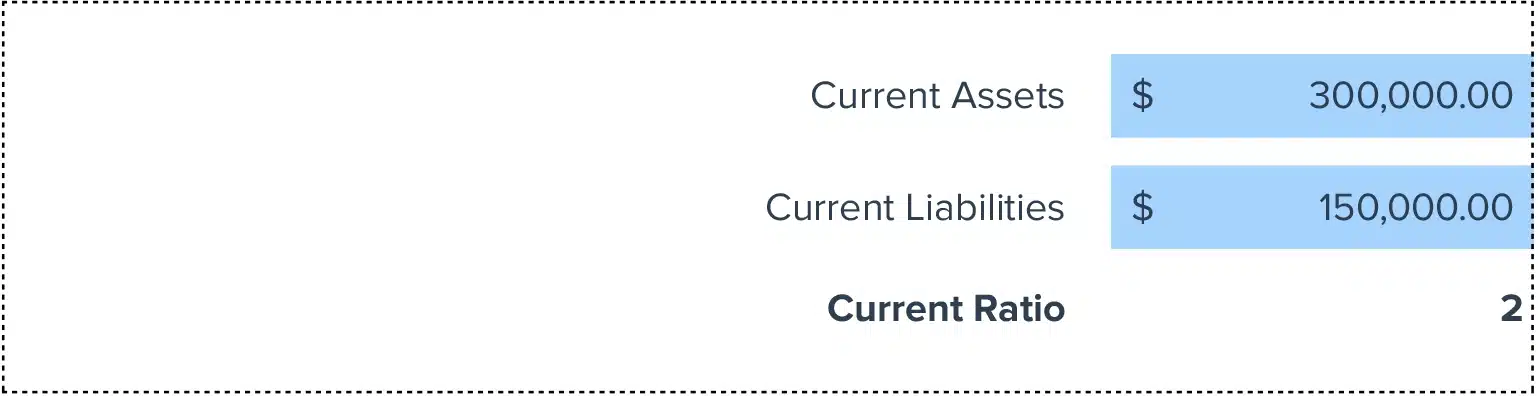

Current Ratio = Current Assets / Current Liabilities

Maximize your financial analysis with our free Current Ratio Calculator, tailored to your organizational needs.

Unlock the potential to swiftly assess your company’s liquidity and make informed financial decisions.

How to Calculate Current Ratio?

- Determine Current Assets: Identify all assets that can be converted into cash within one year.

- List Current Liabilities: Compile all debts and obligations due within the upcoming year.

- Divide Assets by Liabilities: Use the formula to calculate the Current Ratio for a clear view of your company’s short-term financial health.

What is Current Ratio?

The Current Ratio is a key indicator used by businesses to evaluate their ability to pay off short-term liabilities with short-term assets. This metric is crucial for assessing a company’s liquidity and overall financial stability.

Why is Current Ratio Important?

An essential tool for financial management, the Current Ratio helps businesses ensure they have enough liquidity to meet their short-term obligations. It provides stakeholders with a snapshot of financial health, indicating whether a company can cover upcoming bills without selling off long-term assets.

Calculating Current Ratio: Example with Numbers

Consider a business with $500,000 in current assets and $250,000 in current liabilities. Using the formula:

Current Ratio = $500,000 / $250,000 = 2.0

This indicates the business has twice as many assets as liabilities, showcasing strong financial health.

How to Improve Current Ratio?

- Optimize Inventory Management: Reduce excess stock to free up cash, improving your Current Ratio.

- Renegotiate Payment Terms: Extend payable periods with suppliers to delay outflows, enhancing liquidity.

- Monitor Receivables: Expedite invoice payments from clients to ensure a steady cash flow.

- Manage Debt Smartly: Refinance or consolidate short-term debt to longer terms, reducing immediate liabilities.

- Increase Current Assets: Focus on boosting sales or finding alternative revenue streams to elevate asset levels.

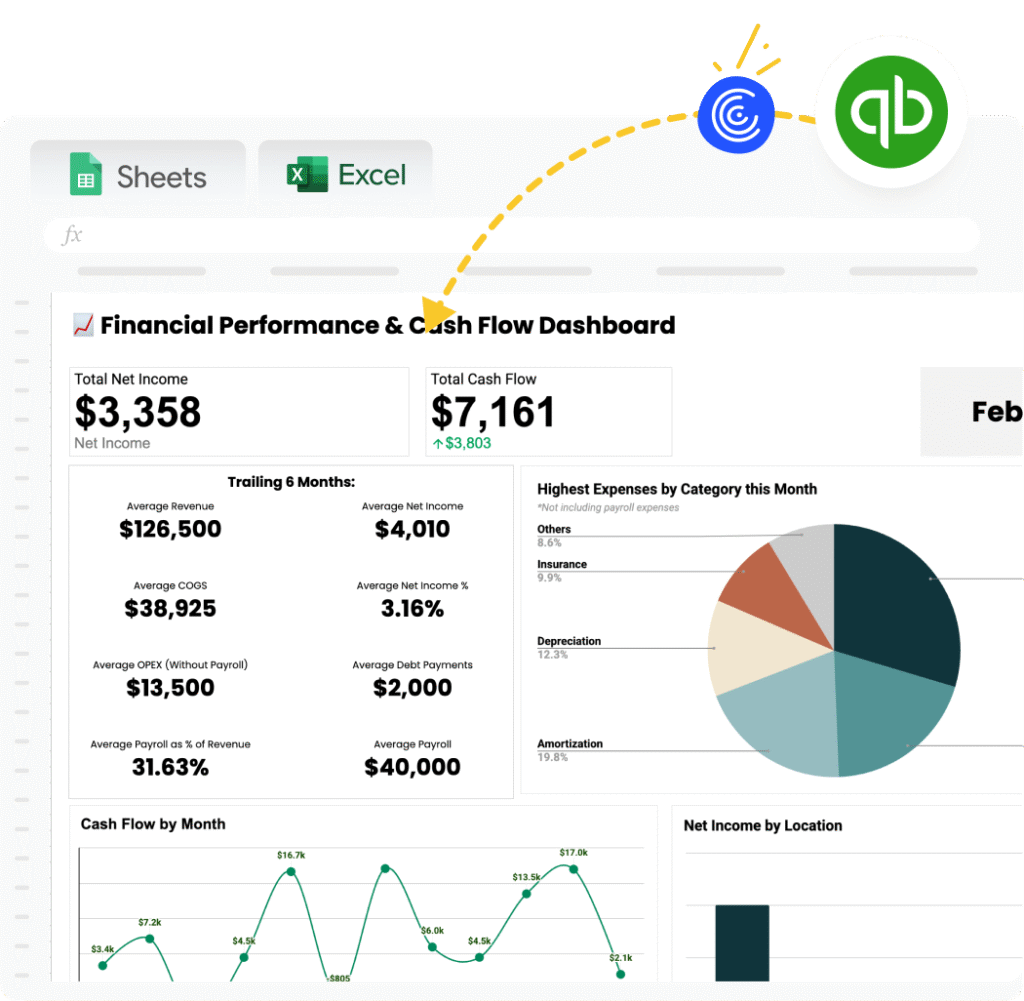

How to Calculate Current Ratio in Google Sheets and Excel?

- Step 1: In cell A1, input your total current assets.

- Step 2: In cell A2, enter your total current liabilities.

- Step 3: In cell A3, apply the formula =A1/A2 to compute the Current Ratio.

Drawbacks of Current Ratio

- Oversight of Asset Quality: Does not account for the quality or liquidity speed of current assets.

- Variable Interpretations: Context such as industry standards can significantly alter its implications.

- Short-term Focus: May encourage practices aimed solely at improving the metric, not overall financial health.

When to Use the Current Ratio Calculator?

Utilize this calculator when preparing for financial reviews, during budgetary meetings, or when assessing the impact of potential financial decisions. It is especially valuable for businesses looking to secure new funding or loans.

Current Ratio Calculator: Tips and Tricks

- Automated Data Imports: Utilize importing features to effortlessly update financial data.

- Scheduled Refreshes: Ensure your financial ratios are always calculated from the latest data.

- Alerts for Critical Changes: Set up notifications for significant changes in your Current Ratio.