Free Cash Flow = Operating Cash Flow – Capital Expenditure

KPIs needed to Calculate Free Cash Flow

– Operating Cash Flow: Money derived from your core business operations.

– Capital Expenditure: Funds used by a company to acquire, upgrade, and maintain physical assets.

How to Calculate Free Cash Flow?

Calculating Free Cash Flow (FCF) allows businesses to see how much cash they have available after maintaining or expanding their asset base. This calculation gives a clear indicator of financial health and potential for growth.

What is Free Cash Flow?

Free Cash Flow is a financial metric indicating the cash a company generates after accounting for cash outflows to support operations and maintain capital assets. It’s vital for assessing profitability, repaying debts, and funding growth.

Why is Free Cash Flow Important?

Understanding Free Cash Flow is crucial for any business focusing on growth, efficiency, and profitability. It represents the cash available for stakeholders and future investments, serving as a fundamental gauge of a firm’s financial health.

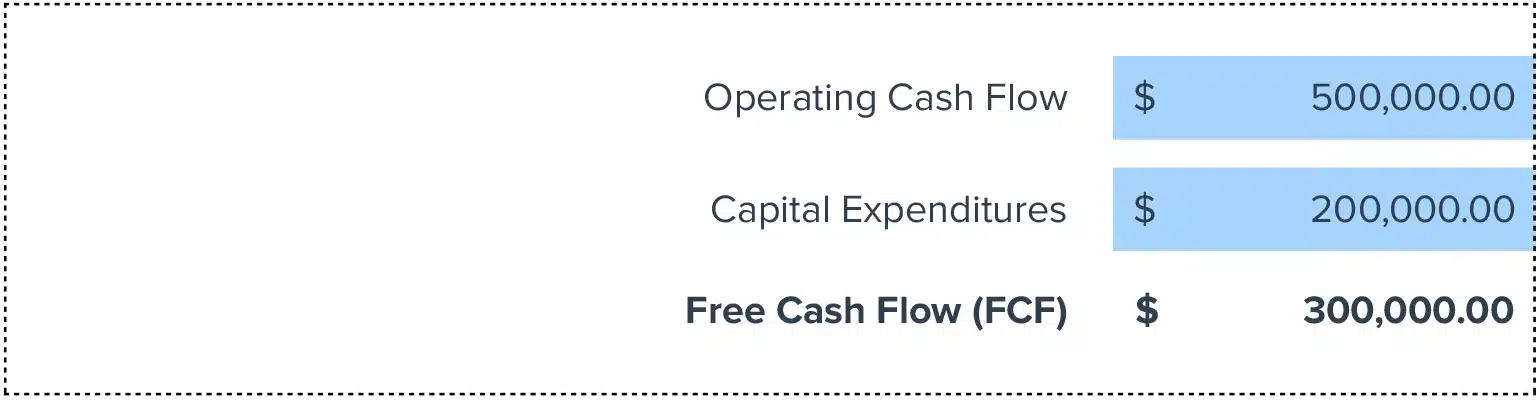

Calculating “Free Cash Flow” Example with Numbers

Imagine a company with $500,000 in Operating Cash Flow and $150,000 in Capital Expenditures for the year:

Free Cash Flow = $500,000 – $150,000 = $350,000

This figure represents the cash available for strategic investments, paying dividends, or reducing debt.

How to Improve Free Cash Flow

Optimize Operations

Streamline operational processes to maximize cash flow efficaciously.

Innovate your production or service delivery to reduce costs without sacrificing quality, potentially increasing your free cash flow.

Rationalize Capital Expenditures

Reassess your capital expenditures, ensuring they are tightly aligned with long-term strategic goals.

Avoid overspending on underperforming assets.

Enhance Receivables Collection

Improve your accounts receivable processes to shorten the cash conversion cycle.

Implement strict credit policies and consider offering discounts for early payments to speed up cash inflows.

Refinance Debt

If possible, refinance high-interest debts to reduce interest expenses, thereby improving your free cash flow.

Negotiate better terms or rates with creditors.

Divest Non-Core Assets

Sell off non-essential assets to increase liquidity.

This strategic move not only boosts your free cash flow but also helps you focus more on core business activities.

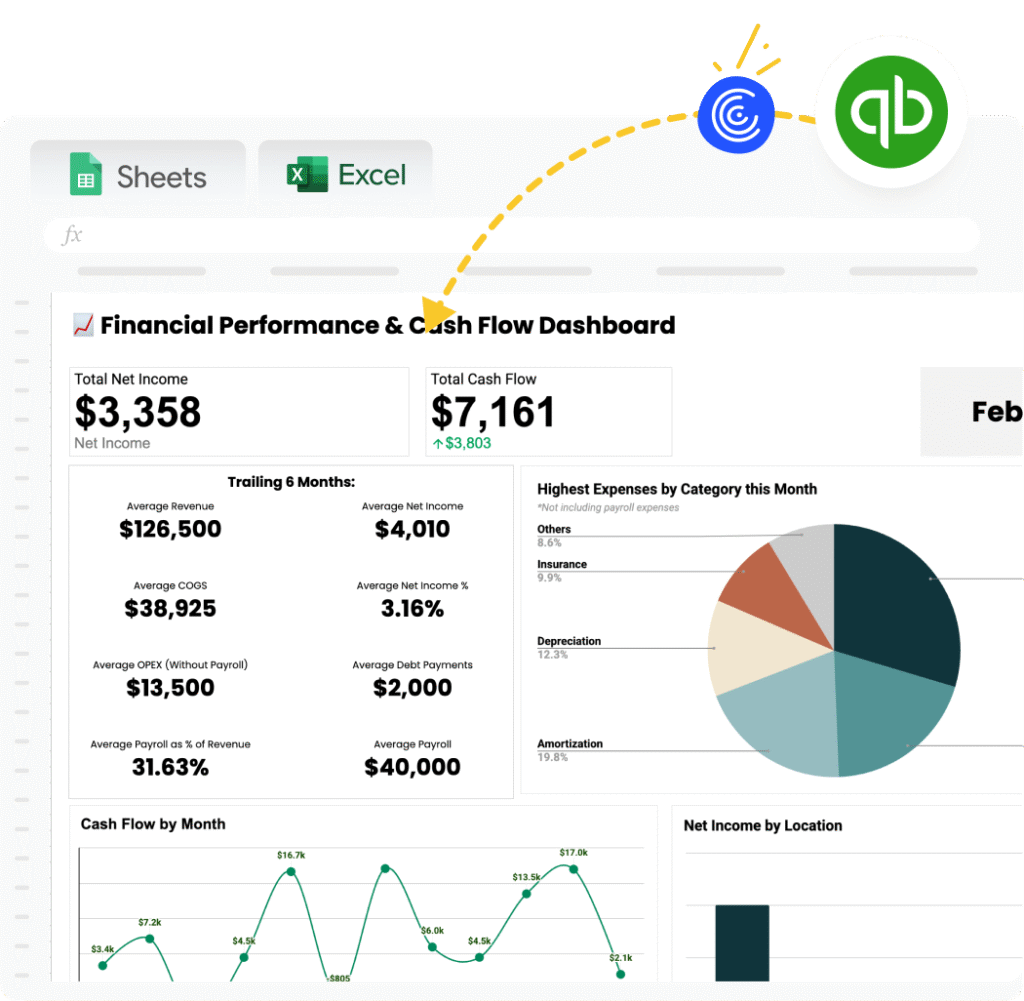

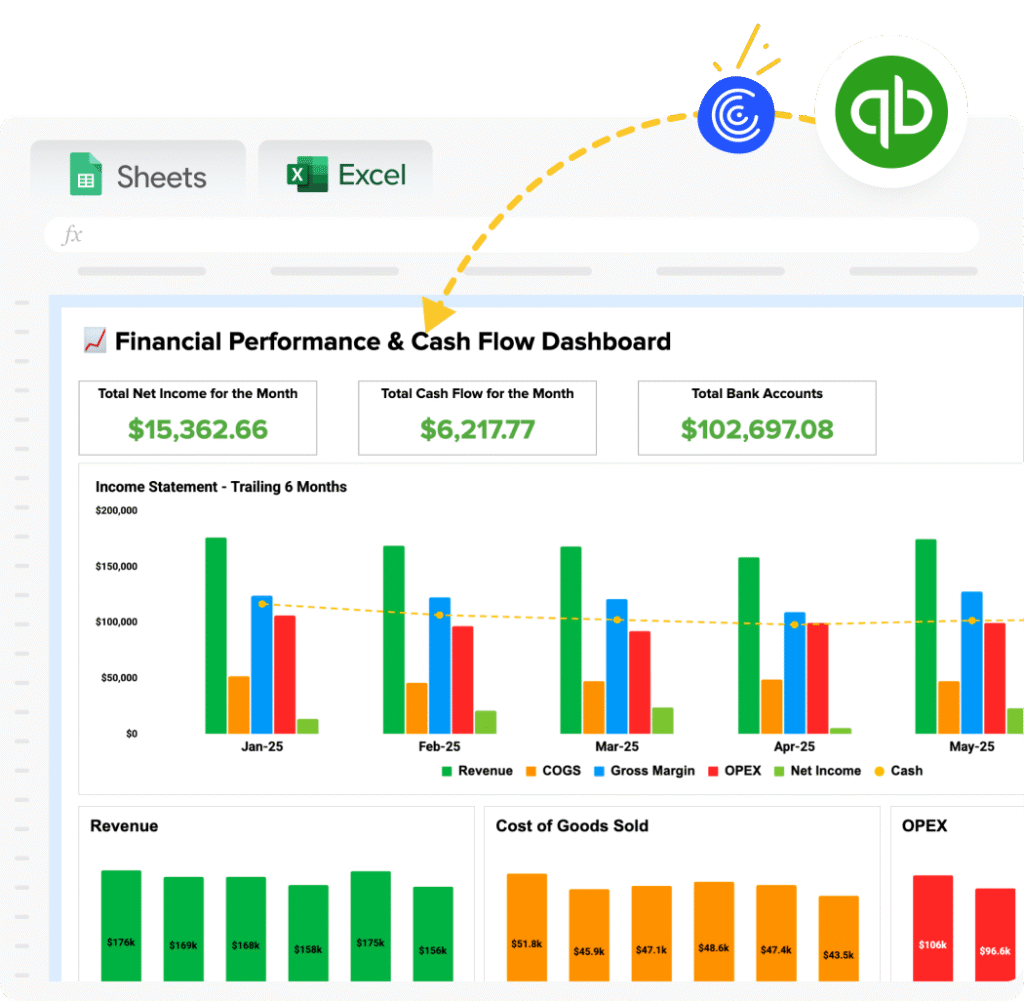

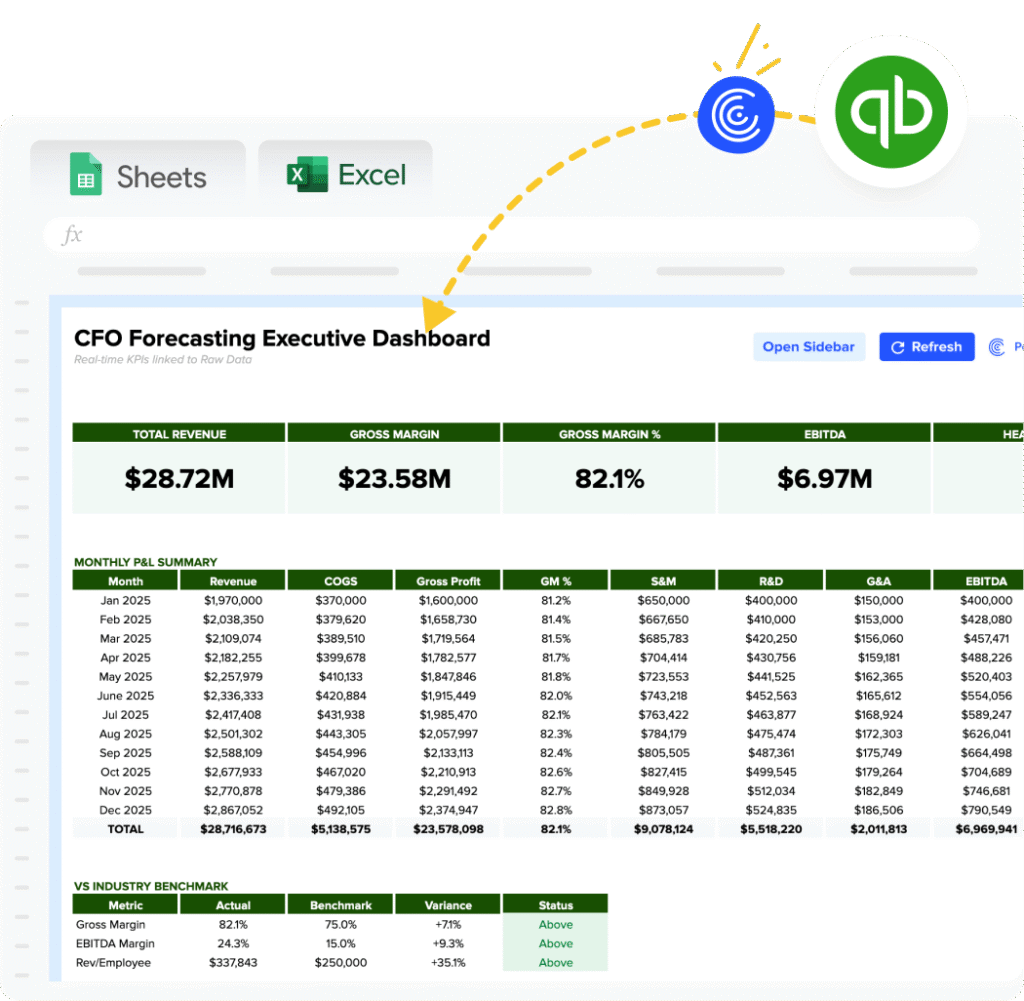

How to calculate Free Cash Flow in Google Sheets and Excel?

1. Google Sheets: Input Operating Cash Flow in cell A1 and Capital Expenditure in cell A2. Use the formula `=A1-A2` in cell A3 to calculate Free Cash Flow.

2. Excel: Similar to Google Sheets, enter Operating Cash Flow in A1, Capital Expenditure in A2, and apply the formula `=A1-A2` in cell A3.

Drawbacks of Free Cash Flow

Capital Expenditure Flexibility

High capital expenditures can temporarily depress free cash flow, not reflecting the company’s ongoing profitability.

Non-Cash Charges

Excludes non-cash charges like depreciation, which can make companies with heavy assets appear less profitable.

Short-Term Focus

Managers might cut necessary long-term investments to improve the free cash flow, potentially harming the firm’s prospects.

When to Use the Free Cash Flow Calculator

Utilize this calculator during financial reviews, strategy planning sessions, or when assessing the impact of potential investments or acquisitions. It’s particularly beneficial for stakeholders needing a snapshot of company liquidity and financial health.

Free Cash Flow Calculator: Tips and Tricks

– Schedule Regular Updates: Keep your inline data sources current with scheduled refreshes.

– Error-Tracking: Implement error-checking formulas to maintain data accuracy.

– Efficient Data Imports: Use easy connection features for faster data importing from financial systems.