Revenue hit $2.3M last month. You budgeted $2.5M. Is that a problem?

Depends. Maybe sales fell short across the board. Or maybe one department overspent while another came in under budget. The top-line variance hides what actually happened.

Budget vs. actual reporting reveals the details behind your numbers. This guide shows you how to build variance analysis that updates itself.

Download the Budget vs. Actual Report Template before you follow along.

What is budget vs. actual reporting variance analysis?

Budget vs actual reporting compares planned financial targets against real results. The difference between budget and actual—the variance—tells you where performance matched expectations and where it didn’t.

Instead of seeing just “expenses over budget by $50K,” you’ll know exactly:

- Which accounts drove the overage

- Whether the variance is improving or getting worse

- How significant the miss is as a percentage of plan

This granular view transforms vague budget discussions into specific action items about spending, revenue, and operational adjustments.

Gather budget and actual reporting data

Traditional analysis starts with export hell. Log into QuickBooks. Download a P&L report. Switch to Excel. Copy and paste. Now do the same for your budget data. Repeat monthly.

Coefficient connectors eliminate this manual process entirely. Pull actual results and budget data directly into your spreadsheet from QuickBooks—no downloads required.

The template expects this data structure:

- Account name or category

- Budget amount by period

- Actual amount by period

- Account type (revenue, expense, etc.)

Set up your chart of accounts mapping

The template’s data structure groups accounts into meaningful categories for analysis. Think “Marketing Expenses,” “Payroll Costs,” and “Software Subscriptions” instead of analyzing 200 individual GL codes.

This grouping step matters. Executives don’t want variance explanations for account #6240-Marketing-Digital-Ads. They want to understand how Marketing vs. Sales spending drove overall results.

Calculate budget vs actual reporting variance amounts and percentages

The formulas behind variance analysis are straightforward, but the template handles all calculations automatically:

Dollar Variance:

Actual Amount – Budget Amount

Percentage Variance:

(Actual – Budget) / Budget × 100

Year-to-Date Variance:

Sum of Actual YTD – Sum of Budget YTD

The template contains these formulas pre-built. Simply connect your data, and watch the variance calculations populate automatically. No need to build complex Excel formulas or worry about calculation errors during month-end close.

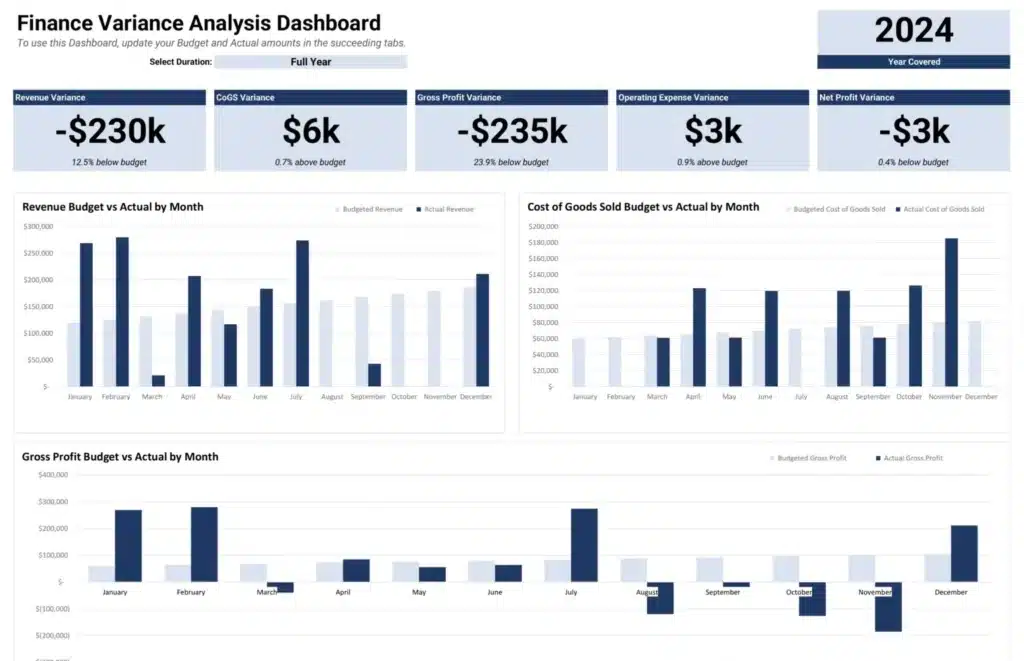

Build the variance dashboard

The template includes visualizations that split total variance into component parts. You’ll see which accounts drove favorable results and which pushed you off plan.

This dashboard design follows financial reporting best practices:

- Variance bars show magnitude of each account’s impact

- Color coding highlights positive vs. negative variances

- Cumulative charts reveal trends across periods

Visualization options

Choose visualization types based on your audience:

- Bar charts work best for comparing variances across accounts

- Waterfall charts help executives see how pieces add to total variance

- Trend lines show whether performance is improving or declining

Coefficient keeps these visuals live as source data refreshes. No more rebuilding charts every month or fixing broken references when accounts change.

Interpret the variances

Raw variance numbers tell only part of the story. Here’s how to read the signals:

Revenue under budget, expenses on track: Sales problem, not spending problem. Investigate why revenue fell short—fewer deals, lower prices, delayed closes. Don’t cut expenses reflexively if the spending generated expected activity.

Revenue on budget, expenses over: Cost control issue. Dig into which expense categories drove the overage. Separate discretionary spending you can cut from fixed costs you can’t.

Both revenue and expenses under budget: Execution miss. You planned to do more than you did. Investigate whether this reflects market conditions, capacity issues, or overly aggressive budgeting.

Large percentage variance on small dollar amount: Context matters. A 50% variance on a $1,000 line item is $500. A 5% variance on a $100,000 line item is $5,000. Focus attention on material amounts.

Drill down by department or class

Add QuickBooks class or location dimensions to isolate specific business units. This analysis reveals which departments drive your variance patterns.

Coefficient automatically pulls class, location, and department dimensions from your accounting system. No manual field mapping required. Filter your variance analysis by department or compare location performance with a single click.

Add prior year comparisons

Layer additional time periods to see Actual vs Budget vs Last Year patterns. Did this month’s expense variance follow seasonal patterns from prior years? How does current revenue compare to the same period last year?

Coefficient imports multiple time periods in one refresh. Build three-way variance analysis without managing separate data imports or version control headaches.

Use these formulas for prior year comparison:

Year-over-Year Change:

(Current Year Actual – Prior Year Actual) / Prior Year Actual × 100

Budget vs Prior Year:

Budget – Prior Year Actual

This shows whether your budget was realistic based on historical performance.

Automate refresh and alerts with Coefficient

Schedule monthly data pulls from QuickBooks. Set Slack or email alerts when variances exceed acceptable thresholds.

For finance teams managing monthly close processes, this automation transforms variance analysis from a manual exercise into an ongoing monitoring system. Your reports update automatically without any manual work.

Example alert conditions:

- Expense variance exceeds 10% of budget

- Revenue falls below 90% of plan

- Any account variance exceeds $25,000

- YTD variance trends negative for three consecutive months

Turn variance into action

Budget vs. actual analysis transforms basic “over/under budget” reports into actionable financial intelligence. Understanding which accounts drive variance—and whether the pattern is improving—enables targeted business decisions.

The template eliminates hours of manual data gathering while providing professional-grade analysis capabilities. Whether you’re a CFO preparing board presentations or a controller managing monthly close, automated variance analysis delivers the insights leadership needs.

Ready to see where your budget stands? Get started with our free template and connect your QuickBooks data for variance analysis that refreshes on your schedule.

FAQs

How do you calculate budget vs actual variance?

Variance equals Actual minus Budget. For percentage variance, divide the dollar variance by budget and multiply by 100. Positive variance on revenue means you exceeded plan. Positive variance on expenses means you overspent.

What is a good budget variance percentage?

Most organizations target variances within 5-10% of budget. Acceptable thresholds depend on your industry, account type, and business stage. Revenue accounts often have tighter tolerances than discretionary expense categories.

How often should you review budget vs actual reports?

Monthly reviews catch problems early enough to course-correct. Weekly reviews make sense for fast-moving expense categories or during critical business periods. Quarterly reviews work for stable, predictable accounts.

Can QuickBooks generate budget vs actual reports?

Yes, QuickBooks offers a built-in Budget vs Actual report. However, it lacks custom variance calculations, multi-period comparisons, and flexible visualization options. The Coefficient template extends QuickBooks reporting with automated analysis capabilities.