CAGR = ((Ending Value / Beginning Value)^(1 / Number of Years)) – 1

Growth rate matters. But simple math can lie to you about how fast your money really grew. CAGR cuts through year-to-year noise to show true performance.

Learn how to calculate it, what the numbers mean, and when your results signal success or warn of trouble. Download our free CAGR template for Excel and Google Sheets.

CAGR Formula Explained

CAGR = ((Ending Value / Beginning Value)^(1 / Number of Years)) – 1

Break this down into parts.

- Ending Value is what your asset is worth now or at the end of your time period. For a stock, that’s the closing price. For a business, that’s revenue or valuation at period end.

- Beginning Value is where you started. The purchase price. The day-one revenue figure. Whatever you paid or what the metric was at time zero.

- Number of Years is the hold period. Five years. Ten years. Three years. It has to match your start and end dates.

Why raise to the power of (1/Number of Years)? That’s the math that spreads growth evenly across each year. CAGR assumes your investment compounded at the same rate every year—even though real life gave you ups and downs.

Why subtract 1? The formula gives you a multiplier (like 1.15). Subtracting 1 converts that to a percentage (15%).

CAGR is excluded from some calculations because it smooths volatility. If you need to see year-by-year swings, CAGR hides them. But for comparing long-term performance, CAGR beats simple averages.

What Is CAGR?

CAGR stands for Compound Annual Growth Rate. It shows the rate your investment would need to grow each year to get from start value to end value.

Think of it as a smoothing tool. Your stock went up 50% year one, down 20% year two, up 30% year three. CAGR gives you one number—the steady growth rate that would produce the same result if it happened every year.

CAGR accounts for compounding. That means each year’s growth builds on the year before. A 10% CAGR over 10 years doesn’t mean you made 100%. You made 159% because gains compound.

Who uses this metric?

- CFOs and Controllers track CAGR to measure revenue growth, cost trends, and performance against plan.

- Private Equity and VC Investors use CAGR to evaluate portfolio company growth and compare deals.

- Financial Analysts rely on CAGR to benchmark investments, forecast trends, and report performance.

- Business Owners track CAGR to see if growth is real or just good years masking bad ones.

How to Calculate CAGR: Step-by-Step

Walk through a real example. You’ll see how the formula works.

- Find your beginning value

In January 2020, you bought shares worth $10,000.

- Find your ending value

In January 2025, those shares are worth $16,000.

- Count the years

From January 2020 to January 2025 is 5 years.

- Divide ending by beginning

$16,000 ÷ $10,000 = 1.6

- Take the nth root

You want the 5th root of 1.6. That’s the same as raising 1.6 to the power of (1/5).

1.6^(1/5) = 1.0986

- Subtract 1

1.0986 – 1 = 0.0986

- Convert to a percentage

0.0986 = 9.86%

Your CAGR is 9.86%.

That means if your $10,000 had grown at a steady 9.86% each year, you’d have $16,000 after 5 years. In reality, some years were great, some were flat, but the compounded result is 9.86% annually.

How to Interpret Your CAGR Number

CAGR by itself isn’t good or bad. Context matters. Compare it to benchmarks, goals, and alternatives.

| CAGR Range | Interpretation | Recommended Actions |

| Below 5% | Weak performance—barely beats inflation. May signal poor growth or declining business. | • Review what went wrong• Compare to market benchmarks• Consider reallocating capital |

| 5% – 10% | Moderate growth—solid but not exceptional. Typical for mature industries. | • Track trends over time• Benchmark against peers• Look for efficiency gains |

| 10% – 15% | Strong growth—outpacing most benchmarks. Sign of healthy business or market. | • Sustain momentum• Invest in scaling• Watch for market headwinds |

| 15% – 20% | Excellent growth—top-tier performance. Often seen in high-growth sectors like tech or biotech. | • Maintain discipline• Plan for plateau• Diversify risk |

| Above 20% | Outstanding growth—rarely sustainable long-term. Verify assumptions and market conditions. | • Stress-test projections• Lock in gains strategically• Prepare for normalization |

A 15% CAGR over 3 years is less impressive than 10% over 10 years. Time matters. Longer periods reduce the impact of lucky timing.

Inflation eats returns. A 7% CAGR during 3% inflation gives you real growth of ~4%. Always adjust for inflation when evaluating long-term performance.

CAGR Benchmarks by Industry

CAGR varies by industry. Capital-intensive sectors grow slower. High-margin tech businesses grow faster. Compare your results to peers, not to every industry.

| Industry | Typical CAGR Range | Notes |

| SaaS / Technology | 15% – 30% | Recurring revenue, high scalability, but competitive |

| Financial Services | 8% – 12% | Regulated, stable, lower volatility |

| Healthcare / Biotech | 10% – 18% | R&D-heavy, long timelines, high risk/reward |

| Manufacturing | 5% – 8% | Mature sector, capital-intensive, cyclical |

| Retail | 3% – 7% | Thin margins, competitive, consumer-driven |

| Energy / Renewables | 8% – 15% | Transition phase, policy-dependent, variable |

| Real Estate | 6% – 10% | Market cycles, location-dependent, leverage effects |

| Consumer Goods | 5% – 10% | Mature markets, brand loyalty, slower innovation |

Why do benchmarks vary so much?

Business model drives CAGR. SaaS companies scale with minimal cost per new customer. Manufacturers need new plants for every growth phase. That’s why tech CAGRs top 20% while industrials hover near 5%.

Market maturity caps growth. Retail is crowded. Most customers already have what they need. Biotech is wide open. New drugs create new markets.

Capital requirements slow growth. Real estate needs cash for every deal. Software needs servers and engineers. Less capital, faster growth.

Benchmark Citations

Investopedia – CAGR Formula and Calculation

Bridgepoint Consulting – Financial Outlook 2025: CFO Survey Findings

MoneyChimp – S&P 500 CAGR Historical Data

Automating CAGR Tracking with Coefficient

Stop exporting CSV files every month. Stop copying data into spreadsheets. Stop recalculating CAGR by hand.

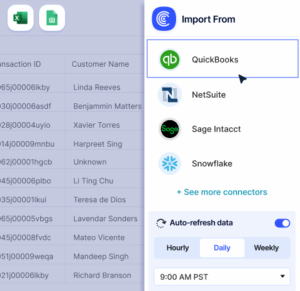

Coefficient connects NetSuite, QuickBooks, Xero, or your data warehouse directly to Excel and Google Sheets. Your CAGR formulas pull live data automatically. One setup. Zero manual updates.

Finance teams save hours per month. You track CAGR across revenue, expenses, customer growth, and any other metric—all in one dashboard. Schedule refreshes daily, weekly, or monthly. Share reports with stakeholders who see real-time numbers.

Perfect for CFOs managing multiple entities or tracking performance across departments.

How to Improve Your CAGR

CAGR measures what happened. You can’t change history. But you can change what happens next.

Increase revenue faster than costs

Revenue growth drives CAGR. But if expenses grow faster, CAGR suffers. Cut waste. Automate tasks. Negotiate better terms with vendors. Every dollar saved flows to growth.

Expand into new markets

New customers, new regions, new products—all boost ending value. A 10% CAGR in one market becomes 15% when you enter two more. Scale strategically.

Improve pricing power

Raising prices by 10% adds 10% to revenue if customers stay. Test pricing. Segment customers. Premium tiers pull CAGR up without adding costs.

Reduce churn

Every lost customer drags CAGR down. Retention compounds. A 90% retention rate beats 85% by double after five years. Invest in customer success.

Accelerate product cycles

Faster innovation means more revenue per year. Shorten time-to-market. Launch more often. First-mover advantage captures growth before competitors.

Optimize capital allocation

Money sitting idle doesn’t compound. Deploy cash into projects with high expected returns. Cut losing investments. Reinvest gains. Compounding accelerates when capital works harder.

CAGR isn’t just about what you measure. It’s about what you do. Small improvements compound over years. A 1% better CAGR over 10 years means 10% more ending value.

CAGR vs. Average Growth Rate vs. IRR

CAGR gets confused with related metrics. They’re not the same.

CAGR

CAGR smooths growth over time using only start value, end value, and years. It assumes growth compounds at a steady rate.

Average Growth Rate

Average Growth Rate (simple average) adds up yearly returns and divides by the number of years. It ignores compounding. If you gain 50% year one and lose 50% year two, the average is 0%. But your money is down 25%. Average growth rates mislead.

Internal Rate of Return (IRR)

Internal Rate of Return (IRR) considers cash flows—when money goes in and out. IRR solves for the discount rate that makes the net present value of all cash flows zero. CAGR can’t handle multiple deposits or withdrawals. IRR can.

When to use each

CAGR works for single investments with no mid-period cash flows. You bought stock, held it, sold it. Beginning and end. That’s CAGR territory.

IRR fits projects with irregular cash flows. Real estate with rental income and a sale. Private equity with capital calls and distributions. Business projects with phased investments.

Average Growth Rate should rarely be used. It overstates performance when volatility is high.

Pro tip for fractional CFOs: Present CAGR when discussing portfolio company growth to LPs. Use IRR when evaluating new deals with staged capital deployment. Present both when cash flows are mixed. Context determines which metric tells the truth.

Start tracking your growth

CAGR shows you the truth about performance. Not the story you tell yourself. Not the cherry-picked good years. The compounded reality of what happened over time.

Calculate it. Compare it to benchmarks. Use it to make better decisions about where your capital goes next. Growth compounds when you measure it right and act on what the numbers tell you.Stop manually tracking metrics in disconnected spreadsheets. Get started with Coefficient and automate your financial reporting today.