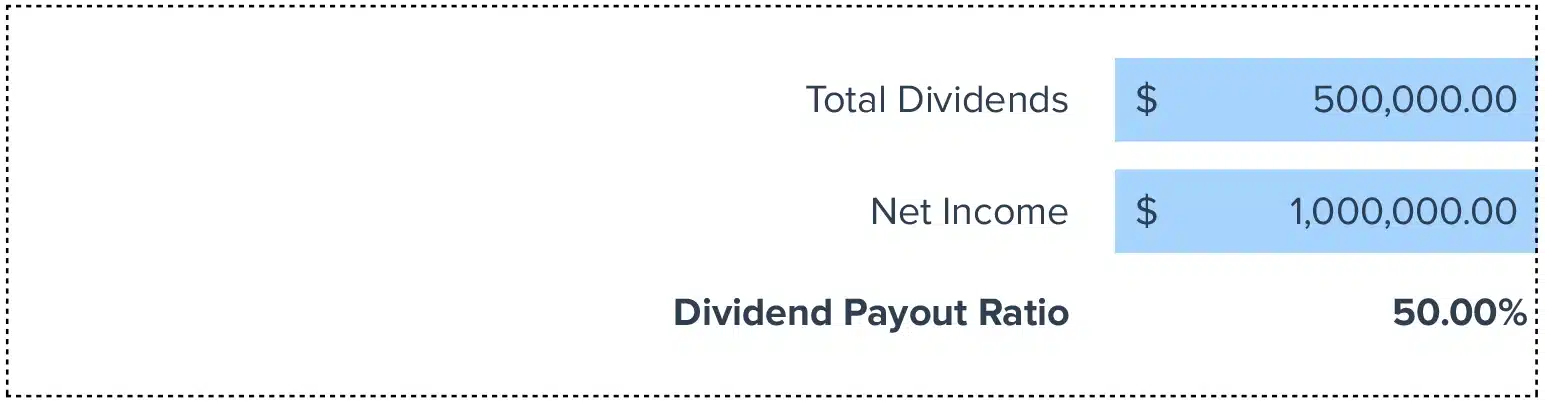

Dividend Payout Ratio = Total Dividends / Net Income

Quickly determine how your organization is rewarding its shareholders. Customize the calculator to suit the specific tracking and reporting needs across different industries.

Formula for Dividend Payout Ratio:

Dividend Payout Ratio = Total Dividends / Net Income

How to Calculate?

- Total Dividends: This is the total amount of dividends that the company has declared to be paid to shareholders.

- Net Income: This is the profit calculated by deducting all expenses, taxes, and costs from total revenue.

What is Dividend Payout Ratio?

The Dividend Payout Ratio is a financial metric that indicates the percentage of a company’s net income that is paid out in the form of dividends to the shareholders.

Why is Dividend Payout Ratio Important?

Understanding the Dividend Payout Ratio helps investors and corporate managers gauge how a company uses its profits.

Calculating Dividend Payout Ratio Example

Imagine a business that posts a net income of $10 million and declares dividends of $2.5 million. The Dividend Payout Ratio would be:

[ \text{Dividend Payout Ratio} = \frac{$2.5 \text{ million}}{$10 \text{ million}} = 25% ]

How to Improve Dividend Payout Ratio

- Consistent Revenue Growth: Enhance your business operations to ensure a steady increase in revenue, thus providing more availability for dividend distribution.

- Cost Management: Reduce unnecessary expenses to maximize the profits which can then be partially distributed as dividends.

- Debt Reduction: Lowering debt can lead to less interest expense, thus more net income and potentially higher dividends.

- Tax Optimization: Strategically manage tax liabilities to increase the net income after taxes.

- Reinvestment Strategy: Wisely choose between reinvestment and dividends to keep the balance that aligns with your strategic financial goals.

How to Calculate in Google Sheets and Excel?

- Input your Total Dividends in cell A1.

- Enter Net Income in cell A2.

- Apply the formula

=A1/A2in cell A3 to get the Dividend Payout Ratio.

Drawbacks of the Dividend Payout Ratio

- Can be Misleading: A high ratio doesn’t always imply financial health but could indicate limited growth opportunities.

- Inconsistent Earnings: Fluctuating net income can make percentages volatile year over year.

- Ignored Capital Needs: Companies may need to retain earnings to fund growth or repay debts, making a lower ratio beneficial.

When to Use the Calculator

Deploy this tool during financial audits, quarterly earnings reports, or when assessing the health of your shareholder returns.

Calculator: Tips and Tricks

- Scheduled Export Feature: Keep all your financial sheets updated with the latest dividend and profit numbers.

- Filter Imports: Selectively sync data to ensure accurate calculation every time.

- Automations for Notifications: Keep track of significant changes in your calculated ratios.