Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

OR

Quick Ratio = (Current Assets – Inventory – Prepaid Expenses) / Current Liabilities

This free quick ratio calculator shows if you can pay bills now. You’ll learn how to find your ratio, read the numbers, and track your cash without selling stock. We’ve also got a free Excel and Google Sheets template you can grab and use right away.

Your cash matters most when bills come due.

Quick Ratio Formula Explained

Quick Ratio = (Cash + Cash Equivalents + Marketable Securities + Accounts Receivable) / Current Liabilities

Or use this version:

Quick Ratio = (Current Assets – Inventory – Prepaid Expenses) / Current Liabilities

Let’s break this down:

Cash and Cash Equivalents: Money you can use right now. This means your bank accounts, money market funds, and any cash that sits ready to spend within days.

Marketable Securities: Stocks and bonds you can sell fast. These turn into cash in 90 days or less under normal terms without big losses.

Accounts Receivable: Money customers owe you. These are bills you sent out that should get paid soon, usually in 30 to 90 days.

We skip inventory here because it takes time to sell. You might need weeks or months to turn products into cash. You might also have to cut prices to move items quickly. Inventory just isn’t liquid enough for this test.

Current Liabilities: Bills due within 12 months. This includes what you owe vendors, short-term loans, wages you need to pay, and taxes coming due.

What Is Quick Ratio?

Quick ratio shows if you can pay short-term debts with liquid assets only. It’s also called the acid-test ratio because it applies a strict test to your finances.

This ratio asks a tough question: “If all our bills came due tomorrow, could we pay them without selling inventory?” The answer tells you if your cash position is strong or weak.

Quick ratio is more strict than current ratio. Current ratio counts all current assets, but quick ratio leaves out inventory and prepaid costs. This makes it a better gauge of true liquidity.

Who uses this metric?

CFOs and Controllers track this to watch working capital and cash health across the company.

Fractional CFOs monitor quick ratios for multiple clients at once to spot trouble before it starts.

Credit Analysts use it to judge if companies can service debt and meet obligations on time.

Financial Analysts build models with it to forecast cash needs and credit risk.

Lenders check this ratio when reviewing loan requests and setting credit terms for borrowers.

How to Calculate Quick Ratio: Step-by-Step

Let’s walk through a real example with actual numbers:

- Get your balance sheet

Pull up your most recent balance sheet. You need current numbers for assets and liabilities from the same date.

- Find total current assets

Look for “Total Current Assets” on your balance sheet. For our example: $450,000

- Locate inventory value

Find the inventory line item on your balance sheet. In our example: $180,000

- Note prepaid expenses

Check for prepaid items like insurance or rent paid ahead. Our example: $20,000

- Calculate quick assets

Subtract inventory and prepaid costs from current assets:

$450,000 – $180,000 – $20,000 = $250,000

This $250,000 is your liquid money that you can access fast.

- Find current liabilities

Your balance sheet shows “Total Current Liabilities.” For our example: $200,000

- Apply the formula

Divide quick assets by current liabilities:

$250,000 ÷ $200,000 = 1.25

- Read your result

A ratio of 1.25 means you have $1.25 in liquid assets for every $1.00 of debt due soon. You can cover all current debts with room left over.

How to Interpret Your Quick Ratio Number

Context matters when reading your quick ratio.

| Ratio Range | Interpretation | Recommended Actions |

| Below 0.5 | Critical shortage – You have less than 50 cents of liquid assets per dollar owed | • Negotiate emergency credit now<br>• Speed up customer payments<br>• Consider factoring receivables<br>• Cut all non-essential spending |

| 0.5 – 0.9 | Tight liquidity – You depend heavily on steady collections to stay current | • Extend payment terms with vendors<br>• Tighten customer credit policies<br>• Monitor cash flow weekly<br>• Build cash reserves when possible |

| 1.0 – 1.5 | Adequate position – You can cover obligations but have little cushion for surprises | • Track trends each month<br>• Keep current practices<br>• Plan for seasonal swings<br>• Consider a credit line buffer |

| 1.5 – 2.5 | Healthy liquidity – Strong position with room for unexpected events or opportunities | • Maintain current discipline<br>• May fund strategic projects<br>• Good position for growth moves |

| Above 2.5 | Very strong – Excellent position, though very high ratios may signal unused cash | • Consider deploying excess cash<br>• Look at investment options<br>• May indicate overly cautious approach |

Quick Ratio Benchmarks by Industry

Your industry matters a lot when reading your quick ratio numbers.

| Industry | Typical Range | Notes |

| SaaS / Software | 1.5 – 4.0 | Low inventory needs, high margins, and steady recurring revenue create strong ratios |

| Professional Services | 1.5 – 3.0 | Minimal inventory with project-based cash flows that vary by engagement |

| Healthcare Services | 1.2 – 2.0 | Depends on payer mix and how fast insurance companies reimburse claims |

| Retail | 0.5 – 0.8 | Heavy inventory loads and thin margins push ratios lower for stores |

| Manufacturing | 0.8 – 1.2 | Raw materials and work-in-process inventory tie up significant capital |

| Utilities | 0.4 – 0.6 | Predictable cash flows offset lower ratios in this capital-intensive sector |

| Biotechnology | 3.0 – 5.0 | High cash reserves needed to fund long R&D cycles before products launch |

Understanding these ranges helps you see if your number fits your industry norm. A ratio that looks weak for software might be strong for retail.

Benchmark Citations

FullRatio Quick Ratio Industry Analysis

Eqvista Quick Ratio Study 2025

Investopedia Quick Ratio Guide

Automating Quick Ratio Tracking with Coefficient

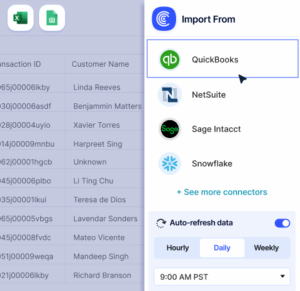

Stop the monthly grind of CSV exports from QuickBooks or NetSuite. Coefficient links your accounting system straight to Excel or Google Sheets. Your quick ratio updates itself from live data.

Set it up once and watch your metrics refresh on the schedule you pick – daily, weekly, or monthly. This saves 15 to 30 minutes per calculation while cutting out copy-paste errors. Finance teams tracking multiple entities or clients can manage all dashboards from one spot.

Get started with Coefficient and connect your accounting system in minutes.

How to Improve Your Quick Ratio

A low ratio isn’t forever. Here’s how to fix it:

Speed up collections

Send payment reminders right away. Offer 2% discounts for paying within 10 days. Tighten credit rules for new customers. Cutting your collection time from 60 to 45 days can lift your ratio by 10% to 20%.

Extend vendor terms

Ask your top suppliers for net-45 or net-60 terms instead of net-30. This keeps cash in your business longer without cutting your assets. Lead with your track record of reliable payments.

Cut excess inventory

Run promotions to clear slow items. Use just-in-time ordering to reduce stock levels. Drop SKUs that don’t move. Since inventory doesn’t count in quick assets, cutting stock by 20% to 30% can improve your ratio by 0.2 to 0.4 points.

Refinance short debt

Turn short-term loans into long-term debt with 3 to 5 year terms. This moves obligations out of current liabilities right away. Look at SBA loans or equipment financing with extended terms.

Review operating costs

Check all subscriptions and service contracts. Cut what you don’t need. Reducing monthly costs by $10,000 saves $120,000 per year in cash, gradually improving liquidity over 6 to 12 months.

Quick Ratio vs. Current Ratio vs. Cash Ratio

People often mix up these three liquidity metrics. Here’s what each one measures and when to use it:

Quick Ratio

(Current Assets – Inventory – Prepaid) ÷ Current Liabilities. Only liquid assets that convert to cash fast. Best for credit analysis and short-term solvency.

Current Ratio

Current Assets ÷ Current Liabilities. All current assets including inventory. Best for general screening of financial health.

Cash Ratio

(Cash + Marketable Securities) ÷ Current Liabilities. Only cash and near-cash items. Best for worst-case scenarios and immediate payment ability.

When to use each

Current ratio is least strict because it counts everything. Quick ratio is moderately strict by cutting out inventory. Cash ratio is most strict by only counting actual cash.

Pro tip for fractional CFOs: Show all three ratios to clients with context. Example: “Your current ratio of 2.1 looks fine, but your quick ratio of 1.1 shows that 48% of your assets sit in inventory. With your 90-day turnover rate, watch receivables collection closely.”

The right metric depends on what question you’re asking about your cash position.

Track what matters

Your quick ratio tells you if you can cover bills without panic. Track it monthly. Watch the trends. Compare to your industry peers.Get started with Coefficient to automate your quick ratio tracking and stop wasting time on manual exports.