Liquidity Ratio = (Current Assets – Inventory) / Current Liabilities

Take control of financial assessments with our easy-to-use TIE Calculator customized for corporate finance departments.

Formula for Liquidity Ratio

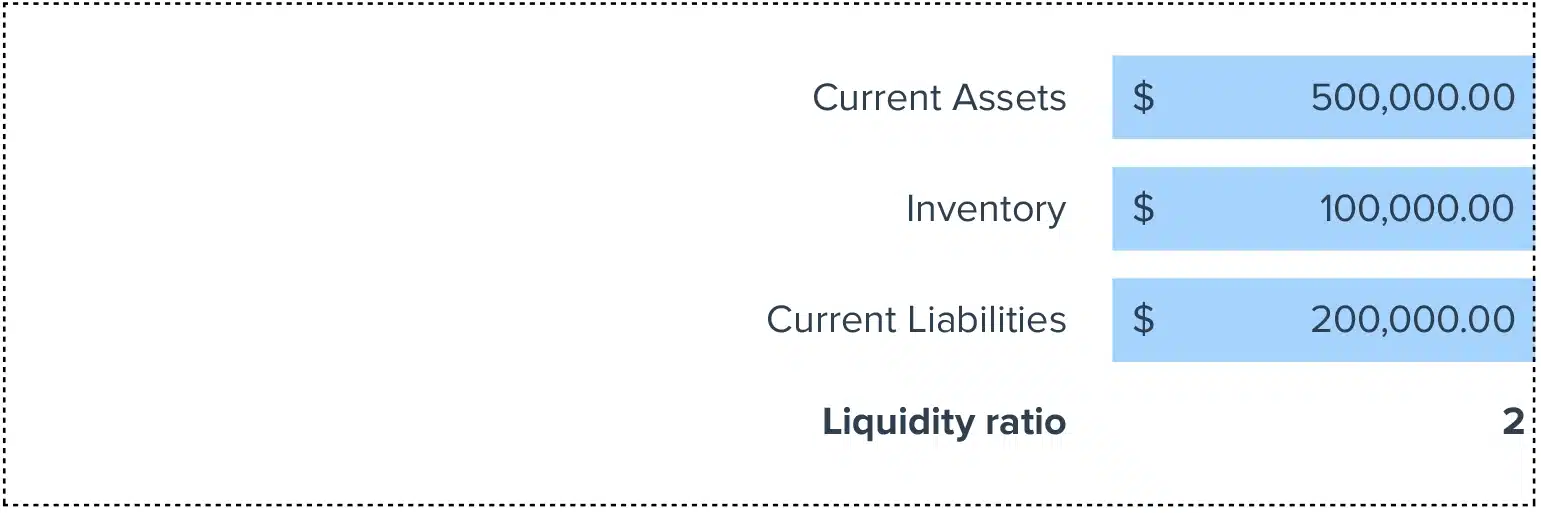

Liquidity Ratio = (Current Assets – Inventory) / Current Liabilities

- Current Assets: Assets expected to convert to cash within one year, such as cash, accounts receivable, and short-term investments.

- Inventory: Goods held for sale or future use.

- Current Liabilities: Debts and obligations due within one year, like accounts payable and short-term loans.

How to Calculate Liquidity Ratio

Combine all current assets and subtract the total inventory. Divide the result by current liabilities to find the liquidity ratio. This shows how quickly your organization can settle short-term debts with accessible assets.

What is Liquidity Ratio?

The Liquidity Ratio is a financial metric used to assess a business’s ability to meet short-term obligations without needing external capital. It reflects a company’s financial stability in the short term.

Why is a Liquidity Ratio Important?

A healthy liquidity ratio ensures a company can quickly convert assets into cash to meet immediate liabilities. This is crucial for maintaining good credit standings and operational flexibility.

Calculating Liquidity Ratio: Example

Consider a business with $200,000 in current assets, $50,000 in inventory, and $100,000 in current liabilities. The Liquidity Ratio is calculated as:

[ \text{Liquidity Ratio} = \frac{(200,000 – 50,000)}{100,000} = 1.5 ]

This means the business has $1.50 in liquid assets for every $1 of short-term liabilities.

How to Improve Liquidity Ratio

Increase Current Assets

Improve accounts receivable processes to collect payments faster, increasing your current assets and liquidity ratio.

Reduce Inventory Levels

Optimize inventory management to reduce excess stock, converting more resources into liquid assets.

Extend Payment Terms

Negotiate longer payment terms with suppliers to delay cash outflow, improving short-term liquidity.

Monitor Spending

Limit unnecessary expenses to prevent cash outflow that could be used to improve liquidity.

Increase Revenue Streams

Develop new product lines or expand into new markets to increase revenue, boosting current assets and liquidity ratios.

How to Calculate Liquidity Ratio in Google Sheets and Excel

- Enter total current assets in cell A1.

- Input total inventory in cell A2.

- Enter total current liabilities in cell A3.

- Apply the formula =(A1-A2)/A3 in cell A4 to calculate the Liquidity Ratio.

Drawbacks of the Liquidity Ratio

- Non-Cash Considerations: Does not account for the quality of current assets like receivables.

- Volatility of Asset Values: Market values of inventories or securities can fluctuate, affecting the ratio.

- Seasonal Variations: Industries may face seasonal liquidity swings.

When to Use the Liquidity Ratio Calculator

Use this calculator during quarterly financial reviews, loan applications, or when evaluating the impact of financial decisions on short-term financial health.

Liquidity Ratio Calculator: Tips and Tricks

- Automate: Use automated solutions for real-time asset value updates.

- Audit Regularly: Regularly audit and clean data to ensure accurate calculations.

- Customize: Customize your spreadsheet to auto-calculate ratios monthly or quarterly.