IRR = Discount rate where NPV = 0

Or in full form:

0 = CF₀ + CF₁/(1+IRR)¹ + CF₂/(1+IRR)² + … + CFₙ/(1+IRR)ⁿ

This free IRR calculator cuts through the math. Whether you need a quick check on one deal or want to track returns across your whole portfolio, you’ll learn how to calculate, interpret, and track IRR fast.

Here’s what you need to know. Grab our free Excel and Google Sheets template to start today.

IRR Formula Explained

IRR = Discount rate where NPV = 0

Or in full form:

0 = CF₀ + CF₁/(1+IRR)¹ + CF₂/(1+IRR)² + … + CFₙ/(1+IRR)ⁿ

CF₀ (Initial Cash Flow): Your up-front cost. This is almost always negative since you’re spending cash. For a $500,000 land buy, CF₀ = -$500,000.

CF₁, CF₂, CFₙ (Future Cash Flows): Money that comes back in year 1, year 2, and so on. These include rental income, cost cuts, or sale proceeds.

IRR (Internal Rate of Return): The rate that makes the math work. It’s the return rate where the present value of all cash inflows equals the initial cost.

Time Periods (1, 2, n): Each cash flow gets discounted by how many years out it occurs. Year 5 cash is worth less than year 1 cash.

The formula sounds complex, but it’s simple. IRR is the break-even return rate. If your actual rate beats IRR, you make money. Excel and Google Sheets both have built-in IRR functions that solve this instantly.

What Is IRR?

IRR measures the rate of return on an investment. It tells you what annual growth rate your cash flows produce from start to finish.

Think of it this way. You put $100,000 into a project. Over five years, you get cash back in chunks. IRR is the one number that sums up whether those chunks grew your money at 8%, 15%, or 25% per year. It factors in timing, so early cash flows count more than late ones.

IRR is also called the internal rate of return because it’s “internal” to the project. It doesn’t rely on outside rates like loan costs or market returns. It just looks at the cash you put in and the cash you get out.

Who uses this metric?

CFOs and VPs of Finance compare IRR across projects to decide where to spend capital and which deals to approve.

Private Equity and VC Investors use IRR to measure fund performance and report returns to limited partners.

Real Estate Investors calculate IRR on property deals to see if rental income and appreciation justify the buy.

Corporate Development Teams run IRR on M&A deals to make sure acquisitions hit target returns.

Fractional CFOs track IRR for multiple clients to show which investments perform best.

How to Calculate IRR: Step-by-Step

Let’s work through an IRR calculation with a real example.

- List all cash flows with dates

You’re buying a warehouse for $200,000. Over four years, you collect rent and then sell. Here’s your cash flow:

- Year 0: -$200,000 (purchase)

- Year 1: $30,000 (rent)

- Year 2: $35,000 (rent)

- Year 3: $35,000 (rent)

- Year 4: $250,000 (rent + sale)

- Set up the IRR formula

You need the rate where the present value of inflows equals the $200,000 outflow.

$200,000 = $30,000/(1+IRR)¹ + $35,000/(1+IRR)² + $35,000/(1+IRR)³ + $250,000/(1+IRR)⁴

- Solve for IRR

This requires trial and error or a calculator. Excel’s IRR function does this instantly.

In Excel: =IRR({-200000, 30000, 35000, 35000, 250000})

- Get your result

IRR = 18.4%

- Interpret the result

An 18.4% IRR means your $200,000 grew at 18.4% per year over four years. If your target was 15%, this deal beats it. If your cost of capital is 20%, this deal falls short.

How to Interpret Your IRR Number

| IRR Range | Interpretation | Recommended Actions |

| Below 8% | Weak return – Your money grows slower than safe bonds or index funds. | • Reject the project unless strategic value exists<br>• Look for cost cuts to boost returns<br>• Consider shorter holding periods<br>• Compare to safer alternatives |

| 8% – 12% | Modest return – Acceptable for low-risk deals but may not beat inflation plus risk premium. | • Proceed if risk is low<br>• Negotiate better terms on future cash flows<br>• Look for ways to accelerate cash inflows<br>• Monitor closely for downside risks |

| 12% – 20% | Good return – Solid performance that justifies moderate risk and effort. | • Green light for most deals<br>• Document assumptions clearly<br>• Set up regular performance reviews<br>• Use as benchmark for similar projects |

| 20% – 30% | Strong return – Well above average. Signals a high-performing investment. | • Execute quickly before conditions change<br>• Stress test assumptions to confirm<br>• Consider increasing investment size<br>• Share learnings across team |

| Above 30% | Excellent return – Exceptional performance, but verify assumptions. High returns can signal high risk. | • Double-check all inputs and assumptions<br>• Confirm exit strategy is realistic<br>• Consider if market timing is favorable<br>• Plan for volatility and risk management |

IRR Benchmarks by Industry

IRR targets vary widely by industry. What’s strong in one sector may be weak in another.

| Industry | Typical IRR Range | Notes |

| Venture Capital | 20% – 35% | High risk, high reward. Early-stage deals aim for 30%+ to offset failures. |

| Private Equity Buyouts | 15% – 25% | Mature companies with stable cash flows. 20% is a common target. |

| Real Estate (Core) | 8% – 12% | Low-risk properties with steady rent. Lower returns but predictable. |

| Real Estate (Value-Add) | 12% – 18% | Properties needing work. Higher returns reflect renovation risk. |

| Real Estate (Opportunistic) | 18% – 25% | Ground-up development or major repositioning. High risk, high return. |

| Manufacturing | 12% – 18% | Capital-intensive. Returns depend on margins and capacity use. |

| SaaS and Technology | 18% – 30% | High margins and scalability drive strong returns for winners. |

| Infrastructure | 10% – 15% | Long-term, stable cash flows. Lower returns due to low risk. |

Industry benchmarks shift with interest rates. When rates were near zero, a 12% IRR looked strong. With rates at 5% today, investors demand 15%+ to justify the risk.

Benchmark Citations

Cambridge Associates Private Investment Benchmarks

McKinsey Global Private Markets Report 2025

Phoenix Strategy Group: VC Fund Performance Metrics

Automating IRR Tracking with Coefficient

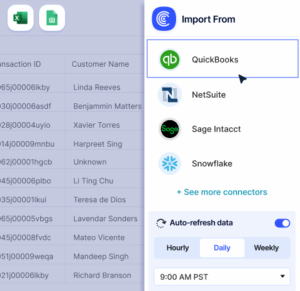

Stop copying cash flow data from NetSuite or QuickBooks every month. Coefficient links your accounting system straight to Excel or Google Sheets. Your IRR formulas pull live data and update on schedule.

Set it once. Your IRR calculations refresh daily, weekly, or monthly. Perfect for fractional CFOs managing multiple portfolios or finance teams tracking dozens of projects.

Get started with Coefficient and automate your IRR tracking.

How to Improve Your IRR

Accelerate cash inflows

Get money back faster. Negotiate shorter payment terms. Offer early payment discounts. Launch products sooner. Every month you pull cash forward boosts IRR because the time value of money rewards speed.

Reduce up-front investment

Cut initial costs without hurting results. Lease equipment instead of buying. Phase rollouts to spread costs. Renegotiate vendor contracts. Lower CF₀ means less capital at risk and higher IRR on the same returns.

Extend revenue streams

Add recurring revenue. Turn one-time sales into subscriptions. Build maintenance contracts. Create add-on services. Longer cash flow tails improve IRR, especially without big new investments.

Exit earlier

Sell or refinance sooner if returns are strong. A four-year hold at 20% IRR beats a six-year hold at 18% IRR. Know when to take profits and redeploy capital into the next deal.

Improve operating margins

Cut costs that don’t add value. Automate tasks. Renegotiate supplier deals. Trim overhead. Higher margins mean more cash flow per year, which directly lifts IRR.

IRR vs. ROI vs. NPV

These three metrics measure returns, but they answer different questions.

IRR (Internal Rate of Return)

What annual growth rate do my cash flows produce? It’s a percentage. Best for comparing deals of different sizes and lengths.

ROI (Return on Investment)

How much did I make relative to what I spent? Simple: (Gain – Cost) / Cost. ROI ignores timing, so $100 profit in year 1 looks the same as $100 in year 5. Use ROI for quick checks, not deep analysis.

NPV (Net Present Value)

What’s the dollar value of my investment today? NPV uses a discount rate you choose. Positive NPV means the deal adds value. Negative NPV means it destroys value. NPV tells you absolute value. IRR tells you the rate that creates that value.

Which one to use?

Use IRR to compare deals. Use NPV to see if a deal is worth doing. Use ROI for fast, rough estimates. If IRR and NPV conflict, trust NPV. NPV assumes you can reinvest at your cost of capital, which is more realistic.

Pro tip for fractional CFOs: Show clients all three. IRR is easy to explain. NPV is technically correct. ROI gives a gut check. Together, they tell the full story.

Make better investment decisions

IRR cuts through complexity. It turns cash flows into a single percentage you can compare across deals. Calculate it right. Benchmark it against your industry. Use it to guide capital allocation.Stop tracking IRR in disconnected spreadsheets. Get started with Coefficient and automate your investment tracking today.