In the world of finance, whether for a small business, a startup, or personal funds, management, efficiency, and accuracy are key.

This brings us to an invaluable tool: the Annual Budget Comparison Ledger Template. But what exactly is this template, and how can it revolutionize your financial management? Let’s dive in and explore.

What is an Annual Budget Comparison Ledger Template?

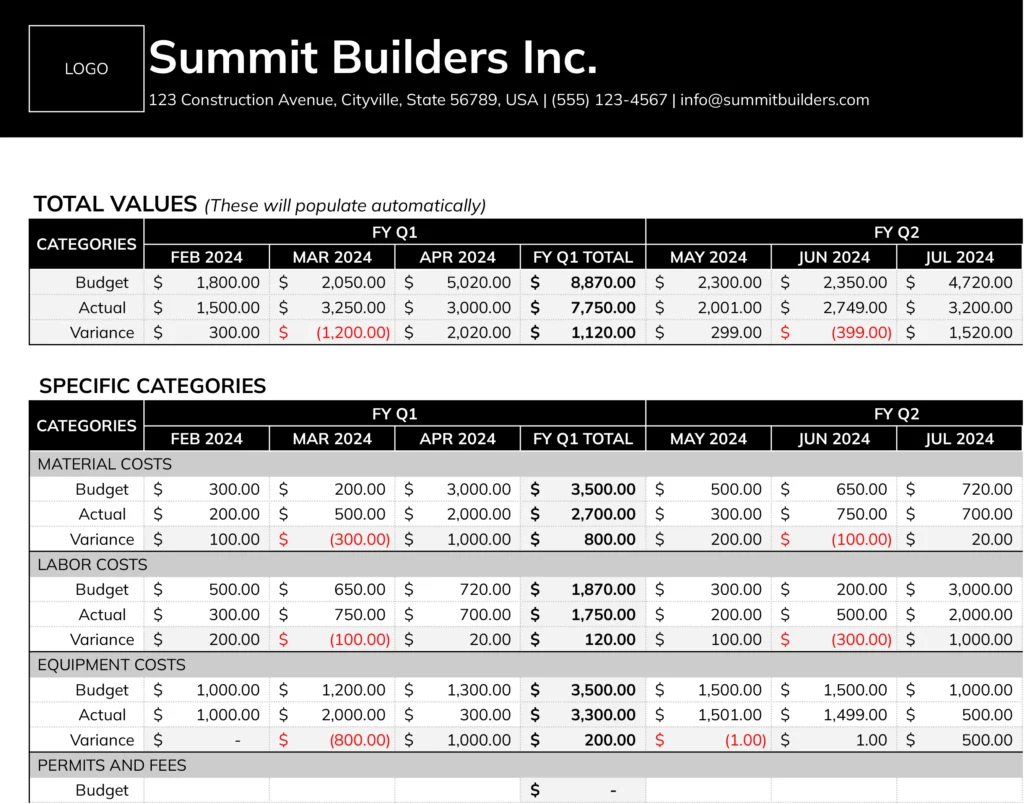

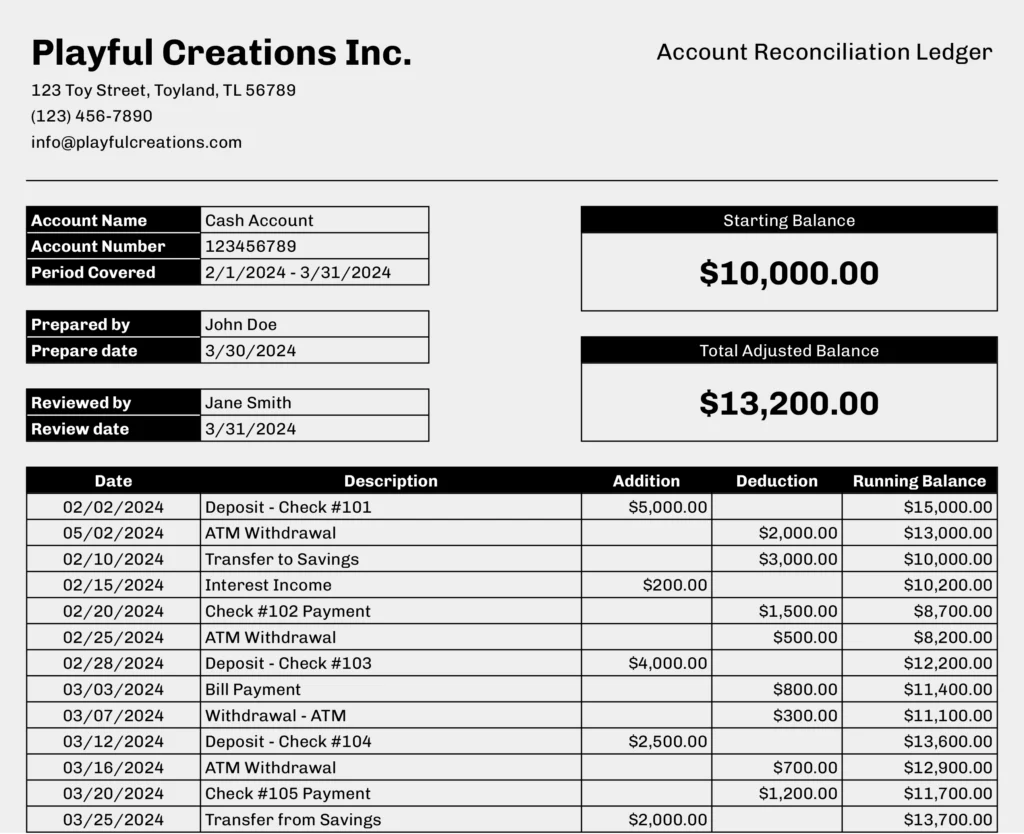

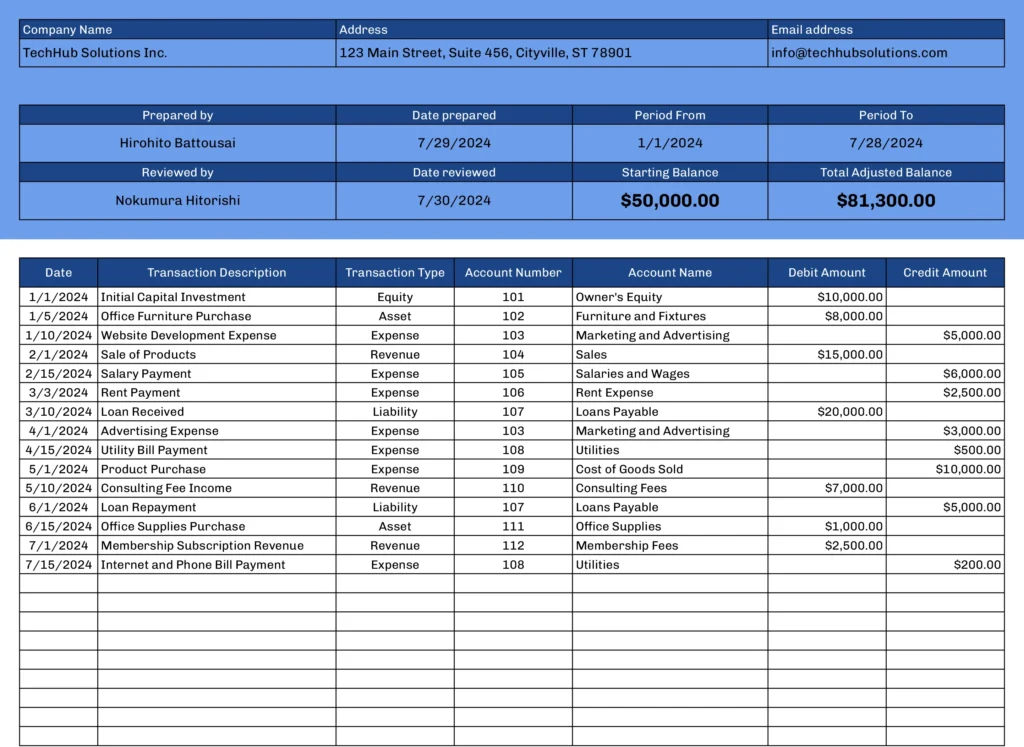

An Annual Budget Comparison Ledger Template is a systematic approach to tracking and analyzing financial data, emphasizing the comparison between actual and budgeted figures.

How Do I Create a Budget Tracking Spreadsheet

The process involves categorizing expenses and income, setting budget limits, and regularly updating the ledger. This template simplifies these steps, enabling you to maintain a clear and concise financial overview.

Budget Tracking with a Ledger Template

Creating a budget tracking spreadsheet is crucial for financial health. This template guides you through setting up a tracking system, making it easy to compare your actual spending against your planned budget, thus keeping your finances in check.

Application in Various Business Contexts

This versatile template transcends basic financial management, offering a range of applications tailored to different business needs.

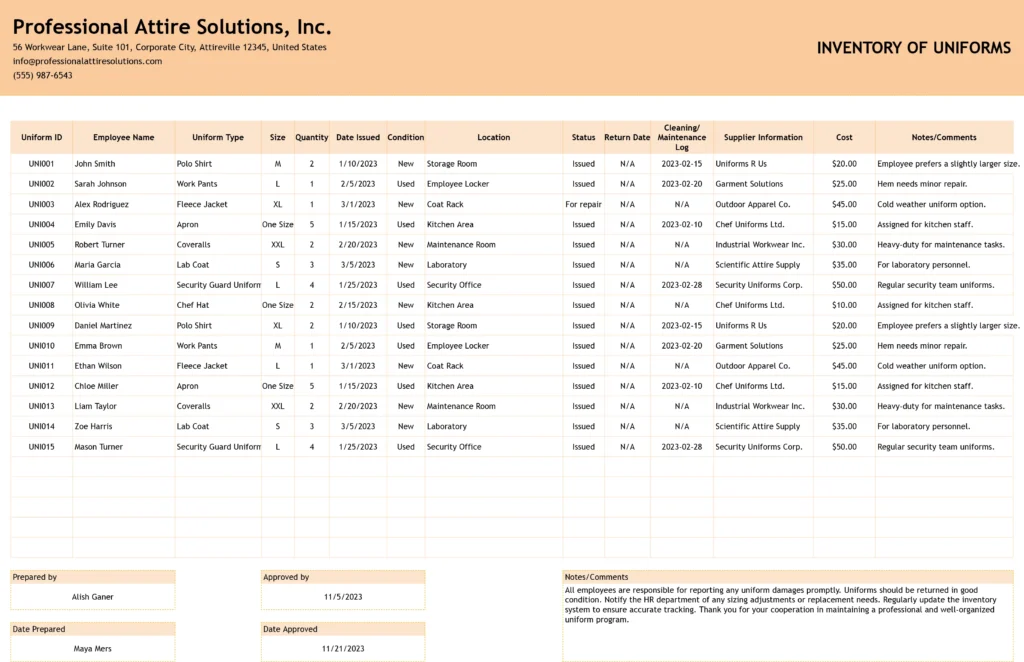

For small businesses, it can be a game-changer, simplifying complex bookkeeping tasks and providing clear insights into cash flow and expenses.

Startups can leverage it for budget forecasting and tracking, essential for maintaining lean operations and attracting potential investors. Even for personal finance management, this tool is invaluable, helping individuals maintain a detailed ledger, similar to a “Simple General Ledger Template,” but with added functionalities for comparing budgeted and actual expenditures.

These features make it a comprehensive solution for varied financial management scenarios, from tracking daily business transactions to planning personal budgets.

Benefits and Limitations

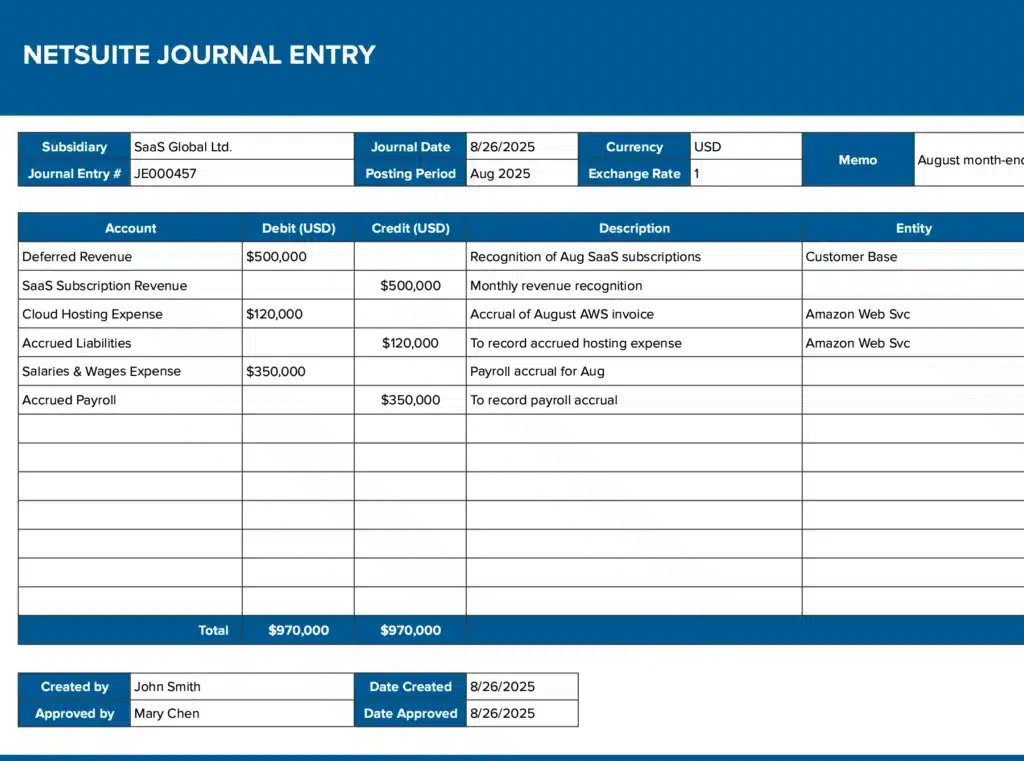

This template offers significant advantages in financial tracking, enhancing the accuracy and reliability of financial data. It aids in the meticulous organization of financial records, making it easier to spot trends, identify potential cost savings, and make informed financial decisions.

For businesses, this could mean better budget allocation and improved financial health. However, the effectiveness of this tool hinges on consistent user engagement. Regular updates are crucial to ensure the data reflects current financial status accurately. Users also need a foundational understanding of financial principles to effectively interpret and utilize the data.

Without this knowledge, there’s a risk of misinterpreting financial information, which could lead to poor decision-making.

Thus, while the template automates and simplifies many financial tasks, the user’s role in maintaining and understanding the data remains paramount.

Conclusion

Ready to take control of your financial tracking? Download our Annual Budget Comparison Ledger Template today and experience the ease and clarity it brings to your financial management!