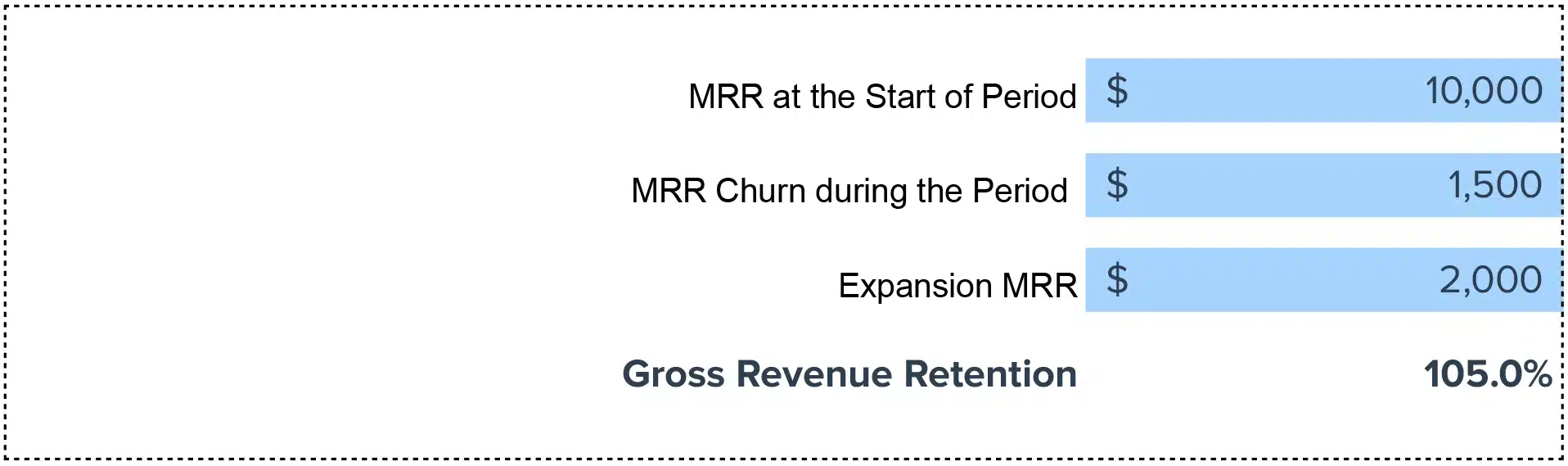

Gross Revenue Retention: (MRR at the Start of Period – MRR Churn during the Period + Expansion MRR) / MRR at the Start of Period

Gross Revenue Retention Simplified: Calculation Guide

- Identify MRR at the beginning of your period.

- Calculate the total MRR lost to churn during the same period.

- Sum any Expansion MRR gained.

- Apply the values to the GRR formula above.

GRR Overview

Gross Revenue Retention (GRR) quantifies a company’s ability to retain revenue, excluding the impact of expansions. It’s a pivotal KPI for understanding your product’s long-term sustainability and customer satisfaction.

Importance of GRR

- Signals customer satisfaction and product-market fit.

- Predicts long-term revenue potential and stability.

- Crucial for investment assessments and valuation.

Real-world Example

A software company starts with $100,000 MRR. By month’s end, it loses $5,000 MRR to churn but gains $10,000 in Expansion MRR. Its GRR would be 105%, signaling healthy growth.

Improvement Strategies

- Enhance Customer Support: A dedicated team can reduce churn.

- Upselling and Cross-selling: Encourage more spending from current customers.

- Customer Feedback Loops: Implement changes based on direct customer insights.

- Loyalty Programs: Reward long-term customers.

- Invest in Training: More skilled employees can provide better services.

Full Tutorial: Calculating GRR in Google Sheets

- Label columns: Start MRR | Churn MRR | Expansion MRR | GRR.

- Enter your data into the first three columns.

- In the GRR column, use the formula: `=(A2-B2+C2)/A2*100`.

- Drag down to apply to multiple rows.

Drawbacks

- Does not account for new MRR: Can mask issues in acquisition.

- Short-term metric: Needs longitudinal analysis for full insights.

Usage Contexts

- Ideal for evaluating customer satisfaction and retention.

- Helps in forecasting future revenue stability.