QuickBooks Online (QBO) from Intuit is cloud-based accounting software trusted by business owners and CPAs. As a complete accounting system, QBO offers powerful job costing capabilities that help track expenses and revenue for each specific job.

Job costing is a bookkeeping method that assigns costs to specific jobs or work orders. This feature helps organizations analyze their finances at a granular level and understand what each particular job is costing them, leading to more informed business decisions.

Before Getting Started

To do job costing in QuickBooks Online, you’ll first need these key pieces of information in your QBO instance:

- Labor costs – Track hours worked on a particular job to calculate wage expenses

- Material costs – Record dollars spent on materials for each individual job

- Overhead costs – Track expenses not directly tied to production, such as rent, insurance, and utilities

Step-by-Step Guide: Job Costing in QBO

Step 1: Enable Job Costing

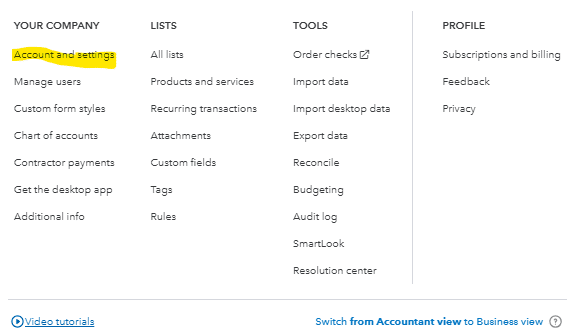

Within QBO, navigate to the gearbox in the top right of your screen to open settings.

Click the gearbox to see a drop-down menu. Select ‘Account and Settings’ under Your Company.

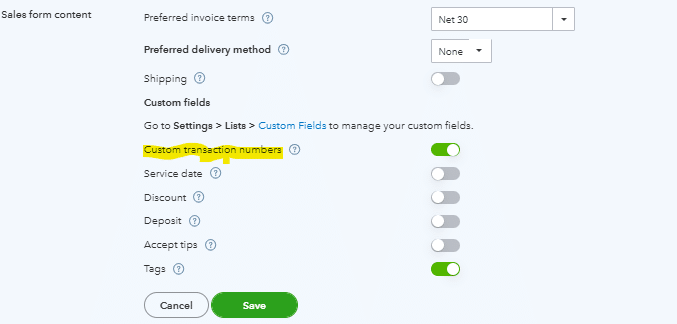

In the Sales section, turn on Custom Transaction Numbers.

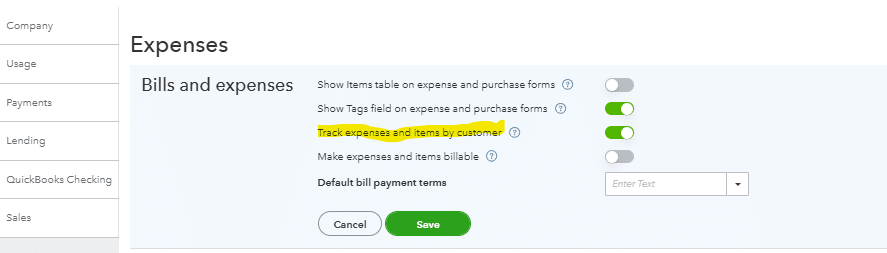

In the Expenses section, enable ‘Track expenses and items by customer’.

Step 2: Add Customers / Projects

In order to calculate job costs by customer and project, you will need to add the corresponding customer and project in QuickBooks.

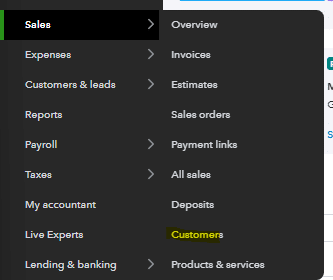

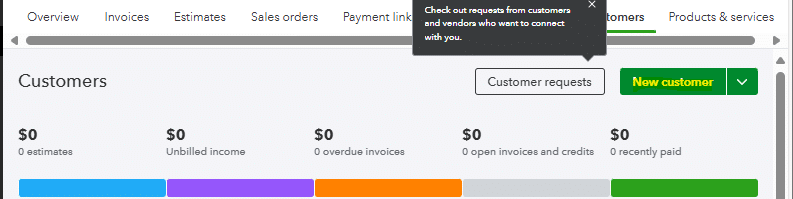

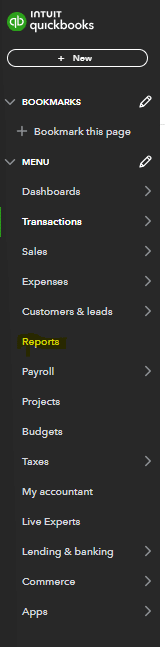

To add a customer, navigate to the sales section of the menu and select customers.

Select ‘New Customer’ in the top right corner.

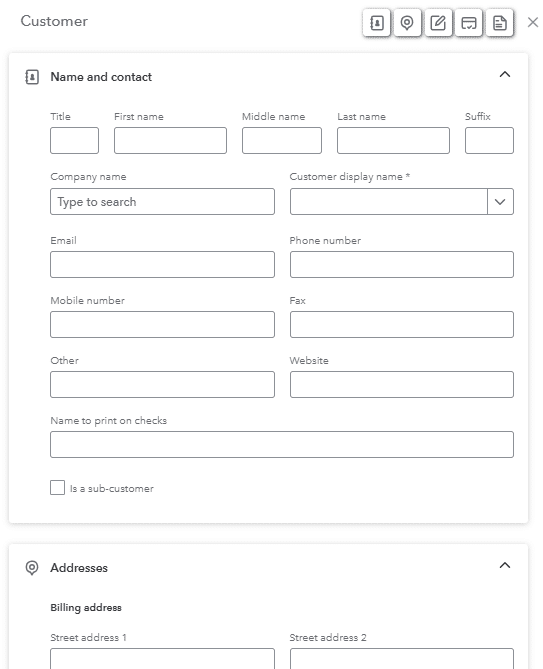

You will then be prompted to fill in your customer’s information, including name and contact, address, payment method, tax information, etc.

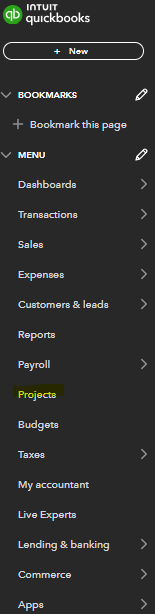

Once you’ve set up your customer, you can set-up your project. The project module is in the main drown-down menu.

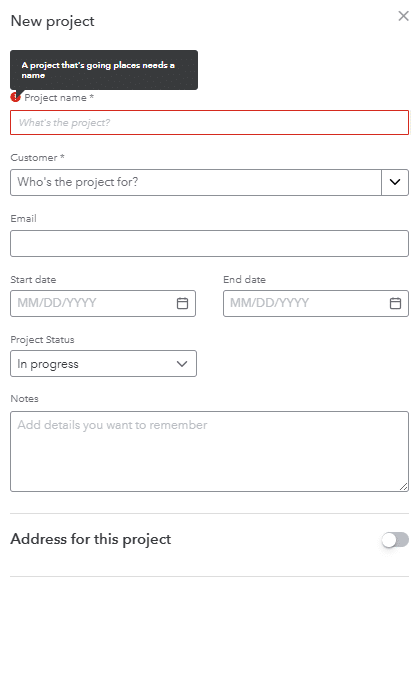

Once you’ve selected the project you will be prompted to add the project name, customer that you just set-up, email, and then the start and end date.

Step 3: Add Job Estimate

Now that you’ve got your customer and project set-up you can create an estimate for the job. This will allow you to add quotes from vendors and track how well you are performing against that estimate as actual expenses come in for that job.

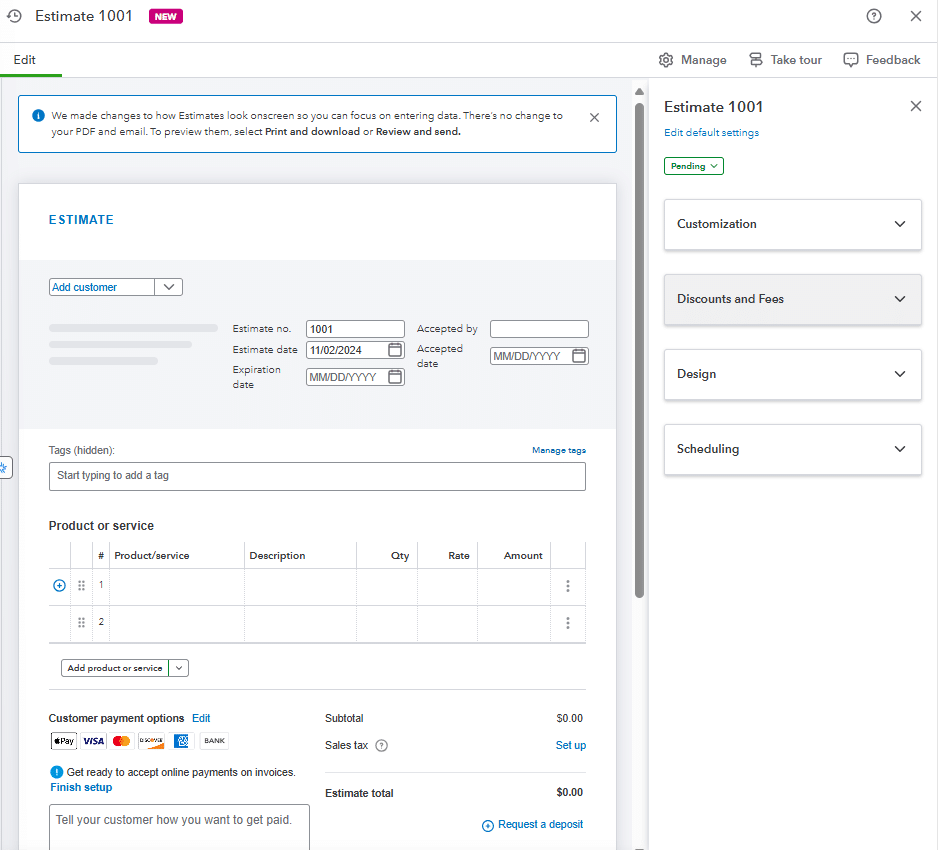

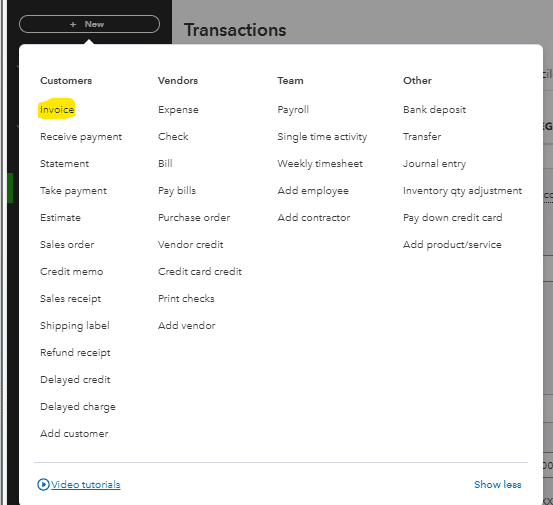

To add an estimate for the job you click the + New button on the QBO homepage and select estimate under the customers column.

Once in the estimate module you will have multiple fields to fill out including the customer, notes from the vendor, copy of a quote, dates, scheduling, payment options, and many more.

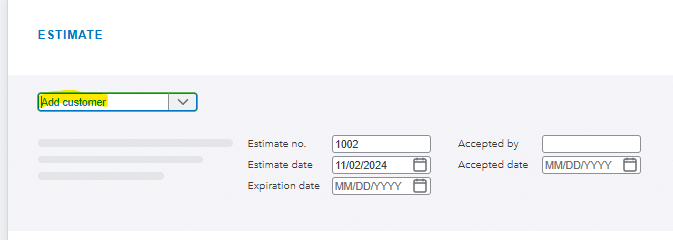

Once you’ve filled out the relevant information in the estimate module for your vendor and project, you can assign the estimate to the project/job previously created.

To do this you have to select the correct customer/project within the add customer dropdown on the estimates screen.

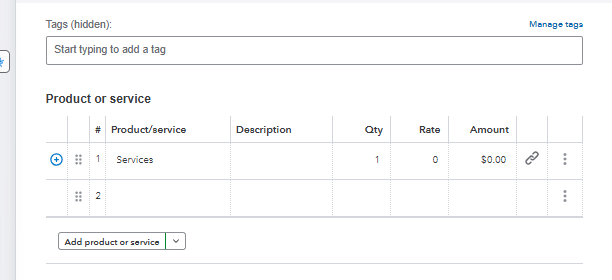

Once you’ve added the customer and project you can get more granular and provide additional details on what that vendor is doing as a part of this project. You can select if they are performing services or providing products & services, and add the corresponding cost associated with those goods or services.

Step 4: Vendor Invoicing

Now that your customer, particular job, and estimate are set-up in QBO, the invoicing process will provide actual costs and revenue information for accurate job costing. This is especially important for construction companies managing multiple construction projects.

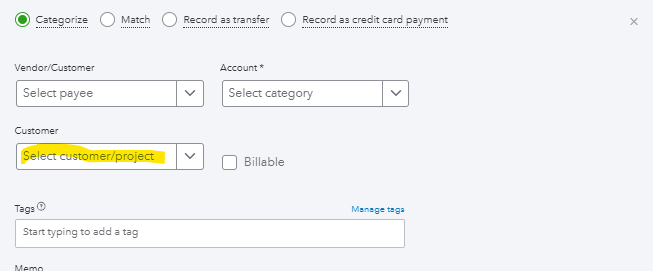

On the vendor side, you receive invoices that you’ll match against the corresponding project. As you process credit card transactions or vendor invoices, assign the customer and project from steps 1 and 2 to each transaction.

This track expenses feature ensures each expense pulls through into your job costing reports and helps monitor project costs in real-time.

Step 5: Customer Invoicing

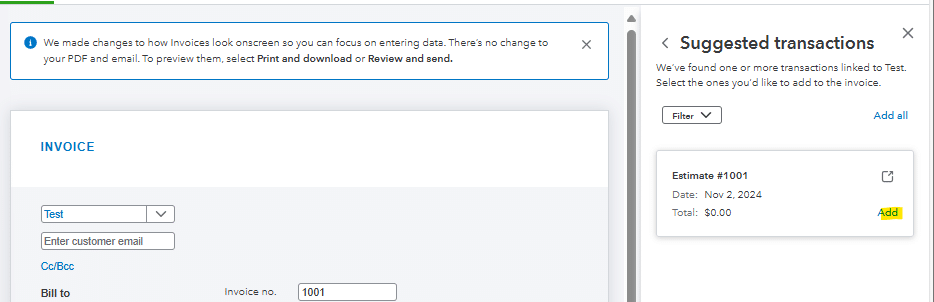

While processing vendor invoices, you’ll need to create invoices for your customers. The method and frequency depend on your contractual terms and agreed billing method.

For construction accounting, some clients prefer progressive billable hours tracking, while others want a single invoice upon project completion. Always refer to your agreement for proper invoicing terms.

To create an invoice from your estimated costs:

- Select the + New button in the main menu

- Choose invoice under the customers column

- Import your previous estimate into the invoice module

- Add your products & services

Once you’ve added the estimate, you can adjust as needed. If scope changes occur, you may need to modify costs or add services before sending. This flexibility helps maintain accurate project profitability tracking.

Once you’ve added the estimate to your invoice you can make any necessary changes to the estimate you need to. If there was a change in scope from the initial estimate you may need to add incremental cost or an additional service/product to your invoice before sending it.

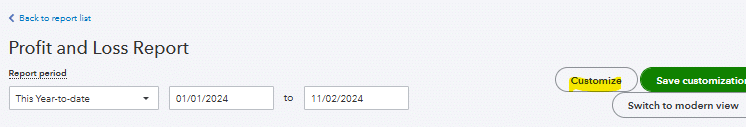

Step 6: Job Cost Reporting

As you invoice your customers and receive invoices from your vendors you will be able to do job costing reports out of QBO to see the profitability and profit margin of each particular job. In order to do this you will want to navigate to the reports section in QBO.

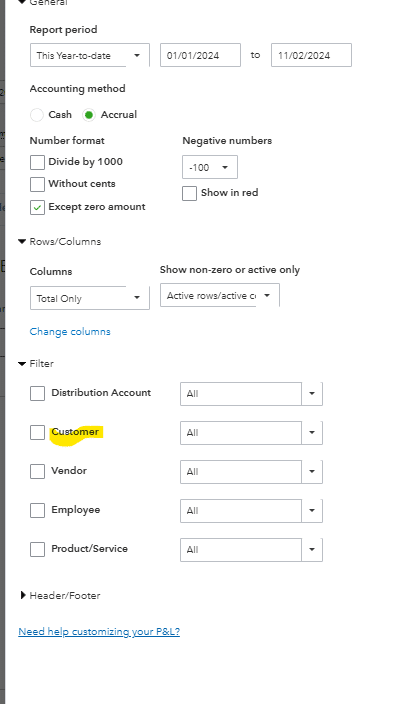

Once in the reports module you can select the financial reports and Profit and Loss Report and then select customize in the top right corner of the report.

Once in the customize section you will be able to select that particular job and project within the customer filter. This will allow you to pull in all of the corresponding revenue and actual costs associated with that specific job during the time period you’ve specified.

After you’ve done this you are able to do job cost reporting that can be shared in real-time with stakeholders throughout your organization.

Use Cases for Job Costing in QuickBooks Online

Job costing provides valuable insights for business owners and CPAs using this accounting system. It helps:

- Distribute real-time information to stakeholders tracking multiple projects

- Track costs and revenue precisely, especially useful for construction business operations

- Monitor project profitability across different customer segments

- Integrate with timesheets for accurate labor costs tracking

- Generate detailed job costing reports for better business decisions

- Improve cash flow management and project planning

- Support comprehensive construction accounting needs

- Monitor actual costs against estimated costs

- Maintain accurate profit margin calculations

- Enable precise time tracking for billable hours

Improve Your Job Costing

Job costing is a very important tool for business planning and decision making. It can help an organization look at their financials at a more granular level to see which jobs, projects, or customers are more profitable than others. It can also help organizations estimate more accurately to improve pricing and reduce the variance in estimates to customers. By following this guide, you will be able to do job costing across all of the jobs/projects your organization performs.

Ready to take your data analysis to the next level?

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time analysis and more advanced financial modeling.