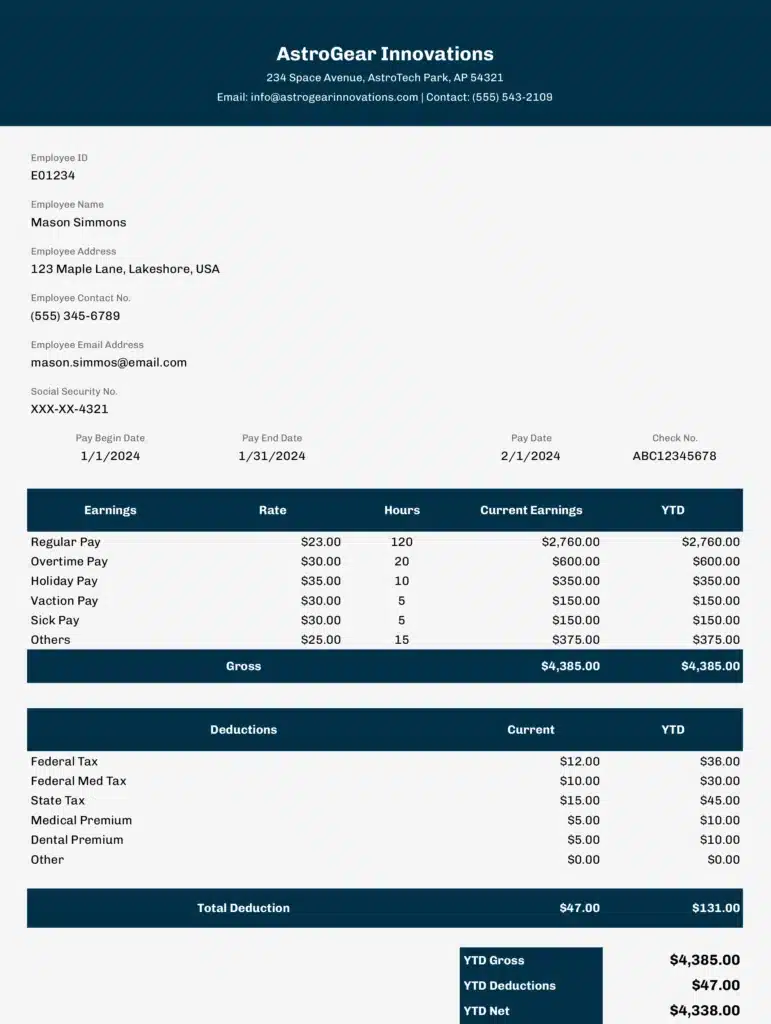

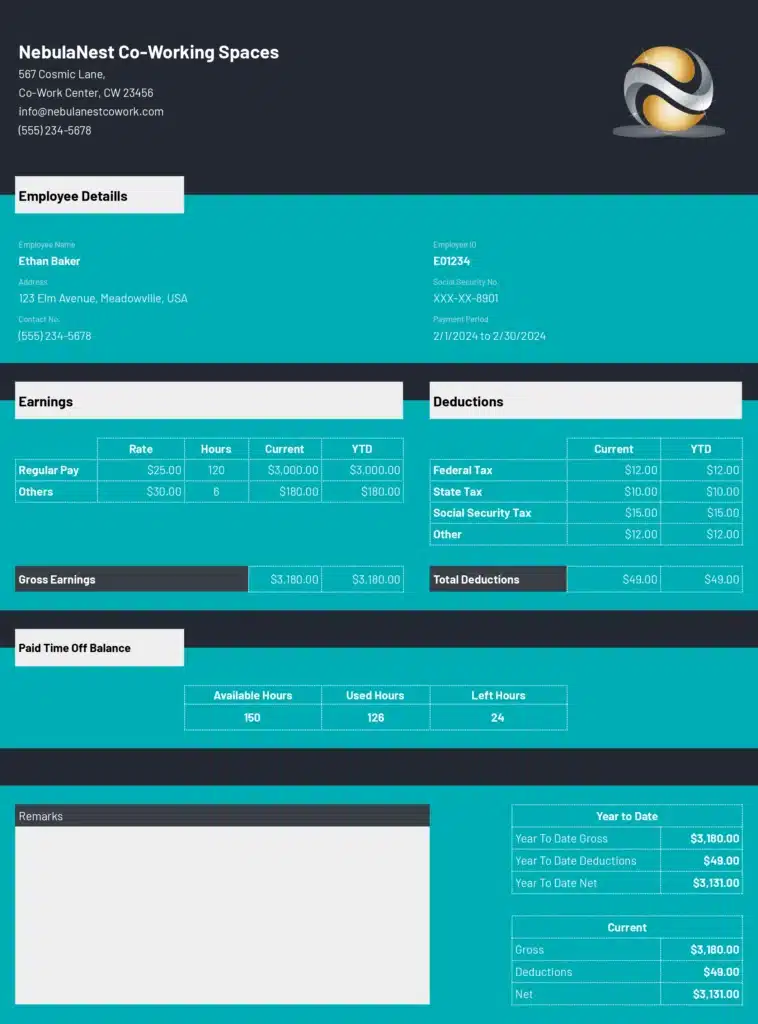

Managing payroll for hourly employees poses unique challenges. The variable nature of their hours demands accuracy and flexibility in payroll processing.

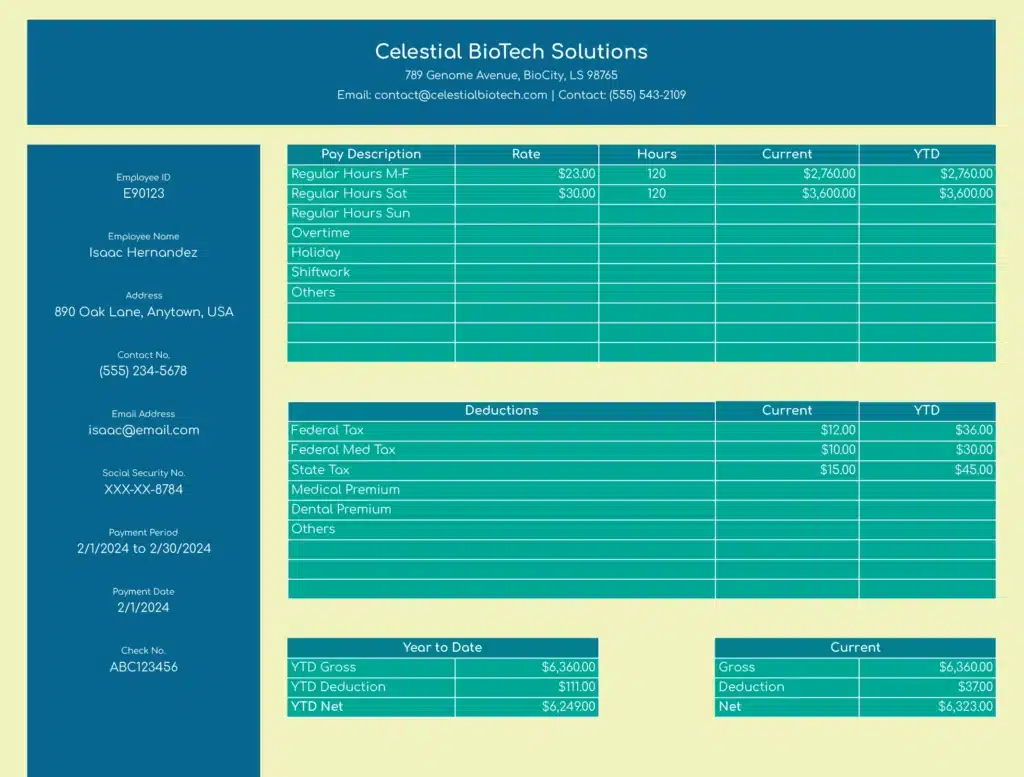

Coefficient’s Pay Stub Template with Hourly Wage is designed to tackle these hurdles head-on, making it easier for businesses to provide clear, accurate pay information to their workers.

Benefits of the Pay Stub Template with Hourly Wage

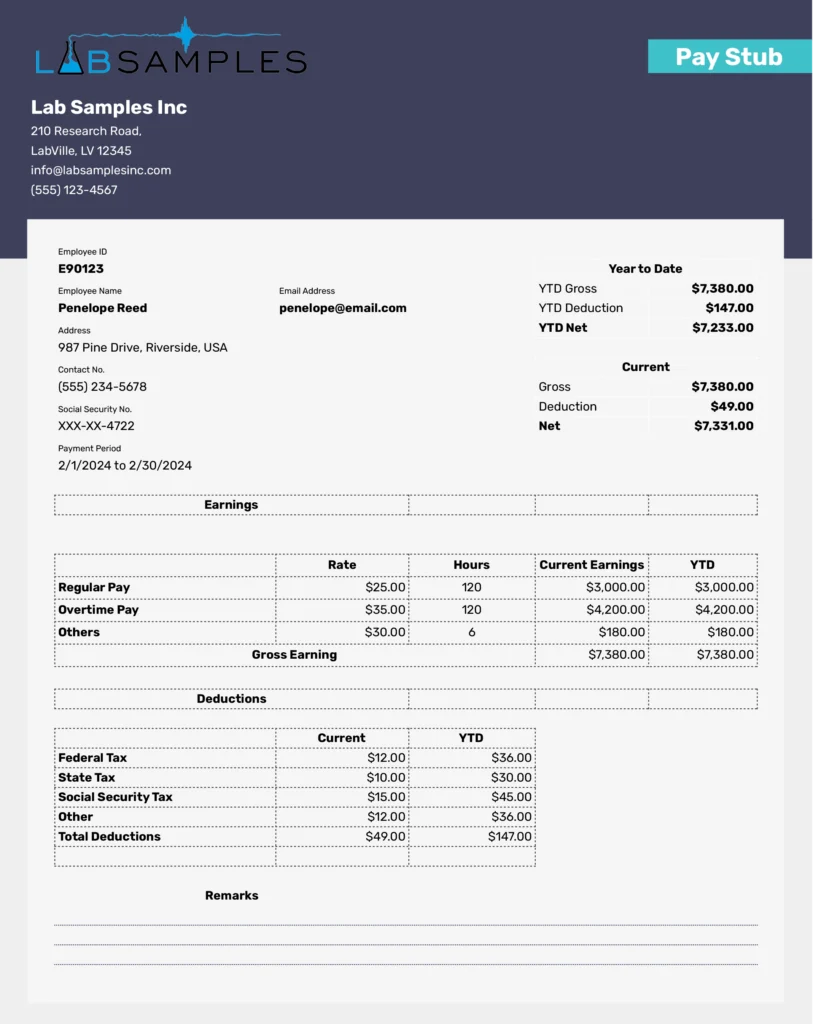

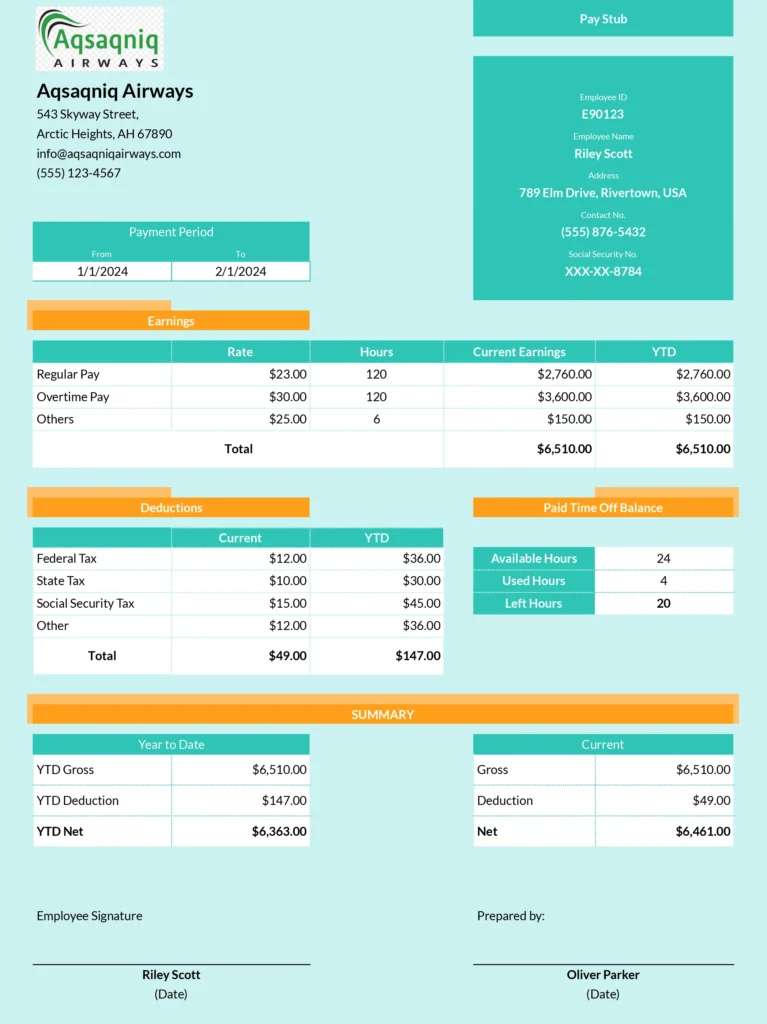

- Accuracy in Every Paycheck: Automatically calculates total earnings based on the number of hours worked, ensuring precise paychecks every time.

- Streamlined Overtime Processing: Easily input overtime hours to calculate additional compensation accurately, in compliance with labor laws.

- Clear Compliance: Adheres to both federal and state regulations for wage and overtime, facilitating legal compliance and audit readiness.

- Simplified Payroll Operations: Reduces the time and complexity involved in processing payroll, freeing up resources for other tasks.

- Transparency with Employees: Generates detailed pay stubs that break down earnings, deductions, and hours worked, fostering trust among your workforce.

Key Features of the Pay Stub Template with Hourly Wage

- Automated Earnings Calculation: Enter hours worked and let the template calculate the total earnings based on preset hourly rates.

- Time Tracking Integration: Syncs seamlessly with popular time tracking systems for an efficient payroll process.

- Overtime Compliance: Pre-configured to calculate overtime pay according to applicable laws, offering peace of mind to both employers and employees.

- Customizable Deductions: Allows for easy input of standard deductions, including taxes, benefits, and other withholdings.

- Easy Distribution: Securely share pay stubs with your employees directly from the template, ensuring privacy and convenience.

How to Use the Template

- Download your template (Excel or Google Sheets) from our website.

- Specify hourly compensation rates for your staff in the template.

- Document the aggregate hours worked during the pay cycle, inclusive of overtime.

- Verify the auto-calculated total earnings for complete accuracy.

- Record any applicable deductions related to taxes, benefits, or withholdings.