Marginal Cost = Change in Total Cost / Change in Quantity

This free marginal cost calculator cuts through the complexity. Whether you need a quick calculation for a production decision or want to optimize ongoing operations, you’ll learn how to calculate, interpret, and track marginal costs efficiently. We’ve also included a free Excel and Google Sheets template you can download and customize for your specific needs.

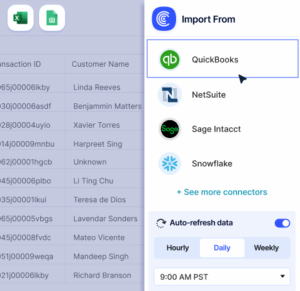

Track production costs in real time.

Marginal Cost Formula Explained

Marginal Cost = Change in Total Cost / Change in Quantity

Let’s break down each part:

Change in Total Cost: This is how much your total expenses increase when you produce more units. It captures the additional variable costs incurred. Include direct materials, direct labor, and variable overhead tied to the extra production. Do not include fixed costs like rent or salaried employees—those don’t change with one more unit.

Change in Quantity: The difference between your current production level and your new production level. If you were making 1,000 units and now make 1,100 units, the change is 100 units.

Why subtract fixed costs? Because your building lease doesn’t change when you produce unit 1,001. Your machine operator’s salary stays the same. Only variable costs matter for marginal cost. This gives you the true incremental expense of scaling up.

What Is Marginal Cost?

Marginal cost shows the added expense of producing one more unit. It helps answer: should we make another batch, or are we better off stopping here?

This metric reveals production efficiency. When marginal cost is low, you’re using resources well. When it spikes, you’ve hit capacity limits or inefficiencies.

Who uses this metric?

CFOs and Controllers making production and pricing decisions that affect profitability.

Operations Managers optimizing production runs and resource allocation.

Manufacturing Engineers identifying bottlenecks and capacity constraints.

Procurement Teams evaluating bulk order discounts and supplier negotiations.

Financial Analysts modeling break-even points and profitability scenarios.

How to Calculate Marginal Cost: Step-by-Step

Let’s walk through with a real example.

- Record your starting point

Note your current production level and total costs. Say you’re making 500 widgets at a total cost of $15,000.

- Increase production

Decide how many more units to produce. You decide to make 100 more widgets, bringing total production to 600 units.

- Calculate new total costs

After producing 600 units, your total costs rise to $17,500. This includes added materials, labor overtime, and extra utilities.

- Find the change in total cost

Subtract your starting costs from your ending costs:

$17,500 – $15,000 = $2,500

- Find the change in quantity

Subtract starting production from ending production:

600 – 500 = 100 units

- Apply the formula

Divide change in cost by change in quantity:

$2,500 / 100 = $25 per unit

- Interpret your result

Your marginal cost is $25. If you sell each widget for $40, making more is profitable. If you can only sell them for $20, stop production now.

How to Interpret Your Marginal Cost Number

Context determines whether your marginal cost signals efficiency or constraint.

| Cost Range | Interpretation | Recommended Actions |

| Below Average Cost | Efficient production – Economies of scale are working | • Increase production volume<br>• Negotiate better supplier terms<br>• Consider expanding capacity |

| Equal to Average Cost | Optimal efficiency point reached | • Maintain current production levels<br>• Monitor for cost changes<br>• Lock in supplier pricing |

| 10-20% Above Average Cost | Mild inefficiency – Approaching capacity limits | • Review production processes<br>• Check for equipment maintenance needs<br>• Evaluate staffing levels |

| 20-50% Above Average Cost | Significant inefficiency – Likely hitting constraints | • Consider capital investment<br>• Negotiate overtime alternatives<br>• Explore outsourcing options |

| Over 50% Above Average Cost | Severe inefficiency – Immediate action needed | • Stop expanding production<br>• Invest in automation or facilities<br>• Reassess business model |

Industry variations matter. Manufacturing tends to see U-shaped marginal cost curves—falling costs from scale, then rising costs at capacity. SaaS companies often see near-zero marginal costs after infrastructure is built. Retail faces higher marginal costs due to inventory and fulfillment expenses.

Marginal Cost Benchmarks by Industry

Your marginal cost behavior depends heavily on your industry’s characteristics. Here’s what typical patterns look like:

| Industry | Typical Marginal Cost Pattern | Notes |

| SaaS / Software | Near-zero to minimal | After infrastructure setup, adding users costs almost nothing. Server capacity and support are main variables |

| Manufacturing (High Volume) | $1-$15 per unit after initial scale | Benefits from economies of scale. Materials and direct labor drive costs |

| Manufacturing (Low Volume) | $25-$100+ per unit | Higher per-unit costs due to smaller batches and less automation |

| Retail / E-commerce | 40-60% of selling price | Inventory, shipping, and returns processing create significant variable costs |

| Professional Services | 60-80% of billing rate | Labor-intensive. Each billable hour requires similar marginal cost |

| Food & Beverage Production | 30-50% of revenue | Raw materials and packaging major cost drivers. Spoilage adds complexity |

| Construction | 70-85% of project value | Materials, subcontractors, and equipment rentals scale with each project |

| Healthcare Services | 20-40% of revenue | Fixed infrastructure spreads across patients. Supplies and staff time vary |

Manufacturing companies with established operations typically see marginal costs of $3-$15 per unit once they achieve scale, according to industry analysis from Epicor and NetSuite.

SaaS businesses, by contrast, report near-zero marginal costs after infrastructure investment. CloudZero’s analysis shows that mature SaaS companies maintain gross margins above 80%, driven by minimal incremental delivery costs.

Retail margins tell a different story. Ecom CFO’s 2025 benchmark report reveals that direct-to-consumer brands face marginal costs of 40-60% of revenue, primarily from fulfillment, returns, and customer acquisition costs.

Benchmark Citations

QuickBooks: Marginal Cost Definition and Calculation

NetSuite: How to Calculate Marginal Cost

Ecom CFO 2025 P&L Benchmark Report

Automating Marginal Cost Tracking with Coefficient

Stop manually copying production data from your ERP every week.

Coefficient connects NetSuite, SAP, Oracle, or QuickBooks directly to Excel or Google Sheets, pulling live cost and production data automatically. Your marginal cost calculates itself.

You set up the formulas once. Coefficient refreshes the data on your schedule—daily, weekly, or in real time. No more stale spreadsheets. No more data entry errors. Your team sees current costs and makes decisions with confidence. Get started with Coefficient and eliminate manual updates.

How to Improve Your Marginal Cost

A high marginal cost doesn’t mean failure. It means opportunity.

Negotiate volume discounts with suppliers

Bulk purchasing reduces per-unit material costs. Contact your top three suppliers and request tiered pricing based on order volume. A 10% discount on materials when ordering 20% more inventory can drop your marginal cost by $3-$5 per unit.

Invest in automation at bottleneck points

Identify where production slows down. If manual assembly takes 15 minutes per unit but a $50,000 machine could cut that to 3 minutes, calculate the payback. With 10,000 units per year, you’ll save 2,000 labor hours—likely paying for the machine in under two years.

Optimize production scheduling to reduce overtime

Overtime labor costs 1.5x to 2x normal rates. Schedule production runs during regular hours when possible. Analyze your demand patterns and adjust shift timing to match peak needs without relying on expensive overtime.

Improve yield rates and reduce waste

Every defective unit or wasted material adds to marginal cost. Implement quality controls at each production stage. If you currently see 5% waste and can cut that to 2%, you’ve just saved 3% of your material costs on every unit produced.

Standardize processes and train operators

Inconsistent processes lead to inefficiency. Document your optimal production flow and train all operators on it. Reduced errors and faster production lower your per-unit costs without capital investment.

Marginal Cost vs. Average Cost vs. Break-Even Point

Understanding these three concepts together gives you complete cost visibility.

Marginal Cost

Cost of producing one more unit. Use for production decisions and pricing floors. Formula: Change in Cost / Change in Quantity.

Average Cost

Cost per unit across all production. Use for overall efficiency and profitability analysis. Formula: Total Cost / Total Units.

Break-Even Point

Units needed to cover all costs. Use for business planning and pricing strategy. Formula: Fixed Costs / (Price – Marginal Cost).

When to use each

Marginal cost shows if the next unit is worth making. Average cost shows if your overall operation is efficient. Break-even shows how many units you need to sell before making profit.

Here’s how they work together: Suppose your average cost is $30 per unit, but your marginal cost for the next 100 units is $25. That’s good—you’re operating below average cost, meaning production is efficient. But if your selling price is only $28, you’re still not at break-even. You’ll need to either raise prices, lower costs further, or increase volume to spread fixed costs.

Pro tip for fractional CFOs: Present all three metrics to clients. Show them their average cost to explain overall efficiency, their marginal cost to justify production decisions, and their break-even point to set realistic sales targets. This trio gives a complete picture of cost structure and profitability potential.

Optimize production decisions

Marginal cost analysis reveals when to scale up, when to hold steady, and when to stop. Track it alongside average cost and break-even for complete operational insight.Get started with Coefficient to automate your marginal cost tracking and make data-driven production decisions.