YoY Growth = (Current Period Value ÷ Prior Period Value) – 1

This free year over year growth calculator takes out the guesswork. Track how your business grows from year to year, spot trends early, and make better calls on where to invest. We show you how to calculate, read, and track YoY growth the right way. Plus, grab our free Excel and Google Sheets template to track growth month by month.

Let’s get started.

Year Over Year Growth Formula Explained

YoY Growth = (Current Period Value ÷ Prior Period Value) – 1

Here’s what each part means:

Current Period Value: The metric you’re tracking at the end of the period. This could be revenue, profit, sales units, or customer count for the current year.

Prior Period Value: The same metric from the same time last year. Using the same period removes seasonal swings that can skew your view.

The Division: When you divide current by prior, you get a ratio. A result of 1.2 means you’re at 120% of last year’s value.

Subtract 1: This converts the ratio to a growth rate. That 1.2 becomes 0.2, or 20% growth. If the ratio is 0.9, you get -0.1, or -10% decline.

The formula works because it shows change as a percent of where you started. A $10,000 gain means more to a $50,000 business than to a $5 million one. YoY growth puts everyone on the same scale.

What Is Year Over Year Growth?

Year over year growth tracks the percent change in a metric between one period and the same period last year. It cuts through monthly ups and downs to show your true growth rate.

Most businesses see swings based on the time of year. Retail spikes in November. Tax firms peak in March. YoY growth compares this January to last January, not to December, so you see real growth instead of seasonal noise.

Who uses this metric?

CFOs and Controllers tracking company health and planning budgets based on growth trends.

Finance Teams building forecasts and spotting when growth slows or speeds up.

Fractional CFOs comparing growth across multiple client portfolios to prioritize resources.

Revenue Operations monitoring sales growth and pipeline velocity quarter over quarter.

Investors and Board Members evaluating company performance and return on their capital.

How to Calculate Year Over Year Growth: Step-by-Step

Let’s walk through a real example using monthly recurring revenue for a SaaS company.

- Pick the metric you want to track

For this example, we’ll use monthly recurring revenue (MRR). You can use any metric: revenue, profit, customer count, unit sales.

- Get your current year value

Pull your MRR for December 2024: $450,000

- Get your prior year value

Pull your MRR for December 2023: $350,000

- Divide current by prior

$450,000 ÷ $350,000 = 1.2857

- Subtract 1 from the result

1.2857 – 1 = 0.2857

- Convert to percentage

0.2857 × 100 = 28.57%

- Read your result

Your YoY growth is 28.6%. You grew revenue by about 29% from December 2023 to December 2024. For a SaaS company, this signals solid growth momentum worth maintaining.

How to Interpret Your Year Over Year Growth Number

Context determines whether your growth rate signals strength or concern.

| Growth Range | Interpretation | Recommended Actions |

| Below 0% | Decline – Revenue or metrics falling year over year. Urgent attention needed. | • Audit customer churn and lost accounts<br>• Review pricing and competitive position<br>• Cut costs that don’t drive revenue<br>• Talk to customers about their needs |

| 0% – 5% | Stagnant – Barely growing or flat. Risky for most businesses. | • Find bottlenecks in sales or operations<br>• Test new marketing channels<br>• Review product-market fit<br>• Survey customers for expansion opportunities |

| 5% – 15% | Steady – Moderate growth. Acceptable for mature firms, low for startups. | • Maintain current strategy<br>• Look for efficiency gains<br>• Test growth experiments<br>• Build cash reserves |

| 15% – 40% | Healthy – Strong growth momentum. Good for most mid-market companies. | • Scale what’s working<br>• Hire ahead of demand<br>• Invest in infrastructure<br>• Monitor unit economics closely |

| Above 40% | Rapid – Very fast growth. Great for startups, verify it’s sustainable. | • Ensure operations can scale<br>• Watch cash flow carefully<br>• Document processes before chaos hits<br>• Check if growth is profitable |

Year Over Year Growth Benchmarks by Industry

Growth rates vary widely by industry. What’s great for retail might be slow for SaaS. Here’s what to expect:

| Industry | Typical Range | Notes |

| SaaS (Early Stage) | 50% – 100% | High growth expected under $5M ARR; slows as company scales |

| SaaS (Growth Stage) | 25% – 50% | $5M-$20M ARR range; 25% median for private B2B SaaS in 2025 |

| SaaS (Mature) | 15% – 25% | Above $50M ARR; public SaaS companies average 17-18% |

| Professional Services | 8% – 15% | Limited by headcount; higher if adding new service lines |

| Manufacturing | 5% – 15% | Cyclical; depends on capital investment and capacity |

| Retail | 3% – 10% | Lower margins; constrained by physical locations and inventory |

| Healthcare Services | 6% – 12% | Steady demand; regulated; growth via new locations or services |

| Real Estate | 4% – 10% | Tied to market cycles; commercial often steadier than residential |

The SaaS industry shows the clearest growth tiers. Companies under $1M ARR grow at 50% median. Those between $1M-$20M ARR grow at 25-30%. Above $20M, growth slows to 20-25% as scale and competition increase.

Traditional industries like retail and manufacturing grow slower because they depend on physical assets, inventory, and local markets. SaaS scales faster because software copies at near-zero cost.

Benchmark Citations

Wall Street Prep – Year over Year (YoY) Formula

SaaS Capital – 2025 Private SaaS Growth Benchmarks

Maxio – 2025 B2B SaaS Benchmarks Report

Automating Year Over Year Growth Tracking with Coefficient

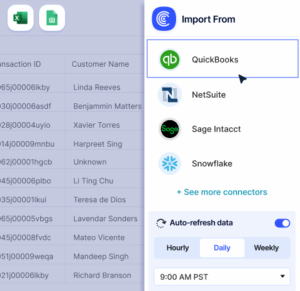

Stop exporting CSVs from NetSuite or QuickBooks every month.

Coefficient pulls your revenue, sales, and financial data into Excel or Google Sheets live. Your YoY growth calculates itself.

Set it once. Your sheets update daily, weekly, or monthly. Perfect for finance teams tracking metrics across divisions or fractional CFOs managing multiple clients. Try Coefficient Free and automate your growth tracking.

How to Improve Your Year Over Year Growth

Accelerating growth requires strategic focus on retention and expansion.

Increase customer retention before chasing new sales

Keeping customers is cheaper than finding new ones. If you lose 20% of customers each year, you need 20% new customers just to stay flat. Cut churn from 20% to 10%, and growth doubles without adding a single new sale.

Raise prices on proven value

Most companies wait too long to raise prices. If you haven’t increased prices in two years and customer complaints are low, test a 10-15% increase on new customers. Existing customers can stay at current rates.

Expand into adjacent products or markets

Sell to the customers you already have. Add a new product line, service tier, or geographic market. Growth from current customers costs less than finding new ones in crowded spaces.

Fix your sales process bottlenecks

Track where deals die in your pipeline. If most deals stall at pricing, your price might be too high or poorly explained. If they stall at decision-making, you’re not reaching the real buyer. Fix the biggest leak first.

Cut products or customers that drain resources

Not all revenue is good revenue. If a product line or customer segment demands constant support but generates low margins, cut it. Redirect those resources to high-growth areas.

Year Over Year Growth vs. Month Over Month vs. Quarter Over Quarter

Understanding which growth metric to use depends on your analysis timeframe.

Year over Year

Long-term trends, removing seasonal swings. Formula: (Current Year ÷ Prior Year) – 1. Best for clean trend lines but slow to show recent changes.

Month over Month

Spotting immediate changes, testing campaigns. Formula: (Current Month ÷ Prior Month) – 1. Fast feedback but noisy with seasonal variation.

Quarter over Quarter

Mid-term tracking, earnings reports. Formula: (Current Quarter ÷ Prior Quarter) – 1. Still shows some seasonal effects.

When to use each

Use YoY when you need the cleanest trend line. A retailer comparing December to December sees growth without holiday spikes. Use MoM when you launch something new and want fast feedback. Use QoQ for board meetings when YoY feels too slow but MoM feels too jumpy.

Pro tip for fractional CFOs: Show all three to clients. YoY proves long-term health. MoM shows you’re watching closely. QoQ bridges the gap and aligns with how most boards think.

Track what matters

Year over year growth reveals your true trajectory beyond seasonal noise. Monitor it alongside retention and unit economics for complete business health visibility.Get started with Coefficient to automate your YoY growth tracking and focus on strategic decisions instead of manual calculations.