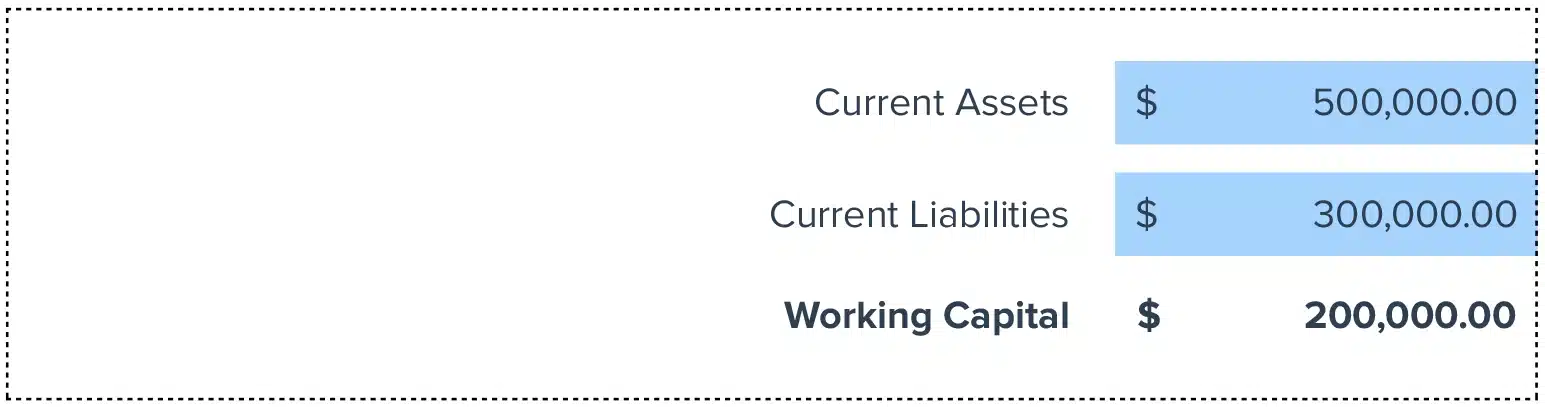

Working Capital = Current Assets – Current Liabilities

– Current Assets: These are the resources that your business can convert into cash within one year. Examples include cash, accounts receivable, and inventory.

– Current Liabilities: These are the obligations that your business needs to settle within one year, such as accounts payable, wages, and short-term loans.

How to Calculate Working Capital?

Compute the total current assets and current liabilities from your financial statements, then apply this simple formula to determine your working capital. Keeping track of this metric helps maintain healthy business operations.

What is Working Capital?

Working Capital refers to the liquidity available to a business to meet its short-term obligations. It is a key indicator of a company’s financial health and operational efficiency.

Why is Working Capital Important?

Managing working capital effectively is crucial for maintaining continuous operations and ensuring that a business can meet its short-term debts and upcoming operational expenses without needing to secure additional financing.

Calculating “Working Capital” Example

Suppose a tech startup has current assets of $150,000 and current liabilities of $70,000. The working capital is then calculated as follows:

Working Capital = $150,000 – $70,000 = $80,000

This positive working capital indicates a good buffer for the startup to manage its daily operations effectively.

How to Improve Working Capital

Optimize Inventory Management

Focus on reducing excess inventory to free up cash, improving your order-to-cash cycle. For instance, apply JIT (Just In Time) principles to decrease the amount of money tied up in unsold stock.

Negotiate Better Payment Terms

Work with suppliers on longer payment terms and encourage customers to pay sooner. For example, offering discounts for early payment can significantly improve your cash flow.

Increase Revenue Streams

Consider diversifying your service offerings or improving sales strategies to accelerate revenue, providing more cash flow to cover liabilities promptly.

Tighten Credit Controls

Improve your accounts receivable by setting strict credit terms and following up diligently on late payments to avoid cash crunches.

Utilize Financing Options

Access short-term financing tools like lines of credit or factoring services to cover gaps in working capital when necessary, ensuring you don’t stall your operational momentum.

How to Calculate Working Capital in Google Sheets and Excel?

Step 1

Enter your total current assets in cell A1.

Step 2

Input your total current liabilities in cell A2.

Step 3

Apply the formula `=A1-A2` in cell A3 to find your Working Capital.

Drawbacks of Working Capital

– Volatility: Relies on fluctuating current asset values, which can result in inconsistent working capital figures.

– Seasonality: Does not account for seasonal variances that might affect a company’s assets and liabilities.

– Liquidity Overemphasis: Prioritizes liquidity without considering the profitability or long-term investments of a company.

When to Use the Working Capital Calculator?

Utilize this calculator during quarterly financial reviews, when evaluating the health of your business, or before making significant operational decisions to ensure you have adequate liquidity.

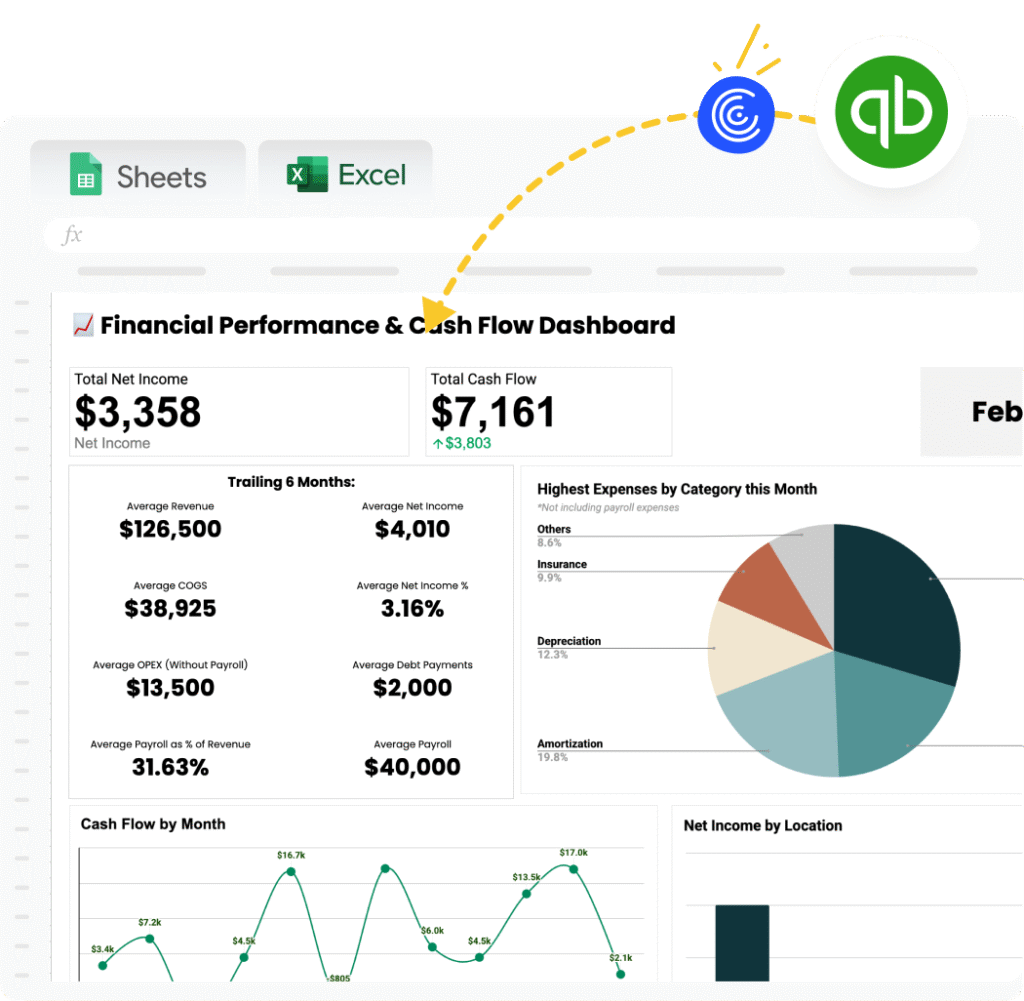

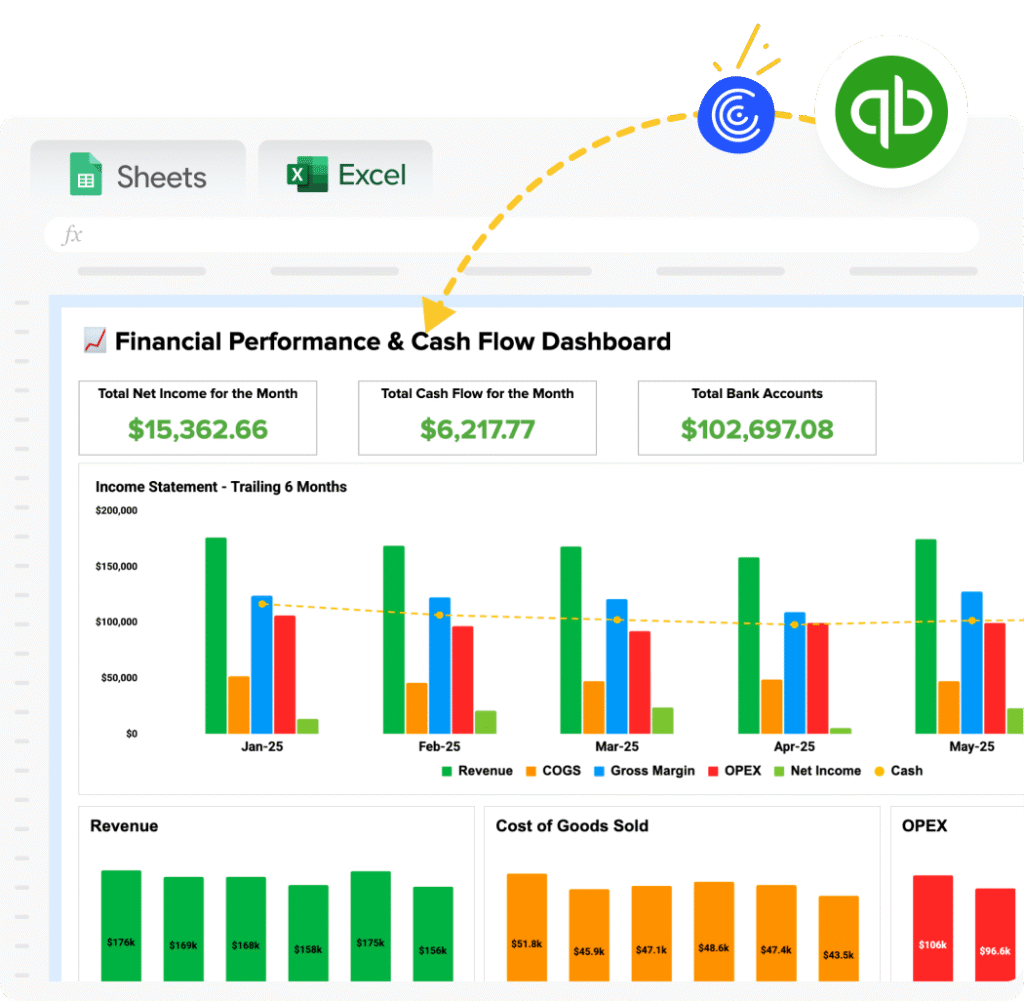

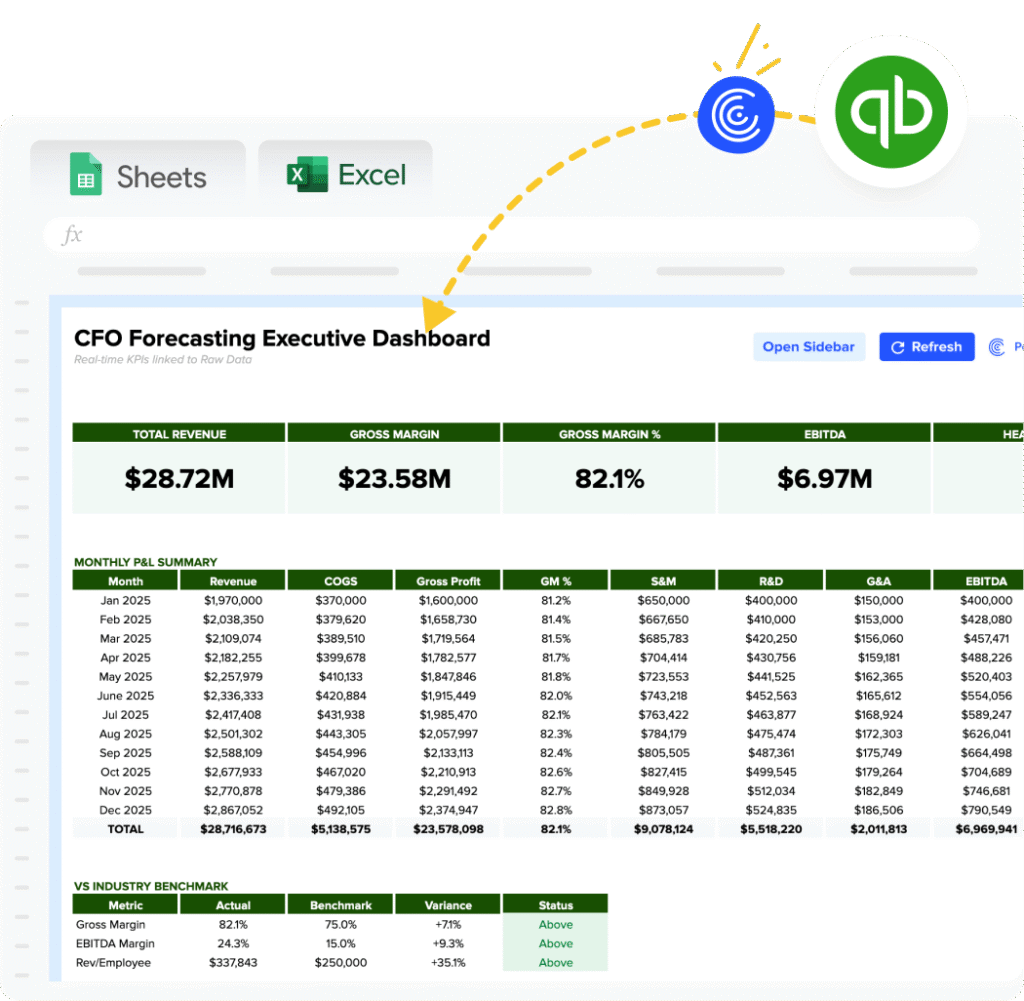

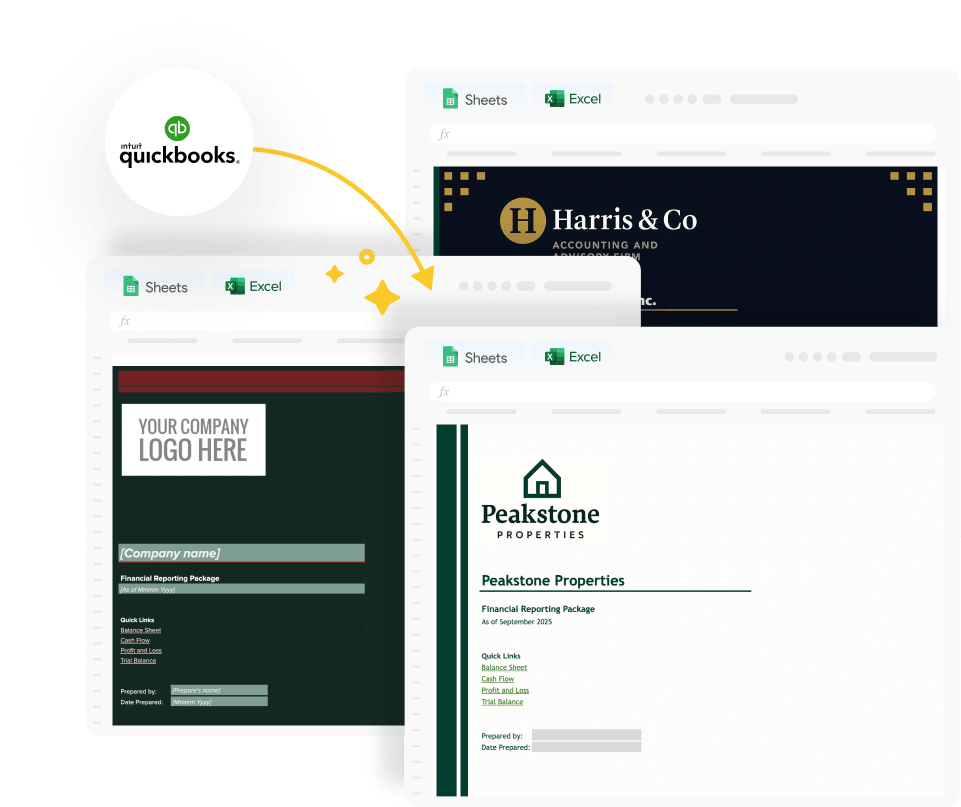

Coefficient.io + Calculator: Tips and Tricks

– Automate Calculations: Set up scheduled import refreshes to keep your data timely without manual input.

– Monitor Trends: Use snapshops to compare working capital across multiple periods to gauge financial health over time.

– Stay Updated: Configure alerts in your spreadsheet to stay on top of significant changes in your working capital metrics.