As a trusted accounting software for small business owners, QuickBooks Online (QBO) offers powerful financial reporting capabilities through its company snapshot feature.

This tutorial will guide you through sharing these vital financial statements and performance metrics with stakeholders, helping you leverage custom reports for better business insights.

Let’s get started!

Step-by-Step Guide: Share Financial Reports in QBO

Several company snapshot views can be generated to analyze your financial performance, including:

- My Income – A graph showing revenue across your chosen time period (last year or current)

- My Expenses – A graph displaying expenses that affect your income statement

- Previous Year Comparison – Track performance against last year with integrated forecasting capabilities

- Accounts Receivable – Monitor who owes you money through the “Who Owes Me” report

- Accounts Payable – Track vendor payments through the “Whom I Owe” report

- Balance Sheet Overview – Review your assets, liabilities, and equity

- Cash Flow Statement – Monitor your cash position

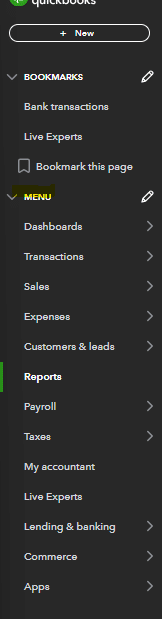

Step 1: Navigating in QBO

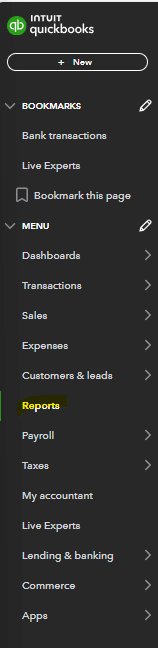

After signing into your company file, navigate to the drop-down menu at the left side of your screen. While this guide focuses on Quickbooks Online, note that Quickbooks Desktop users will find similar functionality.

Select the reports section where you’ll find various Quickbooks reports including your loss report options.

Once in the reports module you will need to scroll down to the business overview section and select the company snapshot report.

Step 2: Review Your Business Snapshot Dashboard Options

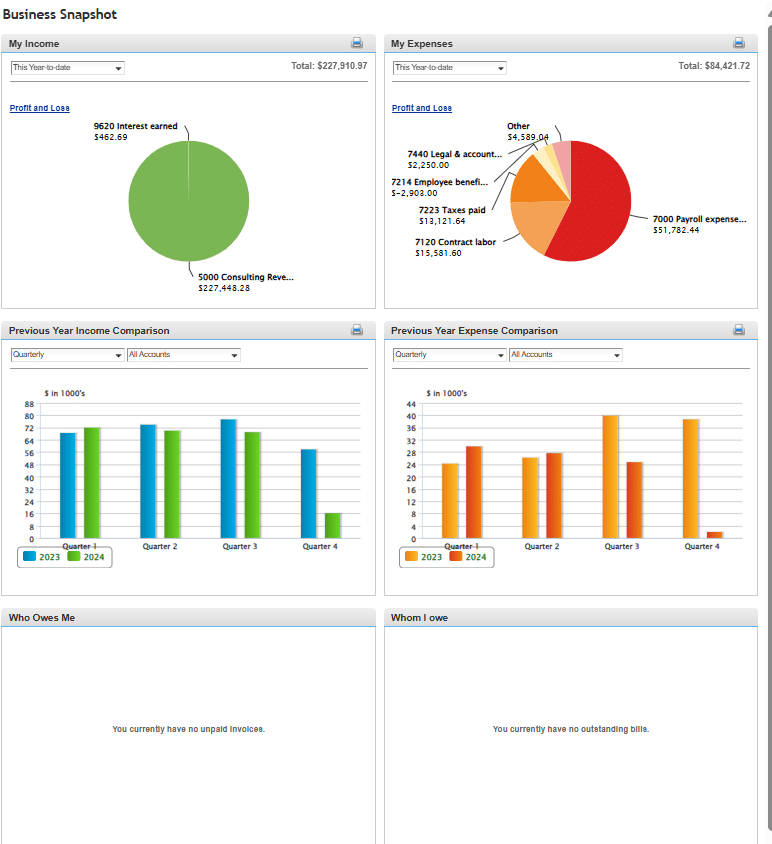

Once you’ve navigated to the business snapshot report within the business overview section you will see the screen below.

Once here you will have the option to change information pulling into the business snapshot.

- My Income – Select the relevant time frame you want to pull into the snapshot (This Year-to-Date, Last Month, Last Quarter, Last Year).

- My Expenses – Select the relevant time frame you want to pull into the snapshot (This Year-to-Date, Last Month, Last Quarter, Last Year).

- Previous Year Income Comparison – Select the relevant time frame you want to pull into the snapshot (quarterly or monthly) and the revenue accounts you want to pull in (dependent on your chart of accounts).

- Previous Year Expense Comparison – Select the relevant time frame you want to pull into the snapshot (quarterly or monthly) and the expense accounts you want to pull in (dependent on your chart of accounts).

- Who Owes Me – Option to drill down into current and past due invoices.

- Whom I Owe – Option to drill down into current and past due invoices.

Step 3: Customize Business Snapshot Report

Once you’ve analyzed your customization options within the business snapshot report you will want to select the options that best fit the needs of your stakeholders (such as your CPA).

Some factors to consider are:

- Which metrics best demonstrate financial performance?

- Does the date range align with reporting needs?

- Should you include supplementary custom reports?

- Would export to Excel be beneficial?

Step 4: Print and Share Report

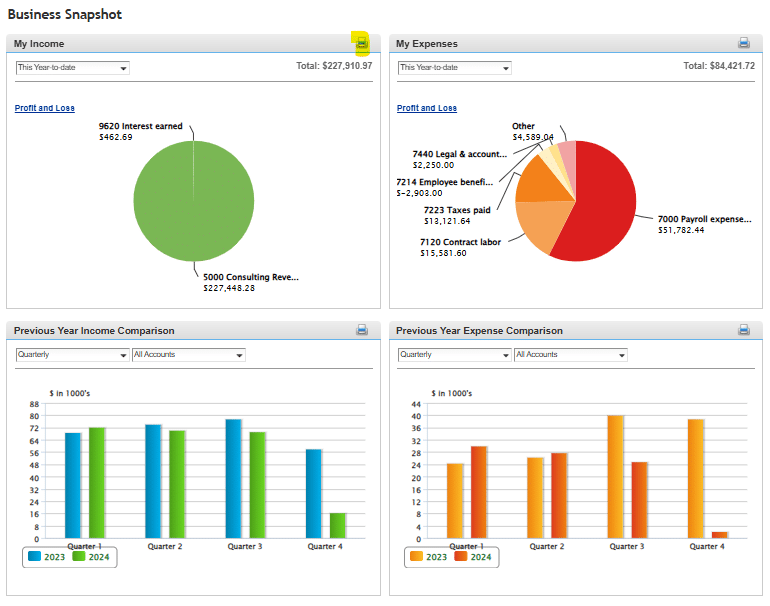

After you’ve customized your business snapshot report to fit the needs of the business and message you are trying to communicate you will want to print and share the report. In order to do this you will need to select the printer icon on the right corner of the screen.

Once you’ve selected the print option you will be able to either physically print a copy of the report out or save a digital copy to email out. You can select as many of the snapshots to send out as needed. Some stakeholders may only need to see certain snapshots.

For example, someone on the accounts payable team may only need to see the whom I owe report so they can prioritize payments that need processed to vendors. The CEO or President of the organization may only want to see the total revenue and total expenses over a certain period of time.

Use Cases for Sharing QuickBooks Financial Snapshots

Company snapshot reports help businesses:

- Share information across departments

- Track financial performance trends

- Support forecasting and budgeting

- Manage accounts receivable collection

- Monitor accounts payable obligations

Improve Your Financial Reporting with QuickBooks Financial Snapshots.

Visual and easy to use financial snapshots are a critical communication tool for accountants and financial reporting to help tell the story of a business and allow leaders to make informed decisions. It can help provide stakeholders with the information needed to help make critical choices as they navigate the landscape that their business operates in and set financial projections.

Ready to take your financial reporting to the next level?

Try Coefficient to seamlessly integrate your Excel with live data from various business systems, enabling real-time break-even analysis and more advanced financial modeling.