Maximize Investment Decisions with Our Discounted Cash Flow Template

Utilize our Google Sheets Discounted Cash Flow (DCF) Template to perform comprehensive valuations of your investments and determine their true worth today.

Why Use a Discounted Cash Flow Template?

Accurate Investment Analysis

Our DCF template provides a rigorous analytical framework to estimate the present value of an investment based on its expected future cash flows, helping you make more informed investment choices.

Informed Financial Decisions

Utilize sophisticated financial modeling to support your investment decisions, ensuring that you consider the true potential of your investments adjusted for the time value of money.

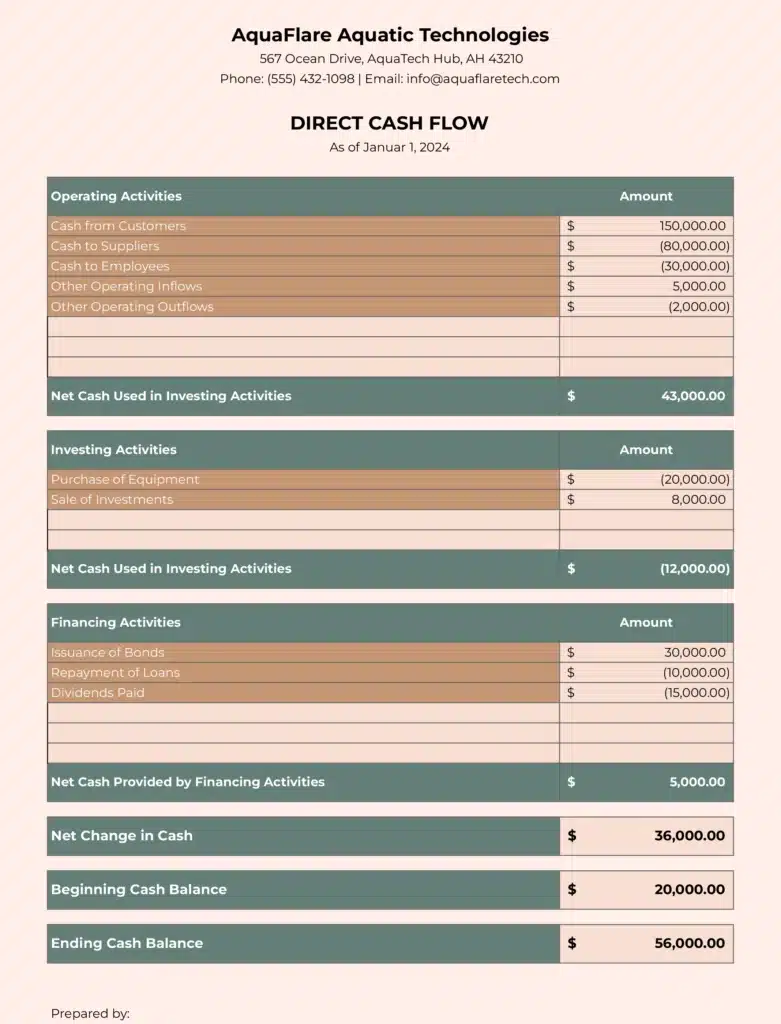

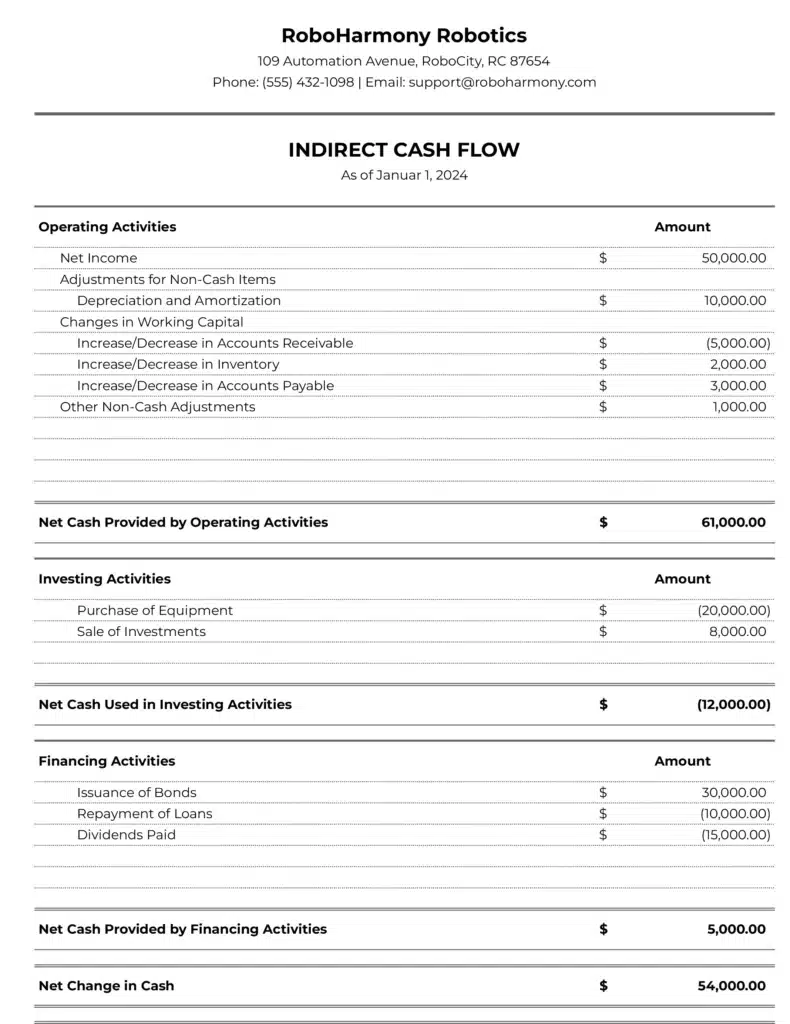

Suitable for Various Investment Types

Whether evaluating startups, capital projects, or financial products, our DCF template adapts to different types of investment scenarios.

Key Features of the Discounted Cash Flow Template

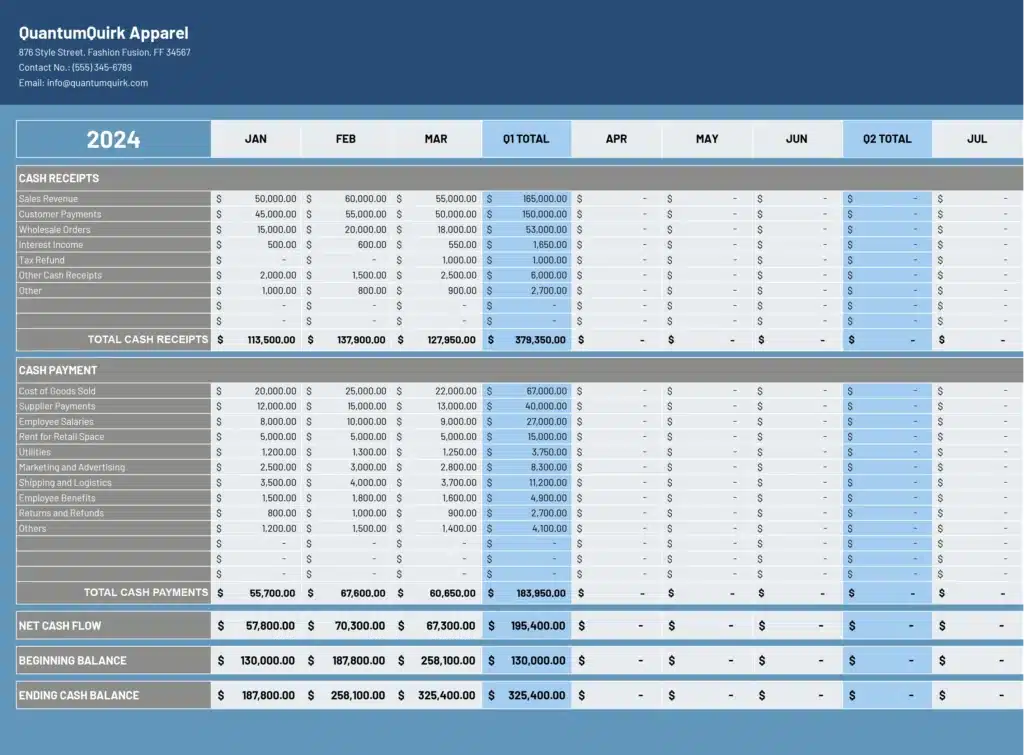

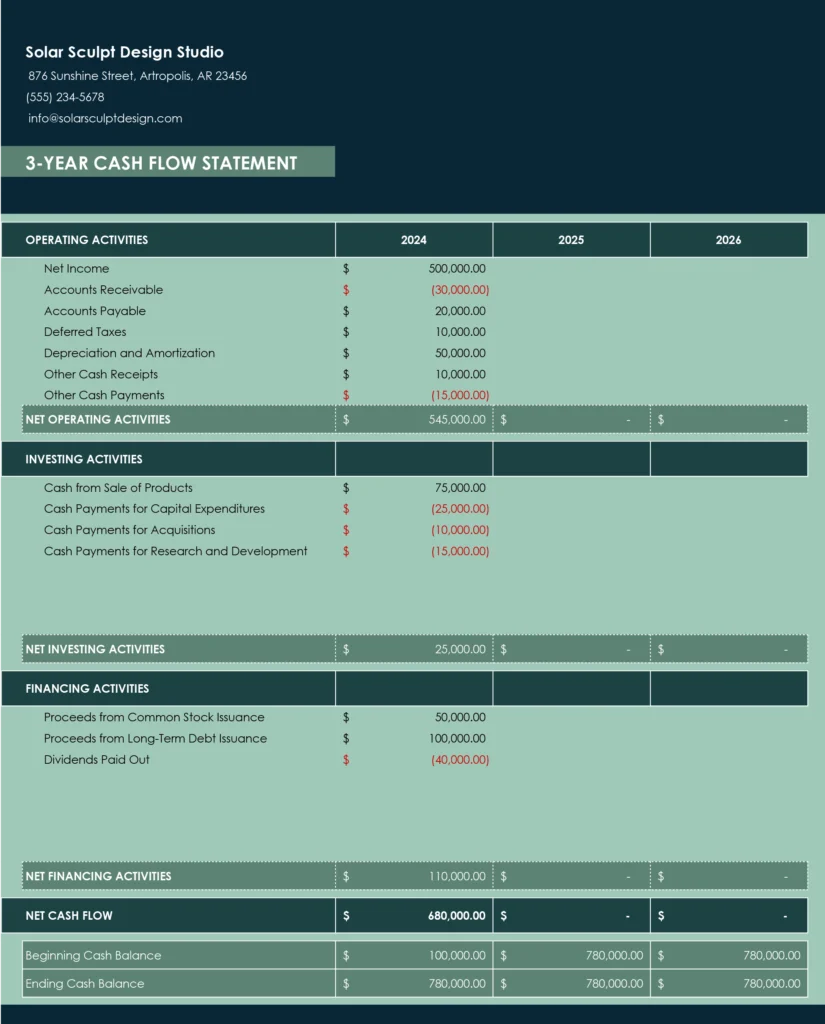

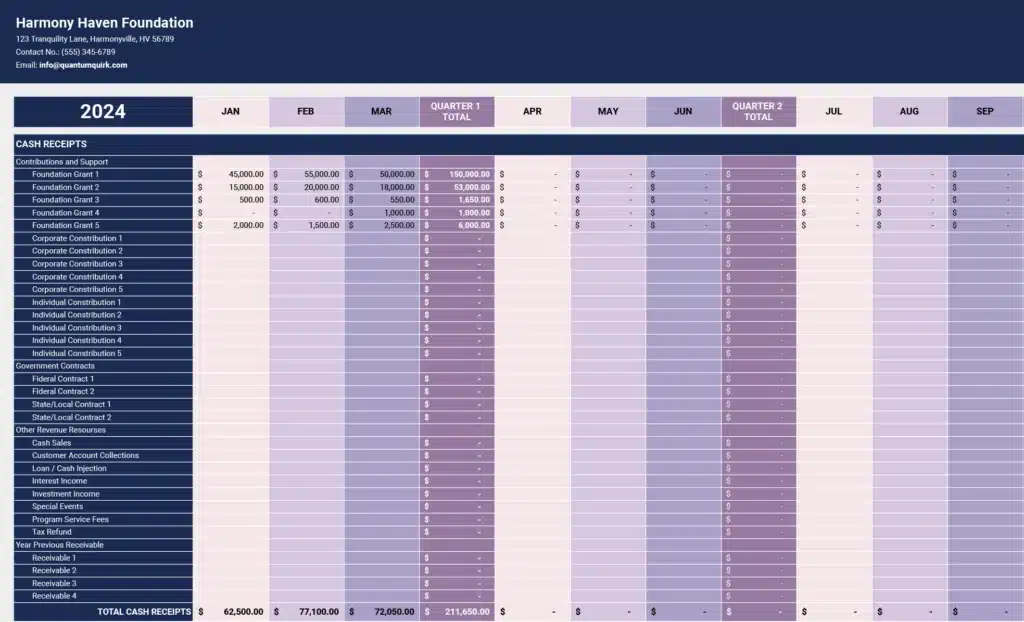

Detailed Forecasting Tools

Project future cash flows with detailed, customizable input fields that allow you to account for variables like growth rates, expenses, and revenue streams over time.

Integrated Discount Rates

Easily adjust the discount rate to reflect the risk profile of your investment, which affects the calculation of its present value.

Customizable for Different Scenarios

Modify assumptions and immediately see how changes impact the financial viability of your investments, enabling scenario analysis and sensitivity testing.

How to Effectively Use the Discounted Cash Flow Template

Inputting Your Data

Enter your estimated cash inflows and outflows into the template. Detailed instructions guide you through inputting appropriate figures like operating costs, expected revenues, capital expenditures, and discount rates.

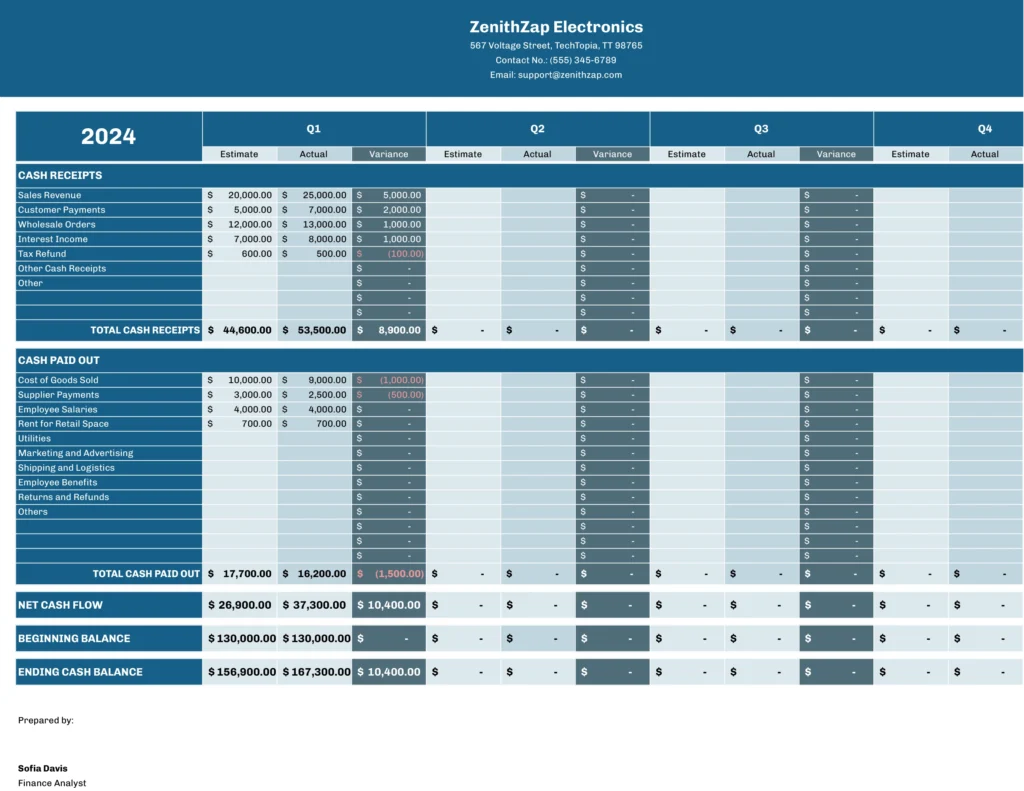

Analyzing the Results

The template automatically calculates the net present value (NPV) of your cash flows, providing a clear indicator of whether the investment is likely to achieve a return above or below your expectations.

Making Strategic Decisions Based on DCF Outcomes

Use the insights gained from the DCF analysis to guide your investment strategies, portfolio management, and financial planning.