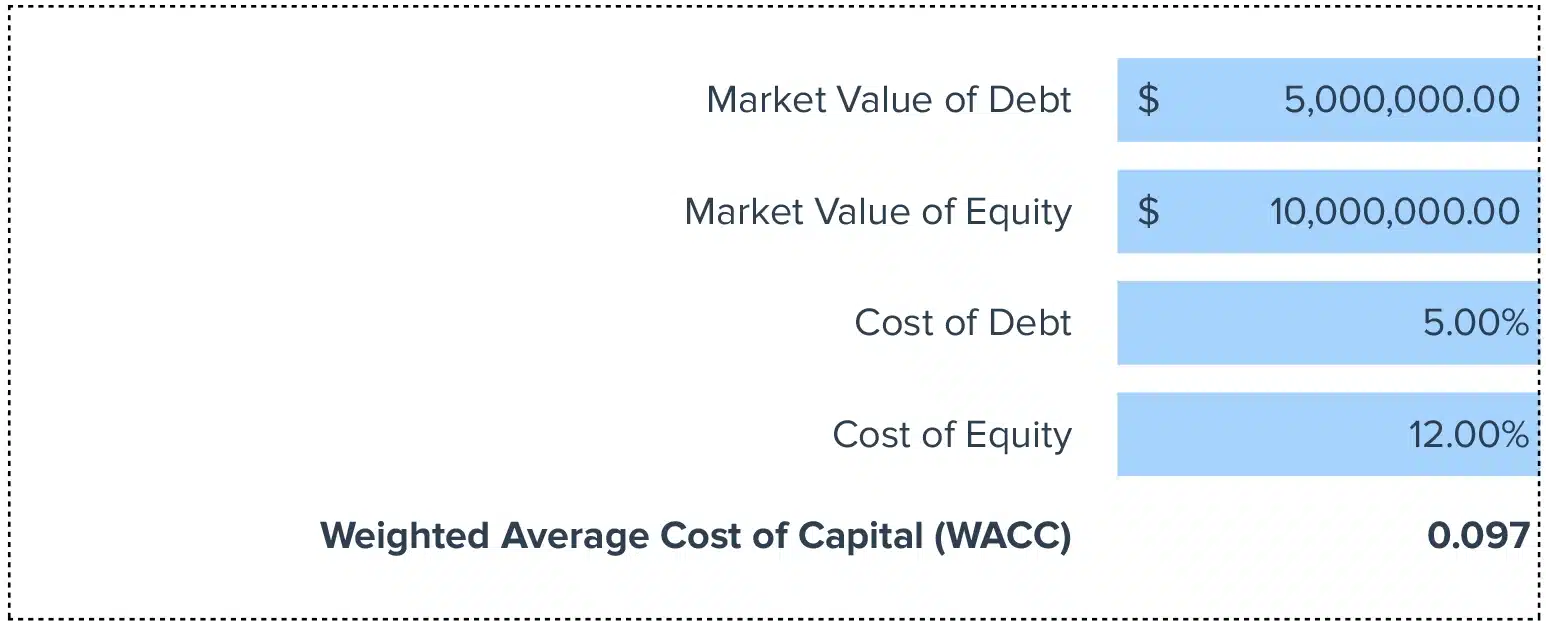

Weighted Average Cost of Capital (WACC) = SUM(Proportion of Capital * Cost of Capital)

Streamline Your Financial Analysis with Our Easy-to-Use Weighted Average Cost of Capital Calculator.

Customize this calculator to help your finance team quickly assess investment opportunities and financial strategies.

How to Calculate WACC?

WACC integrates the costs associated with each capital component proportionally, providing a comprehensive understanding of total capital costs.

What is WACC?

The Weighted Average Cost of Capital (WACC) is the average rate that a company is expected to pay to all its security holders to finance its assets.

Why is WACC Important?

Knowing the WACC helps firms make investment decisions, assess new projects, and evaluate potential acquisitions, ensuring these are profitable enough to justify the risk.

Calculating WACC Example

Let’s consider a company with:

- $100 million debt at 5% cost

- $400 million equity at 10% cost WACC = ($100M/$500M * 5%) + ($400M/$500M * 10%) = 1% + 8% = 9%

How to Improve WACC

Optimize Debt-Equity Ratio

Create a balance between debt and equity to minimize the WACC while ensuring the company remains attractive to investors.

Renegotiate Debt Terms

Seek terms with lower interest rates to reduce the cost of debt, reflecting positively on WACC.

Improve Credit Rating

Work towards a higher credit rating to lower the cost of capital, having a direct impact on reducing WACC.

Dividend Policy Review

Adjust dividend payouts to optimize equity costs without alienating shareholders, thereby impacting WACC beneficially.

Cost Efficiency

Implement cost-cutting measures that free up more capital for other operations, improving overall financial health and potentially reducing WACC.

How to Calculate WACC in Google Sheets and Excel

- Input “Equity” in cell A1 and “Debt” in A2.

- Enter the corresponding values in B1 and B2.

- Put “Cost of Equity” in C1 and “Cost of Debt” in C2, and fill in the values.

- List the “Proportion of Equity” in D1 and “Proportion of Debt” in D2.

- In E1, input the formula =(B1D1C1) + (B2D2C2).

- The result in E1 is your WACC.

Drawbacks of Using WACC

- Market Sensitivity: WACC can be overly sensitive to market fluctuations, leading to inaccuracies.

- Assumptive Nature: Often involves assumptions that might not hold true, affecting the reliability.

- Complexity in Calculation: Proper calculation requires precise data on cost of debt and equity, which might not always be readily available.

When to Use the WACC Calculator

Apply our calculator during strategic planning, investment analysis, or while assessing the feasibility of financing options.

Calculator: Tips and Tricks

- Regularly update your rates as markets change to keep your calculations accurate.

- Use snapshots to keep track of historical calculations.

- Influence your result by adjusting both the Proportion of Capital and Cost of Capital dynamically.