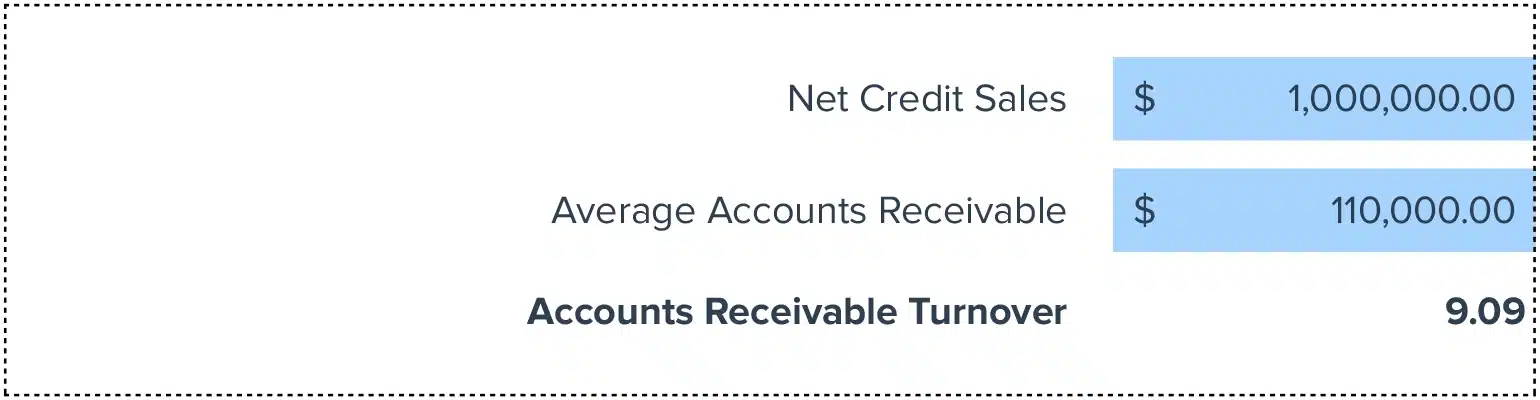

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

KPIs needed for AR Turnover Calculation –

Net Credit Sales:

This represents the total amount of sales made on credit, excluding returns and allowances.

Average Accounts Receivable:

Calculated by adding the opening and closing balances of accounts receivable for a period and then dividing by two. This gives a fair average for the period.

How to Calculate Accounts Receivable Turnover?

1. Identify the total net credit sales for the period.

2. Calculate the average accounts receivable from the beginning and end of the period.

3. Divide the net credit sales by the average accounts receivable to find the turnover rate.

What is Accounts Receivable Turnover?

The Accounts Receivable Turnover Calculator is a financial tool that measures how efficiently a company collects its receivables over a period. It highlights the frequency at which a company clears its accounts receivables through earnings.

Why is Accounts Receivable Turnover Important?

Understanding accounts receivable turnover is vital for assessing a company’s financial health. A higher turnover ratio indicates effective credit and collection policies, signifying efficient management and quicker cash inflows.

Calculating Accounts Receivable Turnover with an Example

Let’s say a company has net credit sales of $500,000 and an average accounts receivable of $50,000. The formula would be:

$500,000 / $50,000 = 10

This result shows that the company collects its receivables 10 times per year.

How to Improve Accounts Receivable Turnover

Regular Review of Accounts

Review your accounts receivable regularly to identify delays or defaults in payments. Early detection enables proactive management steps.

Streamline Billing Processes

Ensure your billing processes are clear and error-free. Fast and accurate billing supports prompt payments from customers.

Tighten Credit Policies

Implement robust credit policies by conducting thorough credit checks on new clients and setting appropriate credit limits.

Foster Strong Customer Relationships

Maintain open, communicative relationships with your clients. This practice can lead to quicker dispute resolutions and faster payments.

Use Incentives and Penalties

Offer early payment discounts and impose late fees to encourage timely payments. This approach balances carrot and stick incentives.

How to Calculate Accounts Receivable Turnover in Google Sheets and Excel?

1. In cell A1, enter your net credit sales.

2. In cell A2, input your starting accounts receivable balance and the closing balance in cell A3.

3. Compute the average accounts receivable in cell A4 with the formula =AVERAGE(A2,A3).

4. Calculate the turnover in cell A5 with the formula =A1/A4.

Drawbacks of Accounts Receivable Turnover Calculator

Interpretation Variance

Different industries have varying benchmarks, making it hard to draw generalized conclusions without industry context.

Data Accuracy

Accurate input data is crucial. Inaccurate data leads to misleading turnover calculations.

Overlooking Cash Sales

This calculation only considers credit transactions, potentially skewing the understanding of a company’s total sales efficiency.

When to Use the Accounts Receivable Turnover Calculator

Utilize this calculator during your financial review periods or when assessing the effectiveness of new credit policies. It’s particularly useful for gauging changes in credit collection strategies.

Accounts Receivable Turnover: Tips and Tricks

– Schedule regular reviews of your turnover ratio to identify trends.

– Align your billing cycles neatly to avoid discrepancies in data.

– Use color coding in your spreadsheets for clear, visual distinctions between different types of entries.