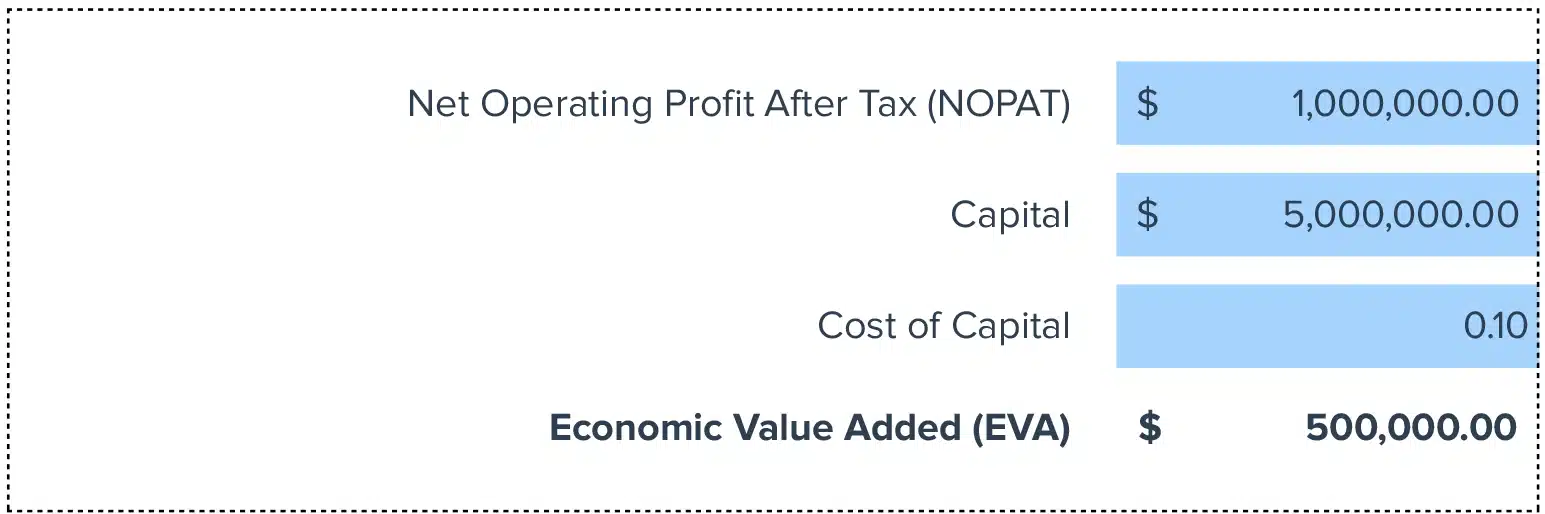

Economic Value Added (EVA) = NOPAT – (Capital * Cost of Capital)

How to Calculate EVA?

- Calculate NOPAT: Deduct taxes from your operating profit.

- Determine Capital: Sum up all investments (debt and equity).

- Identify Cost of Capital: Average the expected returns demanded by debt and equity holders.

- Apply the EVA Formula: Subtract the product of Capital and Cost of Capital from NOPAT.

What is Economic Value Added (EVA)?

EVA is a financial metric used to measure the value a company generates from its funds. It represents the surplus profit over and above the required return of company investors.

Why is EVA Important?

EVA is crucial for measuring the true economic profit of a company. It helps investors understand whether the company is generating adequate returns above its cost of capital, making it an essential tool in financial analysis.

Calculating EVA Example

Let’s assume a company with:

- NOPAT: $150,000

- Capital Invested: $1,000,000

- Cost of Capital: 10%

EVA = $150,000 – ($1,000,000 * 10%) = $50,000.

This indicates that the company generated $50,000 more than its required return.

How to Improve EVA

- Invest Wisely: Invest in projects that yield returns higher than the cost of capital. Analyzing potential projects thoroughly can lead to better investment decisions and improved EVA.

- Optimize Operational Efficiency: Reduce costs without sacrificing quality. Streamlined operations can lead to increased NOPAT, enhancing your EVA.

- Tax Optimization Strategies: Implement legal strategies to minimize tax liabilities. Lower taxes increase NOPAT, thereby potentially increasing the EVA.

- Enhance Capital Structure: Adjust the proportion of debt and equity to minimize the overall cost of capital. A lower cost of capital can improve EVA.

- Focus on Sustainable Growth: Pursue sustainable growth strategies that ensure long-term profitability instead of short-term wins. Consistent performance enhances investor confidence and NOPAT.

How to Calculate EVA in Google Sheets and Excel

- Input NOPAT in cell A1.

- Enter total capital in cell A2.

- Input the cost of capital rate in cell A3.

- Apply the formula

=A1-(A2*A3)in cell A4 to calculate EVA.

Drawbacks of EVA

- Dependent on Accurate Inputs: Misestimation of cost of capital or misreporting of capital can lead to misleading EVA calculations.

- Short-Term Focus Risk: Managers may focus on short-term EVA gains at the expense of long-term sustainability.

- Complexity for Large Firms: Calculating capital and the cost of capital can be complex in diverse, multinational corporations.

When to Use the EVA Calculator?

Utilize this tool during annual financial reviews, strategic planning sessions, or when evaluating new investment opportunities. It’s vital for finance teams aiming to assess the true economic profit of their operations.

EVA Calculator: Tips and Tricks

- Prioritize ROI: Consider projects with the highest potential return on investment.

- Regular Reassessments: Frequently reassess your capital costs and operational strategies.

- Simplify Financial Models: Maintain clear and concise financial models for accurate EVA calculation.