input from all departments. Finance can’t create strategic budgets in isolation. Establish cross-functional planning teams that include operations, sales, product, and other key stakeholders. This ensures initiatives are realistic and have organizational buy-in.

Invest in data infrastructure

Strategic analysis requires accurate, timely data from multiple sources. Manual data wrangling creates bottlenecks and errors.

Coefficient positioning: Automate financial data flows that connect your ERP, CRM, and other systems directly to spreadsheets. This supports real-time strategic analysis and lets you track actuals versus long-term targets without manual exports. When data flows automatically, finance teams can focus on analysis rather than data preparation.

Train finance teams on new skills

Strategic budgeting requires different capabilities than traditional budgeting. Finance teams need skills in scenario modeling, strategic analysis, and business partnering. Invest in training and give teams time to develop these capabilities.

Celebrate early wins

Change is hard. When strategic budgeting delivers measurable improvements—faster decisions, better resource allocation, clearer strategic progress—communicate those wins broadly. Success stories build momentum and overcome skepticism.

3 Strategic budgeting methods

#1 Priority-based budgeting

Priority-based budgeting allocates resources according to how well programs or initiatives align with strategic priorities. Instead of funding departments based on historical spending, it evaluates each initiative’s strategic value and funds accordingly.

How it works: Organizations define strategic priorities, then score each program or initiative against those priorities. High-scoring initiatives receive full funding. Lower-scoring initiatives receive reduced funding or elimination. This forces explicit trade-offs rather than spreading resources thinly across everything.

Best for: Organizations needing to fundamentally realign spending with new strategic direction, or those facing resource constraints requiring tough prioritization decisions.

#2 Rolling strategic budgets

Rolling strategic budgets maintain continuous forward-looking projections (typically 12-18 months) that update regularly rather than fixed annual budgets.

How it works: Instead of creating an annual budget for the fiscal year, organizations maintain a rolling forecast that always projects 12-18 months ahead. Each quarter, the forecast updates based on actual results, revised assumptions, and market changes. As Q1 completes, the forecast extends to include a new future quarter.

Best for: Dynamic industries with rapid change, high uncertainty, or seasonal variability. Technology companies, retailers, and organizations in emerging markets benefit most from continuous planning approaches.

#3 Scenario-based strategic budgeting

Scenario-based budgeting develops multiple budget versions based on different future scenarios (optimistic, baseline, pessimistic) rather than a single plan.

How it works: Organizations identify key uncertainties affecting strategic outcomes—economic conditions, competitive actions, regulatory changes. Finance builds distinct budget scenarios reflecting different assumption sets. Leadership plans responses for each scenario and establishes triggers indicating which scenario is materializing.

Best for: Environments marked by economic volatility, rapid technology change, or geopolitical instability. It transforms strategic budget planning from prediction to preparation, speeding decision-making when conditions change since response plans already exist.

Common strategic budgeting challenges

Resistance to change from traditional budgeting

The problem: Organizations accustomed to incremental budgeting face cultural resistance when shifting to strategic approaches. Department heads feel threatened when past allocations are questioned. Finance teams struggle with new skills required for scenario modeling and strategic analysis.

The solution: Start with pilot programs to demonstrate value. Provide comprehensive training so teams develop confidence with new approaches. Secure executive sponsorship to reinforce the change’s importance. Consider hybrid approaches initially, maintaining some traditional elements while introducing strategic components gradually.

Data quality and integration issues

The problem: Strategic budgeting requires accurate, timely data from multiple sources including ERPs, CRMs, and HR systems. Many organizations struggle with data silos, manual processes, and outdated information. Finance teams waste hours pulling data from different systems and reconciling discrepancies.

The solution: Invest in data integration that automates connections between source systems and planning tools. Establish data governance standards ensuring consistent definitions across the organization. Tools like Coefficient that connect business systems directly to spreadsheets eliminate manual exports and ensure real-time accuracy.

Balancing short-term operations with long-term strategy

The problem: Strategic budgeting emphasizes long-term goals, but organizations can’t ignore short-term operational needs. Over-investment in strategy at the expense of operations can destabilize the business. Excessive operational focus prevents strategic progress.

The solution: Establish explicit allocation frameworks that ensure both needs get addressed. For example, use a 70-30 split between operations and strategy, adjusting based on company maturity and market position. Build strategic initiatives with phased funding that demonstrates value before major commitments.

Measuring strategic progress and ROI

The problem: Unlike operational budgets with clear expense targets, strategic initiatives often have longer payback periods and harder-to-measure benefits. Finance teams struggle to demonstrate whether strategic investments are working.

The solution: Define leading and lagging indicators for each strategic objective during initial planning. Leading indicators provide early signals about whether initiatives are on track. Establish milestone-based funding where initiatives must demonstrate measurable progress to receive subsequent funding. Accept that some strategic value is qualitative, but document assumptions and reassess periodically.

Align your budget with your strategy

Strategic budgeting shifts organizations from maintaining the past to building the future. It replaces incremental thinking with intentional choices about which investments create the most value. The six-step process provides a framework for aligning financial resources with long-term goals.

Implementation takes effort—executive sponsorship, cross-functional collaboration, and technology that supports continuous planning. But organizations that make the shift gain competitive advantage through better resource allocation and faster response to market changes.

Get started with Coefficient to automate the data flows that enable strategic analysis and real-time decision making.