Accounts Payable Turnover = Total Purchases / Average Accounts Payable

KPIs needed for AP Turnover Calculation –

– Total Purchases: The total amount the company spent buying goods and services from suppliers within a given period.

– Average Accounts Payable: The average amount owed to suppliers during the same period, calculated as (beginning accounts payable + ending accounts payable) / 2.

How to Calculate Accounts Payable Turnover

By dividing your total purchases by the average accounts payable, you determine the frequency at which your business pays off its suppliers over a specific period.

What is Accounts Payable Turnover?

Accounts Payable Turnover is a financial metric that shows how quickly a company pays its suppliers. This ratio reflects the company’s ability to manage its debts effectively and maintain good relationships with vendors.

Why is Accounts Payable Turnover Important?

Monitoring this ratio helps businesses assess their liquidity and operational efficiency. A higher turnover rate might suggest that the company is proficient at clearing debts, which can strengthen supplier relations and potentially qualify the business for more favorable terms.

Calculating Accounts Payable Turnover – Example

Scenario: A company has purchases totaling $1,000,000 this year. The accounts payable at the start and end of the year are $200,000 and $300,000, respectively.

Calculation:

Average Accounts Payable = ($200,000 + $300,000) / 2 = $250,000.

Accounts Payable Turnover Ratio = $1,000,000 / $250,000 = 4.

This means the company pays off its suppliers about four times a year.

How to Improve Accounts Payable Turnover

Optimize Payment Terms

Renegotiate payment terms with suppliers for longer periods. Having additional time to pay can improve cash flow management, allowing more strategic financial planning.

Prioritize Supplier Payments

Prioritize payments to key suppliers to secure essential goods and services. Timely payments enhance supplier relationships and can lead to better pricing or terms.

Leverage Early Payment Discounts

Take advantage of discounts offered for early payments. This not only saves money but also increases your turnover ratio, reflecting better on financial statements.

Implement Automated Payment Systems

Use automated systems to ensure timely payments. Automation reduces the risk of late payments, improving turnover rates and administrative efficiency.

Regular Audit of Accounts Payable

Conduct periodic audits to spot inefficiencies or errors in the accounts payable process. Ensuring accuracy in records can prevent overpayments and optimize the payment cycle.

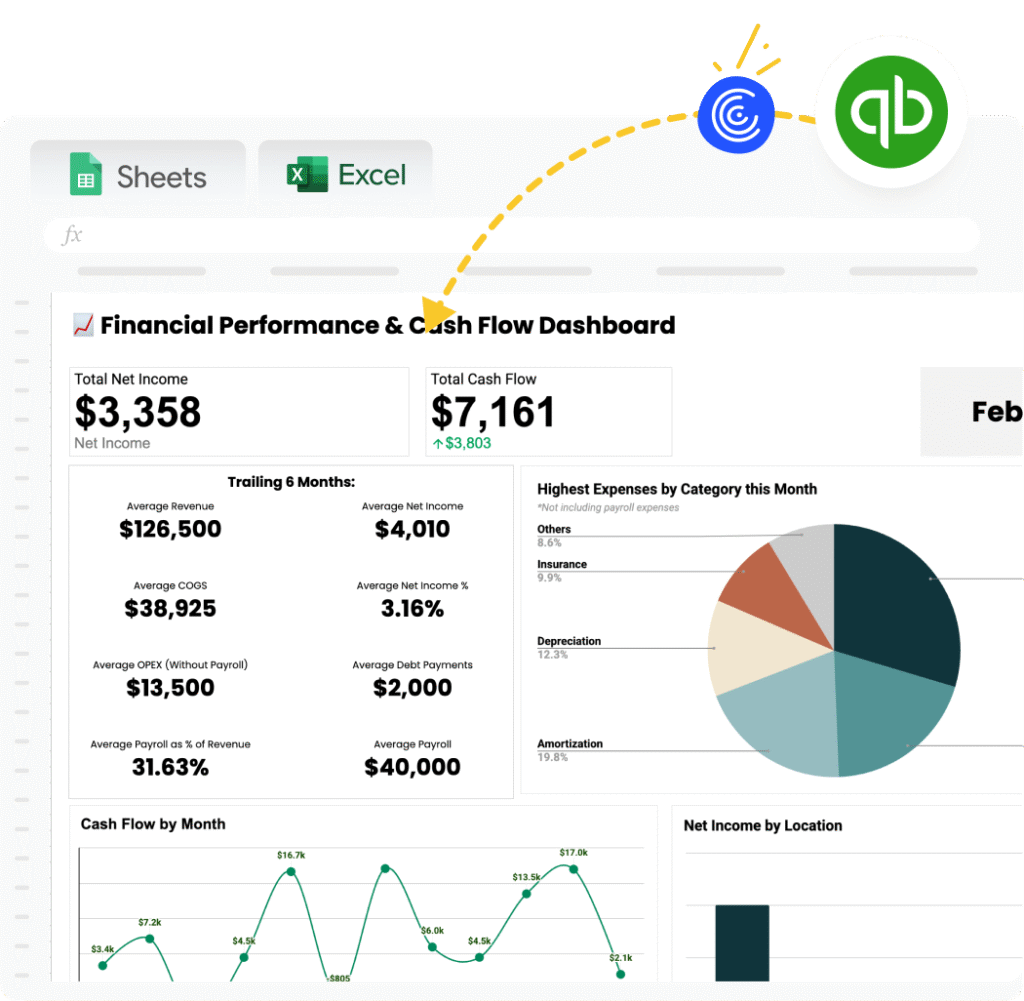

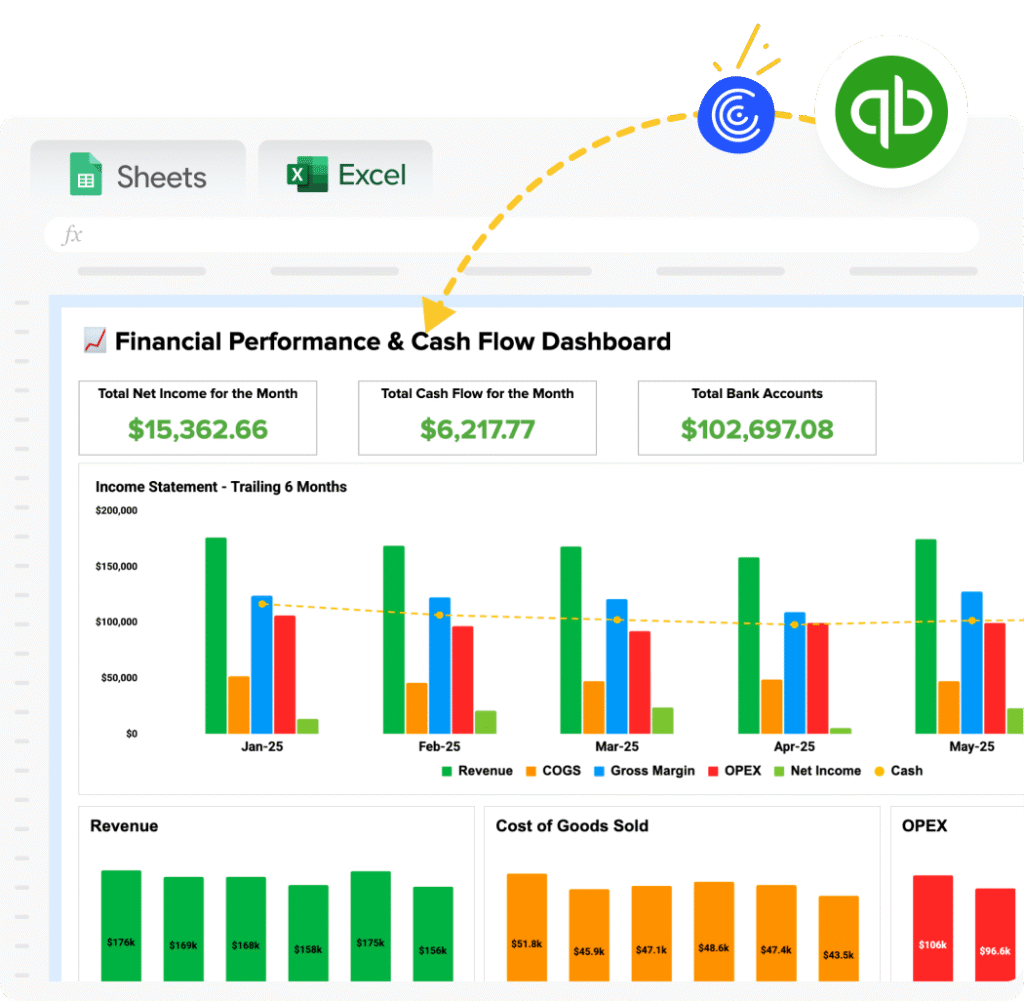

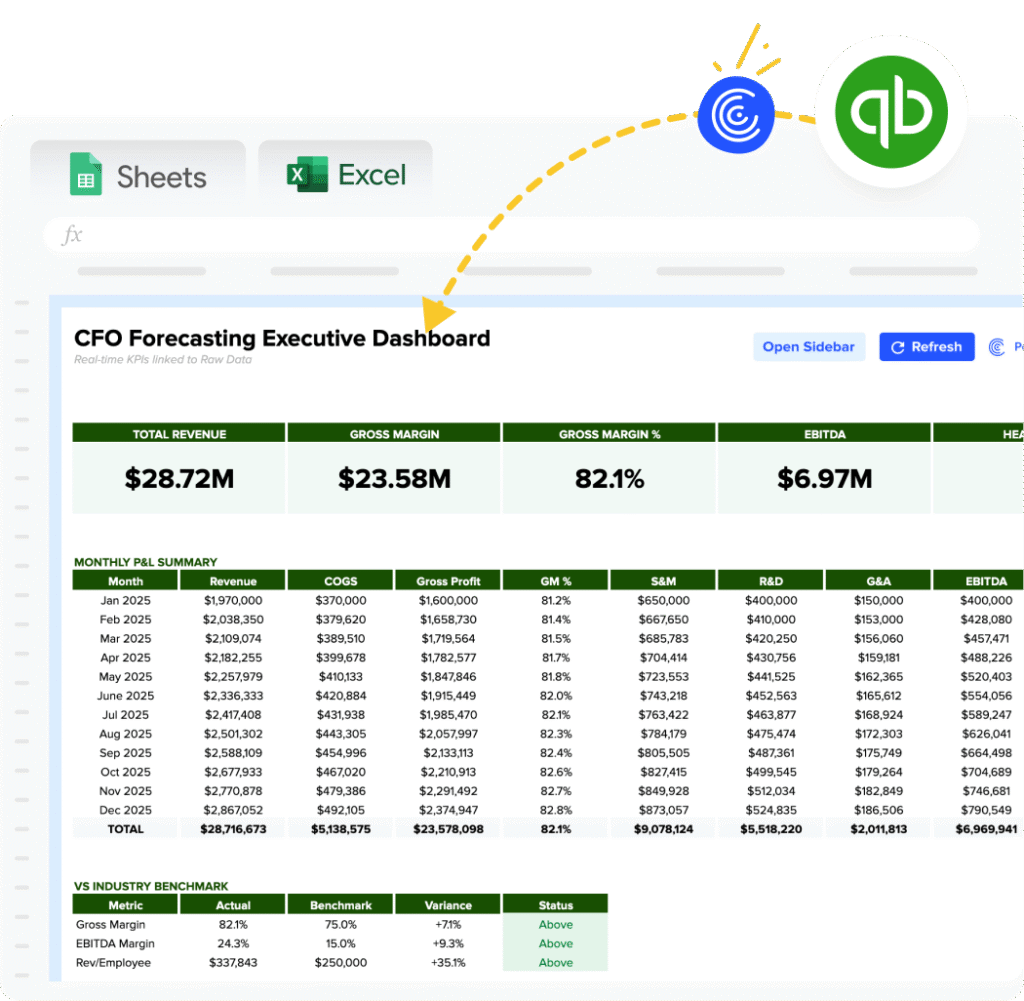

How to Calculate Accounts Payable Turnover in Google Sheets and Excel

1. Insert total purchases in cell A1.

2. Place beginning accounts payable in cell B1 and ending accounts payable in cell B2.

3. Calculate average accounts payable in cell B3 using the formula = (B1+B2)/2.

4. In cell A4, apply the formula =A1/B3 to compute the turnover ratio.

Drawbacks of the Accounts Payable Turnover Ratio

– Varying Industry Standards: Different sectors have unique credit terms; thus, one ratio does not universally apply.

– Short-term Fluctuations: Temporary financial decisions can skew the ratio, not truly reflecting the company’s financial condition.

– Misleading in Isolation: Without context, such as company strategy or economic conditions, this metric can be misleading.

When to Use the Accounts Payable Turnover Calculator

Utilize this calculator during financial reviews, budgeting sessions, or when assessing the efficiency of your accounts payable process. It’s especially beneficial for finance teams aiming to optimize cash flow and supplier relationships.

Coefficient.io + Accounts Payable Turnover Calculator: Tips and Tricks

– Use the Import Refreshes feature in COefficient to keep your financial data current without manual updates.

– Set up Automations to alert you when your turnover ratio falls outside of your target range.

– Utilize Snapshots to document and compare turnover rates over different periods.