Managing financial adjustments and allocations across multiple entities can be complex and time-consuming. Coefficient’s free QuickBooks template for Entities Adjustment and Allocations With Dashboard simplifies this process, providing a clear overview of your financial data in one place.

What is an Entities Adjustment and Allocations Report?

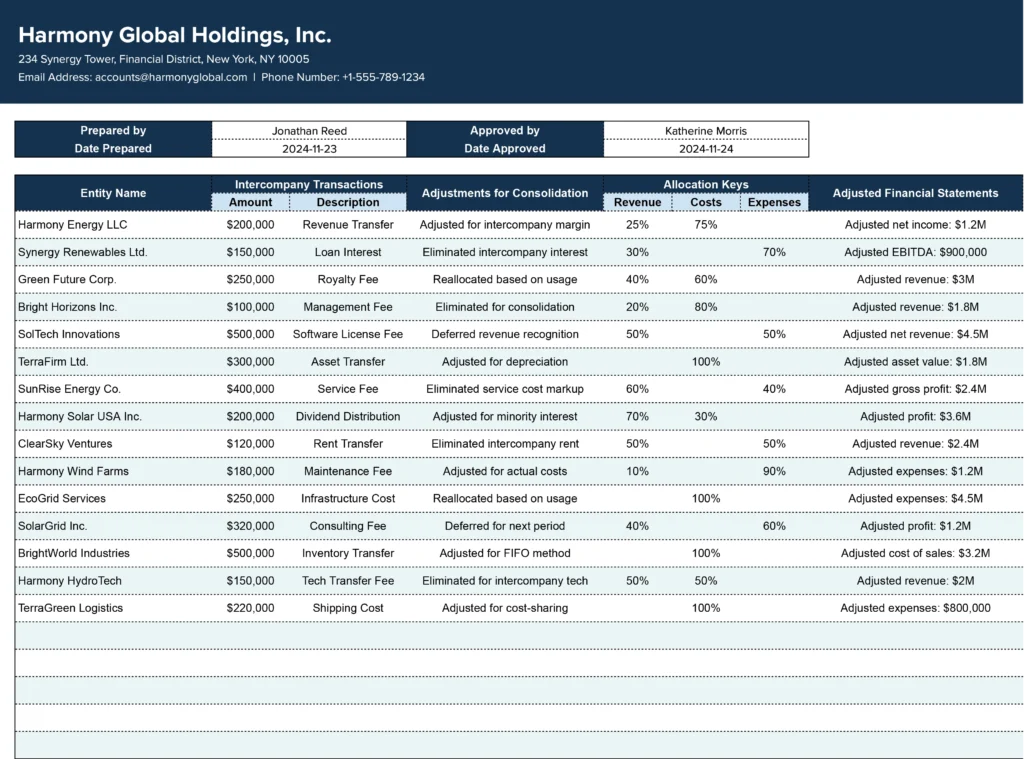

An Entities Adjustment and Allocations report is a financial tool that helps businesses manage and visualize adjustments and allocations across multiple entities or subsidiaries. This report typically includes:

- Intercompany transactions

- Consolidation adjustments

- Allocation of shared costs or revenues

- Adjusted financial statements for each entity

- Consolidated financial metrics

The report allows finance teams to ensure accurate financial reporting, comply with accounting standards, and gain a comprehensive view of the organization’s financial health across all entities.

Who is the Entities Adjustment and Allocations template built for?

This template is designed for:

- Financial managers and controllers in multi-entity organizations

- Accounting professionals handling consolidated financial statements

- Business owners overseeing multiple subsidiaries or divisions

- CFOs and finance teams responsible for group-level financial reporting

What is the primary use case for the Entities Adjustment and Allocations template?

The primary use case for this template is to:

- Consolidate financial data from multiple entities

- Apply necessary adjustments for accurate reporting

- Allocate shared costs or revenues across entities

- Generate adjusted financial statements for each entity

- Provide a dashboard view of key financial metrics across the organization

Benefits of using the QuickBooks Entities Adjustment and Allocations Template

- Simplified Consolidation: Easily combine financial data from multiple QuickBooks accounts into a single, comprehensive view.

- Customizable Allocations: Flexibly allocate costs and revenues based on your specific business rules and drivers.

- Visual Dashboard: Quickly grasp key financial metrics and trends across all entities with intuitive charts and graphs.

- Time-Saving: Reduce manual data entry and calculation errors with pre-built formulas and structures.

- Consistency: Ensure uniform reporting and allocation methods across all entities in your organization.

Metrics Tracked in the Report

- Entity Name

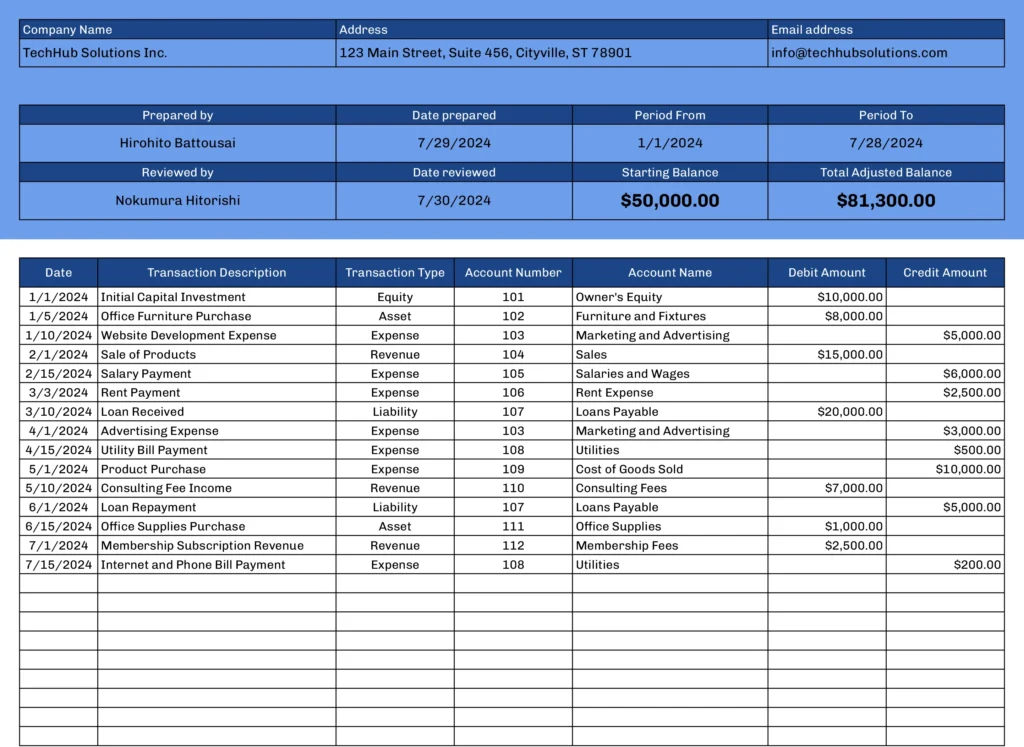

- Intercompany Transactions

- Adjustments for Consolidation

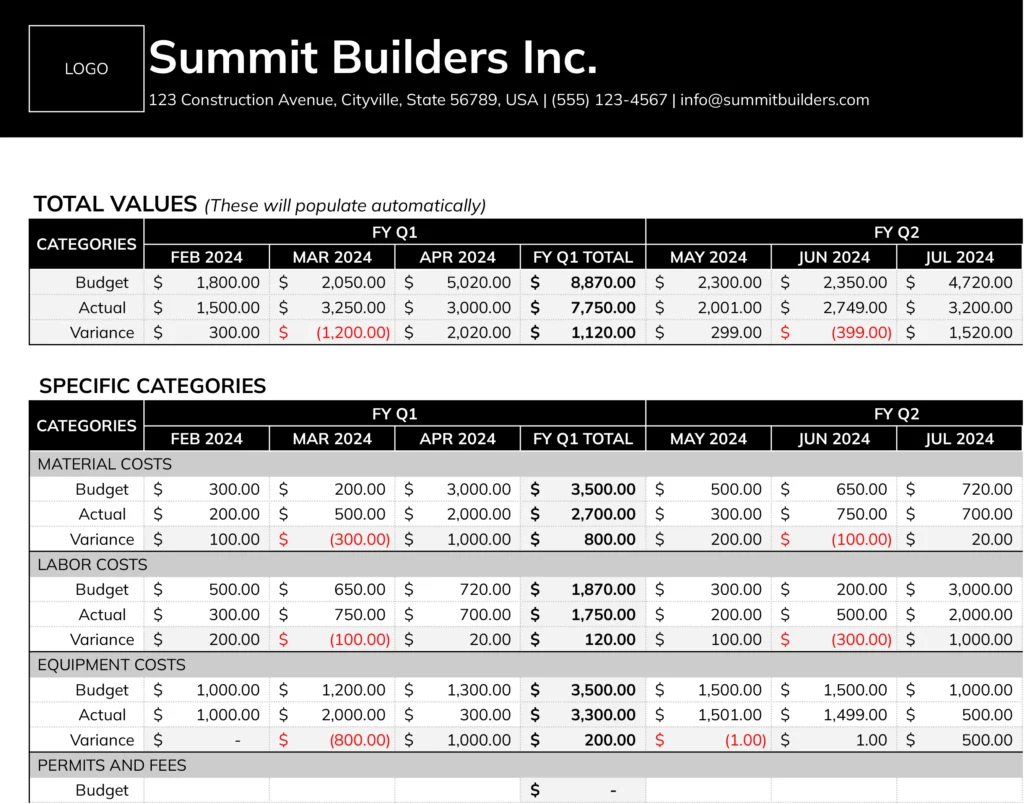

- Allocation Keys (Revenue, Expense Drivers)

- Adjusted Financial Statements per Entity

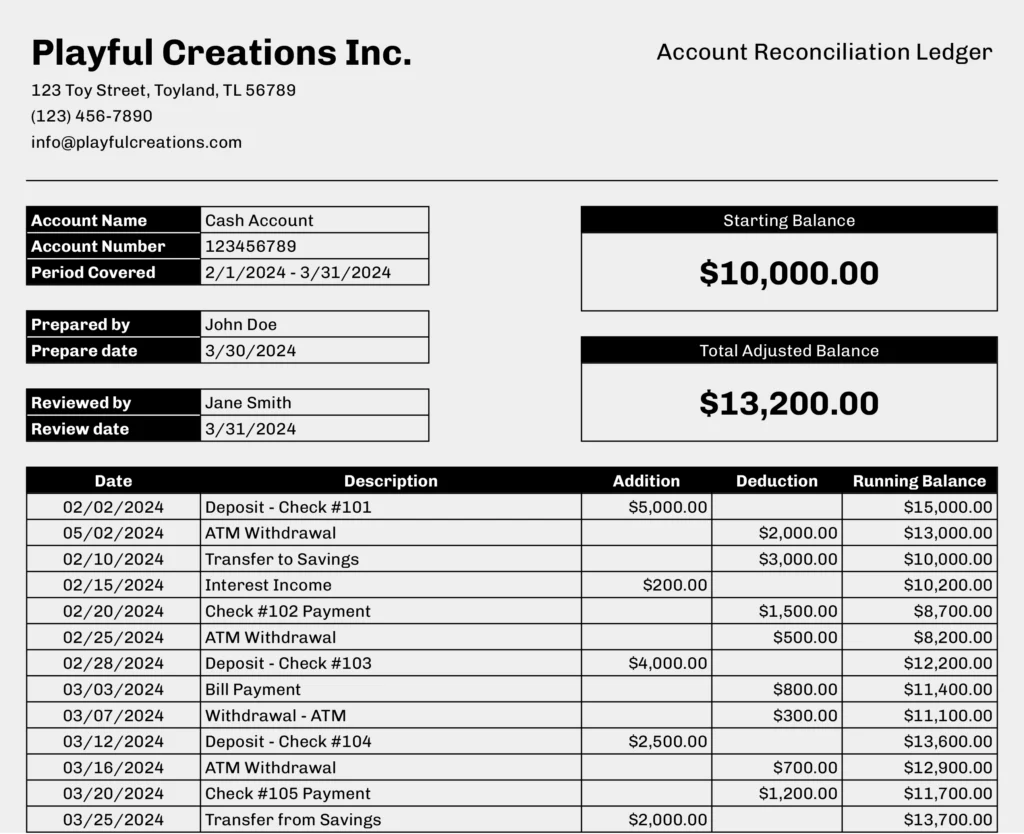

- Consolidated Financial Metrics

- Ownership Percentages

- Equity Adjustments

- Dashboard Visuals (Graphs/Charts)

- Variance Analysis

- Compliance and Regulatory Adjustments

More Metrics to track and analyze on Google Sheets

With Coefficient’s QuickBooks integration, you can expand your financial analysis by pulling additional metrics such as:

- Profit & Loss by Class

- Expenses by Vendor

- Profit & Loss by Month & Class

- Consolidated P&L

- Profit & Loss – MoM Growth

- Accounts Payable Dashboard

- Accounts Receivable Dashboard

You can also:

- Connect to multiple companies

- Choose from various report types

- Maintain cell references during data refreshes

- Drill down into specific data points

- Automatically consolidate multiple reports

- Sort data by Department or Location

Frequently Asked Questions

How do I set up allocation rules for multi-entity accounting?

To set up allocation rules:

- Define your allocation bases (e.g., revenue, headcount, square footage)

- Determine which costs or revenues need to be allocated

- Create allocation formulas in the template

- Apply these formulas consistently across all relevant entities

- Review and adjust allocations periodically to ensure accuracy

What are some best practices for entity adjustments in consolidated financial statements?

Some best practices include:

- Consistently apply accounting policies across all entities

- Eliminate intercompany transactions and balances

- Adjust for differences in reporting periods if necessary

- Consider minority interests in partially-owned subsidiaries

- Document all adjustments clearly for audit purposes

- Regularly review and update adjustment procedures

How can I improve visibility into entity-level financial performance?

To improve visibility:

- Use standardized reporting templates across all entities

- Implement a centralized data collection and consolidation process

- Create dashboards that highlight key performance indicators for each entity

- Set up regular financial review meetings with entity managers

- Use variance analysis to identify and investigate significant deviations from expectations