NOPAT Formula Explained

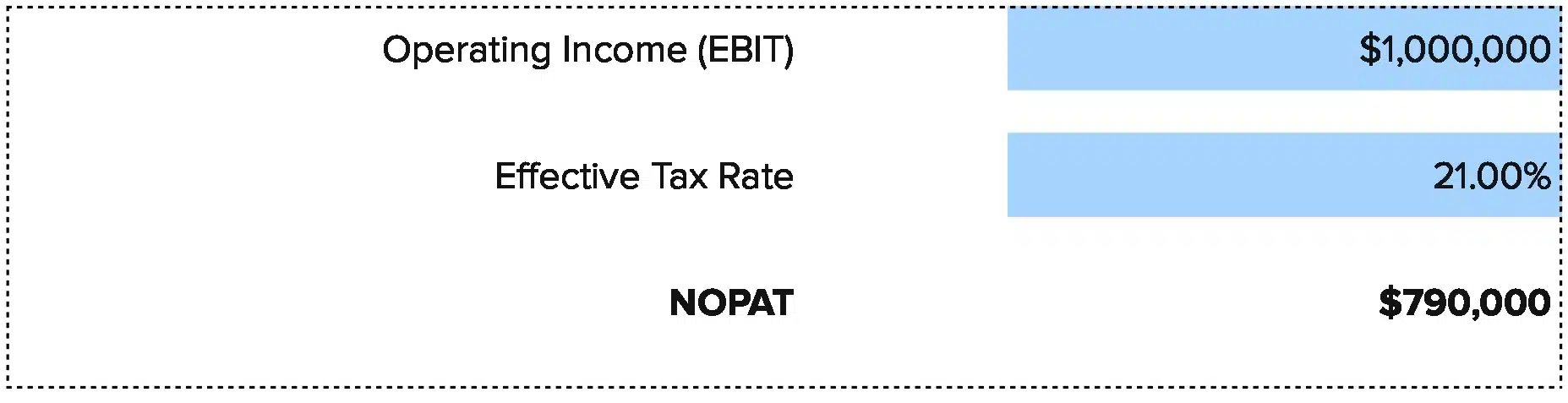

NOPAT = Operating Income × (1 – Tax Rate)

Or, stated another way:

NOPAT = EBIT × (1 – Tax Rate)

Let’s break down each part:

Operating Income (EBIT): This is your earnings before interest and taxes. It’s the profit from your main business work, found on your income statement. It includes revenue from sales minus cost of goods sold and operating costs like wages, rent, and marketing. It leaves out interest on debt and income tax.

Tax Rate: Your tax rate is the share of income paid as tax. Most firms use their effective tax rate, which you find by dividing total tax expense by pre-tax income. For instance, if you paid $200,000 in tax on $1 million in pre-tax income, your tax rate is 20%.

Why exclude interest? Interest is a financing cost, not an operating cost. By removing interest, NOPAT lets you judge operating health on its own. This makes it easy to compare firms with different debt loads.

Why apply tax? Tax is a real cost of doing business. NOPAT applies tax to show profit after this expense, giving a more honest view than EBIT alone.

What Is NOPAT?

NOPAT is Net Operating Profit After Tax. It measures how much profit your core operations make after tax, as if you had zero debt.

Think of it this way: if your business had no loans and no interest to pay, what would you earn? That’s NOPAT. It’s a clean read on operating strength, free from capital structure noise.

NOPAT matters most when comparing companies. Two firms might have the same revenue and costs, but one has heavy debt while the other uses equity. Their net income will differ wildly due to interest. NOPAT removes that financing effect.

Who uses this metric?

CFOs and Controllers tracking core profitability and making capital allocation choices.

Fractional CFOs comparing client performance across different industries and debt structures.

Private Equity Analysts valuing firms in deals, often using NOPAT for DCF models.

Corporate Development Teams running M&A analysis and evaluating operational efficiency.

Investment Analysts building financial models and comparing peer companies.

How to Calculate NOPAT: Step-by-Step

Let’s walk through a full NOPAT calculation with a real example. You’ll see exactly how the math works.

- Pull your most recent income statement

You’ll need your full P&L with operating income and tax expense. Make sure all figures are from the same period—typically a full year or trailing twelve months.

- Find operating income (EBIT)

Look for the line labeled “Operating Income” or “EBIT.” For our example: $2,400,000

- Identify your tax expense

On your income statement, locate “Income Tax Expense.” In our example: $420,000

- Calculate your effective tax rate

Divide tax expense by pre-tax income. If pre-tax income is $1,800,000 and tax is $420,000:

$420,000 ÷ $1,800,000 = 0.233 or 23.3%

- Calculate 1 minus tax rate

Subtract your tax rate from 1:

1 – 0.233 = 0.767

- Apply the NOPAT formula

Multiply operating income by (1 – tax rate):

$2,400,000 × 0.767 = $1,840,800

- Interpret your result

Your NOPAT of $1,840,800 means your core operations generated this much profit after tax, independent of debt. This number is what you use to compare against peers or track over time.

How to Interpret Your NOPAT Number

NOPAT is best viewed as a margin—NOPAT divided by revenue—which shows operating efficiency after tax.

| NOPAT Margin Range | Interpretation | Recommended Actions |

| Below 5% | Low profitability – Operations barely cover costs after tax. High risk of losses with any downturn. | • Cut non-essential overhead immediately<br>• Review pricing strategy and margins<br>• Audit supplier contracts for savings<br>• Consider operational restructuring |

| 5% – 10% | Below average – You’re making profit but with little room for error or reinvestment. | • Benchmark against top quartile competitors<br>• Identify and eliminate cost inefficiencies<br>• Improve sales mix toward higher-margin products<br>• Invest in process automation |

| 10% – 15% | Solid performance – Healthy profitability with flexibility for growth investment and economic shifts. | • Maintain cost discipline<br>• Monitor trends quarter over quarter<br>• Plan strategic initiatives<br>• Build cash reserves for opportunities |

| 15% – 20% | Strong profitability – Well above average, indicates operational excellence and pricing power. | • Consider growth investments (R&D, sales, M&A)<br>• Benchmark to sustain advantage<br>• Evaluate capital allocation options<br>• Plan for tax efficiency strategies |

| Above 20% | Exceptional efficiency – Top-tier performance, often seen in tech, software, or highly scaled operations. | • Assess market position and competitive moats<br>• Evaluate expansion into new markets<br>• Consider strategic acquisitions<br>• Ensure margin sustainability long-term |

These ranges are general benchmarks. Your industry matters. Software firms often hit 20-30% NOPAT margins while retail and manufacturing typically range from 5-12%. Always compare to your sector peers.

NOPAT Benchmarks by Industry

NOPAT margins differ by industry due to cost structure, capital needs, and competitive forces.

| Industry | Typical NOPAT Margin Range | Notes |

| Software (SaaS) | 18% – 28% | Low variable costs, high gross margins, scalable business model with minimal physical assets |

| Financial Services | 11% – 16% | Asset management and insurance show solid margins; banking varies with interest rate environment |

| Pharmaceutical | 17% – 23% | High R&D costs but strong pricing power and patent protection drive margins once drugs launch |

| Healthcare Services | 9% – 12% | Hospitals face labor costs and regulatory burden; reimbursement pressure limits margins |

| Retail | 3% – 10% | Thin margins due to competition and inventory costs; grocery lower, specialty higher |

| Manufacturing | 8% – 14% | Machinery and industrial firms balance volume with efficiency; commodity exposure compresses margins |

| Construction | 4% – 9% | Project-based, labor-intensive, cyclical demand; margins vary with backlog and material costs |

| Professional Services | 10% – 18% | Consulting and advisory leverage expertise; margin depends on utilization rates and pricing |

Capital intensity plays a huge role. Software needs servers and people; manufacturing needs plants and equipment. The more capital you deploy, the lower your return per dollar of revenue—unless you achieve massive scale.

Competitive dynamics also matter. Retail faces price wars and thin margins. Pharma and software enjoy intellectual property protection, which supports higher margins.

Tax rates differ by geography. A firm in high-tax regions will show lower NOPAT than a peer with the same EBIT but lower taxes. This is why NOPAT margin is more fair than EBIT margin when comparing global firms.

Benchmark Citations

NYU Stern Operating Margin Data (January 2025)

Wall Street Prep NOPAT Analysis

Shopify NOPAT Formula Guide (2025)

Automating NOPAT Tracking with Coefficient

Stop pulling CSVs from NetSuite, Sage Intacct, or QuickBooks every month. Coefficient connects your accounting system straight to Excel or Google Sheets. Operating income, tax expense, and revenue import live. Your NOPAT calculates itself.

Key benefits: save 20-40 minutes per close, zero errors, real-time updates on your schedule, and perfect for fractional CFOs tracking multiple clients.

Get started with Coefficient to automate your NOPAT tracking today.

How to Improve Your NOPAT

A weak NOPAT isn’t permanent. Here are five ways to lift your operating profit after tax.

Raise prices where you have leverage

Review your pricing. Many firms leave money on the table. If your service is sticky, test a 5-10% increase on renewals. Even a 3% lift can boost NOPAT by 15-20% if margins are thin.

Cut low-value operating expenses

Audit subscriptions, software, and vendor contracts. Most companies find 10-15% of spend is wasted. Cancel unused tools and renegotiate with vendors. Reducing expenses by $100K drops straight to NOPAT.

Improve gross margin on products

Focus sales on high-margin offerings. If product A earns 60% gross margin and product B earns 30%, shift comp and marketing toward A. A 5-point gross margin improvement can add 3-5 points to NOPAT margin.

Automate labor-heavy processes

Finance and ops teams often run manual workflows that eat hours each week. Automation can cut 20-40 hours per month. That’s $30K-$60K in annual labor savings flowing to NOPAT.

Reduce tax liability with planning

Work with your tax advisor to optimize structure. R&D credits, accelerated depreciation, and entity changes can cut your effective tax rate by 2-5 points. If your EBIT is $2M and you drop tax from 25% to 22%, you gain $60K in NOPAT.

NOPAT vs. EBIT vs. Net Income vs. EBITDA

These metrics all measure profit, but they’re not the same. Here’s how they differ.

EBIT

EBIT = Revenue – COGS – Operating Expenses. Shows operating profit before interest and tax. Use for quick view of operational performance.

NOPAT

NOPAT = EBIT × (1 – Tax Rate). Shows operating profit after tax, with no debt impact. Use for fair comparisons across firms with different debt.

Net Income

Net Income = Revenue – All Expenses. Shows bottom-line profit to shareholders. Use for total profitability and distributable earnings.

EBITDA

EBITDA = EBIT + Depreciation + Amortization. Provides a cash earnings proxy. Use for valuation multiples and cash flow assessment.

When to use NOPAT

Use NOPAT when comparing companies with different capital structures. If you’re valuing a firm or benchmarking peers, NOPAT removes financing noise. It’s also key for calculating ROIC.

Use net income for shareholder analysis. This is what hits retained earnings and gets distributed as dividends.

Use EBIT for pre-tax operating performance. Use EBITDA for a cash proxy or when comparing firms with different depreciation policies.

Pro tip for fractional CFOs: Present NOPAT alongside net income to clients. “Your net income was $400K, but your NOPAT was $650K. The $250K gap is interest expense. If we refinance or pay down principal, that $250K moves closer to your bottom line.” This reframes capital structure as operational opportunity.

Measure what matters

NOPAT reveals your true operating performance. It strips away financing decisions to show what your business actually earns from core operations.

Track NOPAT monthly. Compare it to industry benchmarks. Use it to make better decisions about pricing, cost structure, and capital allocation.

Get started with Coefficient to automate your NOPAT tracking and focus on operational excellence.