Discount Rate Formula Explained

Discount Rate (WACC) = (E/V × Cost of Equity) + (D/V × Cost of Debt × (1-Tax Rate))

Let’s break down each component:

E/V (Equity Weight): The proportion of your company’s total value funded by equity. Calculate this by dividing market value of equity by total enterprise value. This shows how much of your funding comes from shareholders.

Cost of Equity: The return shareholders expect for investing in your company. Typically calculated using CAPM (Capital Asset Pricing Model), which adds risk-free rate to your company’s beta multiplied by market risk premium. Higher risk means higher cost.

D/V (Debt Weight): The proportion of total value funded by debt. Calculate by dividing market value of debt by enterprise value. This represents borrowed capital as a percentage of total funding.

Cost of Debt: The effective interest rate you pay on borrowed funds. Include all interest expenses divided by total debt. We multiply this by (1-Tax Rate) because interest payments are tax-deductible, reducing the true cost.

Tax Rate: Your effective corporate tax rate. This reduces the net cost of debt since interest is tax-deductible. The tax shield makes debt cheaper than equity for most companies.

What Is a Discount Rate?

A discount rate converts future cash flows into present value—answering the question: “What are those future dollars worth to us today?” For corporate finance, this rate represents your company’s weighted average cost of capital (WACC), the minimum return needed to satisfy all investors.

The discount rate reflects risk. Higher rates signal riskier investments requiring greater returns. Lower rates indicate stable, predictable cash flows. Every investment decision, acquisition analysis, and project evaluation relies on an accurate discount rate to compare options fairly.

Who uses this metric?

CFOs and Finance Directors evaluate project viability and capital allocation decisions across the organization.

Investment Bankers perform DCF valuations for M&A transactions and fairness opinions.

Private Equity Investors assess deal returns and determine bid prices for acquisitions.

Corporate Development Teams screen strategic investments and rank capital projects.

Financial Analysts build valuation models and prepare investment recommendations.

How to Calculate Discount Rate: Step-by-Step

Let’s walk through calculating your company’s discount rate with a practical example:

- Determine your capital structure

Find your market value of equity and debt. For our example: Market cap (equity) = $800 million, Total debt = $200 million. Total value (V) = $1 billion.

- Calculate capital weights

Equity weight (E/V) = $800M ÷ $1,000M = 0.80 or 80%

Debt weight (D/V) = $200M ÷ $1,000M = 0.20 or 20%

These percentages show your funding mix. This company funds 80% through equity and 20% through debt.

- Find your cost of equity

Using CAPM: Risk-free rate (10-year Treasury) = 4.2%, Market risk premium = 6.0%, Company beta = 1.3

Cost of Equity = 4.2% + (1.3 × 6.0%) = 12.0%

This 12% represents what shareholders expect as return on their investment.

- Calculate your cost of debt

Annual interest expense = $12M, Total debt = $200M

Cost of Debt = $12M ÷ $200M = 6.0%

- Apply your tax rate

Assume effective tax rate = 25%

After-tax cost of debt = 6.0% × (1 – 0.25) = 4.5%

The tax shield reduces your true debt cost from 6% to 4.5%.

- Calculate WACC (discount rate)

WACC = (0.80 × 12.0%) + (0.20 × 4.5%) = 9.6% + 0.9% = 10.5%

- Interpret your result

A discount rate of 10.5% means any project must generate returns exceeding 10.5% to create value. Projects returning less than 10.5% destroy shareholder value. Use this rate to discount future cash flows in DCF models and evaluate capital investments.

How to Interpret Your Discount Rate Number

| Rate Range | Interpretation | Recommended Actions |

| Below 6% | Very low risk profile – Typical for utilities and established monopolies with stable cash flows | • Verify capital structure is optimal<br>• Consider if low rate reflects missed growth opportunities<br>• Ensure calculation includes all risk factors |

| 6% – 9% | Low to moderate risk – Common for mature companies in stable industries with predictable revenues | • Maintain strong credit rating<br>• Monitor debt levels and refinancing opportunities<br>• Focus on operational efficiency |

| 9% – 12% | Moderate risk – Standard for established businesses with competitive markets and some growth | • Balance debt and equity strategically<br>• Evaluate projects carefully against this hurdle<br>• Track changes in cost components quarterly |

| 12% – 15% | Elevated risk – Typical for growth companies, cyclical industries, or higher leverage situations | • Assess if leverage is too high<br>• Consider equity raises to reduce cost<br>• Prioritize high-return projects only |

| Above 15% | High risk profile – Common for startups, distressed companies, or highly volatile industries | • Review capital structure urgently<br>• Evaluate refinancing options<br>• Focus on cash flow stability before new projects |

Discount Rate Benchmarks by Industry

Understanding how your discount rate compares to industry peers provides crucial context for interpreting your results and making strategic decisions.

| Industry | Typical WACC Range | Notes |

| Technology / SaaS | 10% – 14% | High growth potential but market volatility and rapid innovation create uncertainty |

| Manufacturing | 9% – 11% | Capital intensive with cyclical demand patterns affecting cash flow predictability |

| Consumer Goods | 8% – 10% | Established brands with steady demand but competitive pressure on margins |

| Utilities | 7% – 8% | Regulated industries with predictable cash flows and monopolistic positions |

| Healthcare Services | 9% – 12% | Mix of stable revenues and regulatory risk varies by business model |

| Real Estate | 7% – 10% | Asset-backed with leverage sensitivity and interest rate exposure |

| Financial Services | 8% – 11% | Highly leveraged capital structures with regulatory capital requirements |

| Retail | 9% – 13% | Thin margins and competitive markets increase risk despite scale |

These ranges reflect 2024-2025 market conditions. Your specific rate depends on company size, credit rating, growth stage, and capital structure. Smaller companies typically face 2-3% higher rates than industry averages due to size premium and limited access to capital.

Benchmark Citations

Financial Modeling Tech – Industry Discount Rates Guide

KPMG Cost of Capital Study 2024

Investopedia – Cost of Capital vs Discount Rate

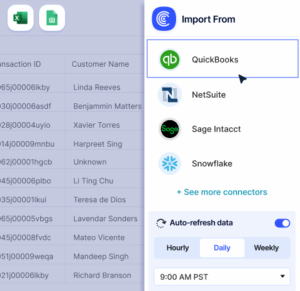

Automating Discount Rate Tracking with Coefficient

Stop manually exporting financial data from NetSuite or your data warehouse every quarter to recalculate WACC.

Coefficient connects your accounting system and financial databases directly to Excel or Google Sheets, automatically pulling equity values, debt balances, and interest expenses. Your discount rate updates itself from live data.

Set up takes 10 minutes. Your WACC calculation stays current without manual work. Perfect for finance teams tracking multiple entities or updating valuations monthly.

Get started with Coefficient and automate your financial metrics today.

How to Improve Your Discount Rate

A lower discount rate makes more projects viable and increases company valuation. Here are five proven strategies to reduce your WACC.

Optimize your capital structure

Shift toward more debt financing up to your optimal point. Debt is cheaper than equity due to tax deductibility. Most companies can safely increase leverage from current levels. Model different debt-to-equity ratios to find your minimum WACC point before financial distress costs offset tax benefits.

Improve your credit rating

Work with rating agencies to upgrade from BB to BBB or better. Each rating notch saves 50-100 basis points on debt costs. Focus on debt service coverage ratios, maintain strong liquidity, and demonstrate consistent cash generation. Investment-grade status dramatically reduces borrowing costs.

Reduce business risk and volatility

Diversify revenue streams, extend customer contracts, and build recurring revenue models. Lower earnings volatility reduces your equity beta, decreasing cost of equity. SaaS companies with 90%+ recurring revenue can achieve betas 20-30% below industry peers. Predictability drives down discount rates.

Refinance expensive debt

Review all debt facilities for refinancing opportunities. Rates have fluctuated significantly. Replacing 8% bonds with 5.5% term loans saves 250 basis points on debt costs. Extend maturities when rates are favorable and eliminate high-cost mezzanine or preferred equity.

Increase scale and market position

Larger companies access cheaper capital. Growing from $50M to $200M revenue can reduce discount rates by 200-300 basis points through scale premium reduction. Build market share, strengthen competitive moats, and demonstrate growth trajectory to attract better financing terms.

Discount Rate vs. Cost of Capital vs. Hurdle Rate

These three terms overlap but serve different purposes. Understanding when to use each matters for clear communication and proper analysis.

Discount Rate

The rate used to convert future cash flows to present value in DCF analysis. For companies, this is typically WACC. For investors evaluating external opportunities, this is their required return based on risk assessment and opportunity cost.

Cost of Capital

The rate a company pays to finance operations, representing the weighted average cost of all funding sources. Cost of capital and discount rate are identical when valuing an entire company. They differ when evaluating specific projects with risk profiles different from the company average.

Hurdle Rate

The minimum return required to approve a project or investment. Companies often set hurdle rates above WACC to account for execution risk, strategic importance, or to ration capital. A company with 10% WACC might use 12-15% hurdle rates for expansion projects.

When to use each

Example in practice: A manufacturing company has 9% WACC (cost of capital). They use 9% as the discount rate for valuing acquisitions in their core market. For a new technology venture, they apply 14% discount rate due to higher risk. Their official hurdle rate for all capital projects is 11% to ensure value creation buffer.

Pro tip for fractional CFOs: Present all three metrics to clients. Show WACC as the baseline, explain project-specific discount rate adjustments, and help boards set appropriate hurdle rates based on their risk tolerance and capital constraints. This framework prevents confusion and improves capital allocation decisions.

Make smarter capital decisions

Your discount rate determines which projects create value. Track it quarterly. Compare it to industry benchmarks. Use it to evaluate every investment opportunity.

Get started with Coefficient and automate your discount rate calculations today.