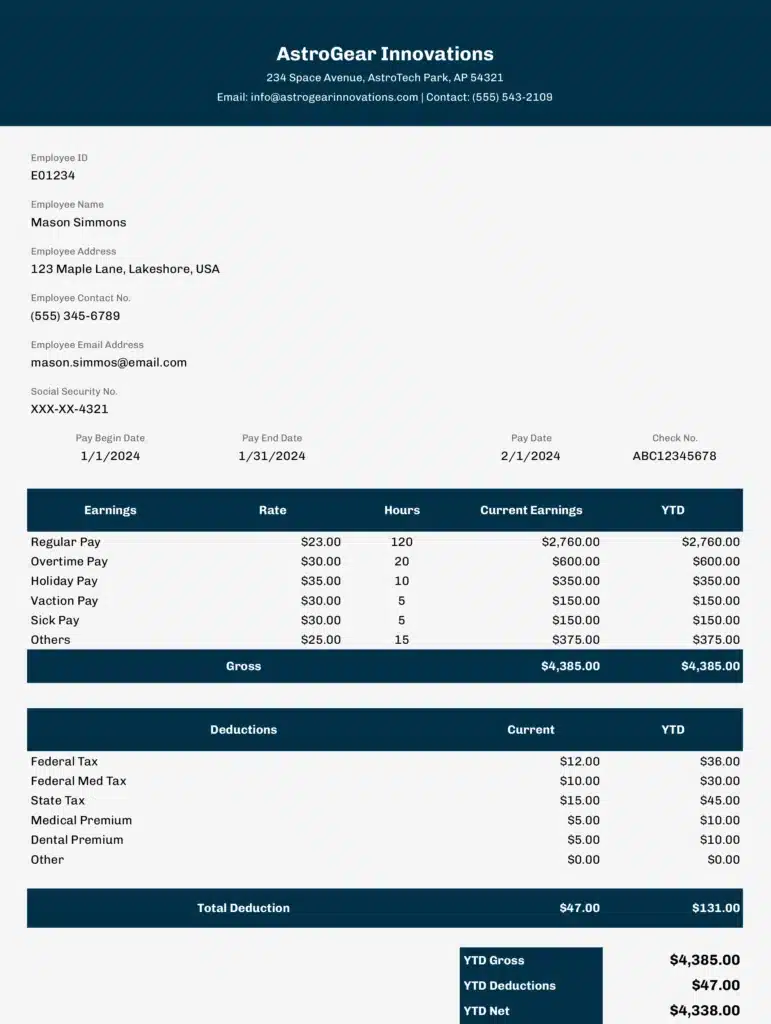

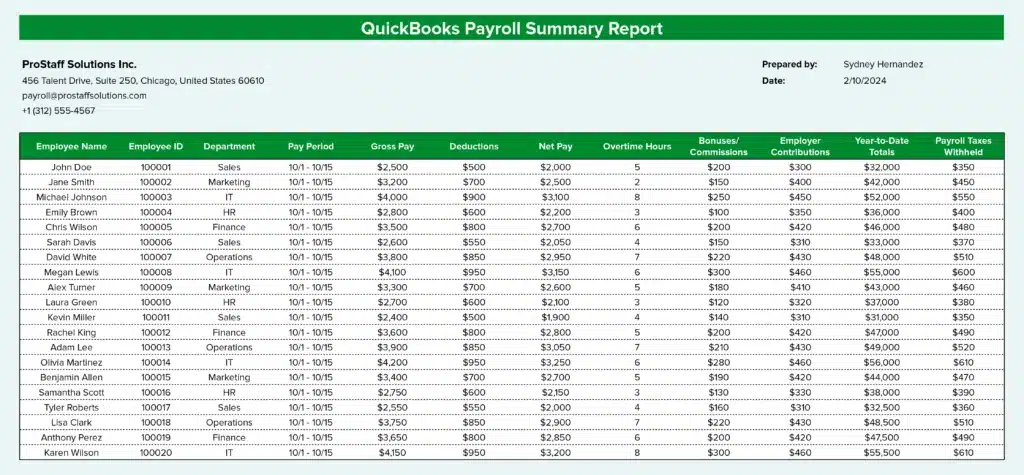

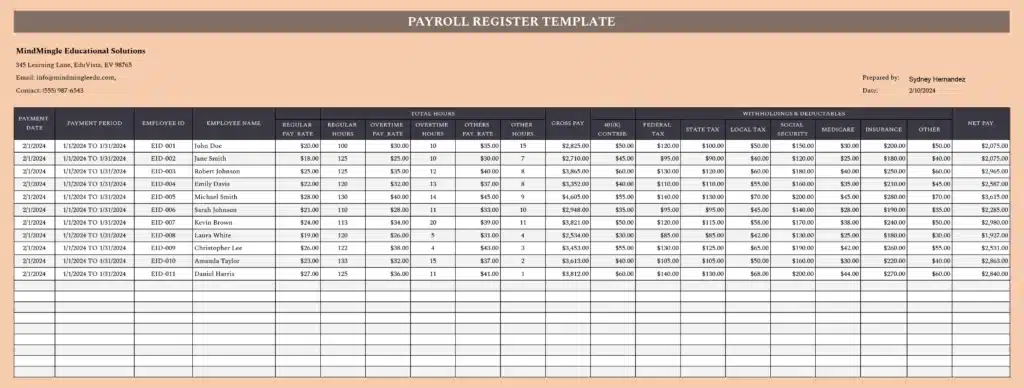

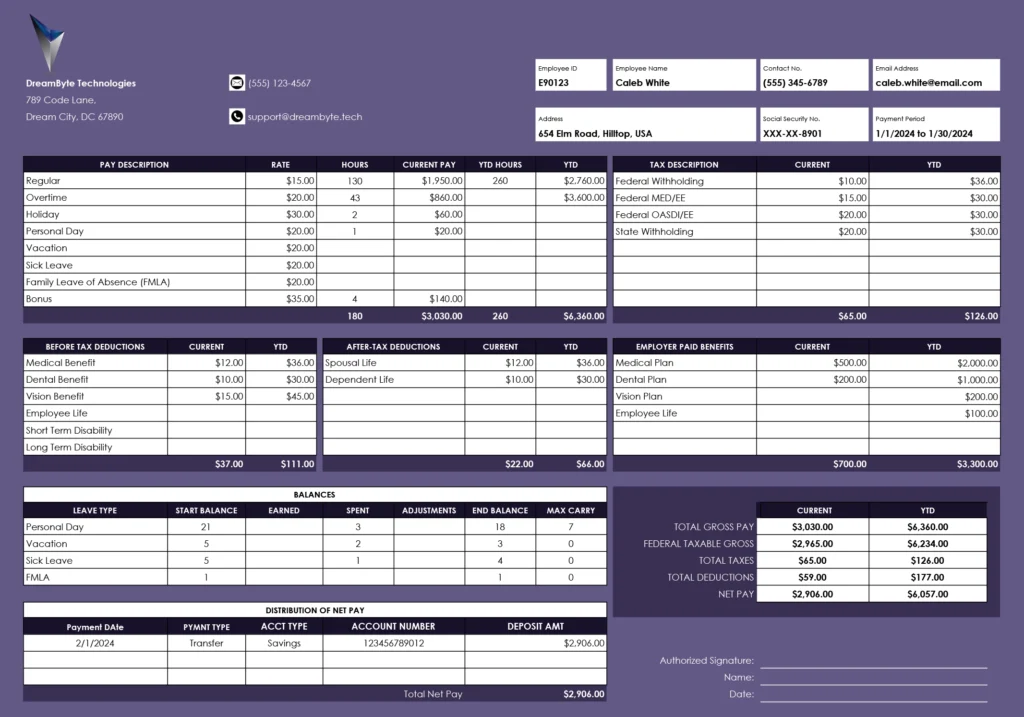

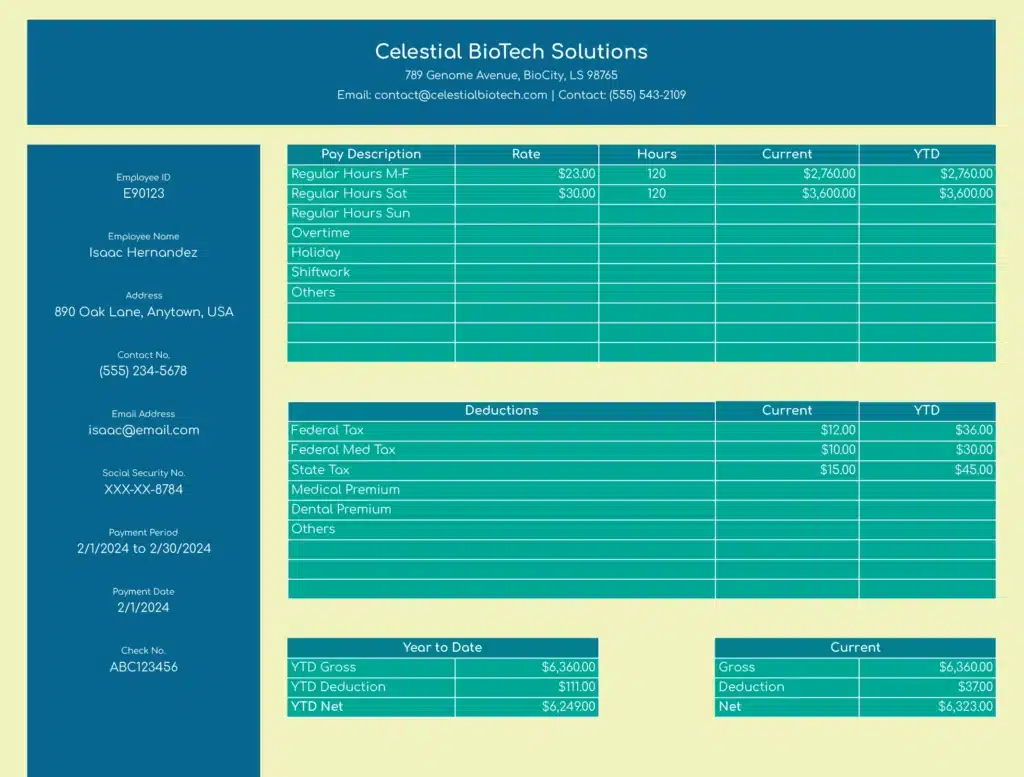

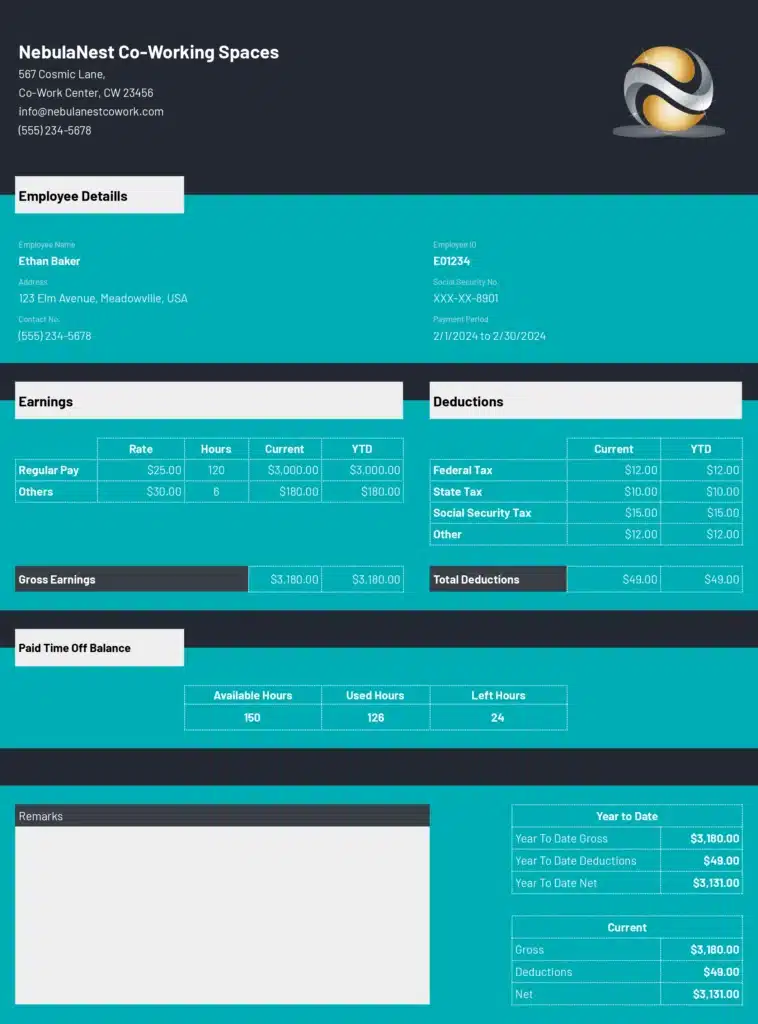

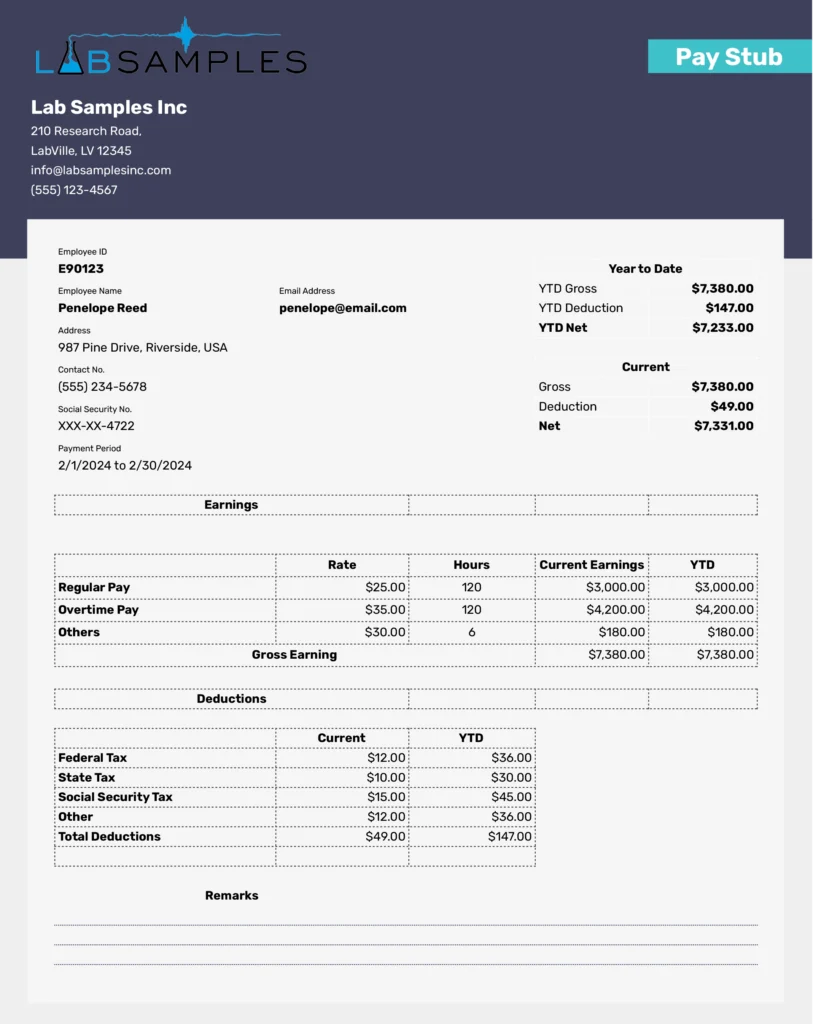

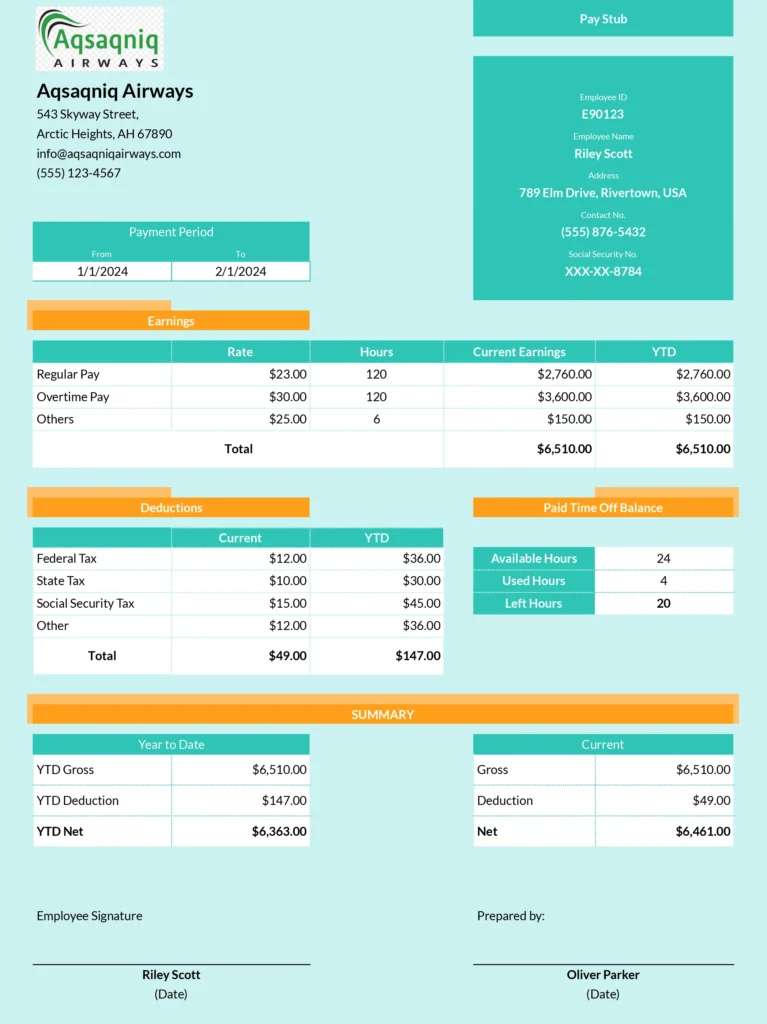

Corporate payroll is multifaceted, interfacing with various financial components including bonuses, benefits, and myriad deductions.

Coefficient’s Corporate Pay Stub Template for Google Sheets and Excel makes things easier. It provides a streamlined pathway to efficient, accurate payroll management tailored for your business.

Benefits of the Corporate Pay Stub Template

- Streamlined Payroll Processing: Navigate the complexities of corporate payroll effortlessly, improving operational efficiency.

- Enhanced Accuracy and Compliance: Ensure compliance with tax regulations and financial laws, minimizing the risk of costly errors.

- Improved Employee Trust: Provide employees with clear, concise pay stubs, reinforcing transparency and trust within your organization.

- Time and Resource Savings: Automate the payroll process to allow your HR team to focus on more strategic tasks, saving both time and valuable resources.

Key Features of Corporate Pay Stub Template

- Extensive Pay Elements: Cover all aspects of corporate compensation, from bonuses to multiple deductions.

- Enhanced Data Protection: Utilize top-notch security measures for the utmost protection of employee data.

- Unified System Integration: Ensure a fluid payroll process by syncing the template with your existing corporate infrastructure.

- Tailor-Made Configuration: Adjust the template to suit the specific requirements of your corporate framework.

How to Use the Template

- Download the Template: Start by downloading the Corporate Pay Stub Template for your spreadsheet of choice: Excel or Google Sheets.

- Customize for Your Need: Adapt the template fields to match your corporate payroll requirements.

- Enter Payroll Data: Carefully input detailed payroll information for each employee

- Share and Distribute: Finalize and securely distribute the pay stubs to your employees, ensuring privacy and compliance.