Return on Equity (ROE) = Net Income / Average Shareholders’ Equity

Net Income: This is the total profit of the company after all expenses and taxes have been deducted from revenues.

Average Shareholders’ Equity: Represents the average amount of net assets owned by shareholders during the period, calculated as the average of beginning and ending equity.

How to Calculate Return on Equity (ROE)?

- Determine Net Income: Locate your company’s total profits after all expenses on the financial statement.

- Calculate Average Shareholders’ Equity: Add the equity at the beginning and end of the period and then divide by two.

- Apply the Formula: Divide the net income by the average shareholders’ equity to find ROE.

What is Return on Equity (ROE)?

Return on Equity (ROE) is a crucial metric that measures the efficiency at which a company provides financial returns to its shareholders. It is expressed as a percentage.

Why is ROE Important?

ROE is vital because it reveals a company’s ability to generate profits from shareholders’ equity. High ROE values typically signify efficient management and potentially attractive returns for investors, attracting more capital.

Calculating ROE Example with Numbers

Suppose a company earns $150,000 in net income with an average shareholders’ equity of $1,000,000.

ROE = $150,000 / $1,000,000 = 15%

This indicates that for every dollar of shareholders’ equity, the company generated 15 cents in profit.

How to Improve ROE

- Increase Net Income: By cutting costs and enhancing productivity, net income increases, boosting ROE.

- Optimize Asset Management: Efficient use of company assets may increase profitability and ROE.

- Reduce Debts: Minimizing debt levels can also improve ROE, as less interest is paid out.

- Financial Leveraging: Wisely using debt to grow can amplify ROE if managed correctly.

- Dividend Policy Adjustments: Redistributing less profit can keep more equity within the company, potentially improving ROE.

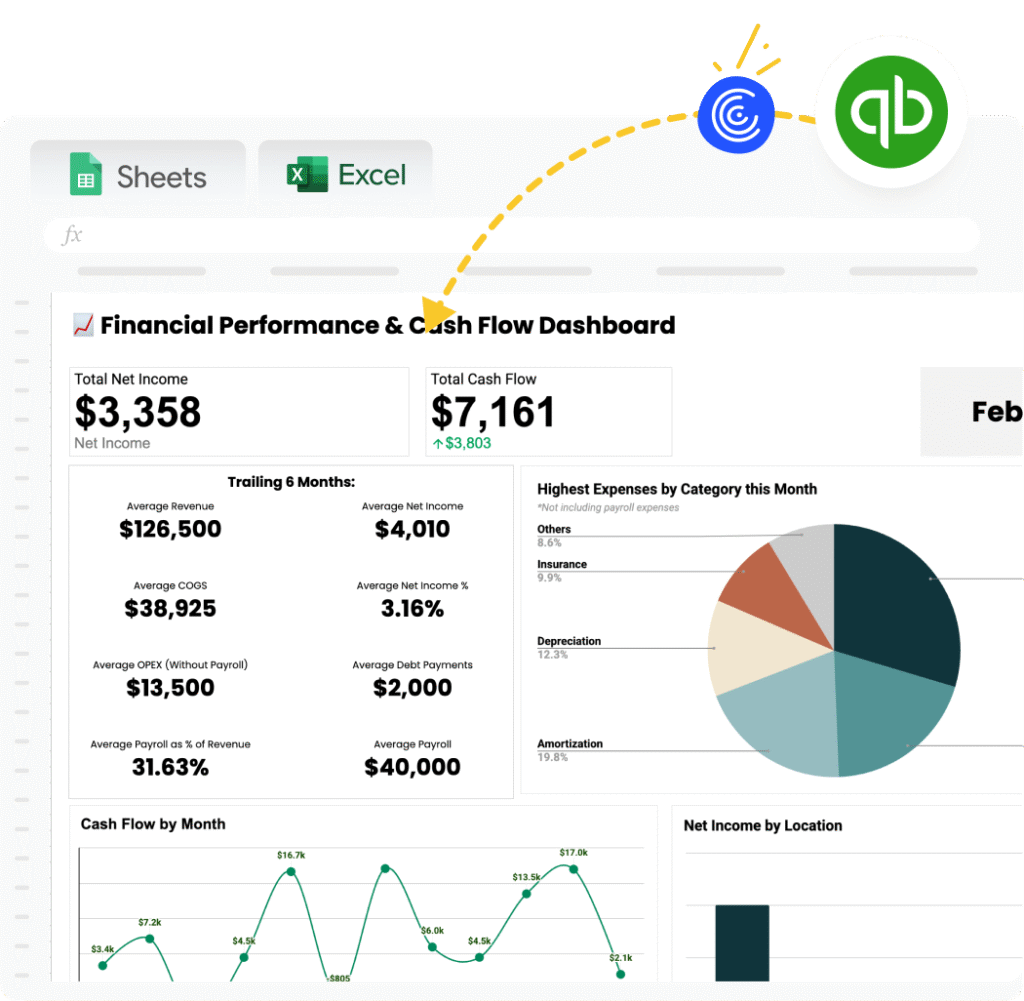

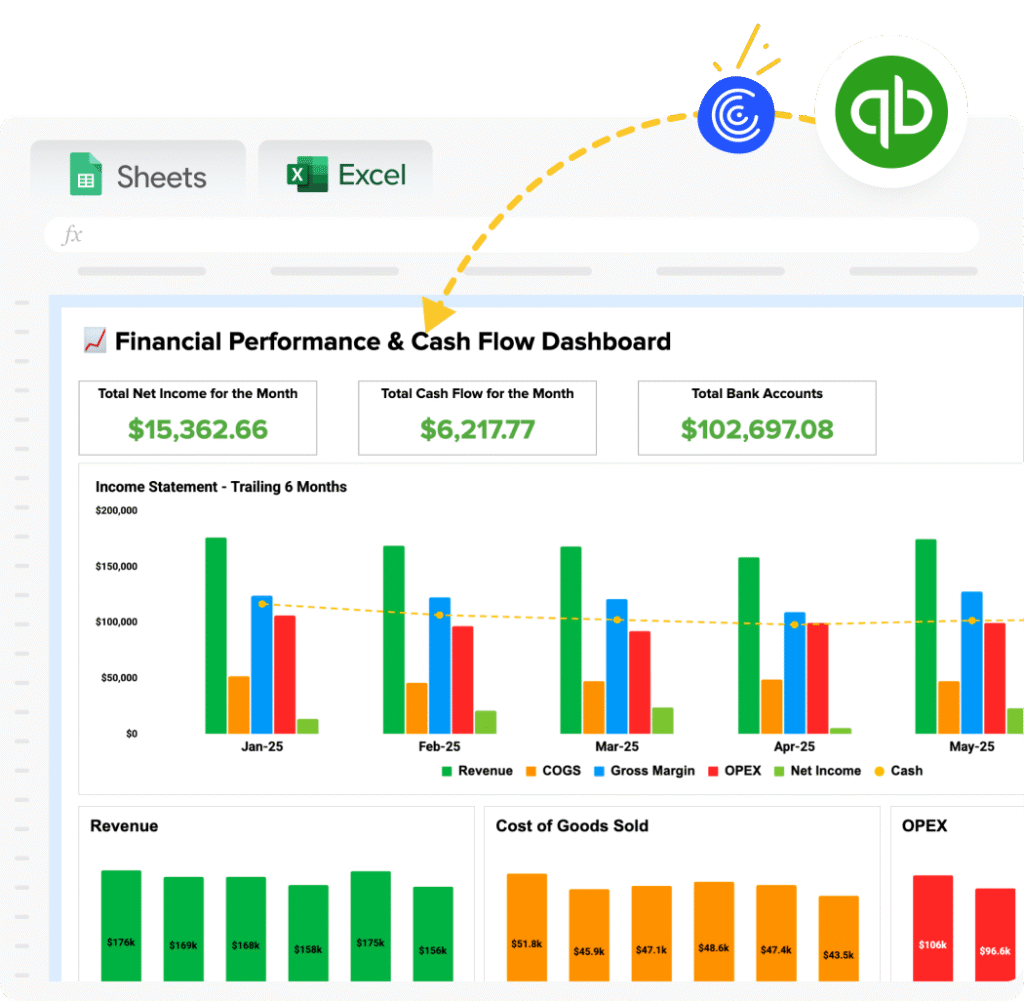

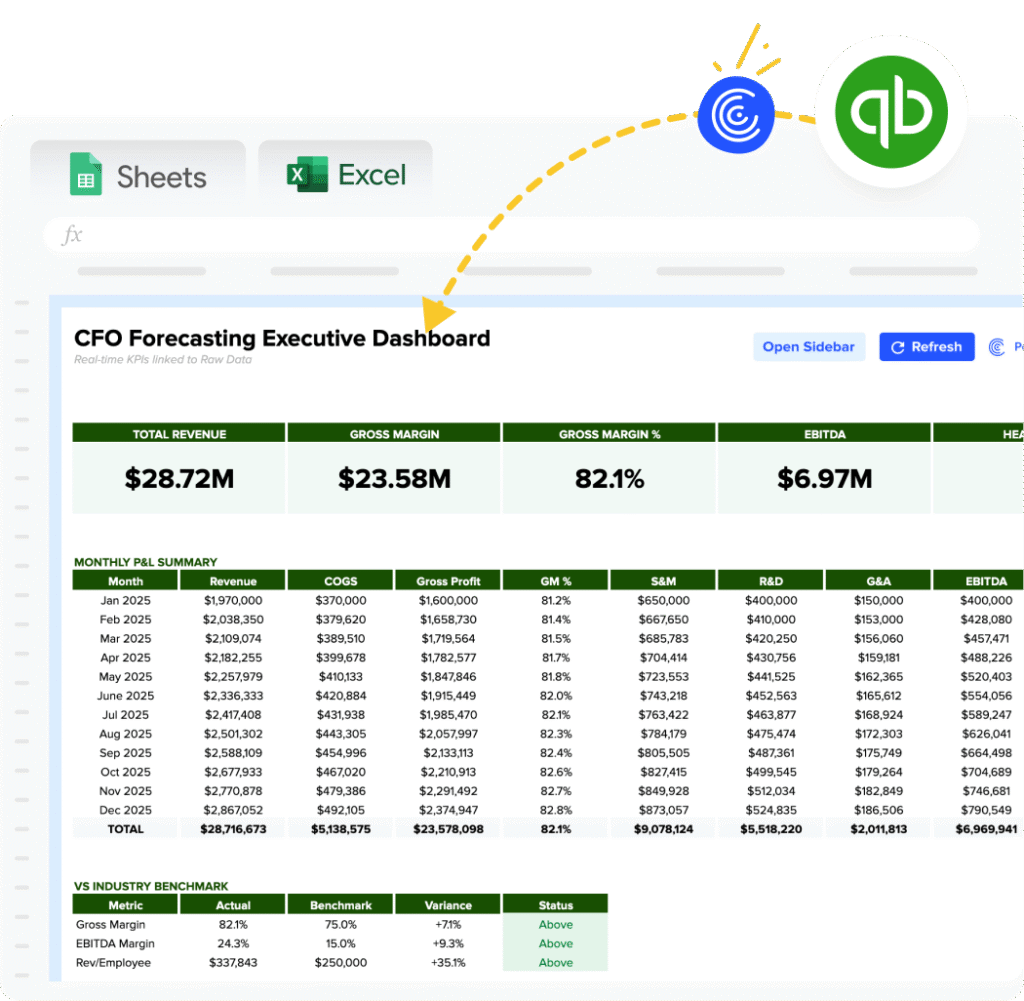

How to Calculate ROE in Google Sheets and Excel?

- Input Net Income in cell A1.

- Enter Total Shareholder Equity in cell A2.

- In cell A3, apply the formula =A1/A2 to compute the ROE.

- Format cell A3 as percentage for clarity.

Drawbacks of ROE

- Volatile Profits: Highly variable net income can lead to misleading ROE figures.

- Not Contextual: Doesn’t factor external economic conditions that might be affecting equity and income.

- Debt Overlook: Companies with high debt might show inflated ROE due to lower net equity.

When to Use the Calculator?

Utilize this ROE Calculator when analyzing company financial health, during audits, or when assessing investment opportunities to understand profitability trends over time.

Return on Equity (ROE) Calculator: Tips and Tricks

- Use automated data refreshes to keep your financial figures updated and accurate.

- Implement filters to focus your financial analysis on specific intervals or categories.

- Regularly verify data inputs for consistency and accuracy to maintain reliable ROE calculations.