Break-Even Point Formula Explained

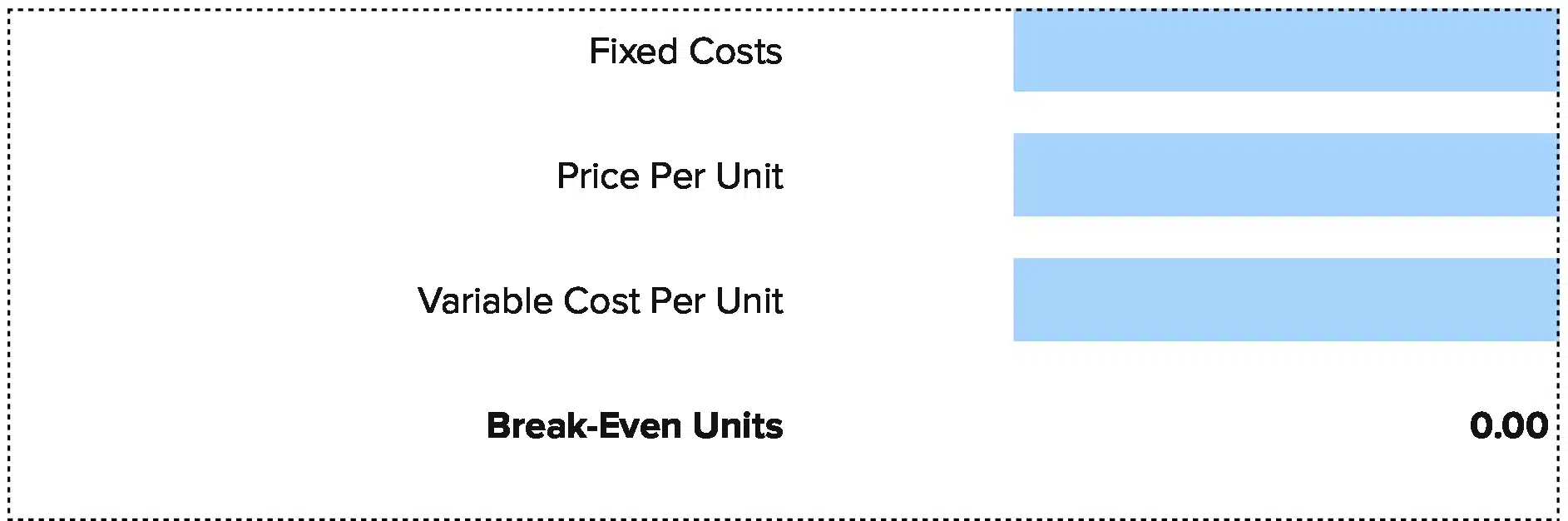

Break-Even Point (Units) = Fixed Costs ÷ (Price Per Unit – Variable Cost Per Unit)

Break-Even Point (Sales Dollars) = Fixed Costs ÷ Contribution Margin Ratio

Let’s break down each component:

Fixed Costs: These are costs you pay no matter how much you sell. Rent, salaries, insurance, and software subscriptions stay the same whether you sell 10 units or 10,000 units.

Variable Costs: These change based on how many units you produce or sell. Raw materials, packaging, shipping, and sales commissions all increase when you sell more. If you sell zero units, your variable costs are zero.

Price Per Unit: The amount you charge customers for one unit of your product or service.

Contribution Margin: The amount left over after you subtract variable costs from the selling price. If you sell a product for $100 and it costs you $40 in variable costs, your contribution margin is $60.

We subtract variable costs from the price because your contribution margin shows how much each sale helps pay off your fixed costs. Once you sell enough units to cover fixed costs, every additional unit sold becomes pure profit.

What Is a Break-Even Point?

A break-even point is the exact moment when your total revenue equals your total costs. At this point, you’re not making money, but you’re also not losing money. It’s the line between loss and profit.

Understanding your break-even point helps you set realistic sales targets, make smart pricing decisions, and know how much cash runway you need before your business becomes profitable.

Who uses this metric?

CFOs and Controllers monitor working capital and assess whether new products or business lines make financial sense.

Fractional CFOs track break-even points across multiple client portfolios to help business owners understand profitability timelines.

Finance Managers calculate break-even for product launches, pricing changes, and cost reduction initiatives.

Business Owners need to know how many sales they must make before covering their costs and turning a profit.

Product Managers use break-even analysis to decide whether a new product justifies the development and operational costs.

How to Calculate Break-Even Point: Step-by-Step

Let’s walk through a real example using a software company selling annual subscriptions.

- List all your fixed costs

Start by adding up all costs that stay the same each month:

- Office rent: $3,000/month

- Salaries: $25,000/month

- Software and tools: $2,000/month

- Marketing budget: $5,000/month

- Insurance and legal: $1,000/month

- Calculate total monthly fixed costs

Add all fixed costs together:

$3,000 + $25,000 + $2,000 + $5,000 + $1,000 = $36,000 per month

- Determine your price per unit

Your annual subscription sells for $1,200 per customer.

- Calculate variable cost per unit

Variable costs include payment processing fees (3%), customer onboarding ($50), and customer support ($30 per customer per year).

Variable cost = ($1,200 × 0.03) + $50 + $30 = $116 per customer

- Find your contribution margin per unit

Subtract variable cost from selling price:

$1,200 – $116 = $1,084 contribution margin per customer

- Apply the break-even formula

Divide fixed costs by contribution margin:

$36,000 ÷ $1,084 = 33.2 customers

- Interpret the result

You need to sell 34 customers per month to break even. At this point, your revenue ($40,800) will equal your total costs. Every customer after the 34th one generates $1,084 in profit.

How to Interpret Your Break-Even Point Number

| Time to Break-Even | Interpretation | Recommended Actions |

| Under 6 months | Strong position – Fast path to profitability | • Maintain current cost discipline<br>• Consider strategic investments in growth<br>• Build cash reserves for expansion |

| 6-18 months | Healthy range – Standard for most businesses | • Monitor cash flow weekly<br>• Secure funding to cover runway<br>• Focus on sales efficiency |

| 18-36 months | Extended timeline – Common for capital-intensive or tech startups | • Review and cut non-essential costs<br>• Improve pricing or gross margins<br>• Extend payment terms with vendors |

| Over 36 months | High-risk zone – Requires strong capital backing | • Reassess business model viability<br>• Explore pivot options<br>• Drastically reduce burn rate |

The right break-even timeline depends on your industry, business model, and access to capital. A restaurant might target 18-24 months, while a biotech startup might plan for 5+ years.

Break-Even Point Benchmarks by Industry

Break-even timelines vary widely across industries due to differences in startup costs, margins, and revenue ramps.

| Industry | Typical Break-Even Timeline | Notes |

| SaaS / Software | 18-36 months | CAC payback is typically 12-18 months for growth-stage companies. |

| Restaurant (QSR) | 3-6 months per location | Quick service restaurants break even fastest at the location level. |

| Restaurant (Casual Dining) | 18-24 months | Casual dining averages 18 months due to higher buildout costs. |

| Restaurant (Fine Dining) | 24-36 months | Fine dining takes longest due to high startup costs and lower turnover. |

| E-commerce / Online Retail | 6-18 months | Low overhead enables faster break-even than brick-and-mortar retail. |

| Manufacturing | 24-48 months | High fixed costs for equipment and facilities slow profitability. |

| Healthcare / MedTech | 36-60 months | Regulatory approvals and clinical trials extend break-even timelines. |

| Professional Services | 6-12 months | Low fixed costs and high margins support fast break-even. |

These benchmarks come from industry studies and startup financial data. Your actual timeline depends on initial capital, pricing strategy, market conditions, and operational efficiency.

Benchmark Citations

FasterCapital: Break-Even Point Industry Benchmarks

Wall Street Prep: Break-Even Point Formula

Growth Unhinged: SaaS Burn Rate Benchmarks

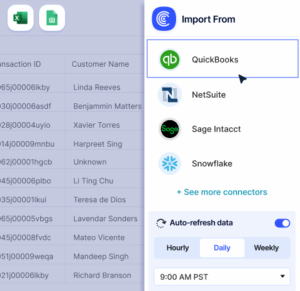

Automating Break-Even Tracking with Coefficient

Stop exporting data from NetSuite, QuickBooks, or Xero every month to update your break-even calculations.

Coefficient connects your accounting system directly to Excel or Google Sheets, pulling in fixed costs, variable costs, and revenue automatically. Your break-even analysis updates itself with live data.

Set up once and your financial models stay current. Perfect for finance teams tracking multiple products or locations.

Get started with Coefficient and download your free template.

How to Improve Your Break-Even Point

A faster break-even timeline means less cash needed and lower risk. Here are five ways to reach profitability sooner.

Reduce fixed costs

Cut or defer expenses that don’t directly drive revenue. Renegotiate your lease, switch to lower-cost tools, or shift from full-time to contract workers. Each $1,000 you cut from monthly fixed costs reduces the units you need to sell.

Increase your prices

Raising prices improves your contribution margin, so you need fewer sales to break even. Even a 5-10% price increase can cut your break-even point by 15-20%. Test price increases with new customers first.

Lower variable costs

Negotiate better rates with suppliers, reduce shipping costs, or find more efficient production methods. If you cut your variable cost per unit by $10, that $10 goes straight to your contribution margin.

Improve sales efficiency

Focus on channels and tactics that deliver the highest conversion rates and lowest customer acquisition costs. Cut spending on low-ROI marketing and double down on what works.

Shift your product mix

If you sell multiple products, push higher-margin items. A product with a 70% gross margin helps you reach break-even much faster than one with a 30% margin. Analyze profitability by SKU and adjust your sales strategy.

Break-Even Point vs. Payback Period vs. ROI

Break-even analysis often gets confused with other financial metrics. Here’s how they differ.

Break-Even Point

Measures when total revenue equals total costs. Formula: Fixed Costs ÷ Contribution Margin. Use it for planning startup runway and launching new products.

Payback Period

Measures how long to recover an initial investment. Formula: Initial Investment ÷ Annual Cash Flow. Use it for evaluating equipment purchases and capital projects.

Return on Investment (ROI)

Measures profit relative to investment cost. Formula: (Gain – Cost) ÷ Cost × 100. Use it for comparing investment options and measuring campaigns.

When to use each

Break-even tells you when you stop losing money. Payback period tells you when you recover your upfront investment. ROI tells you how much profit you make relative to what you spent.

Use break-even analysis when planning overall business finances and cash runway. Use payback period when evaluating specific investments like new equipment. Use ROI when comparing multiple investment options or measuring performance.

Pro tip for fractional CFOs: Present all three metrics together when advising clients on major decisions. For example, “This new product line breaks even at 200 units per month, has a 14-month payback period on the $50K investment, and projects a 35% ROI in year one.” This complete picture helps clients make better capital allocation decisions.

Plan your path to profit

Break-even analysis shows when your business becomes self-sustaining. Track it monthly. Adjust your model as costs and pricing change. Use it to make smarter decisions about growth and spending.

Get started with Coefficient and automate your break-even tracking today.