Managing QuickBooks data across multiple platforms creates bottlenecks that slow down financial decision-making. Third-party connectors eliminate these friction points, enabling real-time data synchronization and automated workflows that boost operational efficiency.

Feature Comparison Table

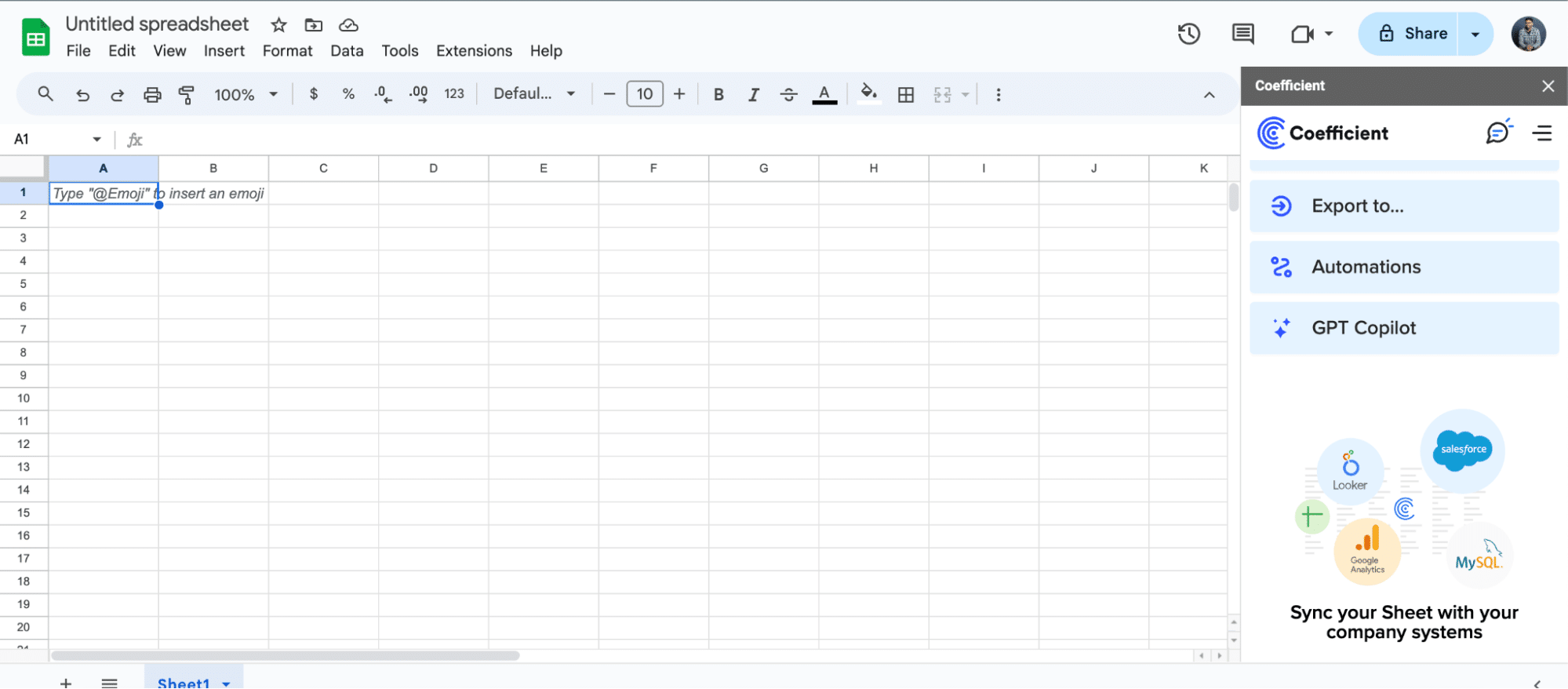

| Connector | Row Limits/Export | Data Sources | Builder License Cost | Viewer License | AI Functionality | Refresh Frequency | Alerts | Security |

| Coefficient | Unlimited (Pro+) | 100+ platforms | $59/month | Shared at no cost | ✅ GPT integration | Real-time | Slack & Email | Enterprise-grade |

| SyncQ | N/A | CRM-focused | $59/month | $24.50/user/month | ❌ | Real-time | Email alerts | Industry standard |

| Shopify Integration | Transaction-based | E-commerce focused | Free (basic) | N/A | ❌ | Daily payouts | Limited | Standard SSL |

| SOS Inventory | 40,000 items | Manufacturing/retail | $65/month | Included | ❌ | Real-time | Low stock alerts | Multi-factor auth |

| QuickBooks Time | Unlimited users (Free) | Time tracking | $20/month + $8/user | Mobile access | ❌ | Real-time | GPS/geofencing | Two-factor auth |

| Bill.com | Transaction-based | AP/AR focused | $45/month | Role-based | ❌ | Real-time | Payment reminders | Bank-level |

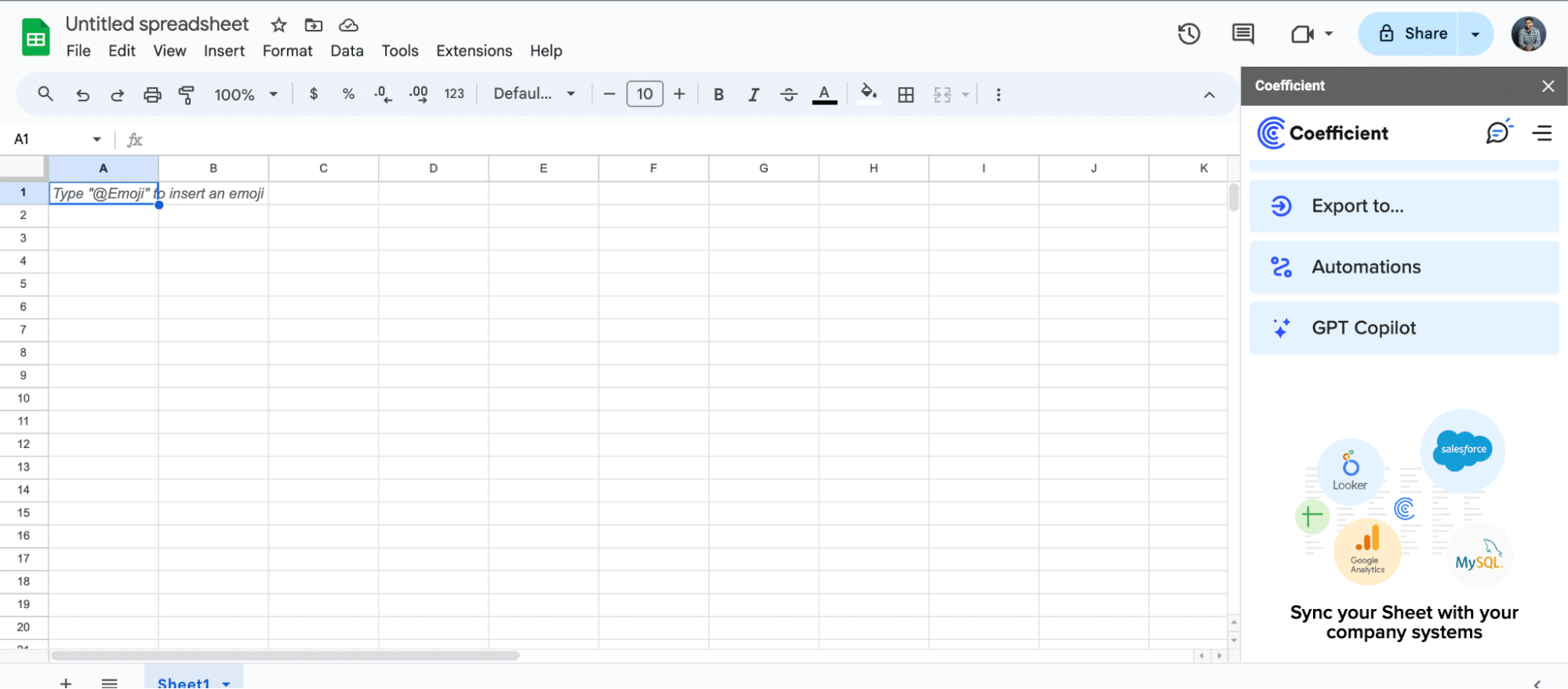

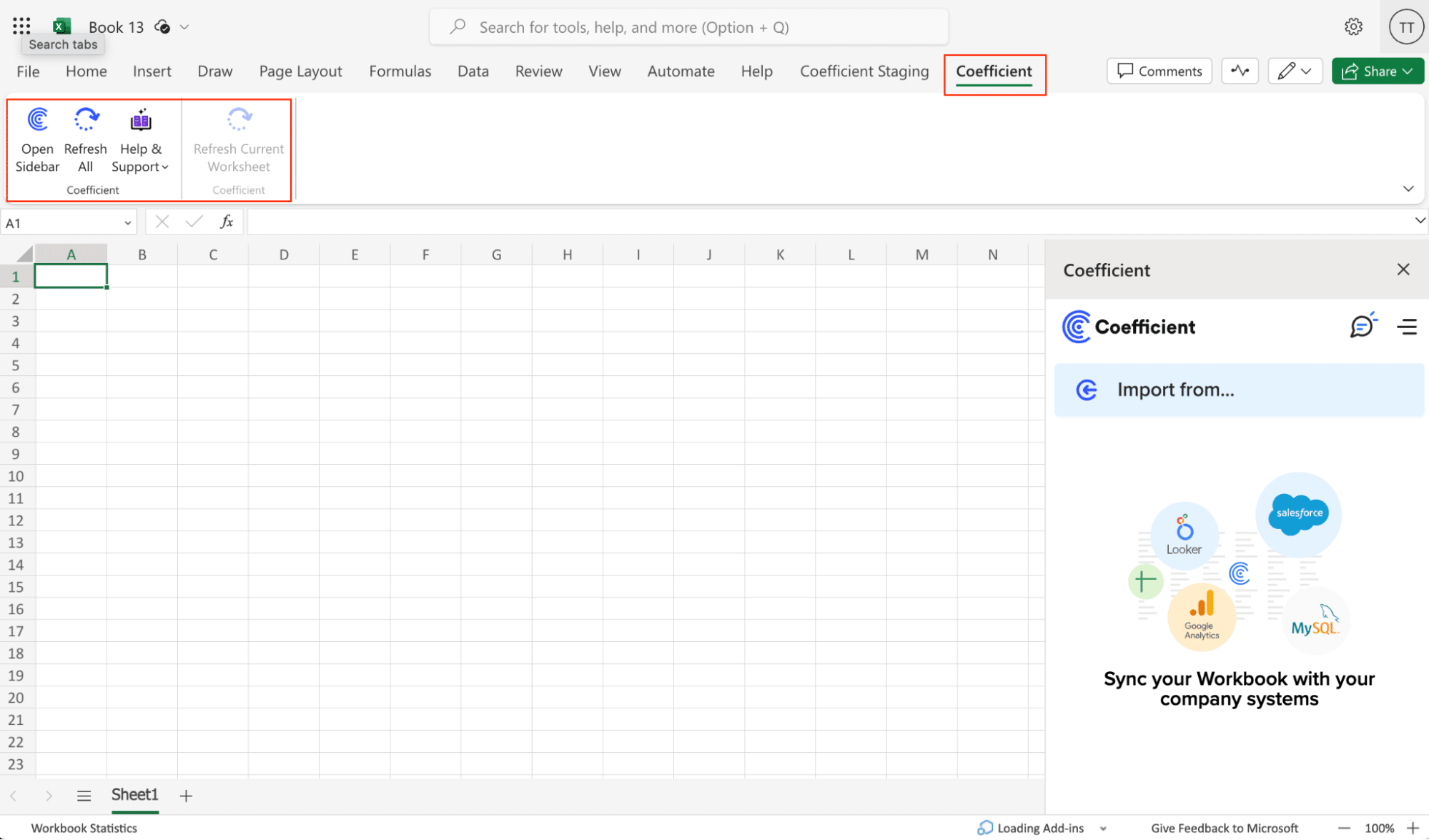

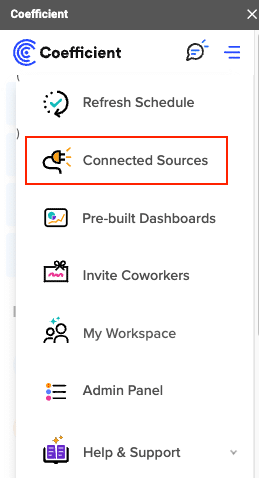

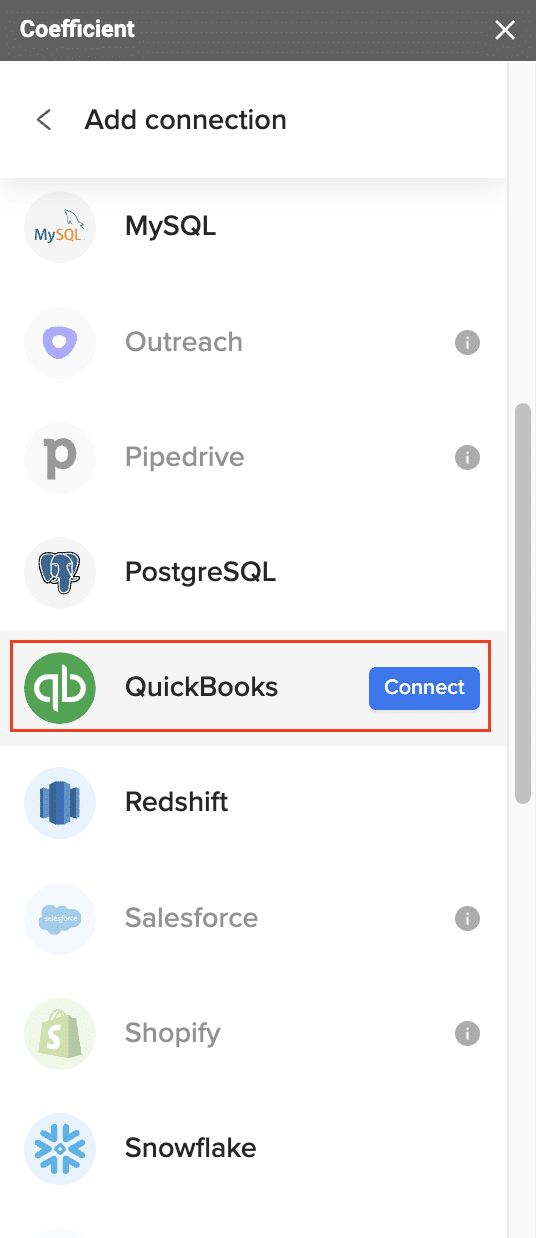

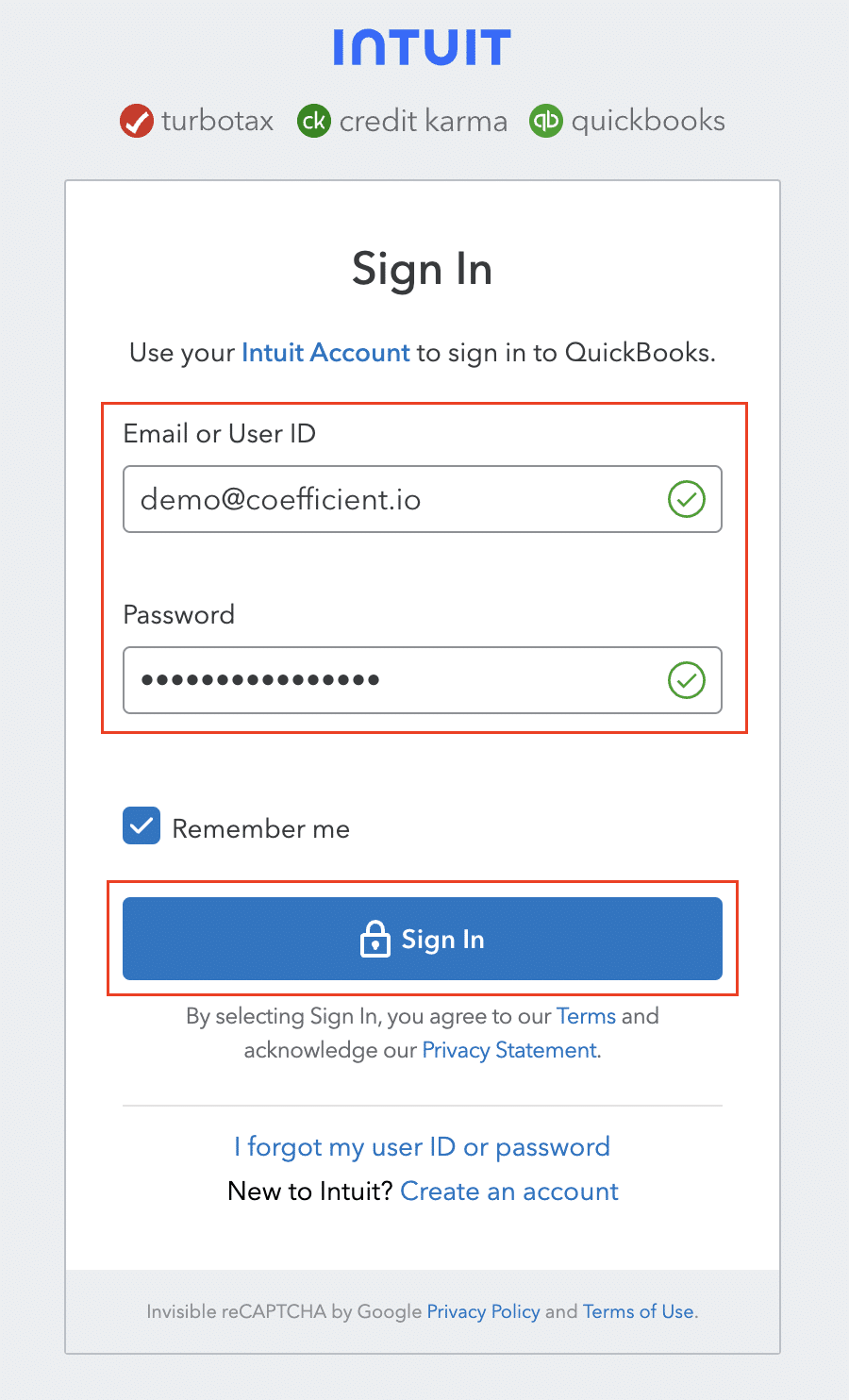

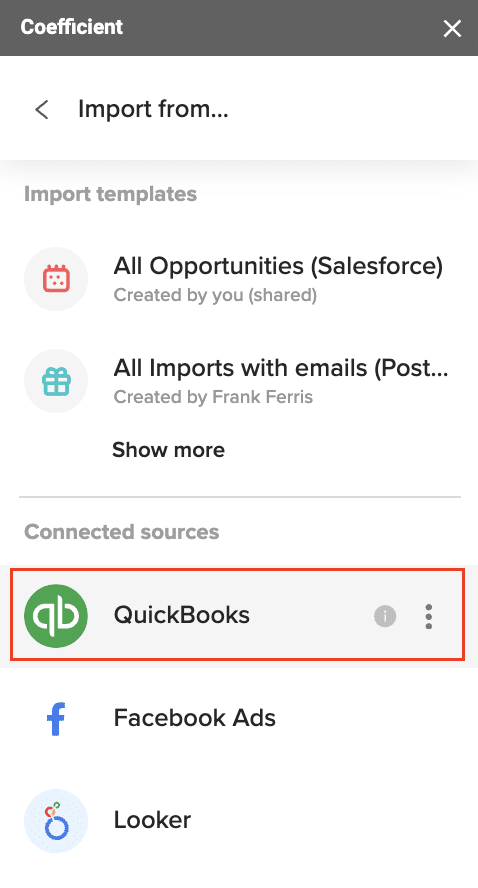

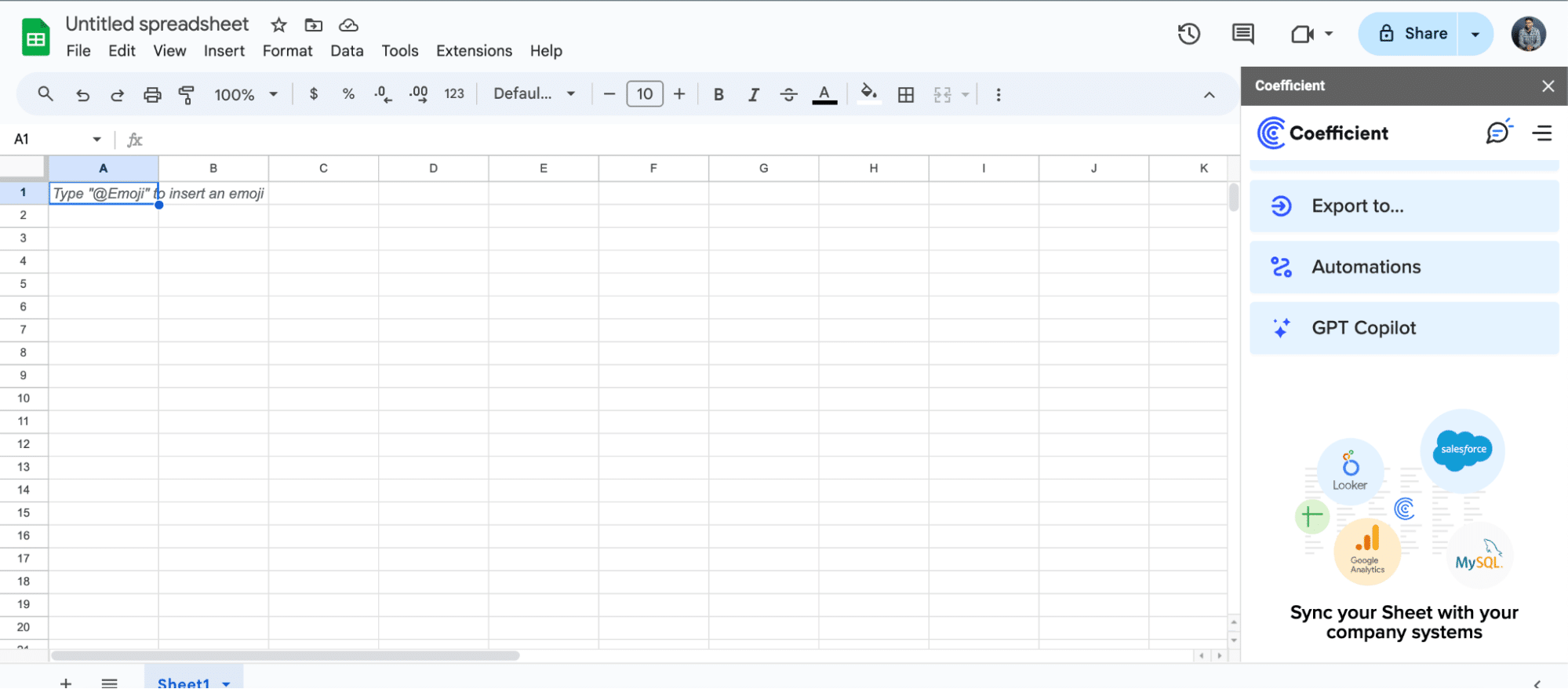

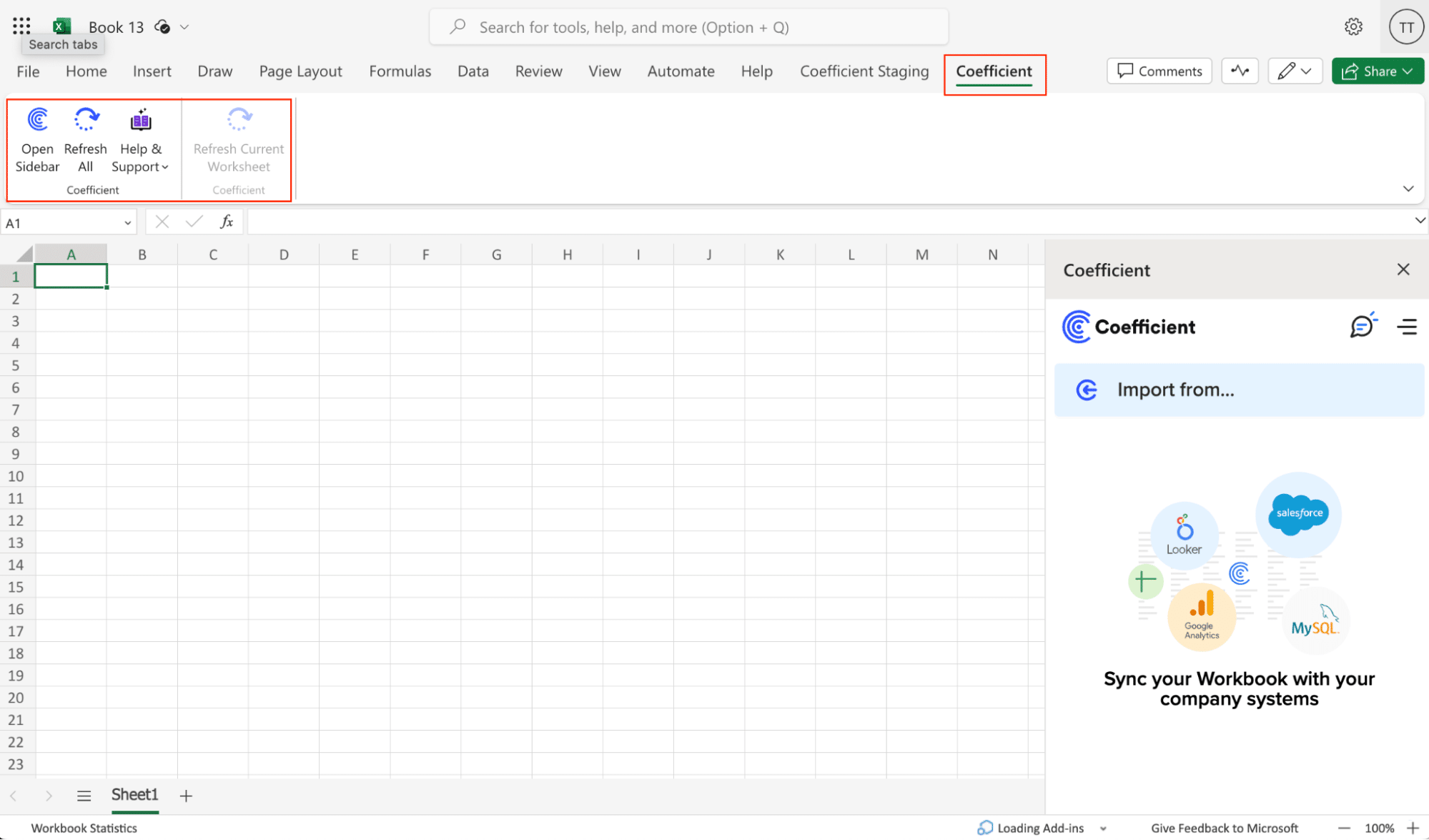

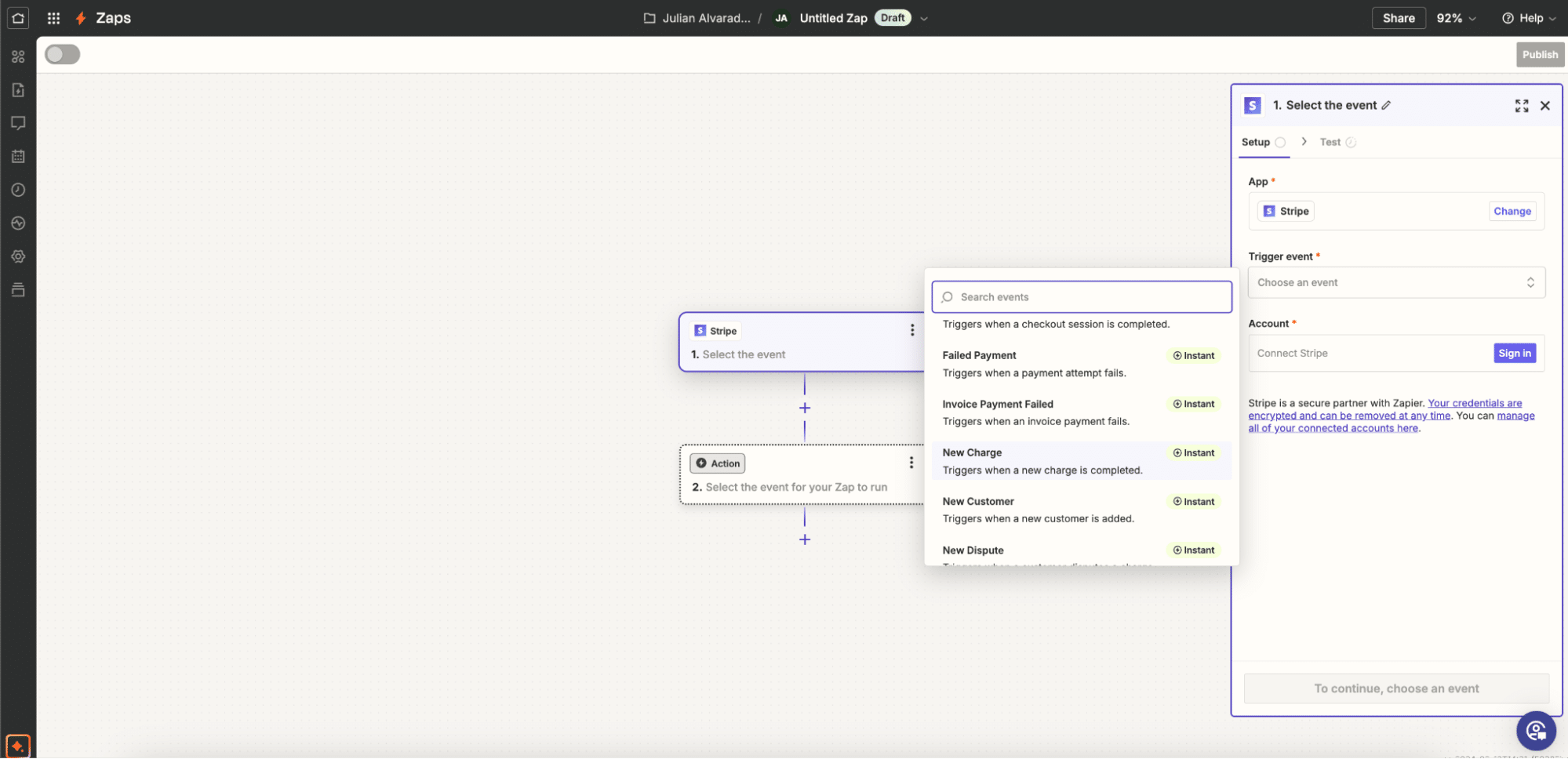

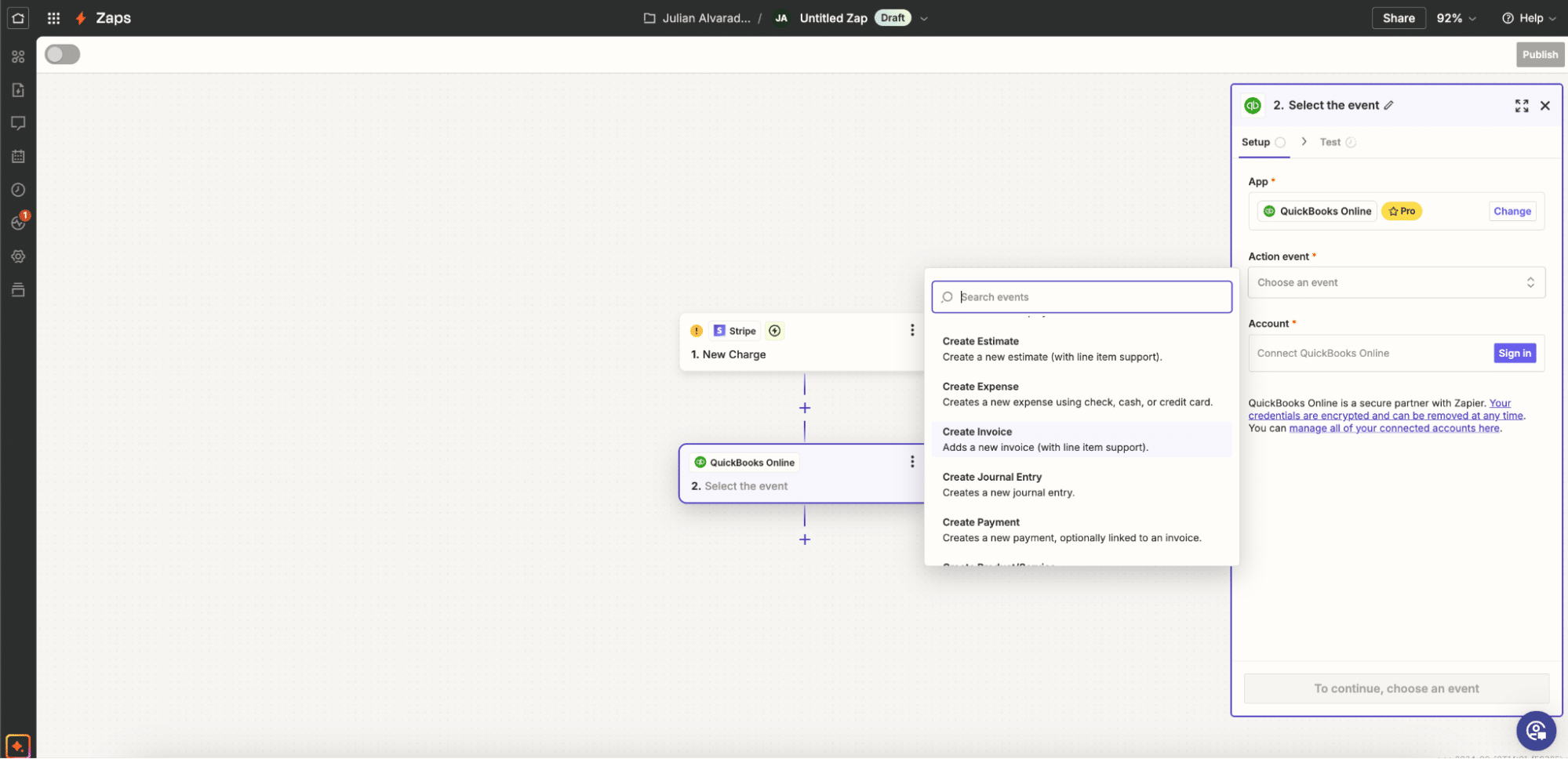

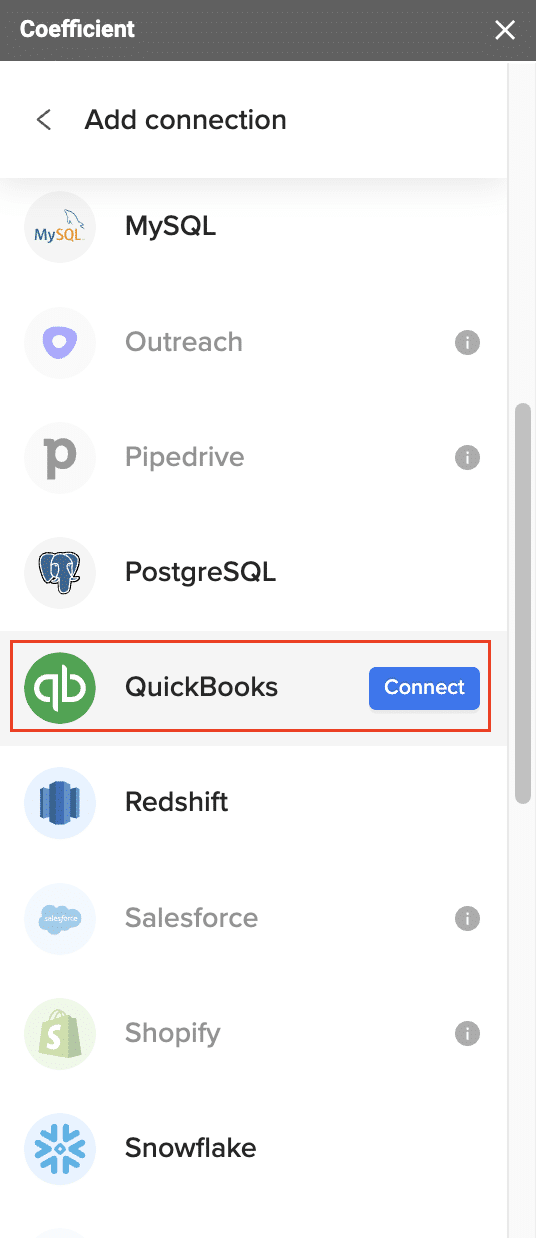

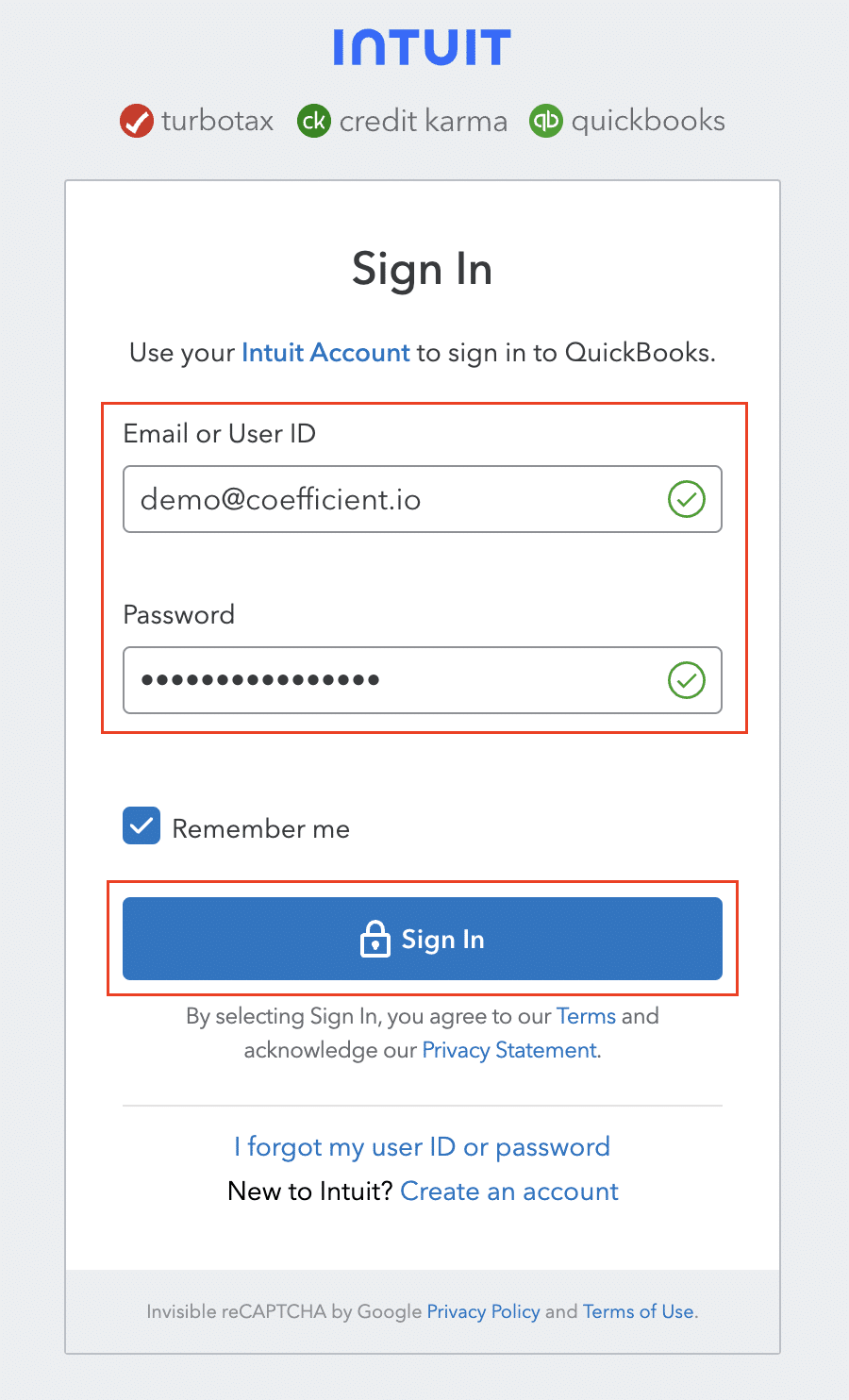

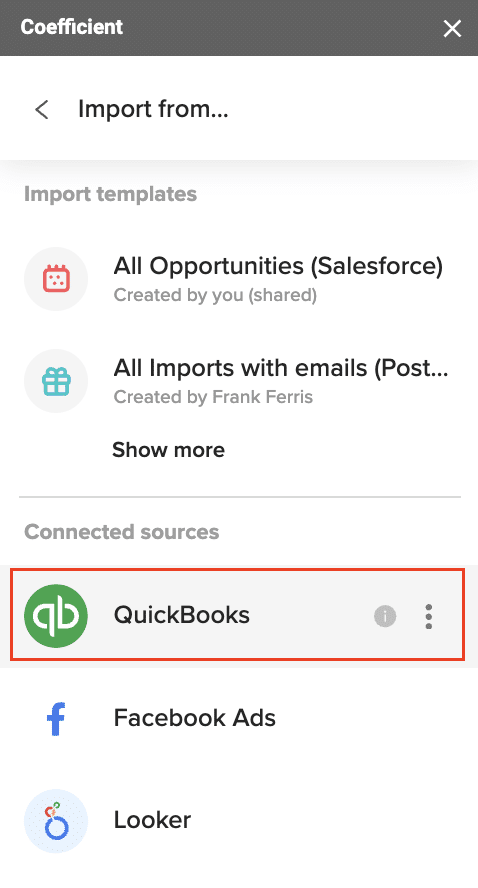

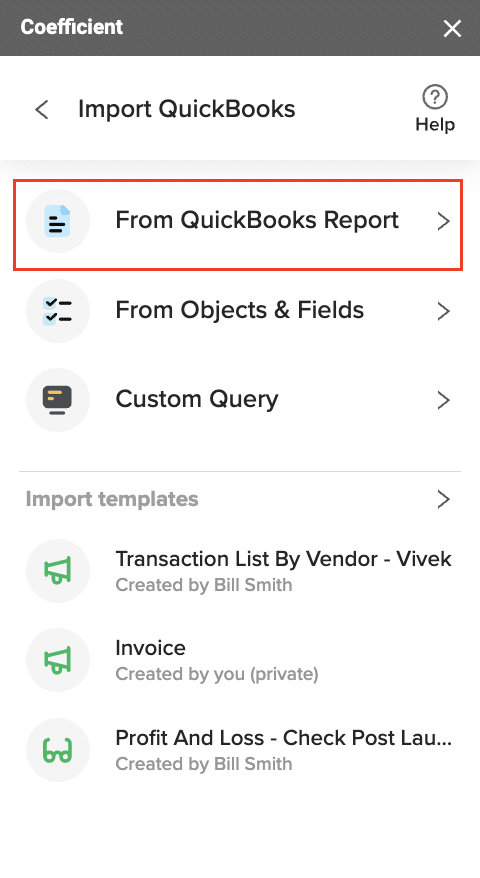

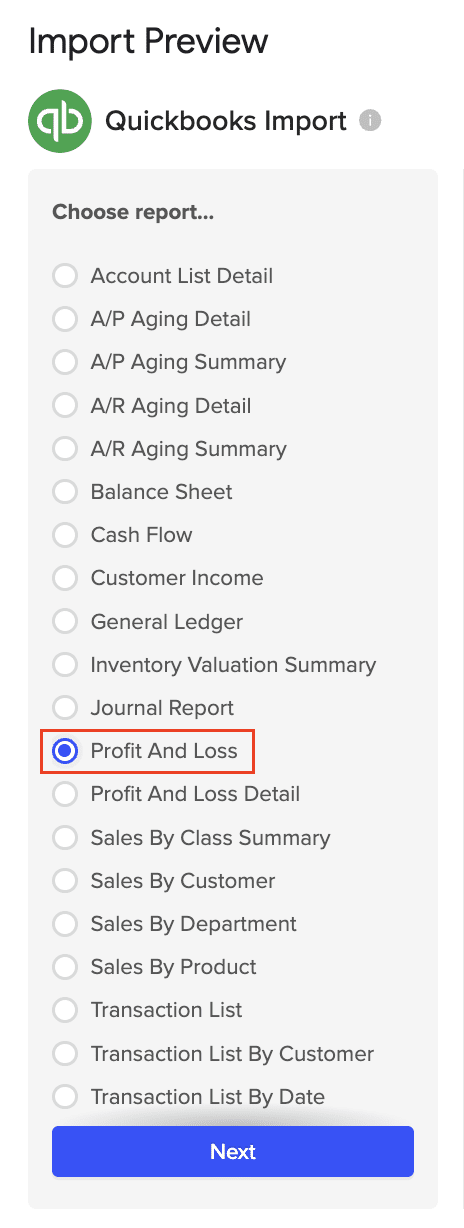

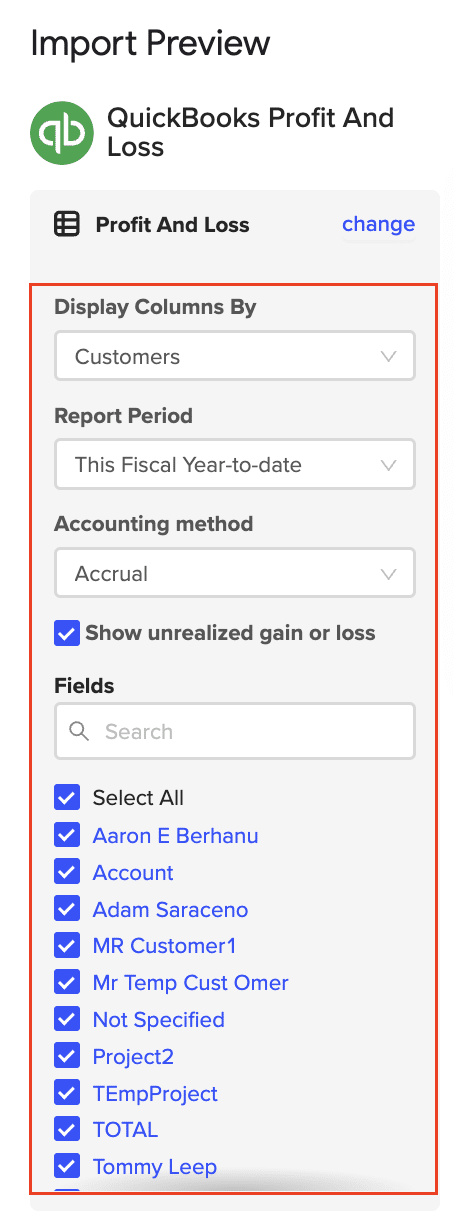

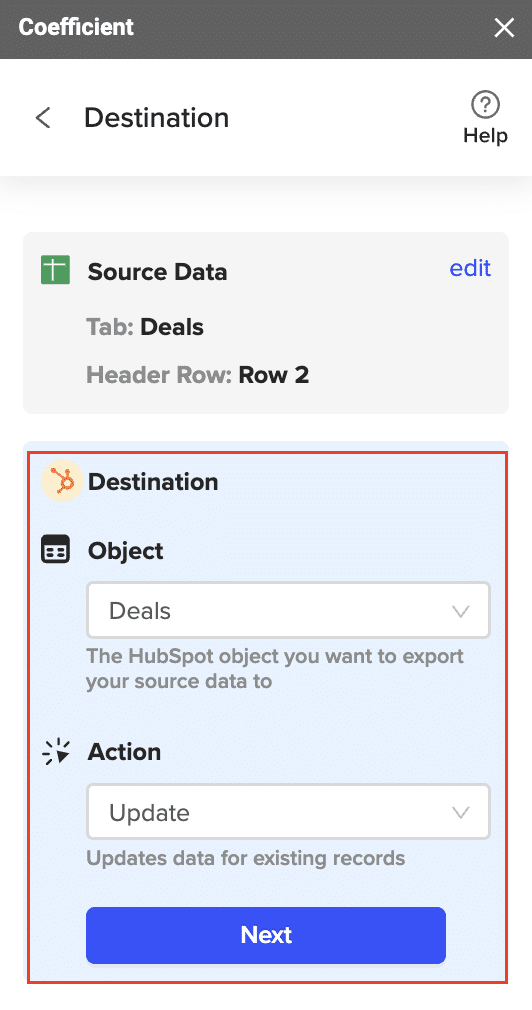

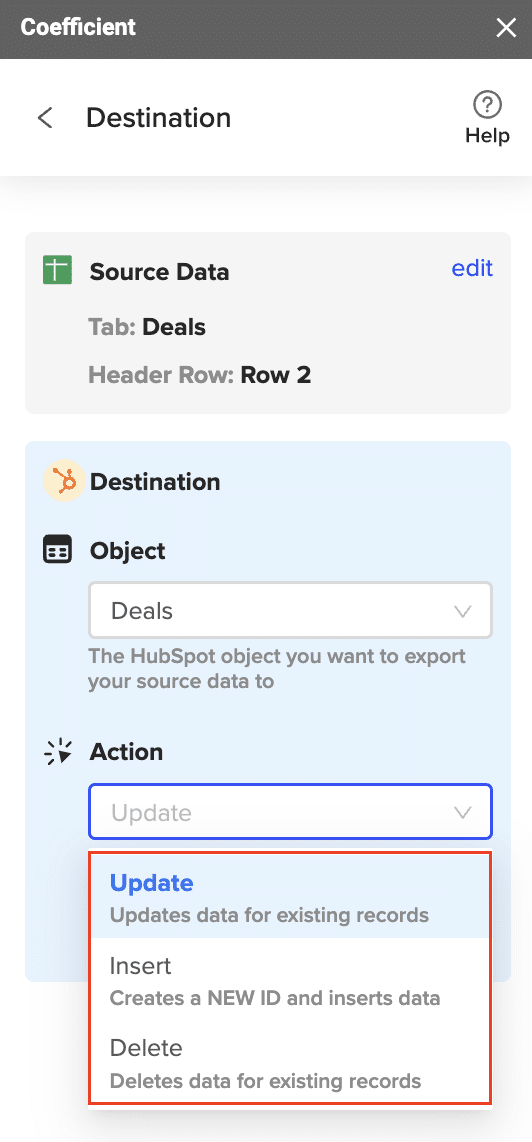

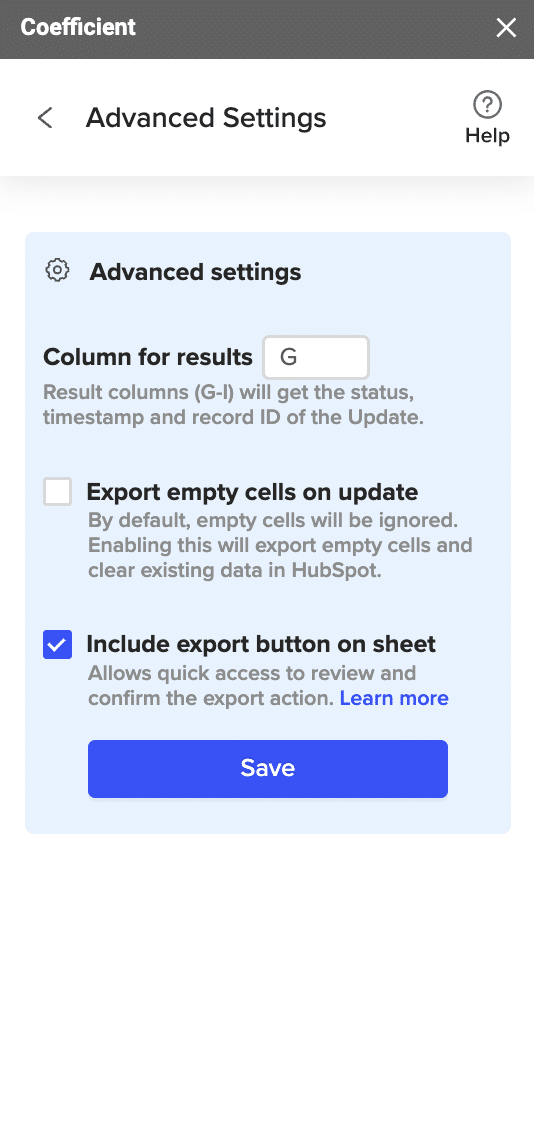

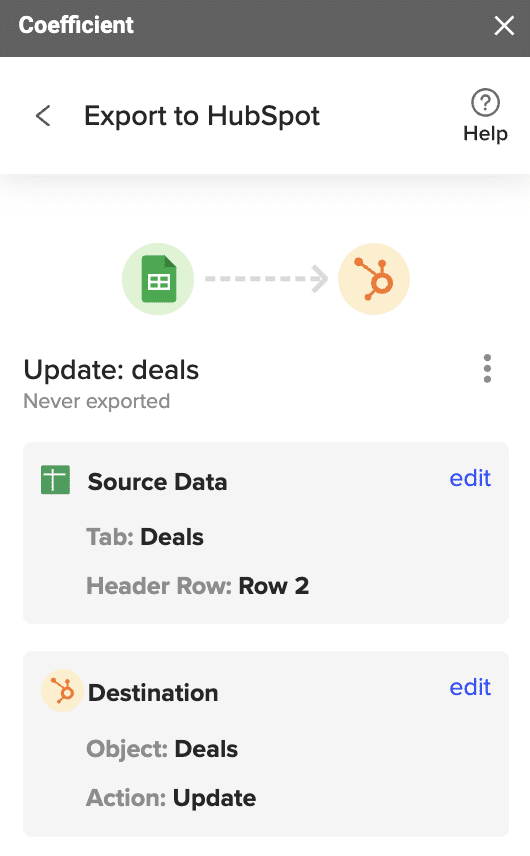

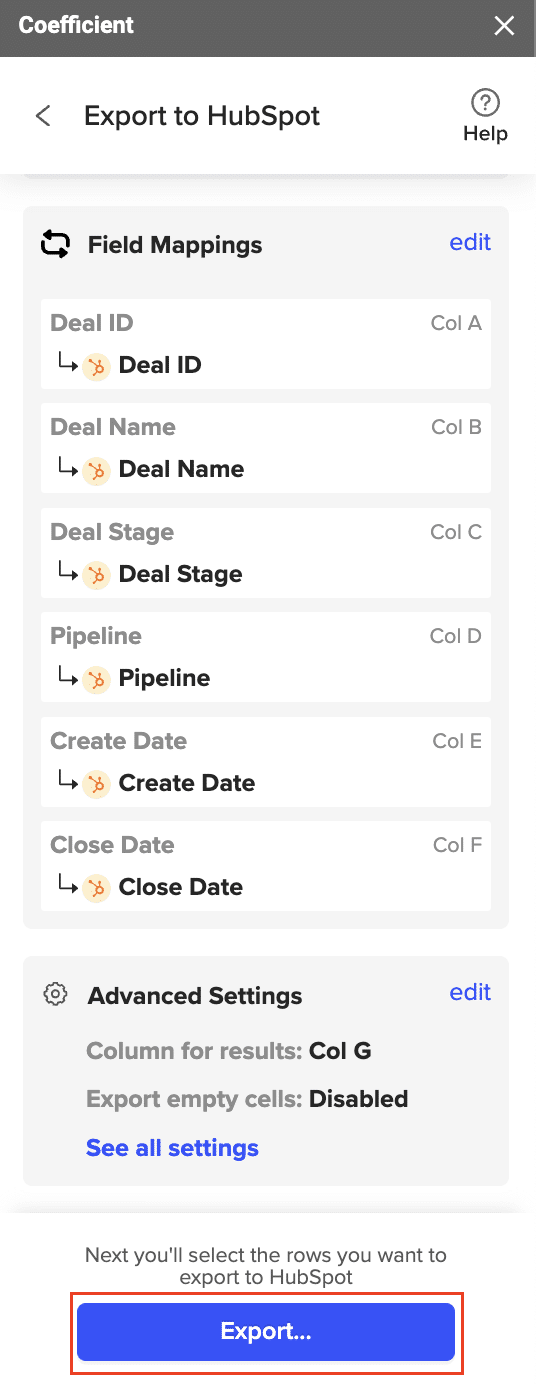

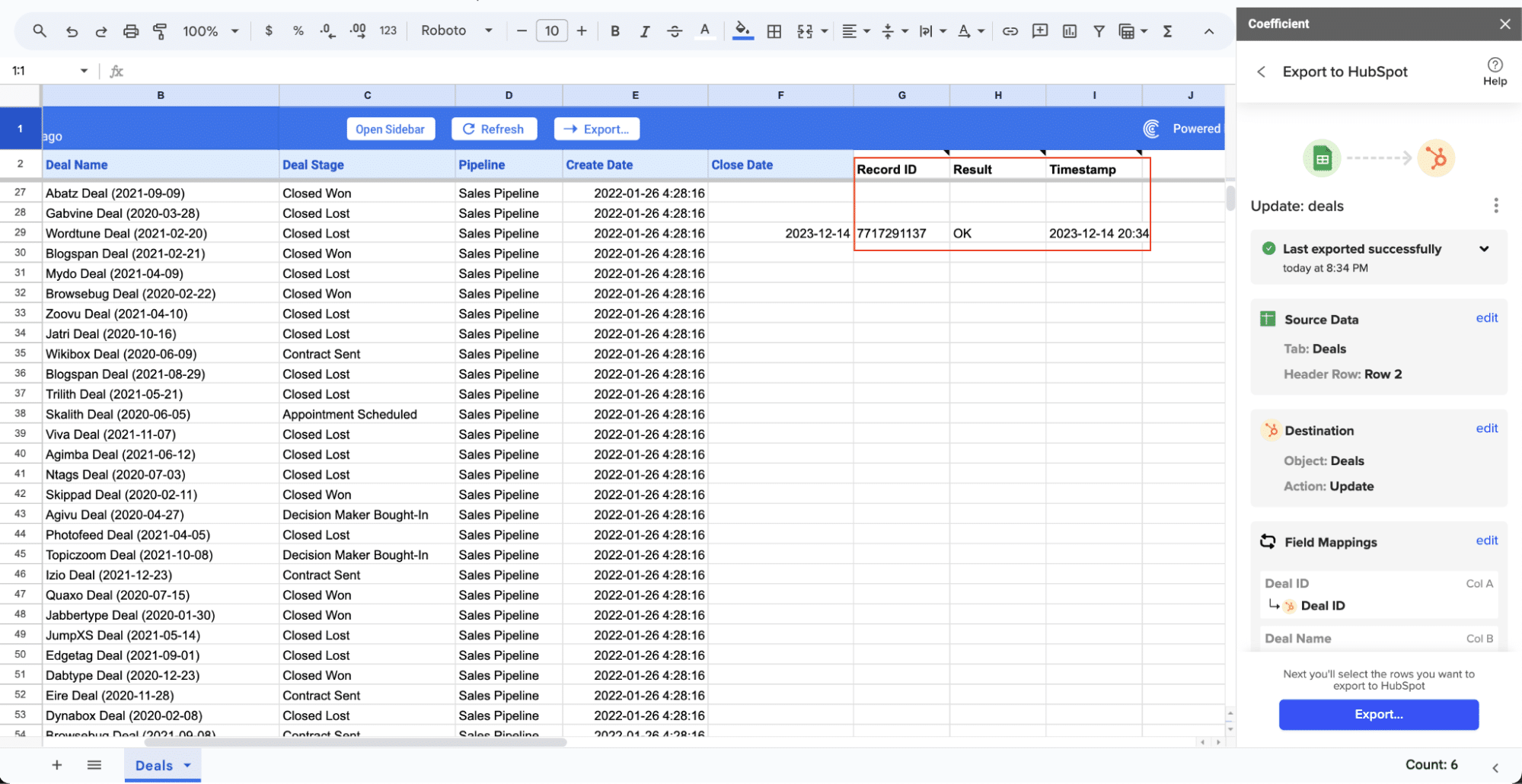

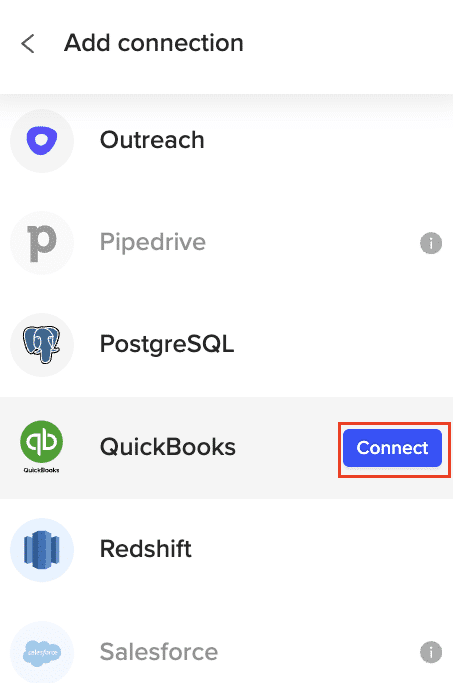

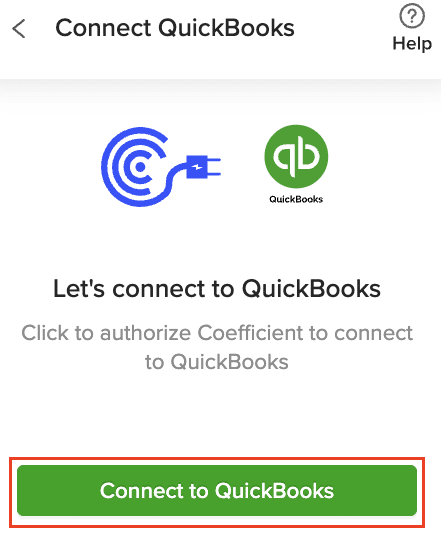

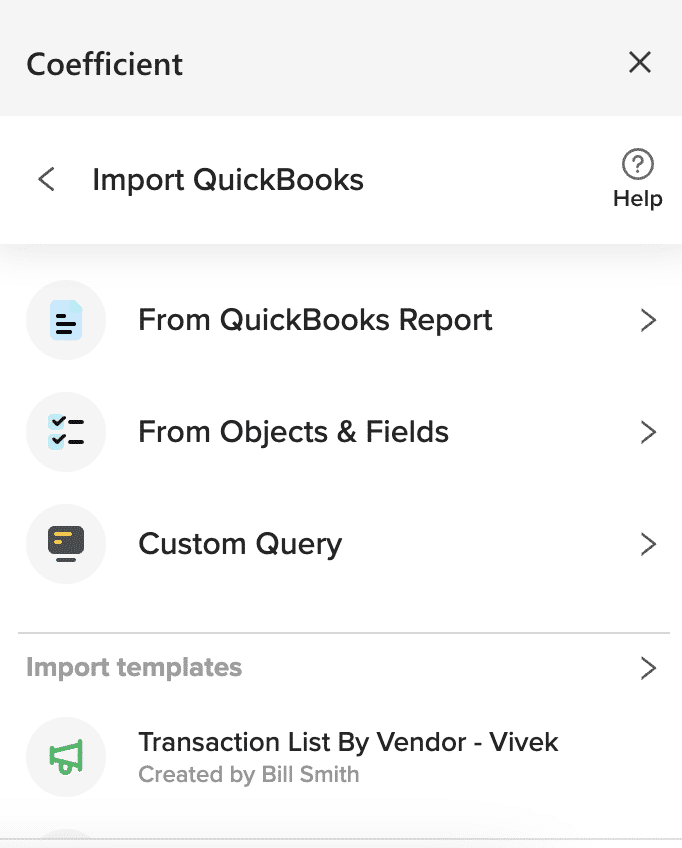

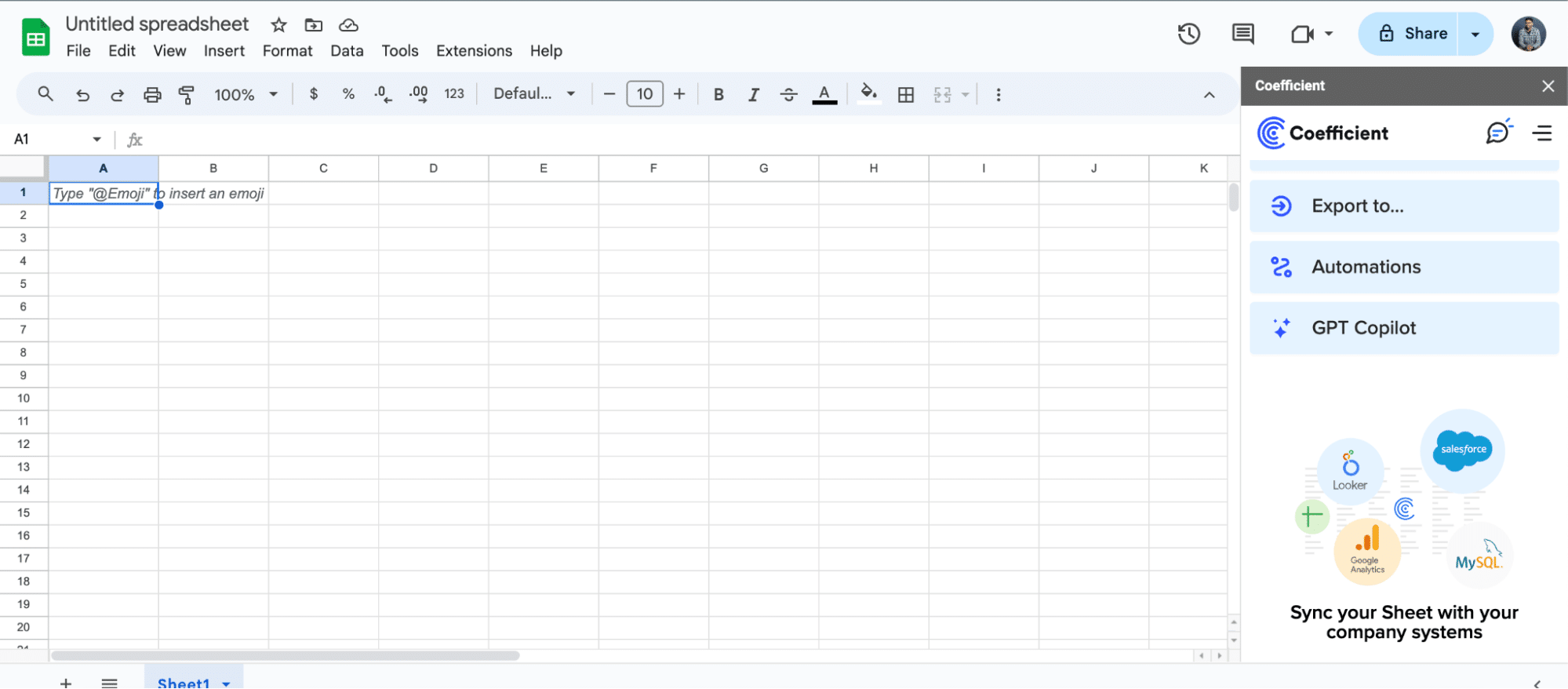

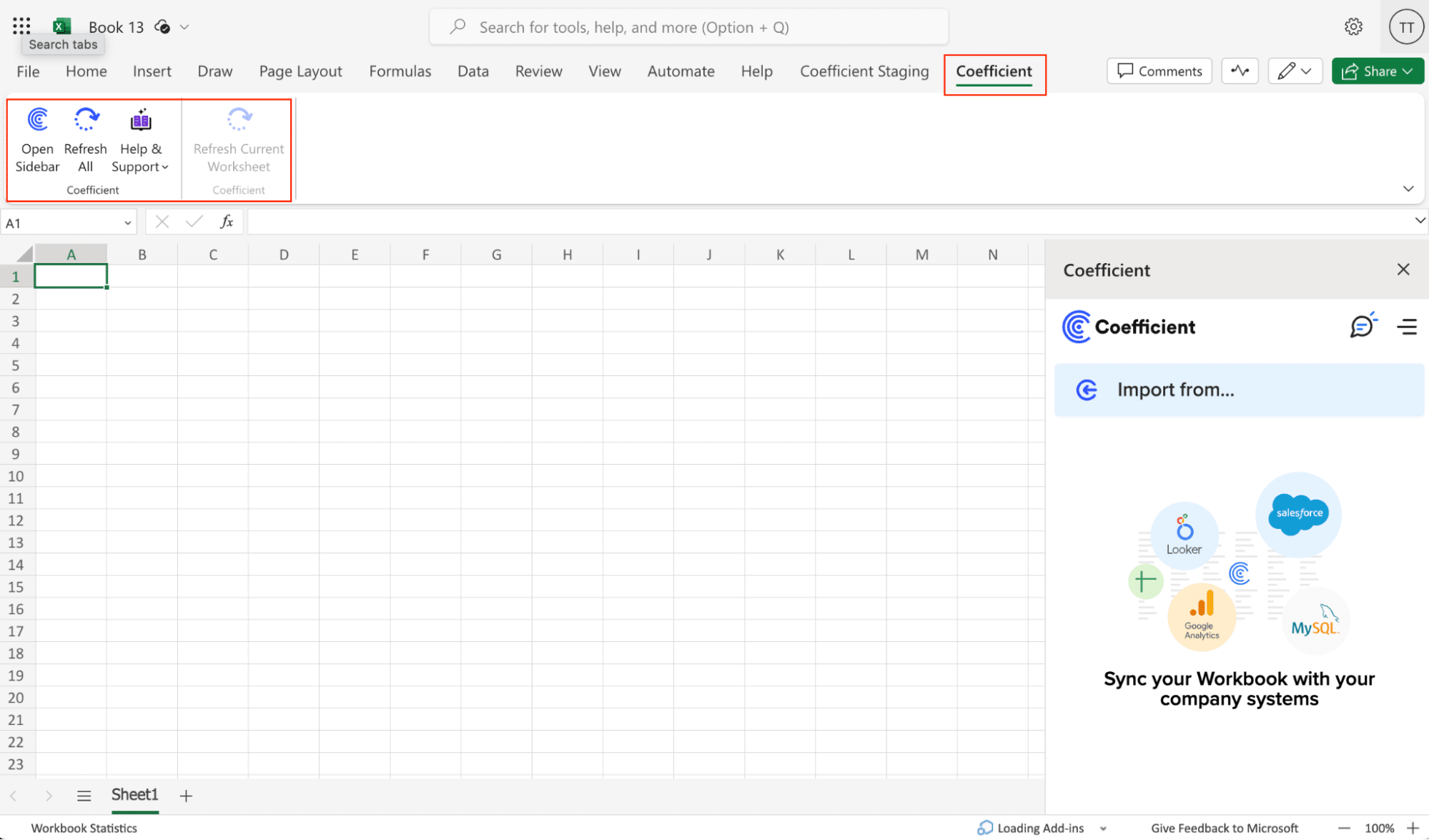

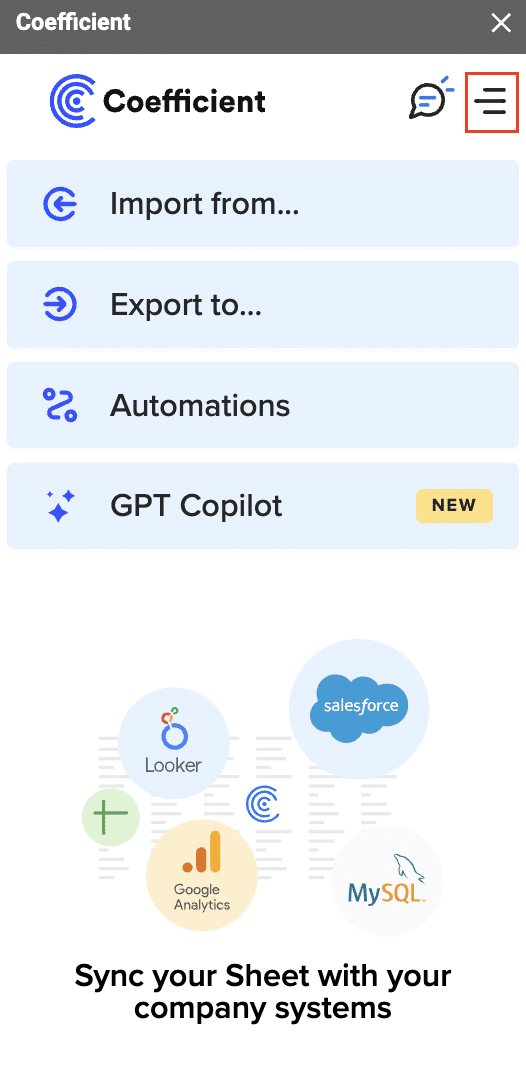

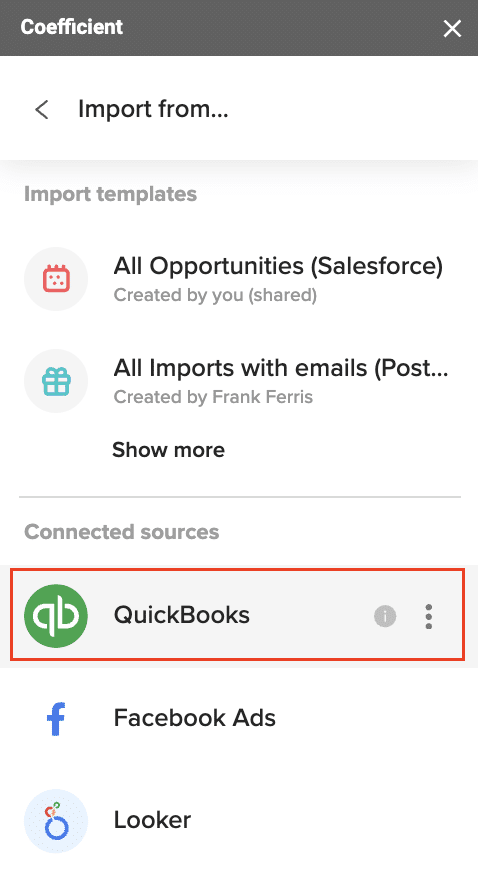

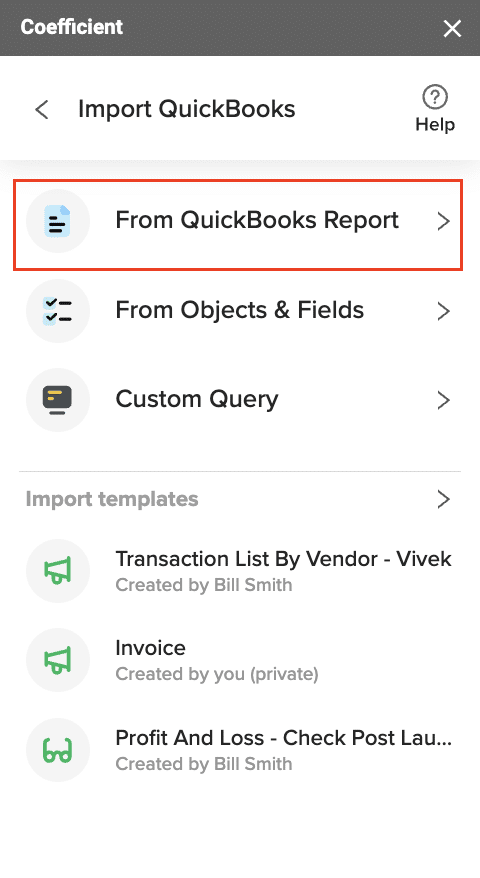

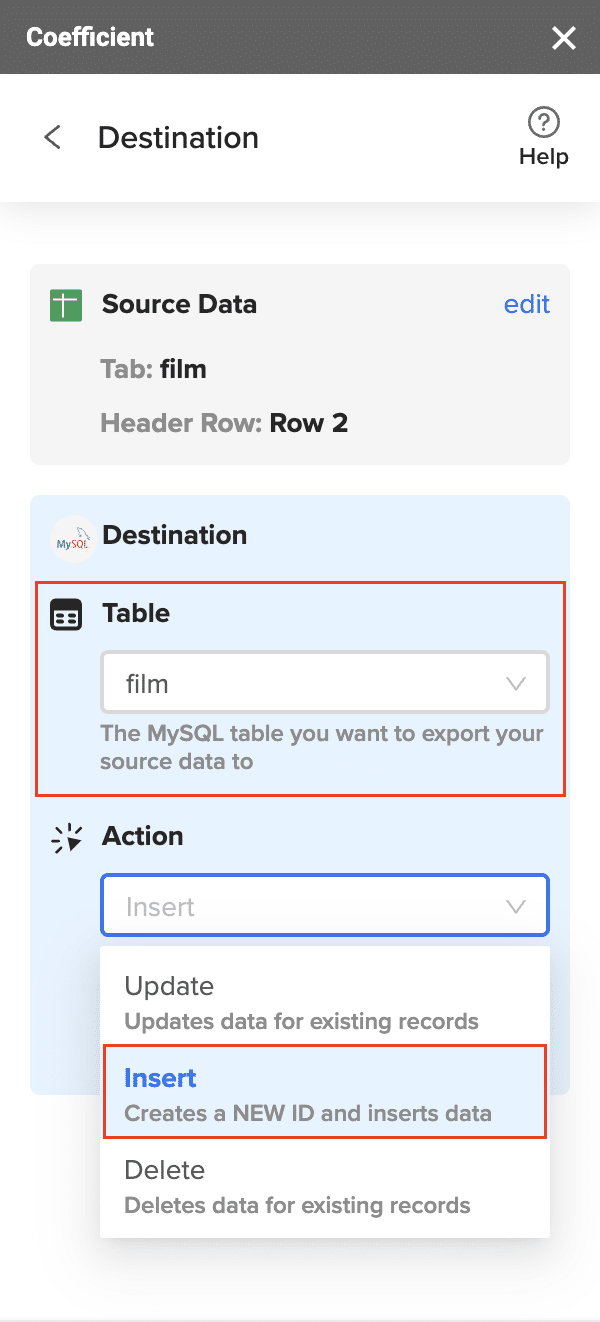

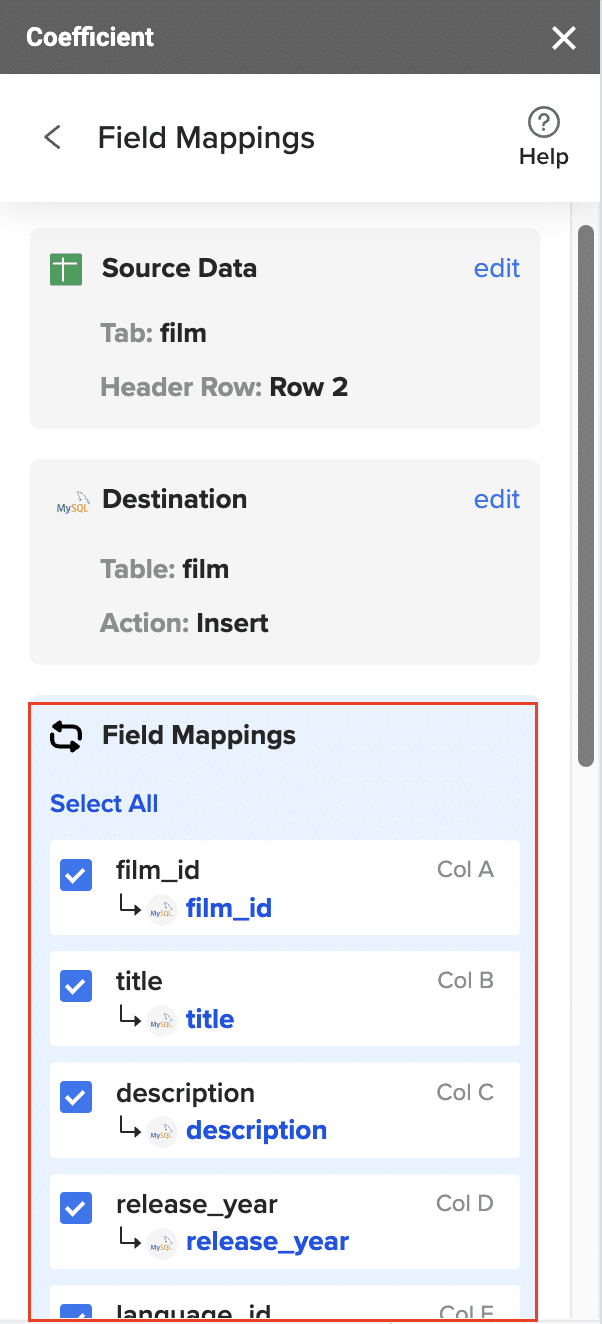

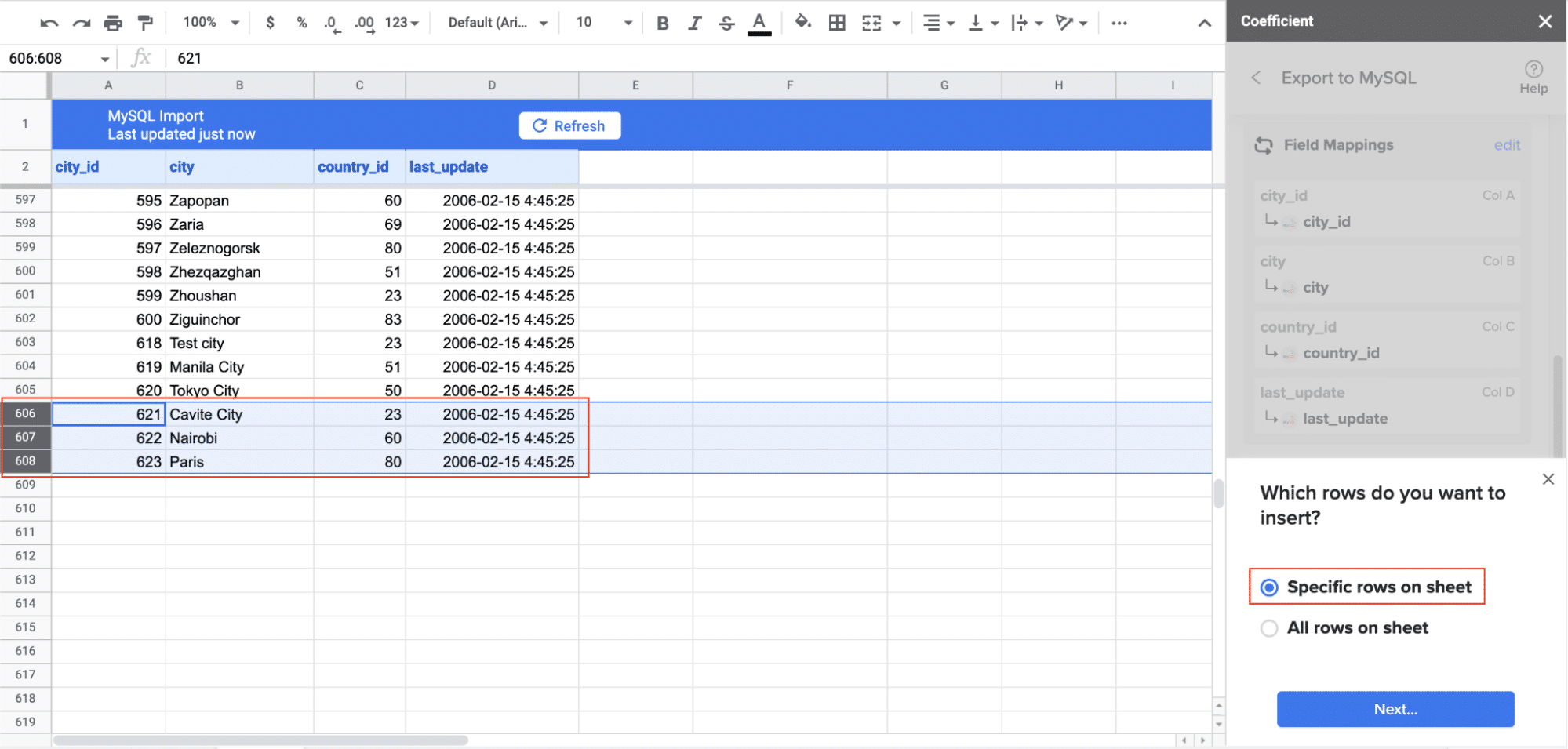

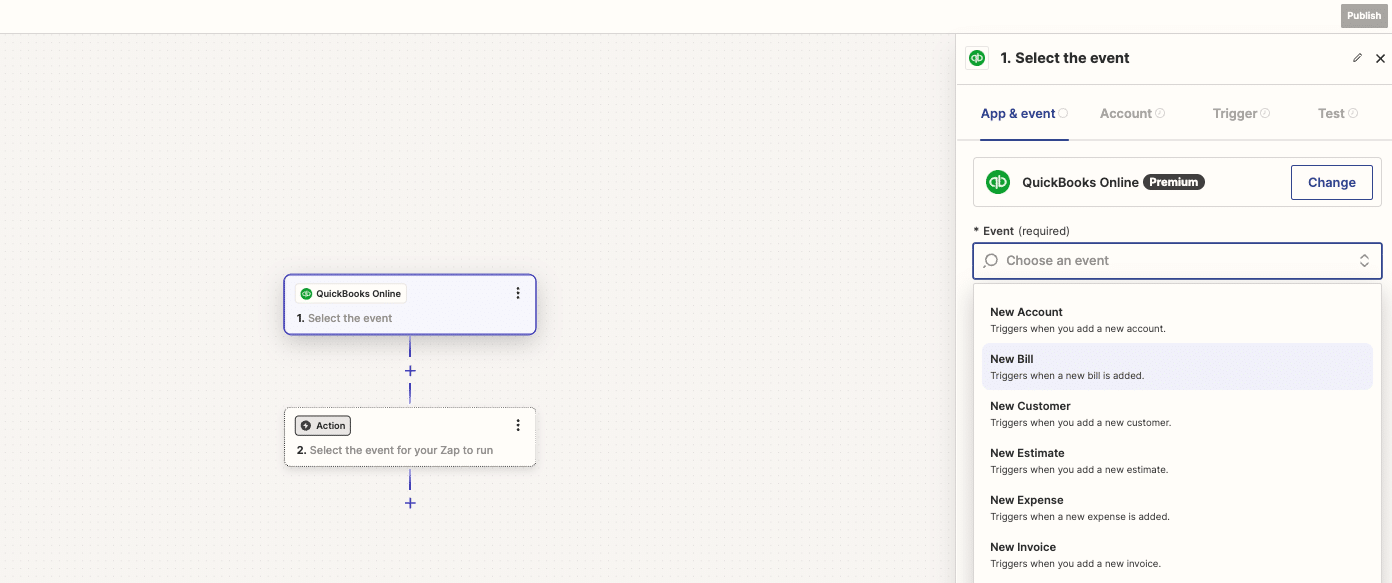

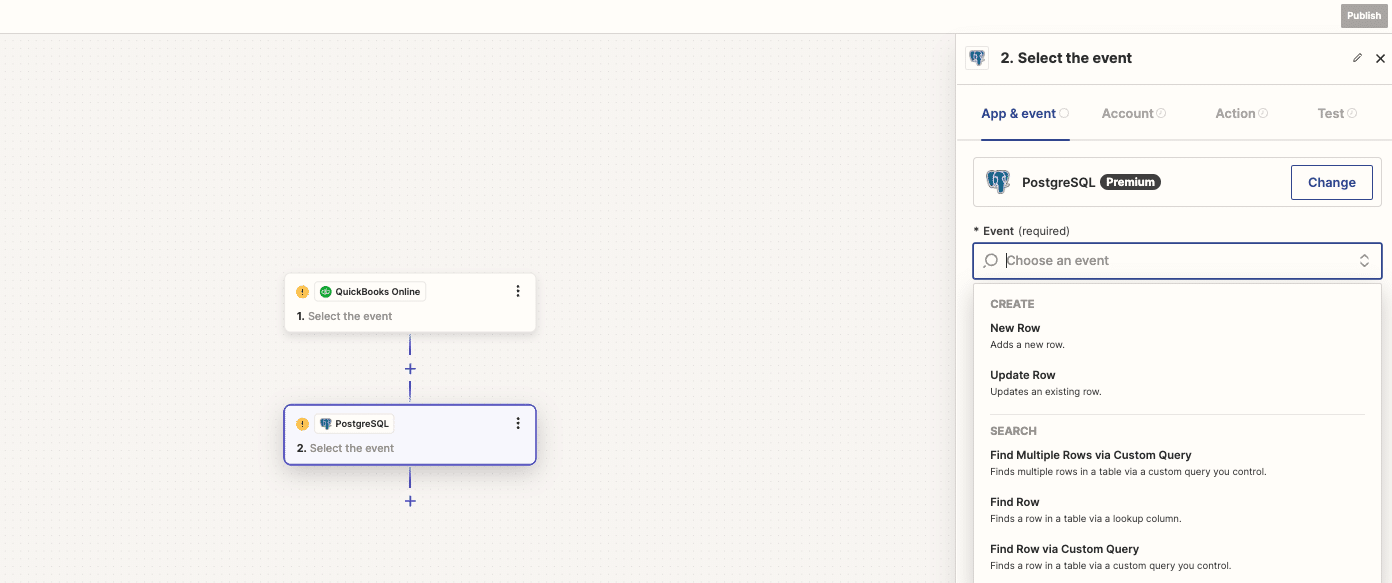

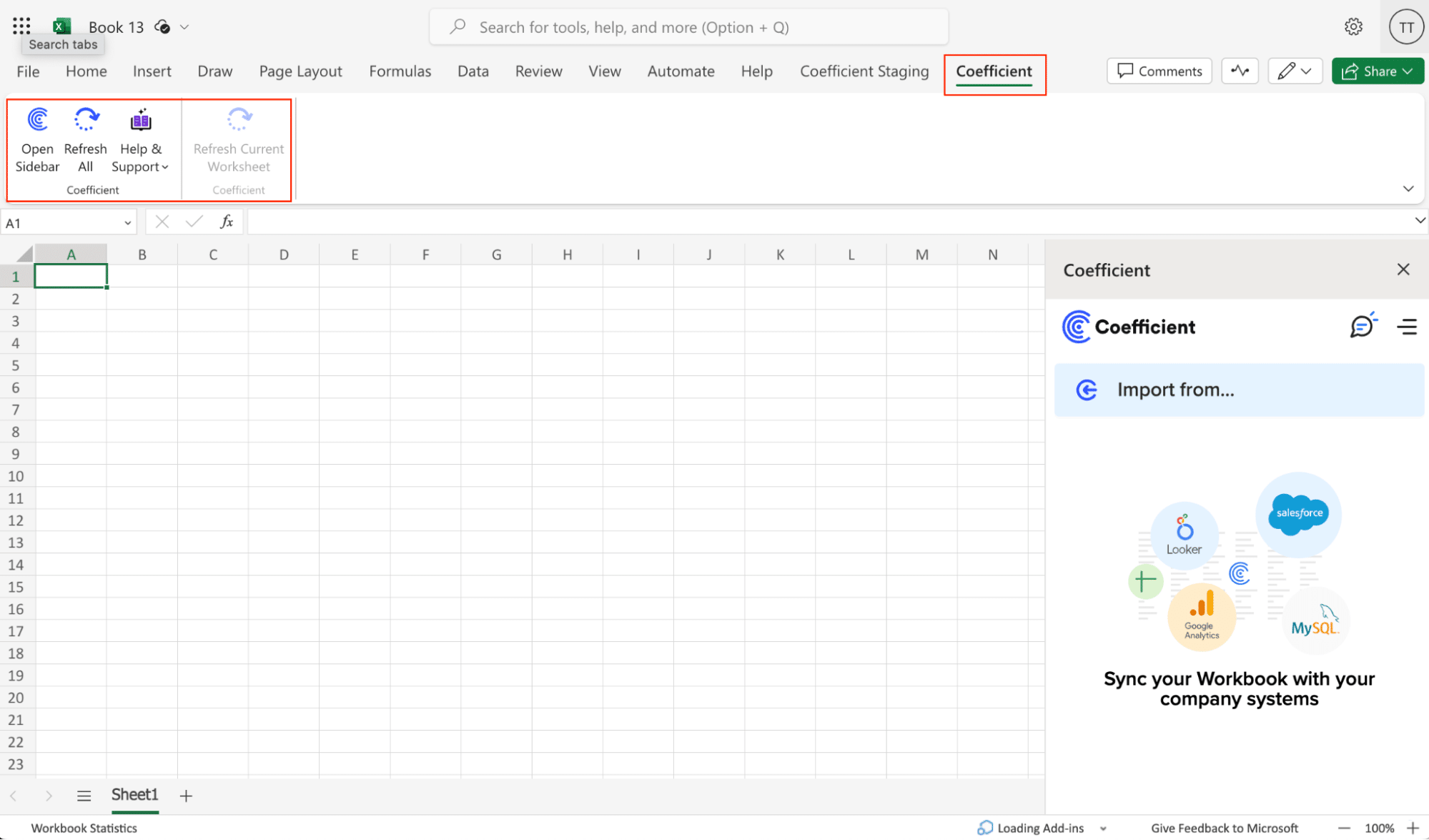

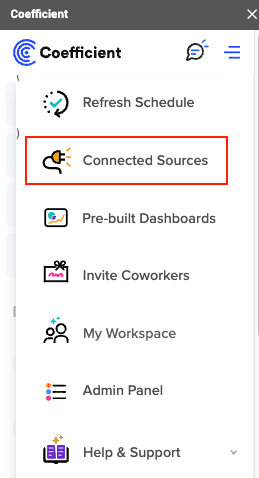

#1 Coefficient (Spreadsheet Connector)

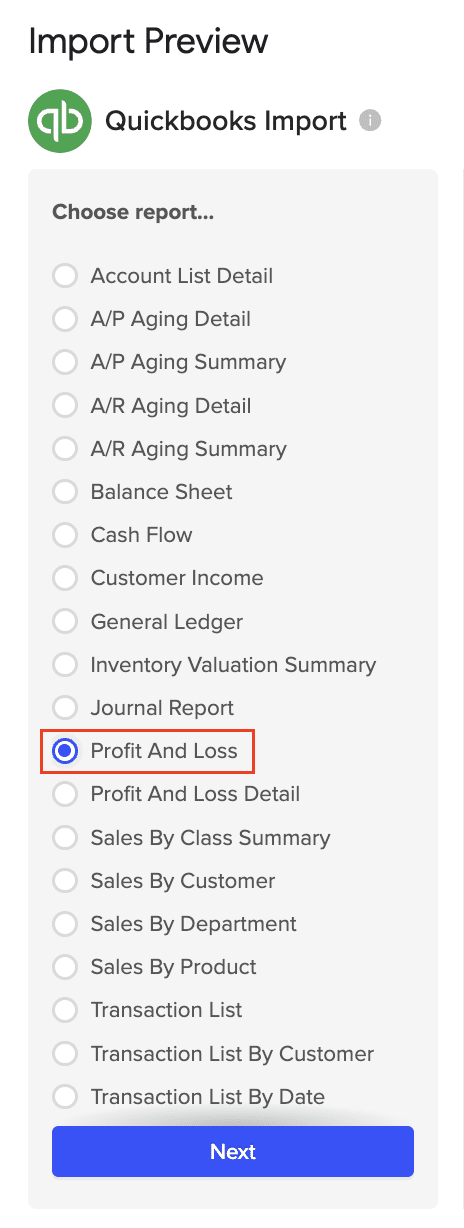

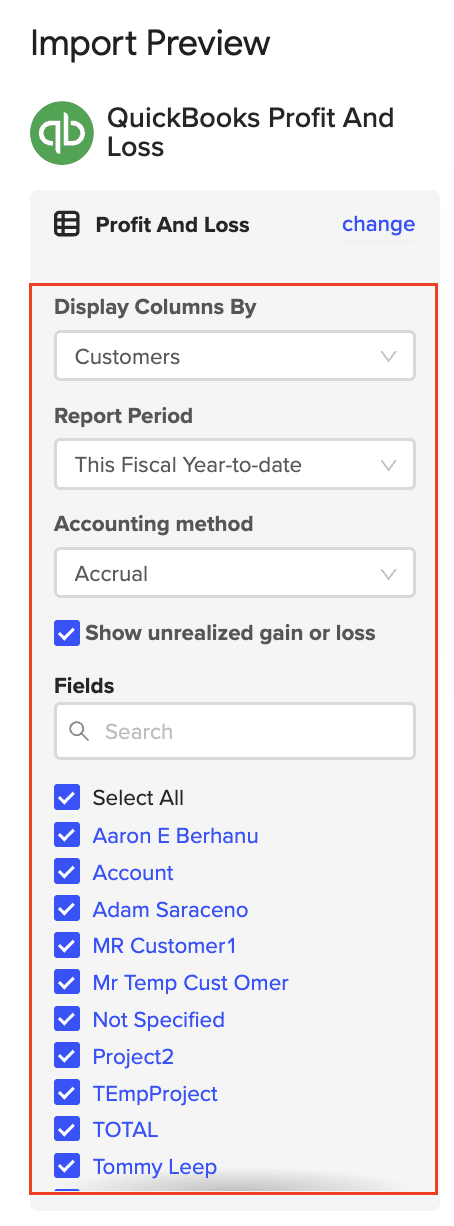

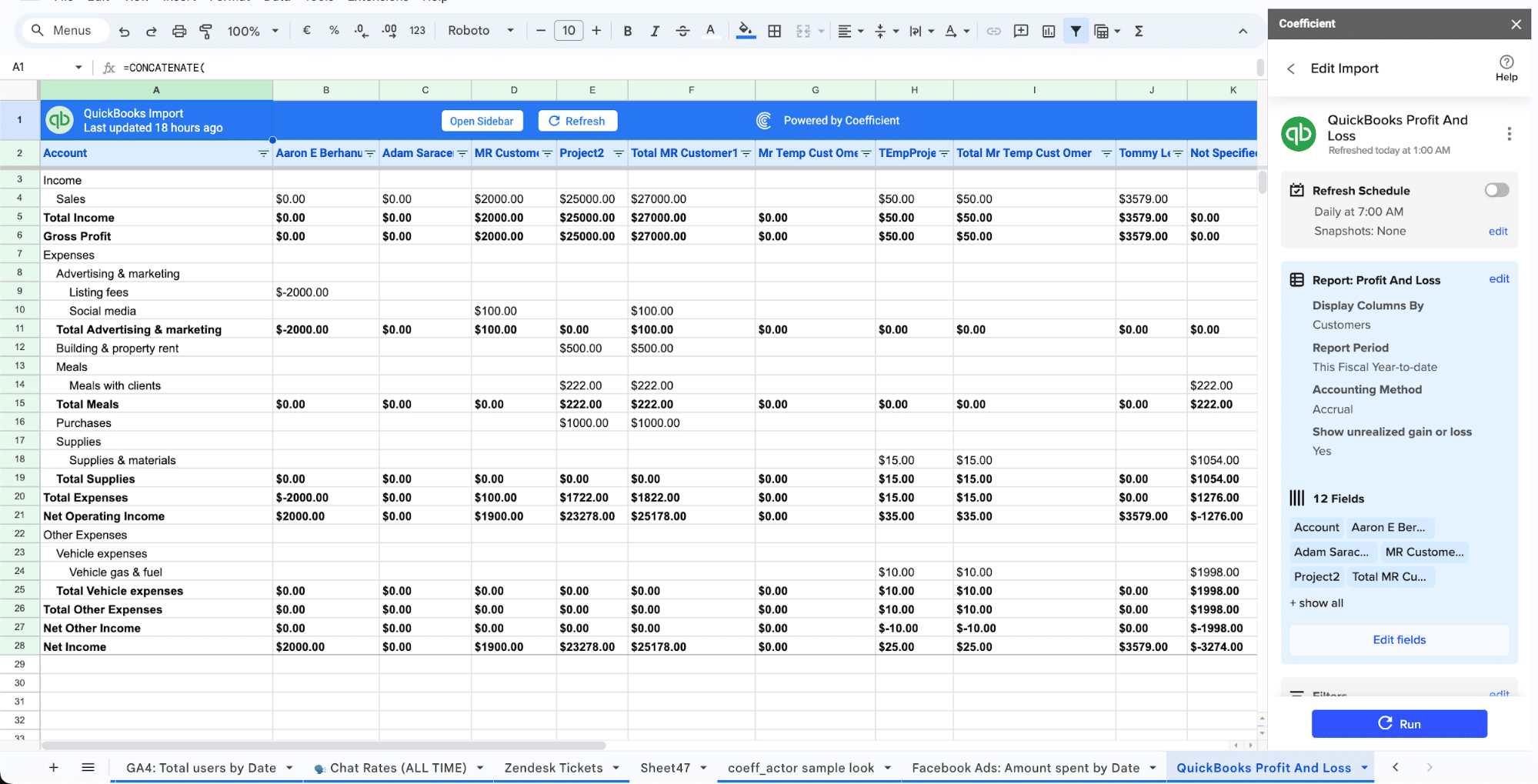

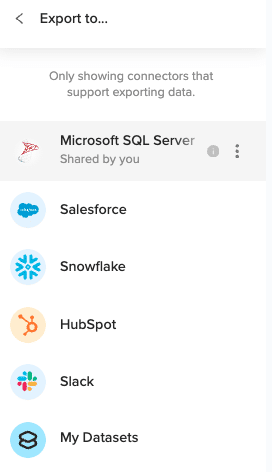

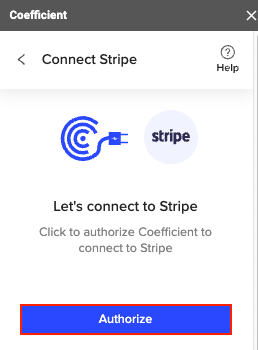

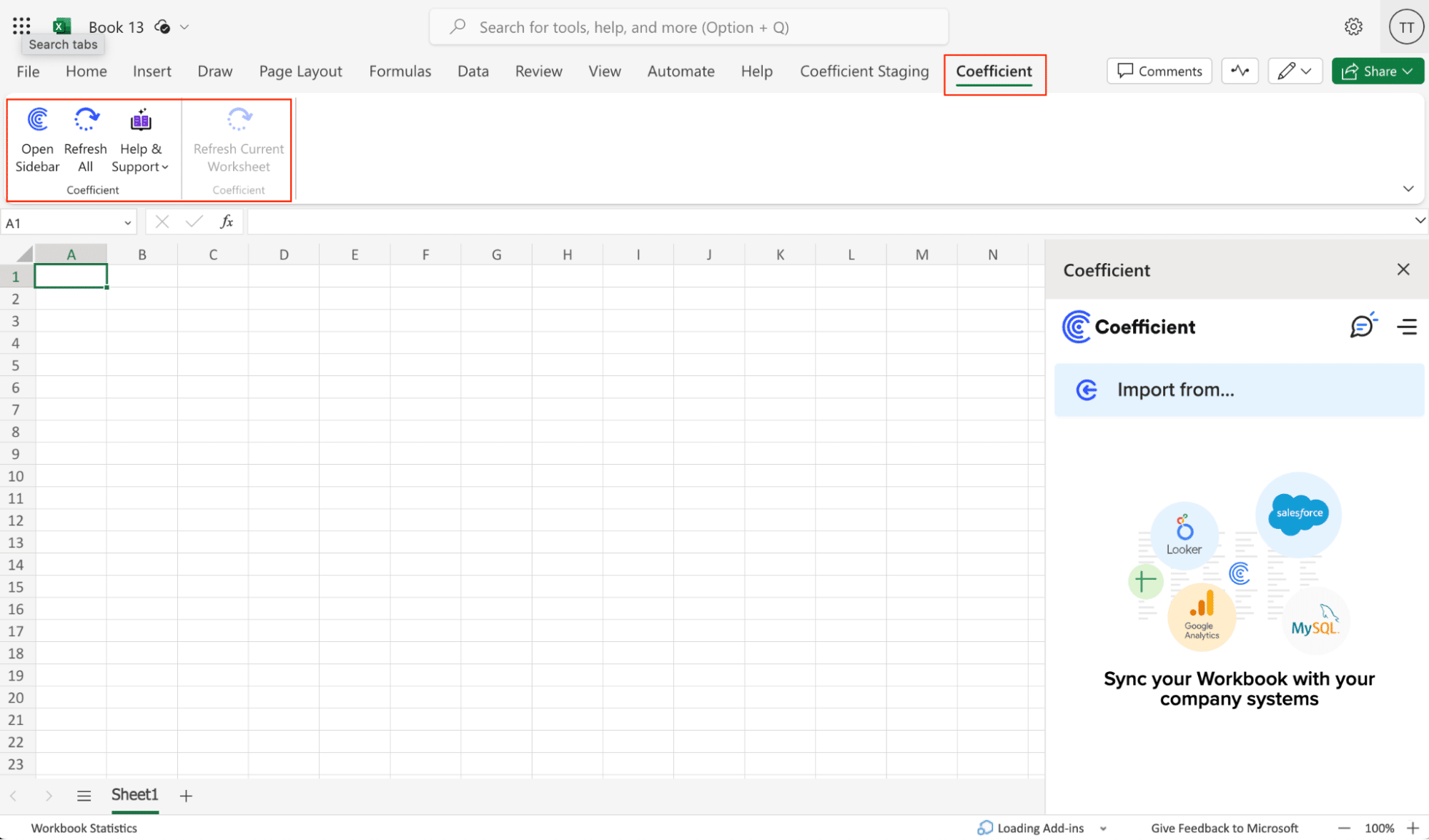

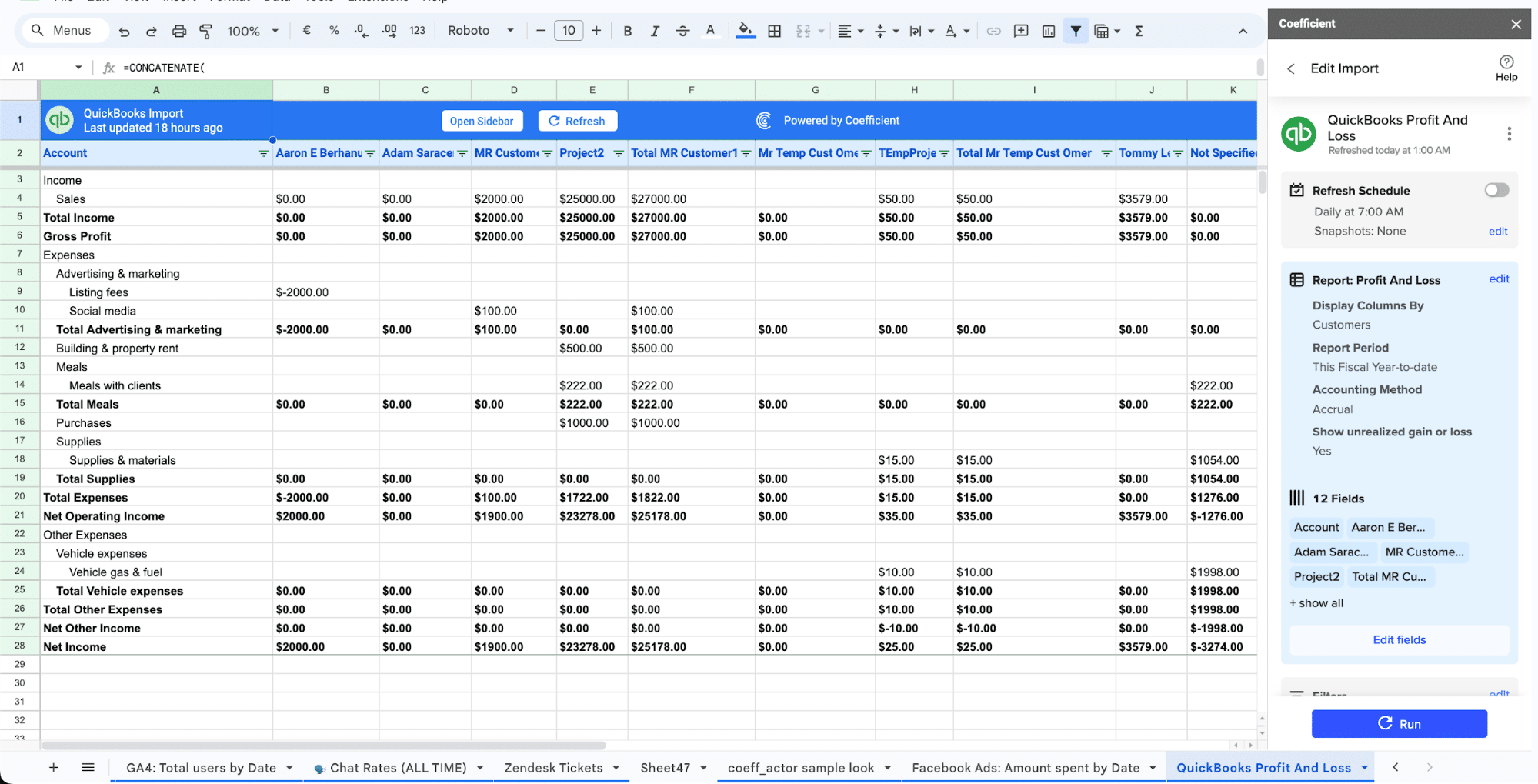

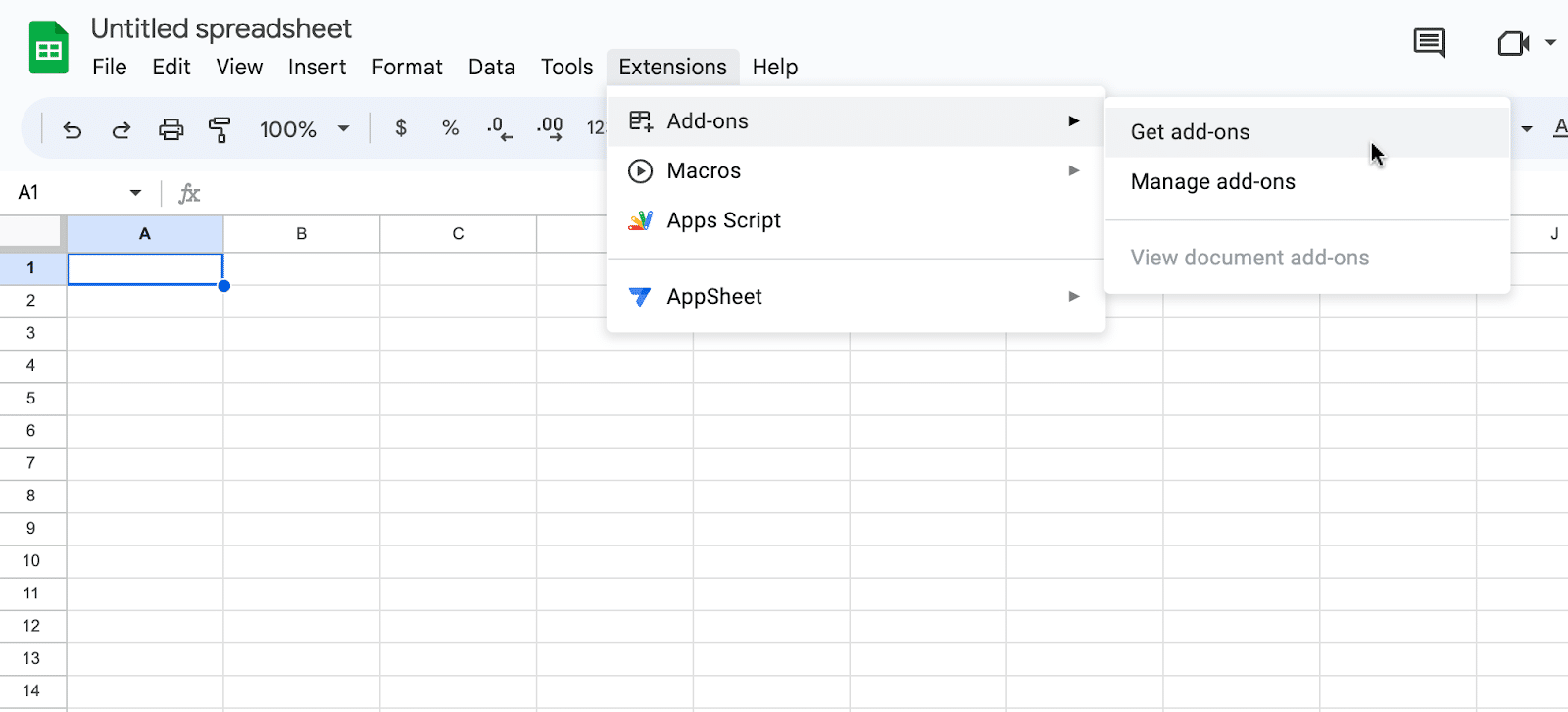

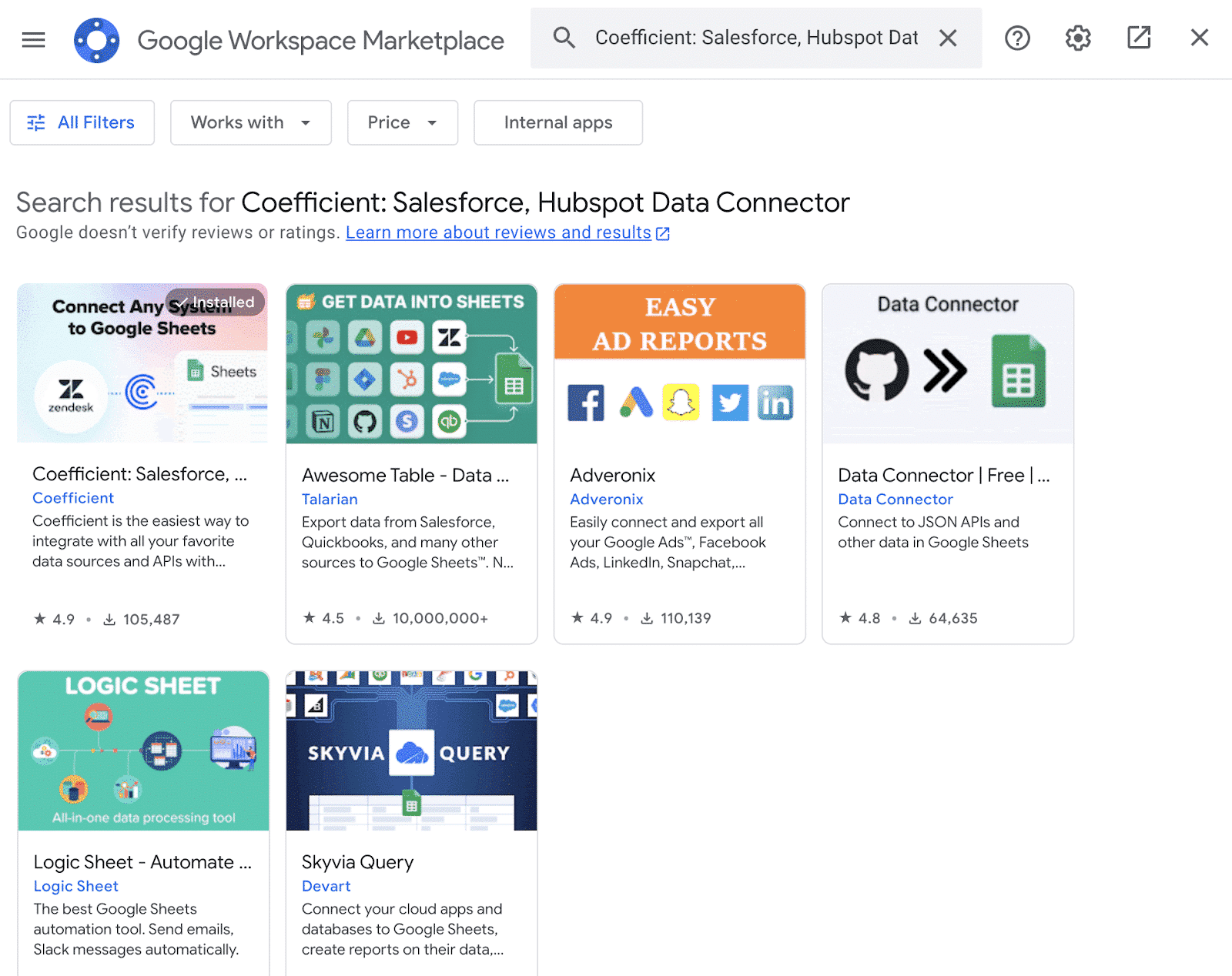

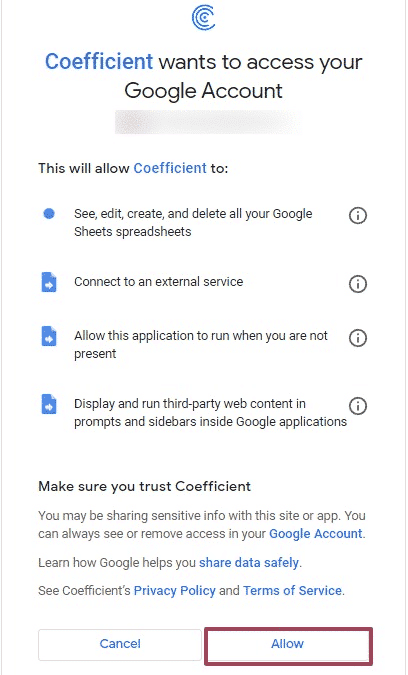

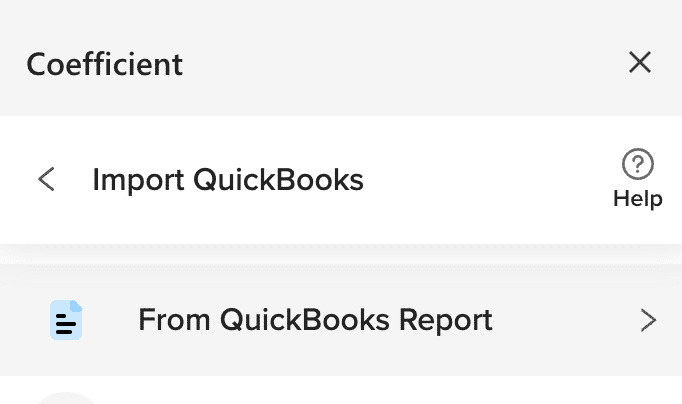

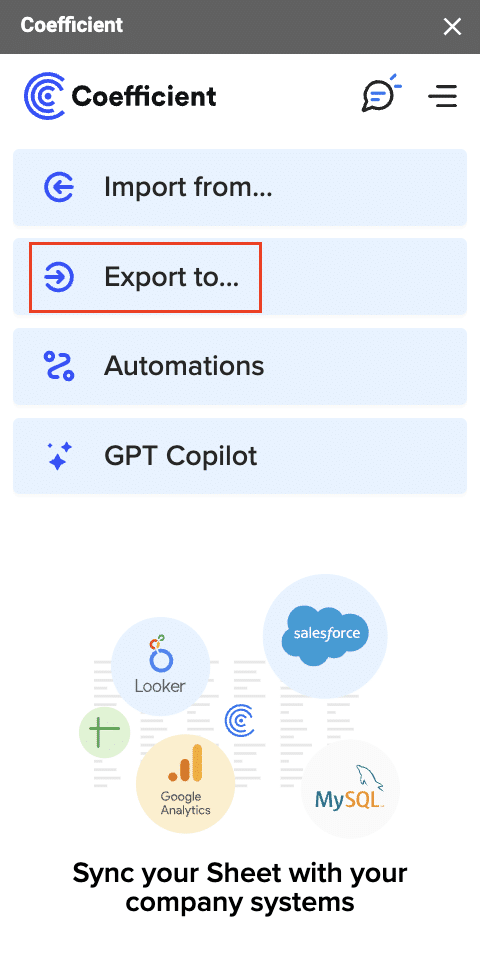

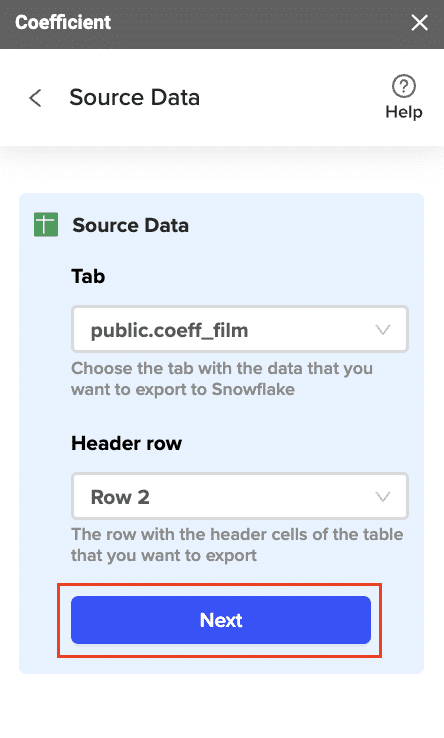

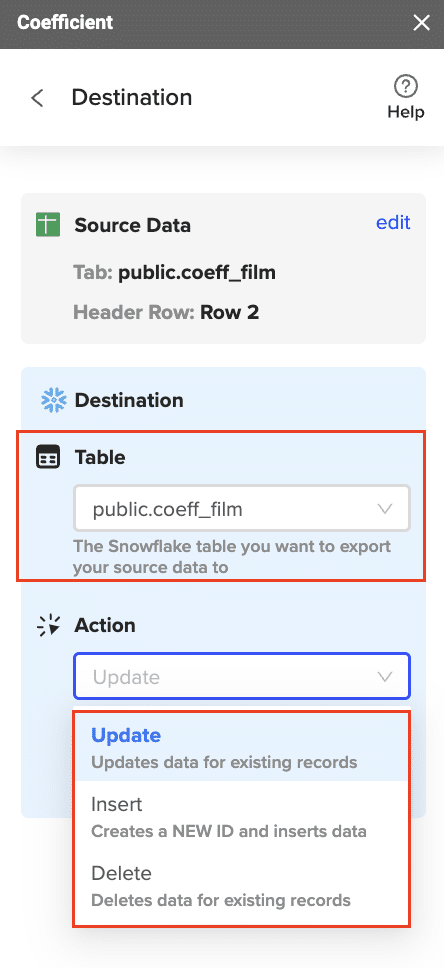

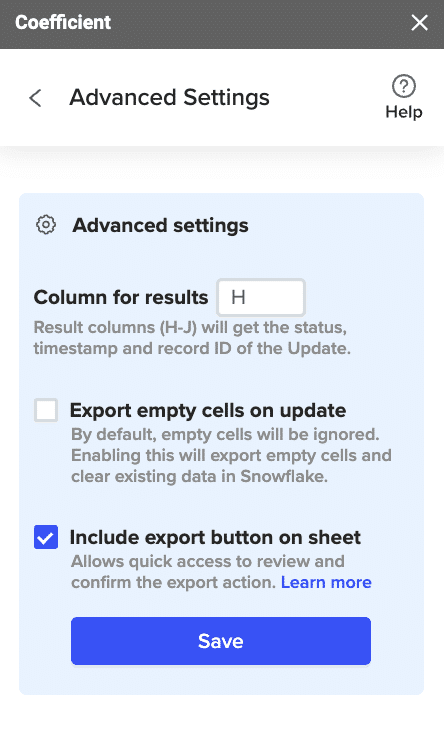

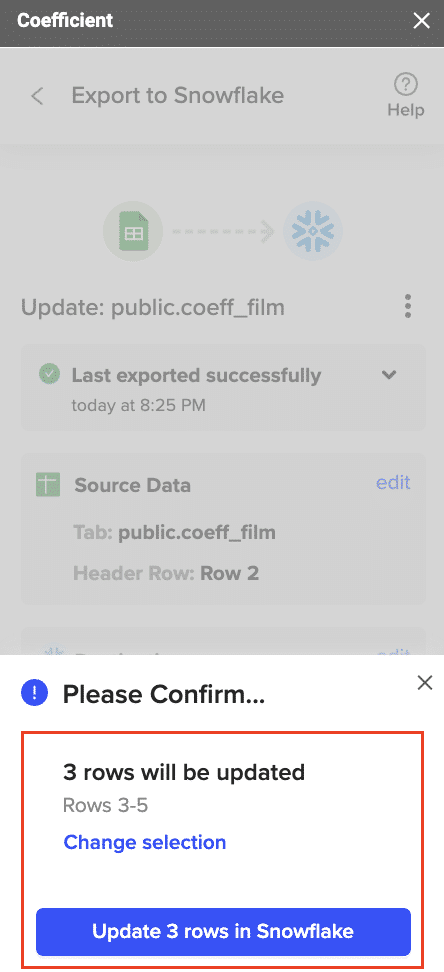

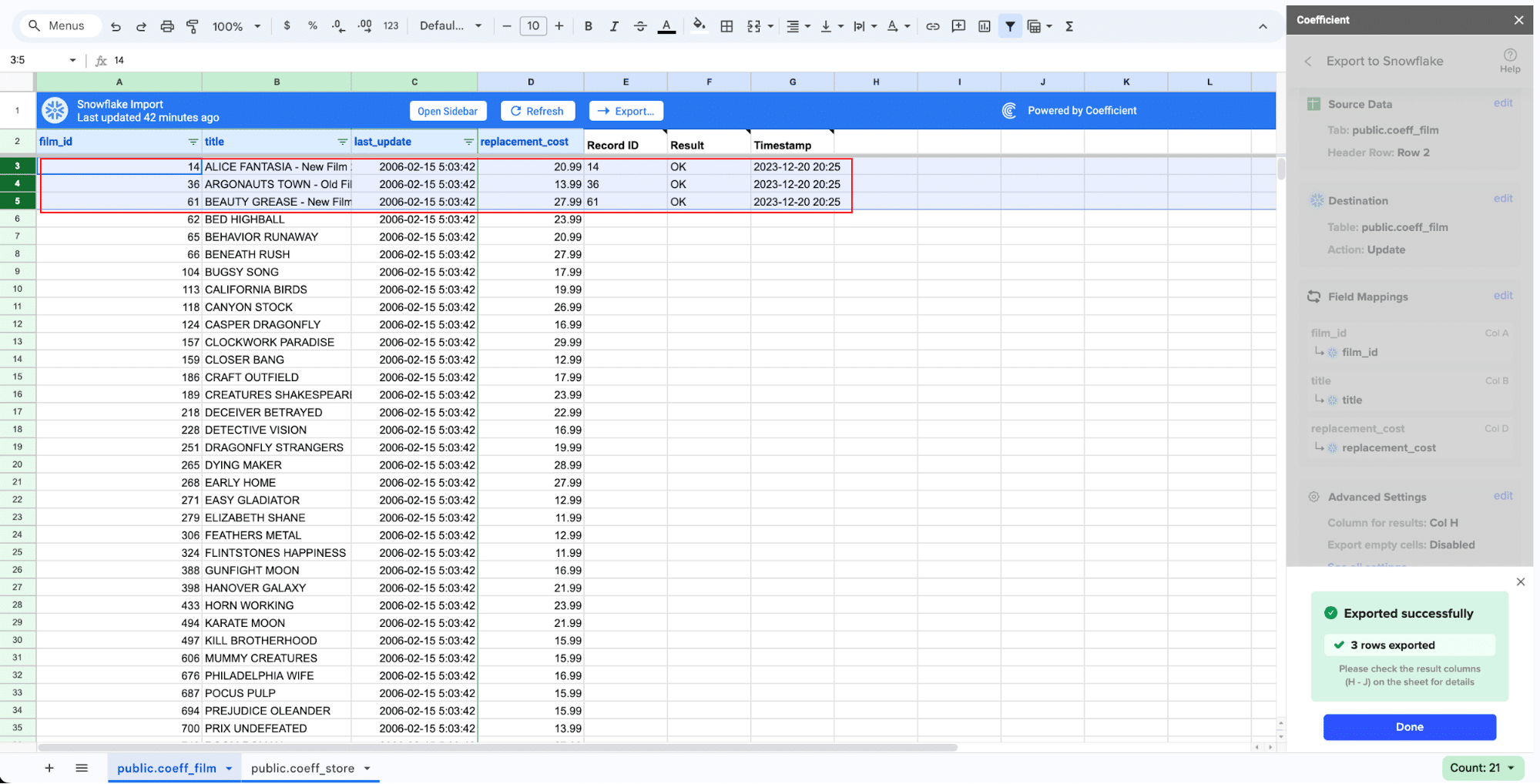

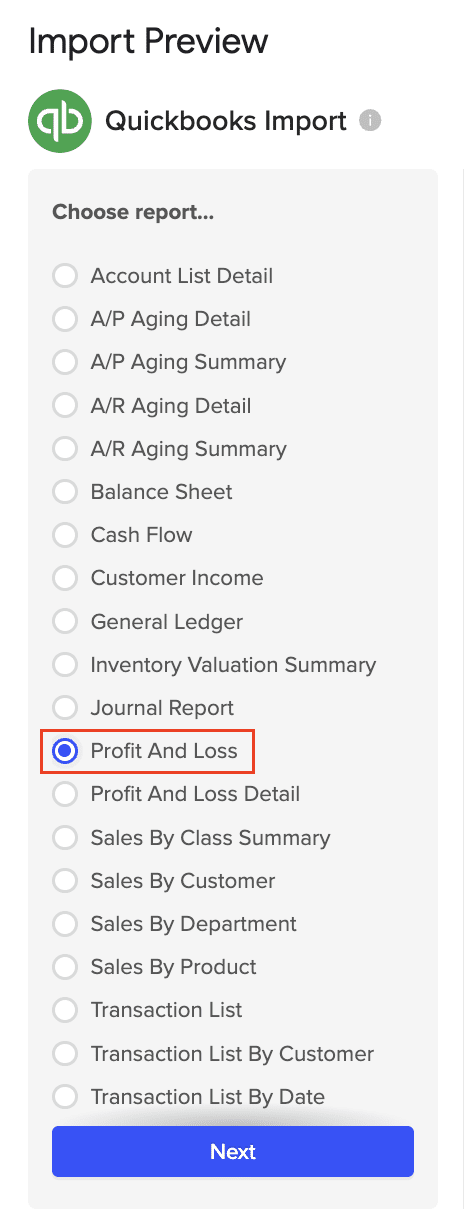

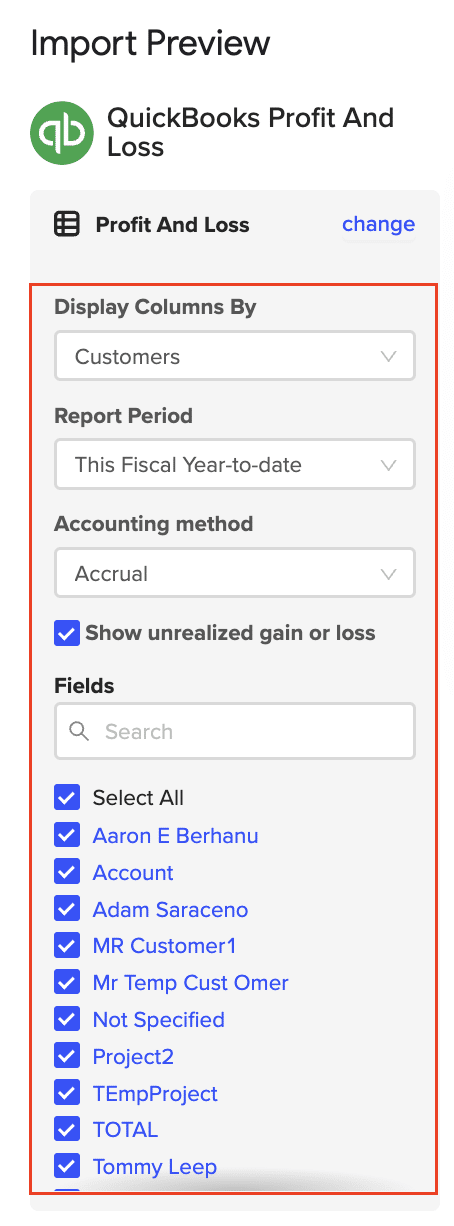

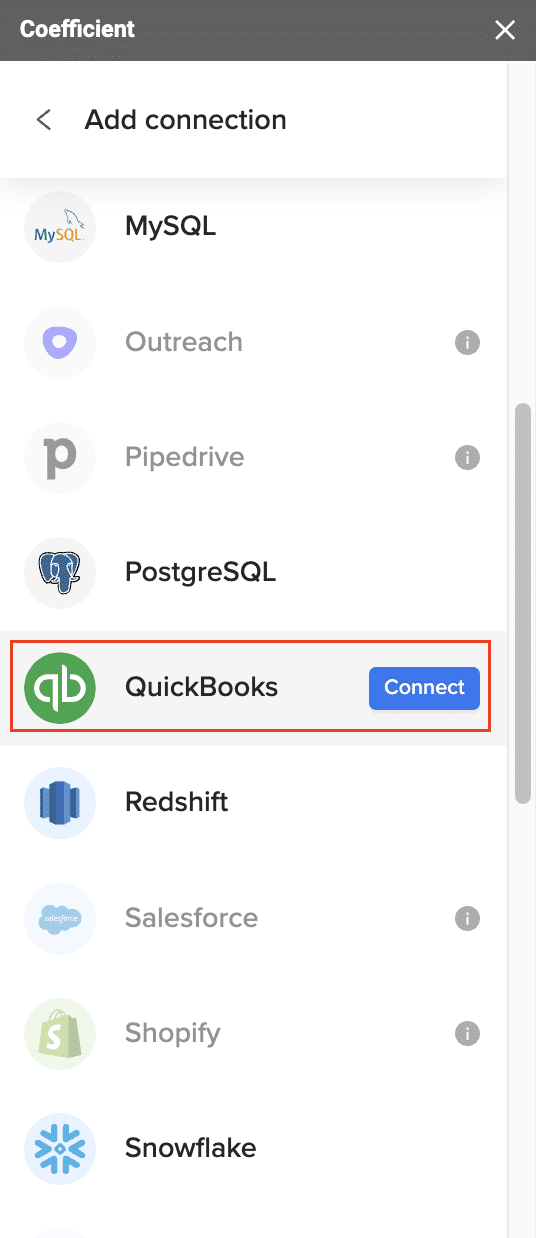

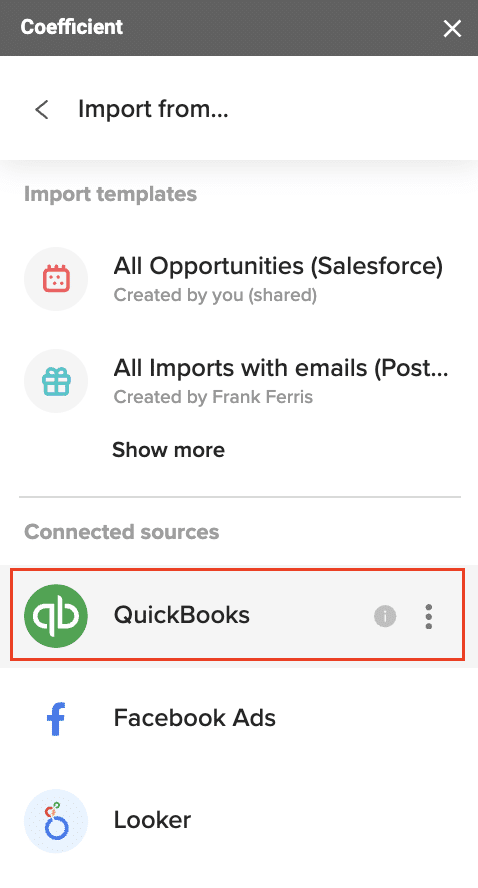

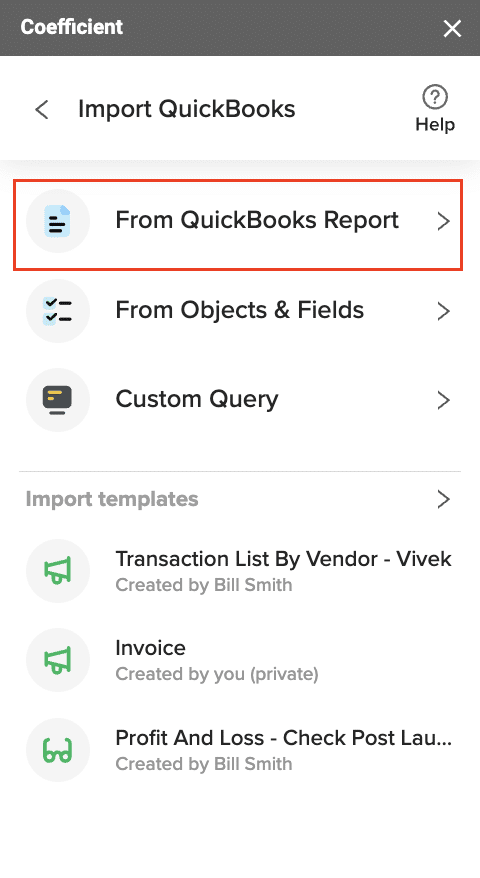

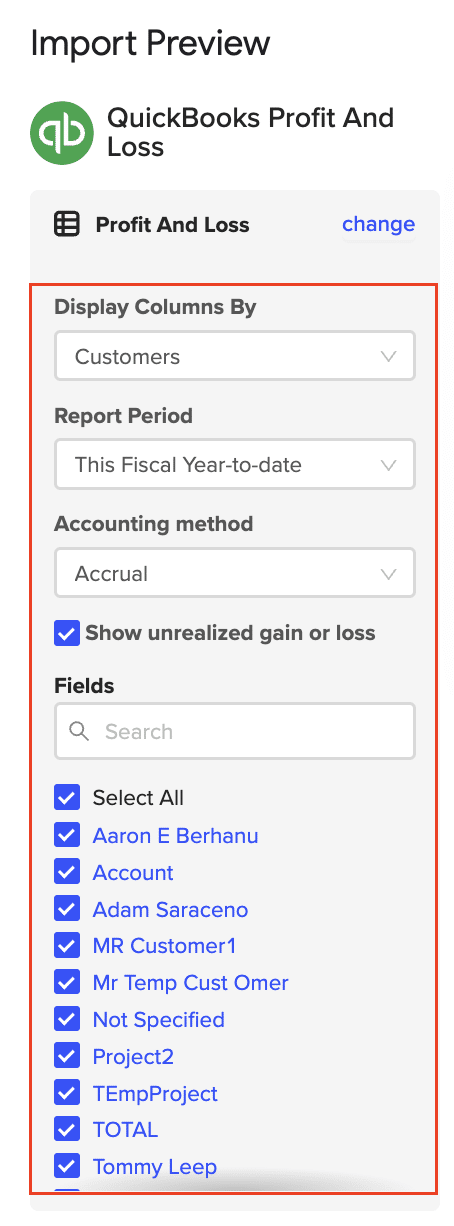

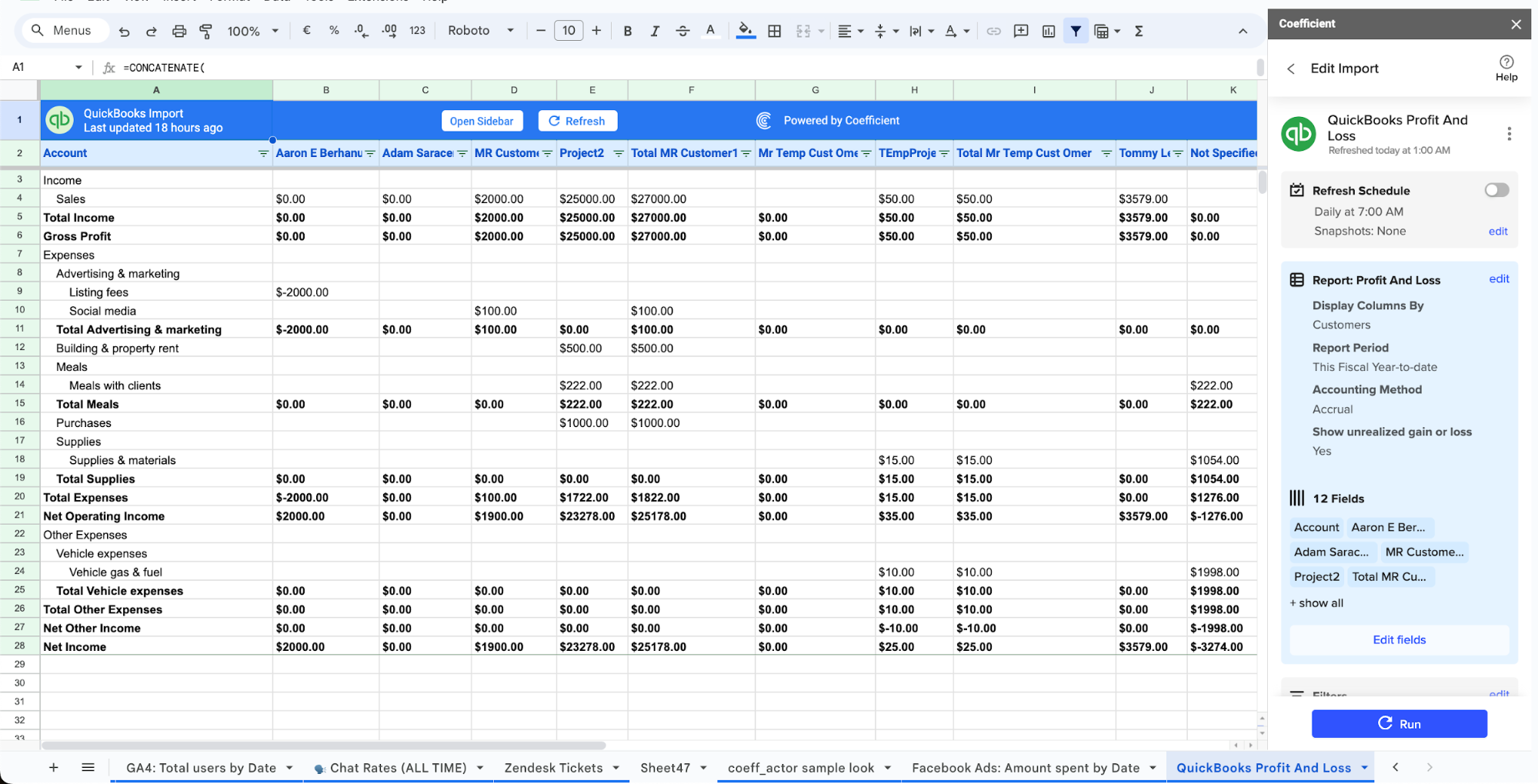

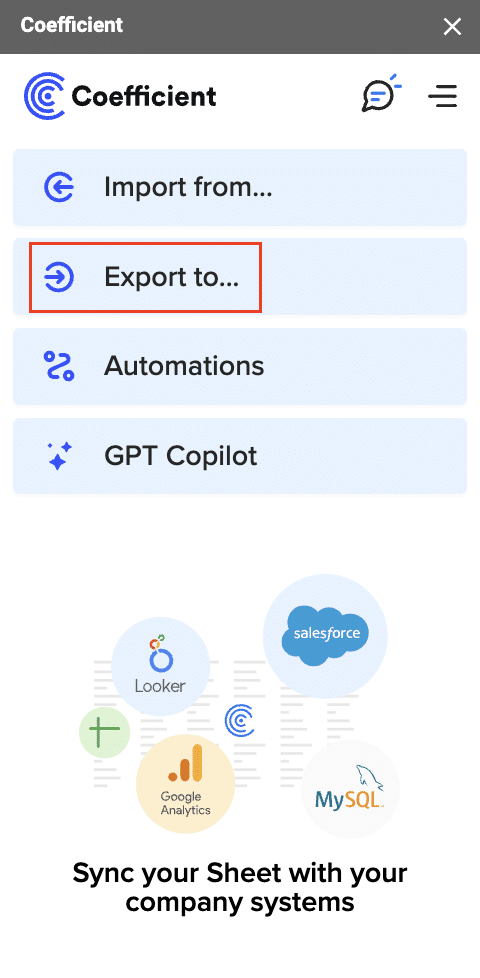

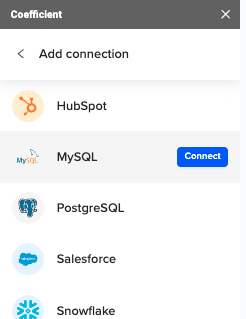

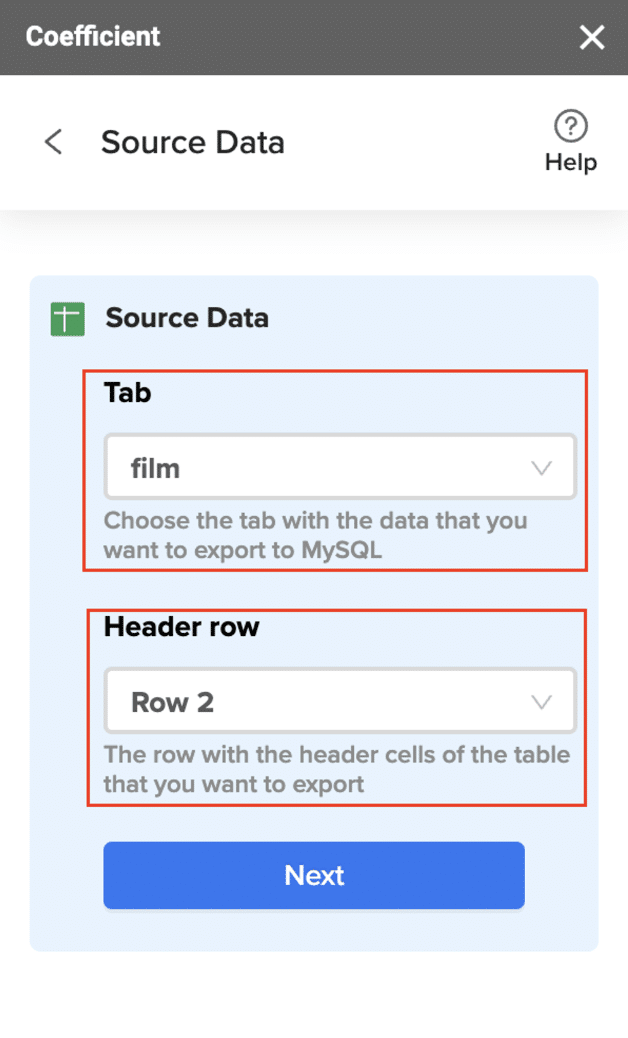

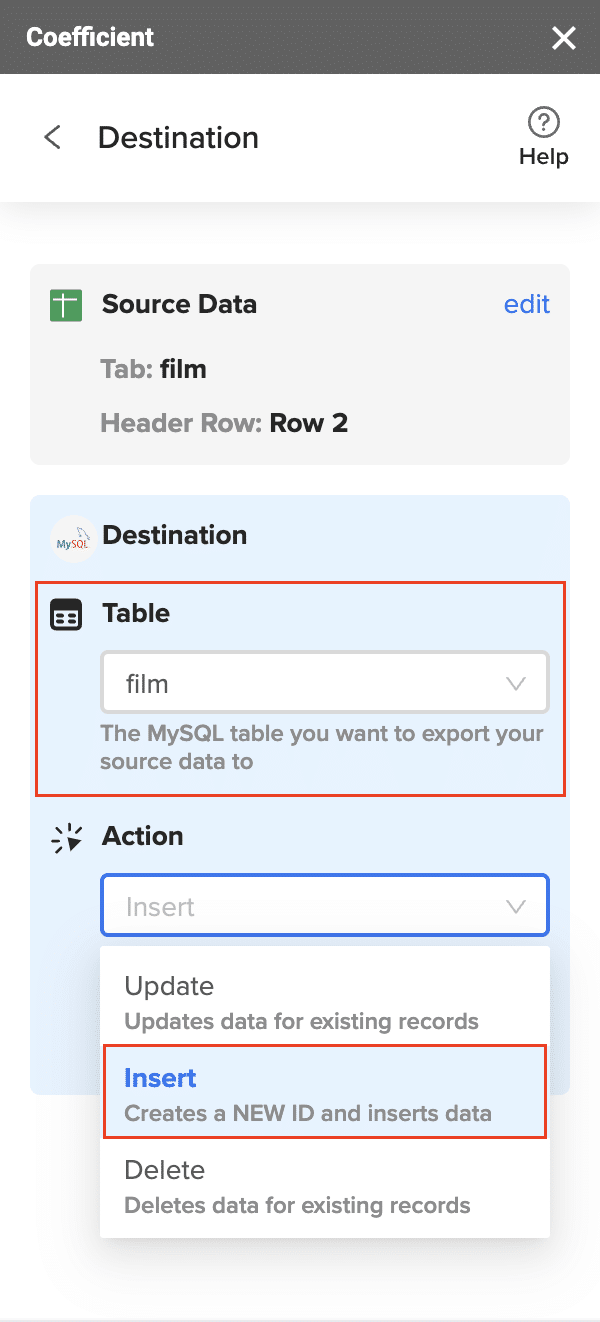

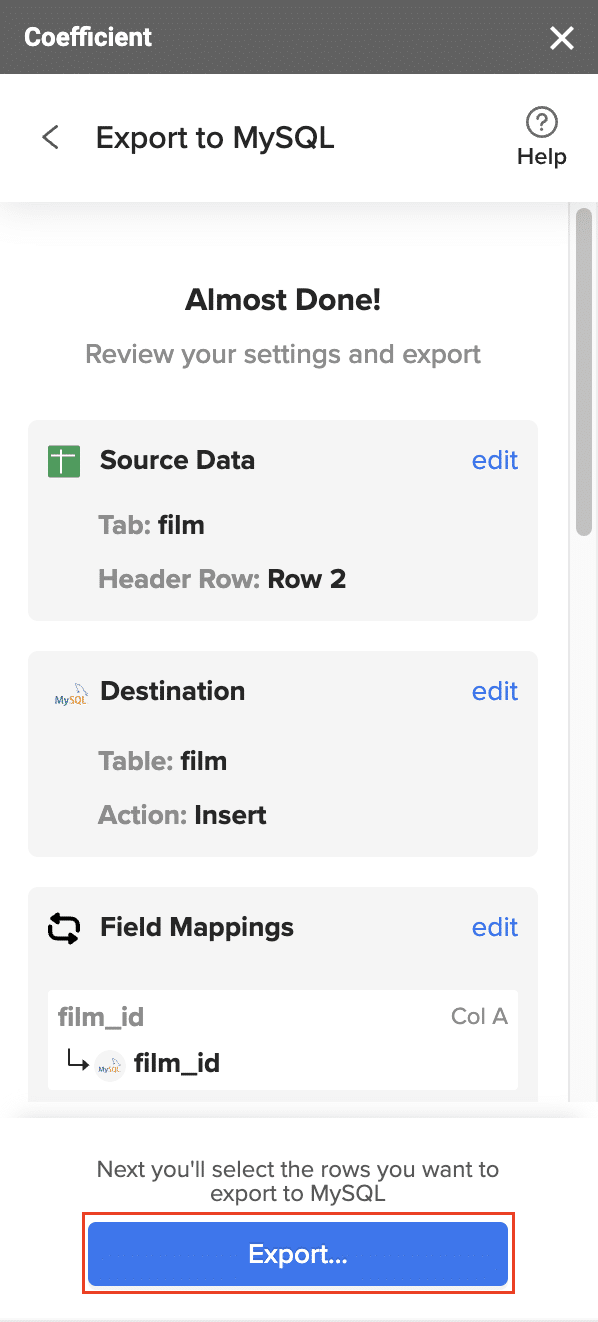

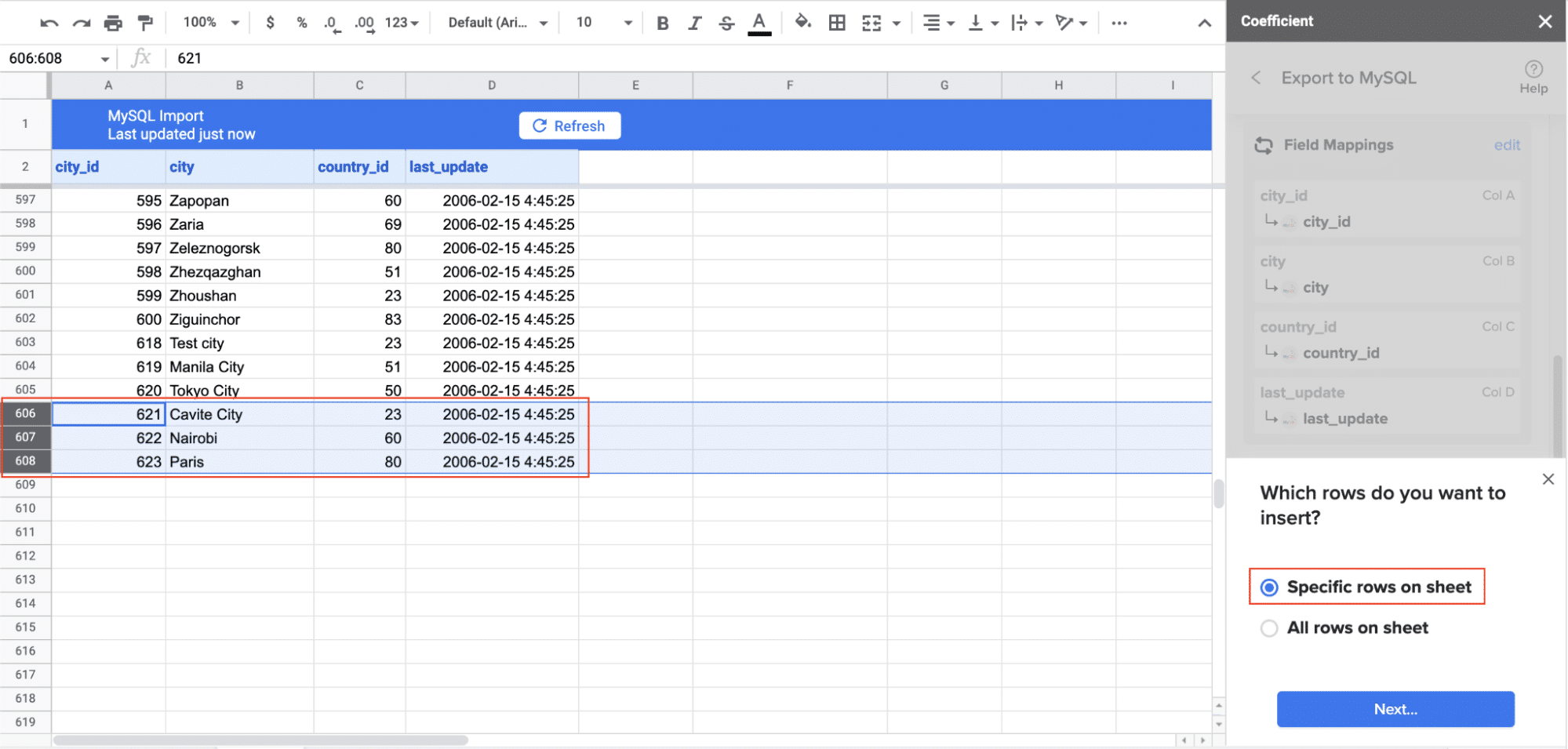

Coefficient transforms Google Sheets and Excel into powerful QuickBooks reporting engines by establishing live data connections that eliminate manual exports and imports. This no-code solution enables finance teams to build dynamic dashboards, automate report generation, and monitor key metrics without leaving their familiar spreadsheet environment.

Highlights of Tool

- Real-time data synchronization keeps financial reports current without manual intervention.

- AI-powered insights help identify trends and anomalies in financial data automatically.

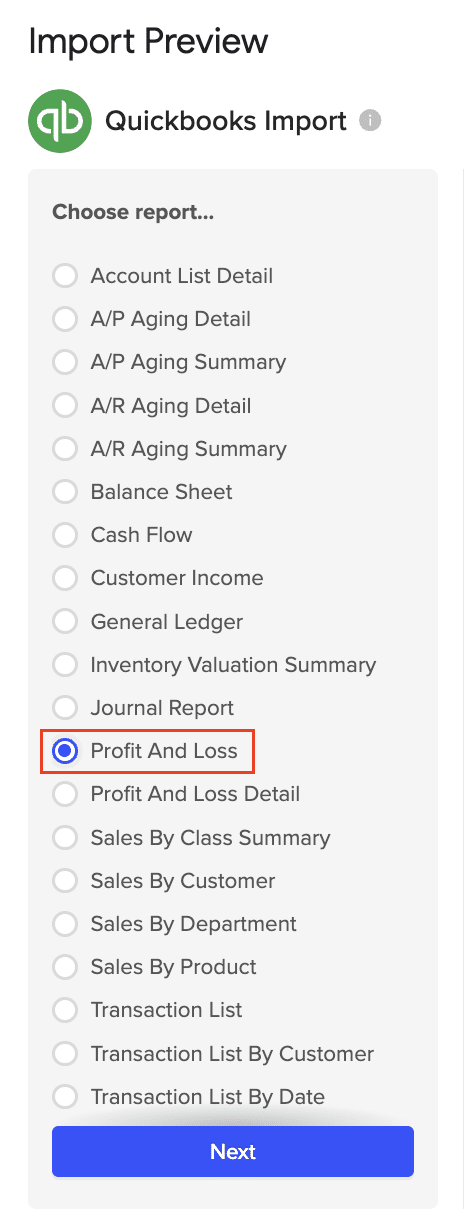

- Pre-built templates for P&L, balance sheet, and cash flow reports accelerate implementation.

- Multi-source data blending combines QuickBooks data with CRM, marketing, and operational systems for comprehensive business intelligence.

Pros

- Unlimited row imports on Pro plans eliminate data export restrictions that plague other connectors

- One-click setup requires no technical skills, making it accessible to finance teams without IT support

- Shared dashboards allow unlimited viewer access without additional licensing costs

Cons

- Spreadsheet dependency may not appeal to users seeking purpose-built BI tools

- Limited customization compared to enterprise-grade business intelligence platforms

- Google Sheets focus though Excel integration is available

Pricing

Starting at $59/month for unlimited data imports and multi-user support. Enterprise pricing available for larger organizations requiring advanced security and governance features (updated September 2025).

What do users say about Coefficient?

Positive: “Setting up QuickBooks workflows to your spreadsheet and automating data refreshes is incredibly easy and reliable.” – David Schneider, Neo Insurance Solutions

Critical: Some users report occasional sync delays during peak usage periods, though support response is generally quick to resolve issues.

Support

24/7 chat support, email assistance, and comprehensive documentation. Free onboarding sessions help teams implement their first automated reports within days.

#2 SyncQ

SyncQ specializes in advanced CRM-to-QuickBooks automation, enabling bidirectional data synchronization that keeps customer records, estimates, and invoices perfectly aligned between systems. The platform’s sophisticated mapping capabilities handle complex workflows that basic integrations cannot support.

Highlights of Tool

- Bi-directional sync ensures CRM and QuickBooks data remains consistent across platforms.

- Custom field mapping accommodates unique business requirements and data structures.

- Multi-line invoice generation from CRM deals streamlines the quote-to-cash process.

- Multiple QuickBooks company support serves businesses managing separate entities.

Pros

- Intuit-approved security meets industry standards for financial system integrations

- Advanced automation handles complex workflows like 2-way and 3-way matching

- Free setup assistance reduces implementation time and complexity

Cons

- CRM-focused scope limits usefulness for businesses needing broader data integration

- Per-user pricing becomes expensive for larger teams

- Learning curve for configuring advanced mapping and automation rules

Pricing

Professional plan starts at $49/month for 2 users, with effective pricing of $24.50 per user monthly. Business Max plan includes custom objects and advanced features (updated 2025).

What do users say about SyncQ?

Positive: “SyncQ automatically shows QuickBooks Estimates, Invoices and Payments details within HubSpot Companies/Contacts note sections.” – HubSpot Marketplace review

Critical: Setup complexity can be overwhelming for non-technical users, though support assistance is available.

Support

Phone support (8AM-6PM CT, Mon-Fri), email assistance, and virtual demos. Plus and Pro plans include priority phone support.

#3 Shopify Integration

Native Shopify-QuickBooks integration automates the transfer of e-commerce transaction data, eliminating manual entry of sales, fees, and tax information. This connector transforms complex multi-channel financial data into organized QuickBooks records that accountants can easily process.

Highlights of Tool

- Payout-based recording matches actual cash flow timing rather than individual transaction dates.

- Automatic fee categorization properly allocates Shopify processing fees, subscription costs, and adjustments.

- Multi-store support consolidates financial data from multiple Shopify locations.

- Tax compliance features ensure proper sales tax reporting across jurisdictions.

Pros

- Free core functionality makes it accessible for small e-commerce businesses

- Native integration provides reliable data transfer without third-party dependencies

- Simplified workflow reduces accounting complexity for multi-channel sellers

Cons

- Shopify Payments only excludes transactions from other payment processors

- Summary-level data lacks individual transaction detail for forensic accounting

- Limited customization offers fewer mapping options than dedicated integration tools

Pricing

Free for basic integration. Shopify subscription fees range from $29-$299/month depending on plan level (updated 2025).

What do users say about Shopify Integration?

Positive: “The integration works great for basic e-commerce accounting needs and eliminates hours of manual data entry.” – Shopify merchant review

Critical: “Limited to Shopify Payments makes it useless for businesses using multiple payment processors.” – E-commerce business owner

Support

Email support, help documentation, and community forums. Higher-tier Shopify plans include priority support channels.

#4 SOS Inventory

SOS Inventory extends QuickBooks with comprehensive inventory management, order fulfillment, and manufacturing capabilities designed specifically for product-based businesses. The seamless integration maintains accurate cost of goods sold calculations while providing advanced inventory tracking features that QuickBooks alone cannot deliver.

Highlights of Tool

- Lot and serial number tracking ensures compliance with FDA, USDA, and ISO standards for regulated industries.

- Multi-location inventory provides real-time visibility across warehouses and retail locations.

- Advanced item management includes barcode scanning, automated reordering, and custom fields.

- Manufacturing features support bill of materials, work orders, and production tracking.

Pros

- Native QuickBooks integration maintains seamless data synchronization without double entry

- Industry-specific features serve manufacturing, food processing, and distribution businesses

- Mobile accessibility enables warehouse staff to manage inventory from smartphones and tablets

Cons

- Setup complexity requires significant configuration time without professional assistance

- Higher cost compared to basic inventory tracking solutions

- Learning curve for teams transitioning from simple inventory methods

Pricing

Companion plan starts at $65/month for 2 users. Plus and Pro plans include additional features and user capacity (updated 2025).

What do users say about SOS Inventory?

Positive: “SOS Inventory has been a real time saver and has allowed us to implement a robust process for inventory close each month, as well as timely information for our management.” – Mitchell Nishi

Critical: “Setup can be time-consuming and a bit confusing without support” – Software Connect review

Support

Phone and email support during business hours (9 AM – 6 PM CT). Free setup assistance and virtual demos available for new customers.

#5 QuickBooks Time

QuickBooks Time delivers comprehensive workforce management by connecting employee time tracking, scheduling, and payroll data directly with QuickBooks accounting records. This integration ensures labor costs are accurately captured and properly allocated across projects, jobs, and departments.

Highlights of Tool

- GPS tracking and geofencing provide location verification for mobile and field employees.

- Mobile time clock enables employees to clock in/out from smartphones with push notifications.

- Project time allocation tracks labor costs against specific jobs or clients.

- Compliance tools help maintain FLSA and DCAA requirements through automated audit trails.

Pros

- Free tier available for single-user unlimited project tracking

- Comprehensive mobile apps work offline and sync when connectivity returns

- Payroll integration streamlines the time-to-pay process for accurate labor costing

Cons

- Cannot track multiple jobs simultaneously limits usefulness for multi-project workers

- No expense or mileage tracking requires additional tools for complete workforce management

- Complex permission structure can be overwhelming during initial setup

Pricing

Free plan for 1 user with unlimited projects. Premium plans start at $20/month base fee plus $8 per user monthly (updated 2025).

What do users say about QuickBooks Time?

Positive: “Feature-rich and integrates well with QuickBooks for seamless payroll processing.” – TrustRadius review

Critical: “Pricey with unreliable overtime tracking that requires manual adjustment.” – Software review site

Support

Email support, help documentation, and phone support for Premium and Elite plans. Mobile app includes in-app support features.

#6 Bill.com

Bill.com revolutionizes accounts payable and receivable processes by automating invoice processing, payment approvals, and cash flow management while maintaining perfect synchronization with QuickBooks financial records. This platform eliminates paper-based workflows and reduces processing time from days to minutes.

Highlights of Tool

- Automated invoice capture extracts data from emailed invoices and converts them into QuickBooks bills.

- Approval workflows route payments through customizable approval chains based on amount thresholds and department rules.

- Multiple payment methods include ACH, check printing, wire transfers, and international payments.

- Cash flow forecasting provides visibility into upcoming payables and receivables.

Pros

- Bank-level security protects sensitive financial data with enterprise-grade encryption

- Audit trail maintenance provides complete payment history for compliance and reporting

- Vendor portal access allows suppliers to submit invoices and track payment status electronically

Cons

- Per-transaction fees can become expensive for high-volume businesses

- Learning curve for teams transitioning from manual payment processes

- Limited customization of approval workflows compared to enterprise solutions

Pricing

Essentials plan starts at $45/month per user. Team ($55/month) and Corporate ($79/month) plans include additional features and user capacity (updated 2025).

What do users say about Bill.com?

Positive: “Cost-effective so it saves us money over time. The integration with QuickBooks is seamless.” – Verified User, TrustRadius

Critical: “Extra charge for ACH payments and sometimes we do not receive all email alerts.” – Tim Edwards, General Office Accounting Administrator

Support

Email support, phone assistance for paid plans, and comprehensive online help center. Implementation support available for Enterprise customers.

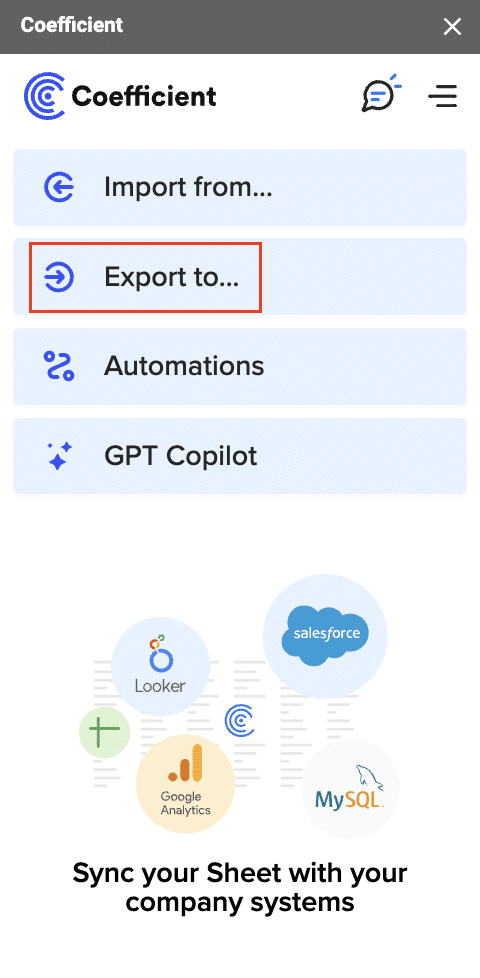

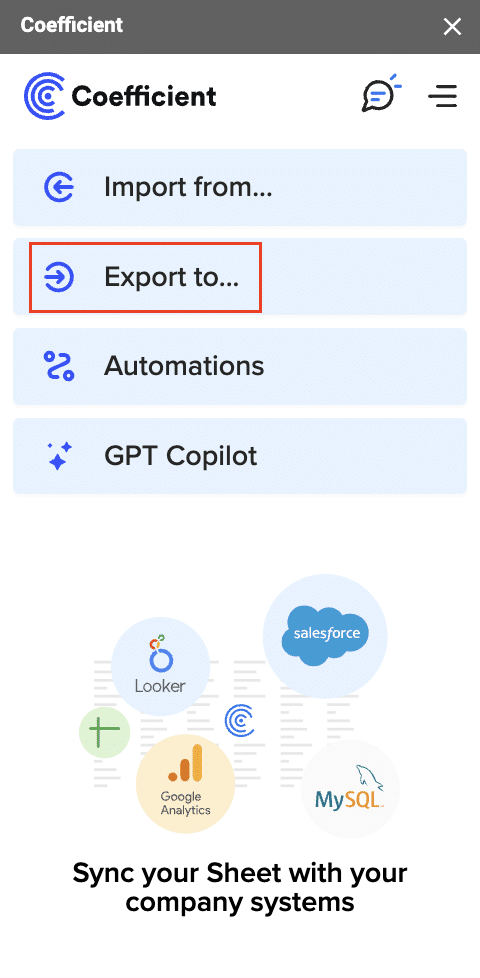

Make Better QuickBooks Reports Today

QuickBooks connectors transform financial data management from a manual chore into an automated advantage. Whether you need real-time spreadsheet reporting, advanced inventory tracking, or streamlined payment processing, the right connector eliminates bottlenecks that slow down business decisions.

Coefficient leads the pack for businesses prioritizing spreadsheet-based reporting and multi-source data integration. Its unlimited data imports, AI-powered insights, and seamless QuickBooks synchronization deliver immediate value for finance teams seeking operational efficiency.

Ready to automate your QuickBooks workflows? Get started with Coefficient today and experience the difference that real-time data connectivity makes for your business intelligence and financial reporting processes.

Start your free trial and transform your QuickBooks data into actionable insights within minutes, not hours.