Return on Assets (ROA) = Net Income / Average Total Assets

How to Calculate Return on Assets (ROA)?

- Identify Net Income: Reference the company’s net earnings from its income statement.

- Determine Average Total Assets: Calculate the average of the beginning and ending total asset balances from the balance sheet.

- Divide Net Income by Average Total Assets: This ratio provides the return on assets metric.

What is the Return on Assets (ROA) Calculator?

The ROA Calculator offers a straightforward approach to assessing a company’s profitability by analyzing how efficiently assets are utilized. This tool simplifies complex financial analyses, allowing finance professionals to gauge asset performance quickly.

Why is Return on Assets (ROA) Important?

Understanding ROA is crucial for investors and stakeholders to evaluate the profitability of a company relative to its total assets. It helps in determining how effectively a company is converting its investments into net profits.

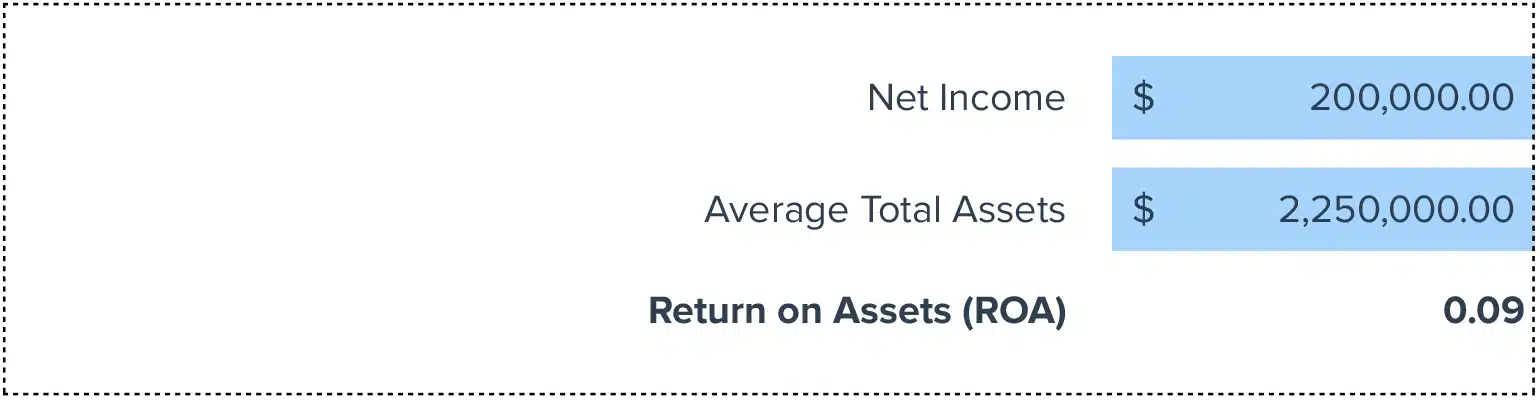

Calculating ROA Example with Numbers

Suppose a company has a Net Income of $200,000 and its Average Total Assets are $1,000,000. Using the ROA formula:

ROA = $200,000 / $1,000,000 = 0.20 or 20%

This indicates that the company generates a 20% return on its assets.

How to Improve ROA

- Efficient Asset Management: Keep track of asset utilization and phase out non-productive assets. For example, sell or repurpose underused equipment or property to enhance asset efficiency.

- Increase Operational Efficiency: Focus on strategies that maximize output while minimizing costs. Streamlining operational processes can effectively boost net income.

- Cost Reduction: Analyze expenditure to find and eliminate unnecessary costs. Regular audits ensure that every dollar spent contributes to generating income.

- Enhance Revenue Streams: Explore new markets or optimize pricing strategies to increase revenue without proportionately increasing asset costs.

- Upgrade Technology: Invest in technology that improves productivity. An updated CRM system, for instance, might enhance both sales team performance and customer satisfaction.

How to calculate ROA in Google Sheets and Excel?

- Step 1. Input Net Income in cell A1.

- Step 2. Enter Average Total Assets in cell A2.

- Step 3. Apply the formula `=A1/A2` in cell A3 to find the ROA. This will display the result as a decimal; to view it as a percentage, format cell A3 to percentage.

Drawbacks of the ROA Calculator

- Variance Over Time: ROA can fluctuate significantly across different fiscal periods, presenting challenges in consistent analysis.

- Dependent on Accounting Practices: Different depreciation or valuation methods can affect asset values, altering ROA outcomes.

- Does Not Account for Risk: While ROA indicates efficiency, it does not consider the risk associated with the asset base.

When to Use the ROA Calculator

Employ this tool for quarterly financial reviews or annual reporting to monitor asset performance over time. It is particularly useful for assessing the impact of strategic decisions on company profitability.

ROA Calculator: Tips and Tricks

- Review asset purchase decisions and consider their impact on ROA before committing.

- Regularly update financial data in your spreadsheet to maintain accuracy in your calculations.

- Take advantage of formula auto-fill to apply the ROA calculation across multiple datasets efficiently.