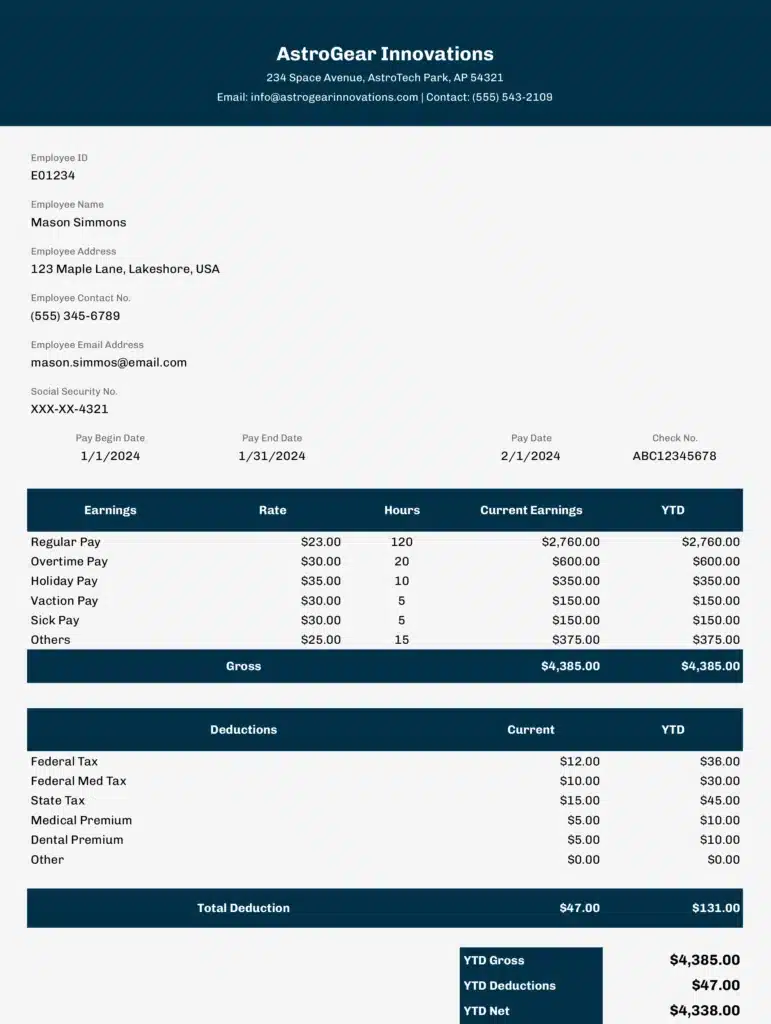

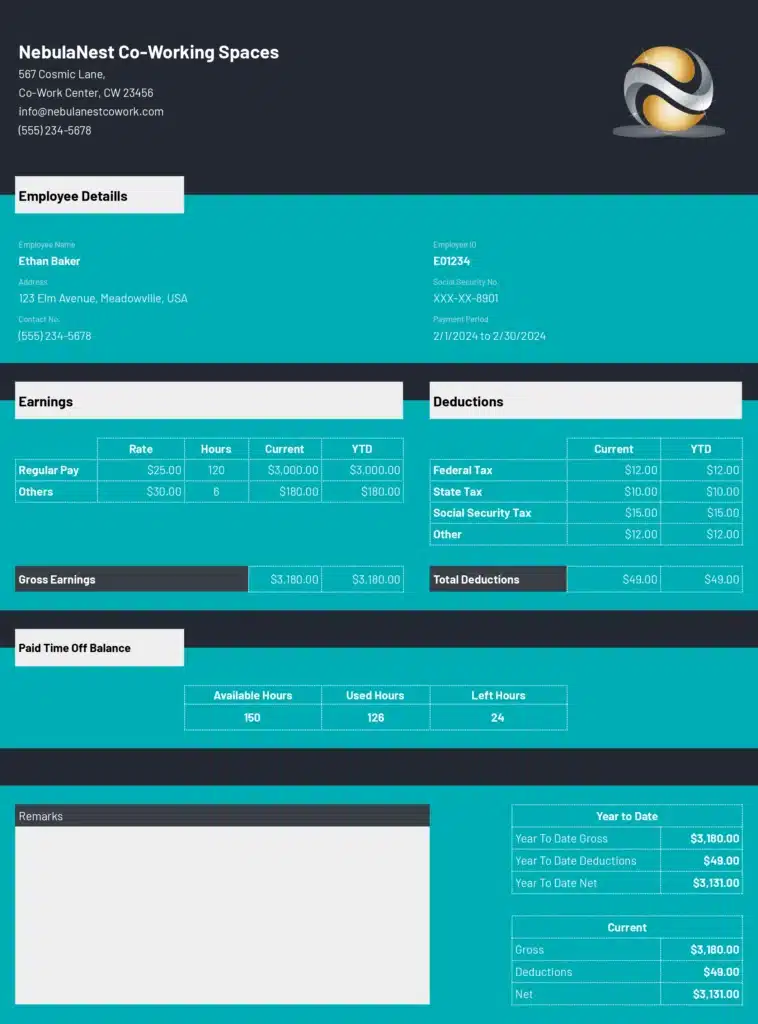

Managing payroll is a critical and complex component of any business operation. It involves meticulous record-keeping and accuracy to ensure every employee is compensated correctly.

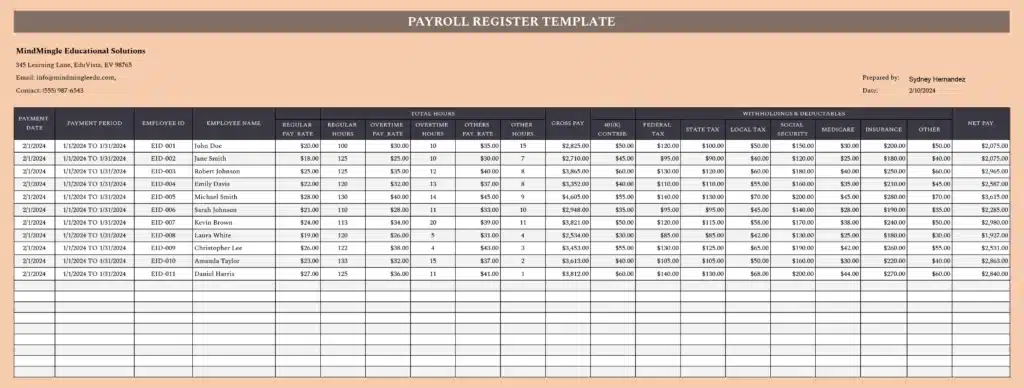

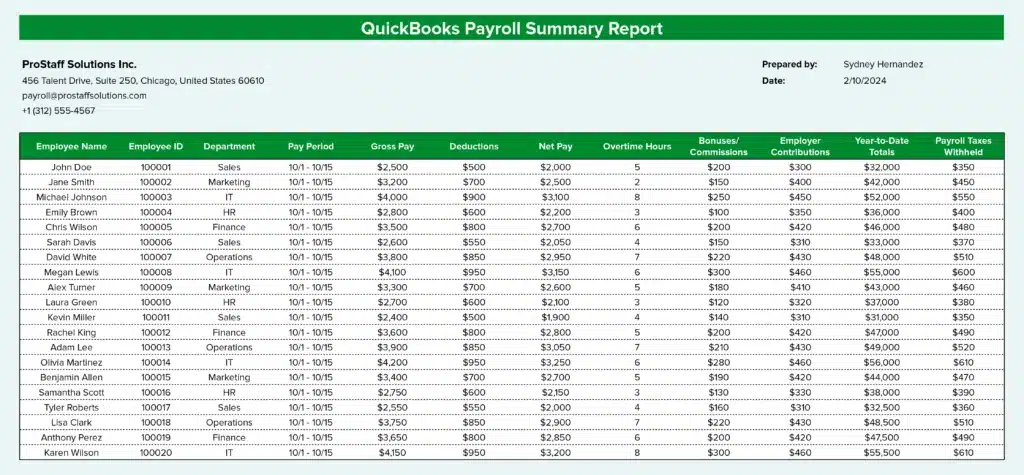

Coefficient’s Payroll Register Template simplifies the process and ensures accuracy and compliance with legal standards with minimal effort.

Benefits of the Payroll Register Template

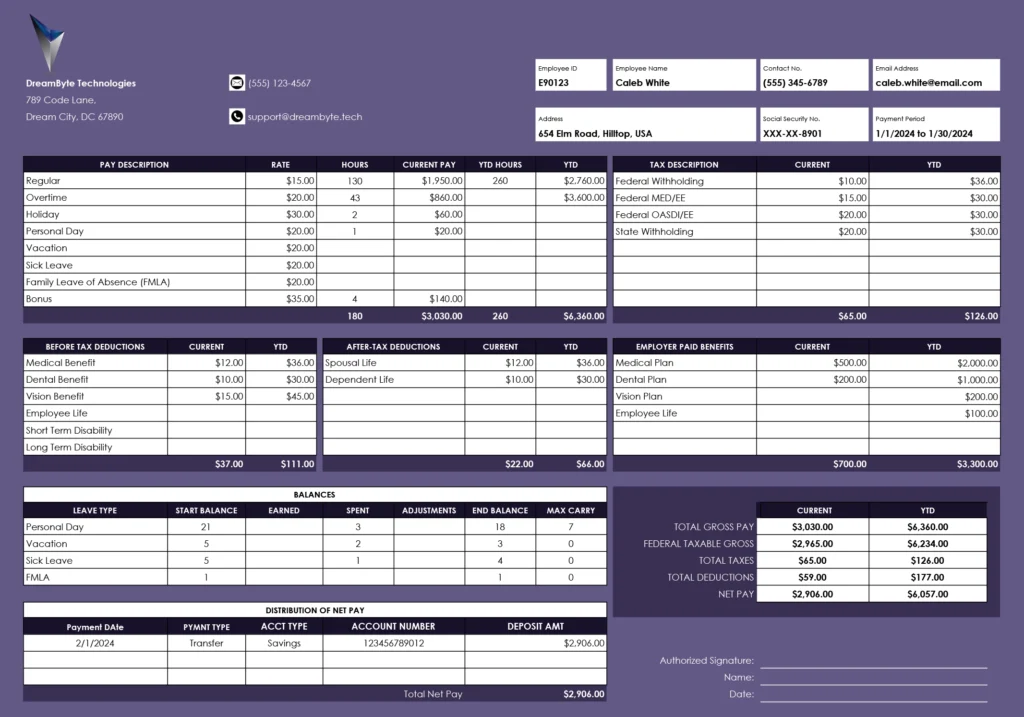

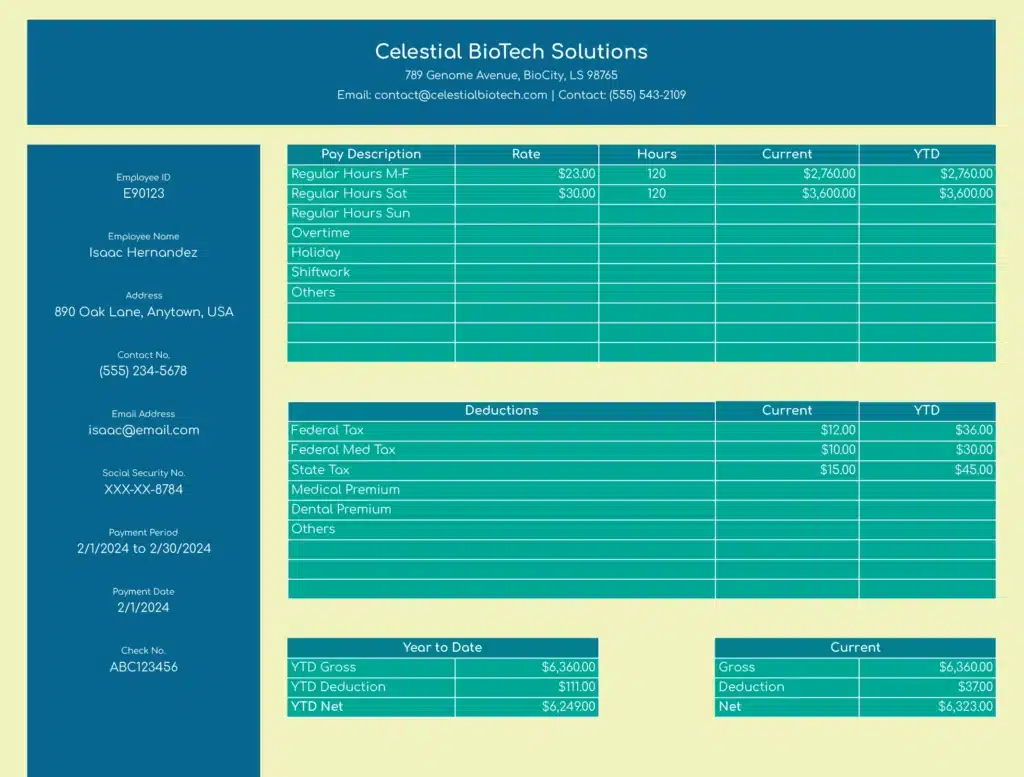

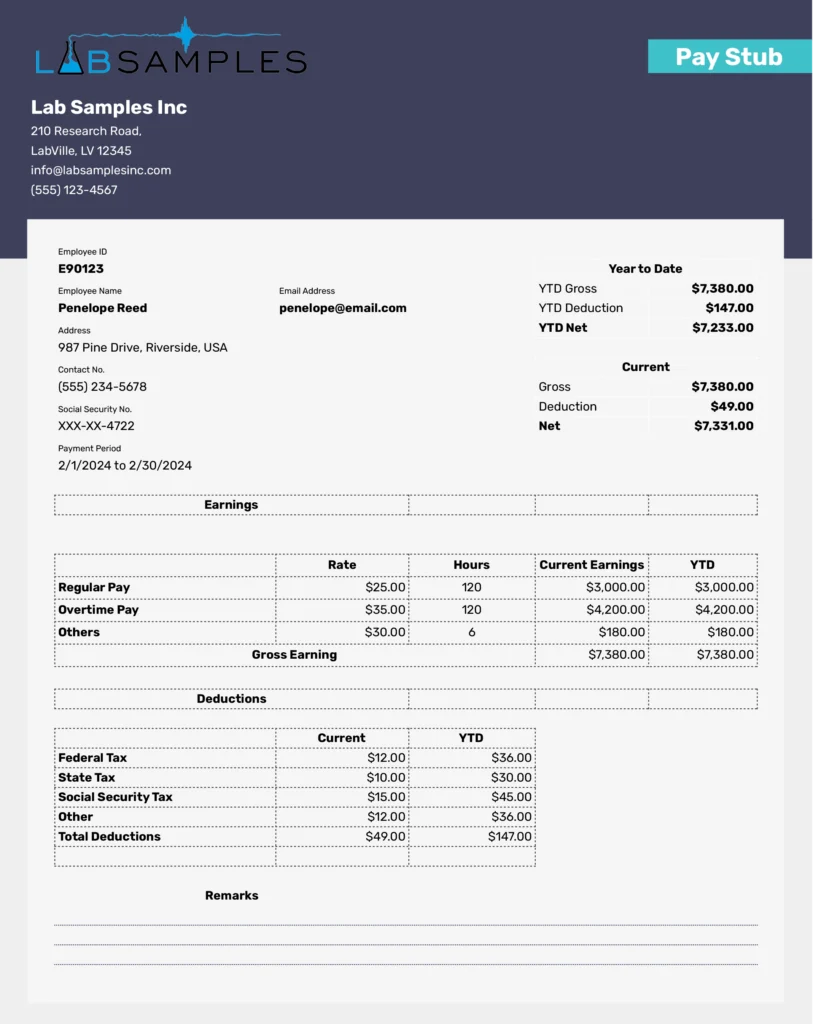

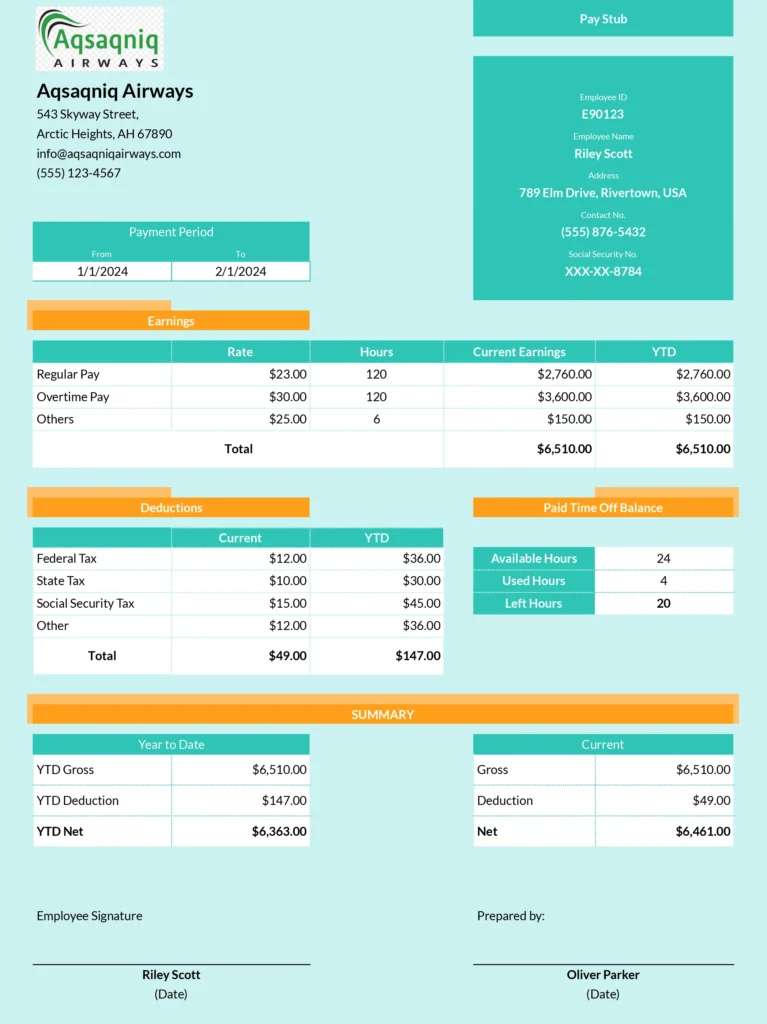

- Comprehensive Record-Keeping: Keep detailed records of each pay period, including gross pay, deductions, and net pay, all in one place.

- Enhanced Accuracy: Minimize manual calculation errors with automated formulas, ensuring accurate payroll processing.

- Time-Saving: Streamline payroll tasks, significantly reducing the time and effort required to manage employee compensation.

- Increased Transparency: Offer employees clear insights into their compensation details, building trust and fostering a transparent work environment.

Key Features: Payroll Register Template

- Automated Calculations: Automated formulas calculate gross pay, taxes, deductions, and net pay for each employee, simplifying the payroll process.

- Customizable Fields: Tailor the template to match your specific payroll requirements, including customizable fields for various types of deductions and benefits.

- Easy Integration: Designed to work seamlessly with Coefficient’s software, allowing for real-time data updates from integrated business systems.

- Secure Sharing: Facilitate secure, direct sharing of payroll information with employees and relevant departments, ensuring data privacy.

- Compliance Support: Built to help businesses adhere to payroll reporting requirements, making it easier to comply with regulations.

How to Use the Template

- Download the Payroll Register Template for Google Sheets or Excel.

- Input Employee Details: Fill in each employee’s basic information, such as name, position, and payment details.

- Enter Payroll Data: For each pay period, input the hours worked, along with any overtime, bonuses, or deductions.

- Review Automated Calculations: Verify the automatically calculated sums for accuracy and make any necessary adjustments.

- Distribute Payroll Summaries: Securely share the finalized payroll register with your finance department and directly with employees, if desired.