FIFO (First In, First Out)

COGS = Cost of oldest inventory × Units sold

Ending Inventory = Cost of newest inventory × Units remaining

LIFO (Last In, First Out)

COGS = Cost of newest inventory × Units sold

Ending Inventory = Cost of oldest inventory × Units remaining

This free FIFO/LIFO calculator shows how each method impacts your cost of goods sold and ending inventory. Whether you need to compare valuation methods for financial reporting or understand tax implications, you’ll learn how to calculate both methods, interpret the differences, and choose the right approach. We’ve also included a free Excel and Google Sheets template you can download and customize for your specific needs.

Here’s how these methods work.

FIFO and LIFO Formulas Explained

FIFO (First In, First Out)

- COGS = Cost of oldest inventory × Units sold

- Ending Inventory = Cost of newest inventory × Units remaining

LIFO (Last In, First Out)

- COGS = Cost of newest inventory × Units sold

- Ending Inventory = Cost of oldest inventory × Units remaining

Let’s break down the logic:

FIFO assumption: You sell the oldest units first. Cost of goods sold uses prices from earlier purchases, while ending inventory reflects recent costs.

LIFO assumption: You sell the newest units first. Cost of goods sold uses the most recent prices, while ending inventory stays at older costs. LIFO is only allowed under U.S. GAAP, not IFRS.

Why the method matters: During inflation, FIFO shows lower COGS and higher profits. LIFO shows higher COGS and lower profits, reducing taxes. The choice affects your income statement, balance sheet, and cash flow.

What Is FIFO and LIFO?

FIFO and LIFO are inventory valuation methods that determine which unit costs flow to your cost of goods sold versus ending inventory. The method you choose affects reported profits, taxes, and how your balance sheet looks to lenders and investors.

FIFO matches the physical flow for most businesses. Grocery stores sell milk purchased weeks ago before newer deliveries. But LIFO can match costs to revenues better during inflation, even if it doesn’t match physical inventory movement.

Who uses these methods?

CFOs and Controllers evaluating which method minimizes taxes while meeting reporting requirements.

Tax Accountants calculating LIFO reserves and managing IRS conformity rules for clients.

Financial Analysts adjusting company comparisons when firms use different inventory methods.

Auditors verifying proper application of FIFO or LIFO under GAAP standards.

Fractional CFOs advising multiple clients on optimal inventory accounting choices.

How to Calculate FIFO and LIFO: Step-by-Step

Let’s walk through both methods using the same inventory data.

- Gather your inventory data

For our example, assume these facts for Q1:

- Beginning inventory: 100 units at $10 = $1,000

- January purchase: 150 units at $12 = $1,800

- March purchase: 200 units at $14 = $2,800

- Total units sold: 300 units

- Calculate FIFO cost of goods sold

Under FIFO, you sell the oldest units first. Start with beginning inventory, then move to January, then March:

- 100 units from beginning inventory × $10 = $1,000

- 150 units from January purchase × $12 = $1,800

- 50 units from March purchase × $14 = $700

- Total FIFO COGS = $3,500

- Calculate FIFO ending inventory

You have 150 units left (100 + 150 + 200 – 300). These are the newest units from March:

- 150 units × $14 = $2,100 ending inventory

- Calculate LIFO cost of goods sold

Under LIFO, you sell the newest units first. Start with March, work backward to January, then beginning inventory:

- 200 units from March purchase × $14 = $2,800

- 100 units from January purchase × $12 = $1,200

- Total LIFO COGS = $4,000

- Calculate LIFO ending inventory

You have the same 150 units remaining, but they come from older purchases:

- 50 units from January purchase × $12 = $600

- 100 units from beginning inventory × $10 = $1,000

- $1,600 ending inventory

- Compare the results

FIFO shows COGS of $3,500 and ending inventory of $2,100. LIFO shows COGS of $4,000 and ending inventory of $1,600. The $500 COGS difference flows directly to gross profit and taxable income.

- Interpret the impact

LIFO produced $500 more in COGS. At a 25% tax rate, LIFO saves $125 in taxes this quarter. But your balance sheet shows $500 less in inventory value, affecting working capital ratios.

How to Interpret Your FIFO and LIFO Numbers

The key difference shows up in three areas: profitability, taxes, and balance sheet strength.

| Scenario | Financial Statement Impact | Strategic Considerations |

| Rising prices (inflation) | FIFO: Higher gross profit, higher taxes, stronger balance sheet<br>LIFO: Lower gross profit, lower taxes, weaker balance sheet | • LIFO saves cash through tax deferral<br>• FIFO shows better profitability to investors<br>• Consider loan covenant requirements |

| Falling prices (deflation) | FIFO: Lower gross profit, lower taxes, weaker balance sheet<br>LIFO: Higher gross profit, higher taxes, stronger balance sheet | • LIFO increases tax burden during deflation<br>• FIFO becomes tax-advantaged<br>• Switching methods requires IRS approval |

| Stable prices | Both methods: Nearly identical COGS, profits, and inventory values | • Method choice matters less financially<br>• Focus on physical flow and administrative ease<br>• Industry norms guide selection |

| LIFO liquidation | LIFO: Old, low-cost inventory sold creates profit spike and tax surge | • Monitor inventory levels carefully<br>• Plan purchases to avoid liquidations<br>• Consider LIFO reserve adequacy |

GAAP vs IFRS consideration: If you report under IFRS or plan international operations, LIFO is prohibited. Only FIFO or weighted average cost are allowed. U.S. companies using LIFO must also calculate and disclose a LIFO reserve to show what inventory would be under FIFO.

IRS conformity rule: If you elect LIFO for tax purposes, you must also use LIFO for financial reporting to shareholders. You cannot use LIFO for taxes but FIFO for your annual report.

FIFO and LIFO Benchmarks by Industry

Different industries favor different methods based on product characteristics and price volatility.

| Industry | Common Method | Why This Method Makes Sense |

| Retail (General) | FIFO | Matches physical flow, reduces obsolescence risk |

| Grocery/Food | FIFO | Perishable goods require selling oldest first |

| Pharmaceuticals | FIFO | Expiration dates mandate oldest-first approach |

| Oil & Gas | LIFO | High price volatility, significant tax benefits |

| Automotive Parts | LIFO | Tax deferral valued over balance sheet strength |

| Manufacturing (Heavy) | LIFO | Commodity price swings, tax savings offset costs |

| Technology/Electronics | FIFO | Rapid obsolescence makes LIFO impractical |

| Wholesale Distribution | FIFO | High turnover, matching physical flow preferred |

Approximately 30% of U.S. public companies still use LIFO, primarily in commodity-based industries. This has declined as companies expand globally and face IFRS restrictions.

Benchmark Citations

CPA Journal – LIFO or FIFO During Inflationary Times

Finale Inventory – Inventory Costing Methods Guide

FreshBooks – How to Calculate FIFO and LIFO

Automating FIFO and LIFO Tracking with Coefficient

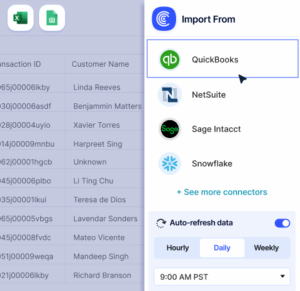

Stop manually exporting inventory data from NetSuite, QuickBooks, or your ERP every month.

Coefficient connects your accounting system directly to Excel or Google Sheets, automatically importing purchase dates, costs, and quantities. Your FIFO or LIFO calculations update themselves from live data.

Set up your formulas once, and they refresh automatically. Perfect for finance teams tracking multiple entities or fractional CFOs managing client portfolios. Try Coefficient free and eliminate manual inventory tracking.

How to Improve Your Inventory Accounting Process

Regardless of which method you use, these strategies strengthen inventory accounting accuracy and efficiency.

Implement cycle counting programs

Replace annual physical counts with ongoing cycle counts. Count different inventory sections weekly or monthly. This catches errors faster and provides continuous validation of your perpetual inventory system.

Automate purchase order tracking

Link purchase orders to receiving documents and vendor invoices in your system. This creates an audit trail showing exactly when inventory arrived and at what cost. Automation prevents goods received but not recorded, which throws off calculations.

Review inventory layers quarterly

For LIFO users, monitor your inventory layers. Watch for potential LIFO liquidations where quantity drops force you to sell old, cheap inventory. This creates unexpected profit spikes and tax bills.

Calculate both methods monthly

Even if you use LIFO for reporting, calculate FIFO values monthly to track your LIFO reserve. Many loan covenants require LIFO companies to report adjusted metrics using FIFO values.

Train staff on method implications

Make sure your purchasing and warehouse teams understand how timing affects costs. Late-quarter purchases can significantly impact LIFO COGS. Education prevents costly mistakes.

FIFO vs. LIFO vs. Weighted Average Cost

Companies choosing inventory methods have three main options under U.S. GAAP.

FIFO (First In, First Out)

Assigns oldest costs to COGS and newest costs to ending inventory. Matches physical flow for most businesses. Shows higher profits during inflation. Required under IFRS.

LIFO (Last In, First Out)

Assigns newest costs to COGS and oldest costs to ending inventory. Reduces taxes during inflation. Creates LIFO reserve disclosure requirement. Only allowed under U.S. GAAP.

Weighted Average Cost

Calculates average cost of all units, then applies this average to both COGS and ending inventory. Falls between FIFO and LIFO. Simple to administer. Allowed under both GAAP and IFRS.

When to use each

During rising prices, LIFO produces the lowest net income, FIFO the highest, and weighted average falls in the middle. Tax strategy, financial reporting goals, and international operations drive the choice.

Pro tip for fractional CFOs: When clients operate across borders, recommend FIFO or weighted average cost. This avoids maintaining dual inventory records. Companies using LIFO domestically but needing IFRS statements for foreign subsidiaries face significant administrative burden.

Choose the right method

Your inventory valuation method affects taxes, profitability, and balance sheet strength. Select based on your tax strategy, reporting requirements, and operational reality.Get started with Coefficient to automate your inventory calculations and ensure accuracy across both FIFO and LIFO methods.