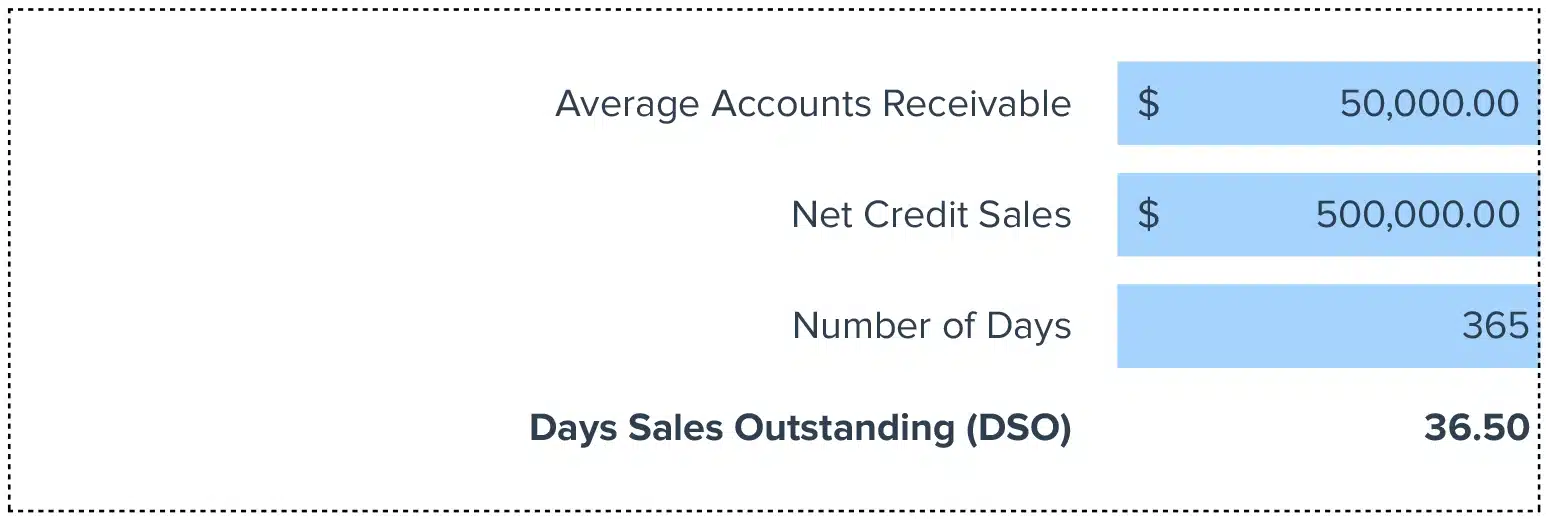

DSO = (Average Accounts Receivable / Total Credit Sales) * Number of Days

How to Calculate DSO?

– Average Accounts Receivable: The average amount of money owed to a company by its customers over a specified period, typically a month or a year.

– Total Credit Sales: The total value of sales provided on credit to customers in the same period.

– Number of Days: Usually the days in the measurement period, such as 30, 90, or 365 days.

What is Days Sales Outstanding?

Days Sales Outstanding (DSO) is a key financial metric that measures the average number of days that a company takes to collect payments after a sale has been made. This indicator is crucial for understanding the efficiency of accounts receivable processes and overall cash flow health.

Why is Days Sales Outstanding Important?

Understanding DSO is critical for managing a company’s cash flow effectively. It provides insights into how quickly customers are paying their bills, which directly affects liquidity and operational efficiency. A lower DSO indicates a more efficient collection process and better cash flow management.

Days Sales Outstanding Example Calculation

– Average Accounts Receivable: $50,000

– Total Credit Sales: $300,000

– Period: 30 Days

– The calculation would then be: (50,000 / 300,000) * 30 = 5 Days

How to Improve Days Sales Outstanding

1. Enhance Invoice Accuracy: Ensure your invoices are correct and concise to minimize payment delays. Case studies show that accurate invoicing can reduce payment times by 10-15%.

2. Automate Payment Reminders: Implement automated reminders before and after invoicing. Automation can speed up the payment process by reminding customers of upcoming and overdue payments.

3. Offer Multiple Payment Methods: By offering a variety of payment options, including digital payments, companies can make it easier for customers to settle invoices promptly.

4. Analyze Customer Payment Behavior: Regularly review customer payment patterns and prioritize follow-ups with consistently late payers to improve DSO.

5. Use Financial Incentives: Provide early payment discounts to encourage quicker payment. This approach often helps to significantly improve the time it takes to receive payment.

How to Calculate DSO in Google Sheets and Excel?

1. Input your Total Credit Sales in cell A1.

2. Enter Average Accounts Receivable in cell A2.

3. Put the Number of Days in cell A3.

4. Apply the formula: =(A2/A1)*A3 in cell A4 to get the DSO.

Drawbacks of Days Sales Outstanding

– Economic Sensitivity: DSO can fluctuate with economic circumstances, sometimes reflecting external factors rather than company performance.

– Sector Variations: Different industries have varying standard payment terms, which can skew comparative analyses.

– Customer Dependency: A few large customers who pay slowly can disproportionately impact the DSO metric.

When to Use the DSO Calculator?

Use the DSO Calculator when reviewing financial health, during internal audits, or when assessing the impact of new credit policies. It’s especially crucial for the finance departments aiming to maintain or improve cash flow and customer payment terms.

DSO Calculator: Tips and Tricks

– Track Regularly: Monitor DSO trends monthly to catch and correct deteriorations in receivables.

– Segment Analysis: Break down DSO by customer or region for more targeted management.

– Forecasting: Incorporate DSO trends into cash flow forecasting to improve financial planning.