Managing cash flow is the lifeblood of any SaaS business. One missed metric can mean the difference between growth and stagnation.

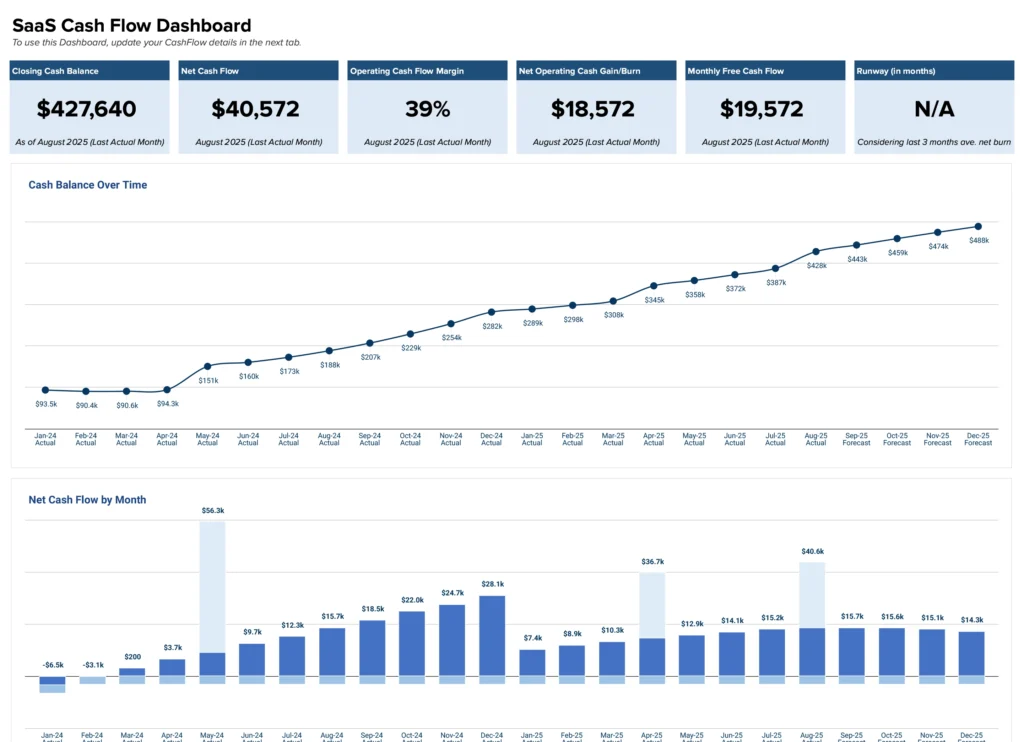

Coefficient’s free SaaS Cash Flow Template gives you instant visibility into your most critical financial metrics. Track everything from Monthly Recurring Revenue to Customer Acquisition Cost in one comprehensive dashboard.

What is a SaaS cash flow report?

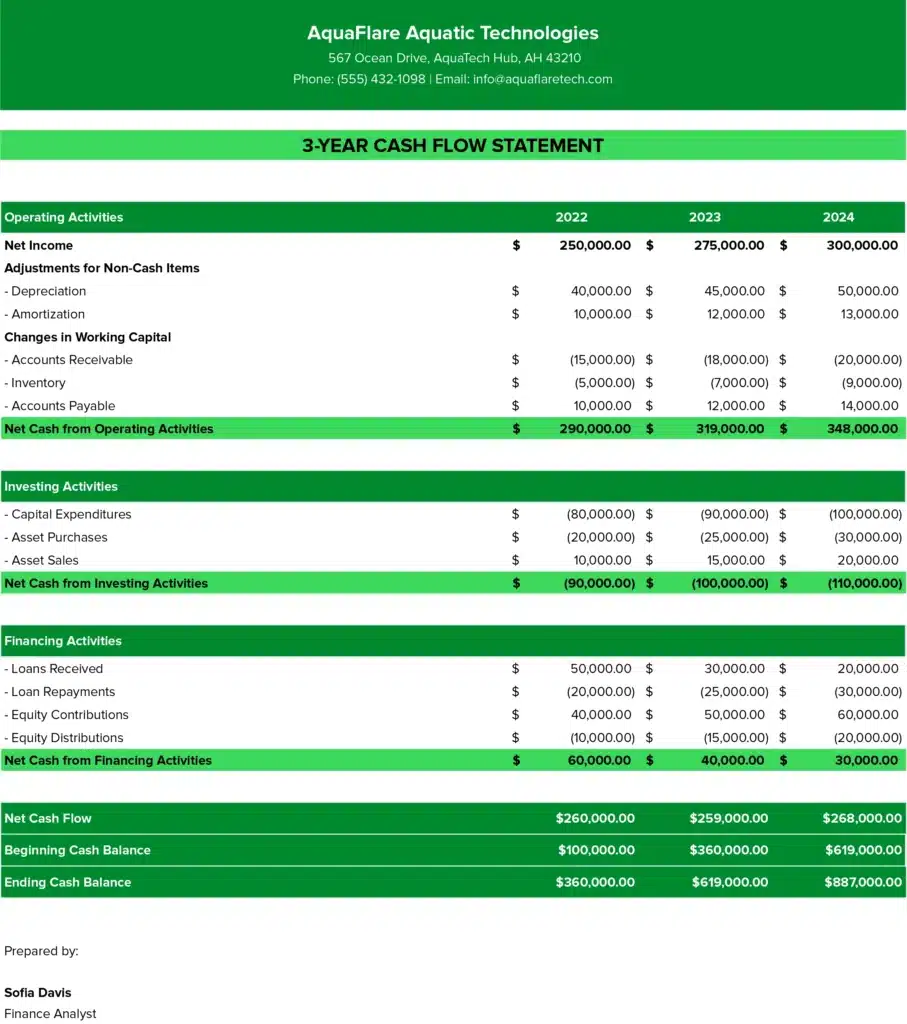

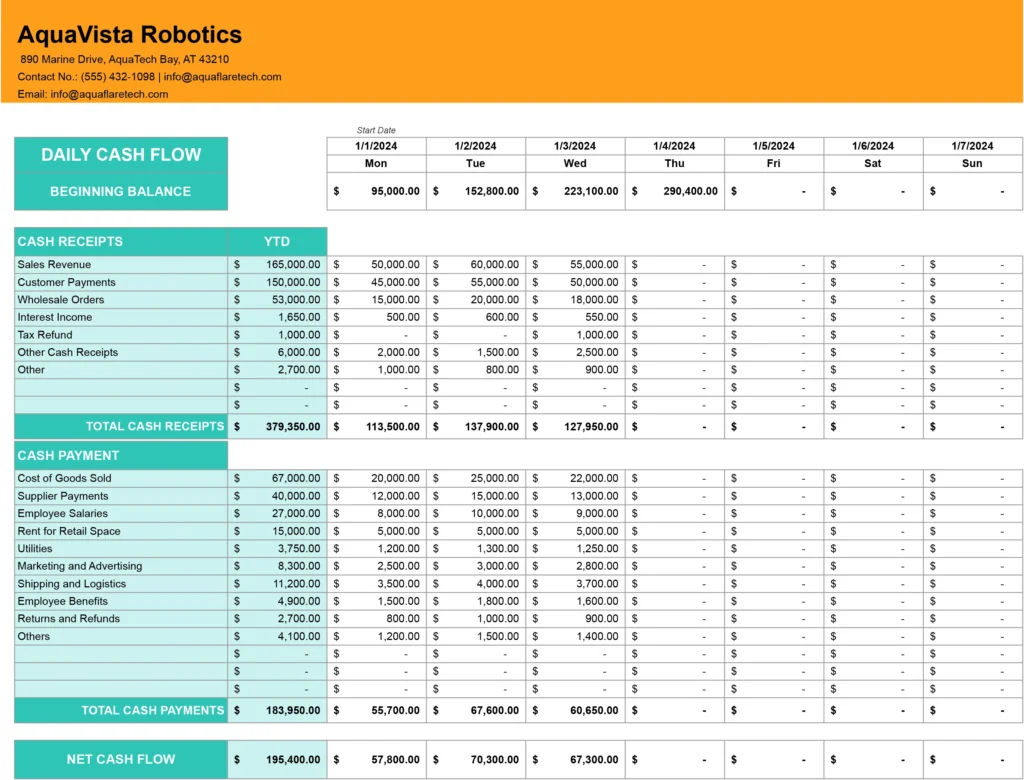

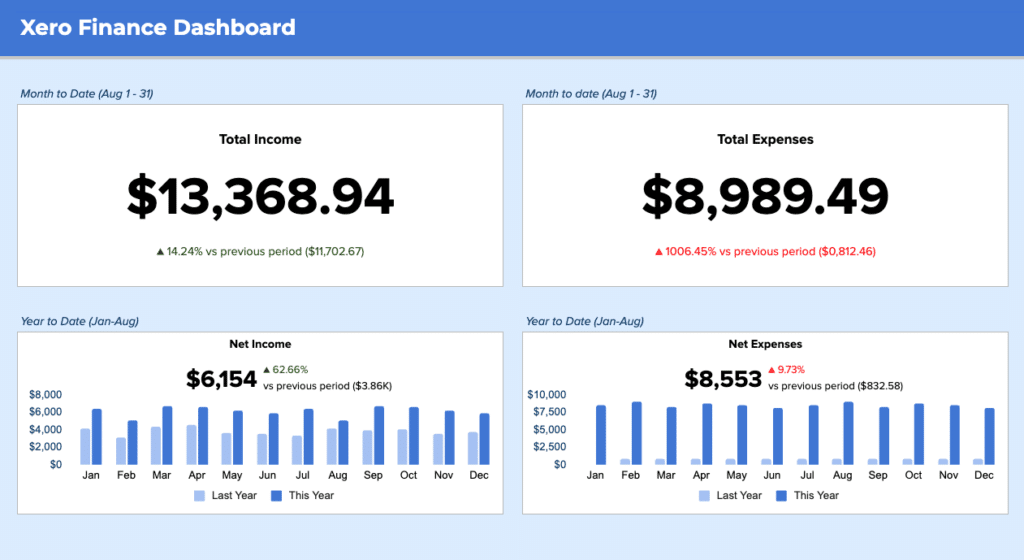

A SaaS cash flow report tracks the movement of money in and out of your subscription business. Unlike traditional cash flow statements, SaaS reports focus on recurring revenue metrics, customer acquisition costs, and retention rates.

This specialized reporting helps SaaS companies understand their unit economics, predict future revenue, and identify potential cash flow issues before they become critical. The template organizes complex subscription data into actionable insights that drive strategic decisions.

Benefits of using our SaaS cash flow template

- Get complete financial visibility Track all your key SaaS metrics in one place. No more jumping between different tools or spreadsheets to understand your business performance.

- Make data-driven decisions faster With pre-built formulas and charts, you can quickly identify trends in your recurring revenue, churn rates, and customer acquisition costs.

- Improve cash flow forecasting Use historical data patterns to predict future revenue and plan for growth or potential shortfalls.

- Streamline investor reporting Present clean, professional financial reports that investors expect. All metrics are organized and calculated automatically.

- Save hours of manual work Skip the tedious setup process. Our template comes pre-formatted with industry-standard SaaS metrics and calculations.

Metrics tracked in the report

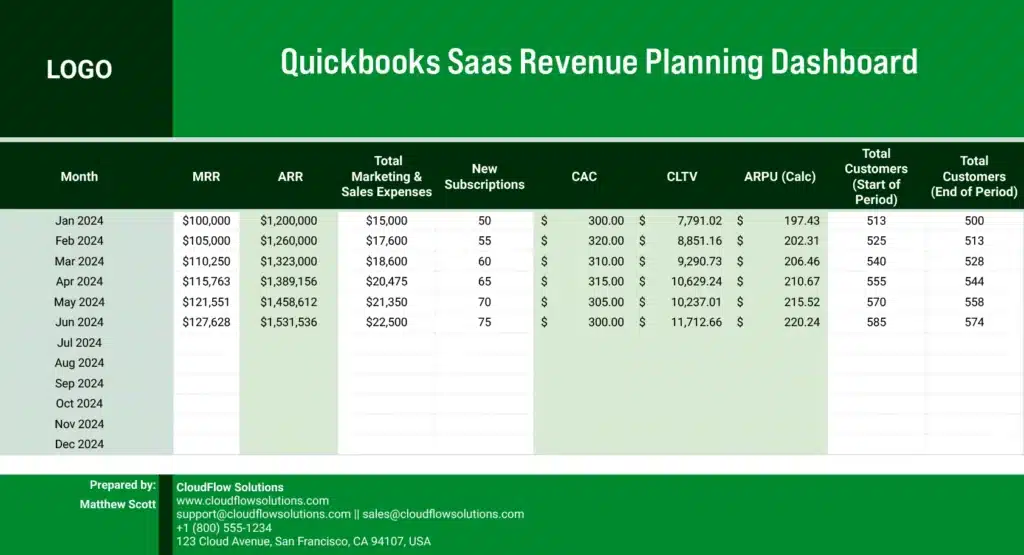

Our comprehensive SaaS Cash Flow Template monitors these essential metrics:

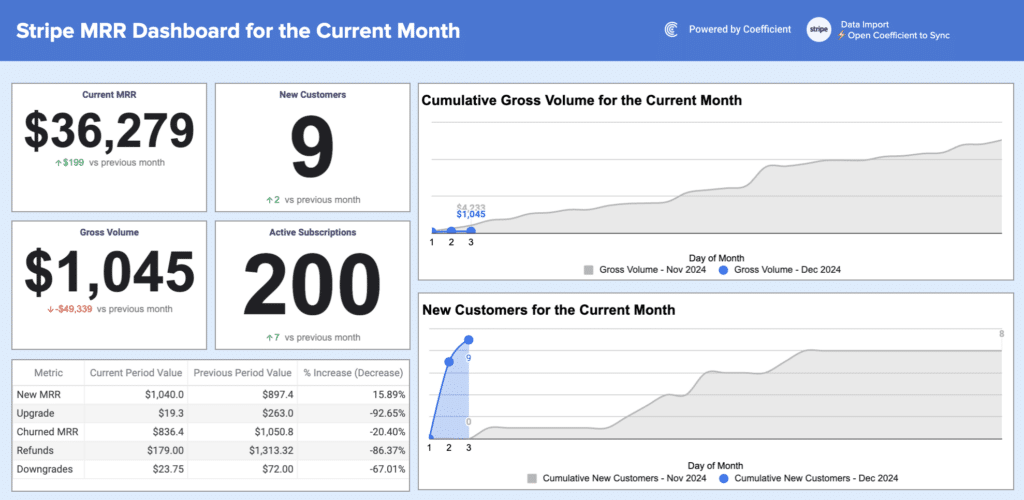

- Monthly Recurring Revenue (MRR) – Your predictable monthly subscription income

- Annual Recurring Revenue (ARR) – Annualized version of your MRR for long-term planning

- New MRR – Revenue from newly acquired customers

- Expansion MRR – Additional revenue from existing customers through upgrades

- Contraction MRR – Revenue lost from downgrades

- Churned MRR – Revenue lost from canceled subscriptions

- Net New MRR – Overall MRR growth after accounting for churn and expansion

- Customer Acquisition Cost (CAC) – Total cost to acquire each new customer

- CAC Payback Period – Time needed to recover customer acquisition investment

- Burn Multiple – Efficiency metric comparing cash burn to net new ARR

- Churn Rate – Percentage of customers who cancel their subscriptions

- Logo Retention Rate – Percentage of customers retained over time

- Revenue Retention Rate – Percentage of revenue retained from existing customers

- Subscription Billing Cycles – Analysis of different billing frequencies

- Deferred Revenue – Money collected but not yet recognized as revenue

- Professional Services Revenue – One-time revenue from implementation or consulting

Frequently asked questions

What’s the difference between MRR and ARR?

MRR (Monthly Recurring Revenue) measures your predictable monthly subscription income. ARR (Annual Recurring Revenue) is simply MRR multiplied by 12. Most early-stage SaaS companies focus on MRR for month-to-month tracking, while larger companies use ARR for annual planning and investor communications.

How do I calculate my SaaS burn multiple?

Burn multiple divides your net cash burn by your net new ARR. A burn multiple of 1x means you’re spending $1 to generate $1 of new ARR. Lower is better – efficient SaaS companies target burn multiples below 2x.

Why is revenue retention rate more important than logo retention?

Revenue retention rate accounts for expansion revenue from existing customers, while logo retention only tracks whether customers stay or leave. You can have 90% logo retention but 110% revenue retention if your remaining customers are upgrading their plans.

Start tracking your SaaS metrics today

Stop guessing about your cash flow. Download our free template and get immediate clarity on your SaaS financial performance. With pre-built calculations and professional formatting, you’ll have investor-ready reports in minutes, not hours.