Manual reconciliation drains finance teams. Mid-market companies spend 6 to 10 days closing their books each month, with reconciliation tasks eating up to 40% of that time. Manual processes introduce a 5 to 10% error rate, forcing teams to hunt down problems instead of doing real analysis. The result: delayed reports, stressed teams, and statements that arrive too late to drive decisions.

This guide covers 11 account reconciliation best practices that can cut your close time by 30 to 70%. You’ll learn how to rank accounts by risk, automate data flows, set thresholds that matter, and track metrics that actually improve results.

11 Account Reconciliation Best Practices

1. Implement risk-based account reconciliation

Not every account needs the same scrutiny. Risk-based reconciliation focuses detailed effort on high-impact accounts while reducing frequency for low-risk ones. This account reconciliation best practice optimizes where your team spends time and ensures critical accounts get the attention they deserve.

Rank accounts using three factors:

- Financial impact: Balance size, materiality thresholds, and effect on financial statements

- Vulnerability: Control strength, transaction complexity, history of errors or adjustments

- Activity level: Volume and frequency of transactions, number of people with access

Apply a three-tier approach:

- High-risk accounts: Reconcile monthly (cash, AR, AP, intercompany, revenue)

- Medium-risk accounts: Reconcile quarterly on a rolling schedule

- Low-risk accounts: Reconcile semi-annually or annually

Currently, 36% of companies reconcile low-risk accounts monthly—wasting significant time on items that don’t matter. A low-balance office supplies prepaid account doesn’t need the same attention as your primary operating cash account.

Set materiality thresholds that reflect account size. Not every variance needs investigation. A $50 variance on a $5 million account is immaterial; the same variance on a $1,000 account might warrant a closer look.

Review risk rankings quarterly. Currently, 32% of companies only reassess annually, missing shifts in account behavior. An account showing unusual month-over-month variance may need temporary elevation to high-risk status until patterns stabilize. Dynamic assessment keeps your approach aligned with actual risk rather than assumptions from a year ago.

2. Define acceptable variance by account size

Stop chasing pennies. Variance thresholds prevent your team from wasting time on differences that don’t matter. This simple policy change can save hours each month.

Create tiered tolerance levels:

- High-value accounts: Lower tolerance (e.g., $100 or 0.1%)

- Medium-value accounts: Moderate tolerance (e.g., $500 or 0.5%)

- Low-value accounts: Higher tolerance (e.g., $1,000 or 1%)

Document these thresholds in your reconciliation policy. Define what needs a journal entry versus what can carry forward to the next period. Different thresholds for different account types ensure consistency while reducing judgment calls.

Clear policies eliminate back-and-forth discussions about whether to investigate minor variances. Your team spends time on material items instead of tracking down rounding differences. Faster close times don’t compromise accuracy when thresholds are set correctly.

3. Automate data imports from your ERP

Manual data entry is the biggest time sink in reconciliation. Companies still downloading CSVs, cleaning data in Excel, and copying between systems waste hours on tasks automation handles in seconds. This single change delivers the highest ROI of any process improvement.

The impact of automation:

- Reduces reconciliation time by 70 to 85%

- Cuts manual data entry errors by 70%

- Achieves 95% fewer errors than manual processes

- Can cut month-end close by 50%

Cyrq Energy faced this exact problem. The geothermal power company operates plants across the Western US with a lean finance team. They needed to deliver complex reports across multiple entities, but manual data work slowed everything down. Previous tools were either too expensive or forced all work into Excel.

The team implemented a NetSuite integration through Coefficient, performing 80% of data cleaning in NetSuite before pulling to Excel. They rebuilt their entire data pipeline in days instead of months. Finance now owns the automation without IT dependency.

The results: Cyrq recreated months of work in days, saved over $50,000 annually in software costs, and cut several hours from weekly reporting. “We were able to recreate reports on our NetSuite data in days with Coefficient. This took us months to build with other database query tools,” explains Sam Sholeff, Director of Finance.

Modern tools connect directly to systems like NetSuite, Sage Intacct, QuickBooks, and data warehouses. Scheduled refreshes run overnight or before key deadlines, so reports always reflect current data.

4. Standardize one template for each account type

When every accountant uses their own format, reconciliations become impossible to review efficiently. Inconsistent processes increase training time, introduce errors, and make period-over-period comparisons meaningless.

Standard templates should include:

- Account information header with name and number

- Beginning and ending balances

- Additions and reductions during the period

- Reconciling items with clear explanations

- Sign-off section for preparer and reviewer

- Supporting documentation references

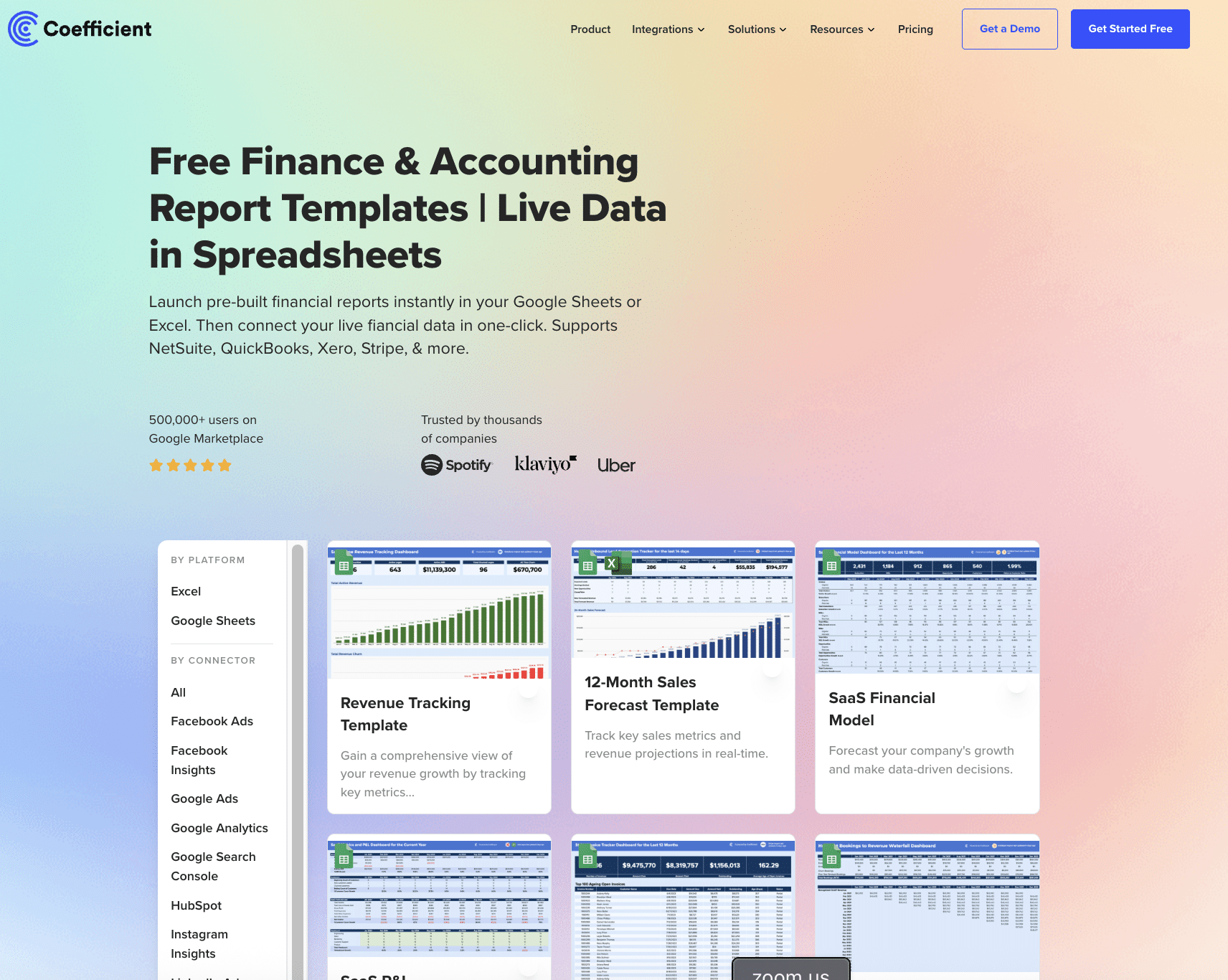

Coefficient’s month-end close checklist template provides a starting point for building your standardized approach.

You can also explore finance and accounting dashboards for pre-built templates that connect to your live data. Consistent formatting speeds up reviews and simplifies cross-training when staff changes.

5. Reconcile high-volume accounts weekly, not monthly

Waiting until month-end creates unnecessary bottlenecks. High-volume accounts should be reconciled more frequently to spread workload and catch problems when details are still fresh in everyone’s mind.

Accounts to reconcile weekly or daily:

- Cash accounts with high transaction volume

- Credit card accounts with daily activity

- High-volume revenue accounts

- Payment processor accounts (Stripe, PayPal, etc.)

Smaller batches of transactions are easier to match. You catch discrepancies when context is still clear instead of trying to remember what happened three weeks ago. The workload spreads throughout the month instead of cramming into the final days. Issues get identified and resolved before they compound.

Companies using continuous reconciliation stay “always closed” rather than scrambling at period-end. This approach reduces month-end stress and delivers financial visibility throughout the month—not just after the close is complete.

6. Separate who prepares, reviews, and approves

Basic fraud prevention requires segregation of duties. The person reconciling accounts cannot be the same person reviewing their work.

Use a three-layer process:

- Preparer: Performs the reconciliation and documents all items

- Reviewer: Verifies work independently, checks calculations, validates explanations

- Approver: Senior person confirms completeness and accuracy

Example workflow: Staff accountant prepares the reconciliation. Senior accountant reviews for completeness and accuracy. Controller or CFO provides final sign-off. All steps get documented with signature and date.

The person reconciling should not have access to bank deposits, check signing, or accounts payable processing. This separation prevents fraud and catches errors before they become problems.

When perfect segregation isn’t possible in small teams, implement compensating controls: more detailed reviews, automation as an additional control layer, and periodic rotation of responsibilities.

7. Track KPIs that actually matter

You can’t improve what you don’t measure. The right metrics drive accountability and continuous improvement across your reconciliation process.

Critical reconciliation KPIs:

- Completion rate: Percentage reconciled by deadline (target: 100% by day 3-5)

- Overdue count: Reconciliations past due date (target: 0)

- Outstanding items: Value and age of unresolved differences (target: <2% of balance, items <30 days old)

- Cycle time: Average days to complete by account type (target: reduce 30%+ annually)

- Error rate: Percentage requiring journal entries (track trends over time)

Dashboard visibility enables real-time monitoring across your entire team. Set threshold alerts for items needing immediate attention.

Coefficient’s Slack and email alerts trigger automatically when KPIs fall outside targets.

You catch problems before they compound instead of discovering issues at month-end. Track metrics across multiple entities without manual reporting. Historical trending shows whether process changes actually deliver improvement over time.

8. Build smart transaction matching rules

Matching rules automate the comparison of records across systems. Well-configured rules achieve 90%+ auto-match rates, dramatically reducing manual effort.

Types of matching rules:

- Exact match: Amount and date match precisely (1-to-1)

- Fuzzy match: Accounts for rounding or transposed digits

- Tolerance matching: Matches within defined variance threshold

- One-to-many: Single payment clears multiple invoices

- Many-to-one: Multiple payments applied to single invoice

Configure rules from most precise to least certain. Start with exact matches, then work down to tolerance matches. Include multiple reference attributes beyond just amount—transaction dates, reference numbers, and customer identifiers all help. Use date ranges to account for timing differences between systems.

Finance teams then focus only on exceptions requiring human judgment. Good rules reduce reconciliation from hours to minutes for high-volume accounts.

9. Document everything, but make it easy

Good documentation is critical for audit trails, compliance, and knowledge retention. Poor documentation leads to failed audits and lost institutional knowledge when staff turns over.

What to document:

- All reconciling items with clear explanations

- Supporting documents (receipts, invoices, approvals)

- Journal entries made to resolve discrepancies

- Who prepared, reviewed, and approved (with dates)

- Reason for any variances or timing differences

Make documentation easy by using templates with required fields. Store documents electronically with consistent naming conventions. Link supporting docs directly to reconciliation items. Automated systems can maintain audit trails without extra effort.

Finance teams with good documentation spend 60% less time on audit prep. Clear trails demonstrate compliance with internal controls and reduce regulatory scrutiny.

10. Review policies every quarter

Account reconciliation best practices and processes will evolve as your business changes. Static policies become outdated and inefficient quickly.

Review quarterly: Risk rankings of accounts, materiality thresholds, variance tolerances, reconciliation frequency, rule configurations, and staffing assignments.

Trigger immediate review when: New acquisitions or subsidiaries get added, ERPs or accounting systems change, new payment processors or bank accounts launch, transaction volumes shift significantly, or key staff turn over.

Continuous improvement means reviewing metrics to identify bottlenecks, updating procedures based on lessons learned, eliminating accounts no longer needed, and optimizing as the company scales.

11. Start reconciling before the period ends

The most efficient finance teams don’t wait for month-end to start reconciling. They begin work during the last week of the period on accounts that can be substantially completed early.

Accounts to start early:

- Fixed assets and depreciation

- Prepaid expenses and amortization

- Accrued liabilities with predictable patterns

- Intercompany accounts with regular activity

Run preliminary reconciliations on day 25-28 of the month. Identify potential issues while there’s still time to research and resolve them. By the time the period officially closes, you’ve already completed 30-40% of your reconciliation work.

This proactive approach turns month-end from a sprint into a steady walk. Your team arrives at close with fewer surprises and more capacity for the accounts that genuinely require final numbers.

Implementation Roadmap: First 90 Days

Rolling out these account reconciliation best practices requires a structured approach. This roadmap breaks implementation into manageable phases.

Month 1: Assess and plan (Days 1-30)

Inventory all accounts requiring reconciliation. Document current owners and frequency. Conduct risk assessment for each account—classify as high, medium, or low based on financial impact, vulnerability, and activity level. Interview preparers and reviewers to identify pain points and bottlenecks. Define materiality thresholds and variance tolerances by account type.

Deliverable: Risk-ranked account list and gap analysis comparing current state to best practices.

Month 2: Standardize and pilot (Days 31-60)

Create standardized templates for each account type with all required fields and sign-off sections. Document reconciliation procedures and define clear roles for preparation, review, and approval. Map out segregation of duties across your team. Pilot the new process with 3-5 high-risk accounts. Gather feedback and refine before full rollout.

Deliverable: Standardized templates and updated reconciliation policies.

Month 3: Scale and automate (Days 61-90)

Roll out the standardized process to all accounts. Train the full team on new templates and procedures. Implement automation for ERP data imports—connect systems and configure scheduled refreshes. Build KPI dashboards and set up alert thresholds. Configure notification rules for Slack or email.

Deliverable: Fully implemented risk-based process with automation.

Quick wins to prioritize: Automate data imports for immediate time savings. Reduce frequency for low-risk accounts. Implement standardized templates for consistency. Set up KPI tracking for visibility.

Common Mistakes That Kill Efficiency

Waiting until month-end to start

The biggest mistake is waiting until the last day of the month to begin. This creates unnecessary time pressure and bottlenecks that stress your team. High-volume accounts should be reconciled weekly or daily throughout the month. Continuous reconciliation spreads workload and catches problems when details are fresh. Companies using this approach stay “always closed” rather than scrambling during the final days. The month-end close becomes a formality instead of a crisis.

Treating all accounts equally

Organizations waste time giving low-risk, low-balance accounts the same attention as high-value ones. Not all accounts carry the same risk or require the same scrutiny. Implement risk-based reconciliation to focus resources where they matter. High-risk accounts like cash, AR, and intercompany get monthly attention. Low-risk accounts can be quarterly or semi-annual. The time saved gets redirected to analysis and decision support instead of immaterial reconciliation work.

Lack of standardized templates

When each accountant uses their own format and approach, reconciliations become difficult to review and audit. Inconsistent processes increase training time, introduce errors, and make period-over-period comparisons meaningless. Create standardized templates with required fields, consistent calculations, and clear documentation requirements for each account type. This ensures quality, enables cross-training, and speeds up review. New team members get productive faster when everyone follows the same approach.

Manual data entry from multiple systems

Downloading, cleaning, and copying data from various systems is the most time-consuming and error-prone practice in reconciliation. Manual entry introduces a 5-10% error rate compared to less than 1% for automated systems. Eliminate manual exports with direct ERP-to-spreadsheet connections through tools like Coefficient. Automation reduces reconciliation time by 70-85% while virtually eliminating data entry errors. The upfront investment pays for itself through monthly time savings.

Rolling forward old unresolved items

Unresolved reconciling items should be investigated and cleared promptly—not rolled forward month after month. Each period should start clean. When old items persist, they indicate control weaknesses or incomplete work. Establish a policy requiring resolution within 30 days. Items older than this threshold get escalated to management. Track age and value of outstanding items as a KPI to drive accountability. Teams prioritize cleanup when metrics are visible.

Start Cutting Close Time Today

These account reconciliation best practices can cut your close time in half while improving accuracy. Risk-based approaches focus effort where it matters. Automated data imports eliminate the manual work that drains finance teams. Standardized templates and clear KPIs drive consistency.

The key: start with quick wins like automation and risk-ranking, then build out the full framework over 90 days. Companies that get started with automated data flows see results in the first month.