NPV = SUM(Ct / (1 + r)^t)

– Ct: Net cash inflow during the period t, often from investments or business project returns.

– r: Discount rate, representing the time value of money and risk.

– t: Period number, indicating the specific time interval (year, quarter, etc.).

Experience the convenience of a robust Net Present Value (NPV calculator) right in your spreadsheet.

Deploy the NPV calculator to enhance financial analysis in sectors like investment banking or corporate finance.

How to Calculate NPV?

- Calculate each period’s net cash inflow (Ct).

- Select an appropriate discount rate (r) according to your investment’s risk profile and opportunity cost.

- Compute the discounted cash flow for each period using the formula (Ct/(1+r)^t).

- Sum up all the discounted cash flows to get the NPV.

What is Net Present Value (NPV)?

NPV is a financial metric used to evaluate the profitability of an investment or project by calculating the difference between the present values of cash inflows and outflows over a period of time.

Why is NPV Important?

NPV is crucial as it helps investors and businesses determine the viability and return of potential investments by considering the time value of money, thus aiding in informed financial decision-making.

Calculating NPV Example with Numbers

Consider an investment with a 5-year horizon where the cash inflows are expected to be $30,000 annually, and the discount rate is 10%:

Year (t) | Cash Inflow (Ct) | Discounted Cash Flow

— | — | —

1 | $30,000 | $27,272

2 | $30,000 | $24,793

3 | $30,000 | $22,539

4 | $30,000 | $20,490

5 | $30,000 | $18,627

**NPV** | | **$113,721**

How to Improve Net Present Value (NPV)

- Regular Investment Reviews: Maintain up-to-date knowledge of market trends to adjust the discount rate (r) accurately.

- Careful Project Selection: Choose projects with higher cash inflows or quicker paybacks to boost your NPV.

- Cost Management: Cut unnecessary expenses to maximize your cash inflows (Ct).

- Risk Mitigation: Develop strategies to minimize risks associated with your investments, enhancing predictability and stability.

- Diverse Portfolio: Diversify your investment portfolio to balance high and low risk, ensuring a steady cash flow.

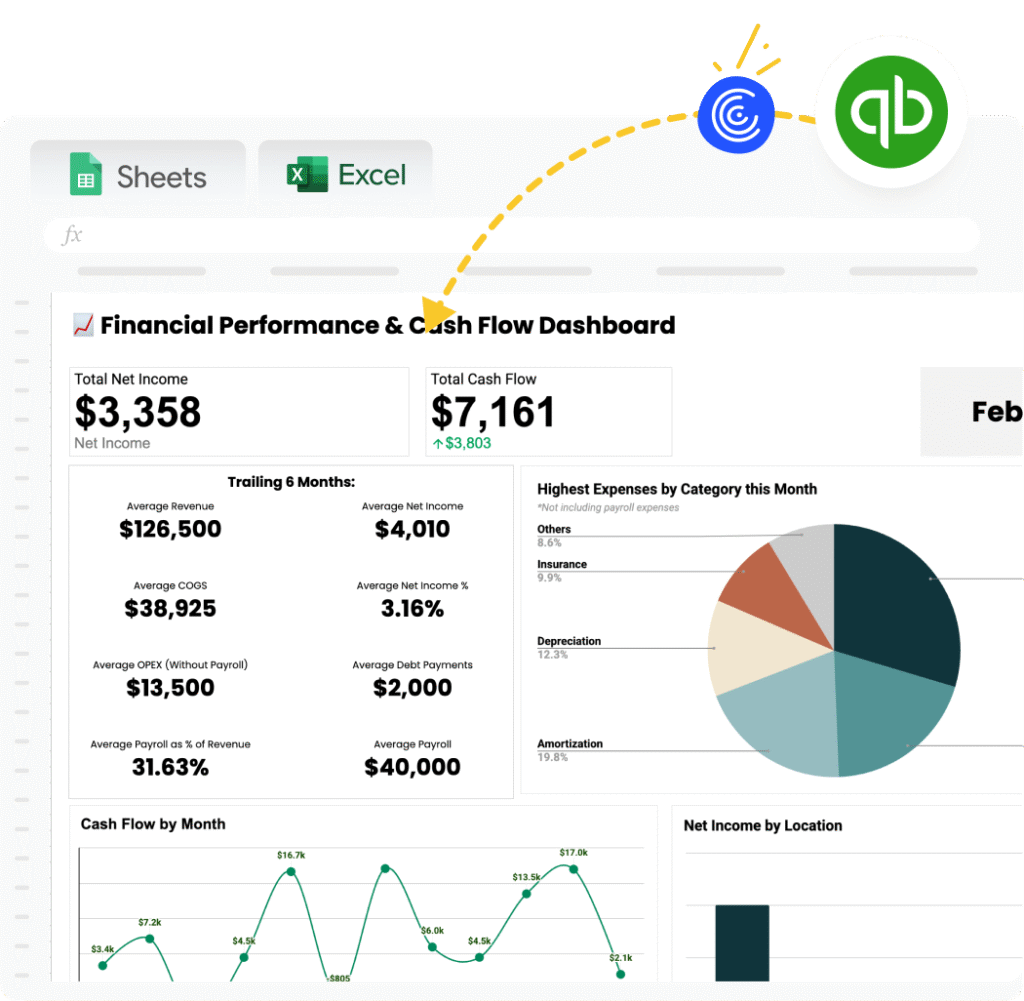

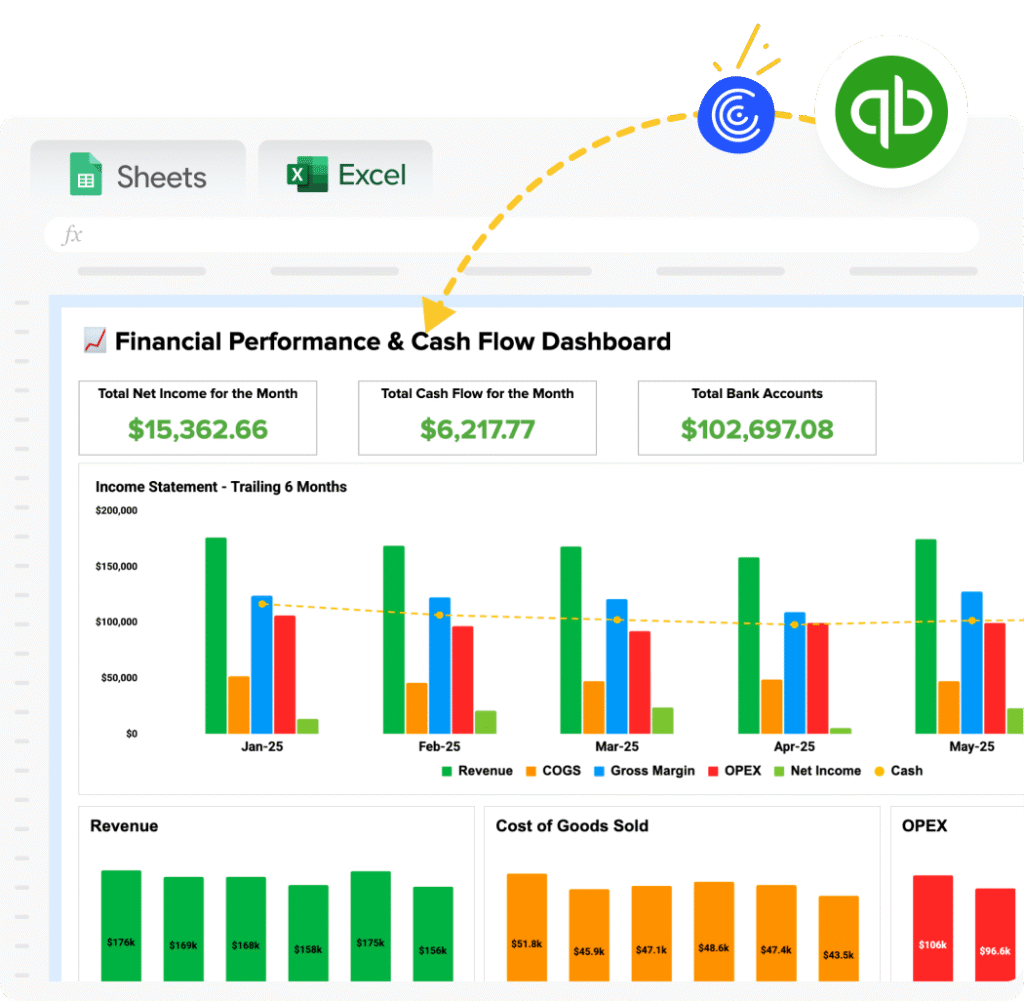

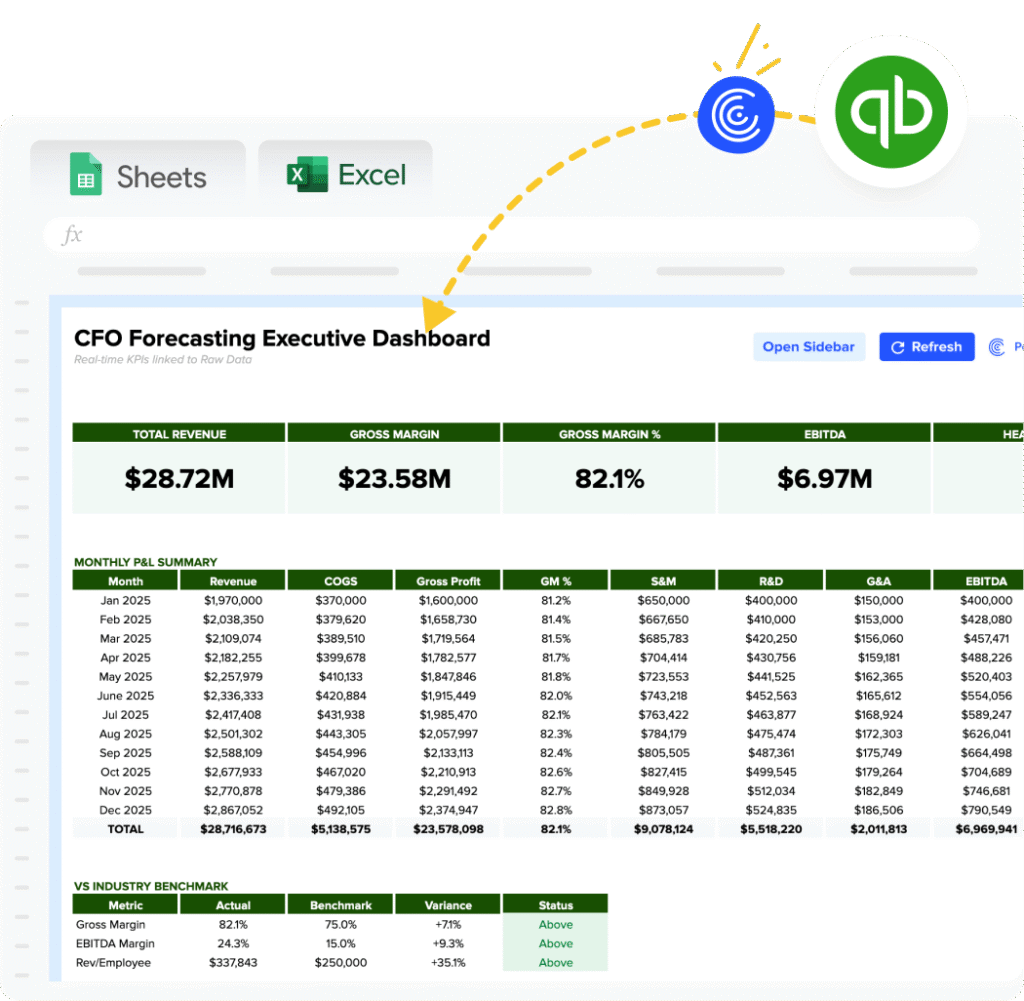

How to Calculate NPV in Google Sheets and Excel?

- Step 1: List your projected cash inflows in a column.

- Step 2: Input your discount rate in a separate cell.

- Step 3: Use the NPV function: =NPV(discount_rate, range_of_cash_flows) + initial_investment.

- Step 4: The result is the NPV displayed in your chosen cell.

Drawbacks of NPV

- Sensitive to Discount Rate: Small changes in r can significantly alter NPV, requiring precise risk assessment.

- Long-Term Predictability: Projects spanning many years are more exposed to forecast errors.

- Upfront Cost Exclusion: NPV formula does not incorporate the cost of capital, potentially misrepresenting profitability.

When to use the NPV Calculator?

Whenever assessing new projects, comparing alternative investments, or conducting long-term financial planning.

NPV Calculator: Tips and Tricks

- Use precise historical data to set a realistic discount rate.

- Regularly update the NPV calculations to reflect the current economic conditions.

- Employ sensitivity analysis to understand how changes in inputs affect NPV.