Download template now

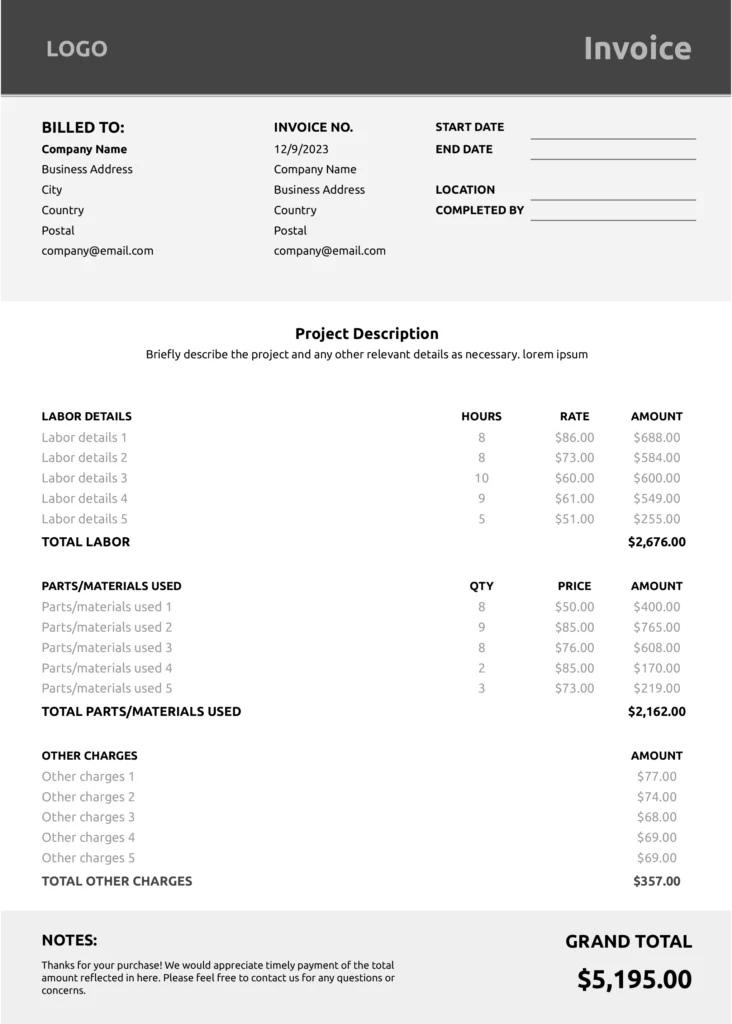

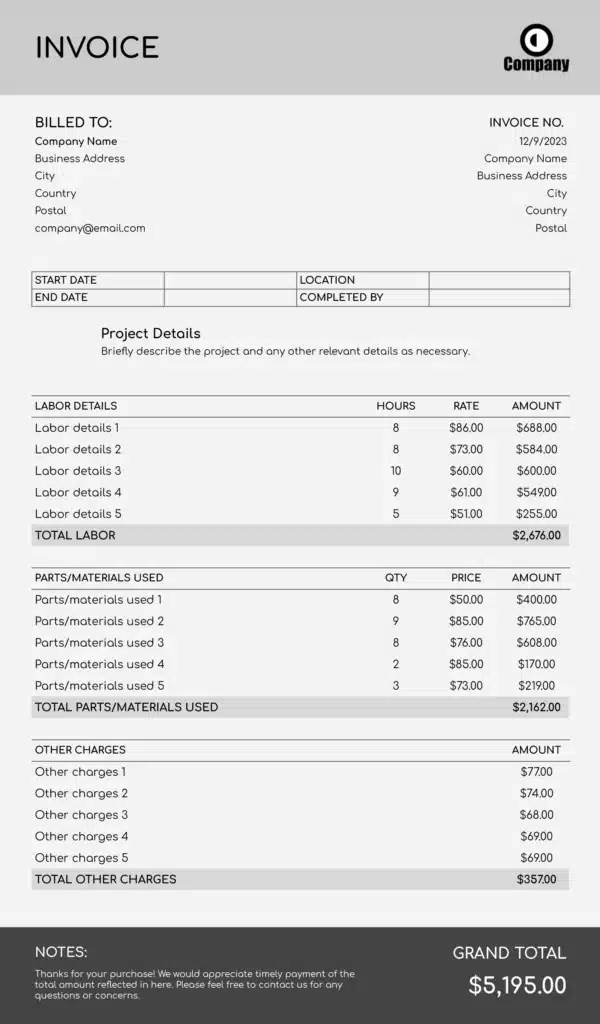

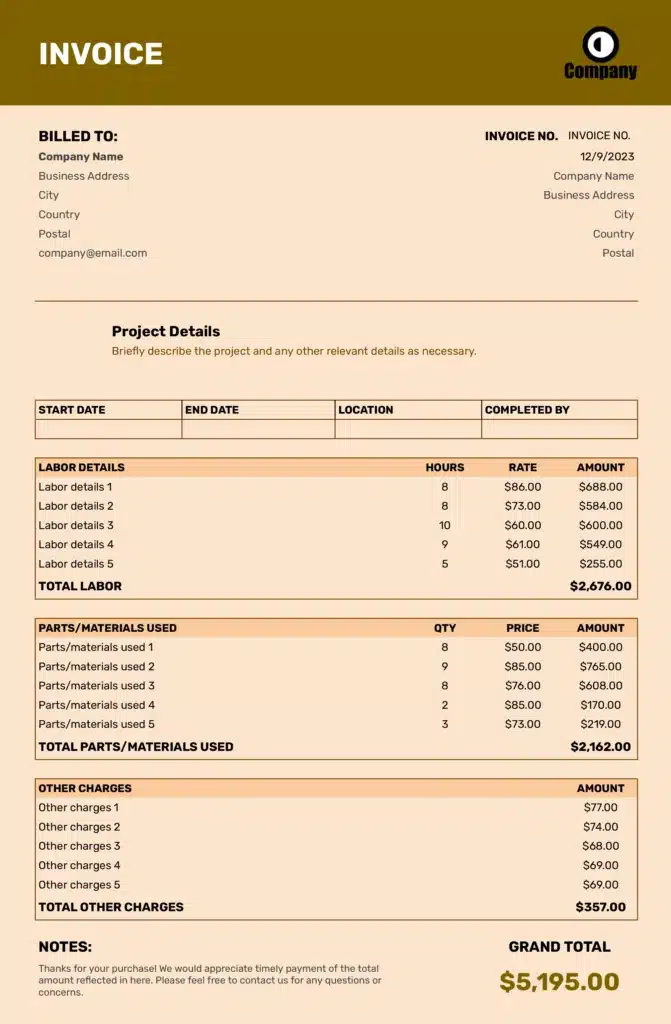

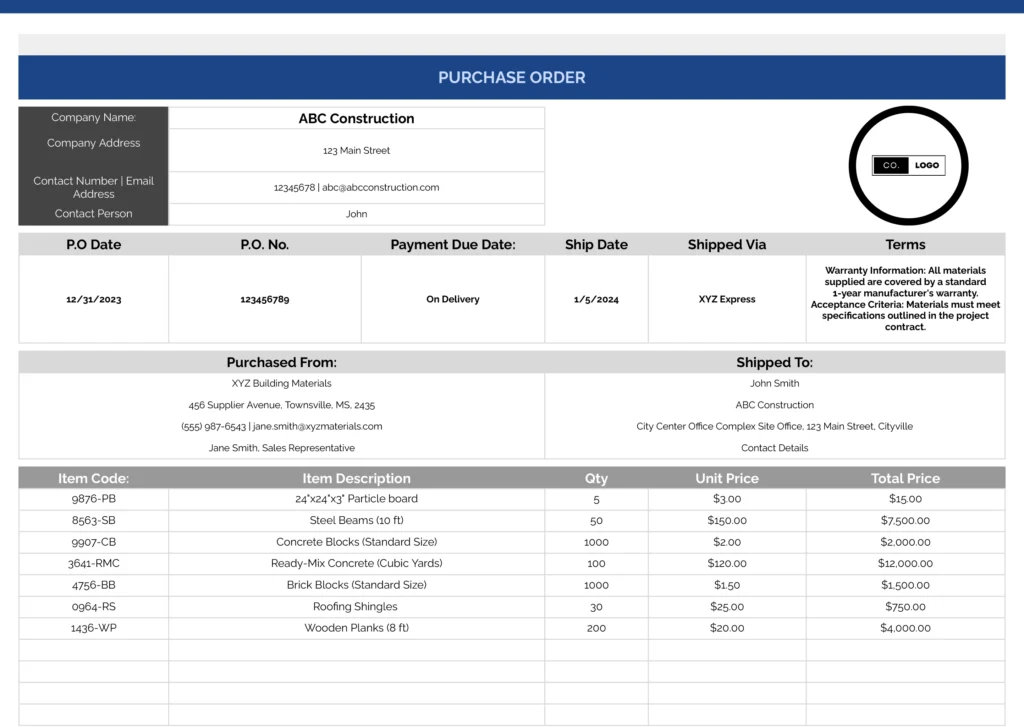

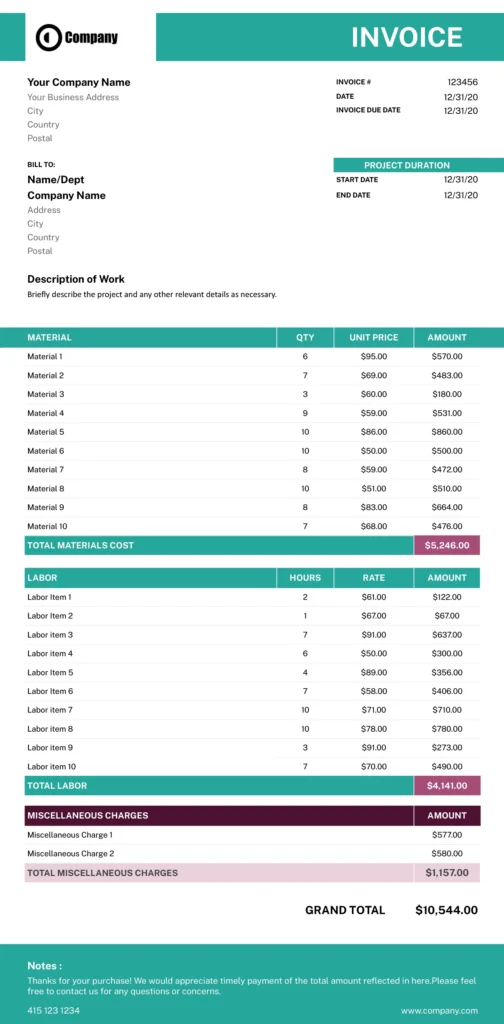

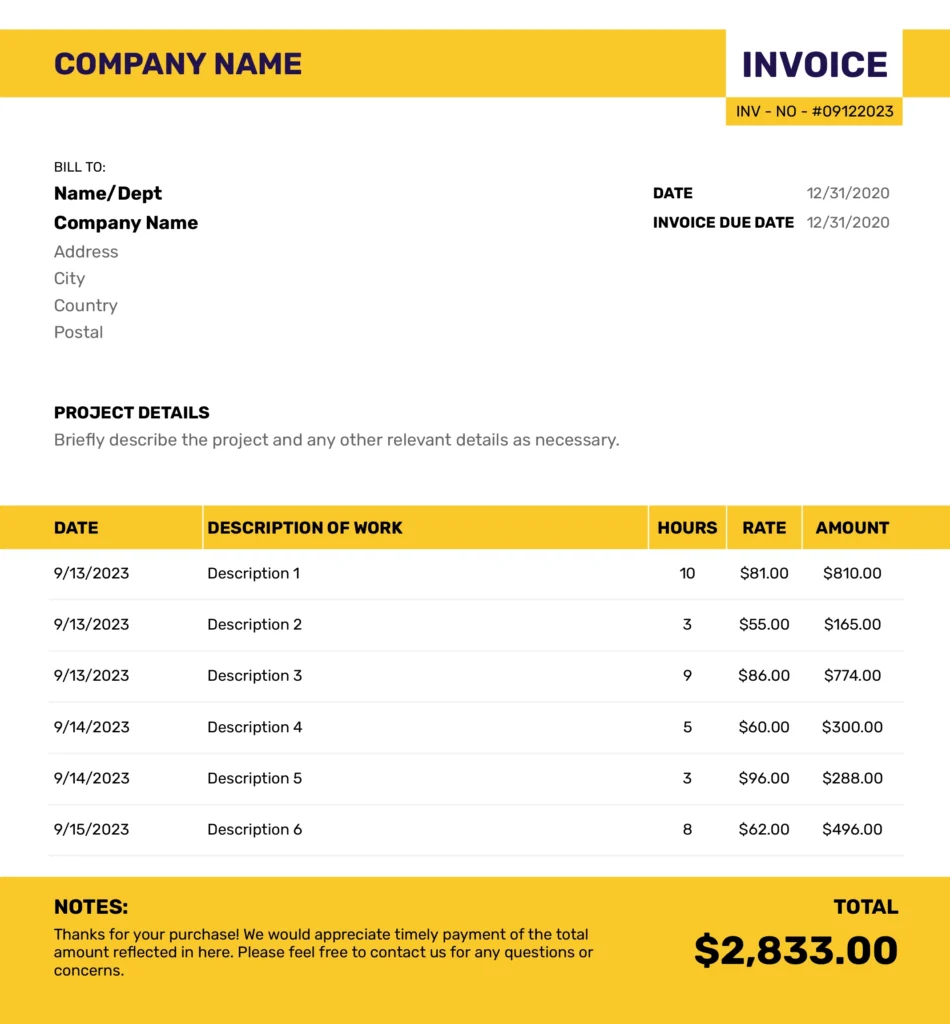

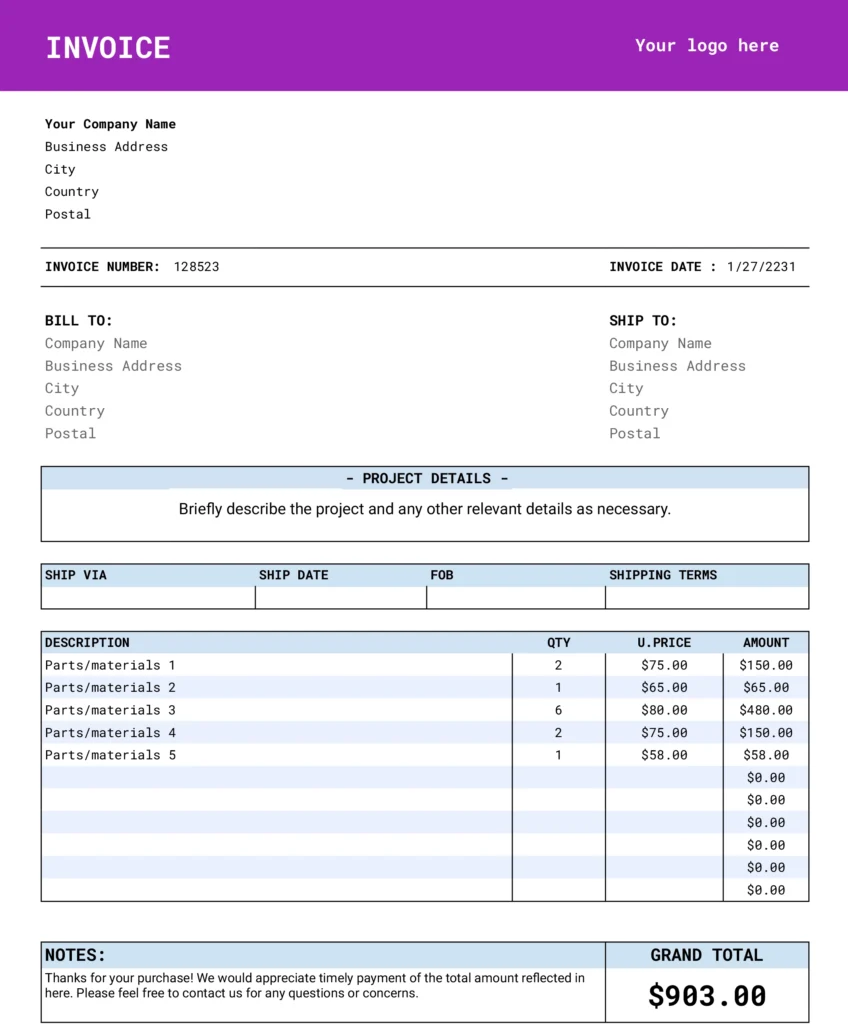

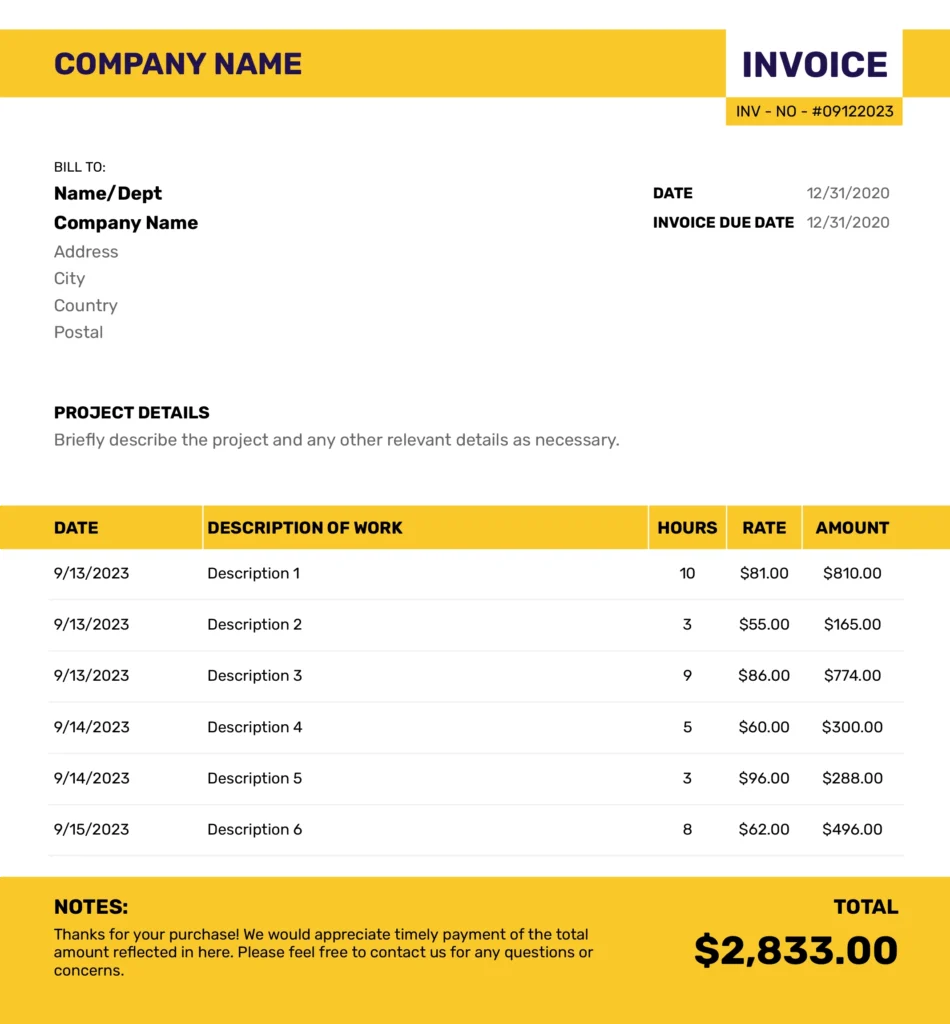

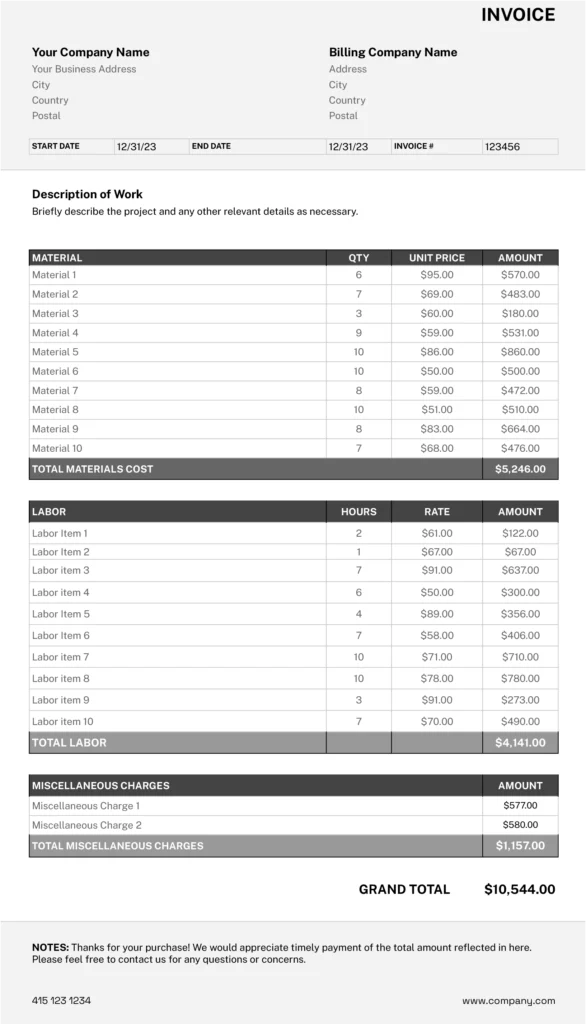

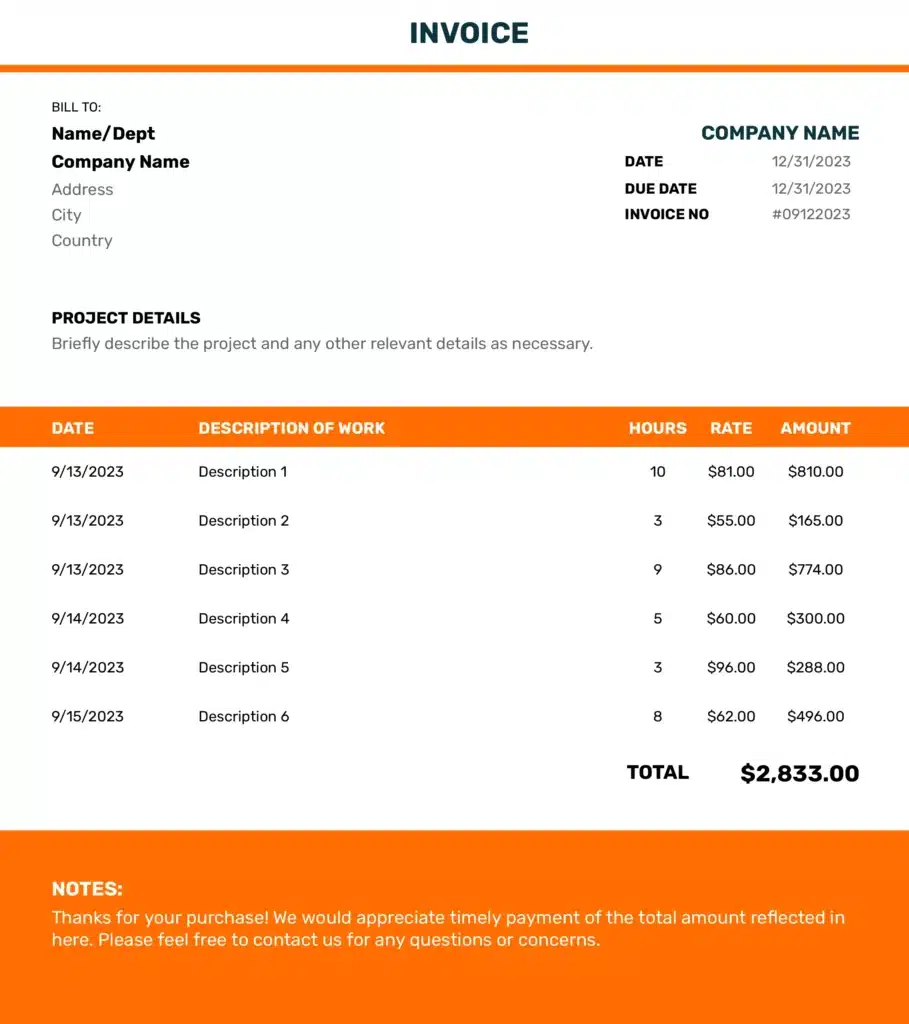

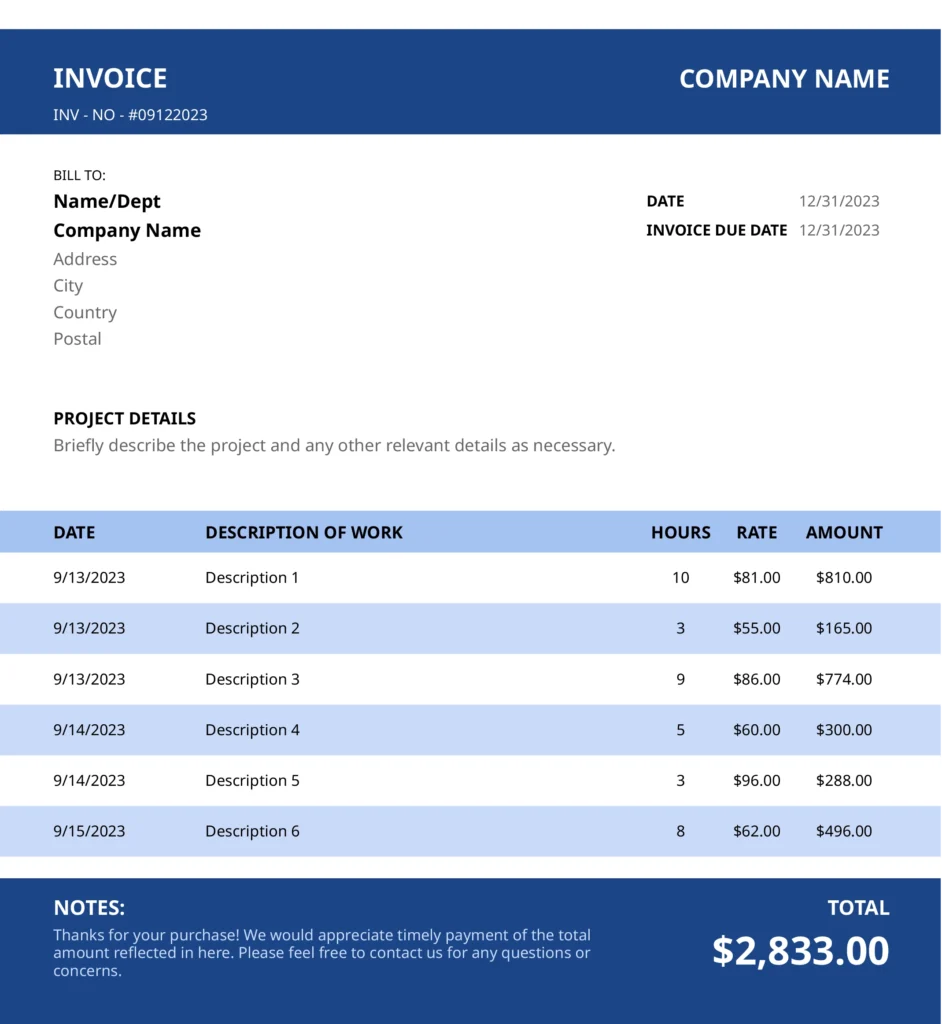

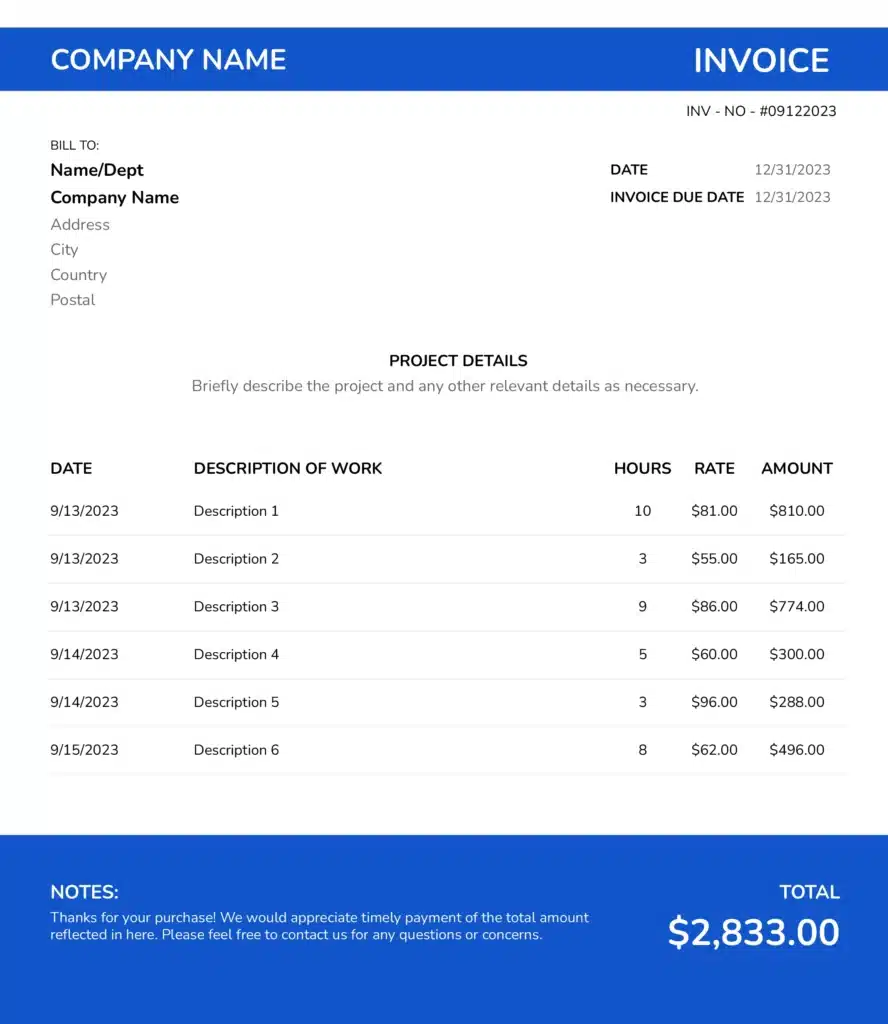

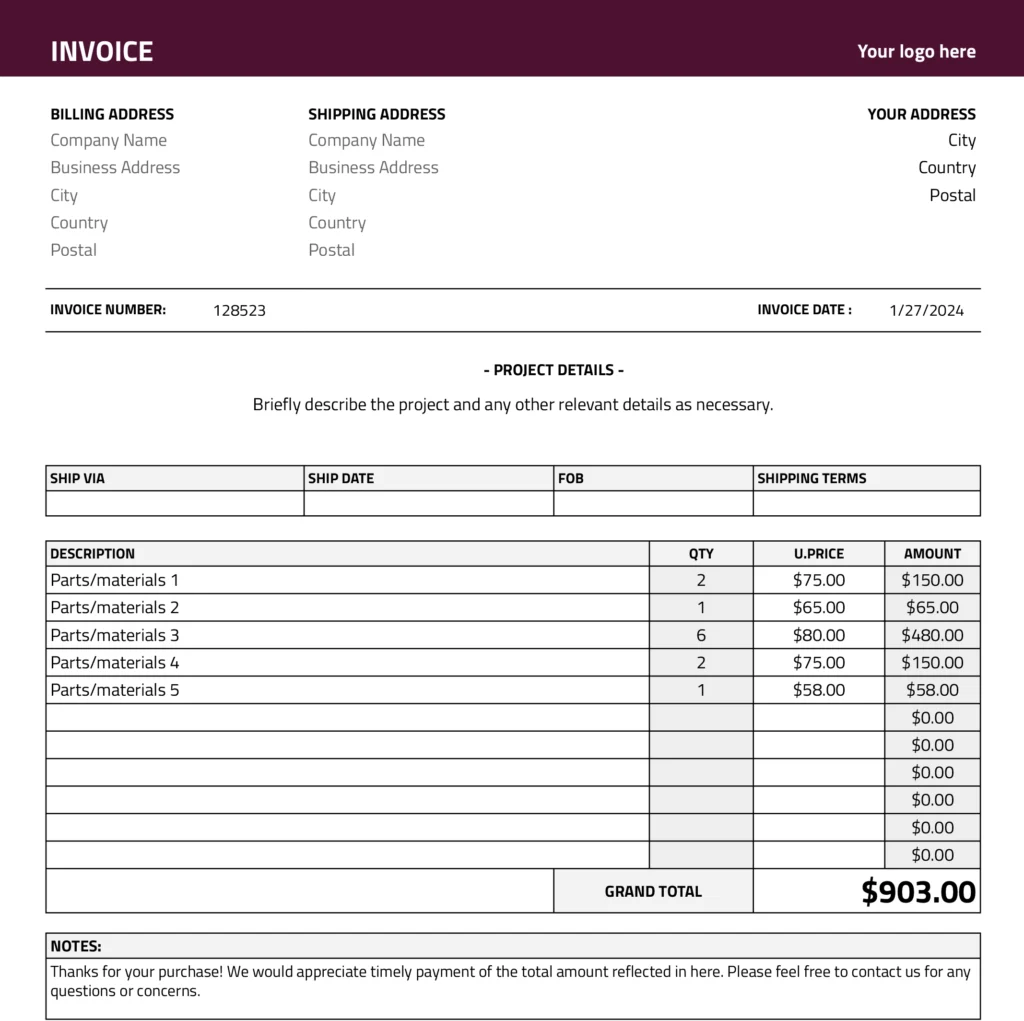

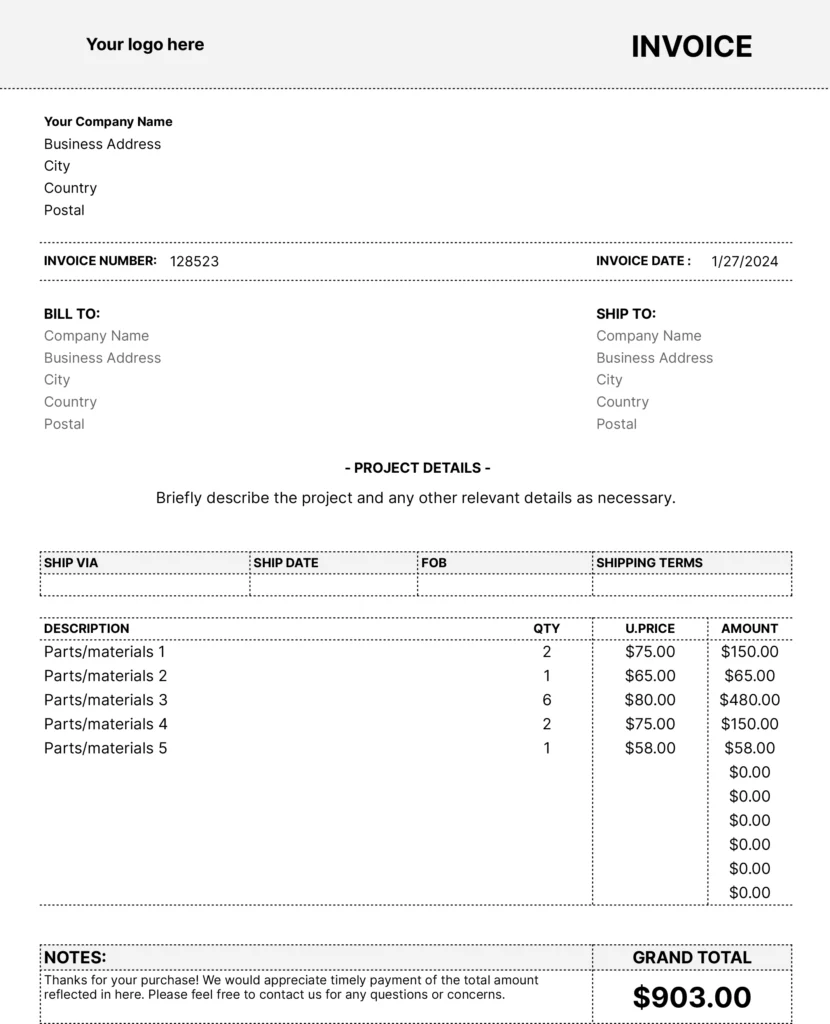

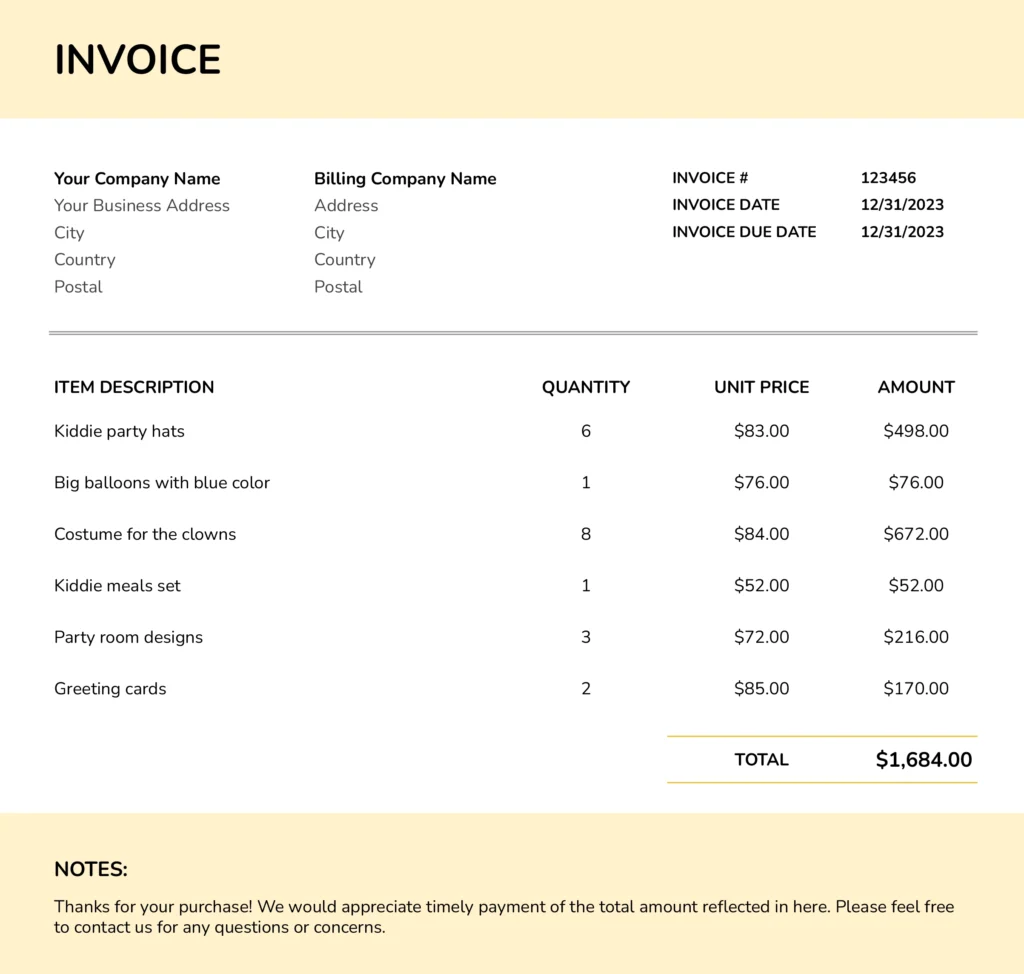

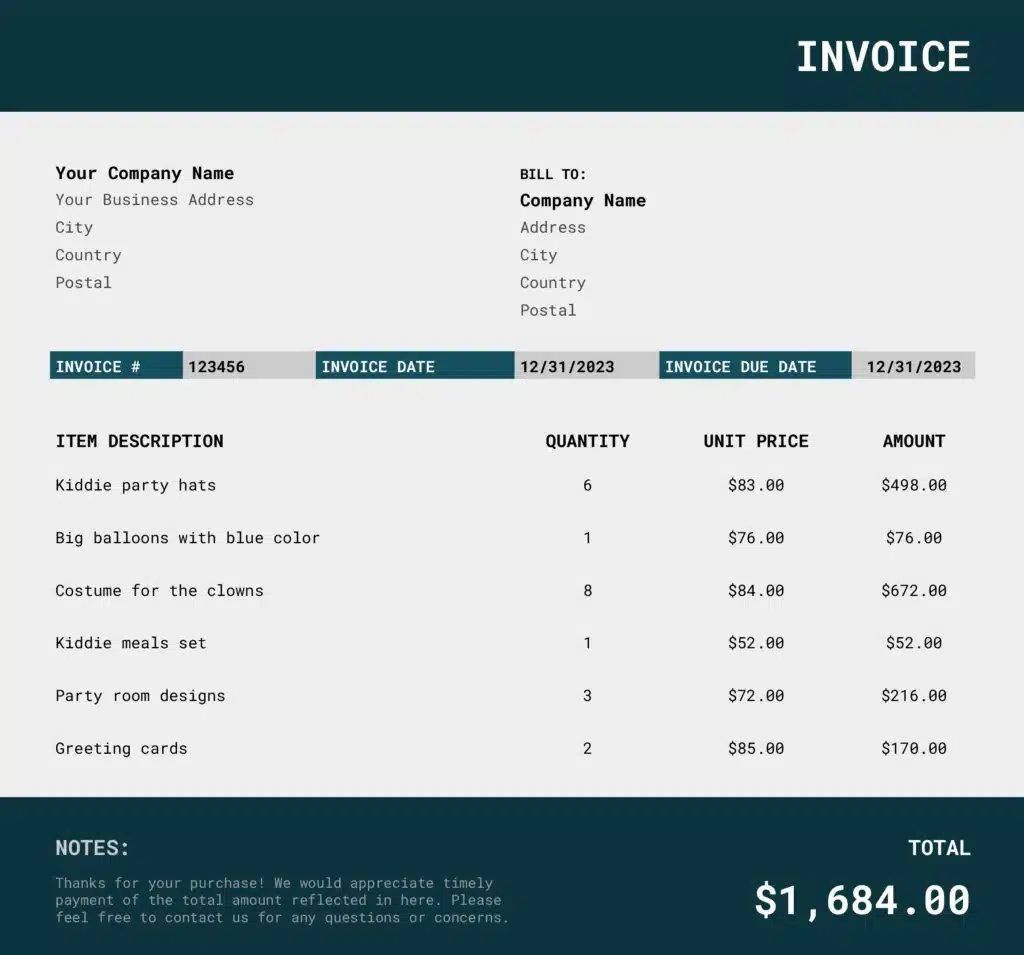

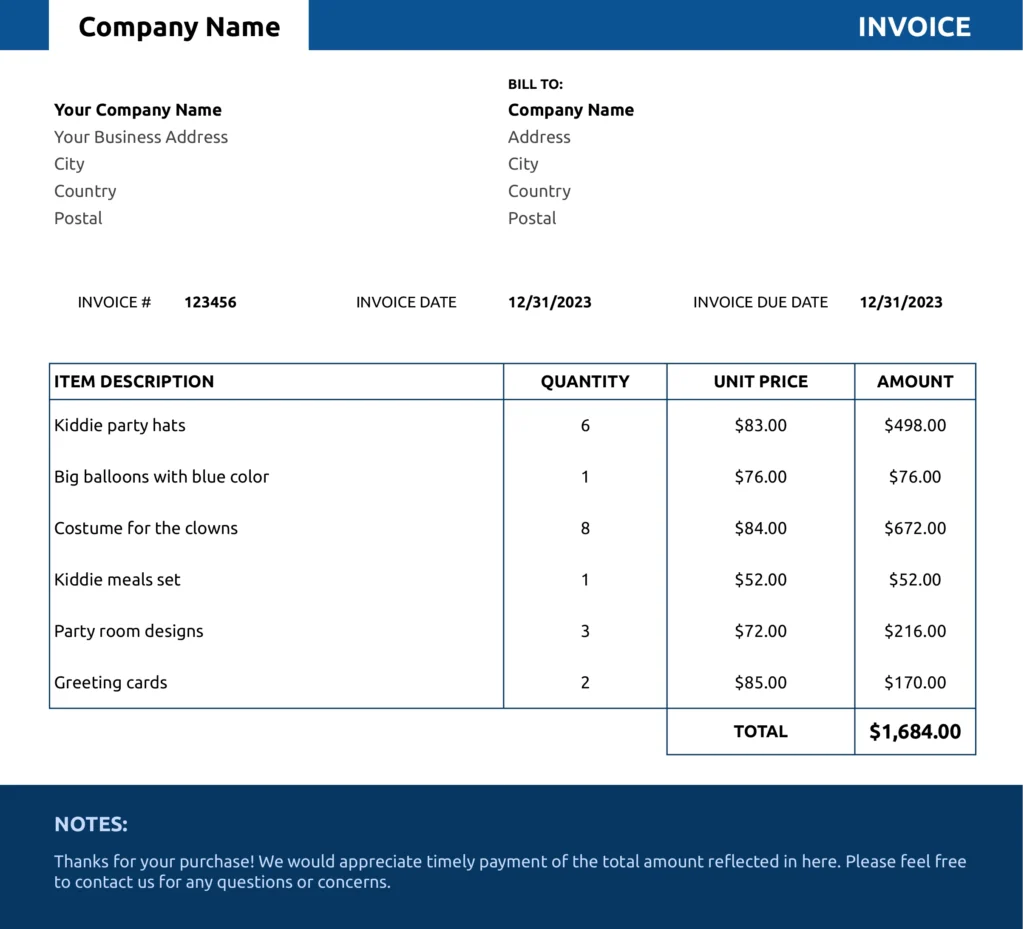

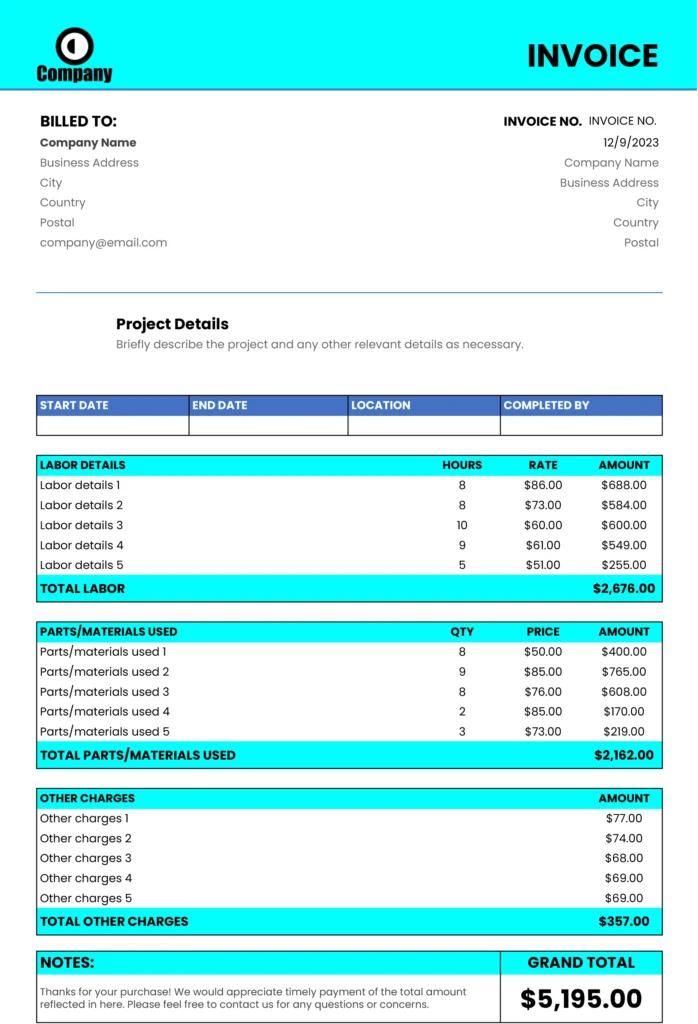

Contractor Invoice Template

Manage your finances efficiently. Download our contractor invoice template and streamline your billing process to meet the specific needs of your contractors.

More Invoices Templates

Advanced Excel & Sheets Templates with Live Business Data

Free QuickBooks

Cashflow Template

Cashflow Template

Tracks sources of cash inflows and outflows and categorize them into operating,…

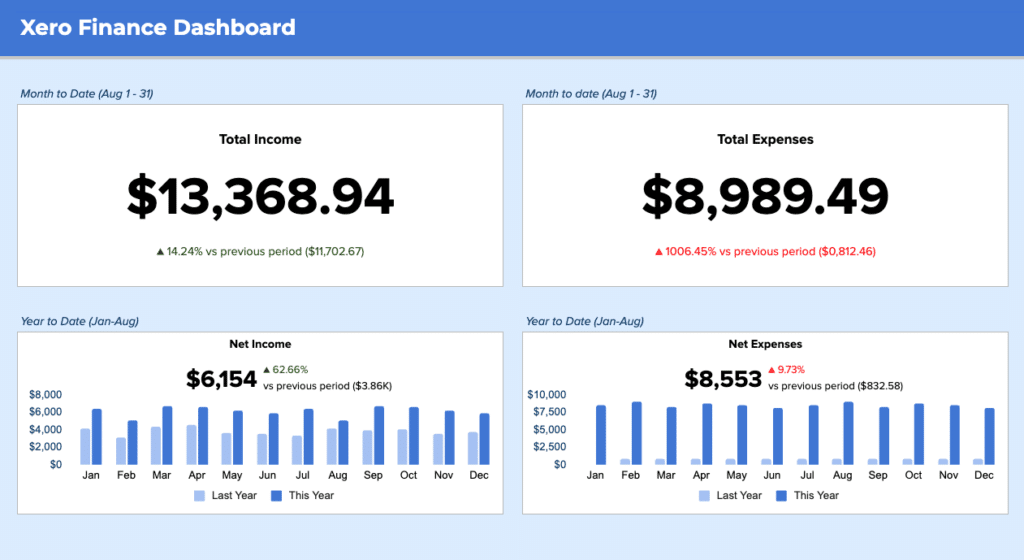

Free Xero Finance

Dashboard

Dashboard

Boost your financial insights with our free Xero finance dashboard template. Track…

Free NetSuite Financial

Forecasting Template

Forecasting Template

Get real-time insights and accurate projections to drive business growth.

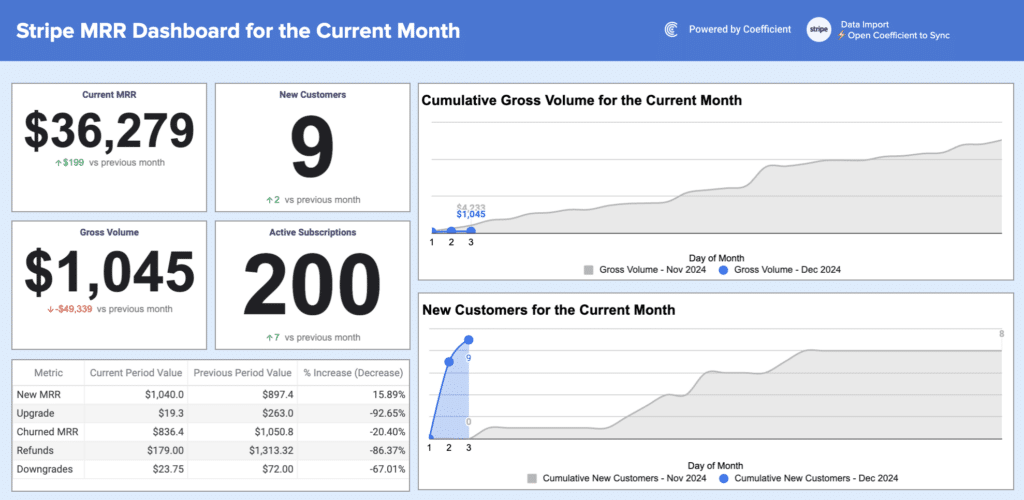

Stripe MRR

Dashboard

Dashboard

Track key metrics, visualize data, and make informed decisions to drive growth.

Salesforce Pipeline

Analysis Template

Analysis Template

Compare monthly results for pipeline creation, win rates, average deal age, and…

Browse Other Templates

Balance Sheet

Budget

Business Quote

Calendar

Cash Flow

Competitor Analysis

Content Calendar

Contract Tracking

Expense Reports

Finance Checklists

Income Statement

Inventory List

Invoices

Issue Tracking

Lead Tracking

Ledger

OKR

Pay Stub

Product Roadmap

Profit and Loss

Project Status Reports

RACI

Receipts

SWOT Analysis

Timeline

Timesheet