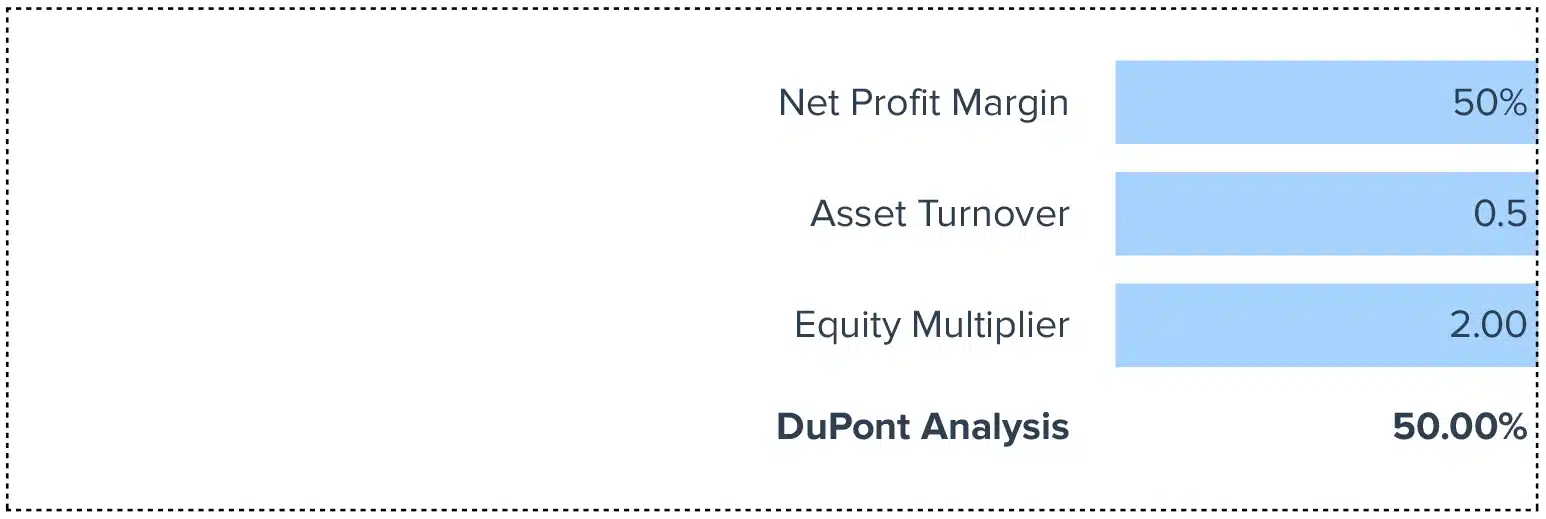

Dupont Analysis = (Net Profit Margin) * (Asset Turnover) * (Equity Multiplier)

Unlock insight into your company’s financial health—download our Dupont Analysis calculator for your spreadsheet today.

How to Perform a Dupont Analysis

Calculate each of the three components separately and then multiply them together to get the Dupont Analysis.

What is Dupont Analysis?

Dupont Analysis is a comprehensive tool used by finance professionals to dissect the components that drive a company’s return on equity (ROE). It helps in understanding how operating efficiency, asset use efficiency, and financial leverage impact overall profitability.

Why is Dupont Analysis Important?

It provides a deeper understanding of the underlying factors affecting ROE, allowing finance managers to identify areas of strength and weakness within the company’s operations.

Calculating Dupont Analysis Example

Consider a business with net income of $150,000, revenue of $1,500,000, total assets of $750,000, and shareholders’ equity of $300,000:

- Net Profit Margin = $150,000 / $1,500,000 = 0.1

- Asset Turnover = $1,500,000 / $750,000 = 2

- Equity Multiplier = $750,000 / $300,000 = 2.5

Dupont Analysis = 0.1 * 2 * 2.5 = 0.5 or 50%

How to Improve Dupont Analysis

Enhance Net Profit Margin

- Optimize Costs: Review operational expenses and optimize supply chain management.

- Boost Revenue: Introduce new products or improve marketing strategies to increase sales.

Improve Asset Turnover

- Asset Management: Regularly audit asset utilization to maximize their productivity.

- Invest Wisely: Allocate funds to high-return assets.

Increase Equity Multiplier

- Debt Management: Use debt wisely to finance growth while avoiding excessive leverage.

- Equity Reduction: Buy back equity to improve ROE, justifying with sustained higher returns.

How to Perform Dupont Analysis in Spreadsheets

Google Sheets:

- Enter Net Profit Margin in cell A1.

- Enter Asset Turnover in cell A2.

- Enter Equity Multiplier in cell A3.

- Use the formula

=A1*A2*A3in cell A4.

Drawbacks of Dupont Analysis

- Limited Scope: Focuses only on ROE components, ignoring other performance metrics.

- Static Analysis: Provides a snapshot, lacking dynamic performance evaluation.

- Overemphasis on Leveraging: High debt can boost ROE but increases financial risk.

When to Use the Dupont Analysis Calculator

Utilize this calculator during annual financial reviews, strategy-setting meetings, or when reassessing business models to ensure comprehensive understanding and efficient decision-making.

Dupont Analysis Calculator: Tips and Tricks

- Utilize conditional formatting to highlight key changes and trends directly in your spreadsheet.

- Regularly update values to maintain accuracy of your financial analysis.

- Employ clear labeling and documentation for transparency and easy collaboration.